Livestock Identification Market Size:

Livestock Identification Market size is estimated to reach over USD 2.96 Billion by 2032 from a value of USD 1.71 Billion in 2024 and is projected to grow by USD 1.81 Billion in 2025, growing at a CAGR of 7.9% from 2025 to 2032.

Livestock Identification Market Scope & Overview:

Livestock identification refers to the process of identifying and tracking animals with the help of a unique identifier for the purpose of record-keeping. Further, animal identification is also utilized for tracking the feed intake of the animals. Additionally, animal identification helps the farmers to track the health history of the animals. Moreover, the rising adoption of ear and neck tags to track cattle, goats, and sheep in farms is driving the market.

Livestock Identification Market Dynamics - (DRO) :

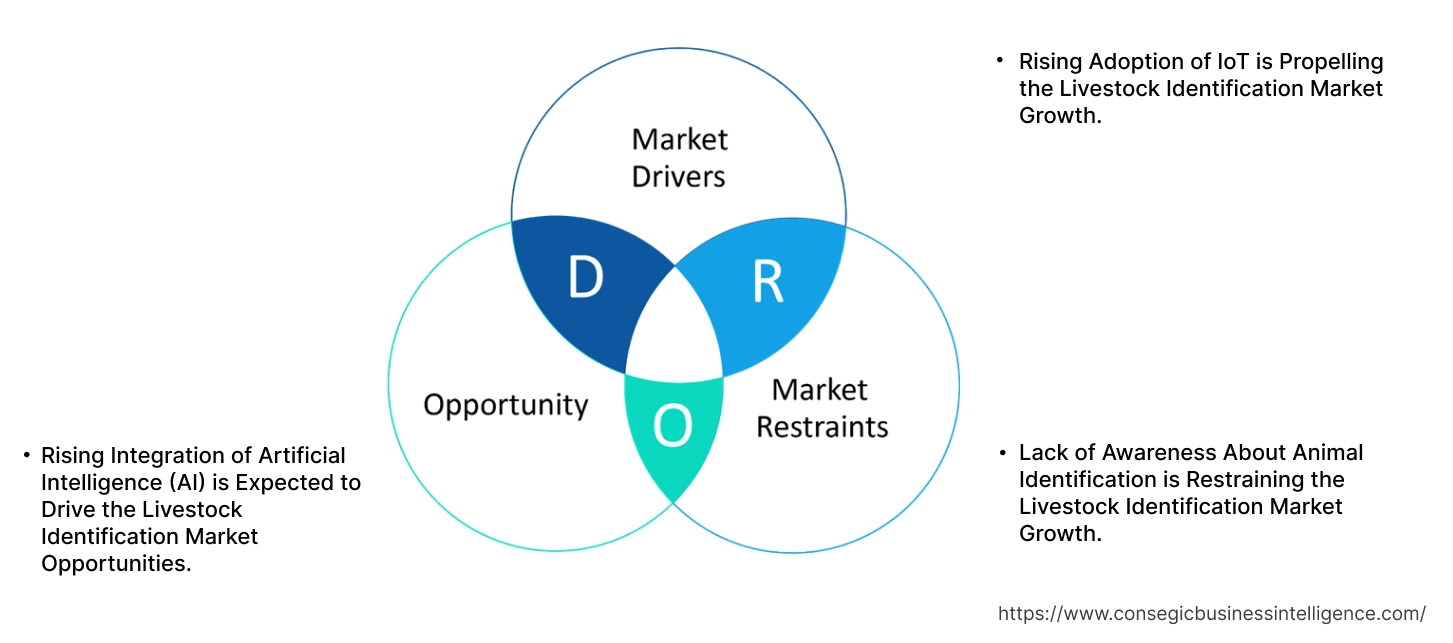

Key Drivers:

Rising Adoption of IoT is Propelling the Livestock Identification Market Growth.

Organizations have started investing in IoT technologies for real-time monitoring of animals on farms. Further, IoT devices use sensors and RFID tags which allow farmers to monitor herds from anywhere which is driving the market. Additionally, many organizations are launching IoT devices that integrate the sensors for intrusion detection and surveillance which is driving the overall market.

- For instance, in February 2022. HerdX introduced a livestock herd management tracking solution that integrates RFID technology. The rise in the adoption of RFID and sensors for animal identification is expected to boost the market.

Hence, the rising adoption of IoT to monitor herds is driving the livestock identification market size.

Key Restraints:

Lack of Awareness About Animal Identification is Restraining the Livestock Identification Market Growth.

Farmers in developing regions lack awareness about benefits of utilizing IoT and AI based software due to low digital literacy. Further, the farmers may find the hardware and software complex to use and implement. Moreover, the farmers may prefer manually checking the animals due to poor network connectivity and lack of infrastructure in remote areas which can act as a restraint to the market growth. Thus, lack of awareness due to complexity of using hardware and software for animal identification acts as a restraint to the livestock identification market expansion.

Future Opportunities :

Rising Integration of Artificial Intelligence (AI) is Expected to Drive the Livestock Identification Market Opportunities.

Companies have started utilizing artificial intelligence in livestock identification to automate animal tracking and health monitoring. Additionally, AI powered cameras in farms use facial recognition to identify individual animals which are driving the market. Moreover, farms have started utilizing AI to manage lameness levels in their herd which is driving the market.

- For instance, in March 2024, GEA announced the acquisition of CattleEye Ltd., with the aim of adding AI system to the company’s portfolio of products catering to dairy farms. The rise in the adoption of AI for cattle monitoring is expected to boost the market.

Thus, the rising integration of artificial intelligence due to automated animal tracking and facial recognition is projected to drive the livestock identification market opportunities during the forecast period.

Livestock Identification Market Segmental Analysis :

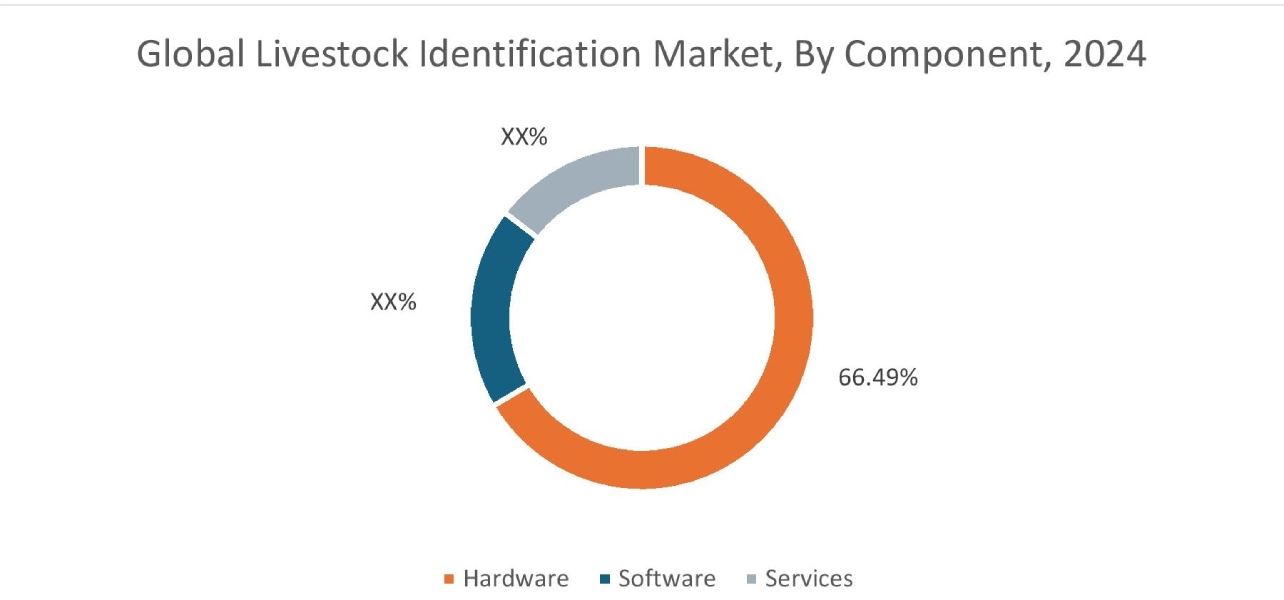

By Component:

Based on the component, the market is segmented into hardware, software, and services.

Trends in the component:

- Increasing adoption of hardware to track animal location is driving the livestock identification market share.

- Rising utilization of software that features real-time visibility to data is driving the livestock identification market trends.

Hardware accounted for the largest revenue share of 66.49% in the year 2024.

- In hardware, RFID tags have experienced a rising utilization in farms to store the animal’s identification number and breed which has resulted in the livestock identification market expansion.

- Additionally, there has been a rising adoption of ear sensors to collect data about the animal’s fertility and nutritional status which is driving the global livestock identification market.

- Moreover, the rising adoption of cameras to track a cow’s body condition and gait is driving the market.

- For instance, GAORFID offers animal ID scanner that integrates a temperature sensor for animal health monitoring. The rise in the adoption of sensors to monitor animal health is expected to drive the market.

- According to the market analysis, the rising advancements related to hardware to identify the breed of animals and fertility status are driving the livestock identification market trends.

Software is anticipated to register the fastest CAGR during the forecast period.

- There has been a rising adoption of software that features visualization of animal data including health and growth which is driving the market.

- Moreover, the growing utilization of software to create a visual catalogue of animals on the farm is boosting the market.

- For instance, Gallagher offers animal performance web and mobile app to track livestock performance. The rise in the adoption of software to categorize animals is expected to boost the market.

- Thus, the increasing utilization of software for visualization of animal data is driving the overall market.

By Type:

Based on the type, the market is segmented into animal ownership identification, disease management & control, milk traceability, breeding record management, farm management & productivity, and others.

Trends in the type:

- Rising adoption of milk traceability to improve milking efficiency is driving the market trends.

- Increasing utilization of disease management & control to detect illness is driving the livestock identification market demand.

Milk traceability accounted for the largest revenue share in the year 2024.

- Milk traceability systems are being utilized to track daily milk yields of cows which are driving the market.

- Further, the systems have experienced a rising adoption in milking parlors which is driving the market demand.

- For instance, Nedap offers animal identification solutions for cows which includes milk yield recording.

- Thus, as per the analysis, the rising adoption of milk traceability to optimize the feeding intake of cattle in real time is driving the market.

Disease management & control is anticipated to register the fastest CAGR during the forecast period.

- Disease management & control systems have experienced a rising adoption to detect stress which is driving the market.

- Moreover, the system has experienced a rising utilization to enable timely interventions which can help improve animal welfare.

- For instance, COWMANAGER offers health monitoring system for tracking the health of cows. The rise in the adoption of disease management & control to catch diseases early is expected to boost the market.

- Therefore, the rising utilization of disease management & control to detect stress and enable timely interventions is driving the market.

By Animal Type:

Based on the animal type, the market is segmented into poultry, cattle, pigs, goats, and others.

Trends in the animal type:

- Increasing adoption of animal identification for cattle to monitor cow location is driving the market trends.

- There has been a rising utilization of animal identification for pigs to provide accurate dosing information for medications which is driving the livestock identification market demand.

Cattle segment accounted for the largest revenue share in the year 2024.

- There has been a rising adoption of animal identification in cattle for early detection of an illness which is driving the market.

- Further, animal identification is being used to ensure optimal breeding schedules for the cattle.

- Moreover, companies have started offering animal identification software that features pregnancy cycle alerts and reminders which are driving the market.

- For instance, Afimilk Ltd. offers cow monitoring system that includes neck collar and leg sensor to improve herd health. The rise in the adoption of neck collars and sensors for cow monitoring is expected to boost the market.

- Thus, the rising adoption of animal identification for early detection of an illness is driving the livestock identification market size.

Pigs segment is anticipated to register the fastest CAGR during the forecast period.

- Animal identification for pigs has experienced a rising adoption to track weight gain and feed intake which is driving the market.

- Moreover, the rising utilization of the system to identify high and low performing pigs for better production management is driving the market growth.

- Additionally, there has been a rising adoption of pig identification software to manage sows, piglets, fattening pigs, and breeding.

- According to the livestock identification market analysis, the rising trend in the adoption of livestock identification for pigs to track weight gain is propelling the livestock identification industry during the forecast period.

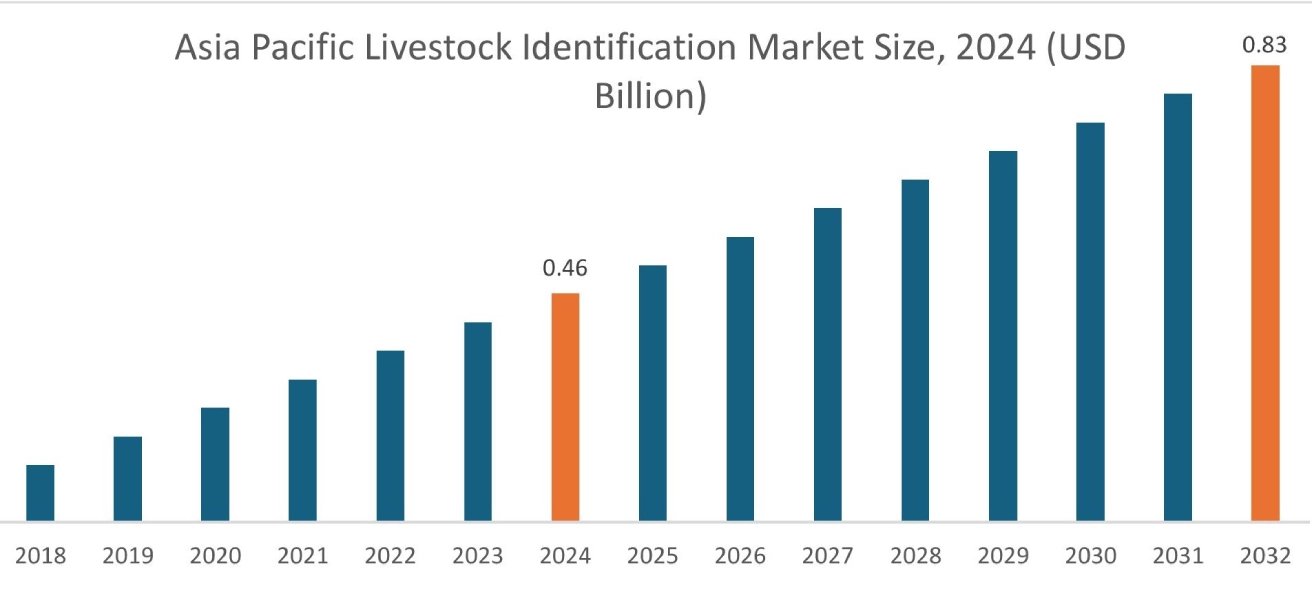

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

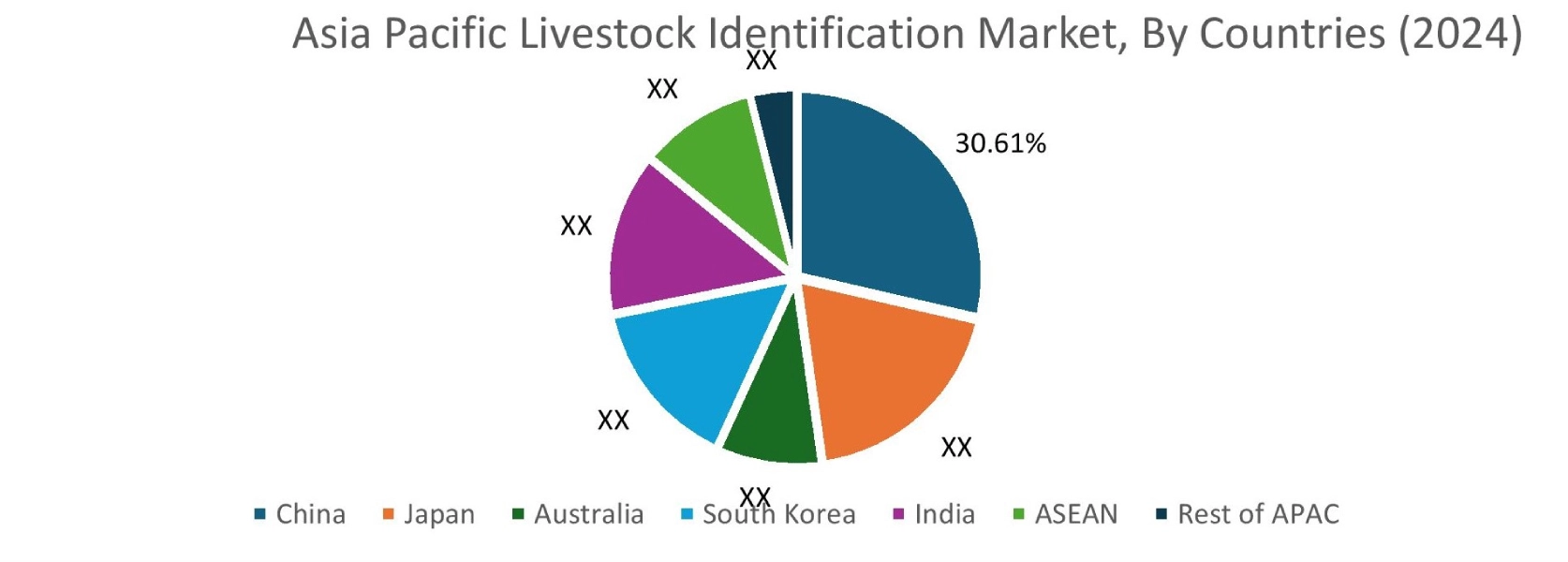

Asia Pacific region was valued at 0.46 Billion in 2024. Moreover, it is projected to grow by 0.49 Billion in 2025 and reach over 0.83 Billion by 2032. Out of this, China accounted for the maximum revenue share of 30.61%. As per the livestock identification market analysis, the growth in the Asia-Pacific region is primarily driven by the increasing utilization of RFID and rising utilization of animal identification for cows.

North America is estimated to reach over USD 0.98 Billion by 2032 from a value of USD 0.56 Billion in 2024 and is projected to grow by USD 0.60 Billion in 2025. In North America, the growth of livestock identification industry is driven by the increasing adoption of GPS and sensors. Moreover, the increasing utilization of animal identification for tracking pigs has resulted in the rise in livestock identification market share.

Additionally, the regional analysis depicts that the rising utilization of animal identification to monitor goats and sheep is driving the market demand in Europe. Furthermore, as per the market analysis, the market demand in Latin America is expected to grow at a considerable rate due to rising utilization of the systems for cattle monitoring. Middle East and African regions are expected to grow at a considerable rate due to factors such as growing investments in animal husbandry and rising GDP among others.

- For instance, according to the Ministry of Fisheries, Animal Husbandry & Dairying, milk production in India has grown by approximately 63% from 2014-15 to 2023-24. The rise in milk production and dairy farming is expected to boost the market as animal identification is utilized for monitoring cattle.

- For instance, according to the USDA National Agricultural Statistics Service, in the year 2022, U.S. farmers had sales of hogs amounting to about USD 36.4 billion. The sales of hogs witnessed an increase of 38% from 2017 to 2022. The rise in pig and hog sales is expected to boost the market as animal identification is utilized to track pig weight and feed intake.

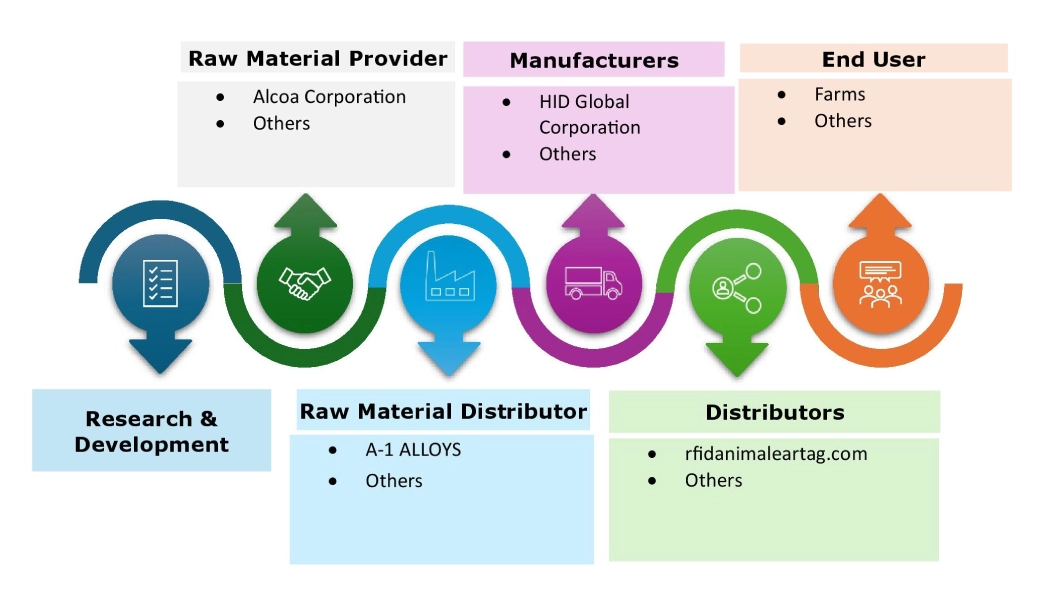

Top Key Players and Market Share Insights:

The global livestock identification market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the livestock identification market. Key players in the livestock identification industry include-

- Datamars (Switzerland)

- Gallagher Group Limited (U.S.)

- AmerisourceBergen Corporation (U.S.)

- Cattle Eye Ltd (U.K.)

- Jio Things Limited (India)

- HID Global Corporation (U.S.)

- Zoetis Services LLC (U.S.)

- FarmKeep (U.S.)

- GEA Group Aktiengesellschaft (Germany)

- Shearwell Data LTD (U.K.)

Recent Industry Developments

Partnership

Livestock Identification Market Report Insights :

- In March 2025, CERES TAG announced that the company entered in a partnership with Jeffers Inc., to boost CERES TAG’s distribution network. The partnership aims to deliver CERES TAG products to farmers in the US through the distribution network of Jeffers Inc.

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 2.96 Billion |

| CAGR (2025-2032) | 7.9% |

| By Component |

|

| By Type |

|

| By Animal Type |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada GMV Innovating Solutions S.L. (Madrid)

|

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

;

Key Questions Answered in the Report

How big is the livestock identification market? +

The livestock identification market was valued at USD 1.71 Billion in 2024 and is projected to grow to USD 2.96 Billion by 2032.

Which is the fastest-growing region in the livestock identification market? +

Asia-Pacific region is experiencing the most rapid growth in the livestock identification market.

What specific segmentation details are covered in the livestock identification market report? +

The livestock identification market report includes component, type, animal type and region.

Who are the major players in the livestock identification market? +

The key participants in the livestock identification market are Datamars (Switzerland), Gallagher Group Limited (U.S.), HID Global Corporation (U.S.), Zoetis Services LLC (U.S.), FarmKeep (U.S.), GEA Group Aktiengesellschaft (Germany), Shearwell Data LTD (U.K.), AmerisourceBergen Corporation (U.S.), Cattle Eye Ltd (U.K.), Jio Things Limited (India), and Others.