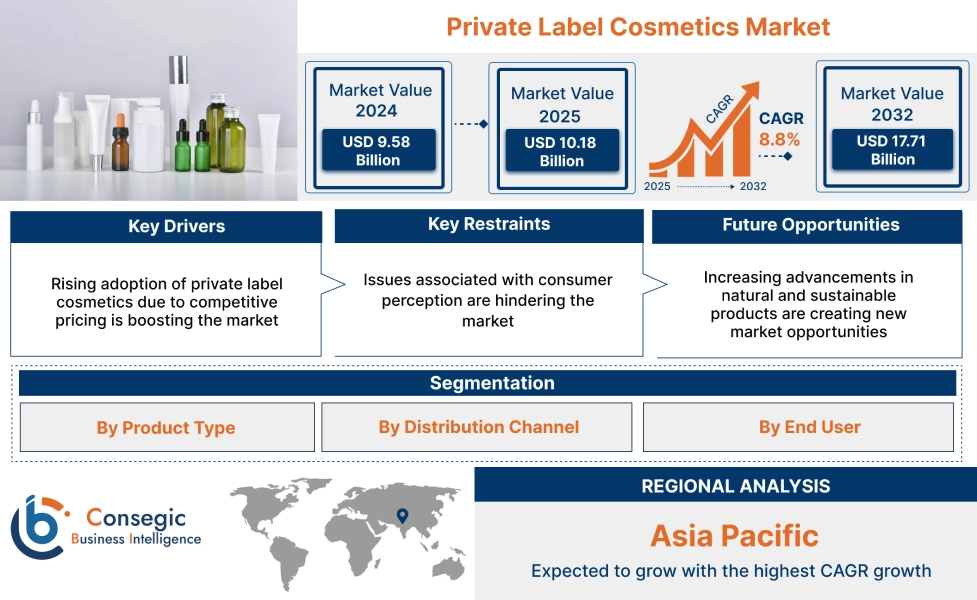

Private Label Cosmetics Market Size:

Private Label Cosmetics Market size is estimated to reach over USD 17.71 Billion by 2032 from a value of USD 9.58 Billion in 2024 and is projected to grow by USD 10.18 Billion in 2025, growing at a CAGR of 8.8% from 2025 to 2032.

Private Label Cosmetics Market Scope & Overview:

Private label cosmetics offer numerous benefits, including increased brand awareness, faster time to market, and greater flexibility in product development and customization. They also provide cost savings by eliminating the need for extensive upfront investments in manufacturing and research. Moreover, private label manufacturers offer a cost-effective alternative to building their manufacturing facility. Private label manufacturers have pre-developed products ready to be customized, significantly reducing the time it takes to bring a product to market. Additionally, private label manufacturers offer extensive customization options, allowing them to create unique products that reflect the users' brand's identity.

How is AI Impacting the Private Label Cosmetics Market?

Artificial Intelligence is significantly influencing the private label cosmetics market by enabling data-driven product innovation, personalization, and supply chain efficiency. Brands leverage AI-powered analytics to study consumer preferences, skin types, and market trends, helping them develop customized formulations and targeted product lines. Machine learning algorithms predict emerging beauty trends, optimizing product launches and reducing market risks. In manufacturing, AI enhances quality control and streamlines production through automated inspection and inventory management. Additionally, AI chatbots and virtual try-on tools elevate customer experiences by offering personalized recommendations and real-time engagement. Overall, AI is empowering private label cosmetic brands to innovate faster, tailor offerings to consumer needs, and strengthen competitiveness in a dynamic beauty market.

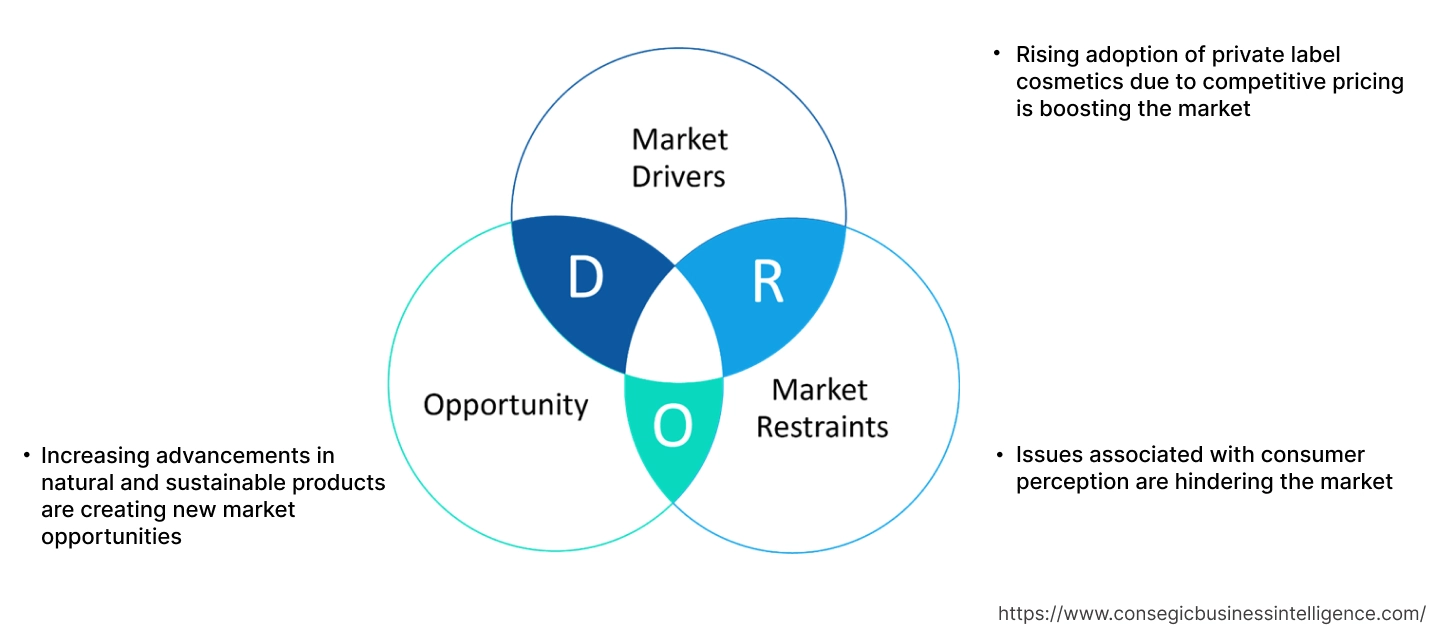

Private Label Cosmetics Market Dynamics - (DRO) :

Key Drivers:

Rising adoption of private label cosmetics due to competitive pricing is boosting the market

Private label cosmetics offer competitive pricing because businesses can directly work with manufacturers, eliminating middlemen and potential cost increases. This enables more control over pricing strategies, leading to lower prices for consumers without compromising profit margins for retailers. Additionally, private label allows faster market entry and more tailored product offerings, further contributing to competitive pricing. Moreover, private label products don't require extensive product development and testing cycles, saving time and resources.

- For instance, Bo International offers cost-effective and low-budget private label cosmetics. These products include baby care, natural oils, oral care, hair care, and other cosmetics.

Thus, the aforementioned factors are boosting the adoption of private label beauty products, in turn driving the private label cosmetics market growth.

Key Restraints :

Issues associated with consumer perception are hindering the market

Private label cosmetics, while offering price and quality advantages, face consumer perception challenges related to trust, perceived quality, and brand loyalty. While many consumers see them as good value or equal to national brands, some still associate them with lower quality or a lack of uniqueness, impacting brand trust and loyalty.

Moreover, consumers are less likely to trust private label brands if they have a history of product failures or quality issues, and these failures can reflect negatively on the retailer as well. Thus, the market analysis shows that the aforementioned factors are restraining the private label cosmetics market demand.

Future Opportunities :

Increasing advancements in natural and sustainable products are creating new market opportunities

Private label cosmetics, coupled with advancements in natural and sustainable products, are a growing trend driven by consumer demand for eco-friendly and ethical beauty solutions. Private label manufacturers offer the flexibility to create custom formulations using natural ingredients and sustainable practices, allowing brands to tap into the lucrative natural beauty market and align with consumer values. This approach also facilitates speed-to-market and access to a broader network of suppliers, making it easier to source eco-friendly materials and packaging. Moreover, consumers are increasingly seeking products with minimal environmental impact, leading to a rise in demand for organic, vegan, and cruelty-free options, which private label manufacturers can readily offer.

- For instance, Cosmetify offers natural, herbal, and organic products. These products include a range of oils, masks, creams, serums, and other cosmetics.

Thus, the ongoing advancements in sustainable cosmetic products are projected to drive private label cosmetics market opportunities during the forecast period.

Private Label Cosmetics Market Segmental Analysis :

By Product Type:

Based on the product type, the market is segmented into skincare, haircare, makeup, and others.

Trends in the Product Type:

- Rising adoption of private label makeup for affordable and personalized options is boosting the private label cosmetics market size.

- Increasing trend in the adoption of private label haircare for sustainable and customized options is driving the market growth.

The skincare segment accounted for the largest revenue share in the private label cosmetics market share in 2024.

- Private label skincare offers businesses cost savings and customization, allowing them to create unique brands and product lines without the initial investment of research and development.

- This strategy also provides faster time to market, access to proven formulas, and the ability to scale operations as the business grows.

- By utilizing pre-formulated and tested products, businesses can minimize the risks associated with product development and manufacturing.

- Therefore, the market analysis shows that the aforementioned factors are boosting the private label cosmetics market growth.

The haircare segment is expected to register the fastest CAGR growth during the forecast period.

- Private label haircare involves another company manufacturing branded haircare products, allowing users to focus on marketing and sales without the complexities of production.

- This model offers benefits like customized formulations, packaging, and marketing, helping users to create a unique brand identity.

- Moreover, unique, private label hair care products can help businesses stand out from the competition and build brand recognition.

- Thus, the rising adoption of haircare products is expected to drive the private label cosmetics market trends during the forecast period.

By Distribution Channel:

Based on the distribution channel, the market is segmented into online and offline.

Trends in the Distribution Channel:

- Rising adoption of online distribution channels, due to wide options, availability, and customer reviews, is boosting the private label cosmetics market size.

- Increasing trend in adoption of offline marketplaces due to tangible experiences and established physical presence in a community.

The offline segment accounted for the largest revenue share in the private label cosmetics market share in 2024.

- Offline distribution of cosmetics offers several benefits, such as increased brand awareness, faster time to market, and greater control over product development and branding.

- This model allows businesses to create unique products and stand out from competitors without the need for extensive research and development.

- Businesses can quickly adapt to market trends by modifying or updating their product lines to meet evolving consumer preferences.

- Therefore, the market analysis depicts that the widespread adoption of offline marketplaces is boosting the private label cosmetics market demand.

The online segment is expected to register the fastest CAGR growth during the forecast period.

- Online distribution of cosmetics offers businesses a way to offer branded products without the overhead of manufacturing.

- This allows greater control over branding, quality, and pricing, while also enabling faster time-to-market and increased profit margins.

- Private label allows businesses to purchase products in bulk, reducing costs compared to building a full-fledged manufacturing operation.

- By leveraging the benefits of private labeling and implementing effective offline distribution strategies, businesses can successfully build their brand, reach target customers, and achieve sustainable growth.

- Thus, the rising adoption of online marketplaces is expected to boost the private label cosmetics market trends during the forecast period.

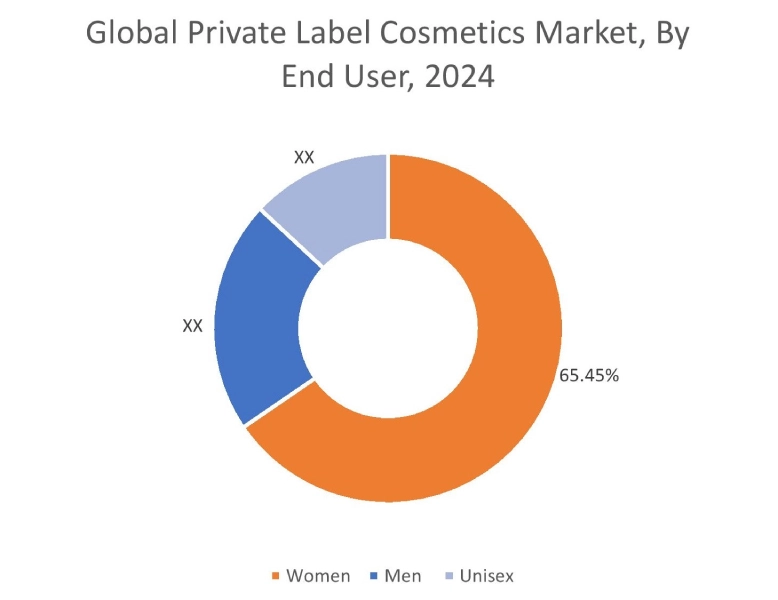

By End User:

Based on the end user, the market is segmented into men, women, and unisex.

Trends in the End User:

- Rising adoption of men's cosmetics, due to rising awareness about wellness and grooming among men.

- Increasing trend in the adoption of unisex cosmetics in urban regions due to product quality, effectiveness, and cost affordability is boosting the private label cosmetics market expansion.

The women segment accounted for the largest revenue share of 65.45% in the market in 2024, and it is expected to register the fastest CAGR growth during the forecast period.

- Women may prefer private label beauty products for their budget-friendliness, quality, and ability to meet specific needs, particularly when compared to white label products.

- Private label beauty products are custom-formulated and branded for a specific retailer, offering greater customization and potentially better quality control.

- Moreover, private label beauty products often offer competitive pricing, making them appealing to consumers seeking affordable beauty products without sacrificing quality.

- Additionally, by offering personalized products and a consistent brand experience, private label beauty products contribute to a more positive and engaging shopping experience.

- Therefore, the market analysis depicts that the rising preference of women to buy private label products is driving the private label cosmetics market opportunities.

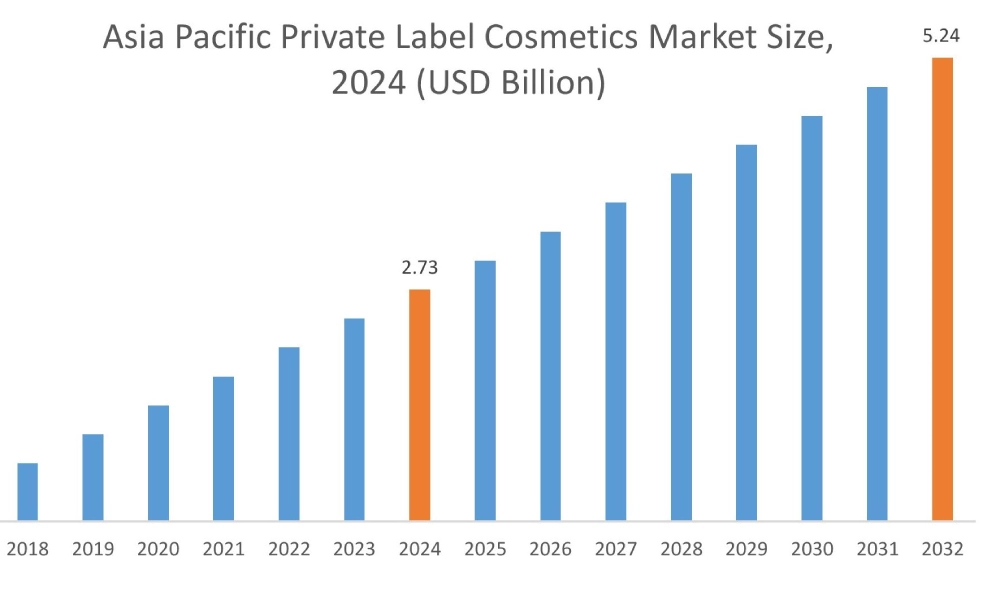

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

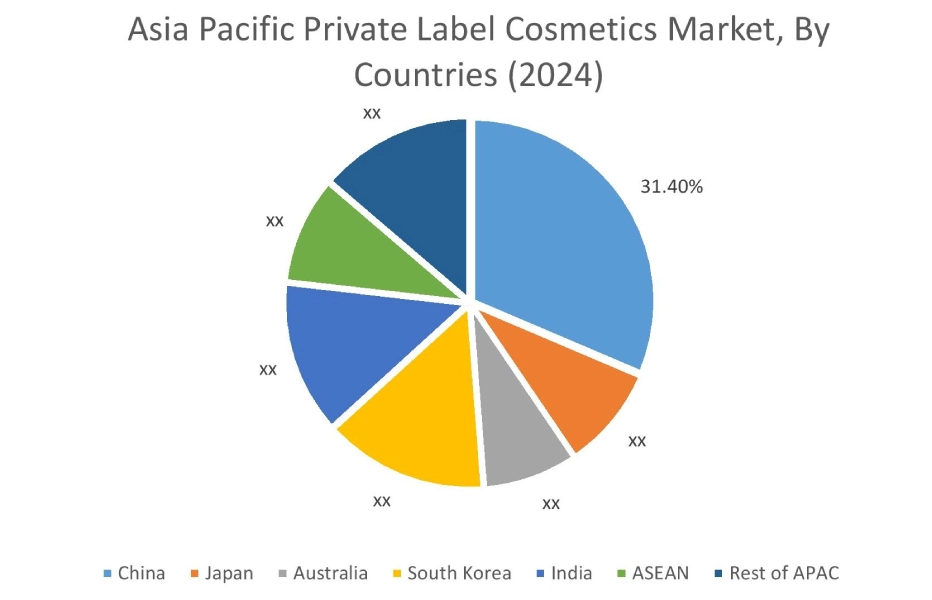

Asia Pacific region was valued at USD 2.73 Billion in 2024. Moreover, it is projected to grow by USD 2.91 Billion in 2025 and reach over USD 5.24 Billion by 2032. Out of this, China accounted for the maximum revenue share of 31.40%. The private label cosmetics market analysis in the region shows that the market is growing due to the rapidly growing middle class, increasing interest in beauty personalization, and growing influence of k-beauty.

- For instance, Invision Pharma Ltd, a manufacturer in India, offers private label cosmetics. These products include skin care, body care, sun care, men's care, hair care, foot care, baby care, and several other cosmetics.

North America is estimated to reach over USD 5.99 Billion by 2032 from a value of USD 3.26 Billion in 2024 and is projected to grow by USD 3.46 Billion in 2025. The market in the North American region is primarily driven by the growing cosmetics industry and rising demand for affordable skincare and makeup products. Moreover, the rising focus on sustainability and clean beauty products is further driving the private label cosmetics market expansion.

Additionally, the private label cosmetics market analysis shows that the market in Europe is growing due to rising demand for vegan and cruelty-free cosmetic products. Moreover, the private label cosmetics industry in Latin America, the Middle East, and Africa is driven by rising awareness of wellness and grooming, increasing urbanization, and the modern retail industry expansion.

Top Key Players & Market Share Insights:

The private label cosmetics market is highly competitive, with major players providing solutions and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global private label cosmetics market. Key players in the private label cosmetics industry include -

- Naturis Cosmetic (India)

- Invision Pharma Limited (India)

- Cosmiko (UK)

- Cosmewax (UK)

- W L Botanist Ltd (UK)

- Lady Burd (US)

- Colorlab Private Label (US)

- Pinnacle Cosmetics (US)

- Aurora Global Brands(US)

- Hera Beauty Ltd (UK)

Private Label Cosmetics Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 17.71 Billion |

| CAGR (2025-2032) | 8.8% |

| By Product Type |

|

| By Distribution Channel |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the private label cosmetics market? +

Private Label Cosmetics Market size is estimated to reach over USD 17.71 Billion by 2032 from a value of USD 9.58 Billion in 2024 and is projected to grow by USD 10.18 Billion in 2025, growing at a CAGR of 8.8% from 2025 to 2032.

What are the major segments covered in the private label cosmetics market report? +

The segments covered in the report are product type, distribution channel, end user, and region.

Which region holds the largest revenue share in 2024 in the private label cosmetics market? +

North America holds the largest revenue share in the private label cosmetics market in 2024.

Who are the major key players in the private label cosmetics market? +

The major key players in the market are Naturis Cosmetic (India), Invision Pharma Limited (India), Lady Burd (US), Colorlab Private Label (US), Pinnacle Cosmetics (US), Aurora Global Brands(US), Hera Beauty Ltd (UK), Cosmiko (UK), Cosmewax (UK), and W L Botanist Ltd (UK).