Guaranteed Auto Protection (GAP) Insurance Market Size :

Guaranteed Auto Protection (GAP) Insurance Market size is estimated to reach over USD 9,351.58 Million by 2032 from a value of USD 4,343.70 Million in 2024 and is projected to grow by USD 4,703.28 Million in 2025, growing at a CAGR of 10.10% from 2025 to 2032.

Guaranteed Auto Protection (GAP) Insurance Market Scope & Overview :

Guaranteed auto protection (GAP) insurance refers to an optional, add-on car insurance coverage that helps certain drivers cover the gap between the amount they owe on their vehicle and the vehicle's actual cash value in case of an accident. Moreover, as per the analysis, guaranteed auto protection insurance offers several benefits including theft coverage, total vehicle damage protection, and others. The above benefits of GAP insurance are primary determinants for driving market growth.

Guaranteed Auto Protection (GAP) Insurance Market Insights :

Guaranteed Auto Protection (GAP) Insurance Market Dynamics - (DRO) :

Key Drivers :

Rising vehicle sales are driving market growth

The rising number of vehicles purchased worldwide is among the primary factors driving the market growth. Guaranteed auto protection insurance offers financial protection to vehicle owners in case of vehicle theft, accident, or total loss by covering the difference between the actual cash value of the vehicle and the amount owed on an auto loan. As a result, based on the analysis, the rising vehicle sales are driving the market demand for GAP insurance for protection against financial losses in case of vehicle accidents or thefts.

Moreover, based on the analysis, factors including rising disposable income, increasing vehicle sales, and a growing need for vehicle insurance for improved financial coverage are among the major prospects driving the adoption of guaranteed auto protection insurance.

For instance, according to the International Organization of Motor Vehicle Manufacturers, the global sales of passenger cars reached 57,485,378 units in 2022, demonstrating a rise of 2% from 56,437,803 units in 2021. Additionally, according to International Organization of Motor Vehicle Manufacturers, the total sales of commercial vehicles worldwide will be 24,143,155 units in 2022.

Therefore, the rising vehicle sales are increasing the adoption of guaranteed auto protection insurance for protection against financial losses in case of vehicle accidents or thefts, in turn proliferating the expansion of the market.

Increasing cases of vehicle thefts are spurring market growth

The growing incidence of vehicle thefts across the world has led to increasing guaranteed auto protection (GAP) insurance market demand. Vehicle owners are becoming more aware of the financial risks imposed by car thefts and seeking comprehensive insurance coverage for better protection against financial losses. Moreover, as per the analysis, the ability of GAP insurance to provide complete theft coverage in case of vehicle theft is a significant factor driving the adoption of guaranteed auto protection insurance.

For instance, according to the National Insurance Crime Bureau, over 1 million cases of vehicle thefts were recorded in the United States in 2022, depicting an increase of 7% in comparison to 2021. Moreover, California and Texas reported the highest cases of vehicle thefts in 2022, reaching up to 202,685 cases and 105,015 cases respectively while Illinois witnessed the highest increase of 35% in vehicle thefts between 2021 and 2022.

Additionally, according to National Police Agency of Japan, the number of car thefts in Japan reached up to 5,734 cases in 2022, witnessing an increase of 552 cases in comparison to the previous year.

Thus, based on the analysis, the rising cases of vehicle thefts are increasing the market demand for guaranteed auto protection insurance to provide complete financial coverage in case of vehicle theft, in turn driving the expansion of the market.

Key Restraints :

The availability of alternatives is restraining the market expansion

There are multiple alternatives to guaranteed auto protection insurance including new car replacement coverage and better car replacement coverage among others, which is a prime factor restricting the market expansion.

For instance, certain insurers offer new car replacement coverage, which reimburses the vehicle at its replacement cost instead of its actual cash value. New car replacement coverage is an ideal option in case the vehicle is totaled while it's relatively new.

Meanwhile, better car replacement coverage pays out for replacing a totaled vehicle with a better or newer model. Therefore, the availability of several alternatives that offer similar benefits as guaranteed auto protection insurance is restraining the expansion of the market.

Future Opportunities :

Rising adoption of electric vehicles is expected to promote potential opportunities for market growth

The rising adoption of electric vehicles is expected to present potential trends and guaranteed auto protection (GAP) Insurance market opportunities. The increasing popularity and adoption of electric vehicles (EVs) are fostering the market demand for GAP insurance tailored to the distinct characteristics of electric vehicles while providing financial protection to EV owners in case of vehicle theft, accident, or total loss.

Factors including progression in electro-mobility, eco-friendliness, availability of a wide range of models, and prevalence of tax rebates and subsidies are driving the adoption of electric vehicles.

For instance, the government of India introduced multiple initiatives including PLI Scheme, FAME-II Initiatives, and duty reduction on electric vehicles for promoting the adoption of EVs in the country.

Additionally, according to the International Energy Agency (IEA), the global sales of electric vehicles reached up to 2 million units during the first quarter of 2022, witnessing a rise of 75% in contrast to the first quarter of 2021.

Hence, the rising adoption of electric vehicles is anticipated to increase the adoption of guaranteed auto protection (GAP) to attain financial protection against vehicle loss, theft, or accident, in turn promoting opportunities for market expansion during the forecast period.

Guaranteed Auto Protection (GAP) Insurance Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 9,351.58 Million |

| CAGR (2025-2032) | 10.1% |

| By Type | Finance GAP Insurance, Vehicle Replacement GAP Insurance, Return to Invoice (RTI) GAP Insurance, and Others |

| By Distribution Channel | Insurance Companies, Credit Union, and Others |

| By Vehicle Type | Passenger Cars and Commercial Vehicles |

| By Region | Asia-Pacific, Europe, North America, Latin America, Middle East & Africa |

| Key Players | Assurant Inc., Direct Gap Ltd., Car Care Plan Ltd, Berkshire Hathaway Inc., Nationwide Mutual Insurance Company, Allstate Insurance Company, Zurich Insurance Group Ltd., Arch Capital Group Ltd., Infinity Insurance, Assurity Solutions Ltd. |

| Geographies Covered | |

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Opportunities, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, Cost Analysis, and Regional Trends & Forecast |

Guaranteed Auto Protection (GAP) Insurance Market Segmental Analysis :

By Type :

Based on the type, the market is bifurcated into finance GAP insurance, vehicle replacement GAP insurance, return to invoice (RTI) GAP insurance, and others. The finance GAP insurance segment accounted for the largest revenue share in the year 2024. The finance GAP insurance is typically available for vehicles that are financed under a finance agreement apart from a contract hire or lease agreement. Moreover, finance GAP insurance offers vehicle buyback and finance agreements with warranties ranging up to 100% of the original costs, which are primary determinants for driving the adoption of finance GAP insurance.

For instance, Lexus Financial Services offers finance GAP insurance in its portfolio of insurance coverage. The Lexus finance GAP insurance Lexus covers any remaining loan balance following a total loss of vehicle involving theft or accident. Thus, the prevalence of significant number of financial or insurance companies providing finance GAP insurance is among the prime factors driving the expansion of the segment.

The return to invoice (RTI) GAP insurance segment is anticipated to register significant CAGR during the forecast period. The return to invoice (RTI) GAP insurance refers to an insurance policy that covers the gap between the invoice value and insured declared value of the car. Moreover, RTI provides additional protection in case the vehicle is declared a total loss by paying the difference between the motor insurer's settlement and the original amount paid by the buyer for the car.

For instance, Direct Gap Ltd is a provider of GAP insurance that offers return to invoice (RTI) GAP insurance in its insurance portfolio. The RTI GAP insurance will pay the difference between the motor insurer's settlement and original purchase price of the vehicle in an event of the vehicle being declared a total loss. Therefore, as per the analysis, the increasing availability of RTI GAP insurance policies by insurance firms is anticipated to boost the trend of the segment during the forecast period.

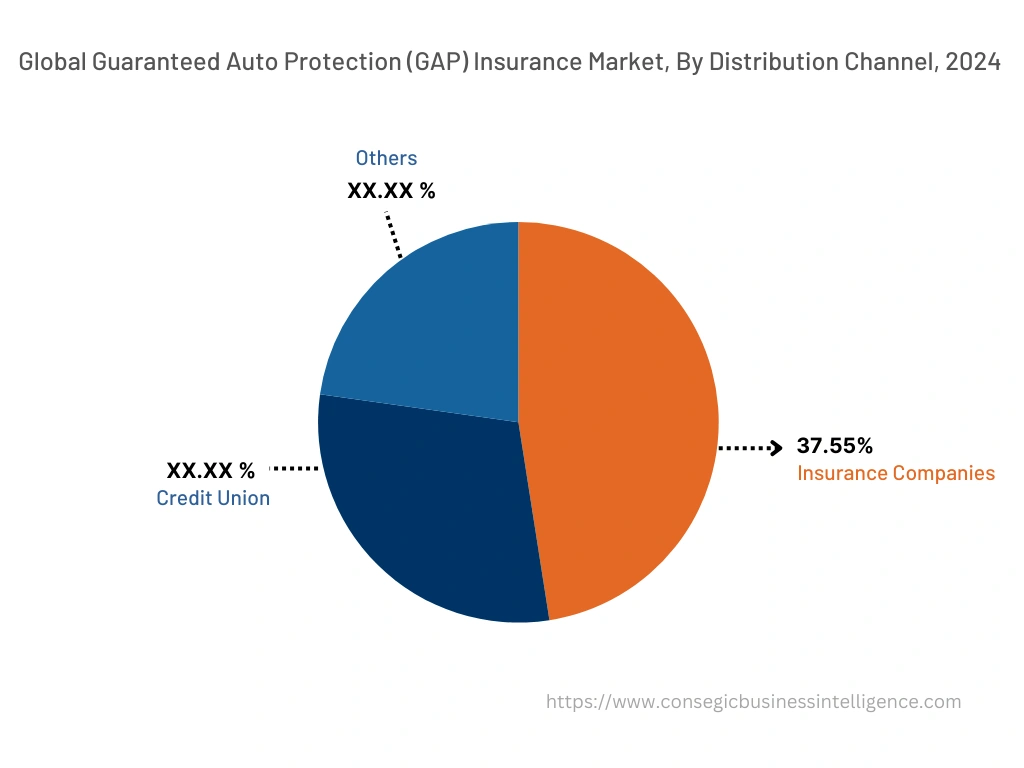

By Distribution Channel :

Based on the distribution channel, the market is segregated into insurance companies, credit unions, and others. The insurance companies segment accounted for the largest guaranteed auto protection (GAP) insurance market share market of 47.81% in the year 2024. Insurance companies are among the primary providers of guaranteed auto protection insurance that provides its customers with access to a broad range of GAP insurance coverage such as finance GAP insurance, vehicle replacement GAP insurance, return to invoice (RTI) GAP insurance, and others. Factors including the rising digitalization of the financial services sector, the prevalence of a substantial number of insurance firms, and the availability of a broad range of guaranteed auto protection (GAP) insurance market policies are key aspects driving the trend of insurance companies

For instance, Nationwide Mutual Insurance Company, Allstate Insurance Company, and Zurich Insurance Group are a few of the insurance companies providing guaranteed auto protection insurance in its product/service offerings. Therefore, the prevalence of a significant number of insurance firms providing GAP insurance is proliferating the trend of the market.

Credit union segment is expected to witness the fastest CAGR growth during the forecast period. Credit unions offer a range of financial/insurance services that are similar to insurance companies, including access to guaranteed auto protection (GAP) insurance market trends.

For instance, Northside Federal Credit Union and Provident Credit Union are a few of the credit unions based in the United States that offer a range of financial services including guaranteed auto protection insurance coverage in its service offerings. Thus, the increasing availability of guaranteed auto protection insurance from credit unions is projected to drive the segment during the forecast period.

By Vehicle Type :

Based on the vehicle type, the market is segregated into passenger cars and commercial vehicles. The passenger cars segment accounted for the largest revenue share in the year 2024. Factors including rising disposable income, increasing passenger car production, and growing adoption of passenger cars are among the key prospects driving the trend of the passenger car segment.

For instance, according to International Organization of Motor Vehicle Manufacturers, the total sales of passenger cars in Australia reached 777,688 units in 2022, demonstrating a expansion of 3.2% from 753,256 units in 2021. Guaranteed auto protection insurance offers financial protection to vehicle owners in case of vehicle theft, accident, or total loss by covering the difference between the actual cash value of the vehicle and the amount owned on auto loan. Therefore, the rising sales of passenger cars is increasing the adoption of guaranteed auto protection (GAP) insurance, in turn proliferating the trends of the market.

The commercial vehicles segment is expected to witness a significant CAGR during the forecast period. The expansion of the commercial vehicle segment is attributed to multiple factors including the rising investments in commercial vehicles and increasing demand for economical modes of transportation and logistics.

For instance, according to the International Organization of Motor Vehicle Manufacturers, the total sales of commercial vehicles in Mexico reached 647,480 units in 2022, witnessing an increase of 23% from 526,620 units in 2021. Additionally, ALA Insurance Brokers offers GAP insurance for commercial vehicles including light commercial vehicles, vans, and others for financial protection in event of a total loss. Thus, the rising sales of commercial vehicles and increasing availability of guaranteed auto protection (GAP) insurance coverage for commercial vehicles is projected to drive the market during the forecast period.

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

-insurance-market-by-region.webp?v=1717145588)

Asia Pacific region was valued at USD 1,279.26 Million in 2024. Moreover, it is projected to grow by USD 1,389.07 Million in 2025 and reach over USD 2,847.56 Million by 2032, registering the highest CAGR of 10.6% during the forecast period. In addition, in the region, the China accounted for the maximum revenue share of 34.6% in the same year.

According to the guaranteed auto protection (GAP) insurance market analysis, the growing pace of urbanization and development is providing lucrative trend prospects for the market in the region. In addition, factors including the presence of a substantial number of financial/insurance firms, increasing vehicle sales, and rising demand for additional insurance coverage for vehicles are driving the guaranteed auto protection (GAP) insurance market growth and trends in the Asia-Pacific region.

For instance, according to International Organization of Motor Vehicle Manufacturers, the total sales of passenger cars in the ASEAN region reached up to 2,232,055 units in 2022, depicting an increase of 19% from 1,875,335 units in 2021. Therefore, the rising vehicle sales are driving the market demand for GAP insurance for protection against financial losses in case of vehicle accidents or thefts, thereby boosting the market trends in the Asia-Pacific region during the forecast period.

North America is expected to register CAGR of 10.2% during the forecast period. The market expansion for guaranteed auto protection (GAP) insurance in North America is primarily driven by the prevalence of a significant number of insurance firms that offer guaranteed auto protection (GAP) insurance in the region including Assurant Inc., Berkshire Hathaway Inc., Nationwide Mutual Insurance Company, Allstate Insurance Company, and others. Moreover, the increasing sales of electric vehicles have been a prevalent factor for industry expansion in the region.

For instance, according to the International Energy Agency, electric car sales in the United States reached 630 thousand units in 2021, depicting a significant rise of over 100% in comparison to 295 thousand units in 2020. Hence, the rising sales of electric vehicles are increasing the adoption of GAP insurance to provide financial protection to EV owners in case of vehicle theft, accident, or total loss. The above factors are proliferating the growth of the guaranteed auto protection (GAP) insurance market growth in North America.

-insurance-market-by-country.webp?v=1717145585)

Top Key Players & Market Share Insights :

The global guaranteed auto protection (GAP) insurance market is highly competitive with major players providing guaranteed auto protection insurance to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and vehicle type launches to hold a strong position in the guaranteed auto protection (GAP) insurance industry. Key players in the guaranteed auto protection (GAP) insurance market include-

- Assurant Inc.

- Direct Gap Ltd.

- Berkshire Hathaway Inc.

- Nationwide Mutual Insurance Company

- Allstate Insurance Company

- Car Care Plan Ltd

- Acron

- Zurich Insurance Group Ltd.

- Arch Capital Group Ltd.

- Infinity Insurance

- Assurity Solutions Ltd.

Recent Industry Developments :

- In December 2020, Assurant Inc. announced the acquisition of EPG Insurance Inc. for USD 43 million. EPG Insurance Inc. is a provider of service contracts and insurance that are sold through heavy equipment manufacturers and dealers.

-insurance-market.webp?v=1717145580)

-insurance-market-dynamics.webp?v=1717145628)