Industrial Computed Tomography Equipment Market Size:

Industrial Computed Tomography Equipment Market Size is estimated to reach over USD 897.83 Million by 2032 from a value of USD 527.04 Million in 2024 and is projected to grow by USD 554.16 Million in 2025, growing at a CAGR of 7.5% from 2025 to 2032.

Industrial Computed Tomography Equipment Market Scope & Overview:

Industrial Computed Tomography (CT) equipment employs X-rays to generate detailed 3D representations of an object's internal and external structures without causing any damage. This non-destructive testing method involves capturing 2D X-ray images from various angles as the object rotates. Software then processes these images using complex algorithms to reconstruct a precise 3D volume, composed of individual volume pixels called voxels. This 3D model allows for in-depth analysis of internal features, detection of flaws, precise dimensional measurements, and the differentiation of materials based on their density. Industrial CT is a powerful tool for quality control, failure analysis, reverse engineering, and assembly verification across a wide range of industries.

How is AI Impacting the Industrial Computed Tomography Equipment Market?

Artificial Intelligence is revolutionizing the industrial computed tomography (CT) equipment market by enhancing image reconstruction, defect detection, and data analysis. AI driven algorithms significantly improve image clarity and processing speed, allowing for faster and more accurate inspection of complex components in industries like aerospace, automotive, and electronics. Moreover, machine learning enables automated flaw detection and dimensional analysis, reducing human error and inspection time. Predictive analytics powered by AI helps optimize equipment maintenance and minimize downtime. Additionally, AI integration supports real-time decision-making and quality assurance in manufacturing workflows. Overall, AI is boosting precision, efficiency, and automation, positioning industrial CT systems as essential tools for advanced industrial inspection and quality control.

Industrial Computed Tomography Equipment Market Dynamics - (DRO) :

Key Drivers:

Increasing demand for stringent quality control and inspection in the manufacturing of components and systems is driving the global industrial computed tomography equipment market growth

5G devices and infrastructure components feature highly miniaturized and complex electronic assemblies. Industrial CT is crucial for inspecting these components for defects like solder voids, misalignments, and ensuring the integrity of connections in densely packed circuit boards and System-in-Package (SiP) modules. Additionally, the battery pack is the most critical and expensive component of an EV, and its safety and performance are paramount. Industrial CT provides detailed internal inspection of battery cells and modules to detect defects such as foreign particles, delamination, electrode overhang issues, and weld porosity, thereby driving the industrial computed tomography equipment market size.

- For instance, in Nov 2021, OMRON Corporation launched the VT-X750-V3, touted as the world's fastest CT-type X-ray inspection system. This advanced device offers true 3D inspection of electronic substrates, designed to meet the escalating quality demands of 5G, electric vehicle, and autonomous driving applications. By enabling high-speed, 100% X-ray inspection without PCB design limitations, OMRON aims to enhance productivity and ensure the quality and safety of customer products in these critical industries.

Consequently, increasing demand for stringent quality control and inspection in the manufacturing of components and systems is driving the industrial computed tomography equipment market expansion.

Key Restraints :

Higher equipment cost and longer scan times are restraining the global industrial computed tomography equipment market growth

High-energy CT systems are expensive to purchase and operate due to the sophisticated X-ray sources and shielding required for safety. This increases the initial investment and operational costs for companies needing to inspect dense parts, potentially hindering adoption, especially for smaller enterprises. In addition, imaging dense objects necessitates longer exposure times per projection to gather enough data. This significantly increases the overall scan time, reducing throughput and making CT less suitable for high-volume production environments.

Therefore, as per the analysis, these combined factors are significantly hindering industrial computed tomography equipment market share.

Future Opportunities :

Development of industrial CT scanners incorporating fast Time-of-Flight (TOF) and Optiso Ultra Dynamic Range (UDR) detector technologies is projected to create industrial computed tomography equipment market opportunity

Fast TOF technology enhances the signal-to-noise ratio, leading to clearer and detailed 3D reconstructions. Combined with the high dynamic range of Optiso UDR detectors, which optimize performance across a wider range of material densities, this results in superior image quality with better contrast and sharper definition of internal features and defects. Additionally, fast TOF technology directly contributes to reducing scan times. By more accurately locating the origin of X-ray photons, less data needs to be acquired to achieve the same level of image quality. This increase in speed makes industrial CT more viable for integration into production lines, enabling faster quality control processes, hence boosting industrial computed tomography equipment market demand.

- For instance, in June 2023, Siemens Healthineers introduced the Biograph Vision.X, a new PET/CT scanner that advances upon the Biograph Vision with an industry-leading time of flight (TOF) of 178 picoseconds. Utilizing its Optiso Ultra Dynamic Range (UDR) detector technology, which incorporates silicon photomultipliers (SiPMs) and small 3.2 mm x 3.2 mm LSO crystals, the Biograph Vision.X achieves superior spatial resolution.

Hence, based on the analysis, development of industrial CT scanners incorporating fast Time-of-Flight (TOF) and Optiso Ultra Dynamic Range (UDR) detector technologies is expected to create industrial computed tomography equipment market opportunities.

Industrial Computed Tomography Equipment Market Segmental Analysis :

By Offering:

Based on the Offering, the market is categorized into Equipment and Services.

Trends in the Offering:

- Growing trend towards the adoption of equipment due to developments like faster scanning speeds, higher resolution imaging, and the integration of artificial intelligence (AI) and machine learning (ML) for automated analysis and improved workflows.

- Trend towards the adoption of industrial CT inspection services by small and medium-sized enterprises (SMEs) instead of purchasing equipment outright.

Equipment accounted for the largest revenue share in 2024.

- Growing trend towards the development of portable CT scanners for on-site inspections, high-energy CT systems capable of penetrating denser objects, and micro- and nano-CT systems for ultra-high-resolution imaging is driving industrial computed tomography equipment market share.

- Moreover, the development of equipment that features a high-efficiency detector with a large field of view is also driving the industry.

- For instance, in Feb 2025, Bruker Corporation launched the X4 POSEIDON, a new benchtop 3D X-ray microscope (XRM) utilizing micro-Computed Tomography (microCT). This innovative system offers high-performance 3D X-ray microscopy, comparable to larger floor-standing models, making it more accessible for demanding industrial and scientific research applications.

- Thus, as per the industrial computed tomography equipment market analysis, the aforementioned factors are driving equipment segment growth.

Services are projected to register the fastest CAGR during the forecast period.

- Service includes analysis reports, advanced defect characterization, dimensional metrology services, failure analysis investigations, and reverse engineering support to provide deeper insights and actionable results for clients.

- Emergence of service companies specializing in application areas, such as additive manufacturing inspection, electronics quality control, or reverse engineering for the automotive sector are driving the market size.

- Service providers are leveraging digital platforms for seamless data transfer, secure result sharing, and collaborative analysis with clients, which enhances efficiency and communication throughout the inspection process.

- As per industrial computed tomography equipment market analysis, the above-mentioned factors are contributing significantly in spurring the market expansion.

By Voltage Range:

Based on the Voltage Range, the market is classified into Low-Energy CT (typically < 200 kV), Medium-Energy CT (typically 200 kV - 450 kV), High-Energy CT (typically > 450 kV), Micro-CT (often < 100 kV), and Nano-CT (often < 100 kV).

Trends in the Voltage Range:

- Medium-Energy CT (200 kV - 450 kV) serves a broad spectrum of industrial needs, including automotive, aerospace, and electronics.

- Medium-energy systems offer a good balance between the ability to penetrate moderately dense materials and achieving reasonable resolution.

High-Energy CT (typically > 450 kV) accounted for the largest revenue share in 2024.

- Industries like aerospace, defense, and heavy manufacturing are driving the need for high-energy CT systems due to their superior penetration capabilities.

- Technological developments in high-power X-ray sources are improving the ability of these systems to image dense materials with better signal-to-noise ratios and reduced scan times, thus driving the industrial computed tomography equipment market demand.

- Research and development efforts are focused on mitigating artifacts that are more pronounced when imaging dense materials with high-energy X-rays, leading to improved image quality and accuracy.

- For instance, NSI offers high-energy industrial CT scanning systems with energies up to 9 MeV, utilizing linear accelerators. These systems are designed for inspecting large, dense components common in aerospace, defense, and automotive industries.

- Thus, as per the industrial computed tomography equipment market analysis, the aforementioned factors are contributing significantly to driving the industry.

Micro-CT (often < 100 kV) is predicted to witness the fastest growth during the forecast period.

- Growing need for non-destructive, high-resolution 3D imaging at microscopic levels is crucial for detailed analysis in life sciences, material science, and industrial applications.

- Micro-CT is becoming vital in life science applications such as preclinical imaging, disease progression studies, tissue engineering, drug development, and the study of small animal models.

- The need for micro-CT is rising in material science for detailed characterization, including porosity analysis, composite material analysis, failure analysis at the micro-level, and studying the internal structures of advanced materials.

- As per industrial computed tomography equipment market, the above-mentioned factors are collectively responsible for boosting the market share.

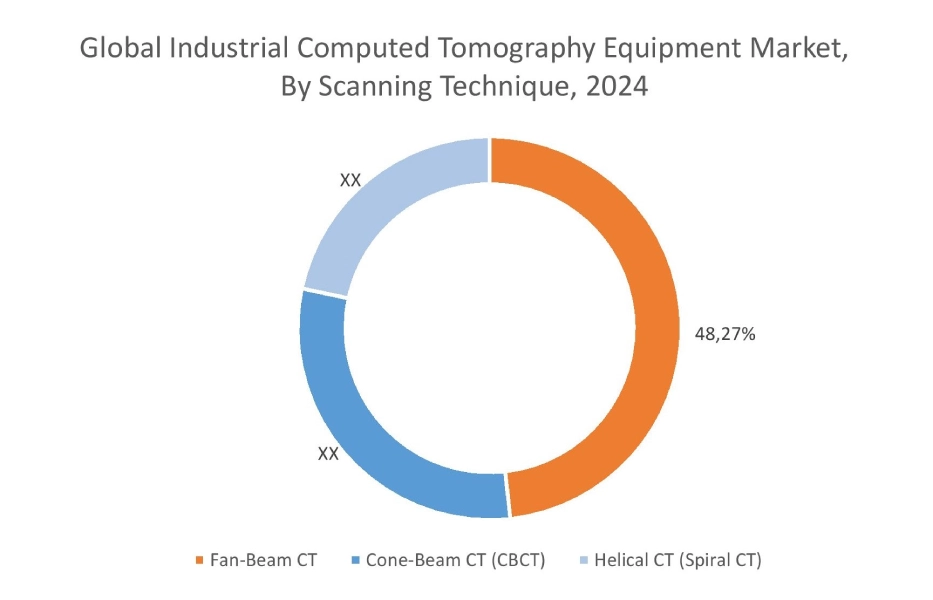

By Scanning Technique:

Based on the Scanning Technique, the market is categorized into Fan-Beam CT, Cone-Beam CT (CBCT), and Helical CT (Spiral CT).

Trends in the Scanning Technique:

- Helical CT is widely used in medical imaging for its speed and continuous data acquisition, and is finding applications in industrial CT, particularly for long or continuous objects like pipes or welds.

- The primary trend is leveraging the speed of helical scanning for efficient inspection of elongated parts, providing a continuous dataset without the start-stop motion of traditional axial scanning.

Fan-Beam CT accounted for the largest revenue share of 48.27% in 2024.

- Growing trend towards the development of fan-beam CT technology for industrial applications, particularly where high image quality and good contrast for soft tissues or lower density materials are required.

- Moreover, combining fan-beam CT data with sophisticated software for detailed geometric dimensioning and tolerancing (GD&T) analysis and image-based finite element methods.

- For instance, in June 2024, Virginia Equine Imaging launched the Asto CT Equina, a specialized standing CT scanner for horses. This dual-axis fan-beam system allows simultaneous imaging of both limbs and the head and neck regions of horses while they are standing under mild sedation, offering a significant advancement in equine diagnostics.

- Thus, as per the industrial computed tomography equipment market analysis, the aforementioned factors are driving equipment segment growth.

Cone-Beam CT (CBCT) is projected to register the fastest CAGR during the forecast period.

- Cone-beam CT is adopted due to its faster acquisition times and ability to scan larger volumes in a single rotation, beneficial for high-throughput inspection.

- CBCT is experiencing strong growth in electronics inspection, automotive, and additive manufacturing.

- Current trends focus on enhancing both the scanning speed and the achievable resolution in CBCT systems, which involves developments in faster detectors and more powerful reconstruction algorithms.

- As per the industrial computed tomography equipment market analysis, the above-mentioned factors are contributing significantly to spurring the market demand.

By End Use Industry:

Based on the End-Use Industry, the market is categorized into Aerospace and Defense, Automotive, Electronics and Semiconductor, Oil and Gas, Medical Devices, Additive Manufacturing (3D Printing), Power Generation, and Others.

Trends in the End-Use Industry:

- The aerospace and defense industries maintain the highest standards for quality and safety, driving significant adoption of industrial CT for non-destructive testing of critical components like turbine blades, composite structures, and welds.

- CT is used to inspect pipelines, welds, and downhole tools for corrosion, cracks, and other defects to ensure operational safety and prevent failures.

Automotive accounted for the largest revenue share in the market in 2024.

- The automotive sector uses industrial CT for inspecting critical parts like engine blocks, airbags, and steering columns to ensure safety and reliability.

- Moreover, with the rise of electric vehicles, CT is vital for inspecting battery cells and packs for defects that could impact performance and safety.

- CT helps in analyzing the internal structure and integrity of lightweight materials like aluminum castings and composites used to improve fuel efficiency.

- For instance, India's electric vehicle market experienced a 20% sales increase in 2024, with EVs comprising over 50% of 3-wheeler sales, around 5% of 2-wheeler sales, and 2% of car sales. Also, the Indian EV battery market is projected to grow significantly, from USD 16.77 billion in 2023 to USD 27.70 billion by 2028.

- Thus, as per the industrial computed tomography equipment market analysis, the aforementioned factors are driving equipment segment growth.

Electronics and Semiconductor are projected to register the fastest CAGR during the forecast period.

- The increasing miniaturization and complexity of electronic components and semiconductor packages drive the need for high-resolution micro-CT for defect detection.

- CT is used to inspect printed circuit board assemblies for defects like component misalignment and solder joint integrity, driving the market size.

- CT plays a crucial role in non-destructively analysing failed electronic components to determine the root cause.

- As per the industrial computed tomography equipment market analysis, the above-mentioned factors are contributing significantly to spurring the market expansion.

Regional Analysis:

The global industrial computed tomography equipment market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

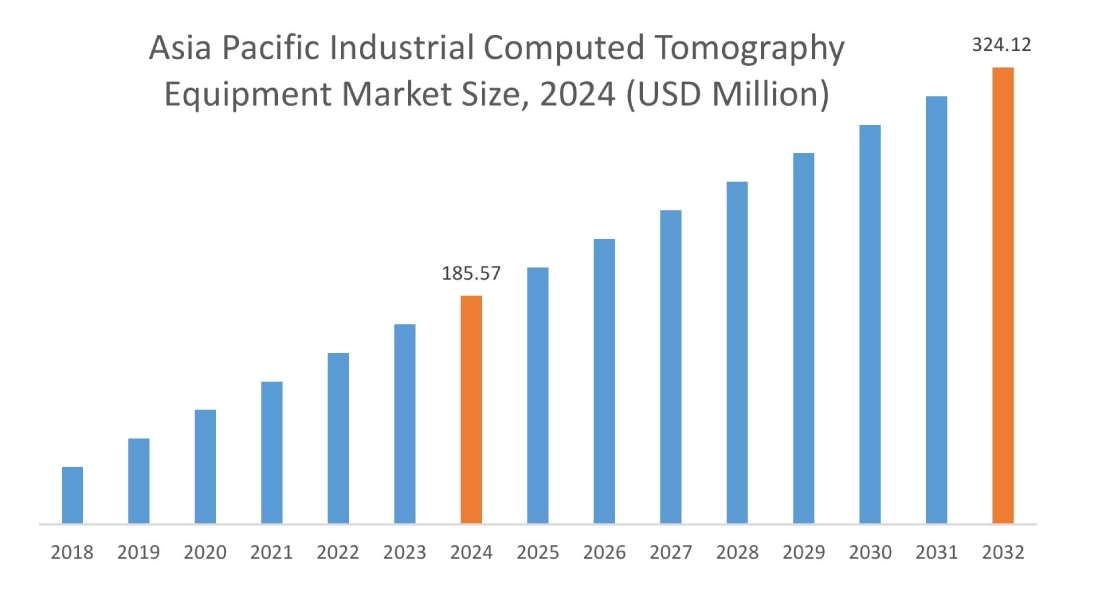

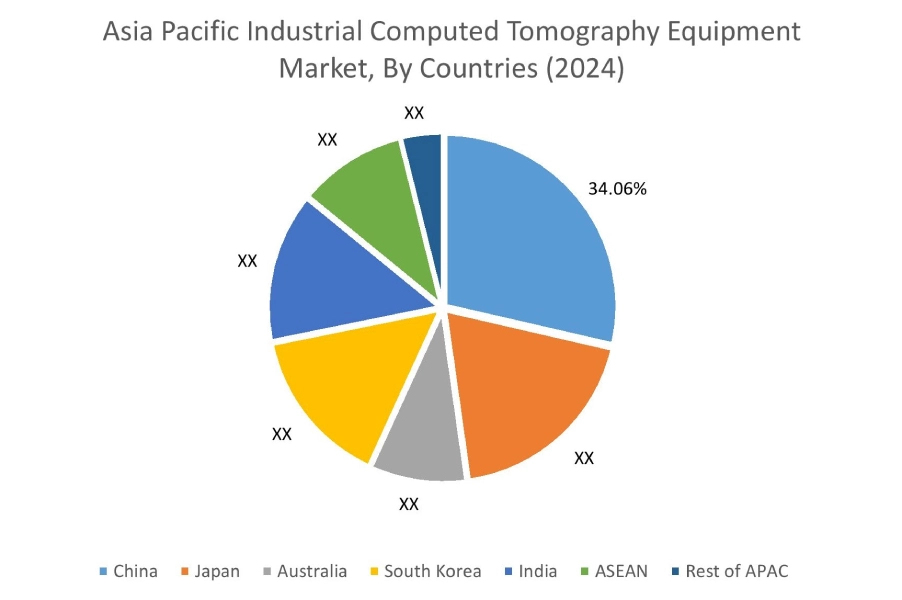

Asia Pacific was valued at USD 185.57 Million in 2024. Moreover, it is projected to grow by USD 195.53 Million in 2025 and reach over USD 324.12 Million by 2032. Out of these, China accounted for the largest revenue share of 34.06% in 2024. The expanding automotive industry in countries like China, Japan, South Korea, and India is a significant end-user of industrial CT for inspecting various components, including castings, battery packs for electric vehicles, and ensuring assembly quality. Additionally, Asia Pacific is a global leader in electronics and semiconductor manufacturing. The increasing complexity and miniaturization of electronic components drive the need for high-resolution micro-CT systems for defect detection and quality control.

North America region was valued at USD 159.85 Million in 2024. Moreover, it is projected to grow by USD 167.83 Million in 2025 and reach over USD 267.55 Million by 2032. Industries such as aerospace, automotive, and medical devices in North America adhere to rigorous quality and safety regulations. This necessitates the adoption of advanced non-destructive testing methods like industrial CT for thorough inspection of components and assemblies. The well-established aerospace and defense industries in the US and Canada are significant end-users of high-energy CT systems for inspecting critical components made of advanced materials and large assemblies. The need for defect detection in composites and for reverse engineering legacy parts further fuels this demand.

As per market analysis, Europe's strong industrial base and emphasis on high-quality manufacturing, particularly in automotive and aerospace, drive steady growth in its industrial CT equipment market. The Latin American industrial CT equipment market is experiencing a gradual increase, driven by increasing adoption in key industrial sectors like automotive and manufacturing as quality standards rise. Middle East and Africa markets show increasing potential, fueled by investments in industrial infrastructure and a growing awareness of the benefits of advanced quality control technologies, particularly in oil & gas and manufacturing.

Top Key Players & Market Share Insights:

The market is highly competitive, with major players providing industrial computed tomography equipment to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the industrial computed tomography equipment industry include-

- Waygate Technologies (Germany)

- Rigaku Corporation (Japan)

- Werth Messtechnik GmbH (Germany)

- VJ Technologies (USA)

- GE Healthcare (USA)

- Siemens Healthineers AG (Germany)

- Philips Healthcare (Netherlands)

- ZEISS Group (Germany)

- Comet Yxlon (Germany)

- Lumafield (USA)

- Nikon Corporation (Japan)

- Shimadzu Corporation (Japan)

- Canon Medical Systems Corporation (Japan)

- Hamamatsu Photonics (Japan)

- JMC Corporation (Japan)

Recent Industry Developments :

Product Launch:

- In Dec 2024, Philips launched its CT 5300 in North America at RSNA 2024, highlighting its AI-powered CT Smart Workflow. This system uses 'Precise' AI software to automate tasks throughout the CT process, aiming to reduce workload for technicians and radiologists, allowing them to focus more on patient care.

Industrial Computed Tomography Equipment Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 897.83 Million |

| CAGR (2025-2032) | 7.5% |

| By Offering |

|

| By Voltage Range |

|

| By Scanning Technique |

|

| By End Use Industry |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the industrial computed tomography equipment market? +

The industrial computed tomography equipment market size is estimated to reach over USD 897.83 Million by 2032 from a value of USD 527.04 Million in 2024 and is projected to grow by USD 554.16 Million in 2025, growing at a CAGR of 7.5% from 2025 to 2032.

What specific segmentation details are covered in the industrial computed tomography equipment report? +

The industrial computed tomography equipment report includes specific segmentation details for offering, voltage range, scanning technique, end-use industry, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the industrial computed tomography equipment market, electronics and semiconductor is the fastest-growing segment during the forecast period.

Who are the major players in the industrial computed tomography equipment market? +

The key participants in the industrial computed tomography equipment market are Waygate Technologies (Germany), ZEISS Group (Germany), Comet Yxlon (Germany), Lumafield (USA), Nikon Corporation (Japan), Shimadzu Corporation (Japan), Canon Medical Systems Corporation (Japan), Hamamatsu Photonics (Japan), JMC Corporation (Japan), Rigaku Corporation (Japan), Werth Messtechnik GmbH (Germany), VJ Technologies (USA), GE Healthcare (USA), Siemens Healthineers AG (Germany), Philips Healthcare (Netherlands), and Others.