Steel Rebar Market Size :

Consegic Business Intelligence analyzes that the steel rebar market size is growing with a CAGR of 5.4% during the forecast period (2023-2031), and the market is projected to be valued at USD 372.41 Billion by 2031 and USD 258.13 Billion in 2023 from USD 247.88 Billion in 2022.

Steel Rebar Market Scope & Overview:

Steel rebar is an abbreviated term used for the reinforcing bar which is a commonly used construction material made from steel. It is typically composed of carbon steel and has ridges or deformations on its surface to enhance its adhesion to concrete. It is primarily used to reinforce and strengthen concrete structures, such as buildings, bridges, highways, and other infrastructure projects.

It in these applications improves the tensile strength of the concrete as concrete has very weak tension but has strong compression. Steel is only used as rebar because the elongation of steel due to high temperatures (thermal expansion coefficient) nearly equals that of concrete. It also provides various advantages over other materials such as the ability to be bent in any shape, robustness, ability to recycle, compatibility with concrete, and high availability.

Steel Rebar Market Insights :

Steel Rebar Market Dynamics - (DRO) :

Key Drivers :

Significant rise in infrastructure development and urbanization projects across the globe

Steel rebar is primarily used in the construction sector to provide strength and tension to the concrete and masonry structure. Based on the analysis, the significant rise in urbanization projects across various developing economies worldwide is driving the market for this material. For instance, in October 2021, the government of India launched 75 urban development projects in Uttar Pradesh under the Smart Cities Mission. Furthermore, growing government initiatives for the development of urban projects is also driving the market. For instance, in May 2023, the European Urban Initiative announced the launch of USD 128.56 million for various urban development projects such as green cities, sustainable tourism, and others. Hence, the growing focus on infrastructure development by the government bodies as well as increasing initiatives for the urban development projects are the prominent factors boosting the market trends.

Growing demand for steel rebar from non-residential construction

Steel rebar is heavily used in the construction sector as a key raw material. Non-residential construction refers to the construction of buildings and structures that are not primarily intended for residential or housing purposes. Instead, these buildings serve various commercial, industrial, institutional, or public functions. Based on the analysis, the significant development in non-residential construction spending is improving the demand for this material in various construction activities driving the market. For instance, according to the report by the U.S. Census Bureau in June 2023, the non-residential construction spending in the U.S. increased by 1.9% in April 2023 from the previous year accounting for a total non-residential construction spending of USD 1.05 trillion in 2023. Therefore, the rising demand for these materials for the construction of non-residential infrastructural projects is influencing the demand for this material. This, in turn, is driving the market trends.

Key Restraints :

Increasing availability of low-cost steel rebar alternatives and decreasing global steel production

Various materials such as stainless-steel concrete reinforcement, engineered bamboo reinforcement, glass fiber reinforced polymer rebar, plastic fiber, helix micro rebar concrete reinforcement, and others are becoming popular and cost-effective alternatives for steel based rebar across the globe. Thus, increasing innovations in the development of these products are restraining the market. For instance, in March 2022, Researchers at the U.S.'s Rensselaer Polytechnic Institute invented an alternative to steel based rebar made from hemp, which they claim avoids the problem of corrosion while cutting carbon emissions from construction. The hemp rebar could be used to support concrete structures in the same way as steel but with a reduced environmental impact due to both its material makeup and its lifespan.

Furthermore, as per the analysis, decreasing global steel production is also affecting the steel rebar market growth. For instance, according to the report by the World Steel Association in January 2022, the global production of crude steel accounted for 140.7 million tons (Mt) in December 2022, a 10.8% decrease compared to December 2021. Thus, the growing development in the production of these materials substitutes and decreasing production of crude steel worldwide is hampering the market worldwide.

Future Opportunities :

Growing innovations in steel manufacturing and processing technologies

The growing innovations in manufacturing and processing technologies of steel are creating lucrative steel rebar market opportunities and trends in the forecast years. Advanced metallurgical techniques have led to the development of high-strength alloys that offer superior performance compared to traditional rebar. These alloys exhibit exceptional tensile strength, making them suitable for use in high-rise buildings, long-span bridges, and other critical infrastructure projects. They allow for the construction of more efficient and cost-effective structures. As per the analysis, various key manufacturers of this material worldwide are focusing on the development of advanced and more efficient manufacturing processes which is expected to benefit the market growth over the forecast period. For instance, in August 2023, Hybar a scrap recycling and rebar production company announced that they have raised an investment of USD 700 million for a green rebar mill in Arkansas, U.S. Hybar's rebar mill aims to demonstrate key components sourced from industry leaders like SMS group and Primetals Technologies. This technology is designed to significantly reduce energy consumption during the rebar production process, setting a new benchmark for efficiency. Hence, the significant development in manufacturing technology and increasing focus on product innovations are expected to provide lucrative opportunities and trends for the market in the forecast years.

Steel Rebar Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2031 |

| Market Size in 2031 | USD 372.41 Billion |

| CAGR (2023-2031) | 5.4% |

| By Type | Carbon Steel Rebar, Stainless Steel Rebar, Galvanized Rebar, Epoxy Coated Rebar, and Others |

| By Reinforcing Type | Deformed and Mild |

| By Bar Size | #3 Bar Size, #4 Bar Size, #5 Bar Size, #6 Bar Size, and Others |

| By End User | Residential, Infrastructure, and Industrial |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Nippon Steel Corporation, ArcelorMittal, NLMK Group, Steel Authority of India Limited, Steel Dynamics, Inc., Mechel PAO, Tata Steel Limited, Commercial Metal Company, Nucor Corporation, Hyundai Steel, and JSW Steel Limited |

Steel Rebar Market Segmental Analysis :

By Type :

The type segment is categorized into carbon steel rebar, stainless steel rebar, galvanized rebar, epoxy-coated rebar, and others. In 2022, the carbon steel rebar segment accounted for the highest market share in the steel rebar market. Carbon steel rebar provides high tensile strength, which is crucial for reinforcing concrete structures and withstanding heavy loads and forces. Based on the analysis, these types of materials exhibit good ductility, allowing them to bend and deform withstanding fracturing. This property is essential in earthquake-prone regions as it helps absorb energy during seismic events. Hence, owing to all these properties, carbon steel rebar is used in the construction sector to exhibit overall strength to the structure, which is increasing the carbon steel rebar market demand and thus driving the segment trends.

However, the stainless-steel rebar segment is expected to be the fastest-growing CAGR over the forecast period. This type of rebar provides excellent durability, fire resistance, structural performance, and exceptional corrosion resistance in harsh marine environments, resisting chlorides and pitting corrosion. Hence, the increasing demand for stainless steel rebar to protect against corrosion is expected to drive the segment development and trends during the forecast period.

By Reinforcing Type :

The reinforcing type segment is categorized into deformed and mild. In 2022, the deformed segment accounted for the highest market revenue in the overall steel rebar market, and it is also expected to hold the fastest CAGR over the forecast period. Deformed steel rebar feature ribs, grooves, and other deformations on their surface which provides several benefits when used in construction and concrete reinforcement. The deformations on the rebar's surface create a mechanical bond with the surrounding concrete. This bond enhances this adhesion between the rebar and concrete, preventing slipping and separation avoiding shrinkage & elongation of concrete, and preventing cracks. Hence, based on the analysis, owing to the large benefits offered by these material they are highly popular across the construction sector and used for various construction activities. This high popularity and advantages offered by the deformed steel rebar are driving the segment expansion and trends across the globe.

By Bar Size :

The application segment is categorized into #3 bar, #4 bar, #5 bar, #6 bar, and others. In 2022, the #4 bar segment accounted for the highest market revenue in the overall steel rebar market. #4 bar typically has a diameter of ½ inch or 12.7 millimeters and offers a good balance between strength and flexibility. It is easy to bend and shape, making it suitable for a wide range of construction applications where intricate design or complex structural configurations are required. This type of rebar is commonly used in commercial and industrial construction projects, such as offices, buildings, warehouses, and manufacturing facilities, where it provides the necessary strength for structural stability. The increasing investment in the development of commercial construction projects is driving the demand for steel rebar industry. For instance, in July 2021, Red Bull, a U.S.-based beverage manufacturing company announced an investment of USD 740 million for the construction of its own manufacturing, filling, and distribution campus in the Concord, North Carolina region.

However, the #5 bar segment is expected to be the fastest-growing segment during the forecast period owing to its widespread uses in the light commercial and residential construction industries, including patio decks, retaining walls, and caissons.

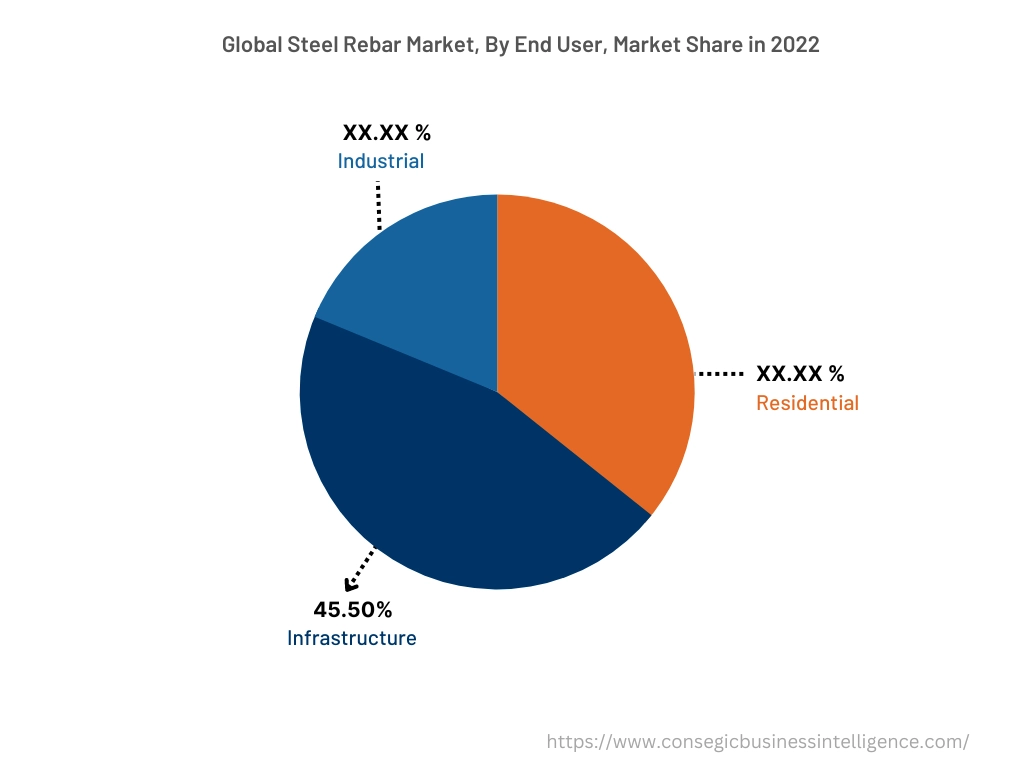

By End-User :

The end user segment is categorized into residential, infrastructure, and industrial. In 2022, the infrastructure segment accounted for the highest market share of 45.50% in the overall steel rebar market. The significant rise in the development of various infrastructure projects worldwide along with increasing investments to boost infrastructure construction activities across developed economies are driving the segment expansion across the globe. For instance, in June 2023, the European Union announced USD 324.25 million for the construction of four new flagship infrastructure projects in Bosnia and Herzegovina. Furthermore, in April 2023, The European Climate, Infrastructure and Environment Executive Agency (CINEA) launched a call for proposals for key cross-border EU energy infrastructure projects worth USD 802.59 million from the European Union budget. Therefore, the growing investment for the construction of various infrastructure projects across the developed economies is driving segmental epansion.

However, the residential segment is expected to be the fastest-growing segment during the forecast period owing to the increasing residential projects across the globe. For instance, in December 2022, the government of the U.S. announced an investment of USD 1.7 trillion among which USD 30.3 billion was allocated for housing choice vouchers.

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

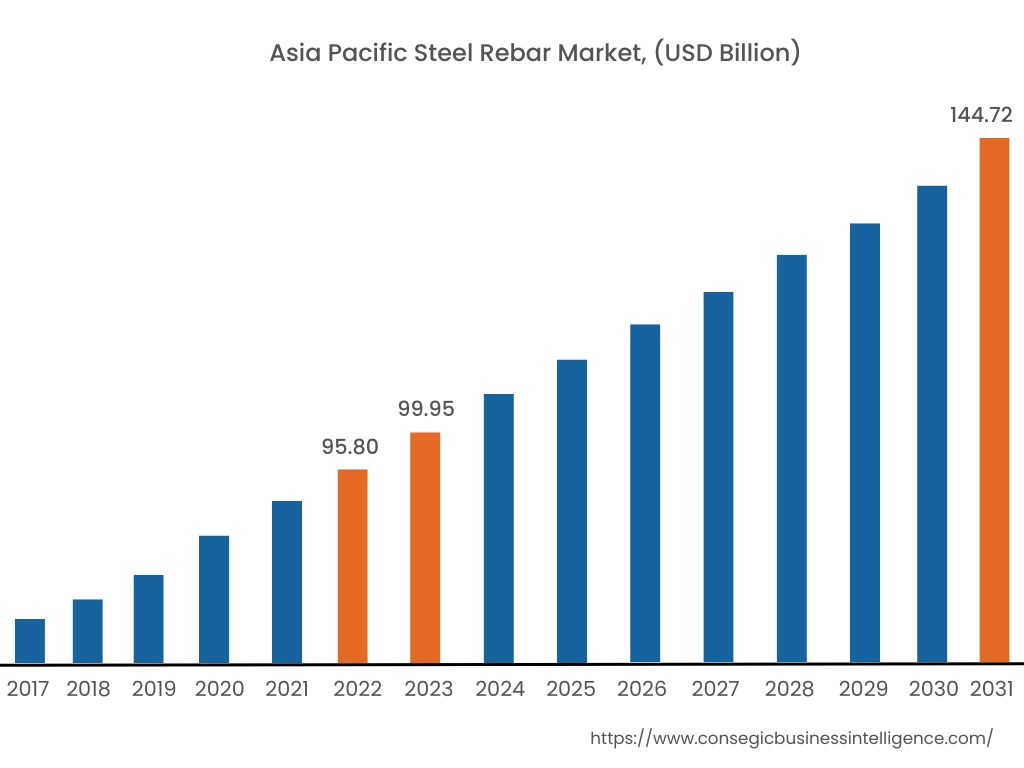

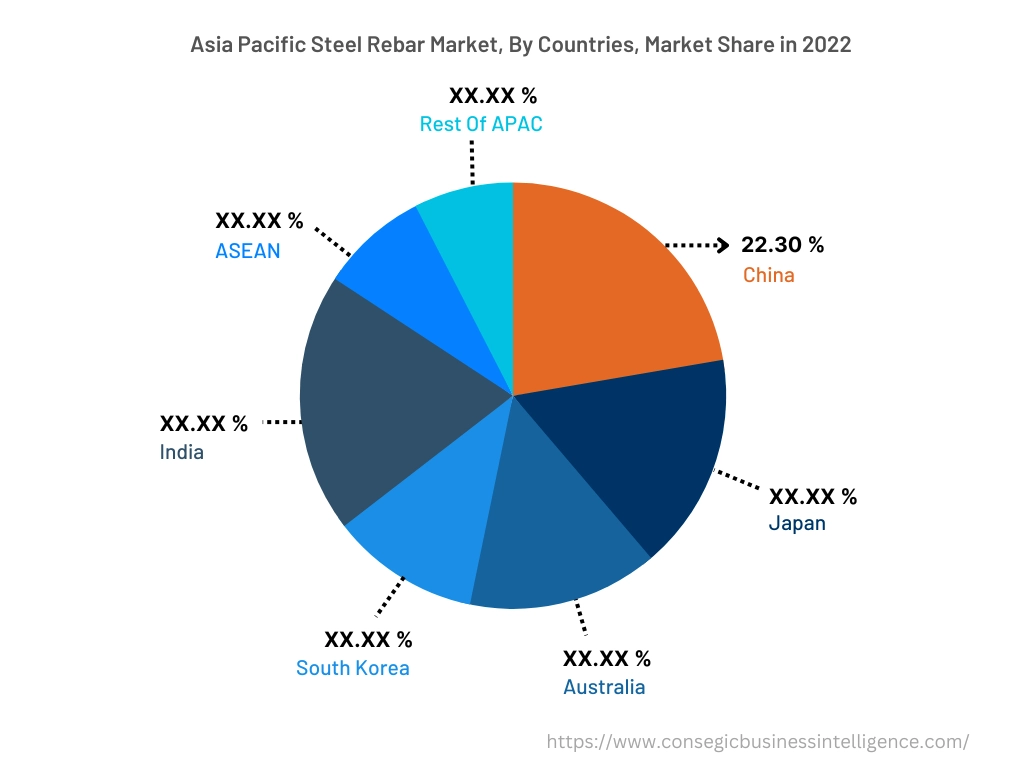

In 2022, Asia Pacific accounted for the highest steel rebar market share at 38.65% valued at USD 95.80 billion in 2022 and USD 99.95 billion in 2023, it is expected to reach USD 144.72 billion in 2031. In Asia Pacific, China accounted for the highest market share of 22.30% during the base year of 2022. Based on the steel rebar market analysis, the significant growth in construction projects across the region is fueling the market. For instance, according to the data published by the China State Council Information Office in February 2023, Chengdu, the capital of southwestern China's Sichuan province, announced the launch of 900 major construction projects this year. Among them, 145 are key infrastructure projects with a total investment of USD 132.13 billion. Meanwhile, more capital has been directed toward high-end industries in coastal areas. The significant growth in the construction sector in India is also driving market growth across the region. For instance, according to the report by the National Investment Promotion and Facilitation Agency, owing to the significant growth in the urban population in India, the construction sector in the country is expected to reach USD 1.4 trillion by 2025.

Furthermore, the North America region is expected to witness significant growth over the forecast period, growing at a CAGR of 6.3% during 2023-20230. This is due to the increasing investments in infrastructure projects across the region. For instance, in February 2022, the government of Mexico prepared a third infrastructure package of USD 3.53 billion for various infrastructure projects across the country. Thus, the aforementioned factors are propelling the steel rebar market trends in the coming years.

Top Key Players & Market Share Insights :

The global steel rebar market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market revenue through mergers, acquisitions, and partnerships. The key players in the market include-

- Nippon Steel Corporation

- ArcelorMittal

- Commercial Metal Company

- Nucor Corporation

- Hyundai Steel

- JSW Steel Limited

- NLMK Group

- Steel Authority of India Limited

- Steel Dynamics, Inc.

- Mechel PAO

- Tata Steel Limited

Recent Industry Developments :

- On the 5th of September 2023, Steel Authority of India Limited announced the capacity expansion of and modernization of its IISCO steel plant located in the eastern state of West Bengal from 2.5 mt per year to 7 mt per year.

- In October 2022, South Korea-based steel manufacturing company Hyundai Steel announced the expansion of its product lineup of its earthquake-resistant structural steel, branded as H Core.

- In December 2022, ArcelorMittal acquired Riwald Recycling (Riwald), a state-of-the-art ferrous scrap metal recycling business based in the Netherlands.

Key Questions Answered in the Report

What was the market size of the steel rebar industry in 2022? +

In 2022, the market size of steel rebar was USD 247.88 billion.

What will be the potential market valuation for the steel rebar industry by 2031? +

In 2031, the market size of steel rebar will be expected to reach USD 372.41 billion.

What are the key factors driving the growth of the steel rebar market? +

Significant growth in infrastructure development and urbanization projects across the globe is fueling market growth at the global level.

What is the dominating segment in the steel rebar market by the end user? +

In 2022, the infrastructure segment accounted for the highest market share of 45.50% in the overall steel rebar market.

Based on current market trends and future predictions, which geographical region is the dominating region in the steel rebar market? +

Asia Pacific accounted for the highest market share in the overall steel rebar market.