Millimeter Wave Technology Market Size:

Millimeter Wave Technology Market size is estimated to reach over USD 22.62 Billion by 2032 from a value of USD 4.25 Billion in 2024 and is projected to grow by USD 5.15 Billion in 2025, growing at a CAGR of 20.3% from 2025 to 2032.

Millimeter Wave Technology Market Scope & Overview:

Millimeter wave (mmWave) technology refers to electromagnetic waves with frequencies between 30 and 300 GHz, which are primarily used for high-speed wireless communication. Moreover, mmWave technology offers several benefits such as wide bandwidths, high data rates, extremely low latency, and high capacity, making it ideal for demanding applications. The above benefits of mmWave technology facilitate massive data transfer and near-instantaneous communication. Additionally, mmWave solutions are used in several industries including telecommunication, military & defense, automotive, transportation, and other sectors.

How is AI Transforming the Millimeter Wave Technology Market?

AI is revolutionizing the global millimeter-wave (mmWave) technology market by boosting both performance and reliability. Machine learning models optimize beamforming and directional signal steering, improving link quality and range in 5G networks and beyond. Furthermore, AI also enables real time interference detection and mitigation, adapting transmissions dynamically based on changing environments. This results in stronger throughput, lower latency, and more robust connections in dense urban or high mobility settings. Additionally, AI-powered predictive maintenance helps spot potential hardware issues in mmWave radios before failures occur. In satellite and fixed wireless applications, AI enhances spectrum management for efficient use of limited bandwidth. As demand for ultra high speed connectivity rises, AI-driven solutions are fueling innovation and wider adoption in mmWave deployments.

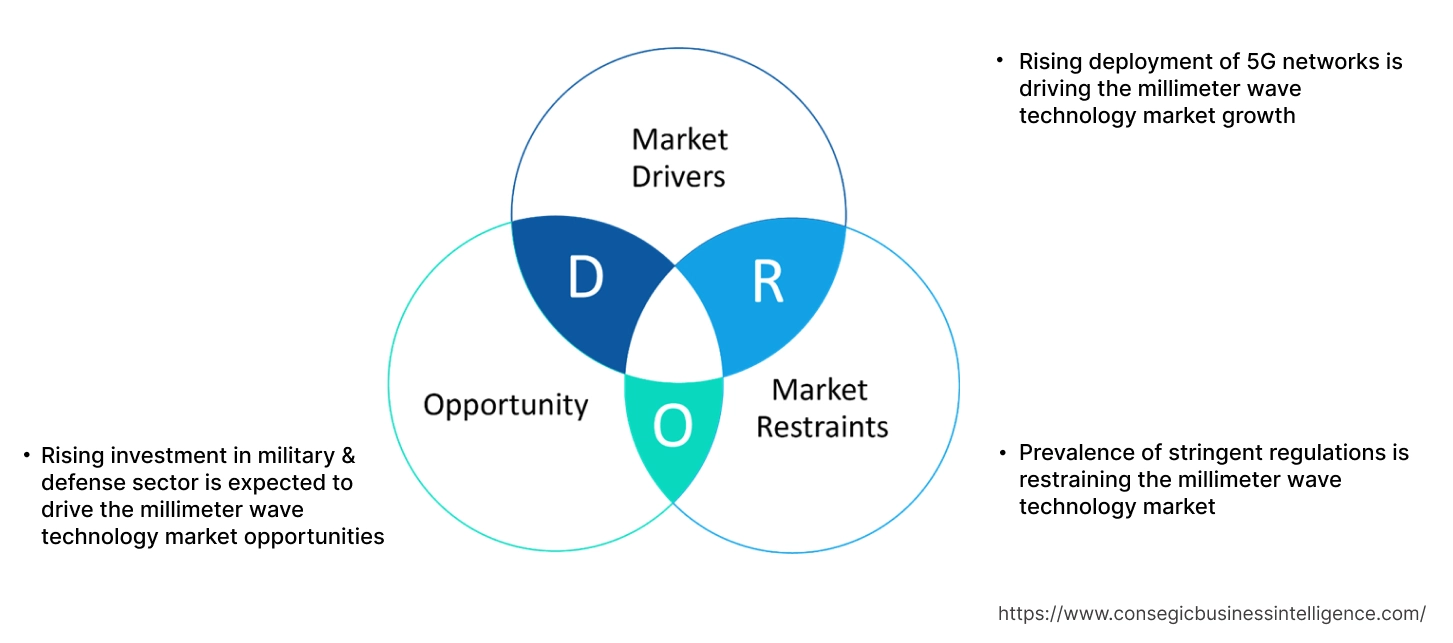

Millimeter Wave Technology Market Dynamics - (DRO) :

Key Drivers:

Rising deployment of 5G networks is driving the millimeter wave technology market growth

Millimeter wave technology plays a crucial role in 5G networks for providing ultra-fast speeds and high capacity in specific areas. It utilizes high-frequency radio waves (24 GHz and above) to achieve faster speeds. Moreover, mmWave operates on high-frequency bands, providing significantly more bandwidth than previous generations of cellular technology. This leads to faster data speeds and the ability to handle a larger number of connected devices simultaneously.

- For instance, Telefonica, a Spanish multinational telecommunications company, deployed its 5G services to approximately 1,400 municipalities in Spain in 2022 and 2,400 municipalities by 2023. Additionally, Telefonica installed 700MHz 5G base stations for serving 700 towns and cities throughout Spain as of February 2022.

Thus, the growing deployment of 5G networks is increasing the adoption of mmWave solutions for facilitating high-speed data transmission and communication, in turn driving the millimeter wave technology market size.

Key Restraints :

Prevalence of stringent regulations is restraining the millimeter wave technology market

The manufacturers of millimeter wave systems and components have to comply with several stringent standards, such as ISO (International Organization for Standardization) Standard - ISO 9001, FCC (Federal Communications) standard, and others, which are among the primary factors constraining the market growth.

For instance, ISO 9001 standard specifies particular requirements for a quality management system. MmWave system manufacturers must comply with the ISO standard for demonstrating the ability to consistently provide products and services that meet regulatory and customer requirements.

Additionally, the FCC Part 15 standard specifies the testing and certification procedures associated with millimeter-wave (mm-wave) applications. Hence, the prevalence of the aforementioned regulations and standards related to mmWave solutions is hindering the millimeter wave technology market expansion.

Future Opportunities :

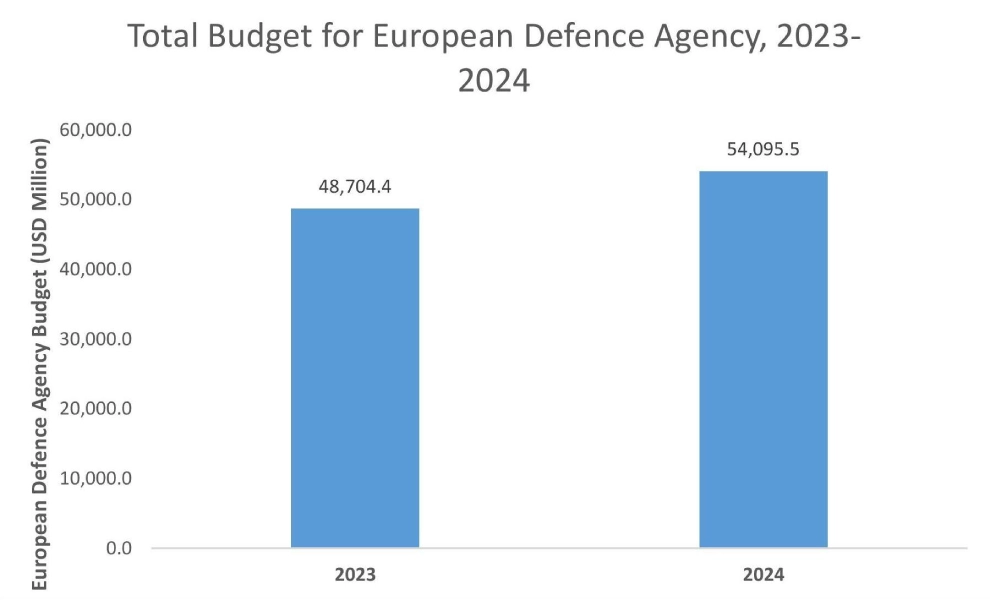

Rising investment in military & defense sector is expected to drive the millimeter wave technology market opportunities

Millimeter wave technology is often used in the military and defense sector, due to its unique characteristics such as high bandwidth, short wavelengths, and potential for secure and stealthy communication. These features enable applications such as enhanced communication systems, advanced surveillance, and improved training methods in military & defense sector. Moreover, mmWave solutions' wide bandwidth enables rapid data transfer, which is crucial for real-time situational awareness and command & control. Further, mmWave solutions are also used in radar systems for surveillance and reconnaissance purposes, among others.

- For instance, according to the European Defense Agency, the general budget for the European Defence Agency was valued at USD 54,095.5 million in 2024, witnessing an increase of 11.1% in comparison to USD 48,704.4 million in 2023.

Hence, as per the analysis, the rising investment in military & defense sector is projected to increase the demand for mmWave solutions for application in communication systems, radar systems, and others. The above factors are anticipated to drive the millimeter wave technology market opportunities during the forecast period.

Millimeter Wave Technology Market Segmental Analysis :

By Component:

Based on component, the market is segmented into antennas & transceivers, communication and networking ICs, amplifiers, frequency converters, signal generators & filters, and others.

Trends in the component:

- Increasing trend towards adoption of mmWave antennas & transceivers in wireless communication, radar systems, and other applications is driving the market growth.

- Rising adoption of mmWave amplifiers, due to its several benefits including high data rates, low latency, and increased bandwidth.

The antennas & transceivers segment accounted for the largest revenue share in the total millimeter wave technology market share in 2024, and is anticipated to register substantial CAGR during the forecast period.

- MmWave antennas refer to antennas that are specifically designed to transmit and receive electromagnetic waves in the millimeter wave (mmWave) frequency range, typically between 24 GHz and 300 GHz.

- This high-frequency range enables significantly faster data speeds and higher bandwidth compared to lower frequency bands, making mmWave antennas a crucial component of wireless communication systems.

- Meanwhile, mmWave transceivers refer to devices that transmit and receive radio waves in the millimeter wave frequency range. mmWave transceivers are used in various applications, including 5G wireless communication, radar systems,and imaging.

- Moreover, mmWave antennas and transceivers offer numerous benefits, including high data speeds, low latency, and increased capacity, among others.

- For instance, NEC Corporation develops mmWave distributed antennas for efficient utilization in 5G millimeter-wave spectrum (28GHz band). The antennas feature high-speed and large-capacity communications with stable propagation channel quality.

- According to the millimeter wave technology market analysis, the rising innovations associated with mmWave antennas and transceivers are driving the millimeter wave technology market growth.

By Application:

Based on application, the market is segmented into wireless communication, radar, security screening, medical imaging, and others.

Trends in the application:

- There is an increasing trend towards adoption of mmWave solutions for wireless communication applications, due to its benefits such aswide bandwidth, ultra-fast data transmission rates, and others.

- Rising adoption of mmWave radar systems for supporting autonomous vehicles, military & defense, and other related applications is driving the market growth.

Wireless communication segment accounted for the largest revenue share in the overall millimeter wave technology market share in 2024.

- Millimeter-wave technology, characterized by its high-frequency radio waves, plays a vital role in 5G wireless communication for supporting ultra-fast speeds and high capacity.

- It is particularly useful in densely populated areas and for specific applications requiring low latency and high throughput.

- Additionally, mmWave's wide bandwidth enables improved handling of a large number of connected devices in dense urban areas along with supporting technologies such as Internet of Things(IoT), and others.

- For instance, in March 2025, NBN Co., Qualcomm Technologies Inc., and Ericsson announced the successful completion of live field trials of 5G millimetre wave technology conducted in parts of the NBN fixed wireless access network, attaining upload speeds over 100 Mbps and download speeds exceeding 1 Gbps at around 14 kilometres.

- Therefore, the rising adoption of millimeter-wave technology for wireless communication applications is driving the millimeter wave technology market trends.

The radar segment is anticipated to register a substantial CAGR during the forecast period.

- Millimeter-wave radar technology utilizes short-wavelength electromagnetic waves in the millimeter range for detecting objects and their characteristics. mmWave technology is used in radar systems to determine the range, velocity, and angle of objects by analyzing reflected signals.

- Moreover, mmWave radar offers benefits including high accuracy, small antenna size, and the ability to operate in various environmental conditions.

- Additionally, millimeter-wave radar solutions are primarily used in applications including automotive, military & defense, and others.

- For instance, in 2024, TMYTEK completed its initial delivery of mmWave radar module samples and also announced its plans to deliver additional samples for specific projects in 2025, along with mass production scheduled in 2026. The mmWave radar solutions are mainly designed for obstacle detection and safety enhancements in automobiles.

- Therefore, theincreasing advancements associated with mmWave radar solutions are expected to drive the millimeter wave technology market size during the forecast period.

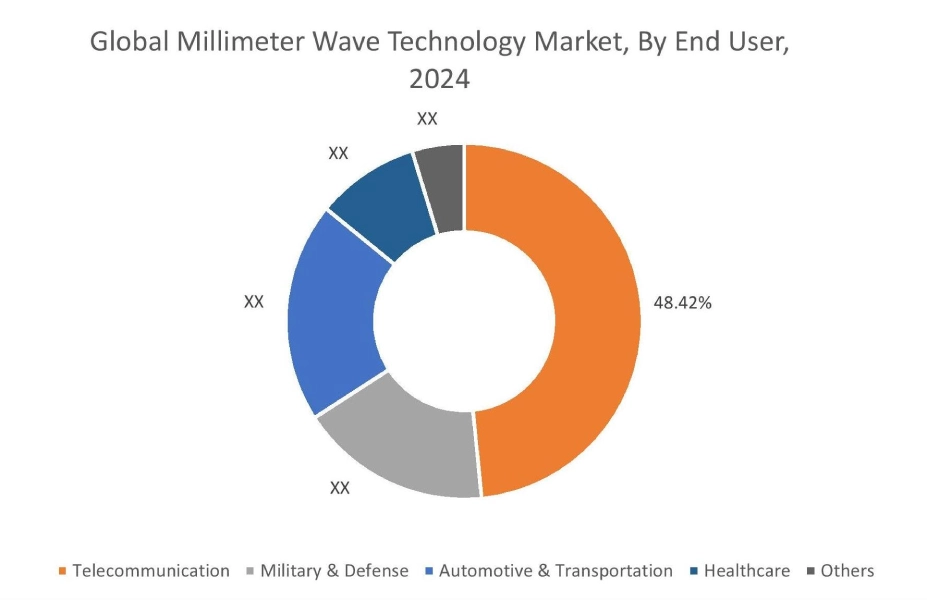

By End User:

Based on the end user, the market is segmented into telecommunication, military & defense, automotive & transportation, healthcare, and others.

Trends in the end user:

- Factors including the increasing demand for wireless communication, growing deployments of 5G infrastructure, and rising adoption of advanced communication devices are key trends driving the telecommunication segment growth.

- Factors such as increasing investments in military & defense sector, rising production of military vehicles and systems, along with advancements in military radar systems are driving the military & defense segment growth.

Telecommunication segment accounted for the largest revenue share of 48.42% in the total market in 2024.

- The segment dominance is attributed to the rising adoption of mmWave solutions in the telecommunication sector for facilitating high-speed data transmission, voice communication, and internet services.

- Millimeter wave technology plays a crucial role in 5G networks for providing ultra-fast speeds and high capacity in specific areas.

- Moreover, mmWave operates on high-frequency bands, providing significantly more bandwidth, which further leads to faster data speeds and the ability to handle a larger number of connected devices simultaneously.

- For instance, according to VIAVI Solutions Inc., approximately 2,497 cities worldwide have deployed commercial 5G networks across 92 countries as of 2022.

- According to the analysis, the rising deployment of 5G networks is increasing the adoption of mmWave solutions, thereby driving the millimeter wave technology market.

Military & defense segment is anticipated to register a significant CAGR during the forecast period.

- mmWave solutions are primarily used in the military & defense sector for applications, including communication systems, radar systems, and others.

- Moreover, mmWavetechnology is often used in the military and defense sector, due to its unique characteristics such as including high bandwidth, short wavelengths, and potential for secure and stealthy communication.

- Further, mmWave solutions are also used in radar systems for surveillance and reconnaissance purposes, among others.

- For instance, according to the European Commission, a budget of approximately USD 9.1 billion was allocated to the European Defence Fund for the period 2021-2027. The defence fund aims at facilitating collaborative defence research and development projects that supplement national contributions.

- Therefore, theincreasing investments in military & defense sector are expected to drive the market during the forecast period.

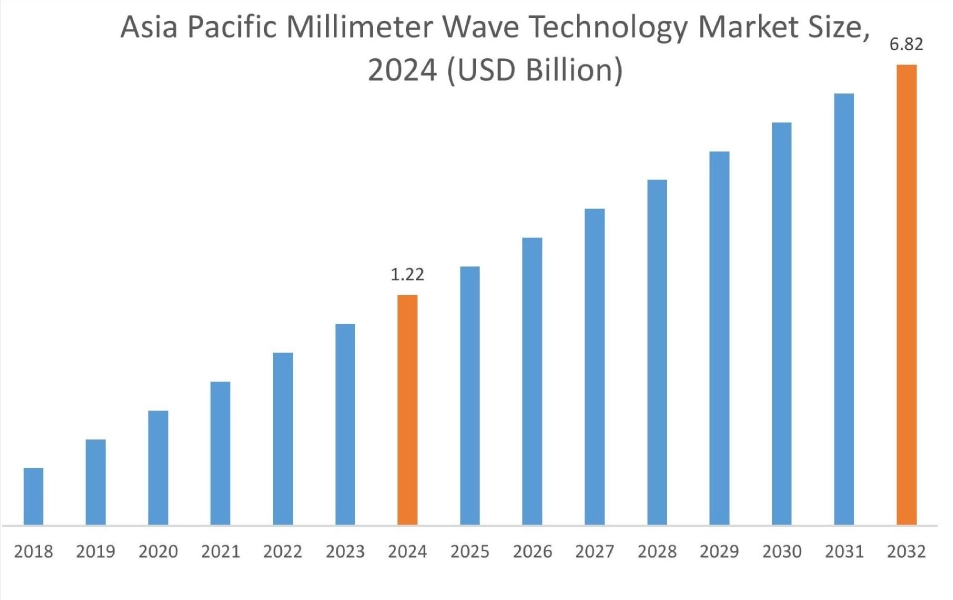

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

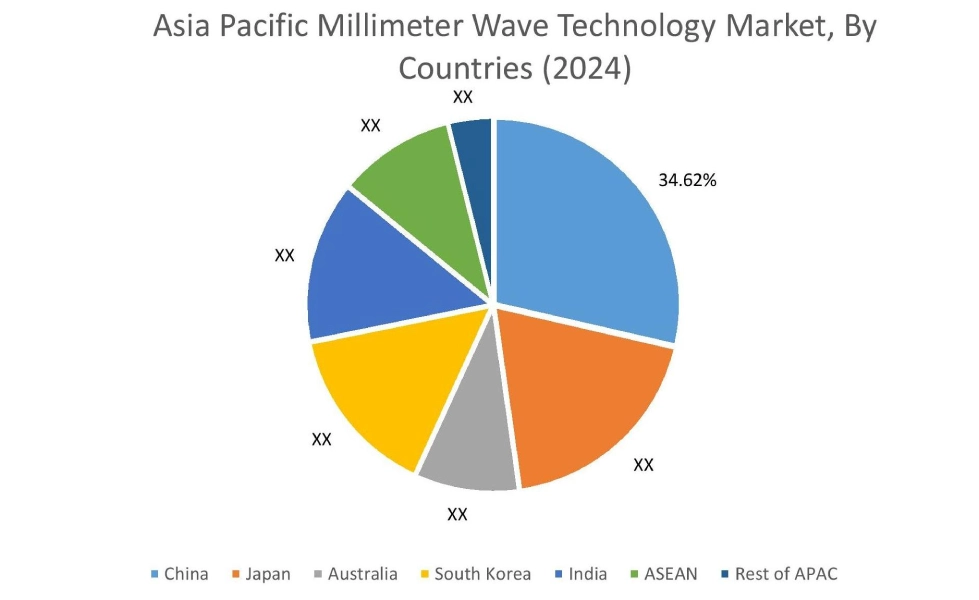

Asia Pacific region was valued at USD 1.22 Billion in 2024. Moreover, it is projected to grow by USD 1.49 Billion in 2025 and reach over USD 6.82 Billion by 2032. Out of this, China accounted for the maximum revenue share of 34.62%. As per the millimeter wave technology market analysis, the adoption of mmWave technology in the Asia-Pacific region is primarily driven by the growing telecommunication, military & defense, and other sectors. Additionally, increasing investments in telecom base stations, specifically 5G base stations, are further accelerating the millimeter wave technology market expansion.

- For instance, according to the Department of Telecommunication of India, the overall deployment of 5G base stations across India reached up to 464,990 base stations as of December 2024, depicting an increase of 10.8% from 419,845 base stations in January 2024. The above factors are driving the adoption of mmWave solutions in telecom sector, in turn driving the market in the Asia-Pacific region.

North America is estimated to reach over USD 8.07 Billion by 2032 from a value of USD 1.53 Billion in 2024 and is projected to grow by USD 1.86 Billion in 2025. In North America, the growth of the millimeter wave technology industry is driven by the rising adoption of mmWave solutions in military & defense, healthcare, telecommunication, and other sectors. Similarly, the rising advancements in autonomous vehicles and growing investments in military & defense industry are contributing to the millimeter wave technology market demand in the region.

- For instance, the U.S. Government allotted USD 883.7 billion budget for national defence for FY 2024, among which USD 841.4 billion was allocated for the United States Department of Defence. The above factors are expected to propel the millimeter wave technology market trends in North America during the forecast period.

Meanwhile, according to the regional analysis, factors including growing telecommunication sector, rising penetration of 5G infrastructure in several countries across Europe, and significant investments in medical imaging solutions are driving the millimeter wave technology market demand in Europe. Additionally, according to the market analysis, the market demand in Latin America, Middle East, and African regions is expected to grow at a considerable rate due to factors such as growing transportation sector, along with increasing investments in telecom infrastructure and military & defense sector, among others.

Top Key Players & Market Share Insights:

The global millimeter wave technology market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the millimeter wave technology market. Key players in the millimeter wave technology industry include-

- Aviat Networks Inc.(USA)

- BridgeWave Communications(USA)

- NEC Corporation (Japan)

- QuinStar Technology Inc. (USA)

- Eravant (USA)

- Ceragon (Israel)

- Trex Enterprises Corporation (USA)

- Keysight Technologies(USA)

- E-Band Communications LLC (USA)

- Farran Technology (Ireland)

- Smiths Interconnect (USA)

- ZTE Corporation (China)

Recent Industry Developments :

Product Launch:

- In June 2024, NEC Corporation developed a compact mmWave distributed antenna, which is specifically designed for Beyond 5G/6G network through the development of a radio-over-fiber system, in turn facilitating low power consumption.

Partnership & Collaboration:

- In February 2025, ZTE Corporation announced a collaboration with EOLO, a fixed wireless broadband provider based in Italy. The partnership enables the companies to jointly develop a 5G stand-alone mmWave network.

Millimeter Wave Technology Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 22.62 Billion |

| CAGR (2025-2032) | 20.3% |

| By Component |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the millimeter wave technology market? +

The millimeter wave technology market was valued at USD 4.25 Billion in 2024 and is projected to grow to USD 22.62 Billion by 2032. q

Which is the fastest-growing region in the millimeter wave technology market? +

Asia-Pacific is the region experiencing the most rapid growth in the millimeter wave technology market.

What specific segmentation details are covered in the millimeter wave technology report? +

The millimeter wave technology report includes specific segmentation details for component, application, end user, and region.

Who are the major players in the millimeter wave technology market? +

The key participants in the millimeter wave technology market are Aviat Networks Inc. (USA), BridgeWave Communications (USA), Keysight Technologies (USA), E-Band Communications LLC (USA), Farran Technology (Ireland), Smiths Interconnect (USA), ZTE Corporation (China), NEC Corporation (Japan), QuinStar Technology Inc. (USA), Eravant (USA), Ceragon (Israel), Trex Enterprises Corporation (USA), and others.