Passenger Service System Market Introduction :

Passenger Service System Market size is estimated to reach over USD 25,446.12 Million by 2032 from a value of USD 10,088.54 Million in 2024 and is projected to grow by USD 11,145.64 Million in 2025, growing at a CAGR of 12.30% from 2025 to 2032.

Passenger Service System Market Definition & Overview :

A passenger service is a comprehensive software platform used by airlines and travel companies to manage and automate various passenger-related processes and services, namely ancillary services and flight management services. Passenger service system encompasses a wide range of functions, including passenger reservations and ticketing, check-in and boarding management, flight scheduling and inventory control, baggage handling, and ancillary services. Additionally, as per the analysis, the system acts as the central hub for handling passenger data and facilitating seamless interactions between travelers and airlines, ensuring efficient and streamlined operations in the aviation industry.

Passenger Service System Market Insights :

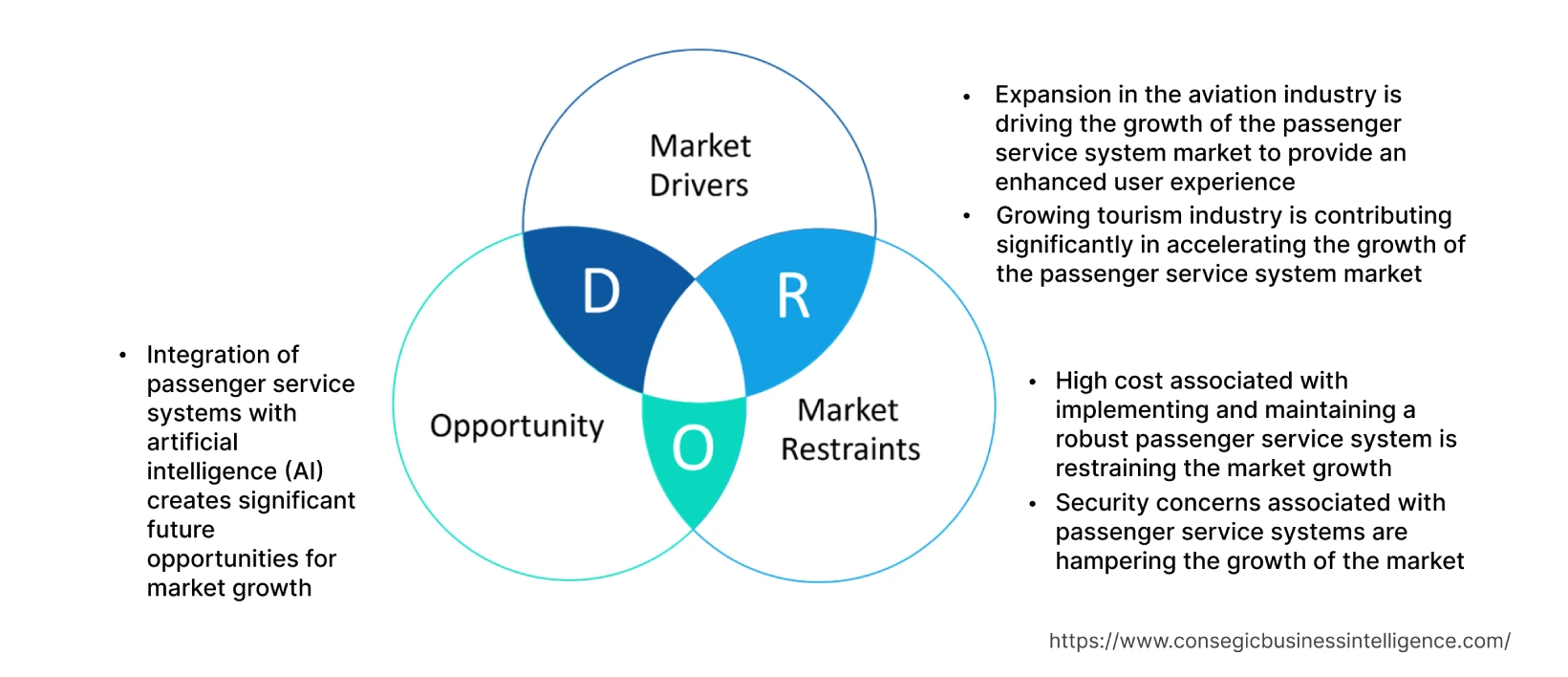

Passenger Service System Market Dynamics - (DRO) :

Key Drivers :

Expansion in the aviation industry is driving the growth of the market to provide an enhanced user experience

The aviation industry is experiencing a steady increase in air travelers which leads to a higher requirement for efficient solutions to handle the increased passenger volume and streamline operations. Additionally, based on the analysis, the growing competition among airlines is also increasing the demand for these systems to provide an improved traveling experience. Moreover, passengers require a seamless journey experience that further raises the demand of passenger service solutions to offer enhanced user experience. These service systems play a vital role in managing passenger data, enabling airlines to offer personalized services, loyalty programs, and efficient customer support. Consequently, the expanding airline sector is driving the trend for advanced passenger service system market demand to provide enhanced passenger satisfaction and loyalty, ultimately driving business growth. For instance, in May 2023, according to Indian Aerospace and Defence Bulletin, the Indian domestic airlines are experiencing a significant passenger surge accounting to 503.92 lakh passengers. The figure demonstrates a prominent annual expansion of 42.85% in comparison to 2022 with 352.75 lakh domestic passengers. The surge in the number of flyers thus contributing in driving the expansion of the passenger service system market to offer improved travel experience.

Growing tourism industry is contributing significantly in accelerating the growth of the market

The surge in tourist numbers is increasing the demand to efficiently manage passenger bookings, reservations, check-in processes, and other services offered throughout the travel journey. These passenger system solutions provide the necessary infrastructure and capabilities to handle the growing volume of tourists and travel requirements. Additionally, tourists expect a seamless and hassle-free travel experience from booking the flights to reaching the destinations. These systems help airlines to deliver a smooth travel experience by integrating various processes, namely ticket booking, seat selection, baggage handling, check-in, boarding, and post-flight services. The systems enable airlines to provide efficient and personalized services, enhancing the overall experience for tourists. Consequently, the growing tourism sector is driving the expansion of the passenger service system market to provide an enhanced traveling experience. For instance, according to the 2021 report of the Indian Ministry of Tourism, approximately 79.2% of Foreign Tourist Arrivals (FTA) entered India through air routes in which Delhi and Mumbai airports accounted to 44.2% of the total FTAs in India. The rise in tourist numbers is thus contributing significantly in propelling passenger service system market growth and trends.

Key Restraints :

High cost associated with implementing and maintaining a robust is restraining the market

Implementing a robust solution involves significant upfront costs including expenses related to software licenses, hardware infrastructure, customization, data migration, and training. The high cost limits the adoption of service systems by small airlines with limited budgets, hampering the growth of the market. In addition, based on the analysis, the cost of maintaining and supporting a the system is also high including regular updates, bug fixes, security patches, and technical support. Airlines must allocate resources to ensure the system is well-maintained, up-to-date, and operating efficiently, resulting in additional upfront costs, thus impeding the expansion of the global passenger service system market.

Security concerns associated with passenger service systems are hampering the market

Passenger service systems store and process vast amounts of passengers' sensitive data including personal information, payment details, travel itineraries, and loyalty program information, raising the risk of data breaches and unauthorized access. Additionally, cyberattacks misuse travelers' data that erode passenger trust, and deter airlines from implementing passenger service solutions, hence restraining the passenger service system market.

Future Opportunities :

Integration of passenger service systems with artificial intelligence (AI) creates significant future opportunities for market

Artificial intelligence enables passenger service solutions to analyze vast amounts of passenger data and derive valuable insights. The algorithms aid in understanding passenger preferences, behaviors, and travel patterns, and these systems offer personalized services based on the derived data. Additionally, AI-powered web engines offer tailored travel options, ancillary services, and personalized promotions, leading to improved customer satisfaction and increased revenue. Moreover, AI-powered chatbots and virtual assistants handle customer inquiries, provide real-time support, and assist with various customer service tasks. Furthermore, airlines offer 24/7 customer support, quick responses to passenger queries, and efficient problem resolution by utilizing AI solutions. Subsequently, as per the analysis the integration of artificial intelligence with these systems is creating potential passenger service system market opportunities and trends in the upcoming years.

Passenger Service System Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 25,446.12 Million |

| CAGR (2025-2032) | 12.3% |

| Based on the Component | Software and Service |

| Based on the Deployment | On-Premise and Cloud |

| Based on the Provider | In-House and Third-Party Provider |

| Based on the Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Amadeus IT Group SA, Bravo Passenger Solutions Pte Limited, Enoya-one LTD (AeroCRS), Hexaware Technologies Ltd., IBM Corporation, KIU System Solutions, Mercator Limited, Radixx International, Sabre Corporation, SITA NV, IBS Software |

Passenger Service System Market Segmental Analysis :

Based on the Component :

The component segment is bifurcated into software and service. The software segment accounted for the largest market share in 2024 and comprises airline inventory system, departure control system, airline reservation system, loyalty system, ancillary system, internet booking system, customer care system, and airport management consulting. Airline reservation system holds the largest revenue as the system handles the core functionality of managing passenger bookings, seat availability, fare classes, and flight schedules. Additionally, based on the analysis the airline reservation system serves as the primary system for customers to search, book, and secure flight reservations. Moreover, the system ensures accurate and up-to-date information regarding flight schedules, seat availability, and pricing to efficiently manage and distribute the inventory, hence contributing significantly in driving the segment.

Services segment is anticipated to witness the fastest CAGR during the forecast period. Passenger service involves integration with various airline systems, including revenue management, crew management, and airport operations. Additionally, airlines require customization to align these service systems with specific workflows, branding, and business requirements. Service providers play a vital role in managing the integration process, providing consultancy, and offering customization services to ensure a seamless and tailored solution. For instance, in July 2022, Tata Group selected Amadeus technology for transforming Air India services including revenue management, merchandising, retailing, and frequent flyer program management. Advanced services are launched to enhance the operational efficiency of the airlines, hence contributing significantly in propelling the market trend.

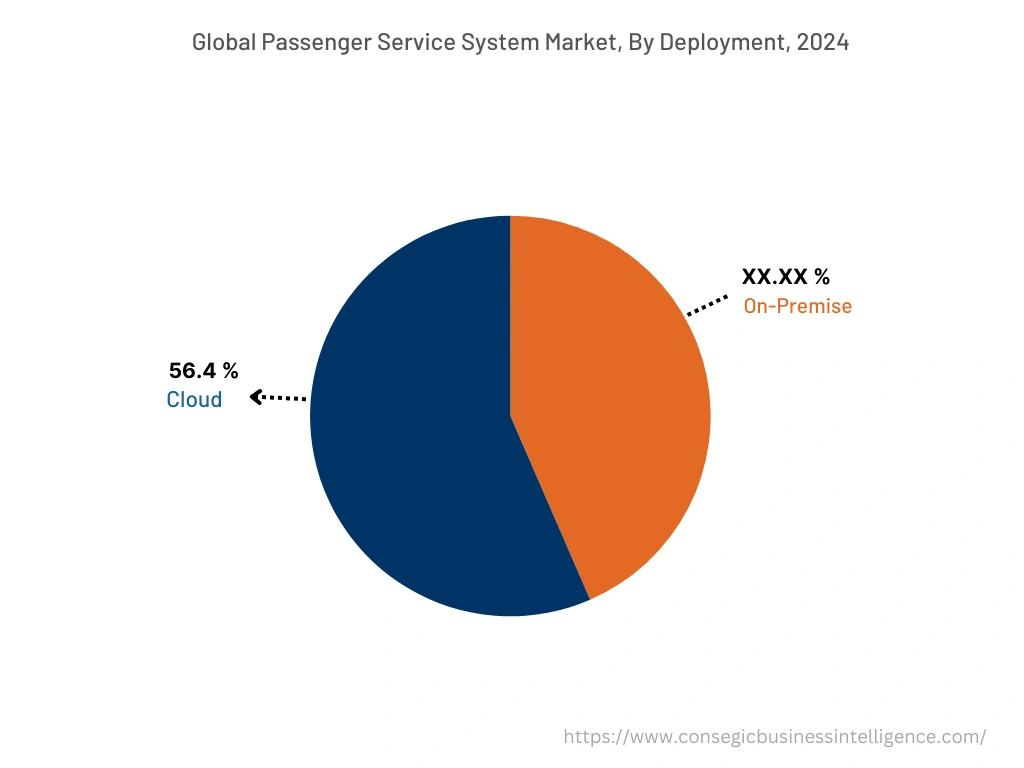

Based on the Deployment :

The deployment segment is bifurcated into on-premise and cloud. Cloud-based passenger service systems accounted for the largest market share of 56.4% in 2024 and is anticipated to witness the fastest CAGR during the forecast period. The expansion is attributed to the ability of cloud-based passenger service solutions to offer scalability and flexibility, allowing airlines to easily scale the operations up or down based on the requirement. In addition, cloud infrastructure enables airlines to quickly adapt to changes, expand the services, and efficiently handle peak periods without investing in infrastructure modifications. Moreover, as per the analysis, cloud platforms dynamically allocate resources based on demand, ensuring optimal performance and cost-efficiency, hence contributing notably in driving the adoption of cloud-based passenger service systems. For instance, in December 2021, DXC Technology announced a multiyear renewal with Copa Airlines in collaboration with Microsoft Corporation to modernize this passenger system by transferring the data to a cloud platform. The agreement was made to provide a scalable and flexible solution to airlines to improve customer and staff experience, thus contributing remarkably in driving the cloud segment.

Based on the Provider :

The provider segment is classified into in-house and third-party providers. Third-party providers accounted for the largest market share in 2024 and will witness the fastest CAGR as third-party providers specialize in developing and offering passenger service solutions as the core business. Additionally, third-party providers have extensive experience and expertise in passenger service solution development, implementation, and support. The specialized focus allows the providers to stay updated with various trends, technological advancements, and best practices, offering airlines cutting-edge solutions and services. Moreover, third-party providers, particularly global distribution system (GDS) providers, have established global networks and connections with travel agencies, online travel agents (OTAs), and other distribution channels. According to the analysis, the extensive reach enables airlines to connect with a wide range of sales channels and expand their market presence without the need for individual connections. Furthermore, third-party providers offer cost-effective systems with flexible pricing models, hence contributing remarkably in accelerating the passenger service system market trend.

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

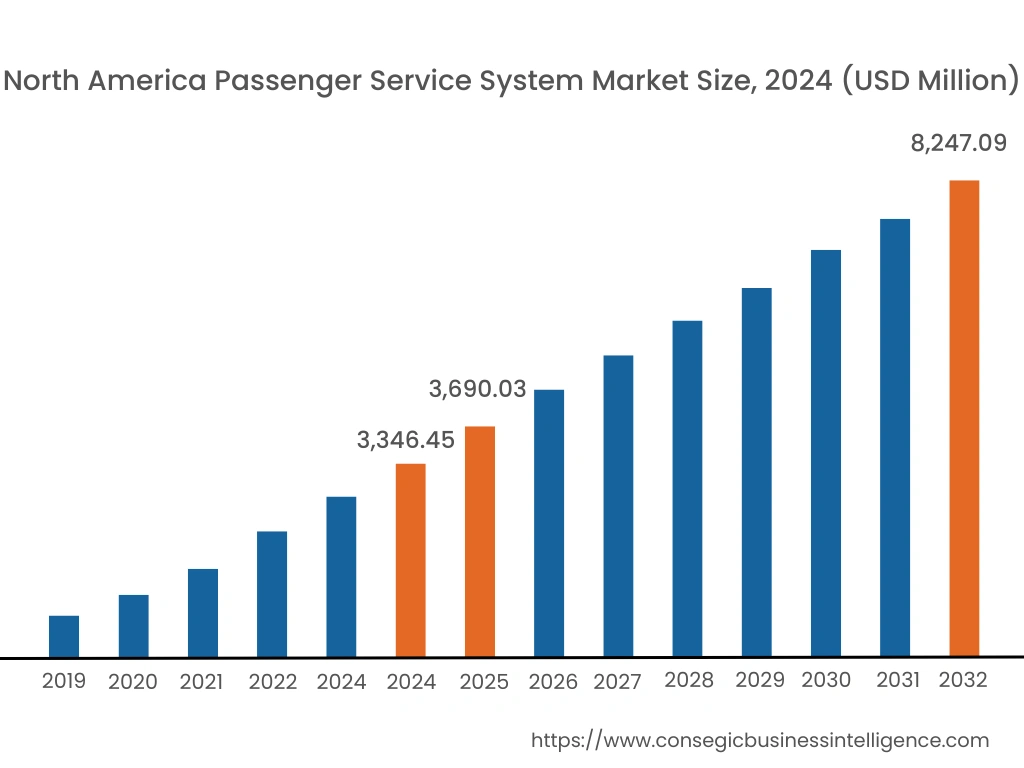

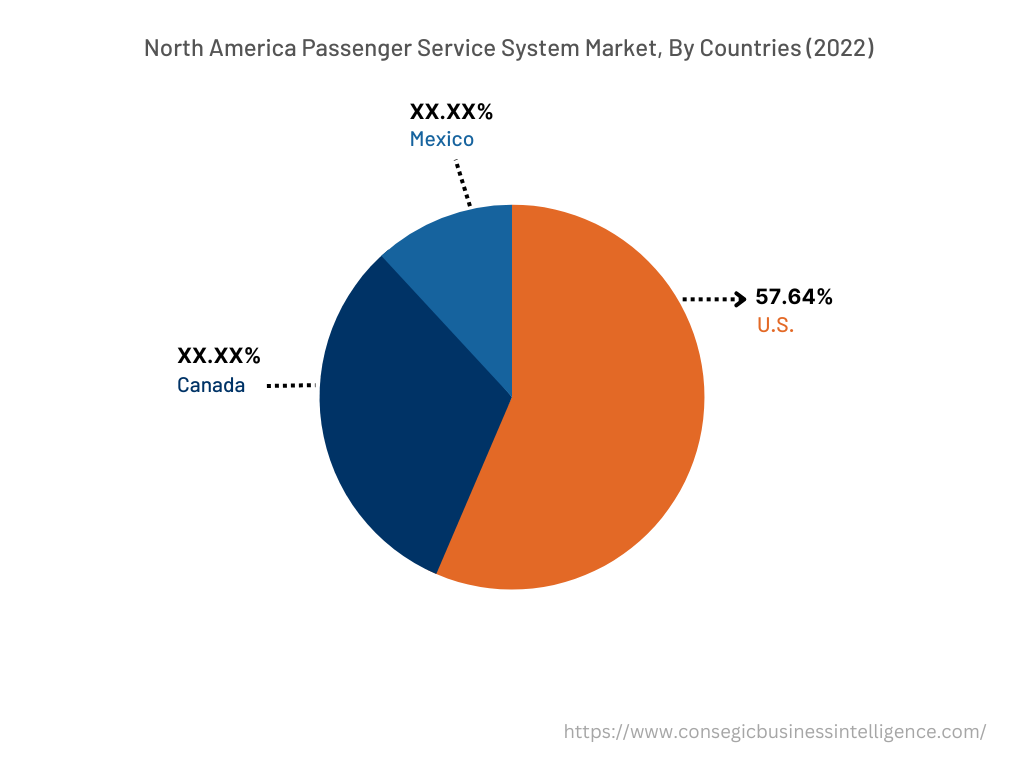

North America is estimated to reach over USD 8,247.09 Million by 2032 from a value of USD 3,346.45 Million in 2024 and is projected to grow by USD 3,690.03 Million in 2025. In addition, in the region, the U.S. accounted for the maximum revenue share of 57.64% in the year 2024. The expansion is attributed to the presence of the largest and most developed aviation industries in the world. The region is home to several major airlines, including American Airlines, Delta Air Lines, and United Airlines, which have a significant market share globally. Additionally, the North American market has a high demand for efficient and customer-centric passenger service system marke solutions. Passengers in North America demand seamless booking experiences, personalized services, and streamlined operations. These service providers in the region focus on meeting such requirements by developing robust, user-friendly, and feature-rich solutions. Consequently, based on the passenger service system market analysis, the aforementioned factors are contributing significantly to driving the adoption of trends for these systems in the region.

Asia Pacific accounted is expected to register the fastest CAGR of 12.7% as the region is experiencing a shift towards digitalization across industries, including aviation. The digital transformation is driving the adoption of these solutions that offer online booking capabilities, self-service options, mobile applications, and personalized digital experiences. Additionally, the expansion in the aviation sector is also contributing significantly in accelerating the growth of the market to manage the increasing passenger volumes, optimize operations, and enhance customer experience. For instance, in May 2023, according to India Brand Equity Foundation (IBEF), the third-largest domestic air passenger market in the world is India and is anticipated to reach USD 30 Million by 2024. The increasing investment by the government to improve the airport infrastructure is contributing significantly in fueling the market growth in Asia Pacific countries.

Top Key Players & Market Share Insights :

The landscape of the passenger service system market is highly competitive and has been examined in the report, along with complete profiles of the key players operating in the passenger service system industry. In addition, the surge in innovations, acquisitions, mergers, and partnerships has further accelerated the growth of the passenger service system market. Major players in the market include-

- Amadeus IT Group SA

- Bravo Passenger Solutions Pte Limited

- Sabre Corporation

- SITA NV

- IBS Software

- Enoya-one LTD (AeroCRS)

- Hexaware Technologies Ltd.

- IBM Corporation

- KIU System Solutions

- Mercator Limited

- Radixx International

Recent Industry Developments :

- In February 2023, Sabre Corporation and JetBlue announced a multi-year renewal of the agreement for the SabreSonic passenger service system. The renewal ensures that JetBlue's content will continue to be available on the Sabre Global Distribution System (GDS). Furthermore, Sabre's collaboration with JetBlue enhances the customer experience and explores revenue opportunities through the advanced capabilities of its passenger service system.

- In April 2022, IBS Software introduced iFly Res, a next-generation passenger service system to offer a customer-centric approach and incorporates cutting-edge features for order management. The system aims to elevate the passenger experience and provide airlines with enhanced operational efficiency and also to deliver personalized offers and streamline the order management process.

Key Questions Answered in the Report

What is a passenger service system? +

A passenger service is a comprehensive software platform used by airlines and travel companies to manage and automate various passenger-related processes and services throughout the travel journey.

What specific segmentation details are covered in the passenger service system market report, and how is the dominating segment impacting the market growth? +

Airline reservation system holds the largest share as the system handles the core functionality of managing passenger bookings, seat availability, fare classes, and flight schedules.

What specific segmentation details are covered in the passenger service system market report, and how is the fastest segment anticipated to impact the market growth? +

Services will witness the fastest CAGR as services play a vital role in managing the integration process, providing consultancy, and offering customization services to ensure a seamless and tailored solution.

Which region is anticipated to witness the highest CAGR during the forecast period, 2025-2032? +

Asia Pacific is anticipated to witness the fastest CAGR during the forecast period owing to the expanding aviation industry and increasing investment by the government to improve the airport infrastructure.