Injection Molding Machine Market Size:

Injection Molding Machine Market Size is estimated to reach over USD 18.38 Billion by 2032 from a value of USD 12.94 Billion in 2024 and is projected to grow by USD 13.30 Billion in 2025, growing at a CAGR of 4.8% from 2025 to 2032.

Injection Molding Machine Market Scope & Overview:

An injection molding machine, also known as an injection press, is a piece of manufacturing equipment designed for producing plastic parts in large volumes. It operates by melting plastic material and then injecting it under high pressure into a mold cavity. This mold, precisely shaped to the desired final product, allows the molten plastic to cool and solidify. Once cooled, the mold opens, and the finished plastic part is ejected. The machine typically consists of two main units: the injection unit, which melts and injects the plastic, and the clamping unit, which holds the mold closed during the injection and cooling phases and opens it for part ejection.

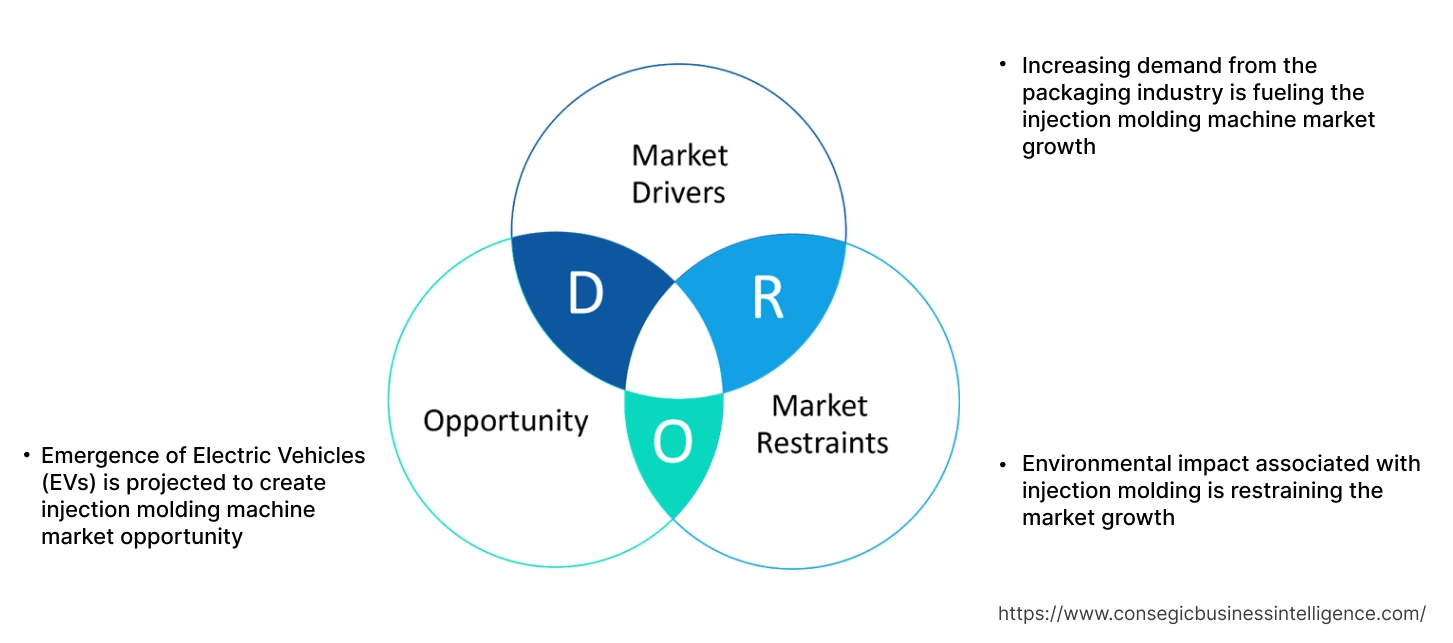

Key Drivers:

Increasing demand from the packaging industry is fueling the injection molding machine market growth

The packaging industry requires the mass production of various plastic items such as bottles, containers, closures, trays, and films. Injection molding is ideally suited for high-volume manufacturing, offering efficiency and cost-effectiveness for producing these large quantities. Additionally, injection molding machines process a wide range of plastic materials, including PET, PP, HDPE, LDPE, and increasingly, recycled and biodegradable polymers. This versatility is crucial for the diverse needs of the packaging industry, which requires materials with specific properties like barrier protection, flexibility, rigidity, and transparency. Moreover, the rising environmental concerns and regulations targeting single-use plastics are significantly increasing the need for sustainable packaging alternatives, including fiber-based products, thereby driving the injection molding machine market size.

- For instance, in Sep 2023, PulPac launched its first injection molding machine, the PulPac Scala, specifically designed for manufacturing fiber-based products. This marks a significant advancement in making their Dry Molded Fiber technology more accessible globally. The Scala platform uniquely combines the principles of plastic injection molding with PulPac's innovative Mill-to-Web fiber processing unit, signaling a new era for sustainable fiber-based packaging production.

Consequently, increasing demand from the packaging industry is driving the injection molding machine market expansion.

Key Restraints:

Environmental impact associated with injection molding is restraining the market growth

Injection molding is an energy-intensive process, requiring significant power for heating, cooling, and operating machinery. This high energy consumption often relies on fossil fuels, contributing to greenhouse gas emissions and climate change. Additionally, as environmental regulations become stricter and carbon taxes are implemented, the operational costs for injection molding companies increase, potentially making their products less competitive or reducing profit margins. Therefore, as per the analysis, these combined factors are significantly hindering injection molding machine market share.

Future Opportunities :

Emergence of Electric Vehicles (EVs) is projected to create injection molding machine market opportunity

Electric vehicles require lighter components to maximize battery range and overall efficiency, as the batteries themselves add considerable weight. Plastics, manufactured through injection molding, are significantly lighter than traditional materials like metal, making them an ideal substitute in various EV parts. This drives the need for injection molding machines capable of producing these lightweight components. Additionally, injection molding allows for the creation of intricate and complex shapes, enabling the consolidation of multiple parts into single components. This is beneficial in EV manufacturing for creating aerodynamic body parts, integrated interior consoles, and complex housings for electronic control units and battery systems, hence boosting injection molding machine market demand.

- For instance, according to European Union, the number of battery-only electric passenger cars in EU countries saw significant growth in 2022, reaching almost 3.0 million, a 55% increase from the 1.9 million in 2021. This growth, while substantial, was slightly lower than the peak annual increase observed between 2019-2020 (+85%) and 2020-2021 (+78%).

Hence, based on the analysis, emergence of electric vehicles is expected to create injection molding machine market opportunities.

Injection Molding Machine Market Segmental Analysis :

By Machine Type:

Based on the machine type, the market is categorized into hydraulic, electric, and hybrid.

Trends in the Machine Type:

- Growing trend towards the adoption of hydraulic injection molding machines due to better injection rates and are resistant to wear and tear.

- Hydraulic machines offer faster cycle times than purely hydraulic machines and better energy efficiency.

Electric accounted for the largest revenue share in 2024 and is also projected to witness the fastest CAGR.

- Electric machines offer substantial energy savings (40-70%) compared to hydraulic counterparts, leading to lower operating costs and a reduced carbon footprint, driving injection molding machine market size.

- Servo motor-driven systems in electric machines provide highly accurate and repeatable control over injection speed, pressure, and mold movements, crucial for producing high-quality parts with tight tolerances.

- Electric machines achieve faster cycle times due to quicker and precise movements, as well as the ability to perform simultaneous operations, further boosting the injection molding machine market trend.

- The absence of hydraulic oil eliminates the risk of leaks and contamination, making electric machines ideal for cleanroom environments, such as those in the medical and pharmaceutical industries.

- For instance, in Oct 2023, Sumitomo Heavy Industries introduced SE-EV-S SERIES of all-electric injection molding machines, emphasizing enhanced sustainability. Key features include "Sustainable Molding" with improved support for defect reduction and energy-saving operations, alongside "Smart Management" capabilities.

- Thus, as per the injection molding machine market analysis, the aforementioned factors are driving the electric segment.

By Material Type:

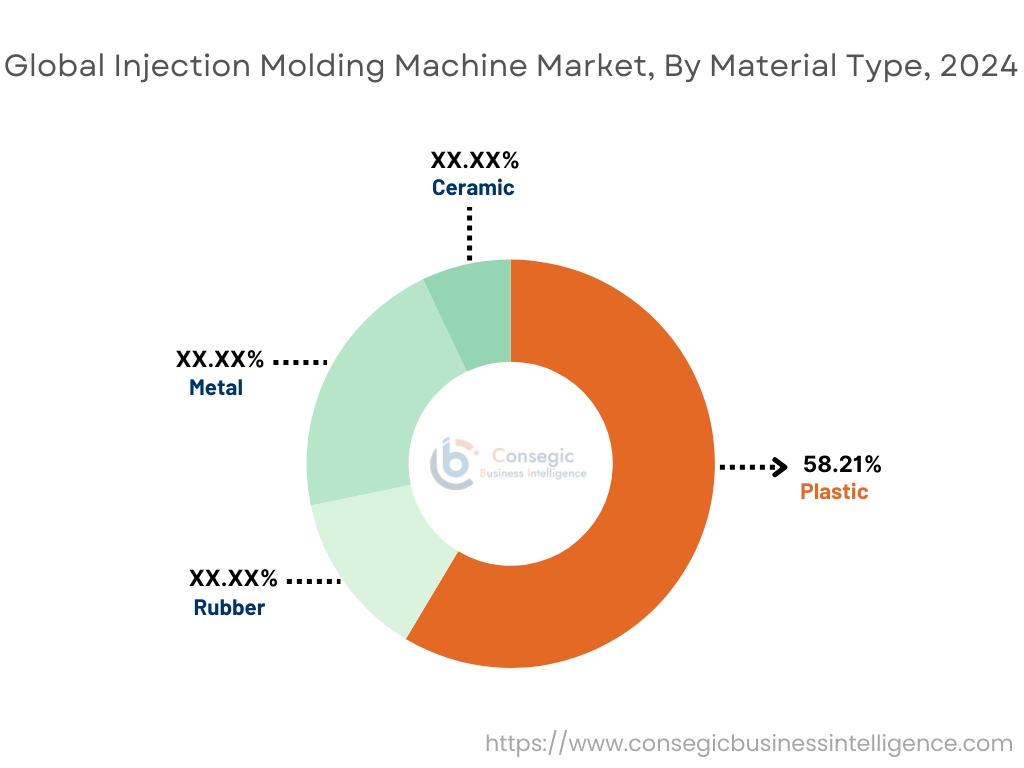

Based on the material type, the market is classified into plastic, rubber, metal, and ceramic.

Trends in the Material Type:

- Rubber injection molding is focusing on precision and efficiency for complex and durable components including the development of advanced elastomers and thermoplastic elastomers (TPEs) that offer design flexibility and recyclability.

- Development of advanced metal powders with enhanced properties, miniaturization for electronics and medical devices, a focus on sustainability by reducing material waste.

Plastics accounted for the largest revenue of 58.21% in 2024 and is also predicted to witness the fastest CAGR.

- Plastics are used extensively across a vast range of industries, including packaging, automotive, consumer goods, electronics, medical devices, and construction, driving the injection molding machine market demand.

- Injection molding of plastics offers a cost-effective method for mass-producing intricate parts with high precision, ideal for the high-volume demands of these major industries.

- In industries like automotive and aerospace, the demand for lightweight materials to improve fuel efficiency and reduce emissions has significantly increased the use of plastic components.

- Thus, as per the injection molding machine market analysis, the increasing production and utilization of plastic in various end use industries is contributing significantly in driving the market size.

By Operation:

Based on the operation, the market is categorized into automatic, semi-automatic, and manual.

Trends in the Operation:

- Modern automatic injection molding machines are increasingly integrated with robotic systems for automated part handling (loading, unloading, stacking), post-processing (trimming, assembly, labeling), and quality control (vision inspection).

- Coiled tubing drilling is used in underbalanced drilling operations, which improve drilling rates and reduce formation damage in certain reservoirs.

Automatic accounted for the largest revenue share in 2024 and is also predicted to register fastest growth.

- Automation integrates high-end technology and equipment that offer greater accuracy in every phase of the molding process.

- These enables real-time monitoring, predictive maintenance, process optimization, and automated part handling, leading to smarter and more efficient manufacturing.

- Modern automatic injection molding machines offer flexibility in design and allow for easier adaptation to changing customer demands through programmable molding patterns and quick mold changeover capabilities.

- The precision offered by automatic systems leads to less material waste compared to manual or semi-automatic operations, contributing to cost savings and more sustainable manufacturing.

- Automatic machines, especially when integrated with advanced control systems and robotics, ensure precise and repeatable molding processes.

- For instance, in Sep 2024, ENGEL introduced the e-mac 500, a new fully automatic electric injection molding machine that expands its existing range. Positioned to handle both standard and more challenging applications, the e-mac 500 also features the iQ motion control digital assistance system, which optimizes the moving platen's acceleration based on the mold weight.

- In conclusion, the aforementioned factors are contributing to the growth of global injection molding machine market expansion.

By Injection Pressure:

Based on the injection pressure, the market is categorized into Below 1000 Bar, Between 1000-2500 Bar, and Above 2500 Bar.

Trends in the Injection Pressure:

- Below 1000 Bar is typically used for processing more viscous materials or for simpler.

- Current trends emphasize improving the energy efficiency and cycle times of these machines through advancements in hydraulic systems and control mechanisms in below 1000 bar machines.

Between 1000-2500 Bar accounted for the largest revenue share in 2024.

- This pressure range is used for producing complex and dimensionally accurate parts required in industries such as automotive, electronics, and medical devices.

- Machines in this category often feature more sophisticated control systems, including multi-stage injection and feedback mechanisms, to ensure high repeatability and part quality.

- This pressure range is capable of processing a wider range of engineering plastics and materials with higher viscosity.

- For instance, ENGEL launched its e-speed Thin Wall Injection Moulding Machine, a 2,000 bar hybrid machine combining an all-electric clamping unit with hydraulic injection powered by batteries. This design achieves rapid acceleration, enabling injection speeds up to 1,200 mm/s and cycle times under 2 seconds.

- In conclusion, the aforementioned factors are contributing to the growth of global injection molding machine market.

Above 2500 Bar is predicted to register the fastest CAGR during the forecast period.

- This high-pressure range is used for specialized applications requiring extremely tight tolerances, thin walls, and high strength, such as certain medical components, micro-molded parts, and some high-performance automotive or aerospace components.

- High injection pressure can lead to improved mechanical strength and reduced molding shrinkage in the final product.

- Further, these machines enable the production of smaller, more complex parts with intricate features and longer flow lengths.

- Moreover, ultra-high-pressure machines require highly advanced control systems to manage the extreme pressures and ensure process stability and safety.

- For instance, JSW expanded its JLM-MGIIe series of magnesium injection molding machines, which utilize the Thixomolding method, with the introduction of the JLM3000-MGIIeL. Boasting a world-leading mold clamping force of 3,000 tons (29,400 kN), this new machine follows the previously launched models in the series, including the 1,300-ton JLM-MGIIeL.

- Subsequently, as per the market analysis, the aforementioned factors are collectively responsible in accelerating the market during the forecast period.

By End-Use:

Based on the end user, the market is categorized into automotive & transportation, construction, consumer goods, packaging, and electrical & electronics, and others.

Trends in the End User:

- Consumer products often prioritize aesthetics and design innovation, machines with advanced features for complex shapes, textures, and multi-color molding.

- Construction industry utilizes injection-molded plastics for various applications like pipes, fittings, window frames, and insulation materials.

Packaging accounted for the largest revenue share in the market in 2024.

- The packaging industry is a major consumer of injection molding machines for producing containers, bottles, caps, and closures, driven by the increasing need for packaged goods and advancements in packaging technology.

- Trends in the packaging industry, such as lightweighting, recyclability, and the use of bio-based polymers, are influencing the requirements for injection molding machines.

- For applications like food and beverage packaging, there's a growing need for high-speed injection molding machines capable of producing thin-walled containers with short cycle times.

- For instance, Sumitomo (SHI) Demag introduced the El-Exis SP 1000-ton injection molding machine, specifically designed for high-volume packaging like pail production and thin-wall stack molding. This hybrid machine offers faster cycle times and boasts significant energy efficiency, consuming up to 20% less energy than its previous generation, aligning with the industry's focus on sustainability.

- In conclusion, the aforementioned factors are contributing to the growth of global injection molding machine market.

Automotive & Transportation is predicted to register the fastest CAGR during the forecast period.

- These machines are used in processing complex geometries and high-performance polymers, requiring higher injection pressures and sophisticated controls.

- Modern vehicles feature integrated and complex plastic parts for interiors, exteriors, and under-the-hood applications, which increases the need machines with multi-component molding capabilities and high precision.

- Further, rise of EVs is increasing the need for plastic parts in battery housings, thermal management systems, and charging infrastructure, requiring specialized injection molding solutions.

- Subsequently, as per the market analysis, the aforementioned factors are collectively responsible in accelerating the market during the forecast period.

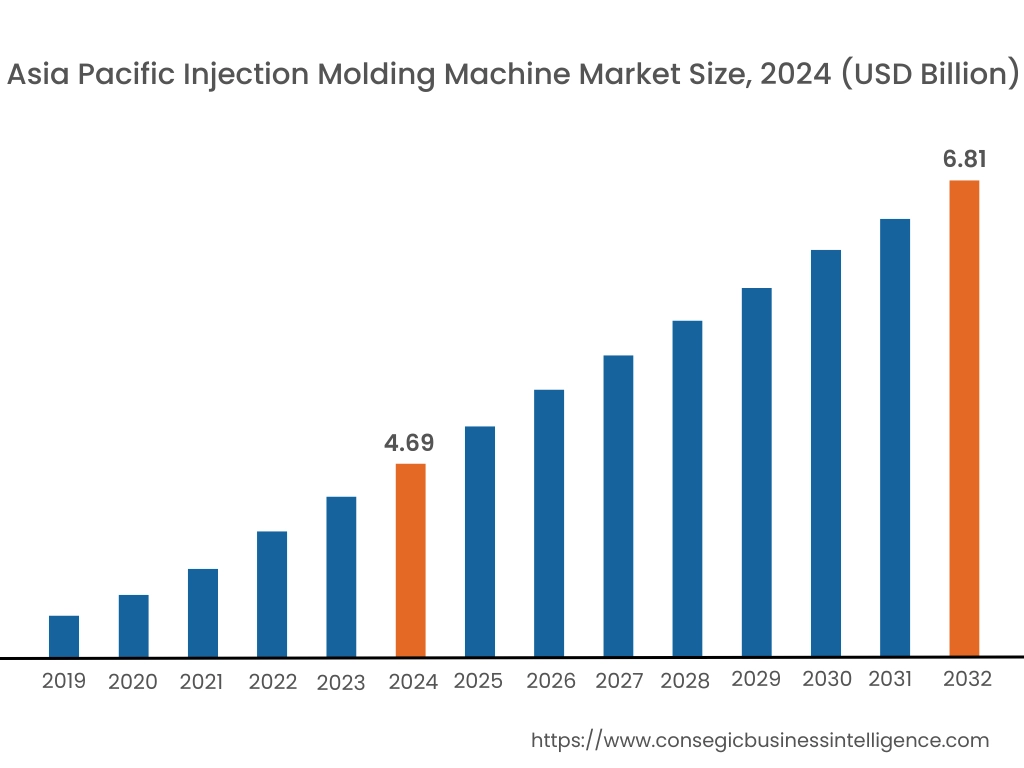

Regional Analysis:

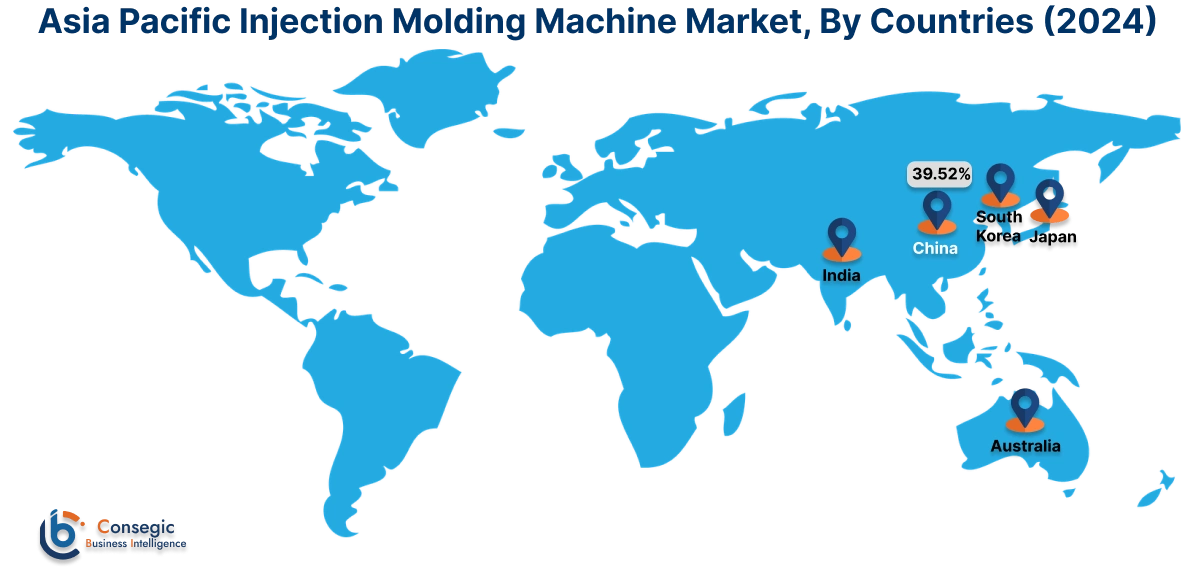

The global injection molding machine market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

Asia Pacific was valued at USD 4.69 Billion in 2024. Moreover, it is projected to grow by USD 4.83 Billion in 2025 and reach over USD 6.81 Billion by 2032. Out of these, China accounted for the largest revenue share of 39.52% in 2024. The automotive sector in Asia Pacific countries, especially in China, India, Japan, and South Korea, is a major consumer of injection molding machines for producing interior and exterior parts, and electronic housings. The increasing production of electric vehicles and rising investments in automotive sector further boosts this demand.

- For instance, between April 2000 and September 2024, the Indian automobile sector attracted approximately USD 36.21 billion in cumulative equity FDI. Furthermore, India is projected to emerge as the largest EV market by 2030, presenting an investment potential exceeding USD 200 billion in this rapidly growing sector.

North America region was valued at USD 3.53 Billion in 2024. Moreover, it is projected to grow by USD 3.62 Billion in 2025 and reach over USD 4.99 Billion by 2032. North American manufacturers are increasingly adopting advanced injection molding technologies, including electric and hybrid machines, as well as integrating automation and robotics to enhance productivity, reduce costs, and improve part quality. The focus on Industry 4.0 technologies like AI and IoT for process optimization and predictive maintenance is also a key trend. Also, manufacturers are undergoing various strategies including expansion and partnerships to strengthen their reach in North American countries.

- For instance, in June 2023, Haitian International launched a new, advanced manufacturing plant in Mexico to boost its local production capabilities. This strategic move aims to reduce delivery times and enhance the supply of superior injection molding machines tailored to the specific technical needs of customers across North America.

As per the injection molding machine market analysis, Europe's market is driven by increasing need for high-precision machines in the automotive and healthcare sectors, with a growing emphasis on sustainable and energy-efficient solutions. Also, the Middle East and Africa market is expanding due to rising industrialization, increased need for consumer goods, and significant investments in construction and infrastructure projects, particularly in the UAE and Saudi Arabia.

Top Key Players and Market Share Insights:

The market is highly competitive with major players providing injection molding machine to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the injection molding machine industry include-

- ARBURG (Germany)

- KraussMaffei (Germany)

- Nissei Plastic Industrial Co., Ltd. (Japan)

- Boy GmbH & Co. KG (Germany)

- Wittmann Battenfeld (Austria)

- Husky Technologies (Canada)

- Shibaura Machine (Japan)

- Engel Austria GmbH (Austria)

- Sumitomo Heavy Industries (Japan)

- FANUC (Japan)

- Milacron (Hillenbrand) (USA)

- Haitian International (China)

- Yizumi (China)

- BMB S.p.A. (Italy)

Recent Industry Developments :

Expansion:

- In Nov 2023, Arburg has reinforced its global presence by launching a new subsidiary in Vietnam. This strategic move aims to improve Vietnamese customers' access to ARBURG's products and services, demonstrating the company's dedication to providing more convenient, efficient, and reliable solutions in the region.

Injection Molding Machine Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 18.38 Billion |

| CAGR (2025-2032) | 4.8% |

| By Machine Type |

|

| By Material Type |

|

| By Operation |

|

| By Injection Pressure |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the injection molding machine market? +

The injection molding machine market size is estimated to reach over USD 18.38 Billion by 2032 from a value of USD 12.94 Billion in 2024 and is projected to grow by USD 13.30 Billion in 2025, growing at a CAGR of 4.8% from 2025 to 2032.

What specific segmentation details are covered in the injection molding machine report? +

The injection molding machine report includes specific segmentation details for machine type, material type, operation, injection pressure, end user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the injection molding machine market, automotive is the fastest-growing segment during the forecast period.

Who are the major players in the injection molding machine market? +

The key participants in the injection molding machine market are ARBURG (Germany), KraussMaffei (Germany), Engel Austria GmbH (Austria), Sumitomo Heavy Industries (Japan), FANUC (Japan), Milacron (Hillenbrand) (USA), Haitian International (China), Yizumi (China), BMB S.p.A. (Italy), Husky Technologies (Canada), Nissei Plastic Industrial Co., Ltd. (Japan), Dr. Boy GmbH & Co. KG (Germany), Wittmann Battenfeld (Austria), Shibaura Machine (Japan), and Others.