Operational Technology Security Market Size:

Operational Technology Security Market size is estimated to reach over USD 69.14 Billion by 2032 from a value of USD 22.43 Billion in 2024 and is projected to grow by USD 25.56 Billion in 2025, growing at a CAGR of 17.2% from 2025 to 2032.

Operational Technology Security Market Scope & Overview:

Operational technology security or OT security refers to solutions and services used to monitor, control, and secure physical process and devices in industry. OT security has experienced a rising adoption to secure a variety of solutions namely sensors, machines, and robots. Further, the rising threats of cyberattacks on infrastructure in various industries including manufacturing and oil and gas has driven the market. Moreover, the rising adoption of operational technology security to ensure 24/7 service and regulatory compliance with cybersecurity laws is driving the market.

Operational Technology Security Market Dynamics - (DRO) :

Key Drivers:

Increasing Awareness About Cybersecurity Threats in OT systems is Propelling the Operational Technology Security Market Growth

Organizations have started investing in OT security to safeguard industrial infrastructure including power grids and water treatment plants. Further, manufacturing and chemical sector have experienced a rising adoption of OT security to prevent explosions or chemical spills. Additionally, companies have started offering programmable security solutions for industrial environments which is driving the overall market.

- For instance, in April 2024, Critical Start unveiled Managed Detection and Response services for OT systems. The rise in the number of security offerings that focus on operational technology is expected to boost the market.

Hence, the increasing awareness about cybersecurity threats to safeguard industrial infrastructure is driving the operational technology security market size.

Key Restraints:

Complexity of Securing Legacy Operating Systems and Equipment is Restraining the Operational Technology Security Market Growth

OT environments typically utilize legacy operating systems which can be vulnerable to cybersecurity attacks. Further, the legacy operating systems do not receive regular security updates or patches which increases their vulnerability to new attacks. Moreover, outdated systems may also face compatibility issues with OT security software which can act as a restraint to the market growth. Thus, complexity of securing legacy operating systems and equipment acts as a restraint to the operational technology security market expansion.

Future Opportunities :

Rising Integration of Artificial Intelligence in OT Security is Expected to Drive the Operational Technology Security Market Opportunities

Companies have started integrating AI into OT security for anomaly and threat detection in industrial environments. Additionally, AI is being utilized for continuous monitoring of OT networks which is driving the market. Moreover, AI can help in automating incident response to accelerate response efforts which is driving the market.

- For instance, Sectrio offers OT and IoT security solutions that integrate AI for anomaly detection in industrial processes. The rise in the integration of AI in OT security for threat detection is expected to boost the market.

Thus, the rising integration of artificial intelligence in OT security for anomaly and threat detection is expected to drive the operational technology security market opportunities during the forecast period.

Operational Technology Security Market Segmental Analysis :

By Component:

Based on the component, the market is segmented into solutions and services.

Trends in the component:

- Increasing adoption of solutions for securing OT networks is driving the operational technology security market share.

- Rising utilization of services that feature threat detection and incident response is driving the operational technology security market trends.

Solutions accounted for the largest revenue share in the year 2024.

- OT security solutions have experienced a rising adoption to secure both wired and wireless access points, which has resulted in the operational technology security market expansion.

- Additionally, there has been a rising adoption of the solutions to analyse traffic for vulnerabilities which is driving the global operational technology security market.

- Moreover, the increasing utilization of the solutions that unify OT and IT security is driving the market.

- For instance, Cisco offers Cyber Vision protecting industrial IoT and industrial control systems by extending IT security to OT. The rise in the number of offerings that integrate IT security with OT security is expected to boost the market.

- According to the market analysis, rising adoption of the solutions for analysing traffic vulnerabilities is driving the operational technology security market trends.

Services segment is anticipated to register the fastest CAGR during the forecast period.

- There has been a rising adoption of OT security services including security risks assessment and regulatory compliance audit which is driving the market.

- Moreover, the rising utilization of threat management services to detect industrial malware and network anomalies is boosting the market.

- For instance, Aujas offers OT security services to secure industrial systems and networks. The rise in the offerings by companies for securing industrial systems from malware is expected to boost the market.

- Thus, the increasing utilization of services including security risks assessment and regulatory compliance audit is driving the overall market.

By Enterprise Size:

Based on the enterprise size, the market is segmented into large enterprises and small/medium enterprises.

Trends in the enterprise size:

- Increasing adoption of OT security by large enterprises to help with compliance is driving the market trends.

- There has been a rising utilization of OT security by small enterprises to avoid downtime which is driving the operational technology security market demand.

Large enterprises accounted for the largest revenue share in the year 2024.

- OT security systems have experienced a rising adoption by large enterprises as the enterprise typically have large budgets to secure the industrial environment.

- Further, the rising utilization of the security solutions to protect SCADA system from unauthorized access and modification is driving the operational technology security market demand.

- Moreover, OT security systems have witnessed a rising adoption to protect industrial control systems from various types of human error including improper configuration of equipment and incorrect programming of machinery which is driving the market.

- Thus, as per the analysis, the rising adoption of OT security by large enterprises secure SCADA systems and industrial control systems is driving the market.

Small/medium enterprises segment is anticipated to register the fastest CAGR during the forecast period.

- OT security systems have experienced a rising adoption by small/medium enterprises to protect old OT systems from cyber threats.

- Moreover, rising utilization of OT security to mitigate risks related to poor security patch managements has further driven the market.

- For instance, according to the Ministry of Micro, Small & Medium Enterprises, India, the total number of registered MSME in manufacturing stood at about 13.5 million in 2025. The rising MSME sector is expected to boost the market as the enterprises utilize OT security to secure industrial equipment.

- Therefore, the rising utilization of OT security to protect old OT systems and mitigate risks related to poor patch management is driving the market.

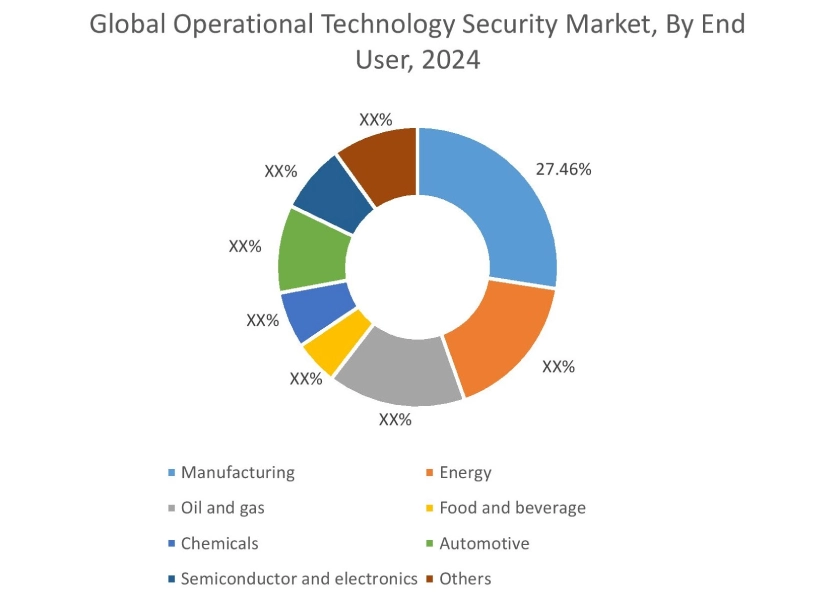

By End User:

Based on the end user, the market is segmented into manufacturing, energy, oil and gas, food and beverage, chemicals, automotive, semiconductor and electronics, and others.

Trends in the end user:

- Increasing adoption of OT security in manufacturing to protect against ransomware is driving the market trends.

- Rising adoption of operational technology security specifically data acquisition systems in semiconductors and electronics for data logging, measurement, and monitoring is driving the market growth.

Manufacturing accounted for the largest revenue share of 27.46% in the year 2024.

- OT security has experienced a rising adoption in manufacturing sector to protect against vulnerabilities in EtherNet/IP communication modules which has driven the global operational technology security market.

- Further, rising utilization of OT security to provide better logging and monitoring in manufacturing is driving the market demand.

- Moreover, the increasing growth experienced in the manufacturing sector is driving the market as the security systems are used to prevent downtime.

- For instance, according to a report by UNIDO, the manufacturing sector in China experienced a rise of 1.1% in Q3 2024. The rising manufacturing sector is expected to boost the market as OT security is utilized to protect machinery in manufacturing.

- Therefore, the increasing demand for OT security in manufacturing to protect against vulnerabilities in communication modules is driving the operational technology security market size.

Semiconductor and electronics segment is anticipated to register the fastest CAGR during the forecast period.

- OT security has experienced a rising adoption in semiconductor and electronics due to prevalence of legacy systems that have reached end of life status which is driving the market.

- Moreover, the rise in the adoption of OT security in semiconductor to protect assets in the water fab by scanning for malicious software is driving the growth of the market.

- For instance, TXOne offers security solutions to protect equipment in semiconductor fabs. The rise in the adoption of OT security solutions to protect equipment from malicious software is expected to boost the market.

- According to the operational technology security market analysis, the rising trend in the adoption of OT security in semiconductor and electronics to protect against assets in the water fab is propelling the operational technology security industry during the forecast period.

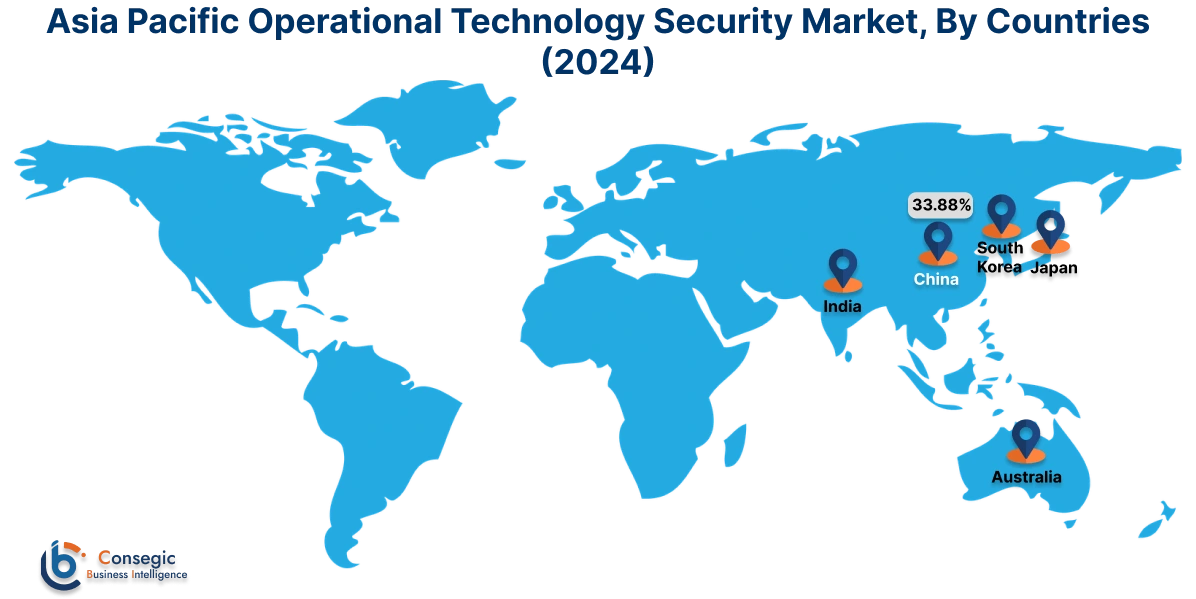

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at 6.64 Billion in 2024. Moreover, it is projected to grow by 7.60 Billion in 2025 and reach over 21.31 Billion by 2032. Out of this, China accounted for the maximum revenue share of 33.88%. As per the operational technology security market analysis, the growth in the Asia-Pacific region is primarily driven by the increasing utilization of security solutions and rising utilization of OT security in manufacturing.

- For instance, according to the Ministry of Statistics & Programme Implementation, the manufacturing sector in India witness a rise of 3% in December 2024. The growing manufacturing sector is expected to boost the market as OT security is typically used in manufacturing to protect machinery.

North America is estimated to reach over USD 22.11 Billion by 2032 from a value of USD 7.14 Billion in 2024 and is projected to grow by USD 8.14 Billion in 2025. In North America, the growth of operational technology security industry is driven by the increasing adoption of OT security services across the industries. Moreover, the increasing utilization of the OT security in semiconductor manufacturing has resulted in the rise in operational technology security market share.

- For instance, in June 2025, Micron unveiled its plans to expand its investments in the United States by investing about USD 200 Billion in semiconductor manufacturing. The rising investments in semiconductor manufacturing is expected to boost the market as OT security solutions are utilized in semiconductor fabs.

Additionally, the regional analysis depicts that the rising investments in the chemicals sector is driving the market demand in Europe. Furthermore, as per the market analysis, the market demand in Latin America is expected to grow at a considerable rate due to rising utilization of OT security in energy to secure power grids. Middle East and African regions are expected to grow at a considerable rate due to factors such as growing investments in oil and gas and rising food and beverage sector among others.

Top Key Players and Market Share Insights:

The global operational technology security market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the operational technology security market. Key players in the operational technology security industry include-

- Cisco Systems, Inc. (U.S.)

- Honeywell International Inc. (U.S.)

- Zscaler, Inc. (U.S.)

- DRAGOS, INC. (U.S.)

- Tenable, Inc. (U.S.)

- Rockwell Automation, Inc. (U.S.)

- Fortinet, Inc. (U.S.)

- Palo Alto Networks (U.S.)

- IBM (U.S.)

- Siemens (Germany)

Recent Industry Developments :

Product Launch

- In May 2025, Immersive unveiled an OT security training solution for industrial environments lacking strong security measures. The solution features hands-on labs that teach the user to address threat actors and malware for any OT environment and scenario-based team exercises.

Operational Technology Security Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 69.14 Billion |

| CAGR (2025-2032) | 17.2% |

| By Component |

|

| By Enterprise Size |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the operational technology security market? +

The operational technology security market was valued at USD 22.43 Billion in 2024 and is projected to grow to USD 69.14 Billion by 2032.

Which is the fastest-growing region in the operational technology security market? +

Asia-Pacific region is experiencing the most rapid growth in the operational technology security market.

What specific segmentation details are covered in the operational technology security market report? +

The operational technology security market report includes component, enterprise size, end user and region.

Who are the major players in the operational technology security market? +

The key participants in the operational technology security market are Cisco Systems, Inc. (U.S.), Rockwell Automation, Inc. (U.S.), Fortinet, Inc. (U.S.), Palo Alto Networks (U.S.), IBM (U.S.), Siemens (Germany), Honeywell International Inc. (U.S.), Zscaler, Inc. (U.S.), DRAGOS, INC. (U.S.), Tenable, Inc. (U.S.), and Others.