Push Buttons and Signaling Devices Market Size :

Push Buttons and Signaling Devices Market size is estimated to reach over USD 3,030.26 Million by 2032 from a value of USD 2,026.26 Million in 2024 and is projected to grow by USD 2,094.71 Million in 2025, growing at a CAGR of 5.20% from 2025 to 2032.

Push Buttons and Signaling Devices Market Scope & Overview:

Push buttons are devices that are designed to open or close an electric circuit when a button or knob is pressed and return to a normal position after the button is released. Meanwhile, signaling devices refer to electronic devices that are used for sending audible and visual signals. Both of them are primarily used in automotive, healthcare, food & beverage, construction, and other industrial sectors.

Push Buttons and Signaling Devices Market Insights :

Key Drivers :

Growing automotive sector is driving the push buttons and signaling devices market

Push buttons are primarily used in the automotive sector, particularly in automobile interiors for applications including engine start/stop, vehicle forward and reverse rotation, interlock, and lighting switches among others. Moreover, push buttons offer a range of benefits, including ease of utilization, less space consumption, lower cost, durability, and resistance to higher voltages or short circuits. The above benefits of push buttons are crucial to increasing its adoption in the automotive sector.

Factors including increasing investments in automobile manufacturing facilities, rising automotive production, advancement in autonomous driving, and growing adoption of electric vehicles are among the vital prospects driving the automotive sector.

For instance, according to the International Organization of Motor Vehicle Manufacturers, the production of passenger cars across the world reached 61.59 million in 2022, representing an increase of around 8% as compared to 57.05 million in 2021.

Meanwhile, according to the European Automobile Manufacturers Association, the production of passenger cars in the European Union reached up to 10.9 million in 2022, demonstrating an incline of 8.3% in contrast to 2021. Thus, the market analysis shows that the rise in automobile production is driving the adoption of push buttons for application in automobile switches, in turn driving the push buttons and signaling devices market growth.

The rising utilization in the food & beverage industry is spurring push buttons and signaling devices market

Push buttons are used in food & beverage facilities for operating various equipment and machinery installed across the facility. Likewise, signaling devices including audible and visual signaling devices are often installed in food & beverage processing facilities to provide a warning in the event of equipment malfunction, process control, start-up, and a range of other safety-related applications for harsh environments. The benefits of including high-pressure and high-temperature wash down, lower cost, sealed surfaces for food and debris resistance, and others are key prospects for increasing its utilization in the food & beverage sector.

Factors including significant investments in the food & beverage sector, increasing consumer demand for packaged and processed food products, along rising adoption of automated solutions in the food industry are primary determinants for driving the growth of the food & beverage sector.

For instance, according to Food Drink Europe, a European Union confederation for the food industry, the food and beverage industry in the European Union was valued at EUR 1,121 billion (USD 1,292.0 billion) in 2022, demonstrating a growth of 2.6% in comparison to EUR 1,093 billion (USD 1,177.8 billion) in 2021.

Therefore, the market analysis shows that the growth of the food & beverage sector, in turn, proliferates the push buttons and signaling devices market growth and demand.

Key Restraints :

The prevalence of stringent regulations and standards associated is restraining the market

Push buttons and signaling devices are used in various industries including automotive, oil & gas, food & beverage, healthcare, and others. However, manufacturers have to compulsorily comply with various stringent standards and regulations, which is a prime factor restricting the market.

For instance, push button and signaling device manufacturers have to comply with various standards such as the RoHS (Restriction of Hazardous Substances) Directive, ISO (International Organization for Standardization) standard - ISO 7227:1987/ISO 6969, and others.

Additionally, materials used in these devices must comply with RoHS about Directive 2011/65/EU, including the amendment to Annex II, 2015/863/EU. Further, the quality assurance system and procedures must be audited and certified in compliance with ISO standards. Therefore, the analysis of market trends depicts that the prevalence of the aforementioned standards associated is constraining the push buttons and signaling devices market demand.

Future Opportunities :

Rising investments in the healthcare sector are expected to promote potential opportunities for the market

The rising investments in the healthcare sector are expected to present potential opportunities for the market. Push buttons are often installed in healthcare facilities to help admitted patients communicate with nurses or other healthcare staff in cases of assistance requirements or emergencies. Additionally, healthcare facilities are integrating signaling devices and warning systems for monitoring patients, improving patient safety, and enhancing operational efficiency among others.

The market analysis depicts that the factors including the rise in healthcare expenditure, growing incidence of diagnostics and surgical procedures, and increasing in-patient admissions are expected to facilitate development prospects for the market.

For instance, according to the American Medical Association, healthcare spending in the U.S. was valued at USD 4.3 trillion in 2021, representing an incline of 2.7% as compared to 2020. Furthermore, the European Commission invested USD 6 billion budget for the 2021-27 period to support the healthcare sector in Europe.

Hence, increasing investments in the healthcare sector are projected to increase the integration of push buttons and signaling devices in healthcare facilities for improving patient care and operational efficiency, in turn promoting push buttons and signaling devices market opportunities during the forecast period.

Push Buttons and Signaling Devices Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 3,030.26 Million |

| CAGR (2025-2032) | 5.2% |

| By Product | Push Buttons and Signaling Devices |

| By Connectivity | Wired and Wireless |

| By End-User | Automotive, Healthcare, Oil & Gas, Food & Beverage, Construction, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | ABB, Honeywell International Inc., Rockwell Automation, Schneider Electric, Eaton, Robert Bosch GmbH, Johnson Electric Holdings Limited, Siemens, OMRON Corporation, R. STAHL AG, Emerson Electric Co. |

Push Buttons and Signaling Devices Market Segmental Analysis :

By Product :

Based on the product, the market is bifurcated into push button and signaling device. The push buttons segment accounted for the largest revenue share in the year 2024 of the global market. Push buttons refer to devices that are designed to open or close an electric circuit when a button or knob is pressed and return to a normal position after the button is released. Moreover, they offer several benefits including less space consumption, ease of utilization, lower cost, durability, and resistance to higher voltages or short circuits among others. The aforementioned benefits are driving its utilization in automotive, healthcare, construction, and other sectors.

Honeywell International Inc. offers a DPDT - 87940 series of emergency stop push buttons in its product portfolio. The push buttons are primarily designed for utilization in automotive, construction, and other industries. Thus, the segmental trends analysis concludes that rising innovations associated with push buttons for industrial applications are among the prime factors driving the market.

The signaling devices segment is anticipated to register the fastest CAGR during the forecast period. Signaling devices refer to electronic devices that are used for sending audible and visual signals. Moreover, they are used for conveying simple messages associated with the operation of machinery, manufacturing lines, or individual industrial equipment in oil & gas, food & beverage, and other industries.

For instance, R. STAHL AG offers a wide range of audible and visual signaling devices for providing improved safety in hazardous zones. The company offers audible and visual signaling devices for utilization in oil & gas, food & beverage, chemical, and other related industries. Therefore, the analysis of the segment shows that the rising development of signaling devices for utilization in industrial sectors is anticipated to boost the push buttons and signaling devices market opportunities during the forecast period.

By Connectivity :

Based on the connectivity, the market is bifurcated into wired and wireless. The wired connectivity segment accounted for the largest revenue share in the year 2024 of the total push buttons and signaling devices market share. Wired push buttons are primarily used in industrial control systems, consumer electronics, and communication devices for mode selection, power on/off, and volume control. The benefits include high reliability, tactile feedback, compact design, and ease of integration into circuit boards among others.

For instance, Honeywell International Inc. offers RPW101A1003/A model of wired push buttons in its product portfolio. Therefore, the increasing availability of push buttons with wired connectivity is a key factor driving the segment.

The wireless connectivity segment is anticipated to register the fastest CAGR during the forecast period. Wireless pushbuttons do not require any cable and enable very flexible handling and arrangement of the switches and pushbuttons. Additionally, they enable users to send a signal from up to 100 meters away from a button that generates its power and is ideal for deployment in industrial environments that require high flexibility, modularity, and mobility among others.

For instance, Omron Corporation offers an A2W model of wireless push buttons. The wireless push buttons are integrated with an IP65 rating and work efficiently within a 100m range. Thus, the segmental trends show that the rising development of push buttons with wireless connectivity for industrial applications is a key factor anticipated to drive the segment during the forecast period.

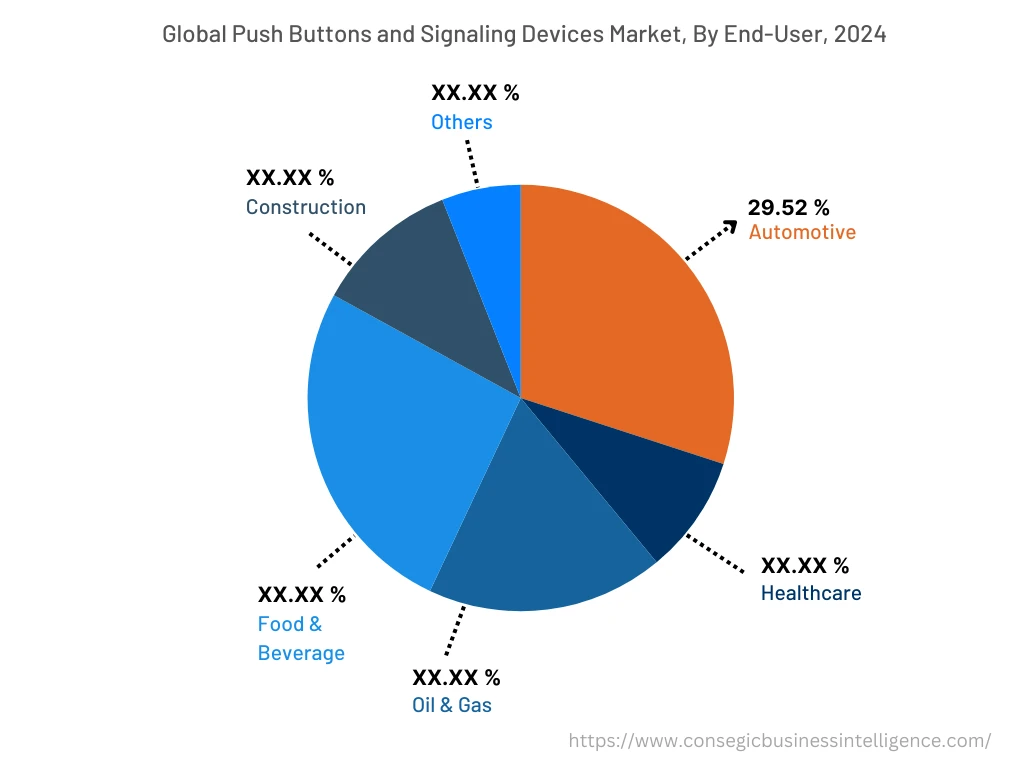

By End-User :

Based on the end-user, the market is segregated into automotive, healthcare, oil & gas, food & beverage, construction, and others. The automotive segment accounted for the largest revenue share of 29.52% in the year 2024 of the overall push buttons and signaling devices market share. Factors including increasing investments in automobile manufacturing facilities, rising automotive production, advancement in autonomous driving, and a growing trend of adoption of electric vehicles are driving the automotive segment.

For instance, according to the International Organization of Motor Vehicle Manufacturers, the overall automotive production in North America reached 14.79 million in 2022, witnessing a growth of nearly 10% from 13.46 million in 2021. Therefore, the growing trends in the automotive sector are driving the adoption of push buttons for their application in automobile engine start/stop, vehicle forward and reverse rotation, interlock, and lighting switches, in turn fostering the market.

Food & beverage segment is expected to witness the fastest CAGR during the forecast period. The growing food & beverage segment is primarily driven by multiple factors including significant investments in the food & beverage sector, increasing consumer demand for packaged and processed food products, along rising adoption of automated solutions in the food sector among others.

For instance, R. STAHL AG is a manufacturer of push buttons and signaling devices that provides a range of push buttons and audible & visual signaling devices for utilization in the food & beverage sector. Additionally, Omron Corporation offers a broad series of push buttons for industrial applications including food & beverage in its product portfolio. Thus, the analysis portrays that the rising development of push buttons and signaling devices for utilization in the food & beverage sector is projected to drive the push buttons and signaling devices market trends during the forecast period.

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

Europe is estimated to reach over USD 831.2 Million by 2032 from a value of USD 548.56 Million in 2024 and is projected to grow by USD 567.71 Million in 2025. As per the push buttons and signaling devices market analysis, the adoption of push buttons and signaling devices in the European region is mostly driven by its utilization in healthcare, automotive, construction, food & beverage, and other sectors. Moreover, the increasing expansion of food manufacturing facilities increasing utilization for operating various equipment, and providing warning signals across the facility are among the significant factors driving the push buttons and signaling devices market expansion in the region.

For instance, in September 2021, Nature Bio Foods BV launched its new organic food processing facility in Rotterdam, Netherlands. The new facility aims at providing organic food ingredients to consumers throughout the country. Thus, the development of food processing facilities is driving the integration of these devices for operating various equipment and providing warning signals across the facility, in turn accelerating push buttons and signaling devices market expansion in the European region. Additionally, increasing investment in the automotive and healthcare sectors is anticipated to promote push buttons and signaling devices market demand in Europe during the forecast period.

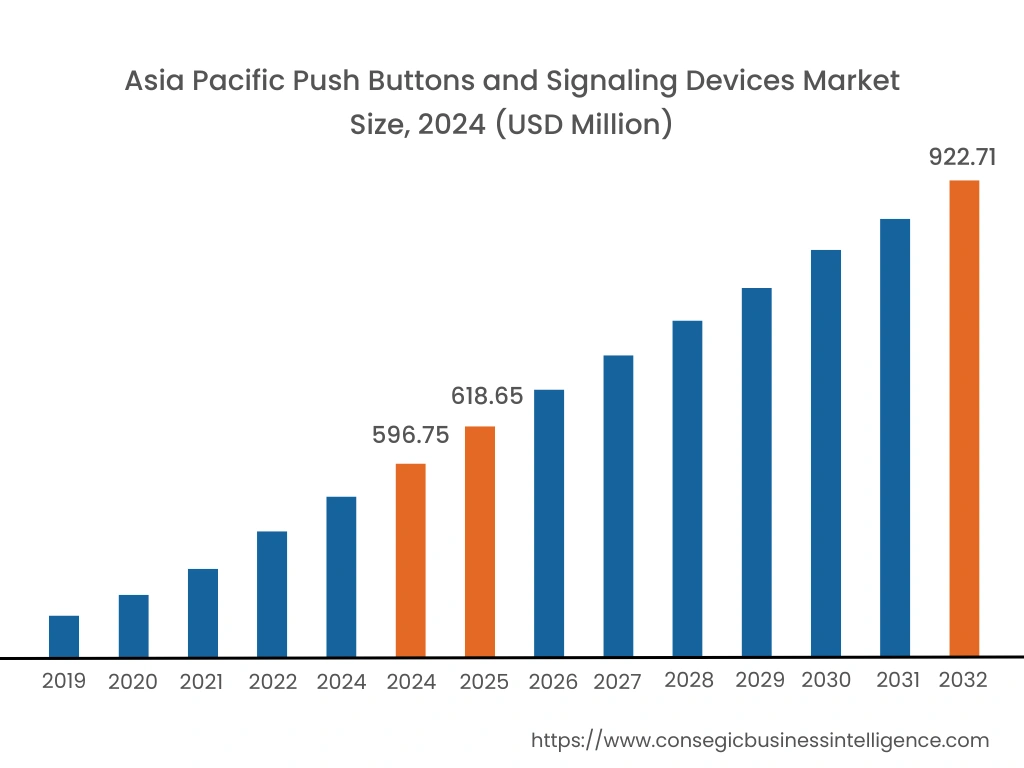

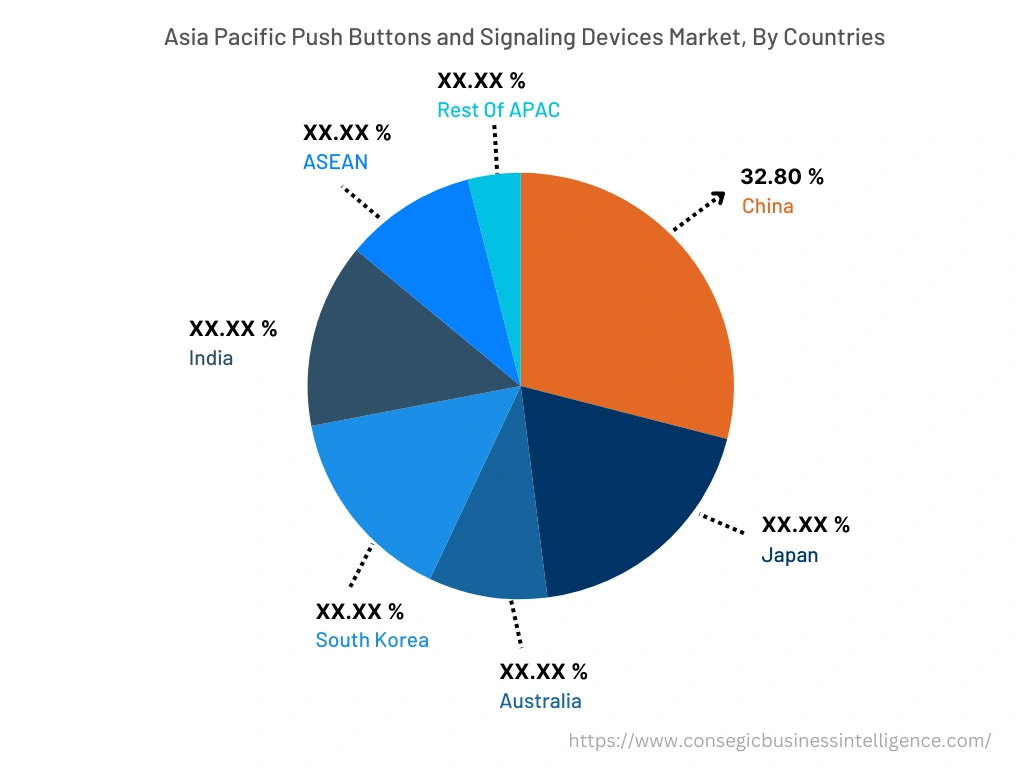

Asia-Pacific is expected to grow with the highest CAGR of 5.6% and is estimated to reach over USD 922.71 Million by 2032 from a value of USD 596.75 Million in 2024 and is projected to grow by USD 618.65 Million in 2025. In addition, in the region, China accounted for the maximum revenue share of 32.80% in the same year.

The growing trends of industrialization and development are driving the market in the region. In addition, factors including the development of various industries including automotive, oil & gas, construction, and others are driving the market in the Asia-Pacific region.

For instance, according to Invest India, the oil and gas sector in India witnessed a growth of around 5% in FY 2021-22 as compared to the previous year. Additionally, the total refining capacity of India is equivalent to 251 MMTPA as of October 2022, comprising 23 refineries. Signaling devices including audible and visual signaling devices are often installed in oil & gas facilities to provide a warning in the event of equipment malfunction, process control, start-up, and a range of other safety-related applications for harsh environments. Hence, the growing oil & gas sector is driving the deployment of signaling devices, thereby boosting the push buttons and signaling devices market trends in the Asia-Pacific region.

Top Key Players & Market Share Insights:

The push buttons and signaling devices market is highly competitive with major players providing push buttons and signaling devices to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the push buttons and signaling devices market

- ABB

- Honeywell International Inc.

- OMRON Corporation

- R. STAHL AG

- Emerson Electric Co.

- Rockwell Automation

- Schneider Electric

- Eaton

- Robert Bosch GmbH

- Johnson Electric Holdings Limited

- Siemens

Key Questions Answered in the Report

What is push buttons and signaling devices? +

Push buttons are devices that are designed to open or close an electric circuit when a button or knob is pressed and return to a normal position after the button is released. Meanwhile, signaling devices refer to electronic devices that are used for sending audible and visual signals.

What specific segmentation details are covered in the push buttons and signaling devices report, and how is the dominating segment impacting the market growth? +

For instance, by product segment has witnessed push buttons as the dominating segment in the year 2024, owing to the increasing adoption of push buttons in automotive, healthcare, construction, and other sectors.

What specific segmentation details are covered in the push buttons and signaling devices market report, and how is the fastest segment anticipated to impact the market growth? +

For instance, by end-user segment has witnessed food & beverage as the fastest-growing segment during the forecast period due to rising adoption of push buttons and signaling devices in food & beverage facilities for operating equipment and providing warning signals.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2025-2032? +

Asia-Pacific is anticipated to register fastest CAGR growth during the forecast period due to rapid pace of industrialization and growth of multiple industries such as automotive, oil & gas, construction, and others, and others.