Virtual Security Appliance Market Size:

Virtual Security Appliance Market size is estimated to reach over USD 7.54 Billion by 2032 from a value of USD 2.74 Billion in 2024 and is projected to grow by USD 3.06 Billion in 2025, growing at a CAGR of 15.2% from 2025 to 2032.

Virtual Security Appliance Market Scope & Overview:

Virtual security appliance (VSA) is a software-based security solution that performs security functions within a virtualized environment. The solution offers features including intrusion detection/prevention, firewalls, web filtering. VSA is deployed quickly and easily within a virtualized environment and is scaled up or down based on network traffic and security needs. VSA is managed from a central console, simplifying security administration and enforces security policies across the entire virtualized environment. Moreover, VSA provides visibility into network traffic and application usage and allows administrators to prioritize and control network traffic based on application and user needs.

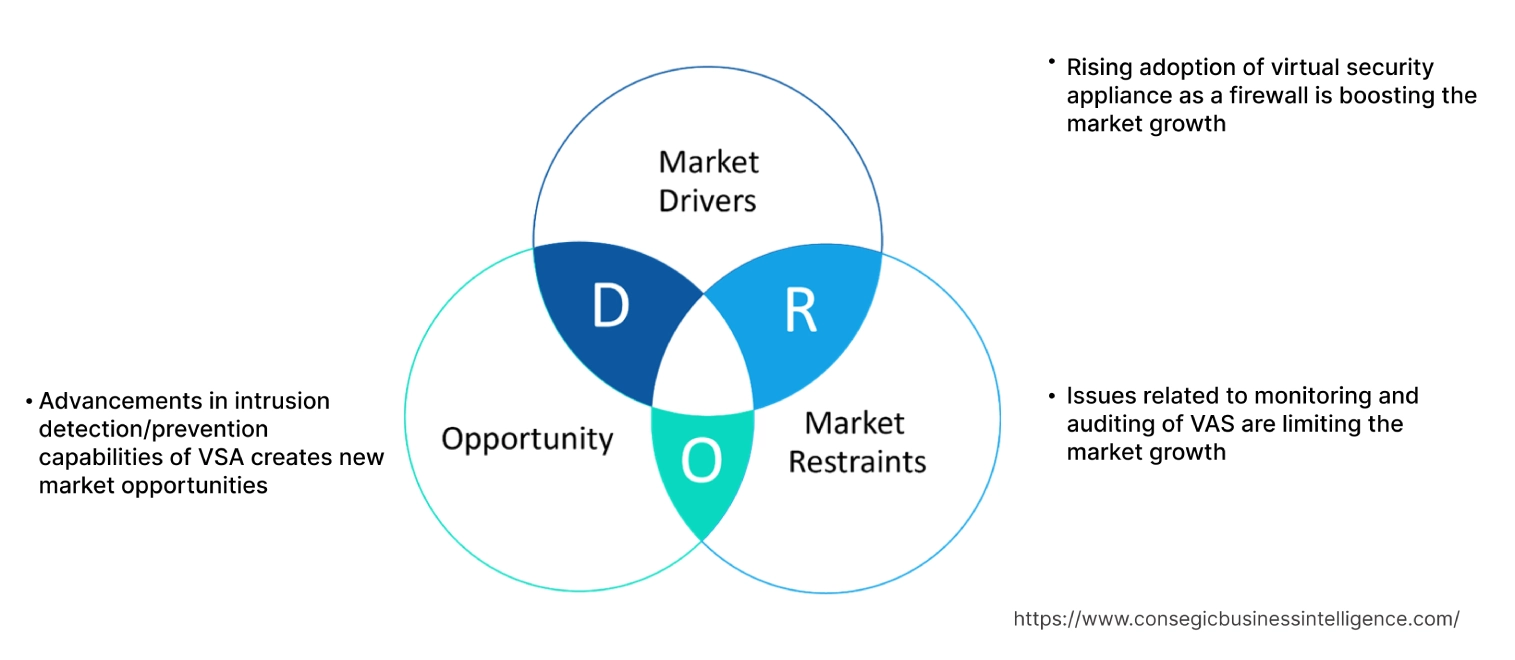

Virtual Security Appliance Market Dynamics - (DRO) :

Key Drivers:

Rising adoption of virtual security appliance as a firewall is boosting the market growth

A virtual security appliance includes firewall functionality that runs within a virtualized environment that offers flexible and scalable security for cloud and virtualized infrastructure. Virtual firewalls inspect and control network traffic, blocking unauthorized access and protecting against threats. Virtual firewalls are particularly well-suited for protecting cloud and virtualized infrastructure, where traditional hardware firewalls can be less practical. Virtual firewalls are easily deployed, moved, and scaled up or down as needed. They are less expensive to deploy and maintain than traditional hardware firewalls. Virtual firewalls are managed centrally, making it easier to apply security policies across multiple virtual environments.

- For instance, in July 2024, Sophos launched Firewall v20 MR2. The system includes new functionalities including active directory SSO improvements, new backup and restore assistant, and web protection optimizations.

Thus, the aforementioned factors are boosting the usage of security appliance, in turn driving the virtual security appliance market growth.

Key Restraints:

Issues related to monitoring and auditing of VAS are limiting the market growth

VSAs lead to overhead that makes it harder to monitor and audit their performance and security posture. VSAs share resources with other virtual machines, leading to potential performance blocks and security vulnerabilities that require careful monitoring. The virtual nature of VSAs limit the level of physical access to the hardware as they would with physical appliances, potentially hindering the ability to conduct certain types of audits.

Moreover, VSAs have vulnerabilities that need to be identified and patched, which is challenging in a virtual environment. Thus, the market analysis shows that the aforementioned factors are restraining the virtual security appliance market demand.

Future Opportunities :

Advancements in intrusion detection/prevention capabilities of VSA creates new market opportunities

VSA with intrusion detection/prevention (IDPS) capabilities provides a network security solution that monitors traffic, identifies threats, and can actively block malicious activity, within a virtualized environment. If malicious activity is detected, the IDPS take action, such as blocking the traffic, alerting administrators, or logging the event. Some IDPS systems are configured to detect and prevent attacks on specific applications or systems. Virtualization allows for easy deployment and management of IDPS capabilities across multiple networks or locations.

- For instance, in June 2021, Palo Alto Networks, in collaboration with Google Cloud, announced Cloud IDS (Intrusion Detection System) network threat detection service. The systems allow organizations to get insights from threats including malware, command-and-control attacks, and spyware.

Thus, the ongoing advancements in the technologies are projected to drive virtual security appliance market opportunities during the forecast period.

Virtual Security Appliance Market Segmental Analysis :

By Deployment Type:

Based on the deployment type, the market is segmented into cloud-based and on-premises.

Trends in the Deployment Type:

- Rising demand in cloud-based deployment of security appliance for scalability, flexibility, and cost-effectiveness.

- Increasing trend in adoption of on-premise security appliances for simpler management and enhanced security.

The cloud-based segment accounted for the largest revenue share in the virtual security appliance market share in 2024.

- Cloud-based security appliances offer benefits including flexibility, cost-effectiveness, and ease of deployment that allows organizations to secure their cloud environments with centralized software and rapid scaling.

- Cloud-based security solutions provide better visibility into network traffic and security events, allowing for faster threat detection and response.

- Cloud-based security solutions are designed to integrate seamlessly with cloud platforms that simplifies the deployment and management.

- For instance, in April 2024, Fortinet and IBM Cloud collaborated to launch the Fortinet Virtual FortiGate Security Appliance (vFSA) on IBM Cloud. The vFSA offers services in finance, retail, and manufacturing sectors.

- Therefore, the adoption of cloud-based security appliance is boosting the virtual security appliance market demand.

The on-premises segment is expected to register substantial CAGR during the forecast period.

- Virtual appliances are deployed quickly and easily, reducing the time to market for new security solutions.

- Virtualization simplifies the maintenance and management of security infrastructure, reducing the need for specialized hardware and expertise.

- VSAs are deployed across different environments, ensuring consistent security policies and controls.

- For instance, in May 2024, Cisco Systems enhanced its product AppDynamics with AI features. The AppDynamics on-premises integrates with Cisco’s secure application package that monitors for application threats and vulnerabilities in services, containers, pods, workloads, and business transactions.

- Thus, the market analysis shows that the rising implementation of on-premise security appliance is projected to drive the virtual security appliance market trends during the forecast period.

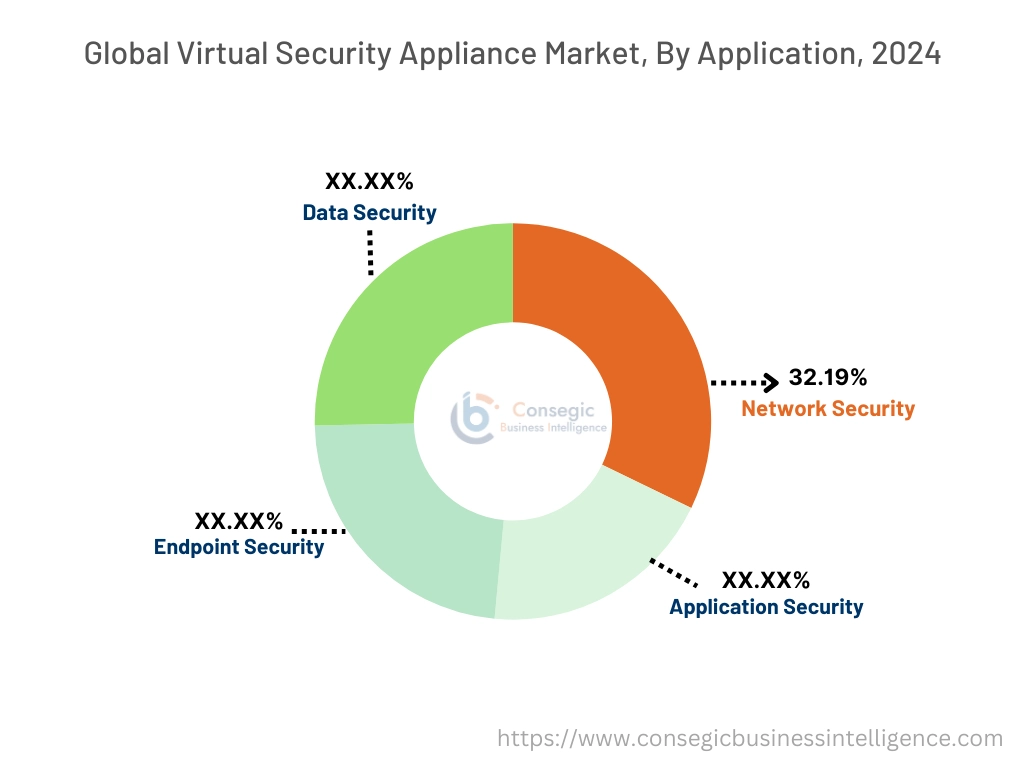

By Application:

Based on the application, the market is segmented into network security, application security, endpoint security, and data security.

Trends in the Application:

- Rising demand in endpoint security for centralized management and enhanced protection against advanced threats is boosting the virtual security appliance market size.

- Increasing trend in adoption of application security to enable quick deployment and efficient management of security controls including firewalls and intrusion detection systems within virtualized environments.

The network security segment accounted for the largest revenue share of 32.19% in the market in 2024.

- VSAs reduce the cost of network security compared to traditional hardware appliances, as they use existing hardware infrastructure and are deployed and managed centrally.

- VSAs provide a wide range of security features, including firewalls, data loss prevention (DLP), intrusion detection/prevention systems (IDS/IPS), and VPNs, to protect against a variety of threats.

- For instance, in January 2024, Veracity Industrial launched Veracity OT network security appliance. The solution reduces the complexity of enhancing industrial networks. This is achieved by integration of OT-SDN functionality with a virtual switch suited for OT environments.

- Therefore, the market analysis depicts that the widespread adoption of network security appliance is driving the virtual security appliance market growth.

The data security segment is expected to register the significant CAGR during the forecast period.

- VSAs can help protect data from unauthorized access, modification, or destruction through various security mechanisms.

- VSAs assist to prevent sensitive data from leaving the organization's control, either through accidental or malicious medium.

- VSAs streamline security operations, making it easier to manage and maintain security policies and configurations.

- Thus, the market analysis depicts that the rising demand for data security appliance is expected to boost the virtual security appliance market opportunities during the forecast period.

By End User:

Based on the end user, the market is segmented into government, large enterprises, and small and medium enterprises.

Trends in the End User:

- Rising trend in adoption of VSAs in small and medium enterprises for data and network security applications is boosting the virtual security appliance market size.

- Increasing demand for VSAs in large enterprises for improved performance, and intelligent threat security, among others.

The large enterprises segment accounted for the largest revenue in the virtual security appliance market share in 2024.

- In large enterprises, VSAs offer a software-based alternative to traditional hardware, providing functions including firewalls, intrusion detection, and malware protection.

- VSAs also enable centralized management, scalability, flexibility, and cost-effectiveness.

- Moreover, VSAs are optimized for specific security tasks, delivering high performance and throughput.

- Additionally, virtualization allows for the isolation of security functions, reducing the risk of a security breach affecting the entire network.

- Therefore, the wide applications of security appliance solutions in large enterprises are boosting the virtual security appliance market expansion.

The small and medium enterprises segment is expected to register the fastest CAGR during the forecast period.

- In small and medium enterprises, VSA offers a cost-effective, scalable, and flexible security solution. They provide functions including application control, network perimeter security, threat detection, and secure remote access, without the need for dedicated hardware.

- Moreover, VSAs enable secure communication between the SME's network and cloud services, protecting data in transit and at rest. VSAs can be easily scaled up or down based on the SME's requirements, offering flexibility in deployment and resource utilization.

- Furthermore, VSAs are managed centrally, simplifying security administration and reducing the burden on IT staff in SMEs, in turn leading to cost-effectiveness and enhanced operational efficiency.

- Thus, the market analysis shows that the rising adoption of security appliance in virtual environment in small and medium enterprises is anticipated to boost the virtual security appliance market trends during the forecast period.

Regional Analysis:

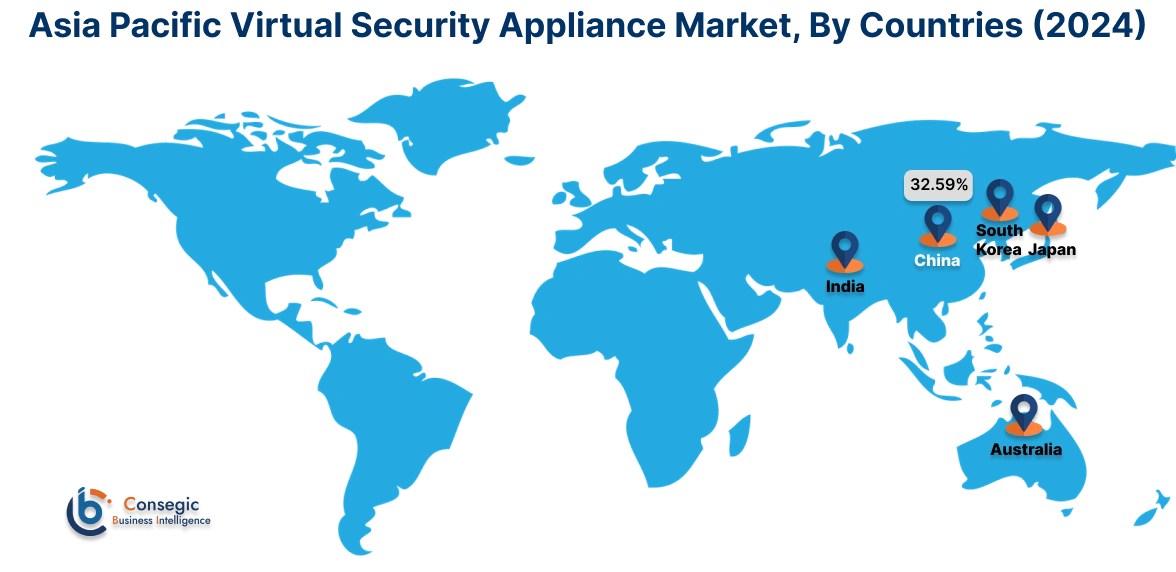

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

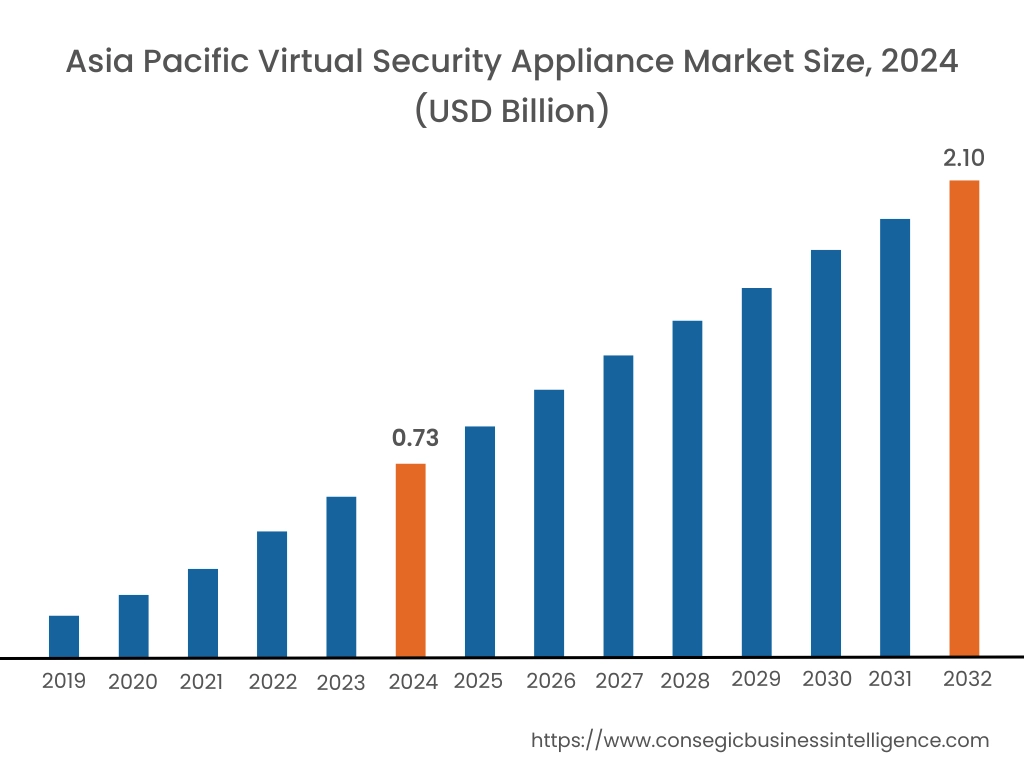

Asia Pacific region was valued at USD 0.73 Billion in 2024. Moreover, it is projected to grow by USD 0.82 Billion in 2025 and reach over USD 2.10 Billion by 2032. Out of this, China accounted for the maximum revenue share of 32.59%. The virtual security appliance market analysis depicts that the market in the region is primarily driven by expanding IT industry, leading to adoption of VSAs in enterprises. Moreover, the rising shift of governments towards the usage of VSA’s to protect critical data and network infrastructure is further boosting the market growth.

- For instance, according to Economic and Social Commission for Asia and the Pacific (ESCAP), MSMEs account for an average 97 per cent of all enterprises and 69 per cent of the national labor force. Thus, the large number of SMEs lead to increasing adoption of VSAs in the region.

North America is estimated to reach over USD 2.52 Billion by 2032 from a value of USD 0.93 Billion in 2024 and is projected to grow by USD 1.03 Billion in 2025. The market growth in the region is primarily driven due to well-established IT and telecommunications industry that uses VSA for enhanced performance, security, and operational efficiency. Thus, the aforementioned factors are responsible for the virtual security appliance market expansion in the region.

- For instance, according to CompTIA, there are approximately 585,000 IT services and software companies in the United States. Thus, the rising adoption of VSA in IT and telecommunication enterprises is driving the market growth in North America.

The virtual security appliance market analysis shows that the market in European region is growing due to rising demand for VSA solutions from countries including UK, Germany, and France, driven due to growing need for security services and appliances in the government sector. The rising focus of governments to protect sensitive government data and infrastructure from cyber threats and to protect government networks from unauthorized access by monitoring and filtering network traffic is propelling the market in Europe. In Latin America, Middle East and Africa, the market growth is driven by the rising number of enterprises that require VSA solutions for network, application, endpoint, and data security.

Top Key Players and Market Share Insights:

The virtual security appliance industry is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global virtual security appliance market. Key players in the virtual security appliance industry include -

- Microsoft (US)

- Fortinet, Inc. (US)

- SonicWall Inc. (US)

- 6Wind (France)

- Cisco Systems Inc. (US)

- Gartner (US)

- Juniper Networks (US)

- WithSecure (Finland)

- Palo Alto Networks (US)

- Barracuda Networks (US)

Virtual Security Appliance Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 7.54 Billion |

| CAGR (2025-2032) | 15.2% |

| By Deployment Type |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the virtual security appliance market? +

Virtual security appliance market size is estimated to reach over USD 7.54 Billion by 2032 from a value of USD 2.74 Billion in 2024 and is projected to grow by USD 3.06 Billion in 2025, growing at a CAGR of 15.2% from 2025 to 2032.

What are the major segments covered in the virtual security appliance market report? +

The segments covered in the report are deployment mode, application, end user, and region.

Which region holds the largest revenue share in 2024 in the virtual security appliance market? +

North America holds the largest revenue share in the virtual security appliance market in 2024.

Who are the major key players in the virtual security appliance market? +

The major key players in the market are Microsoft (US), Fortinet, Inc. (US), SonicWall Inc. (US), 6Wind (France), Cisco Systems Inc. (US), Gartner (US), Juniper Networks (US), WithSecure (Finland), Palo Alto Networks (US), and Barracuda Networks (US).