RFID Tags Market Size:

RFID Tags Market size is estimated to reach over USD 25,420.96 Million by 2031 from a value of USD 12,519.40 Million in 2023 and is projected to grow by USD 13,455.35 Million in 2024, growing at a CAGR of 9.3% from 2024 to 2031.

RFID Tags Market Scope & Overview:

RFID (Radio Frequency Identification) tags are small electronic devices that store information and communicate with other devices using radio waves. It is essential to track and identify objects, animals, or even people without needing direct contact and line of sight. These tags are small devices that can be attached to a wide variety of items, ranging from products in a retail store to equipment in a warehouse or livestock on a farm. Additionally, there are two main components in tags which include a microchip and an antenna. The role of the microchip is to store information about unique identifiers, product details, and others depending on the application. Further, the information is transmitted through an antenna that interacts with an RFID reader. Moreover, it is widely used in inventory management by providing real-time data on stock levels, tracking medical equipment and items, managing information and contactless payments. Furthermore, it offers scalable, reliable solutions for tracking and managing assets, reducing errors, and improving efficiency. The aforementioned features of tags are major determinants for increasing their deployment in retail, healthcare, logistics, and other industries.

RFID Tags Market Insights:

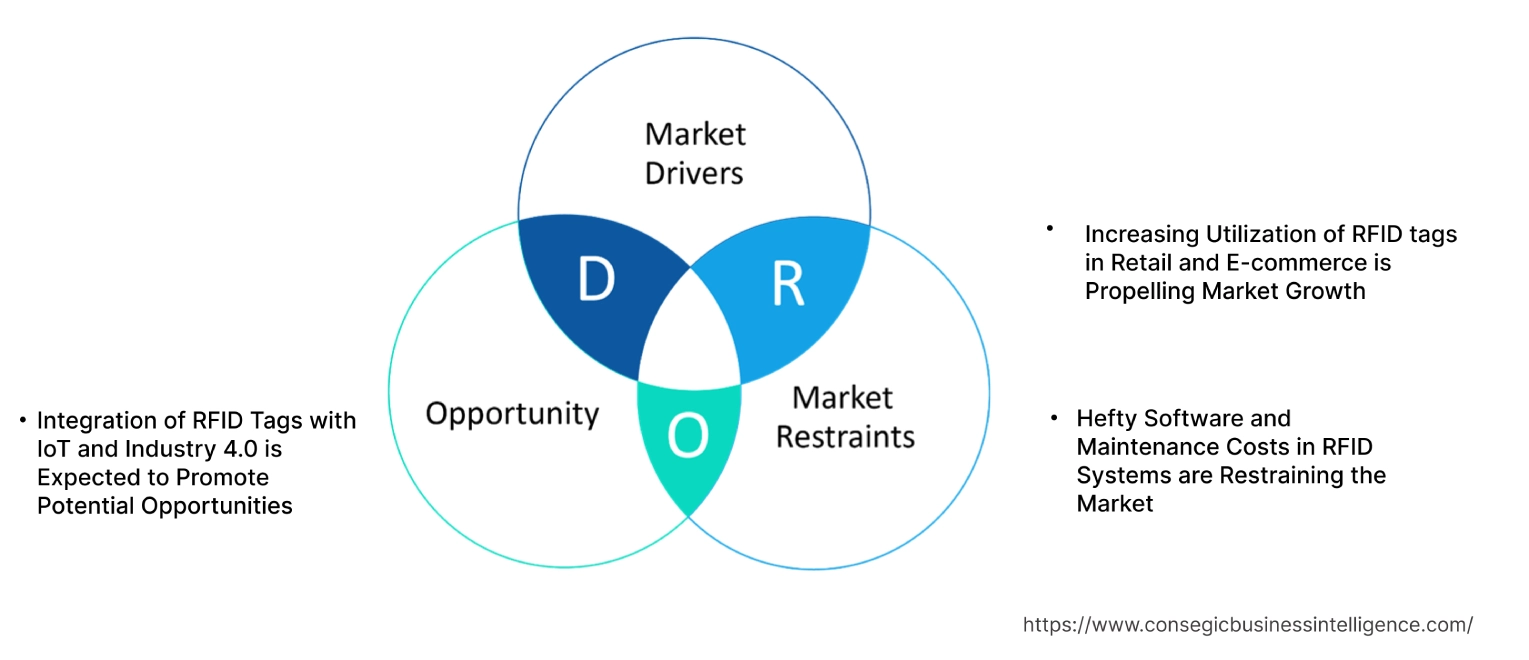

RFID Tags Market Dynamics - (DRO) :

Key Drivers:

Increasing Utilization of RFID tags in Retail and E-commerce is Propelling Market Growth

The growth of e-commerce and the ongoing digital transformation within the retail industry have created a fertile environment for the widespread adoption of RFID tags. As consumers increasingly turn to online shopping, retailers face new challenges in managing inventory, preventing theft, and meeting customer expectations for fast and accurate order fulfillment. RFID technology is playing a crucial role in addressing these challenges and driving efficiency across retail operations. Additionally, these tags enable retailers to gain real-time visibility into their stock, helping them track every item from the moment it enters the warehouse to the point of sale by reducing downtime and improving operational efficiency.

- In October 2021, Honeywell introduced the IH40 RFID Handheld Reader, aimed at improving field operations and inventory management in retail. This device allows workers to quickly scan and update inventory data on the go, enhancing operational efficiency, improving accuracy, and reducing downtime.

Therefore, the rise of e-commerce and the digital transformation of the retail industry have significantly driven the RFID tags market growth.

Key Restraints :

Hefty Software and Maintenance Costs in RFID Systems are Restraining the Market

RFID systems require specialized software for managing and analyzing the data collected. The cost of acquiring, licensing, and maintaining this software can contribute to the overall expense. Data management platforms handle the vast amounts of data generated by tags, including inventory levels, asset tracking, and movement patterns. Licensing these platforms often involves significant upfront costs. Additionally, major version upgrades are necessary to keep the software up-to-date with technological advancements and changes in industrial standards. These upgrades involve substantial costs, both in terms of software licensing fees and the potential demand for new hardware or additional training. Hence, the cumulative costs of software licensing, updates, maintenance, and support contribute to the hefty investment, hindering the RFID tags market demand.

Future Opportunities :

Integration of RFID Tags with IoT and Industry 4.0 is Expected to Promote Potential Opportunities

As businesses embrace automation and smart manufacturing, tags have become essential tools in creating interconnected and intelligent environments. RFID technology, when combined with IoT, allows for continuous and real-time data collection from various assets and processes. Additionally, in a smart manufacturing setup, these tags can be embedded in equipment, products, and components to capture data on their status, location, and usage. This real-time monitoring provides valuable insights into the operational health of machinery, inventory levels, and supply chain movements. Moreover, connecting this data with IoT, enables predictive management, efficient asset management, enhanced supply chain, improved decision-making, and enhanced automation.

- In November 2022, Impinj unveiled M780 and M781 RAIN RFID tag chips for IoT connectivity. It is designed to offer extended read ranges, manage shell life, reduce waste, and high-speed data transmission. These tags are used for large product identifiers to cater the industrial-specific solutions.

Consequently, as per the analysis, this synergy between RFID and IoT enhances efficiency and overall operational performance, fueling the RFID tags market opportunities.

RFID Tags Market Segmental Analysis :

By Product Type:

Based on product type the market is bifurcated into active RFID and passive RFID.

Trends in the type:

- There is a growing trend towards Active RFID tags which are increasingly integrated with IoT devices and sensors for enhanced data collection, supporting predictive maintenance, condition monitoring, and environmental tracking.

- Ongoing innovations are improving the durability and performance of passive tags, this trend makes them suitable for harsh environments including cold chain logistics or industrial supply chains.

The passive RFID segment accounted for the largest revenue share in 2023.

- Passive RFID do not have a built-in power source, they rely on the energy emitted from RFID reader to activate and transmit information.

- These tags are highly efficient for close-range scanning and often embedded products, packaging, or labels for tracking.

- Additionally, these tags are used for theft prevention, inventory management, product authentication, and stock control.

- In May 2022, HID Global acquired Vizinex RFID to expand its portfolio of high-performance passive RFID tags. This acquisition aimed at expanding the presence of HID Global across various industries including healthcare, manufacturing, oil & gas, data centers, and others. The Vizinex RFID offers high-quality standards, improved tracking, security, and authentication.

- Therefore, according to analysis, the aforementioned features are factors determining the widespread adoption of passive RFID across various industries, fueling the RFID tags market trend.

The active RFID is anticipated to register the fastest CAGR during the forecast period.

- Active RFID tag comes with their power source, which enables them to have a significantly longer read range.

- The built-in batteries and active RFID continuously broadcast signals, enabling real-time tracking of assets.

- Additionally, as the demand for connected devices and IoT systems increases, active tags will play a key role in enabling seamless communication and data sharing across networks, enhancing automation and operational efficiency.

- In February 2023, HID Global attains GuardRFID to expand healthcare offerings along with security for patients and staff. The GuardRFID portfolio consists of RFID readers, tags, exciters, and software support. It features infant security, improved communication, and asset tracking. This offering when merged with HID's IoT business unit will enhance operational efficiency.

- Thus, analysis shows that extended range, enhanced data capabilities, and real-time monitoring features of active tags are proliferating the global RFID tags market.

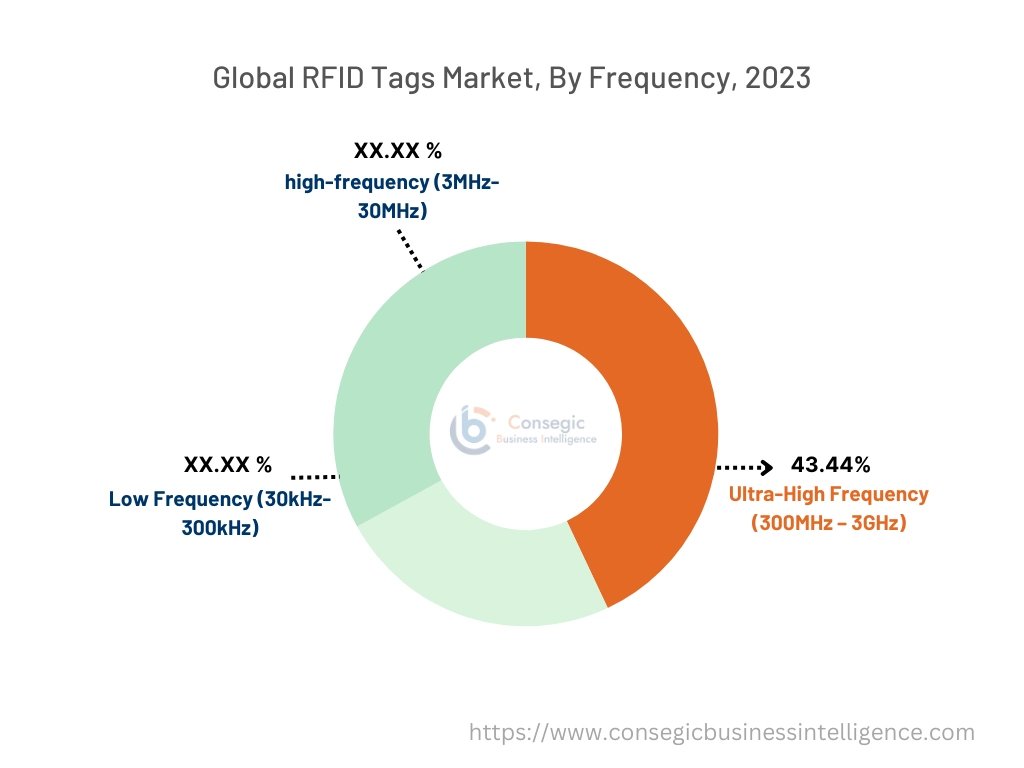

By Frequency:

Based on the frequency the market is trifurcated into low frequency (30kHz-300kHz), high-frequency (3MHz-30MHz), and ultra-high frequency (300MHz – 3GHz).

Trends in the Frequency:

- The growth of contactless payment solutions and the increasing adoption of smart labels in various industries including retail and logistics are driving advancements in high-frequency RFID. Innovations are focusing on enhancing security features, improving read/write speeds, and integrating with mobile technologies.

- Technological advancements are driving improvements in ultra-high frequency RFID tag and reader performance, including higher sensitivity, better interference resistance, and greater durability. This trend in enhancements is aimed at expanding the use of UHF RFID in challenging environments and applications requiring high performance.

The ultra-high frequency accounted for the largest revenue share of 43.44% in the year 2023 and is anticipated to register the fastest CAGR during the forecast period.

- Ultra-high frequency (UHF) ranges 300MHz-3GHz, it offers a longer read range of up to 12 meters or more, making it ideal for applications that require tracking over greater distances.

- UHF RFID handles higher data transfer rates, which is crucial for applications involving large volumes of data or requiring fast processing speeds.

- Moreover, it is extensively used in supply chain and logistics for tracking goods throughout the entire supply chain, from manufacturing to retail. Its ability to provide real-time visibility and automation has made it the preferred choice for these sectors.

- In March 2021, InvoTech launched UHF-RFID technology to automate the inventory process, providing real-time data on the location and status of uniforms. By implementing this system, organizations significantly reduce labor costs, minimize uniform loss, and improve overall operational efficiency.

- Thus, as per the analysis, the capability of UHF RFID including higher data throughput and widespread adoption is proliferating the global RFID tags market share.

By End-User:

Based on end-user the market is segmented into retail, transportation and logistics, agriculture and forestry, manufacturing, healthcare, and others.

Trends in the End-User:

- There is a growing trend towards RFID systems which enable automated inventory management and warehouse operations, including real-time stock level monitoring and automatic reordering, thus reducing manual labor and errors.

- RFID technology enables secure access control in government buildings and facilities, providing a streamlined and secure method for managing personnel entry and exit.

The retail segment accounted for the largest revenue share in the year 2023.

- RFID technology is extensively used in retail for various applications including inventory management, loss prevention, and improving the customer shopping experience.

- It provides real-time visibility into inventory levels, helping retailers manage stock more effectively. This leads to reduced out-of-stock situations, better stock replenishment, and minimized excess inventory.

- In October 2022, Checkpoint Systems launched SFERO, a modular RFID as an EAS solution. This tag is designed to provide customized RFID, high performance, and improve both loss prevention and inventory accuracy in retail stores.

- Hence, the retail application is currently leading the RFID tags market demand due to significant benefits in inventory management and loss prevention.

Healthcare is anticipated to register the fastest CAGR during the forecast period.

- RFID technology is crucial for reducing medication errors, tracking patient movements, and ensuring proper patient identification, which enhances overall patient safety.

- Hospitals and healthcare facilities use RFID to track medical supply chain management, equipment, and pharmaceuticals, improving inventory management and reducing waste.

- In May 2022, Avery Dennison introduced dual frequency RFID inlays, AD Medio Web DF EM4425 and AD Web DF EM4425 V12. It is specifically designed for medical applications by providing supply chain management, inventory management, product authentication, brand protection, and customer engagement.

- Hence, the analysis shows that these factors are driving the healthcare segment towards dominance in the RFID tags market opportunities.

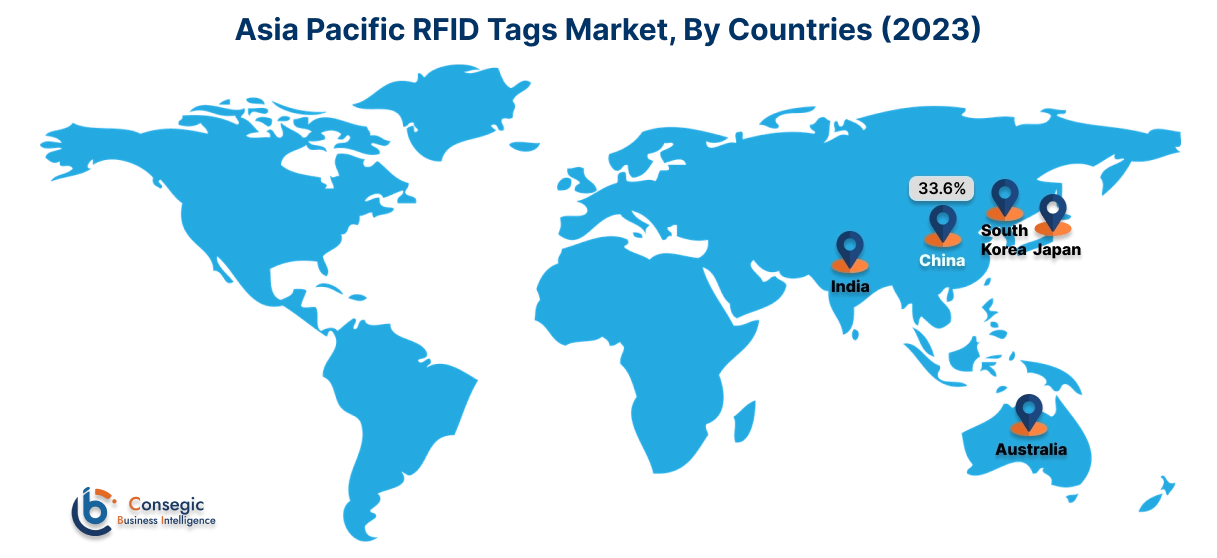

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 3,144.77 Million in 2023. Moreover, it is projected to grow by USD 3,389.64 Million in 2024 and reach over USD 6,606.91 Million by 2031. Out of this, China accounted for the maximum revenue share of 33.6%. According to the RFID tags market analysis, Asia Pacific is anticipated to dominate. The region's rapid economic growth, particularly in countries like China, India, and Japan, is driving substantial investments in RFID technology across various sectors, including retail, logistics, supply chain, and healthcare. Additionally, the expansion of e-commerce and retail sectors in Asia-Pacific further fuels the demand for RFID solutions, as businesses seek to improve inventory management, streamline operations, and enhance customer experiences.

- In August 2024, BCI (Bar Code India) launched Dristi a ‘Made in India' IoT RFID reader. It is designed to revolutionize supply chain management across manufacturing, distribution, transportation, and retail applications. It is incorporated with a powerful processor with a large memory capacity and 4G-LTE/Wi-Fi network connection.

North America is estimated to reach over USD 9,405.75 Million by 2031 from a value of USD 4,723.99 Million in 2023 and is projected to grow by USD 5,068.93 Million in 2024. North America is currently dominating the RFID tags market due to its leadership in technological innovation and high adoption rates, particularly in sectors such as retail and logistics. The region's advanced infrastructure, substantial investments in research and development, stringent regulatory requirements, and incorporation with IoT drive widespread deployment and integration of RFID systems.

- In August 2023, Avery Dennison collaborated with Wiliot to build and scale the future of the IoT. This collaboration aimed at integrating the AD's RFID tags with Wiliot's IoT features. It will leverage R&D capabilities and scale to design and manufacture Wiliot tags and enhance supply chain management.

Europe is experiencing growth in RFID adoption driven by stringent regulatory requirements, especially in healthcare and food safety. European countries are increasingly integrating RFID technology to comply with regulations and enhance operational efficiencies.

Latin America is an emerging RFID tags market for RFID technology, with growing interest in improving supply chain efficiencies and retail operations. Adoption is increasing in sectors such as logistics, healthcare, and retail.

The Middle East and Africa are gradually adopting RFID technology, with a focus on improving supply chain efficiency and enhancing security in various sectors. Growth is driven by increasing investments in infrastructure and technology.

Top Key Players & Market Share Insights:

The RFID tags market is highly competitive with major players providing reliable and scalable solutions for identifying and tracking assets to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the RFID tags market. Key players in the RFID tags industry include-

- Avery Dennison Corporation (US)

- Zebra Technologies Corporation (US)

- Impinj, Inc. (US)

- Smartrac N.V. (Netherlands)

- Checkpoint Systems, Inc. (US)

- NXP Semiconductors N.V. (Netherlands)

- Tageos SAS (France)

- HID Global Corporation (US)

- Alien Technology, LLC (US)

- Honeywell International Inc. (US)

- Confidex Ltd. (Finland)

- RF Code, Inc. (US)

- Invengo Information Technology Co., Ltd. (China)

- GAO RFID Inc. (Canada)

- Omni-ID, Inc. (US)

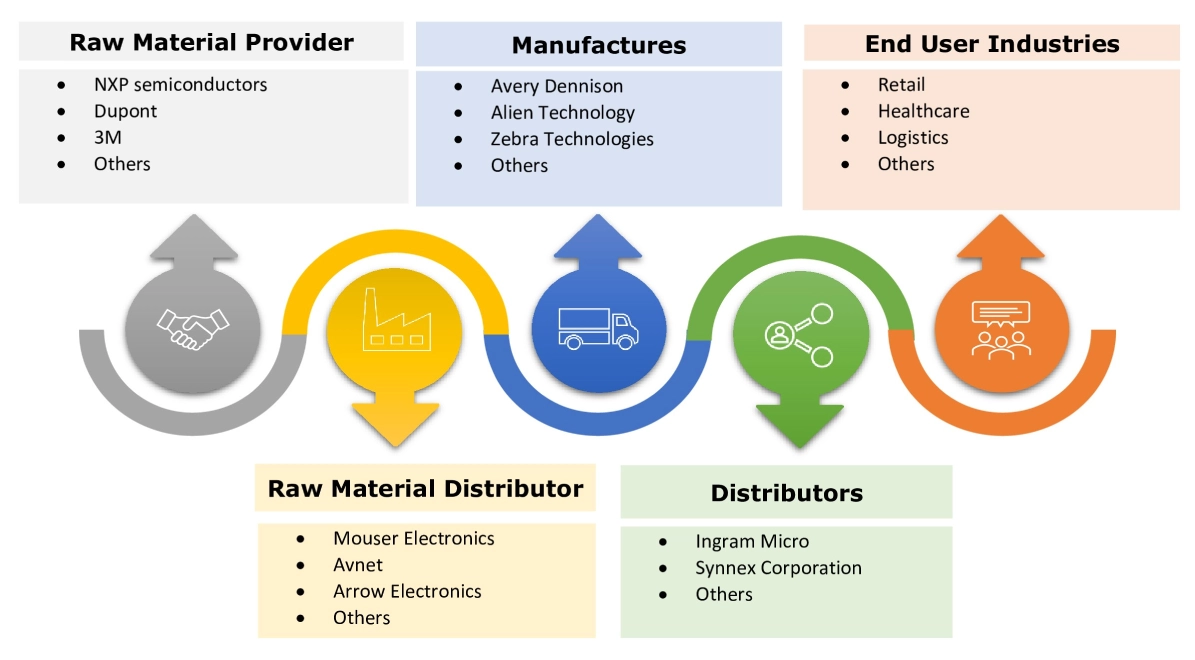

RFID tags Market Ecosystem:

Recent Industry Developments :

Collaboration:

- In January 2024, Avery Dennison unveiled a digital solutions lab at the Microsoft Technology Center (MTC) in Shanghai. The MTC introduced RFID solutions to cater to several businesses including food, beauty, and healthcare segments. This solution facilitates supply chain management and operational efficiency along with Microsoft's cutting-edge technology in applications and solutions across various industries.

Product Launches:

- In April 2024, Powercast introduces the RAIN RFID reader module to sustain extreme temperatures and weather conditions. This ruggedized module is designed to operate and communicate from -40oC to +85oC temperature. The RFID reader helps in identifying, tracking, and product authentication.

- In January 2024, Zebra Technologies introduced an FXR90 ultra-rugged fixed RFID reader. This reader provides maximum visibility even in rugged environments of retail warehousing or fulfillment centers. It features minimized data and inventory loss, enhanced tracking, and optimized operational efficiency.

- In November 2023, Impinj introduced the Impinj R720 RAIN RFID reader. This reader is equipped with Edge intelligence technology for optimizing speed, reducing network load and latency, increased read accuracy and range. It is targeted at automation in logistics and supply chain applications, offering real-time visibility and efficiency in asset tracking.

- In March 2023, NXP Semiconductors unveiled its UCODE 9xm RFID tags to cater to industrial-specific needs. The new tag IC features improved memory and processing capabilities, making it ideal for applications requiring high data integrity and performance, including supply chain management and asset tracking.

Investment:

- In January 2023, Avery Dennison announced a USD 100 million investment in the Querétaro, Mexico RFID plant. The investment aimed at technological development at the new facility to create more connected and transparent supply chains to enhance operational efficiency across multiple industries.

RFID Tags Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 25,420.96 Million |

| CAGR (2024-2031) | 9.3% |

| By Product Type |

|

| By Frequency |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

What are RFID tags? +

RFID (Radio Frequency Identification) tags are small electronic devices that store information and communicate with other devices using radio waves. It is essential to track and identify objects, animals, or even people without needing direct contact and line of sight.

How big is the RFID tags market? +

The RFID Tags Market size is estimated to reach over USD 25,420.96 Million by 2031 from a value of USD 12,519.40 Million in 2023 and is projected to grow by USD 13,455.35 Million in 2024, growing at a CAGR of 9.3% from 2024 to 2031.

Which region will lead the global RFID tags market? +

The Asia-Pacific region is anticipated to lead the RFID market due to the expansion of e-commerce and retail sectors in Asia-Pacific further fuels the demand for RFID solutions, as businesses seek to improve inventory management, streamline operations, and enhance customer experiences.

Who are the major key players in the RFID tags market? +

The key players in RFID tags market are Avery Dennison Corporation (US), Zebra Technologies Corporation (US), Alien Technology, LLC (US), Impinj, Inc. (US), Smartrac N.V. (Netherlands), Checkpoint Systems, Inc. (US), NXP Semiconductors N.V. (Netherlands), Honeywell International Inc. (US), Confidex Ltd. (Finland), RF Code, Inc. (US), Invengo Information Technology Co., Ltd. (China), GAO RFID Inc. (Canada), Omni-ID, Inc. (US), Tageos SAS (France), HID Global Corporation (US) and others.