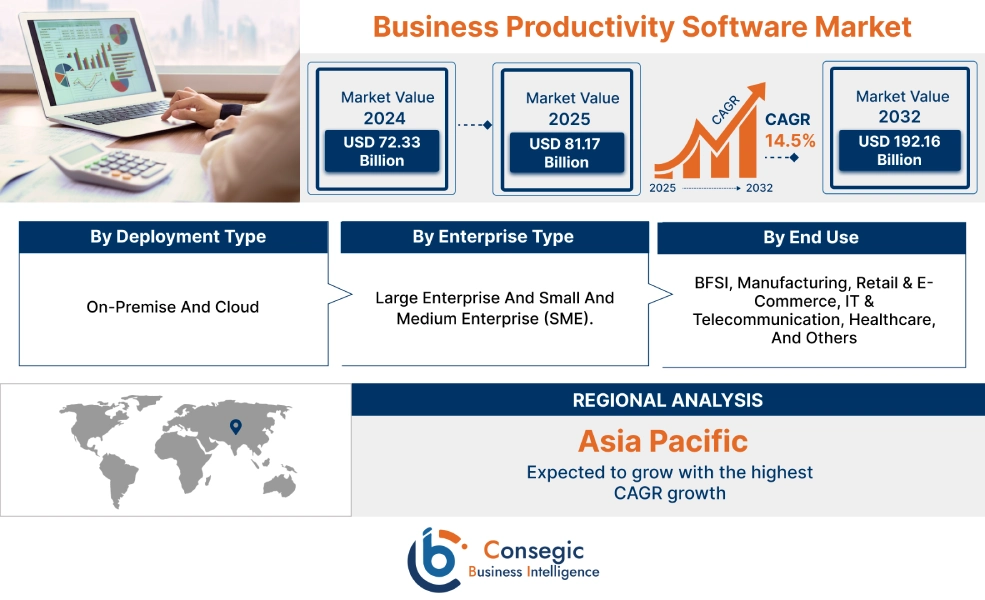

Business Productivity Software Market Size:

Business Productivity Software Market size is estimated to reach over USD 192.16 Billion by 2032 from a value of USD 72.33 Billion in 2024 and is projected to grow by USD 81.17 Billion in 2025, growing at a CAGR of 14.5% from 2025 to 2032.

Business Productivity Software Market Scope & Overview:

Business productivity software includes programs or applications that are designed to facilitate productivity in a work setting. This software can range from basic tools, including word processors and spreadsheets, to advanced project management and communication platforms. Moreover, business productivity software is used for improving operational efficiency by automating routine tasks, improving communication & collaboration, and providing means for effective project tracking. Additionally, business productivity solutions offer several benefits including enhanced collaboration, improved time management, and increased operational efficiency and productivity.

How is AI Transforming the Business Productivity Software Market?

The utilization of AI is significantly transforming the business productivity software market. AI is being integrated to automate tasks, enhance decision-making, and improve overall efficiency. This includes automating routine tasks, optimizing processes, reducing errors, and providing data-driven insights. Moreover, AI-powered business productivity tools can automate tasks such as data entry, scheduling, and even responding to basic customer inquiries, freeing up employees for more complex work. Additionally, AI integration can streamline various business processes, making them more efficient and cost-effective. Therefore, the aforementioned factors are expected to positively impact the market growth in the upcoming years.

Business Productivity Software Market Dynamics - (DRO) :

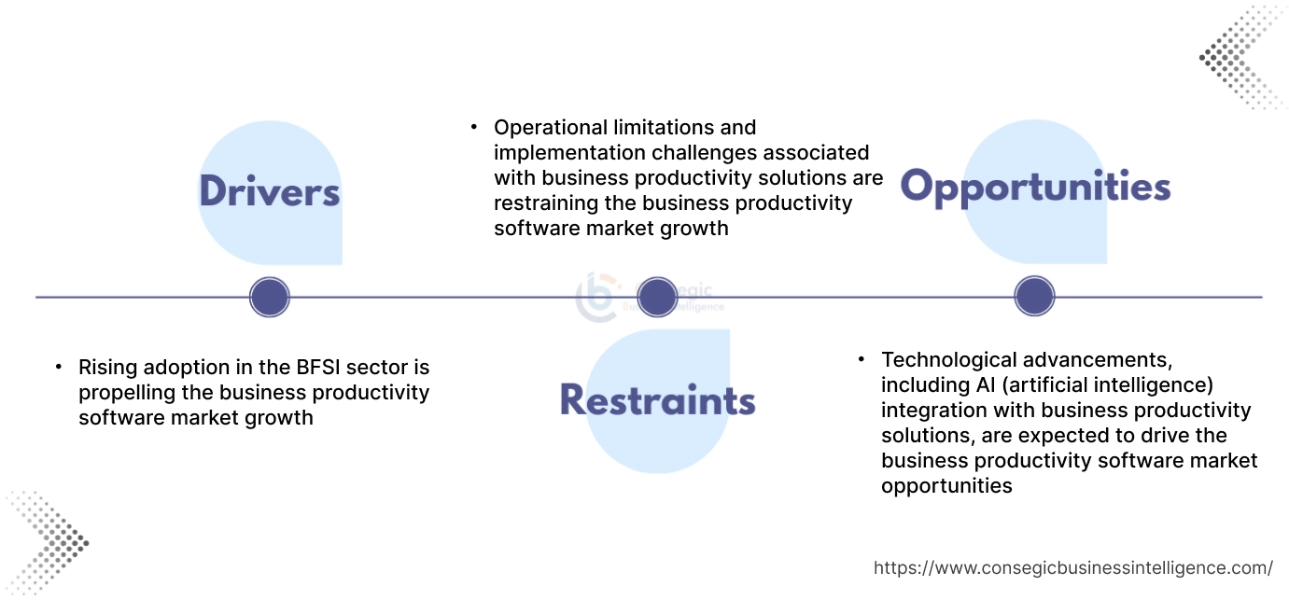

Key Drivers:

Rising adoption in the BFSI sector is propelling the business productivity software market growth

Business productivity solutions are primarily used in the BFSI (banking, financial services, and insurance) sector to help BFSI firms deliver efficient, secure services along with facilitating regulatory compliance and risk management, among others. Moreover, business productivity solution enables BFSI firms to improve document & content management, workflow optimization, employee collaboration, and compliance & reporting, among others.

- For instance, according to the Federal Deposit Insurance Corporation (FDIC), the United States is comprised of approximately 4,136 commercial banks along with 69,905 total branches across the country as of 2022.

Hence, according to the analysis, the growing BFSI industry is increasing the demand for business productivity solutions for improving document & content management, workflow optimization, and operational efficiency, in turn driving the business productivity software market size.

Key Restraints:

Operational limitations and implementation challenges associated with business productivity solutions are restraining the business productivity software market growth

The implementation of business productivity software is often associated with certain operational limitations and challenges, which are among the key factors restraining the market. For instance, implementing too many productivity software solutions can be time-consuming and often associated with high setup costs. High initial costs can limit its adoption, specifically among businesses operating with limited budgets.

Moreover, a significant amount of time must be invested in onboarding, training, and integrating the software with old or existing systems. Additionally, certain productivity software can be complex, and often takes a long time for users to properly learn how to use it, which can further slow down the work instead of making it faster. Thus, high initial investment and operational challenges are hindering the business productivity software market expansion.

Future Opportunities :

Technological advancements, including AI (artificial intelligence) integration with business productivity solutions, are expected to drive the business productivity software market opportunities

Business productivity software providers are frequently investing in the development of new technologies associated with business productivity solutions to ensure safe and effective application in various industries, including IT & telecommunication, BFSI, manufacturing, retail & e-commerce, and others. As a result, business productivity solution providers are launching new solutions integrated with advanced technologies and features such as artificial intelligence, and others, which are providing lucrative aspects for market development.

- For instance, in May 2025, Scalafai launched Safia, an AI-powered business productivity platform. The AI-powered platform is designed to transform how teams align, collaborate, and execute their work on day-to-day operations.

Hence, as per the analysis, the rising technological advancements associated with business productivity solutions are projected to boost the business productivity software market opportunities during the forecast period.

Business Productivity Software Market Segmental Analysis :

By Deployment Type:

Based on deployment type, the market is segmented into on-premise and cloud.

Trends in the deployment type:

- The adoption of on-premise deployment is primarily driven by factors including higher security and privacy, and more control over server hardware.

- Factors including the ease of integration, rapid deployment, and increasing consumer preference for flexible, scalable, reliable, and cost-effective business productivity solutions are driving the cloud deployment segment.

Cloud segment accounted for the largest revenue share in the overall business productivity software market share in 2024, and it is anticipated to register the fastest CAGR growth during the forecast period.

- The cloud-based deployment offers seamless collaboration along with fast and cost-effective access to business productivity solutions by multiple users, irrespective of the time and location of the user.

- Moreover, cloud-based deployment provides numerous benefits such as rapid implementation, minimal capital expense, ease of utilization and integration, faster processing, and higher scalability, among others.

- For instance, Zoho Corporation offers Zoho Workplace in its solution offerings, which is a cloud-based business productivity solution. It consists of a suite of tools that are optimized to level up business productivity by transforming the manner in which businesses collaborate.

- Consequently, the increasing advancements related to cloud-based business productivity solutions are driving the business productivity software market trends.

By Enterprise Type:

Based on enterprise type, the market is segmented into large enterprise and small and medium enterprise (SME).

Trends in the enterprise type:

- Increasing trend in adoption of business productivity solutions in large enterprises for streamlining employee collaboration, business operations, and improving operational efficiency.

- Factors including growing investments in the development of small and medium enterprises and rising deployment of cloud-based business productivity solutions in SMEs are key trends driving the small and medium enterprise segment.

Large enterprise segment accounted for the largest revenue share in the total business productivity software market share in 2024.

- Large enterprises refer to companies that have an above-average business size, perform large operations, and have high economies of scale.

- Large enterprises primarily consist of a larger workforce, generate a high amount of revenue, and have a greater competitive capacity in comparison to small and medium enterprises.

- Moreover, large enterprises typically deal with complex business operations and requirements. Business productivity solution helps large enterprises streamline these complex business processes by enhancing employee collaboration and communication to complete assigned tasks.

- For instance, Microsoft offers Microsoft 365 in its offerings, which is a business productivity solution designed for all types of enterprises, including large enterprises. The company’s business productivity solution enables large enterprises to facilitate enhanced communication/collaboration among employees, save time and cost, and free up valuable resources.

- Therefore, the increasing adoption of business productivity solutions in large enterprises is driving the business productivity software market trends.

Small and medium enterprise (SME) segment is anticipated to register substantial CAGR growth during the forecast period.

- Small and medium enterprises refer to companies that maintain revenues, workforce, and assets below a certain threshold.

- SMEs often account for the majority of the businesses that are operating across the world.

- Moreover, business productivity solution is often deployed in SMEs to simplify and manage business operations, enhance employee collaboration, and increase operational efficiency, among others.

- For instance, according to the U.S. Chamber of Commerce, the number of small businesses in the United States reached 33.2 million in 2022, representing nearly 99.9% of total businesses in the U.S.

- Thus, the rising number of small and medium enterprises is expected to boost the adoption of business productivity solutions, in turn driving the business productivity software market size during the forecast period.

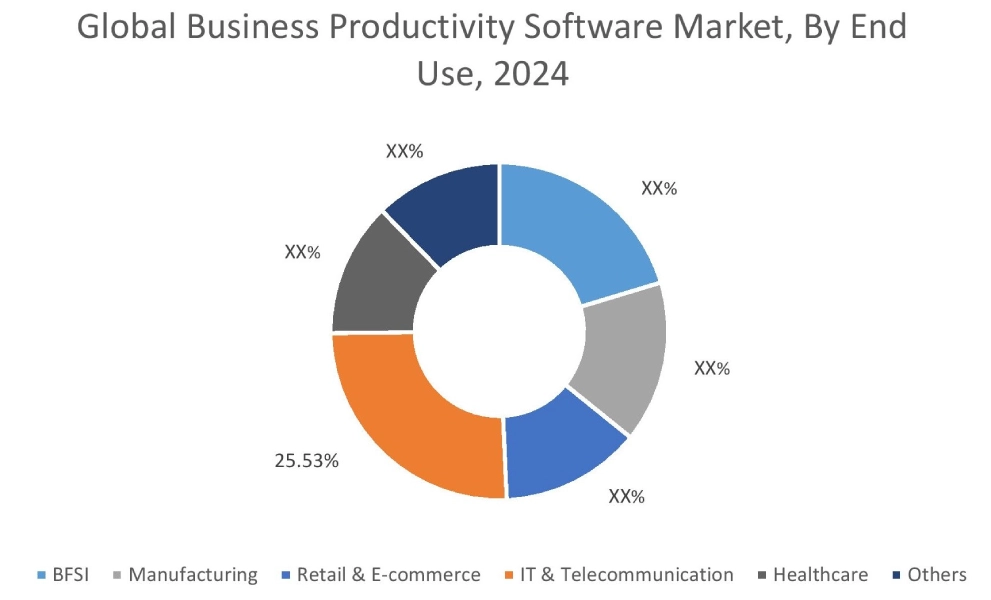

By End Use:

Based on end use, the market is segmented into BFSI, manufacturing, retail & e-commerce, IT & telecommunication, healthcare, and others.

Trends in the end use:

- Increasing adoption of business productivity solutions in the IT & telecommunication sector for facilitating enhanced team collaboration, improved workflow transparency, and increased operational efficiency, among others.

- There is a rising trend towards the utilization of business productivity solutions in the BFSI industry to improve document & content management, workflow optimization, and compliance & reporting.

The IT & telecommunication segment accounted for the largest revenue share of 25.53% in the overall market in 2024.

- Business productivity solution plays a vital role in the IT & telecommunication sector for managing highly distributed workforces, complex projects, and high volumes of digital information.

- Business productivity tools play a crucial role in supporting daily operations and business continuity among IT enterprises, particularly in the modern remote work culture that is prevalent in the IT sector.

- Moreover, business productivity solutions are primarily used in IT enterprises for ensuring improved collaboration & communication, task/project management, file and document management, and seamless remote operations, among others.

- Additionally, the utilization of business productivity solutions among IT enterprises offers several benefits, including enhanced team collaboration, faster project delivery, improved workflow transparency, increased operational efficiency, and others, which are further driving its adoption in the IT sector.

- According to the business productivity software market analysis, the rising utilization of business productivity solutions in the IT & telecommunication sector is driving the market demand.

BFSI segment is anticipated to register the fastest CAGR growth during the forecast period.

- Business productivity solutions are often used in the BFSI (banking, financial services, and insurance) sector to help BFSI firms deliver efficient, secure services along with facilitating regulatory compliance and risk management, among others.

- Moreover, business productivity solution enables BFSI firms to improve document & content management, workflow optimization, compliance & reporting, and other related applications.

- For instance, according to the Federal Reserve Board, there are approximately 2,160 large commercial banks in the United States as of March 2025. These banks have consolidated assets of USD 300 million or more, with several branches in the U.S. as well as other countries.

- Therefore, the growing BFSI sector is projected to drive market growth during the forecast period.

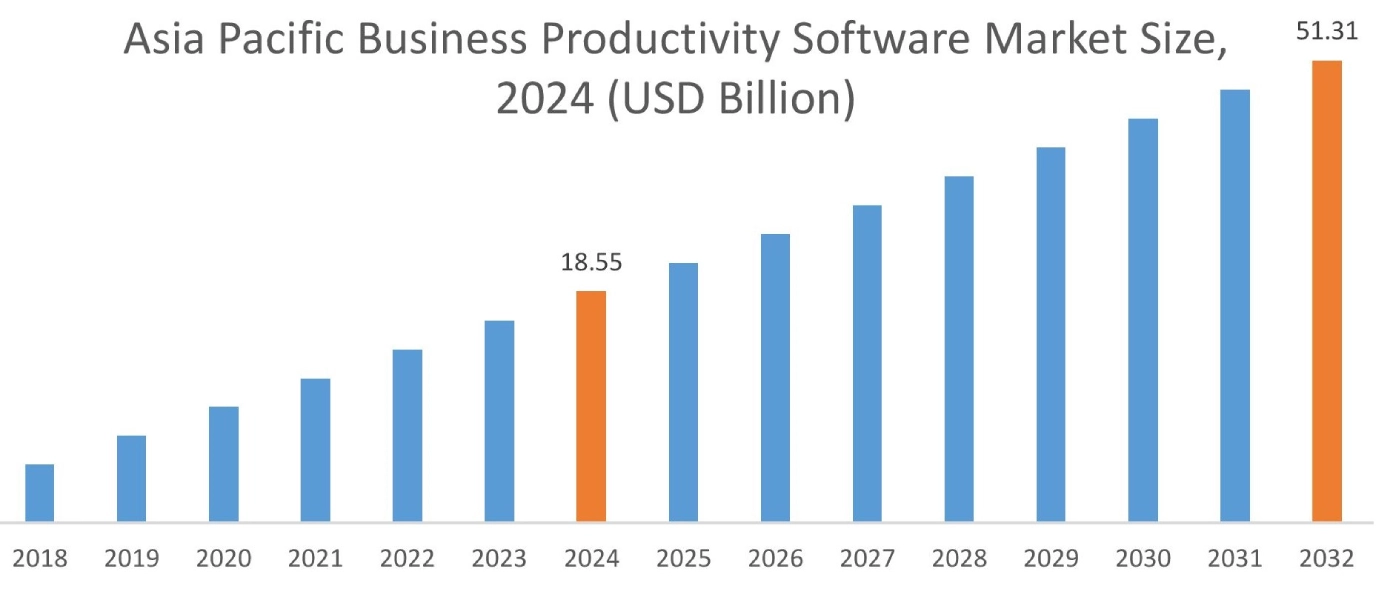

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

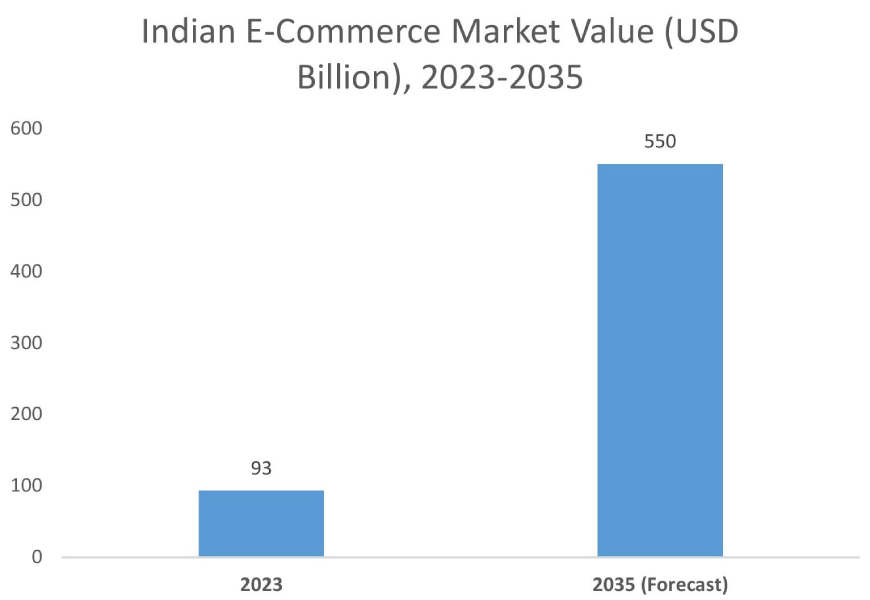

Asia Pacific region was valued at USD 18.55 Billion in 2024. Moreover, it is projected to grow by USD 20.88 Billion in 2025 and reach over USD 51.31 Billion by 2032. Out of this, China accounted for the maximum revenue share of 32.40%. As per the business productivity software market analysis, the adoption of business productivity solutions in the Asia-Pacific region is primarily driven by the growing IT, healthcare, and BFSI sectors, among others. Additionally, the growing retail & e-commerce sector and increasing adoption of business productivity tools among retail enterprises for streamlining processes, managing resources, and others are further accelerating the business productivity software market expansion.

- For instance, according to the India Brand Equity Foundation, the e-commerce sector in India was valued at USD 93 billion in 2023, and it is projected to grow to USD 550 billion by 2035. The aforementioned factors are anticipated to drive market growth in the Asia-Pacific region during the forecast period.

North America is estimated to reach over USD 68.12 Billion by 2032 from a value of USD 25.76 Billion in 2024 and is projected to grow by USD 28.90 Billion in 2025. In North America, the growth of the business productivity software industry is driven by growing investments in BFSI, healthcare, retail & e-commerce, and other sectors. Moreover, the increasing adoption of business productivity solutions in the BFSI sector for improving document & content management, workflow optimization, and operational efficiency is contributing to the business productivity software market demand.

- For instance, in July 2022, Citi Bank launched its new Citi Commercial Bank in Canada, as a part of the company’s global extension plan. Citi Commercial Bank offers a wide range of institutional solutions and products to meet the evolving needs of corporates. The above factors are further driving the market in North America.

Additionally, the regional analysis depicts that the growing manufacturing, BFSI, and healthcare sectors and the increasing need for efficient collaboration solutions among business enterprises are driving the business productivity software market demand in Europe. Further, as per the market analysis, the market demand in Latin America, Middle East, and African regions is expected to grow at a substantial rate due to several factors such as increasing development of retail & e-commerce business, expansion of IT firms, and growing manufacturing sector, among others.

Top Key Players and Market Share Insights:

The global business productivity software market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the business productivity software market. Key players in the business productivity software industry include-

- Microsoft (U.S)

- Zoho Corporation Pvt. Ltd. (India)

- Adobe Inc. (U.S)

- IBM (U.S)

- Salesforce Inc. (U.S)

- Dropbox Inc. (U.S)

- Oracle Corporation (U.S)

- Google LLC (U.S)

- Atlassian Corporation (Australia)

- Intuit Inc. (U.S)

- SAP SE (Germany)

Recent Industry Developments :

Product Launch:

- In September 2024, Oracle announced over 50 role-based AI agents within its Oracle Fusion Cloud Applications Suite to help business enterprises attain new levels of productivity. The AI agents can perform frequent, repetitive tasks and enable employees to focus their time on more strategic tasks and initiatives.

Business Productivity Software Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 192.16 Billion |

| CAGR (2025-2032) | 14.5% |

| By Deployment Type |

|

| By Enterprise Type |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the business productivity software market? +

The business productivity software market was valued at USD 72.33 Billion in 2024 and is projected to grow to USD 192.16 Billion by 2032.

Which is the fastest-growing region in the business productivity software market? +

Asia-Pacific is the region experiencing the most rapid growth in the business productivity software market.

What specific segmentation details are covered in the business productivity software report? +

The business productivity software report includes specific segmentation details for deployment type, enterprise type, end use, and region.

Who are the major players in the business productivity software market? +

The key participants in the business productivity software market are Microsoft (U.S), Zoho Corporation Pvt. Ltd. (India), Oracle Corporation (U.S), Google LLC (U.S), Atlassian Corporation (Australia), Intuit Inc. (U.S), SAP SE (Germany), Adobe Inc. (U.S), IBM (U.S), Salesforce Inc. (U.S), Dropbox Inc. (U.S), and others.