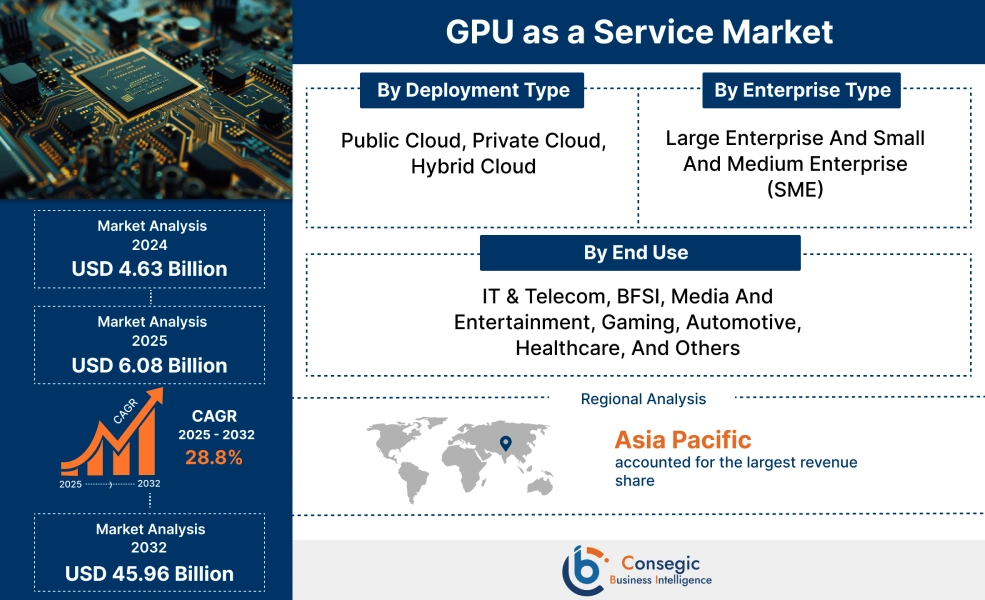

GPU As A Service Market Size:

GPU As A Service Market size is estimated to reach over USD 45.96 Billion by 2032 from a value of USD 4.63 Billion in 2024 and is projected to grow by USD 6.08 Billion in 2025, growing at a CAGR of 28.8% from 2025 to 2032.

GPU As A Service Market Scope & Overview:

GPU as a service (GPUaaS) is a cloud-based service that provides access to GPU (graphics processing unit) resources over the internet. This service enables users to leverage advanced GPU hardware without the need to purchase and maintain physical hardware on their premises. Moreover, GPU as a service offers several benefits including cost-effectiveness, scalability, ease of accessibility and management, improved time-to-market, and others. Additionally, GPUaaS is primarily used for tasks that require high computational power, such as deep learning, machine learning, data visualization, gaming, rendering, and scientific simulations among others.

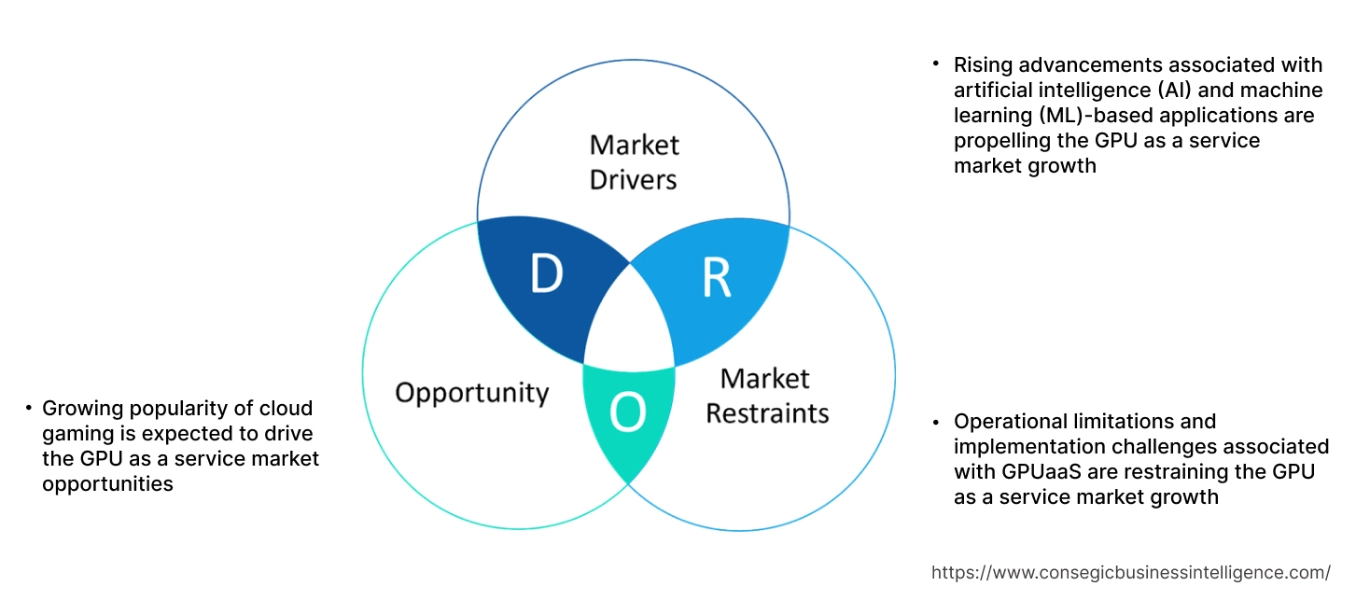

Key Drivers:

Rising advancements associated with artificial intelligence (AI) and machine learning (ML)-based applications are propelling the GPU as a service market growth

The increasing advancements related to AI and ML-based applications are among the key factors driving the market. Modern AI and ML models, particularly deep learning architectures, require substantial computational power for training and inference. These models often require parallel processing capabilities that can be provided by GPUs. Moreover, startups and smaller business enterprises that may not have the capital to invest in expensive GPU hardware can leverage GPUaaS to access the computing power required to compete in AI-driven markets.

- For instance, in November 2024, Rackspace Technology introduced its new on-demand GPU-as-a-Service, which is powered by NVIDIA accelerated computing. The GPUaaS is designed to provide on-demand access to powerful accelerated resources for machine learning, AI, data analytics, and graphics rendering workloads among others.

Hence, according to the analysis, the increasing advancements related to AI and ML-based applications are driving the GPU as a service market size.

Key Restraints:

Operational limitations and implementation challenges associated with GPUaaS are restraining the GPU as a service market growth.

The implementation of GPU as a service is often associated with certain operational limitations and challenges, which are among the key factors restraining the market. For instance, executing GPU-heavy tasks usually requires transmitting extensive data sets back and forth. Networking and latency issues can slow down workflows, specifically if users have limited bandwidth.

Moreover, the use of GPU-as-a-service is often associated with concerns related to security, privacy, and compliance, as most of the sensitive information is stored and processed in the cloud, which makes it vulnerable to cyberattacks. Additionally, GPU-as-a-service is also associated with vendor lock-in issues, wherein migration of large AI or HPC (high-performance computing) workflows from one cloud platform to another can be quite time-consuming and challenging. Therefore, the aforementioned factors are hindering the GPU as a service market expansion.

Future Opportunities :

Growing popularity of cloud gaming is expected to drive the GPU as a service market opportunities

Cloud gaming refers to a type of online gaming that is designed to run video games on remote servers and stream the game output directly to the user's device. It enables users to play the game remotely from the cloud while eliminating the need for downloads and saving storage space. Moreover, GPU as a service is primarily used by game developers and cloud gaming platforms for applications involving game development, hosting, and simulations. Additionally, cloud gaming platforms also use GPUaaS for streaming advanced graphics to end users.

- For instance, the total number of cloud gaming users worldwide reached approximately 396 million in 2024, witnessing a substantial increase from 295 million users in 2023 and 182 million users in 2022 respectively.

Hence, as per the analysis, the growing popularity of cloud gaming is projected to boost the GPU as a service market opportunities during the forecast period.

GPU As A Service Market Segmental Analysis :

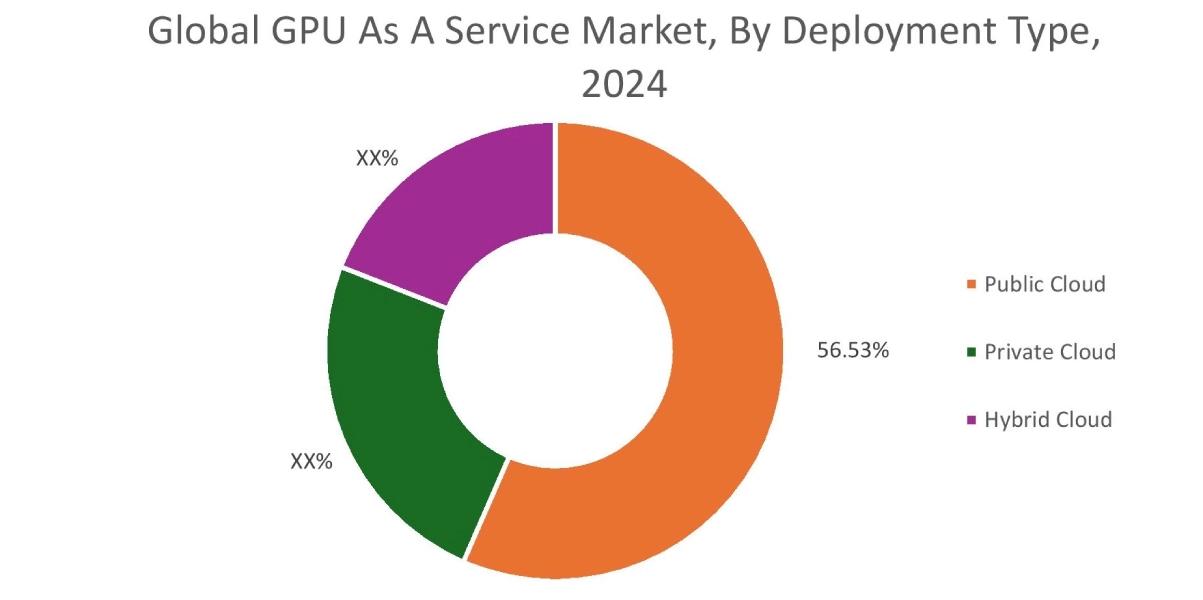

By Deployment Type:

Based on deployment type, the market is segmented into public cloud, private cloud, hybrid cloud.

Trends in the deployment type:

- Factors including the rapid pace of digital transformation and increasing consumer preference for flexible, scalable, reliable, and cost-effective cloud platform are primary determinants for driving the public cloud segment.

- Factors including ease of integration, flexibility, higher security, and more control over sensitive assets of an organization are key aspects driving the private cloud deployment segment.

The public cloud segment accounted for the largest revenue share of 56.53% in the overall GPU as a service market share in 2024, and it is anticipated to register significant CAGR growth during the forecast period.

- In public cloud deployment, computing services including GPU as-a-service are available on-demand to enterprises over the public internet.

- Moreover, cloud GPU resources including servers, storage, and others are typically owned and operated by a third-party cloud service provider and delivered over the internet.

- Moreover, public cloud deployment offers several benefits higher accessibility, no maintenance requirement, increased scalability, and relatively lower costs in comparison to other types of cloud deployment.

- Consequently, the above benefits related to public cloud deployment are further driving its adoption for the deployment of GPUaaS, in turn propelling GPU as a service market trends.

By Enterprise Type:

Based on enterprise type, the market is segmented into large enterprise and small and medium enterprise (SME).

Trends in the enterprise type:

- Increasing trend in the deployment of private cloud-based GPUaaS in large enterprises, due to its increased flexibility, higher security, and more control over sensitive assets of an enterprise.

- Factors including growing investments in the development of small and medium enterprises and rising deployment of public cloud-based GPUaaS in SMEs are key trends driving the small and medium enterprise segment.

Large enterprise segment accounted for the largest revenue share in the total GPU as a service market share in 2024.

- Large enterprises primarily use GPUaaS for extensive data analysis and training complex machine learning models. This is specifically prevalent in industries such as healthcare, finance, IT, and others.

- Moreover, large enterprises often use GPUaaS for applications involving high-performance computing (HPC), graphics rendering, AI workloads, and others that require real-time processing of large amounts of data.

- For instance, Krutrim offers Ola Krutrim Cloud in its solution offerings, which is a GPUaas that provides flexible, on-demand access to powerful NVIDIA GPUs for applications involving AI training and inference tasks. This service enables large enterprises to utilize cutting-edge hardware without the need for substantial upfront investments, in turn facilitating improved scalability and cost-efficiency for large enterprises.

- Therefore, the increasing adoption of GPUaaS in large enterprises is driving the GPU as a service market trends.

Small and medium enterprise (SME) segment is anticipated to register the fastest CAGR growth during the forecast period.

- Small and medium enterprises are companies that typically maintain workforce, revenues, and assets below a certain threshold.

- Moreover, SMEs usually account for the majority of the businesses that are operating across the world.

- Additionally, SMEs often use GPUaaS to develop and prototype applications that require intensive computation, including machine learning models and design applications among others.

- Similarly, small or medium businesses in creative fields can utilize GPUaaS to access high-quality rendering tools without the need to invest in expensive hardware.

- For instance, according to the U.S. Chamber of Commerce, the number of small businesses in the United States reached 33.2 million in 2022, representing nearly 99.9% of total businesses in the U.S.

- Thus, the rising number of small and medium enterprises is expected to boost the adoption of GPUaaS, in turn driving the GPU as a service market size during the forecast period.

By End Use:

Based on end use, the market is segmented into IT & telecom, BFSI, media and entertainment, gaming, automotive, healthcare, and others.

Trends in the end use:

- Increasing adoption of GPUaaS in the IT & telecom sector for facilitating applications involving AI/ML workloads, data analytics, and real-time processing, and others.

- There is a rising trend towards the utilization of GPUaaS in the gaming industry for providing a cost-efficient solution for game development, cloud gaming, and graphics rendering among others.

The IT & telecom segment accounted for the largest revenue share in the overall market in 2024.

- GPUaaS plays a vital role in the IT & telecom sector for applications involving AI/ML workloads, data analytics, and real-time processing, and others.

- IT & telecom service providers can use GPUaaS for analyzing large amounts of data sets generated from network traffic.

- Moreover, the use of GPUaaS enables IT and telecom companies to scale their GPU capabilities based on fluctuating demands.

- Additionally, the utilization of GPUaaS offers several benefits, including improved scalability, cost-efficiency, faster deployment, and others, which are further driving its adoption in the IT & telecom sector.

- According to the GPU as a service market analysis, the rising utilization of GPUaaS in the IT & telecommunication sector is driving the market.

The gaming segment is anticipated to register the fastest CAGR growth during the forecast period.

- GPUaaS are often used in the gaming sector for applications including game development, cloud gaming, and graphics rendering among others.

- GPUaaS plays a vital role in game streaming platforms by providing the necessary computational power for rendering games on remote servers, which enables players to enjoy high-quality gaming experiences even on lower-end devices.

- Moreover, game developers use GPUaaS for prototyping, testing, and rendering graphics, which facilitates faster iteration times without the need to invest in expensive hardware.

- Additionally, virtual reality (VR) and augmented reality (AR) applications require substantial graphical processing power. This can be attained through GPUaaS, which enables developers to create immersive gaming experiences without local hardware capabilities.

- Therefore, the growing gaming sector is projected to drive market growth during the forecast period.

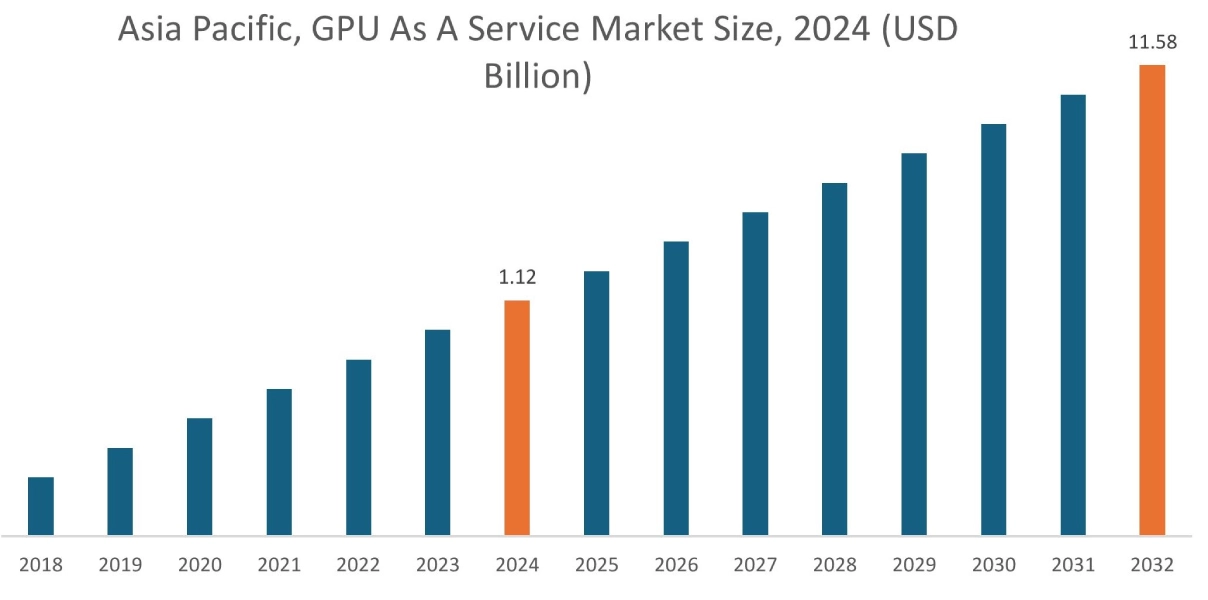

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 1.12 Billion in 2024. Moreover, it is projected to grow by USD 1.48 Billion in 2025 and reach over USD 11.58 Billion by 2032. Out of this, China accounted for the maximum revenue share of 33.28%. As per the GPU as a service market analysis, the adoption of GPUaaS in the Asia-Pacific region is primarily driven by the growing IT, healthcare, and BFSI sectors, among others. Additionally, the growing gaming sector and increasing adoption of GPUaaS for applications including game development, cloud gaming, and graphics rendering are further accelerating the GPU as a service market expansion.

- For instance, according to the China Audio-Video and Digital Publishing Association, the overall sales revenue of the domestic gaming sector in China reached RMB 302.96 billion (approx. USD 41.68 billion) in 2023, representing an increase of 13.95% as compared to 2022. The aforementioned factors are anticipated to drive market growth in the Asia-Pacific region during the forecast period.

North America is estimated to reach over USD 16.73 Billion by 2032 from a value of USD 1.69 Billion in 2024 and is projected to grow by USD 2.22 Billion in 2025. In North America, the growth of the GPU as a service industry is driven by growing investments in IT & telecom, media & entertainment, autonomous vehicles, and other industries. Moreover, the increasing adoption of GPUaaS in aforementioned industries for applications including data analytics, AI/ML workloads, video rendering, content streaming, and others is contributing to the GPU as a service market demand.

Additionally, the regional analysis depicts that the growing IT, BFSI, automotive, and healthcare sectors and increasing need for cost-efficient GPU solutions among business enterprises are driving the GPU as a service market demand in Europe. Further, as per the market analysis, the market in Latin America, Middle East, and African regions is expected to grow at a substantial rate due to several factors such as increasing investments in gaming sector, expansion of IT firms, and prevalence of several SMEs among others.

Top Key Players and Market Share Insights:

The global GPU as a service market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the GPU as a service market. Key players in the GPU as a service industry include-

- IBM Corporation (U.S)

- CoreWeave (U.S)

- Amazon Web Services Inc. (U.S)

- Arm Limited (United Kingdom)

- Rackspace Technology (U.S)

- Microsoft (U.S)

- NVIDIA Corporation (U.S)

- Intel Corporation (U.S)

- Oracle (U.S)

- Google LLC (U.S)

Recent Industry Developments :

Product Launch:

- In October 2024, Sify Technologies Limited launched its GPU cloud, CloudInfinit+AI Platform, which offers GPU as a service. This service is designed to support compute-intensive tasks such as deep learning, machine learning, model training, data analytics, inferencing, rendering, and others, which require substantial processing power.

GPU As A Service Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 45.96 Billion |

| CAGR (2025-2032) | 28.8% |

| By Deployment Type |

|

| By Enterprise Type |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the GPU as a service market? +

The GPU as a service market was valued at USD 4.63 Billion in 2024 and is projected to grow to USD 45.96 Billion by 2032.

Which is the fastest-growing region in the GPU as a service market? +

Asia-Pacific is the region experiencing the most rapid growth in the GPU as a service market.

What specific segmentation details are covered in the GPU as a service report? +

The GPU as a service report includes specific segmentation details for deployment type, enterprise type, end use, and region.

Who are the major players in the GPU as a service market? +

The key participants in the GPU as a service market are IBM Corporation (U.S), CoreWeave (U.S), Microsoft (U.S), NVIDIA Corporation (U.S), Intel Corporation (U.S), Oracle (U.S), Google LLC (U.S), Amazon Web Services Inc. (U.S), Arm Limited (United Kingdom), Rackspace Technology (U.S), and others.

How big is the GPU as a service market? +

The GPU as a service market was valued at USD 4.63 Billion in 2024 and is projected to grow to USD 45.96 Billion by 2032.

Which is the fastest-growing region in the GPU as a service market? +

Asia-Pacific is the region experiencing the most rapid growth in the GPU as a service market.

What specific segmentation details are covered in the GPU as a service report? +

The GPU as a service report includes specific segmentation details for deployment type, enterprise type, end use, and region.

Who are the major players in the GPU as a service market? +

The key participants in the GPU as a service market are IBM Corporation (U.S), CoreWeave (U.S), Microsoft (U.S), NVIDIA Corporation (U.S), Intel Corporation (U.S), Oracle (U.S), Google LLC (U.S), Amazon Web Services Inc. (U.S), Arm Limited (United Kingdom), Rackspace Technology (U.S), and others.