Life Insurance Policy Administration Systems Market Size:

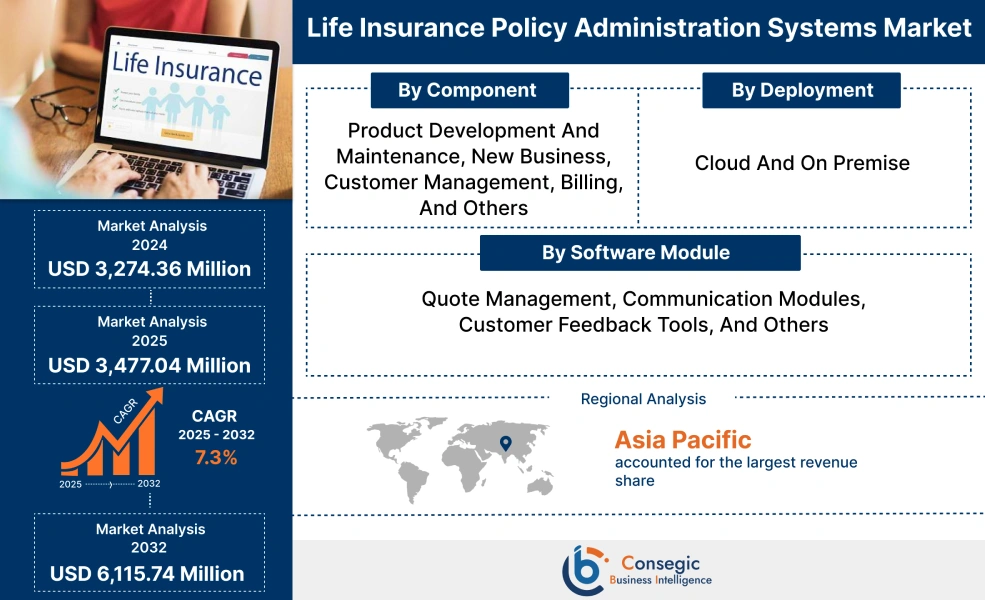

Life Insurance Policy Administration Systems Market size is estimated to reach over USD 6,115.74 by 2032 from a value of USD 3,274.36 Million in 2024 and is projected to grow by USD 3,477.04 Million in 2025, growing at a CAGR of 7.3% from 2025 to 2032.

Life Insurance Policy Administration Systems Market Scope & Overview:

Life insurance policy administration systems refer to strategic software that simplifies the entire lifecycle of policy and seamlessly integrates with various systems ensuring a cohesive flow. Life insurance policy administration system offers personalized policies, self-service portals, and multi-channel communication, ensuring tailored requirements of the individuals. Additionally, insurance policy administration software facilitates efficient management and data analysis, enabling insurers to respond quickly to meet regulatory requirements. Thus, life insurance policy administration systems automate key processes, improve operational efficiency, and enhance customer service.

Life Insurance Policy Administration Systems Market Dynamics - (DRO) :

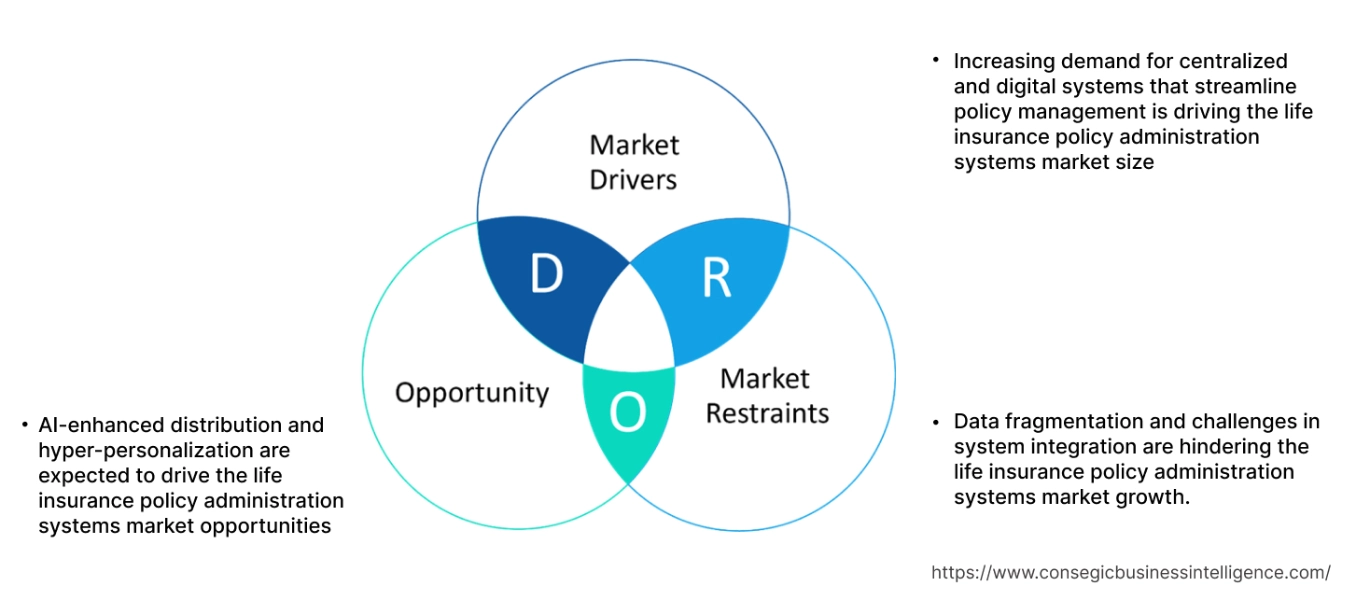

Key Drivers:

Increasing demand for centralized and digital systems that streamline policy management is driving the life insurance policy administration systems market size

Life insurance policy administration systems are essential software platforms utilized by insurance companies to manage the service life of policies including creation, underwriting, rating, quoting, and claims processing. Policy administration systems automate several key tasks like endorsements, policy issuance, and cancellations by reducing paperwork. Moreover, a centralized platform allows the system to manage data efficiently by ensuring accuracy and minimizing errors.

- For instance, Damco Solution offers an insurance policy administration system that streamlines the complete policy lifecycle from issuance to renewal. Moreover, the integration of artificial intelligence automates document generation and optimizes decisions focusing on customer service and operational excellence.

Hence, as per the life insurance policy administration systems market analysis, the above factors are driving the life insurance policy administration systems market size.

Key Restraints:

Data fragmentation and challenges in system integration are hindering the life insurance policy administration systems market growth.

Data fragmentation in policy administration software refers to the data spread across multiple locations and systems within an organization. In life insurance policy administration, insurers often operate with various separate systems including those for underwriting, policy issuance, and ongoing management, further leading to data silos.

Additionally, migrating data from one system to another often leads to inefficiencies in operations since it deals with different formats and structures. Hence, data fragmentation and other challenges associated with system integration further hinder the life insurance policy administration systems market expansion.

Future Opportunities :

AI-enhanced distribution and hyper-personalization are expected to drive the life insurance policy administration systems market opportunities

Integration of AI in life insurance policy administration software is designed to handle the complexities of large organizations while maintaining the highest level of security and compliance. In life insurance policy administration, automated workflows help to manage the review and approval processes in various applications like Power Apps, Power Automate, and custom web parts from SharePoint to enhance the overall experience for customers and stakeholders.

- For instance, Xoralia, an AI-powered policy and procedure management software, facilitates AI-powered search, automated workflows, and chabot integration in Microsoft 365, and Teams as it streamlines the entire policy lifecycle.

Hence, the rapid proliferation of AI-enhanced distribution and hyper-personalization in life insurance policy administration are projected to boost the life insurance policy administration systems market opportunities during the forecast period.

Life Insurance Policy Administration Systems Market Segmental Analysis :

By Component:

Based on component, the market is segmented into product development and maintenance, new business, customer management, billing, and others.

Trends in the component:

- Increasing trend in the adoption of customer management solutions due to the rise in automation, and the growing need for personalization and improved customer services.

- There is a rising trend toward the utilization of new business solutions, attributed to their several processes including new business case management, new business underwriting, and policy issuance.

Customer management segment accounted for the largest revenue in the overall life insurance policy administration systems market share in 2024.

- Customer management is the key aspect of life insurance policy administration intended to address the challenges of the industry.

- In life insurance policy administration systems, customer management solutions offer various features, including consolidated database and automated report generation, which provide real-time insights with minimal human effort.

- For instance, Salesforce offers various features within its platform that can be used to streamline policy administration processes.

- According to the life insurance policy administration systems market analysis, the rising adoption of customer management solutions is driving the life insurance policy administration systems market trends.

New business segment is anticipated to register the fastest CAGR growth during the forecast period.

- In the insurance policy administration system, new business refers to the process of onboarding and underwriting new policies, highlighting the success of sales and marketing to facilitate improved customer services.

- Moreover, new business solutions offer several functions including new business submission, case management, underwriting dashboards, endorsements, and others.

- For instance, Oracle offers Oracle insurance policy administration with new business underwriting (OIPA), which offers key benefits for business and IT roles. It includes various features like automated tasks, case management, and in-force underwriting for improved efficiency.

- Therefore, the above trends are propelling the life insurance policy administration systems market growth during the forecast period.

By Deployment:

Based on deployment, the market is segmented into cloud and on premise.

Trends in the deployment:

- The adoption of on-premise deployment is primarily driven by factors like enhanced security, reliability, personalized customization, and others.

- Key trends including enhanced scalability, availability of pay-as-you-go service, and enhanced security measures are driving the cloud deployment segment.

- In life insurance policy administration, cloud based deployment offers modular approach to policy management to provide robust solutions for life insurance policy management.

- Moreover, cloud-based life insurance policy administration provides end-to-end automated policy to manage a vast range of tasks like compliance management, documentation management, client database management, and others.

- For instance, Sapiens provides a comprehensive set of transformation products like BillinfPro, ClaimsPro, CoreSuite, and DigitalSiute to fully automate the insurance landscape.

- Thus, rising advancements associated with cloud-based policy administration solutions are driving the market.

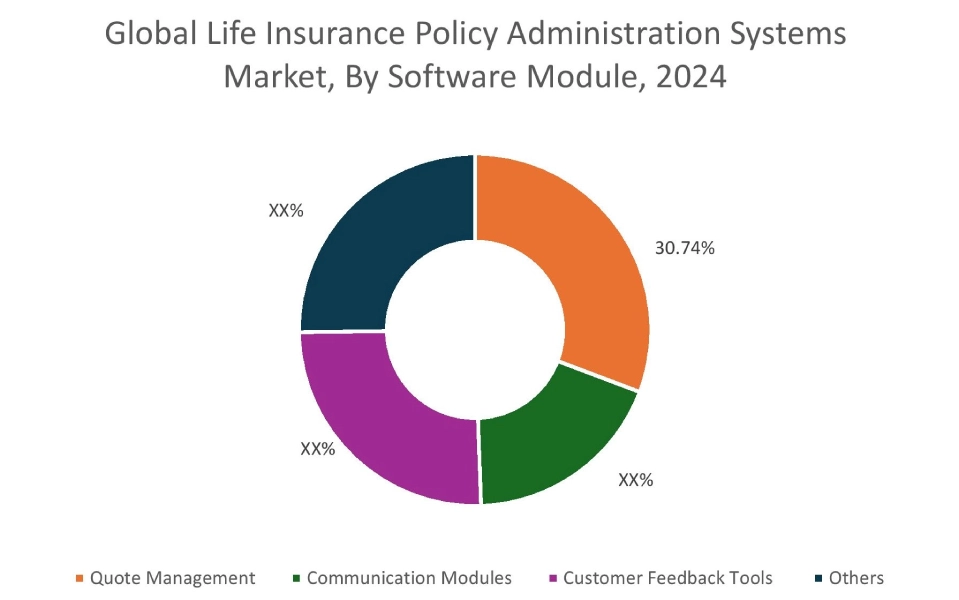

By Software Module:

Based on software module, the market is segmented into quote management, communication modules, customer feedback tools, and others.

Trends in the software module:

- Key factors including diversified feedback types, integration of AI features, and others are driving the life insurance policy administration systems market trends.

Quote management segment accounted for the largest revenue share of 30.74% in the overall market in 2024.

- Quote management in life insurance policy administration refers to the process of managing, creating and tracking insurance quotes for better compliance with quotation repository, accurate quotation and faster deal closures.

- Moreover, quote management streamlines the quoting process by seamlessly integrating with internal and external databases by improving sales forecasting and enhancing overall efficiency.

- For instance, Newgen provides quotation management solution to reduce data entry and collation efforts, lower cost of servicing, and simplify the transition of quotation into proposal.

- Therefore, the rising adoption of quote management solutions is further driving the market growth.

Customer feedback tools is anticipated to register fastest CAGR growth during the forecast period.

- In life insurance policy administration systems, customer feedback tools provide the statistics gathered from policy holders about their experience with the insurance company, which includes policy administration process.

- Customer feedback tools collect the data like direct feedback, indirect feedback, solicited feedback, unsolicited feedback, qualitative feedback and others.

- For instance, Diceus’s Vitaminise product suite includes customer feedback tool, which provides customer experiences, data-driven insights, and enhances operational efficiency of insurance companies.

- Therefore, the rising demand for customer feedback tools is expected to drive the life insurance policy administration systems market during the forecast period.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

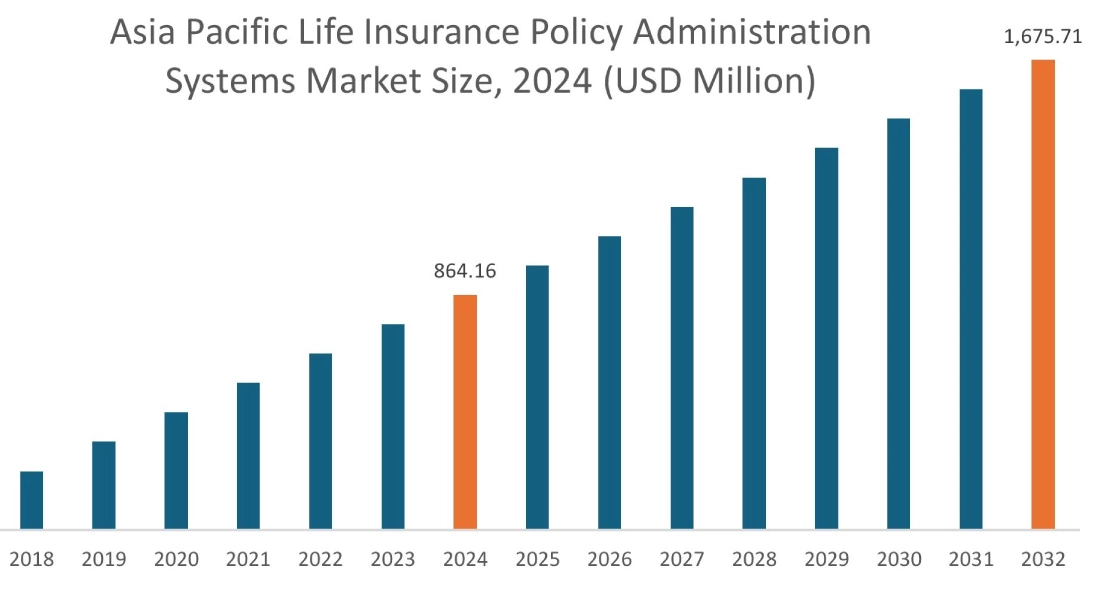

Asia Pacific region was valued at USD 864.16 Million in 2024. Moreover, it is projected to grow by USD 920.57 Million in 2025 and reach over USD 1,675.71 Million by 2032. Out of this, China accounted for the maximum revenue share of 28.72%. As per the market analysis, there is rising adoption life insurance policy administration in Asia-Pacific region, which is primarily driven by centralized data management and growing need for enhanced customer experience. Further, the significant proliferation of cloud-based insurance policy administration solutions along with increasing adoption of customer feedback tools are further driving the life insurance policy administration systems market expansion.

- For instance, Angular Minds, an India-based company offers a custom-built insurance policy administration systems to enhance operational efficiency, policy management, and risk assessments. The above factors are driving the life insurance policy administration systems market in the Asia-Pacific region.

North America is estimated to reach over USD 2,041.43 Million by 2032 from a value of USD 1,094.91 Million in 2024 and is projected to grow by USD 1,162.51 Million in 2025. In North America, the market growth is driven by rising developments in new business and customer management solutions, which further leads to significant rise in the adoption of the insurance policy administration system in the region. As per the analysis, rising enhancements related to customer feedback tools and increasing adoption of quote management solutions due to increased efficiency are further contributing to the life insurance policy administration systems market demand.

- For instance, Majesco, a U.S. based insurance company, provides Gen AI in insurance to enhance operational efficiencies and improve customer satisfaction. Moreover, utilizing Gen AI in insurance helps manage risk assessment by providing real time insights, which further helps insurers manage policy strategies efficiently.

Additionally, the regional analysis depicts that factors such as growing adoption of insurance policies and increasing need for effective insurance policy management solutions are driving the life insurance policy administration systems market demand in Europe. Furthermore, the market demand in Latin America, Middle East, and African regions is anticipated to grow at a substantial rate due to factors such as increasing adoption of AI and machine learning in risk assement and policy verification & reinsurance, along with growing focus on customer-centric approach, among others.

Top Key Players and Market Share Insights:

The global life insurance policy administration systems market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the life insurance policy administration systems industry. Key players in the life insurance policy administration systems industry include –

- Majesco (U.S.)

- Sapiens International (Israel)

- Life Pro (U.S.)

- EIS Group Inc. (U.S.)

- Instec Corporation (U.S.)

- Ebix Inc (U.S)

- Agency Smart LLC (U.S.)

- DXC Technology (U.S.)

- Accenture PLC (Ireland)

- Oracle Corporation (U.S.)

Recent Industry Developments :

Product Launch:

- In August 2024, Duck Creek Technologies launched a new policy administration solution called Policy with Active Delivery. Moreover, the solution offers low-code configuration tools for ensuring consistent and optimized outcomes.

Life Insurance Policy Administration Systems Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 6,115.74 Million |

| CAGR (2025-2032) | 7.3% |

| By Component |

|

| By Deployment |

|

| By Software Module |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the life insurance policy administration systems market? +

The life insurance policy administration systems market was valued at USD 3,274.36 Million in 2024 and is projected to grow to USD 6,115.74 Million by 2032.

Which is the fastest-growing region in the life insurance policy administration systems market? +

Asia-Pacific is the region experiencing the most rapid growth in the life insurance policy administration systems market.

What specific segmentation details are covered in the life insurance policy administration systems report? +

The life insurance policy administration systems report includes specific segmentation details for component, deployment, software module, and region.

Who are the major players in the life insurance policy administration systems market? +

The key participants in the life insurance policy administration systems market are Majesco (U.S.), Sapiens International (Israel), Ebix Inc (U.S.), Agency Smart LLC (U.S.), DXC Technology (U.S.), Accenture PLC (Ireland), Oracle Corporation (U.S.), Life Pro (U.S.), EIS Group Inc. (U.S.), Instec Corporation (U.S.) and others.