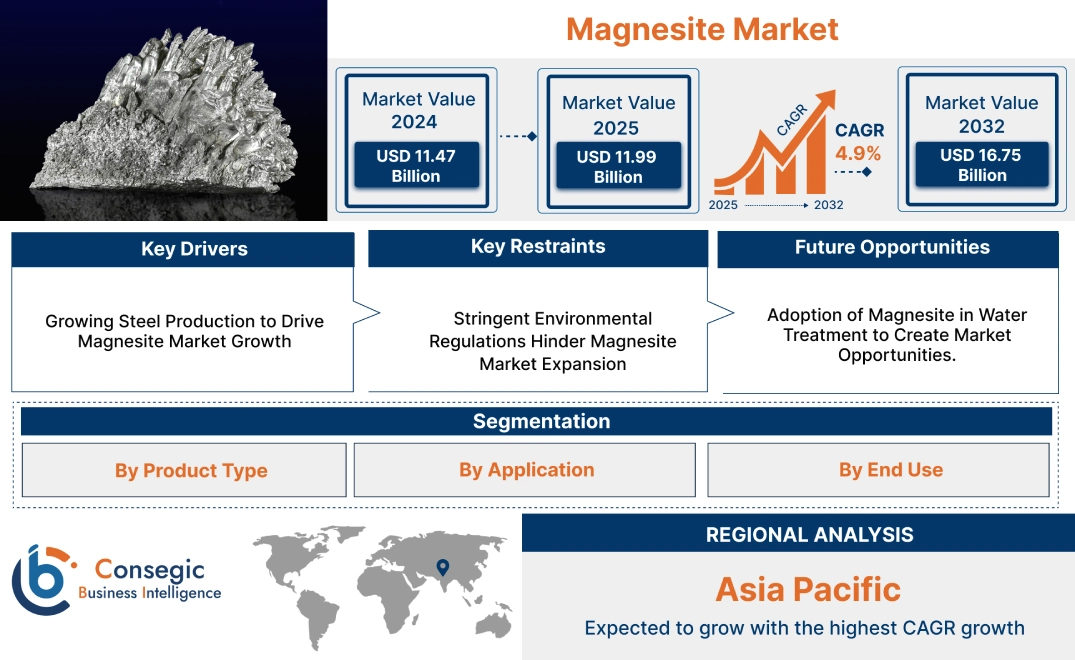

Magnesite Market Size:

The Magnesite Market size is growing with a CAGR of 4.9% during the forecast period (2025-2032), and the market is projected to be valued at USD 16.75 Billion by 2032 from USD 11.47 Billion in 2024. Additionally, the market value for 2025 is attributed to USD 11.99 Billion.

Magnesite Market Scope & Overview:

Magnesite (MgCO3) is a carbonate of magnesium. It occurs as a secondary deposit as veins and in an alteration product of ultrabasic rocks, serpentinite, and other magnesium-rich rock types. It presents as a typical white, grayish-white, or yellowish substance, exhibiting a vitreous to dull luster. Characterized by moderate hardness, the compound’s principal economic significance lies in its role as the primary source for the production of magnesia through calcination. This derived magnesia is a critical component in the manufacturing of refractory materials, which are essential for high-temperature industrial applications within the steel, cement, and glass sectors. Beyond its refractory applications, the compound serves as a feedstock for various magnesium compounds utilized in agriculture, chemical processing, and even emerging fields such as water treatment.

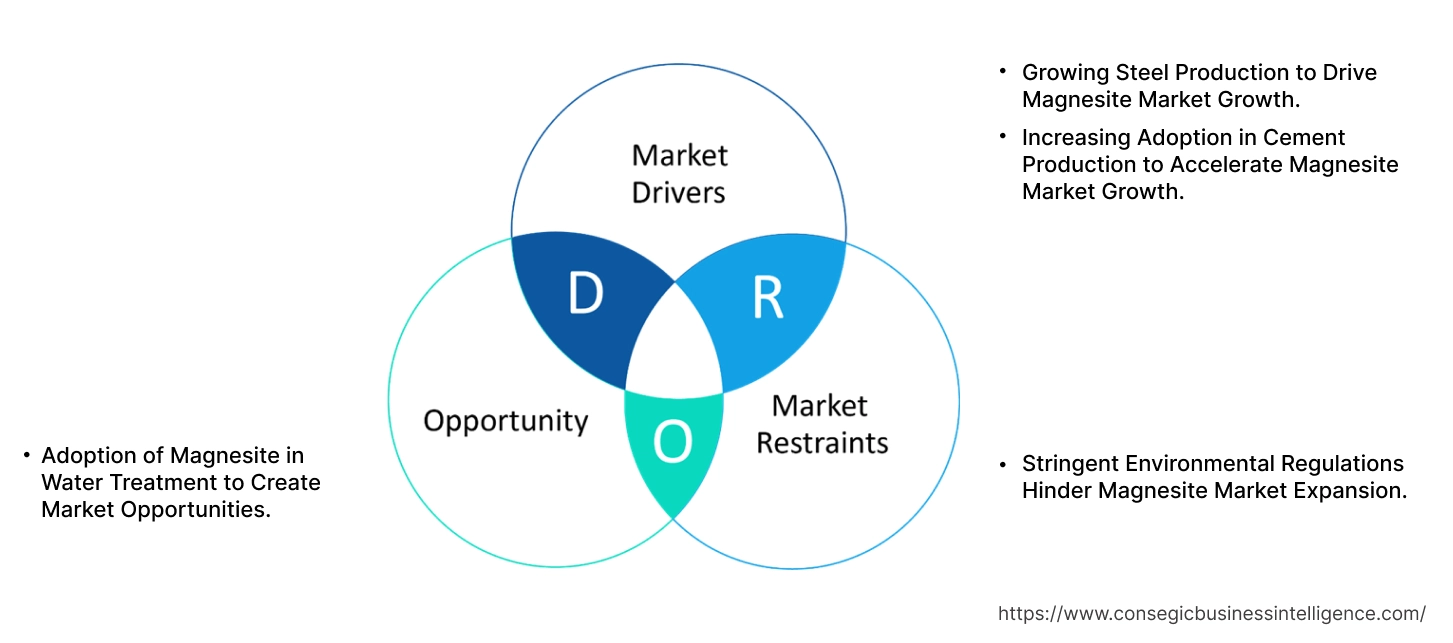

Key Drivers:

Growing Steel Production to Drive Magnesite Market Growth.

The high-temperature processes involved in steel manufacturing necessitate the use of robust refractory materials to line furnaces, converters, ladles, and other critical equipment. Steel production employs magnesite, particularly in the form of dead-burned form (DBM) as a vital component in refractory linings for furnaces and converters. Refractories use the inherent ability of the compound to withstand high furnace temperatures. Additionally, it also delivers the ability to withstand rapid temperature changes and resistance to reaction with molten steel and slag. As adoption accelerates, the sector's requirement for refractory materials surges, directly impacting market demand.

- For instance, according to World Steel Association AISBL, steel production across the globe including 71 countries increased by 5.6% from 2023 reaching 5 million tonnes in 2024.

Thus, due to the above-mentioned factors, the market for the compound in steel production is growing.

Increasing Adoption in Cement Production to Accelerate Magnesite Market Growth.

The properties of magnesite, which offer a combination of excellent high-temperature resistance, chemical stability in alkaline environments, and resistance to abrasion, are used in refractory linings of cement kilns. High-quality refractories contribute to the longer lifespan and operational efficiency of cement kilns. As the world is experiencing the continued upgradation of infrastructure and construction activities are increasing, the requirement for cement production is rising.

- For instance, according to IBEF, India's cement production in FY23 reached 374.55 million tonnes, marking a year-over-year (YoY) increase of 6.83%.

Thus, as per the market analysis, the increasing requirement for the compound in refractories for cement production is contributing to the market revenue.

Key Restraints:

Stringent Environmental Regulations Hinder Magnesite Market Expansion.

The mining of magnesite is often associated with substantial soil and water contamination, alongside the generation of waste and air pollution that requires rigorous regulatory oversight. These regulations are important for environmental preservation which lead to an increase in production costs. This acts as a financial hurdle for key players operating in the market. Furthermore, the complex nature of waste disposal and processing needs significant capital. Consequently, compliance with these stringent standards leads to supply chain disruptions, as mining and processing operations face potential closures or restrictions due to non-compliance. The global focus on sustainability is further amplifying the regulatory pressure, leading the key players to adopt more environmentally responsible practices. Hence, as per analysis, the aforementioned factors are restraining magnesite market expansion.

Future Opportunities :

Adoption of Magnesite in Water Treatment to Create Market Opportunities.

The role of magnesite in water treatment, especially those in the calcined form, is one of the major factors creating new magnesite market opportunities. These compounds are known for their ability to precipitate and remove various heavy metals from contaminated water through adsorption and co-precipitation mechanisms. This is crucial for industrial wastewater treatment and environmental remediation. As governments and industries worldwide increase their investments in water treatment infrastructure, the need for water treatment chemicals is expected to increase significantly.

- For instance, the S. Environmental Protection Agency announced USD 6.2 billion in FY25 Bipartisan Infrastructure Law funding to upgrade essential water infrastructure for safe wastewater management and drinking water.

Hence, this increasing adoption of the compound in water treatment directly benefits the magnesite market demand.

Magnesite Market Segmental Analysis :

By Product Type:

Based on product type, the market is categorized into dead burnt magnesite (DBM), caustic calcined magnesite (CCM), fused magnesite (FM), and others.

Trends in Product Type:

- Demand for higher-grade DBM with lower impurities is increasing to meet stringent requirements of advanced steel production

- Interest in lightly calcined magnesite for specific chemical processes and the production of magnesium compounds is rising.

The dead burnt magnesite (DBM) segment accounted for the largest market share in 2024.

- DBM refers to the magnesite that is chemically unreactive. It is produced by high-temperature calcination and is characterized by its low reactivity and high refractoriness.

- Steel furnaces and converters require substantial quantities of high-quality refractories to withstand extreme temperatures and corrosive environments, and DBM's properties make it suitable for this application.

- Additionally, the significant demand for steel across the globe further fuels the segment's revenue.

- For instance, according to IBEF, India's consumption of finished steel reached 119.17 million tonnes in the fiscal year 2023, subsequently rising to 138.5 million tonnes in FY24. Projections indicate a consumption volume of 111.25 million tonnes for FY25.

- As per the analysis, owing to the high adoption of steel, the DBM segment dominates the magnesite market demand.

The fused magnesite (FM) segment is expected to grow at the fastest CAGR over the forecast period.

- Fused magnesite, also known as electrofused magnesia, is a high-purity refractory material produced by melting natural magnesite in an electric arc furnace that results in a dense and highly crystalline structure.

- The adoption of FM is fueled by rising demand for high-performance refractories in specialized sectors, and expanding applications in electrical insulation for advanced electronics and power infrastructure.

- Additionally, its suitability for niche applications in advanced materials and chemical processes is expected to boost its adoption in the upcoming years.

- Hence, owing to the above-mentioned factors, the FM segment is expected to grow at the fastest rate over the future years.

By Application:

Based on application, the market is categorized into refractories, fertilizers, building materials, animal feed, water treatment, chemical processing, and others.

Trends in the Application:

- Focus on extending the lifespan and improving the energy efficiency of refractory linings is a trend positively impacting the market.

- The adoption of magnesite-derived products for efficient pH adjustment and phosphate precipitation in water treatment is rising.

The refractories segment accounted for the largest magnesite market share in 2024.

- A significant volume of mined and processed magnesite is ultimately utilized in the production of essential refractory materials which are crucial for the operational integrity of key end-use sectors.

- Specifically, the steel, cement, and glass sectors exhibit a reliance on magnesite-based refractories for lining their critical high-temperature processing units, including furnaces, kilns, and converters.

- The large scale of production within these core sectors necessitates a correspondingly large and consistent consumption of compounds in refractory applications.

- For instance, the National Bureau of Statistics of China stated that cement output was 2.02 billion tonnes in the year 2023. The China Cement Association (CCA) estimated that the capacity utilization rate was 59% in 2023.

- Consequently, the refractories segment functions as the principal determinant of dynamics within the broader market.

The water treatment segment is expected to grow at the fastest CAGR over the forecast period.

- Increasingly stringent environmental regulations worldwide are mandating more rigorous treatment of industrial and municipal wastewater, particularly concerning the removal of harmful pollutants such as heavy metals, phosphates, and sulfates.

- Magnesite compounds present effective and more environmental alternatives for meeting these demanding standards.

- Furthermore, the escalating global focus on sustainable water management is driving the adoption of natural and potentially less energy-intensive treatment solutions, where magnesium-based products are gaining recognition.

- Their cost-effectiveness and efficiency in key processes like pH adjustment and pollutant precipitation, coupled with ongoing technological advancements and research into innovative applications, further solidify this growth trajectory.

- Hence, owing to the above-mentioned analysis, the water treatment segment is expected to grow at the fastest rate over the future years, creating magnesite market opportunities.

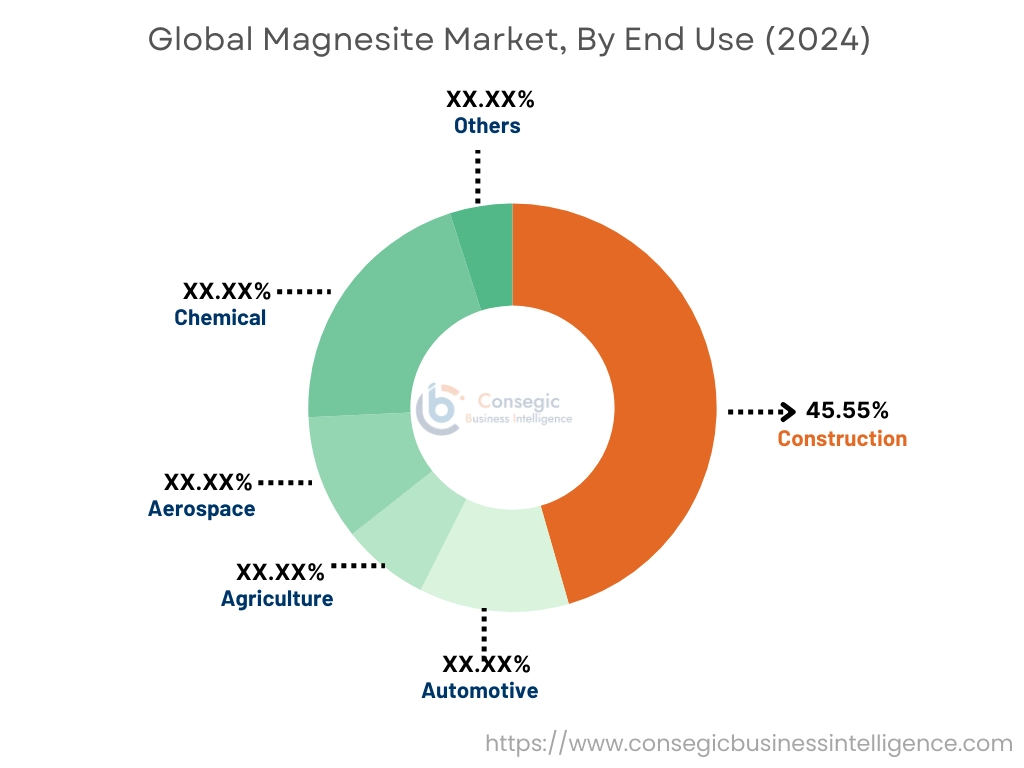

By End Use:

The end use segment is categorized into construction, automotive, agriculture, aerospace, chemical, and others.

Trends in the End Use:

- Increasing use of magnesia-based cement for specialized, rapid-setting, and fire-resistant applications in urban infrastructure.

- The growing requirement for magnesite-based high-performance alloys in automotive compounds.

The Construction segment accounted for the magnesite market share of 45.55% in 2024.

- Magnesite is utilized in the construction industry primarily in the production of specialized cement, steel, and other magnesia-based binders. These cements offer unique properties such as rapid hardening, high early strength, good abrasion resistance, and fire resistance, making them suitable for specific applications like industrial flooring, fireproof panels, and repair materials.

- Furthermore, the compound is used as a component in certain types of wall panels and as a filler in some construction composites.

- The growth in this segment is influenced by the rise in infrastructure development, particularly for specialized industrial and commercial buildings requiring these unique properties.

- For instance, according to the data published by the United States Census Bureau, it is stated that total private non-residential construction spending that includes commercial construction accounted for USD 757.5 billion in 2025, which is 2.5% from 2024.

- Thus, as per the magnesite market analysis, the construction segment is dominating the magnesite market trends.

The Automotive segment is expected to grow at the fastest CAGR over the forecast period.

- The focus on vehicle lightweighting in the automotive sector is the major factor that is creating lucrative options for magnesite in the market.

- Stringent emission regulations and the burgeoning electric vehicle market are key factors, as reducing vehicle mass is crucial for enhanced fuel efficiency and extended battery range, respectively.

- Consumer need for improved fuel economy in conventional vehicles further reinforces this trend.

- Ongoing technological advancements in magnesite-based alloys are yielding stronger, more durable, and cost-effective materials, facilitating their increasing substitution for heavier alternatives like aluminum and steel across various automotive components.

- This convergence of environmental pressures and technological progress positions the automotive industry as significant growth for consumption in the forecast period.

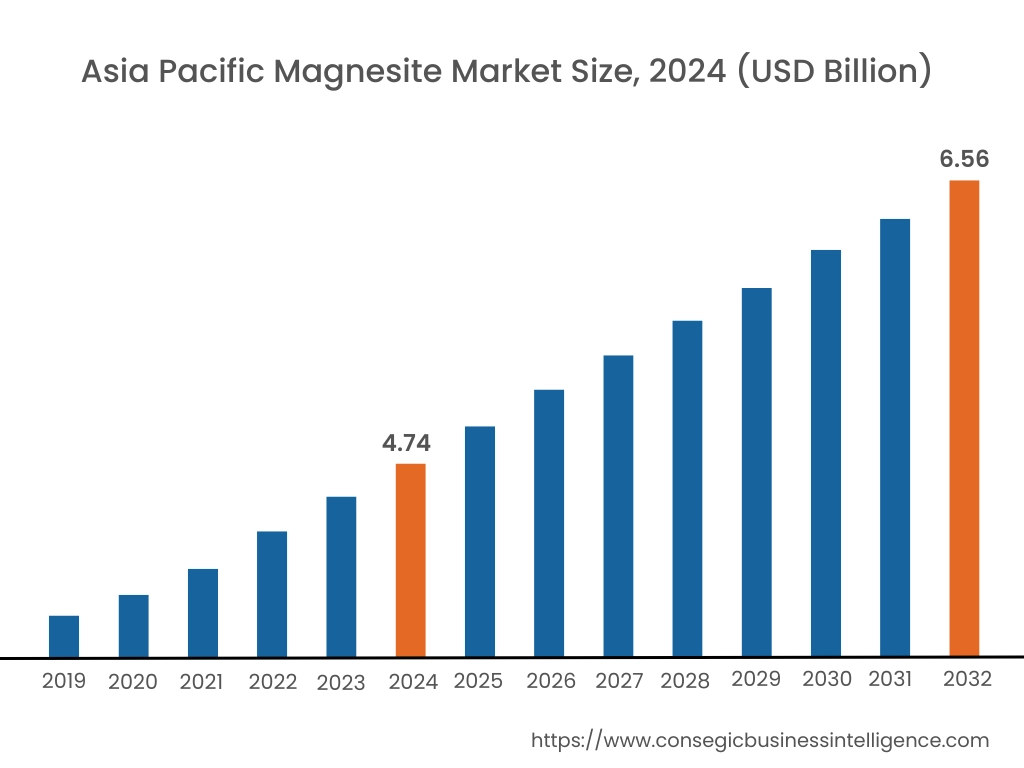

Regional Analysis:

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

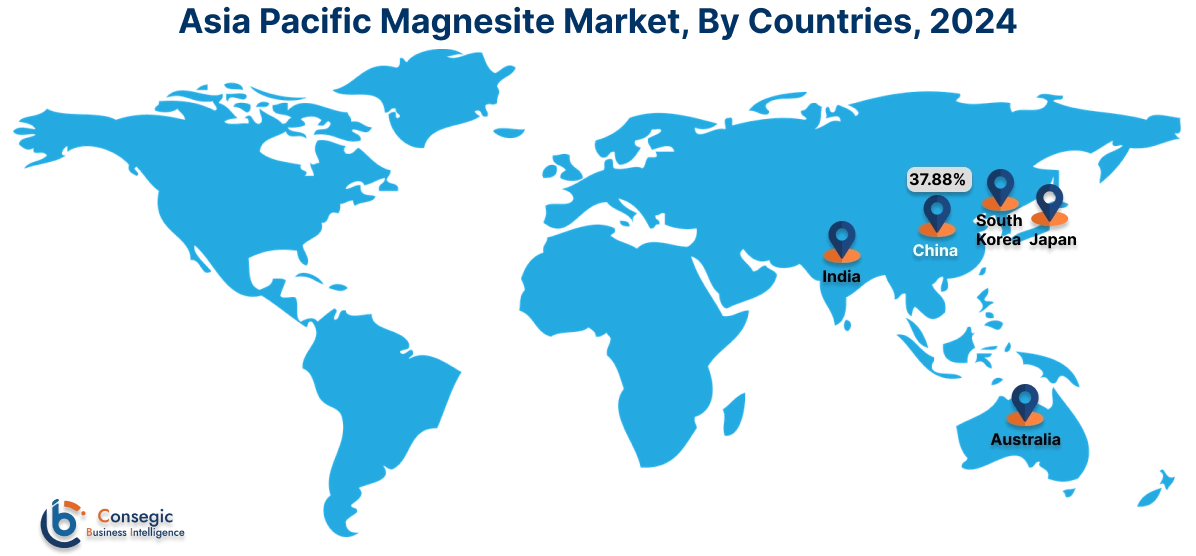

In 2024, Asia Pacific accounted for the highest market share at 41.33% and was valued at USD 4.74 Billion and is expected to reach USD 6.56 Billion in 2032. In Asia Pacific, China accounted for a market share of 37.88% during the base year of 2024. Asia Pacific's influence on the market is significant due to the region being both the major production hub and dominant consumer. China's significant magnesite output positions the region as a vital source of the compound. Additionally, the region's robust manufacturing sector, particularly in steel and cement, drives substantial requirements. Moreover, the expanding construction and automotive market is further contributing to the share in this region.

- For instance, according to the China Association of Automobile Manufacturers, in 2023, China's car output exceeded 30.16 million units, with an 11.6% year-on-year rise.

These factors create a strong upward trajectory for the Asia Pacific market, positioning it as a key region for players.

In Europe, the magnesite industry is experiencing the fastest growth with a CAGR of 5.6% over the forecast period. One of the key factors contributing to the region’s market revenue is the availability of magnesite reserves and production. Industrialized nations across Europe are major consumers, primarily driven by the requirement for high-quality refractories in their established steel, cement, and glass sectors. Furthermore, replacement needs within these mature sectors, coupled with a strong focus on superior refractory performance and the influence of environmental regulations on industrial processes are crucial factors. These factors collectively present a positive impact on the European market.

The North American market for magnesite is significantly defined by the high adoption of steel and cement. The region's need for high-quality building and automotive materials all reliant on the compound is driving market revenue. Moreover, niche applications in chemicals and environmental treatment play a critical role. Furthermore, the adoption of the compound in fertilizer and animal feed products further along with the growing agriculture sector contributes to the region's upward market trajectory over the forecast period.

The Latin American magnesite market trend is driven by the region's focus on infrastructure development. The growing investments in manufacturing sectors, particularly in countries such as Brazil, contribute significantly to this requirement, particularly for magnesite-based refractories used in their steel and cement sectors. Furthermore, the growing agricultural sector in several Latin American nations is creating an adoption of CCM as a soil amendment and fertilizer. Supportive government policies are further contributing to the market need in the region. International investments and expertise are further accelerating these initiatives. These aforementioned trends are contributing to the upward trajectory of the market.

The Middle East and African magnesite market analysis is currently characterized by a reliance on imports. This has led to significant growth potential for the market in the upcoming years. Additionally, increasing infrastructure projects across many countries in the Middle East and Africa are leading to increased requirements for cement. The oil and gas sector, dominant in many Middle Eastern countries, indirectly influences the market through the need for specialized refractories used in petrochemical plants and related high-temperature applications. This presents an opportunity to meet rising needs.

Top Key Players and Market Share Insights:

The Global Magnesite Market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D) and product innovation to hold a strong position in the global Magnesite market. Key players in the Magnesite industry include

- QMAG Pty Limited (Australia)

- Grecian Magnesite (Greece)

- SONGMAG (China)

- American Elements (U.S.)

- Sibelco (Belgium)

- RHI Magnesita (Austria)

- Magnezit Group (Russia)

- Baymag Inc. (Canada)

- Beihai Group (China)

- LKAB (Sweden)

Recent Industry Developments :

- In June 2023, Grecian MagnesiteA. announced that its Turkish subsidiary, Akdeniz Mineral Kaynaklari AS (AMK), has signed an EPC contract to build a new rotary kiln at its Kümbet plant. This expansion project will more than double AMK's annual caustic calcined magnesia production capacity to around 50,000 metric tons, with the new kiln capable of producing over 100 tons of CCM (or approximately 70 tons of deadburned magnesia) per day.

Magnesite Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 16.75 Billion |

| CAGR (2025-2032) | 4.9% |

| By Product Type |

|

| By Application |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Magnesite market? +

In 2024, the Magnesite market is USD 11.47 Billion.

Which is the fastest-growing region in the Magnesite market? +

Europe is the fastest-growing region in the Magnesite market.

What specific segmentation details are covered in the Magnesite market? +

By Product Type, By Application and End Use segmentation details are covered in the Magnesite market.

Who are the major players in the Magnesite market? +

QMAG Pty Limited (Australia), Grecian Magnesite (Greece), RHI Magnesita (Austria), LKAB (Sweden) are some of the major players in the market.