Industrial Control Systems Market Size:

Industrial Control Systems Market size is estimated to reach over USD 441.82 Billion by 2032 from a value of USD 207.28 Billion in 2024 and is projected to grow by USD 223.84 Billion in 2025, growing at a CAGR of 8.9% from 2025 to 2032.

Industrial Control Systems Market Scope & Overview:

Industrial control systems (ICS), also known as process control systems, play a crucial role in modern industries for monitoring and controlling complex processes. These systems combine hardware and software solutions to automate, optimize, and ensure safe operation of industrial processes across various sectors. Moreover, it offers a wide range of benefits, including greater accuracy and precision, real-time monitoring, improved productivity, increased operational efficiency, and others. Additionally, process control systems are used in various industries including automotive, oil & gas, chemicals & petrochemicals, food & beverage, pharmaceuticals, and others.

Industrial Control Systems Market Insights:

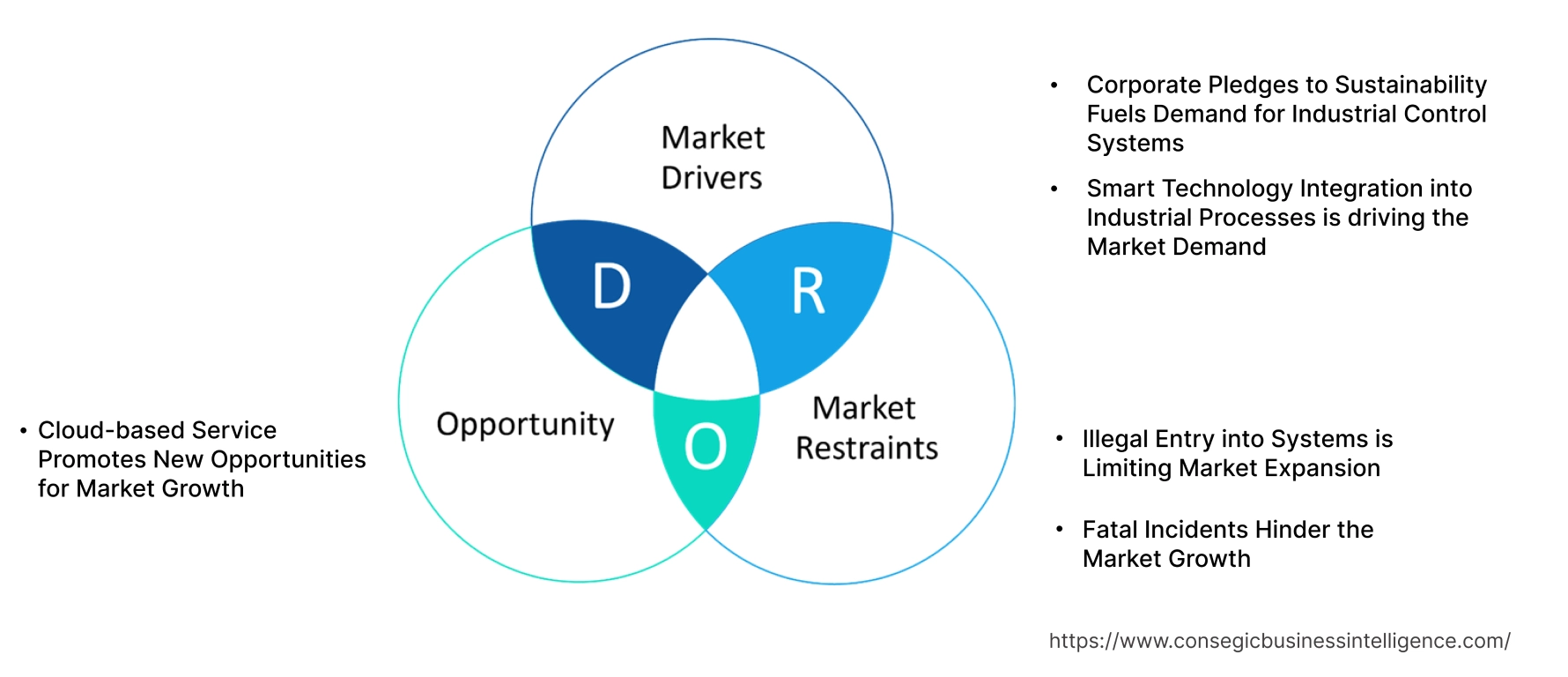

Industrial Control Systems Market Dynamics - (DRO) :

Key Drivers:

Rising adoption of industrial automation, fueled by Industry 4.0, is driving the industrial control systems market growth

Industry 4.0 enabled manufacturing signifies extreme flexibility, automation readiness, minimal human intervention, and enhanced productivity. It emphasizes the use of automation and robotics to enhance production efficiency and flexibility. Advanced industrial control systems play a critical role in controlling and coordinating these automated systems, ensuring seamless integration and optimal performance, further contributing to the market growth. Moreover, process control systems enable real-time monitoring and control of industrial processes and continuous production capabilities while minimizing downtime and maximizing throughput.

Additionally, manufacturing companies are increasingly focused on improving operational efficiency, and process control systems can help achieve this by streamlining industrial processes. Further, the utilization of process control systems in factories can analyze workflows and optimize operations, helping manufacturers to become more agile and responsive to the market demands.

- For instance, in July 2024, Xiaomi launched its completely automated smart factory in Beijing, China. The automated factory spans across 860,000 square feet and it is developed to manufacture approximately 10 million smartphones each year without any human intervention.

Thus, the rising adoption of industrial automation in manufacturing facilities is driving the industrial control systems market size.

Key Restraints :

High initial investment is restraining the industrial control systems market

The high initial investment associated with setting up industrial control system is among the key factors limiting the market. Moreover, the upfront costs associated with the acquisition of control system hardware, software, and integrating them into existing systems can be considerably high, which may cause financial barriers, mostly for smaller businesses or businesses with limited budget constraints.

Additionally, advanced control systems can be quite complex to install and integrate, which further requires additional expenses on training personnel or hiring specialized experts for implementing and maintaining the systems effectively. Hence, the high initial investment associated with process control systems is hindering the industrial control systems market expansion.

Future Opportunities :

Rising advancements associated with industrial control and automation technologies are expected to drive the industrial control systems market opportunities

Industrial control solution providers are constantly investing in the development of new technologies associated with industrial control hardware and software solutions to ensure its safe and effective utilization in industrial facilities such as oil & gas, food & beverage, pharmaceuticals, chemicals, automotive, and others, for enhanced operational efficiency and minimal human intervention. As a result, manufacturers are launching new products with advanced features, which is expected to provide lucrative aspects for market growth.

- In February 2023, ABB introduced its updated version of ABB Ability Symphony Plus distributed control system that supports digital transformation for water and power generation industries. The solution also features a new process controller that is capable of increasing performance and enabling plant-wide digitalization, while providing a non-invasive modernization of the installed base.

Hence, the rising advancements associated with industrial control solutions are anticipated to boost the industrial control systems market opportunities during the forecast period.

Industrial Control Systems Market Segmental Analysis :

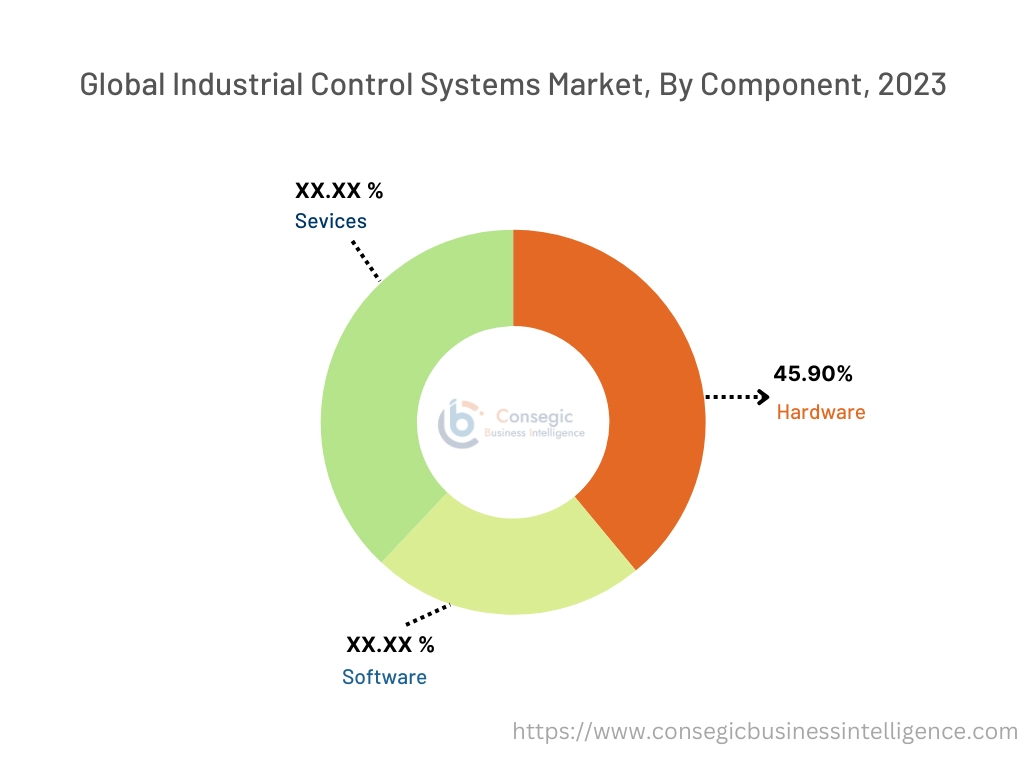

By Component:

Based on component, the market is segmented into hardware, software, and services.

Trends in the component:

- Increasing technological advancements associated with industrial control devices, such as sensors, actuators, controllers, and others, are driving the market.

- There is a rising trend towards utilization of industrial control and automation solutions in industrial facilities for facilitating constant monitoring, optimization, and improved operational efficiency.

Hardware segment accounted for the largest revenue share of 46.32% in the total industrial control systems market share in 2024.

- The primary hardware components used for process control systems include controllers, sensors, actuators, human machine interfaces (HMIs), and others.

- Industrial controllers are used to control machinery and processes automatically. Meanwhile, sensors are used for gathering data from the environment, while actuators are utilized for performing the necessary actions based on control signals.

- Moreover, the aforementioned hardware components help in facilitating precise process control and automation within industrial facilities, in turn leading to improved efficiency, precision, and safety in industrial processes.

- For instance, in April 2023, Omron Corporation announced the launch of its NX-series of controllers that are integrated with advanced information control and safety control. The launch responds to the rising efforts towards carbon neutrality at manufacturing sites.

- According to the industrial control systems market analysis, the rising innovations associated with hardware components for facilitating improved industrial control are further accelerating the industrial control systems market growth.

The software segment is anticipated to register the fastest CAGR growth during the forecast period.

- Industrial control software provides a centralized platform for monitoring and controlling the equipment and control systems used within industrial facilities. The software has the ability to capture, organize, and analyze data to monitor industrial equipment and system performance.

- Moreover, the benefits of integrating industrial control software include smarter maintenance and effective analysis of equipment performance within industrial facilities.

- For instance, in October 2022, Schneider Electric launched EcoStruxure Automation Expert v24, its next-generation of industrial control and automation software. The upgraded software is capable of supporting larger industrial plants and additional communication protocols.

- Therefore, the increasing advancements associated with industrial control software are anticipated to drive the market during the forecast period.

By Application :

Based on application, the market is segmented into manufacturing & production processes, extraction & pipeline maintenance, monitoring & controlling, safety & security, power generation & distribution, robotics, and others.

Trends in the application:

- Industrial facilities have witnessed a rising utilization of industrial control systems for optimizing and streamlining industrial processes.

- The prevalence of favorable government initiatives for industrial automation is driving the manufacturing & production processes segment.

The manufacturing & production processes segment accounted for the largest revenue share in the overall market in 2024, and it is anticipated to register the fastest CAGR growth during the forecast period.

- This dominance is attributed to the rising adoption of process control systems in manufacturing facilities for optimizing production processes and operations with minimal human intervention.

- Additionally, the increasing development of smart factories and technological advancements in manufacturing equipment, such as artificial intelligence (AI), industrial internet of things, and others, has further propelled the market expansion.

- For instance, in December 2023, Mitsubishi Electric India introduced its new smart manufacturing facility for advanced factory automation systems in the state of Maharashtra, India. The new manufacturing facility is optimized to deliver products with the highest quality and reliability while strengthening its business in India and addressing the increasing demand for advanced automation and smart manufacturing solutions.

- According to the analysis, the rising developments associated with smart factories and adoption of automation in manufacturing and production processes are driving the market.

By End-User:

Based on the end user, the market is segmented into automotive, oil & gas, chemical & petrochemical, energy & utility, pharmaceuticals, food & beverage, metals & mining, water & wastewater management, and others.

Trends in the end user:

- Factors including rising development of advanced factories and industrial facilities, along with growing trend of industrial automation fueled by Industry 4.0, are driving the market.

- Factors including the rising development of oil refineries, increasing exploration of gas resources, rising investments in new mining exploration activities, and growing production from chemicals, pharmaceutical, and other industries are among the key aspects driving the adoption of advanced process control systems.

The automotive segment accounted for the largest revenue in the industrial control systems market share in 2024.

- Process control systems are primarily used in the automotive sector to enhance manufacturing processes, improve vehicle performance, and enable advanced features.

- These systems automate production and quality control, optimize energy consumption, and contribute to improved operational efficiency in vehicle manufacturing processes.

- For instance, according to the International Organization of Motor Vehicle Manufacturers, the total passenger car production in Europe reached up to 15,449,729 units in 2023, representing an increase of nearly 13% from 13,727,841 units in 2022.

- Hence, the rising automotive production is increasing the adoption of ICS to streamline vehicle manufacturing processes, in turn boosting the industrial control systems market trends.

Oil & gas segment is anticipated to register a significant CAGR growth during the forecast period.

- Process control systems play a crucial role in the oil and gas sector for facilitating automation and remote management of critical processes across the entire value chain, ranging from exploration and production to refining and distribution.

- Moreover, process control systems help in optimizing operations, enhancing safety, and improving efficiency in hazardous oil & gas environments.

- For instance, in March 2023, Shell plc completed a final investment in the Dover deepwater oilfield development project within Mississippi Canyon, which is approximately 170 miles offshore southeast of New Orleans, Louisiana, in the U.S. Gulf of Mexico. The production hub is capable of producing up to 21,000 barrels of oil equivalent per day at peak rates.

- Therefore, the increasing developments associated with oil & gas sector are expected to drive the industrial control systems market size during the forecast period.

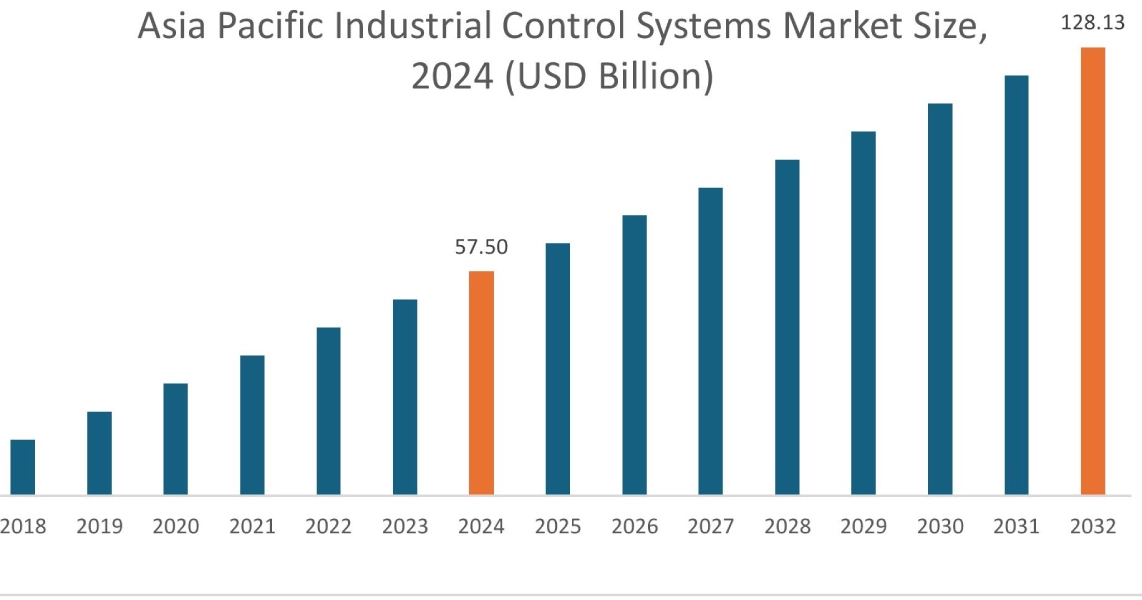

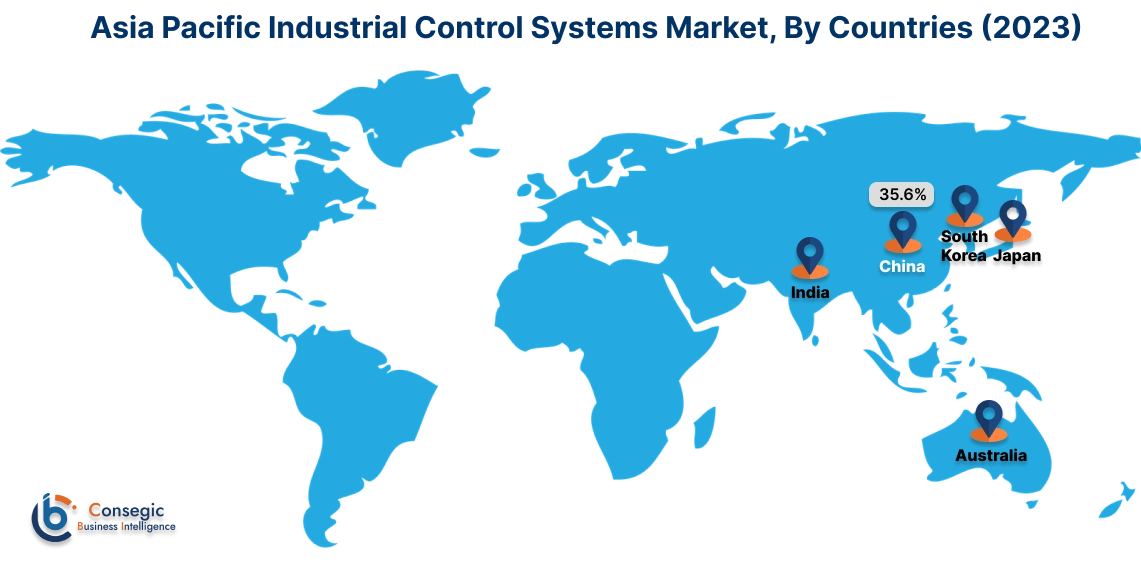

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 57.50 Billion in 2024. Moreover, it is projected to grow by USD 62.33 Billion in 2025 and reach over USD 128.13 Billion by 2032. Out of this, China accounted for the maximum revenue share of 34.25%. As per the industrial control systems market analysis, the adoption of process control systems in the Asia-Pacific region is primarily driven by the rising deployment of industrial automation for improving operational efficiency in the region. Similarly, the increasing development of smart factories is further accelerating the industrial control systems market expansion.

- For instance, in September 2024, Panasonic Smart Factory Solutions India launched its advanced smart factory solutions and products that are integrated with technologies such as IIoT (industrial internet of things), AI (artificial intelligence), automation, and others. These innovations are optimized to integrate with manufacturing processes seamlessly, in turn driving quality, efficiency, and production capacity to exceptional levels. The above factors are further driving the market in the Asia-Pacific region.

North America is estimated to reach over USD 156.58 Billion by 2032 from a value of USD 73.81 Billion in 2024 and is projected to grow by USD 79.67 Billion in 2025. In North America, the growth of the industrial control systems industry is driven by the rising investments in development of industrial facilities, including food & beverage, chemical, pharmaceuticals, automotive, and others. Similarly, the rising trend of factory automation, driven by technological advancements, is further contributing to the industrial control systems market demand.

- For instance, Kerry Group, a food and beverage company, announced the launch of its new food production facility in Georgia, United States, in 2022. The food production facility was developed to meet the rising consumer demand in seafood, poultry, and alternative protein markets across the United States and Canada. The above factors are expected to propel the industrial control systems market trends in North America during the forecast period.

Meanwhile, according to the regional analysis, the prevalence of favorable government measures for facilitating industrial automation and rising development of industrial factories are driving the industrial control systems market demand in Europe. Additionally, according to the market analysis, the market in Latin America, Middle East, and African regions is projected to expand at a substantial rate, attributing to factors such as rising pace of industrialization and increasing investments in development of industrial facilities including oil & gas, food & beverage, wastewater treatment, and others.

Industrial Control Systems Market Competitive Landscape:

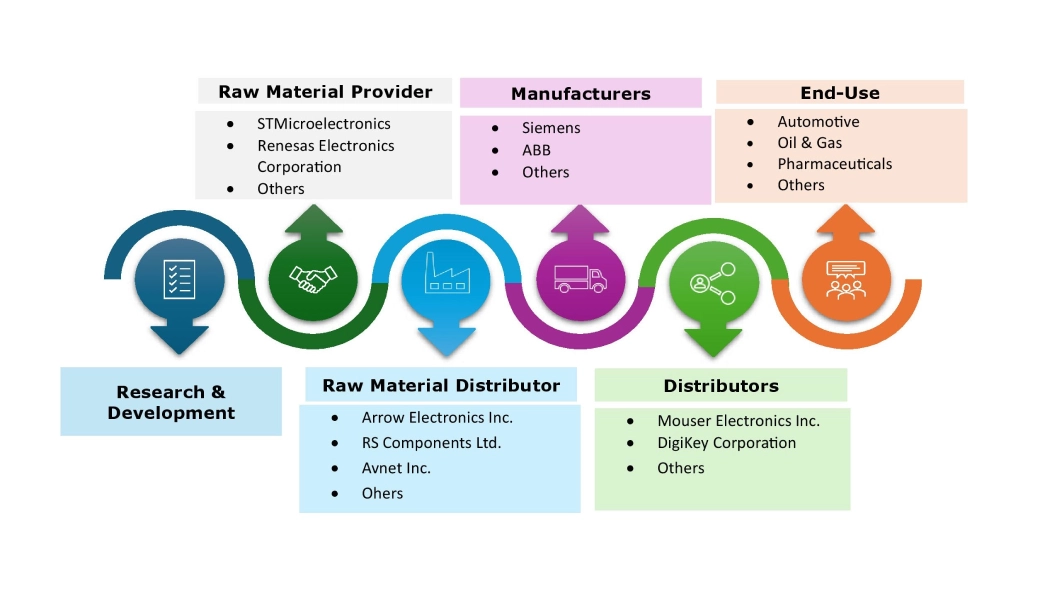

The global industrial control systems market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the industrial control systems market. Key players in the industrial control systems industry include-

- Siemens (Germany)

- ABB (Switzerland)

- Yokogawa Electric Corporation (Japan)

- Omron Corporation (Japan)

- Valmet (Finland)

- Rockwell Automation (U.S)

- Honeywell International Inc. (U.S)

- Schneider Electric (France)

- Emerson Electric Co. (U.S)

- Mitsubishi Electric Corporation (Japan)

Recent Industry Developments :

Product launches

- In July 2024, Nozomi Networks Inc., launched the first OT and IoT security sensor embedded in Mitsubishi Electric PLCs. This allows for the analysis and prevention of process-related attacks and harmful user actions without compromising other resources or hindering important networks.

Mergers & Acquisitions

- In March 2024, Siemens AG acquired the industrial drive technology (IDT) division of ebm-papst. This strategic acquisition aims at enhancing Siemens Xcelerator portfolio and reinforces Siemens's market stake as a premier solutions provider for flexible production automation.

- In July 2024, Johnson Controls International plc sold its residential and light commercial HVAC branch to the Bosch Group in an all-cash transaction. This sale encompasses North American ducted business and a global Residential joint venture with Hitachi, Ltd., with a 60% stake held by Johnson Controls and the remaining 40% owned by Hitachi. The entire transaction amounts to $8.1 billion, of which about $6.7 billion is attributable to Johnson Controls.

Partnerships & Collaborations

- In June 2024, DirectDefense, Inc., announced a partnership with Dragos, a global leader in OT cybersecurity. This collaboration combines DirectDefense's managed security services expertise with Dragos's advanced technology for OT cyber threat visibility, detection, and response. The partnership aims to tackle threats against control systems, enhancing security in this critical area.

- In January 2023, Schneider Electric, a global pioneer in the digital transformation of energy management and automation, and BitSight, a leader in cyber risk detection and management announced a strategic partnership. This collaboration aims to enhance the detection of Operational Technology (OT) cybersecurity exposure by identifying misconfigured connected devices.

Government Initiative

- In July 2024, the Cybersecurity and Infrastructure Security Agency (CISA) issued four advisories related to ICS. These advisories, which include National Instruments IO Trace, Hitachi Energy AFS/AFR Series Products, National Instruments LabVIEW, and Hitachi Energy IED Connectivity Packages and PCM600 Products, offer up-to-date information on current security issues, vulnerabilities, and others.

Industrial Control Systems Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 441.82 Billion |

| CAGR (2025-2032) | 8.9% |

| By Component |

|

| By Application |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Industrial Control Systems Market? +

Global Industrial Control Systems Market size is estimated to reach over USD 393.44 Billion by 2031 from a value of USD 196.77 Billion in 2023 and is projected to grow by USD 211.07 Billion in 2024, growing at a CAGR of 9.0% from 2024 to 2031.

What specific segmentation details are covered in the Industrial Control Systems report? +

The Industrial Control Systems report includes specific segmentation details for components, applications, end-users, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the component segment, the hardware segment is the fastest-growing segment during the forecast period due to the surge in industrial automation drives industries to heavily invest in control system advancements for enhanced efficiency, productivity security, and others.

Who are the major players in the Industrial Control Systems Market? +

The key participants in the Industrial Control Systems Market are Bosch Industriekessel GmbH (Germany), Siemens (Germany), ABB (Switzerland), Rockwell Automation (U.S), Honeywell International Inc. (U.S), Schneider Electric (France), Emerson Electric Co. (U.S), Mitsubishi Electric Corporation (Japan), Yokogawa Electric (Japan), Omron Corporation (Japan) and others.

What are the key trends in the Industrial Control Systems Market? +

The Industrial Control Systems Market is being shaped by several key trends including the growing demand for advanced process control software, industries moving towards more sustainability and adopting smart manufacturing technologies, and others.