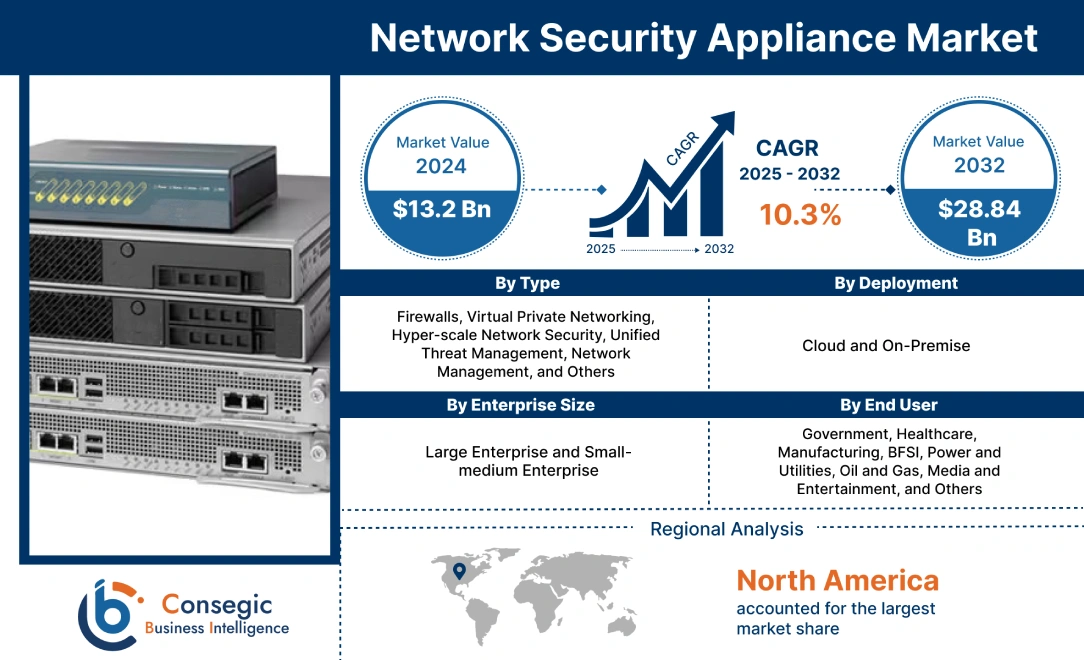

Network Security Appliance Market Size :

Network Security Appliance Market Size is estimated to reach over USD 28.84 Billion by 2032 from a value of USD 13.2 Billion in 2024, growing at a CAGR of 10.3% from 2025 to 2032.

Network Security Appliance Market Scope & Overview:

A network security appliance (NSA) is a hardware device designed to enhance the security and protection of computer networks against various threats and vulnerabilities including breaches and intrusions, among others. They operate as a specialized gateway or intermediary between the internal network and external sources to monitor, filter, and manage data traffic in real-time. Their purpose is to safeguard the network infrastructure from unauthorized access and potential data breaches, ensuring the overall integrity, confidentiality, and availability of network resources.

Network Security Appliance Market Insights :

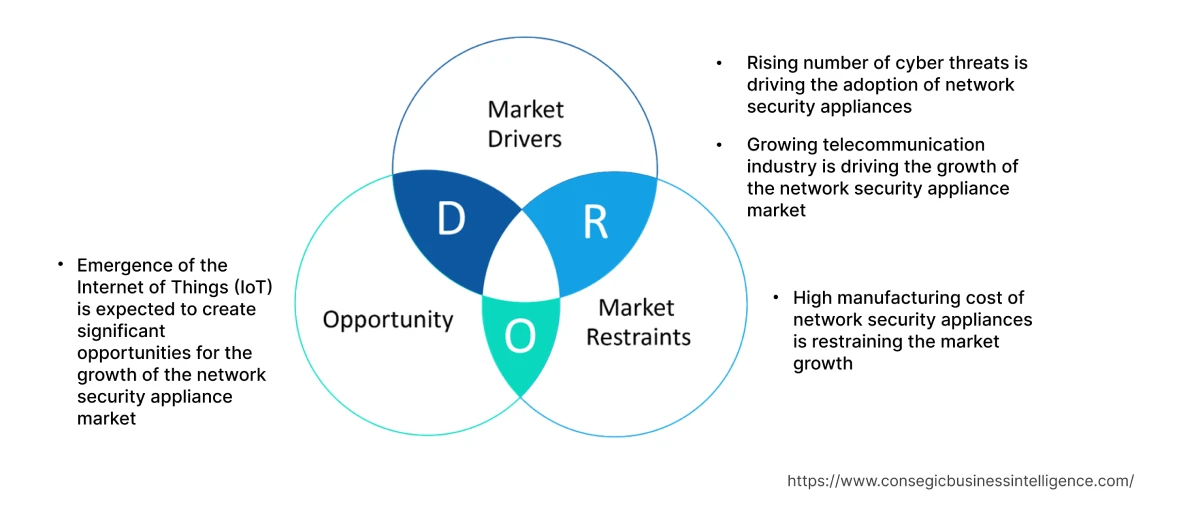

Network Security Appliance Market Dynamics - (DRO)

Key Drivers :

Rising number of cyber threats

The increasing number of cyber threats is posing serious risks to individuals, businesses, and governments, requiring organizations to invest in network security solutions to protect sensitive information. Cybercriminals continuously devise new attack methods to breach network defenses and steal valuable data, particularly from large enterprises and government entities. NSAs offer a comprehensive approach to monitor and protect various access points that are susceptible to cyberattacks, in turn offering improved security and protection to organizations. Additionally, governments and regulatory bodies worldwide are also imposing strict regulations on data security and privacy, mandating organizations to implement robust security measures to protect sensitive information. The appliances provide essential features including encryption, intrusion detection, and access controls to fulfill compliance requirements. Analysis of market trends concludes that the growing number of cyberattacks is highlighting the need for advanced appliances to offer enhanced security measures to enterprises and governments, thus driving the network security appliance market demand. For instance, according to IT Governance UK, the three biggest cyberattacks in June 2023 were on Oregon and Louisiana departments of motor vehicles, Genworth Financial, and Wilton Reassurance. Oregon and Louisiana's 6 million records were stolen including driver's license information, Genworth Financials' 2.5 million records were exposed, and Wilton Reassurance's 1,482,490 members were affected. Therefore, the aforementioned data depicts that the increasing number of cyberattacks is driving the demand for advanced appliances to offer improved security.

Growing telecommunication industry

The telecommunication industry is responsible for connecting individuals, businesses, and devices worldwide. However, the telecom equipment creates an attack surface for potential cyber threats, increasing the requirement for NSAs. They are crucial in providing the necessary defenses against cyberattacks including Distributed Denial of Service (DDoS) attacks, ransomware, malware, and phishing attempts. The continuous evolution of threats necessitates updated and robust security solutions, further boosting the demand for them. Additionally, telecom companies handle vast amounts of sensitive data, including personal information, financial transactions, and business communications. Ensuring the privacy and security of the data is critical for maintaining customer trust and compliance with regulations including GDPR (General Data Protection Regulation). The appliances play a vital role in safeguarding data and preventing unauthorized access, thus contributing remarkably to accelerated market expansion. Analysis of market trends concludes that the expanding telecommunication sector is contributing significantly in spurring the market proliferation. For instance, according to the Department of Telecommunications report published by the Government of India, the number of mobile subscribers increased from 969.54 million in 2015 to 1,157.67 in 2020. Additionally, the number of Internet Broadband subscribers also grew from 99.20 million subscribers in 2015 to 687.44 million subscribers in 2020, thus contributing remarkably in fueling the network security appliance market demand.

Key Restraints :

High manufacturing cost

The cost of production of NSAs is expensive, which limits the adoption of the appliances by small organizations with limited budgets. Assessment of market trends indicates that the upfront costs associated with scaling hardware, and additional resources are also high, further restraining the expansion of the market. Moreover, the maintenance and repair fees of the security appliance are also substantially high, ultimately hindering the proliferation of the global network security appliance market.

Future Opportunities :

Emergence of the Internet of Things (IoT) is expected to create significant opportunities

IoT involves the interconnection of various devices including smart home appliances, wearables, industrial sensors, and connected vehicles through the internet, generating massive amounts of data and are susceptible to cyber threats. The increasing number of connected devices expands the attack surface, increasing the requirement for NSAs to protect the endpoints. Additionally, IoT encompasses a wide range of devices with different operating systems, protocols, and communication standards. The security of such a diverse and complex ecosystem requires specialized security solutions, leading to a higher demand for the appliances tailored for IoT environments. Moreover, IoT devices are vulnerable to cyber-attacks due to weak security measures, lack of updates, and hardcoded passwords. Analysis of market trends concludes that these appliances provide a defense layer against potential threats including DDoS attacks, malware infiltration, and unauthorized access to IoT devices, further contributing to the market proliferation. Consequently, the aforementioned factors are projected to create potential network security appliance market opportunities in the upcoming years.

Network Security Appliance Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 28.84 Billion |

| CAGR (2025-2032) | 10.3% |

| By Type | Firewalls, Virtual Private Networking, Hyper-scale Network Security, Unified Threat Management, Network Management, and Others |

| By Deployment | Cloud and On-Premise |

| By Enterprise Size | Large Enterprise and Small-medium Enterprise |

| By End-User | Government, Healthcare, Manufacturing, BFSI, Power and Utilities, Oil and Gas, Media and Entertainment, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Key Players | TXOne Networks, Trend Micro Inc., Palo Alto Networks Inc., NortonLifeLock Inc., Juniper Networks Inc., Intel Corporation, Honeywell International Inc., Hewlett Packard Enterprise Company, Fortinet Inc., Cisco Systems Inc., Check Point Software Technologies, Jupiner Networks |

Network Security Appliance Market Segmental Analysis :

By Type :

The type segment is classified into firewalls, virtual private networking, hyper-scale network security, unified threat management, network management, and others. In 2024, the Firewalls segment accounted for the highest network security appliance market share as firewalls offer a wide range of features, including stateful packet inspection, URL filtering, antivirus and antimalware scanning, and deep packet inspection. The multi-layered approach allows organizations to defend against various types of threats, creating firewalls as an attractive all-in-one security solution. Additionally, firewalls offer more granular control over the DNS enquiring behavior and automatically detect accounts and resources that fail to comply with the organization's set of security rules. Firewalls are responsible to configure, monitor, and maintain security policies across the network, thus contributing notably to the dominance of the segment. For instance, in March 2021, Amazon Web Services, Inc. launched Amazon Route 53 Resolver DNS Firewall to block DNS queries for malicious domains and also provide granular control over the DNS querying. Additionally, the firewall offers two managed domain botnet command and control domains and malware domains to offer protection against threats, thus contributing notably to propel the network security appliance market growth.

Virtual Private Networking (VPN) is anticipated to register the fastest CAGR in the network security appliance market during the forecast period. VPNs provide a secure method for remote users to access corporate networks over the internet. Additionally, the increasing trend of remote work and rising need for secure access to company resources from various locations, is fueling the demand for VPNs. Moreover, VPNs encrypt data transmitted between the user's device and the corporate network, safeguarding sensitive information and thus contributing to market expansion. Furthermore, VPNs help users to maintain privacy by hiding the real IP addresses and routing the internet traffic through secure servers. This feature is particularly important while accessing the internet from public Wi-Fi networks or in countries with strict internet censorship, thus contributing notably in bolstering the market proliferation.

By Deployment :

The deployment segment is bifurcated into cloud and on-premise. In 2024, the Cloud segment accounted for the highest network security appliance market share are also predicted to witness the fastest CAGR in the upcoming years. The proliferation is attributed to the ability of cloud-based solutions to offer improved scalability to quickly adjust to meet the changing requirements of organizations. Additionally, traditional on-premises security appliances require substantial upfront investments in hardware, maintenance, and ongoing updates. Cloud-based solutions shift the capital expense to an operational expense model, allowing organizations to pay for only the used resources. Moreover, cloud-based security appliances receive real-time updates and threat intelligence from the service provider, thus offering protection against emerging threats. Consequently, the above-mentioned benefits offered by cloud-based appliances are contributing notably in bolstering the market expansion. For instance, in April 2023, Akamai Technologies, Inc. launched a Prolexic network cloud firewall to provide improved flexibility to the users to secure the network edge. The advanced cloud-based solution is extensively adopted in data centers, offering advanced protection against cyberattacks, hence contributing remarkably in bolstering the network security appliance market growth.

By Enterprise Size :

The enterprise size segment is bifurcated into large enterprise and small-medium enterprise. Large enterprises accounted for the largest market share in 2024 as large enterprises have higher bandwidth requirements compared to small businesses. The enterprises rely on fast and reliable internet connectivity to support the operations and involve data-intensive activities including cloud computing, video conferencing, large-scale file transfers, and remote access to corporate networks. The vast network of large enterprises is subjected to cyberattacks, thus necessitating the need for advanced security appliances to provide improved protection. NSAs are crucial in providing the necessary defenses against cyberattacks, namely Distributed Denial of Service (DDoS) attacks, ransomware, malware, and phishing attempts. Consequently, the aforementioned reasons are contributing significantly in propelling the proliferation of the market.

Small-medium enterprises are anticipated to witness the fastest CAGR in the network security appliance market during the forecast period. The growth is attributed to the increasing adoption of cloud services and e-commerce solutions by small-medium enterprises that require fast and reliable internet connectivity. E-commerce websites are highly subjected to cyberattacks, further increasing the usage of the appliances to offer enhanced security, thus contributing in promoting the expansion of the small-medium enterprises segment during the forecast period.

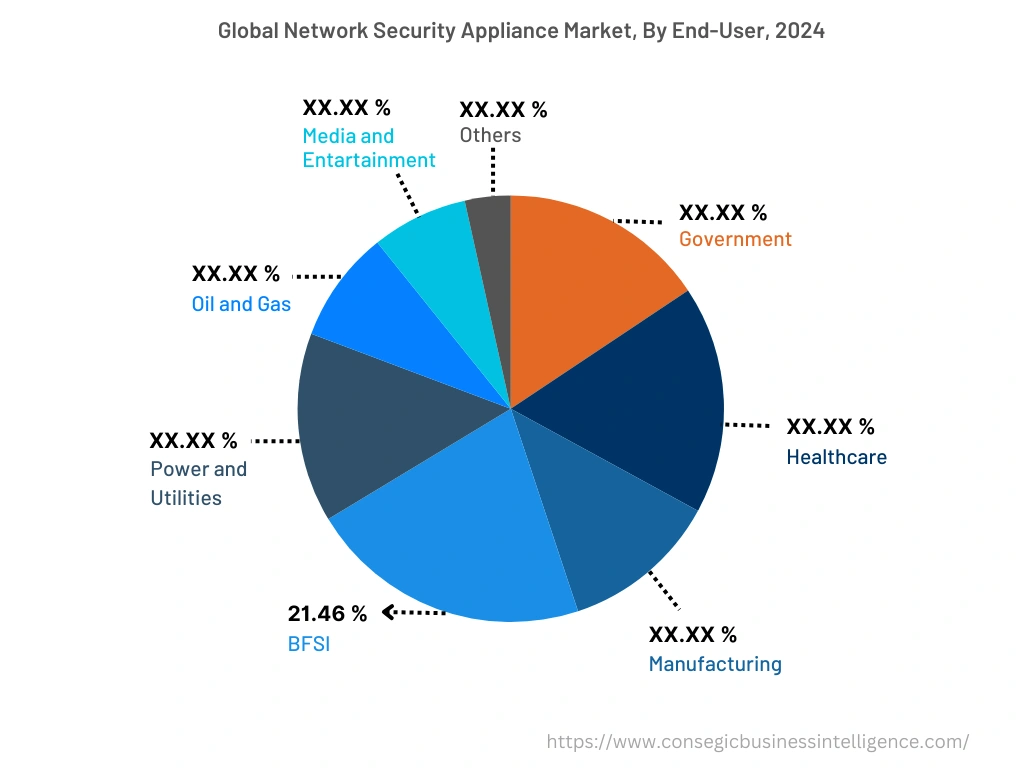

By End-User :

The end-user segment is classified into government, healthcare, manufacturing, BFSI, power and utilities, oil and gas, media and entertainment, and others. BFSI sector accounted for the largest market share of 21.46% in 2024 owing to the increasing number of cyberattacks on financial institutions including banks. Additionally, the growing need to provide digital privacy and sealed security solutions to financial institutions for the efficient functioning of financial management systems is further contributing to market the market expansion.

The appliances function by filtering and inspecting incoming and outgoing network traffic, preventing unauthorized access to the network, and protecting against various cyber threats, including malware, DDoS attacks, and intrusion attempts. Analysis of network security appliance market trends concludes that the increasing need for advanced security solutions in financial institutions is driving the growth of the market.

The healthcare segment is anticipated to register the fastest CAGR in the network security appliance market during the forecast period. The healthcare sector handles patient's sensitive information including health history and records of financial statements, which raises the frequency of cyber-attacks. The appliances monitor network traffic for suspicious activities and patterns that indicate an intrusion attempt. Additionally, the appliances detect and block or alert administrators about potential threats, helping to mitigate security breaches. Analysis of network security appliance market trends concludes that the the ability of these appliances to prevent unauthorized access of data is contributing remarkably in bolstering the proliferation of the healthcare segment during the forecast period.

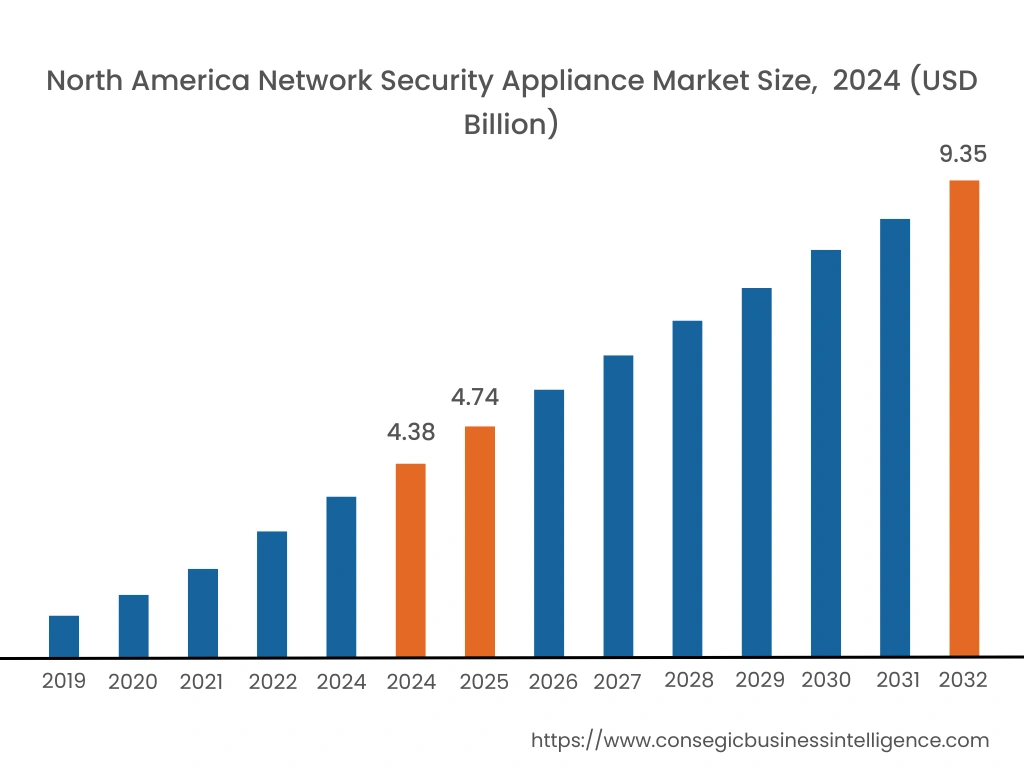

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

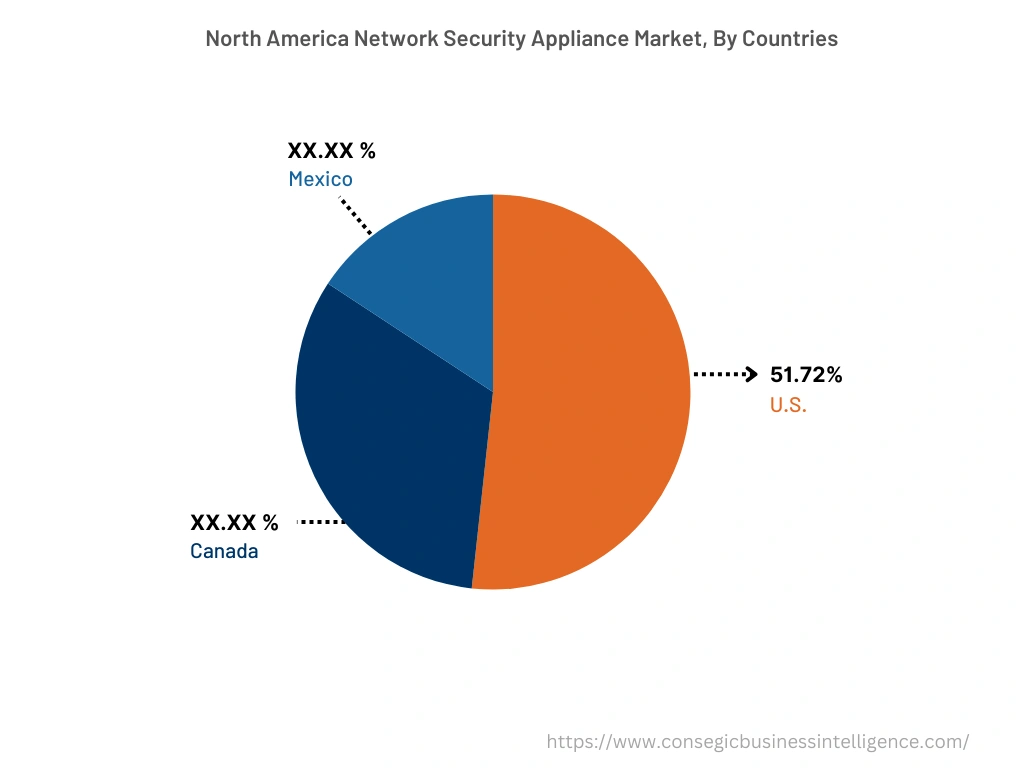

North America accounted for the largest market share accounting to USD 4.38 Billion in 2024 and is expected to reach USD 9.35 Billion in 2032 in the network security appliance market. In addition, in the region, the U.S. accounted for the maximum revenue share of 51.72% in the year 2024. North America, particularly the United States, is at the forefront of technological innovation, especially in the field of cybersecurity. Additionally, many renowned tech companies and startups in the region are focusing on developing cutting-edge network security appliances, leveraging the latest advancements in technology. The network security appliance market analysis concluded that the rising number of cybercrimes in the region is also contributing notably in increasing the adoption of the security appliances, which in turn is promoting market growth. For instance, in March 2023, according to the Federal Bureau of Investigation, the Internet Crime Complaint Center (IC3) received a total of 800,944 cybercrime cases in the United States, with losses exceeding USD 10.3 billion. Phishing was the major crime with 300,497 complaints and cryptocurrency investment fraud grew from USD 907 million in 2021 to USD 2.57 billion in 2022.

Asia Pacific is expected to register the fastest CAGR of 10.7% in the network security appliance market during the forecast period. The growth is attributed to the expanding IT industry, creating a favorable environment for the adoption of the appliances. Additionally, businesses in the region heavily rely on interconnected networks, small cell power amplifiers and cloud services, driving the requirement for reliable and effective security solutions. The network security appliance market analysis concluded that the presence of key players in the region including Huawei Technologies Co., Ltd., and Check Point Software Technologies Ltd. among others, focusing on improving efficiency and enhancing operations to stay competitive in the market, is further contributing to market growth.

Top Key Players & Market Share Insights:

The landscape of the network security appliance market is highly competitive and has been examined in the report, along with complete profiles of The major companies operating in network security appliance industry. In addition, the surge in innovations, acquisitions, mergers, and partnerships has further accelerated the proliferation of the network security appliance market. Major players in the market include-

- TXOne Networks

- Trend Micro Inc.

- Fortinet Inc.

- Cisco Systems Inc.

- Check Point Software Technologies

- Jupiner Networks

- Palo Alto Networks Inc.

- NortonLifeLock Inc.

- Juniper Networks Inc.

- Intel Corporation

- Honeywell International Inc.

- Hewlett Packard Enterprise Company

Recent Industry Developments :

- In March 2023, TXOne Networks launched EdgeIPS 103 intrusion prevention system to provide broad operational technology (OT) visibility, and sense existing network traffic without disrupting operations.

- In March 2023, Mastercard acquired Baffin Bay Networks to offer multi-layered cloud-based protection to customers against cyber-attacks.

Key Questions Answered in the Report

What is a network security appliance? +

A network security appliance is a hardware device designed to enhance the security and protection of computer networks against various threats and vulnerabilities.

What specific segmentation details are covered in the network security appliance market report, and how is the dominating segment impacting the market growth? +

Firewalls dominate the market in 2024 as firewalls offer a wide range of features, including stateful packet inspection, URL filtering, antivirus and antimalware scanning, and deep packet inspection. The multi-layered approach allows organizations to defend against various types of threats, creating firewalls as an attractive all-in-one security solution.

What specific segmentation details are covered in the network security appliance market report, and how is the fastest segment anticipated to impact the market growth? +

Healthcare is projected to register as the fastest segment as the sector handles patient’s sensitive information including health history and records of financial statements, which raises the frequency of cyber-attacks. Network security appliances monitor network traffic for suspicious activities and patterns that indicate an intrusion attempt.

Which region is anticipated to witness the highest CAGR during the forecast period, 2025-2032? +

Asia Pacific is anticipated to witness the fastest CAGR during the forecast period due to the expanding IT industry, creating a favorable environment for the adoption of network security appliances.