Rye Flour Market Introduction :

Consegic Business Intelligence analyzes that the rye flour market size is growing with a CAGR of 3.4% during the forecast period (2023-2031). The market accounted for USD 42.70 million in 2022 and USD 43.83 million in 2023, and the market is projected to be valued at USD 57.12 Million by 2031.

Rye Flour Market Definition & Overview:

Rye (Secale cereale L.) is a widely cultivated cereal crop that belongs to the Poaceae family, also known as Gramineae. It has genetic similarities with barley and wheat but is tougher than both. Rye is grown extensively as a grain, a cover crop, and a forage crop. It is remarkably hardy in winter and can be cultivated in sandy, low-fertility soils, making it suitable for growth in areas where other cereal crops are not viable.

This flour is produced by grinding rye berries, also called whole rye kernels. It has a slightly sweet-sour taste with a mild, nutty, earthy, and slightly malty flavor. It is available in different types, such as white, medium, dark, and pumpernickel. This flour is an excellent source of macro- and micronutrients, including fiber, protein, and B-complex vitamins like thiamin, riboflavin, niacin, and folate, which are all necessary components of a healthy human diet. Rye contains a higher proportion of gliadin and less gluten than wheat. Unlike wheat flour, this flour has lower levels of gluten and contains higher levels of dietary fiber, which can range from 15% to 21%. This flour is used to prepare various food items such as rye bread, sourdough bread, crackers, gingerbread, crispbreads, fruitcakes, scones, and pasta. In the USA, it is also used as a filler for soups, sauces, and pancake flour.

Rye Flour Market Insights :

Rye Flour Market Dynamics - (DRO) :

Key Drivers :

Increasing demand for rye flour in the food industry

The rising demand for specialty flour in the bakries is one of the prominent reasons fuelling the rye flour market demand which is driving the growth of the market across the globe. Rye flour is characterized by its mild, nutty, earthy, and slightly malty flavor, which is akin to that of whole wheat flour but with a fresher taste. It is often used as a substitute for wheat flour in many cereal products. As per the analysis, this flour is widely used by bakers and food processing industries to produce a variety of breads, including rye bread, sourdough bread, pumpernickel bread, and crackers. Additionally, this flour is a staple in the creation of gingerbread, fruitcakes, scones, and pasta. Moreover, it is also utilized as a filler for soups and sauces, enhancing the flavor profile of the end product. Additionally, rye based flour is used as raw material by the alcoholic beverage industries to alcoholic drinks, such as rye whiskey and rye beer. Furthermore, as per the analysis, increasing investment by the government in the food sector and progress in the array of programs offered are propelling the barley market. For instance, according to the report published by the United Nations Industrial Development Organization (UNIDO) & and the Department of Science & Technology, Government of India, the food and beverage sector had foreign direct investment (FDI) equity inflows of USD 709.72 million during the financial year (FY) 2021-22. The total FDI received from April 2000 to June 2022 was USD 11.34 billion. Thus, the increasing use of this flour is driving the market.

Rising awareness about the health benefits of rye flour

Rye flour is gaining renewed attention worldwide due to its rich content of functional ingredients. It is an excellent source of macro- and micronutrients, including fiber, protein, and B-complex vitamins like thiamin, riboflavin, niacin, and folate, all of which are essential components of a healthy human diet. Additionally, it contains a higher proportion of gliadin and less gluten than wheat, and it has all nine essential amino acids.

Moreover, rye is also gaining popularity among agricultural and culinary experts due to its unique phytochemical composition and health benefits. Based on the analysis, it has been proven to help improve certain health conditions such as weight loss, blood sugar reduction, anti-inflammatory properties, anticancer activity, antioxidant activity, detoxifying properties, and boosting the immune system. Its nutrient-dense composition and versatility make it a wholesome food and a valuable addition to a variety of diets and cuisines. Furthermore, according to the data published on NCBI, on June 9, 2022, results from intervention studies showed that rye-based foods vs. (wheat) control foods had a positive effect on both insulin and glucose responses in the postprandial phase, rather than on insulin alone. Therefore, the increasing awareness about the dietary significance of rye, coupled with the rise in the number of health-conscious consumers, is driving the growth of the rye flour market.

Key Restraints :

Limited supply of rye leading to high price sensitivity

The global market for rye flour is significantly affected by a limited supply of rye, which has led to high price sensitivity. Climate changes and high energy prices are causing an increase in the costs of fertilizer, transportation, and agricultural production. As a result, there is a shortage of rye grain in the market. Additionally, as per the analysis, a decrease in the production of rye is further exacerbating the price sensitivity of rye flour. According to the report published by the European Commission on October 17, 2023, a sharp reduction in the harvested area of rye across the European Union was recorded in 2022 (a total -9.9 %) filtered through to a decline (-7.7 %, or 0.6 million tonnes) in harvested production to 7.8 million tonnes. This EU decline stemmed principally from lower production in Poland (-9.5 %), Germany (-5.8 %), and Spain (-33.1 %). Thus, the limited supply of rye is substantially restraining the global rye flour market.

Future Opportunities :

Rising fitness and wellness trends among consumers in the rye flour industry

The rye flour market is expected to grow soon due to the rising demand for nutritious and low-gluten food items, increased use of rye in health-conscious diets, and the use of functional flour in premium food products. Rye fibers absorb a substantial amount of water which can lead to a feeling of fullness, making it a valuable addition to the diet of fitness enthusiasts and those looking to lose weight. Moreover, its nutrient-dense composition and versatility make it a wholesome food and a valuable addition to a variety of diets and cuisines. The fitness industry has been booming in recent years and with good reason. Based on the analysis, people are becoming more and more aware of the importance of staying healthy and active, and they are looking for ways to do so in a way that is both enjoyable and sustainable. Thus, this flour is a healthy, nutritious, and versatile ingredient that can be used in a variety of ways. It is a good source of fiber, vitamins, and minerals, and it has been linked to several health benefits which is expected to boost the rye flour market growth and trend over the forecast period.

Rye Flour Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2031 |

| Market Size in 2031 | USD 57.12 Million |

| CAGR (2023-2031) | 3.4% |

| By Product Type | Organic Rye Flour and Normal Rye Flour |

| By Distribution Channel | Supermarket/Hypermarkets, Convenience Stores, Specialty Stores, Online Channels, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Great River Organic Milling, Ratton Pantry Ltd., FWP Matthews Ltd, La Milanaise., Shipton Mill, Grain Millers, Inc., Swiss Bake Ingredients Pvt. Ltd., King Arthur Baking Company, Inc., Bay State Milling Company, DOBELES DZIRNAVNIEKS AS, Doves Farm Foods Ltd., Arrowhead Mills, Hodmedod's British Wholefoods., SwissBake®, Bob's Red Mill Natural Foods. And Craggs & Co Farms Limited. |

Rye Flour Market Segmental Analysis :

Based on the Product Type :

The product type is categorized into organic and normal. In 2022, organic segment accounted for the highest market revenue in the rye market and is expected to hold the highest CAGR over the forecast period. Organic is made from pesticide-free rye plants. The Organic segment is expected to witness growth due to the rising awareness about the health benefits of organic foods and new food safety standards for health and well-being combined with consumers' increasing spending on organic farm food. For instance, according to a report published by the International Federation of Organic Agriculture Movement (IFOAM) in February 2023, in a survey done for 191 countries, it is found that the market size has grown from USD 84 billion in 2015 to USD 129 billion in 2020 and total retail sales of organic products amounted to almost USD 133.36 billion in 2021, suggesting that the demand for chemical-free organic produces has increased in the international market. Thus, the aforementioned factors are propelling the trend of the segment

Based on the Distribution Channel :

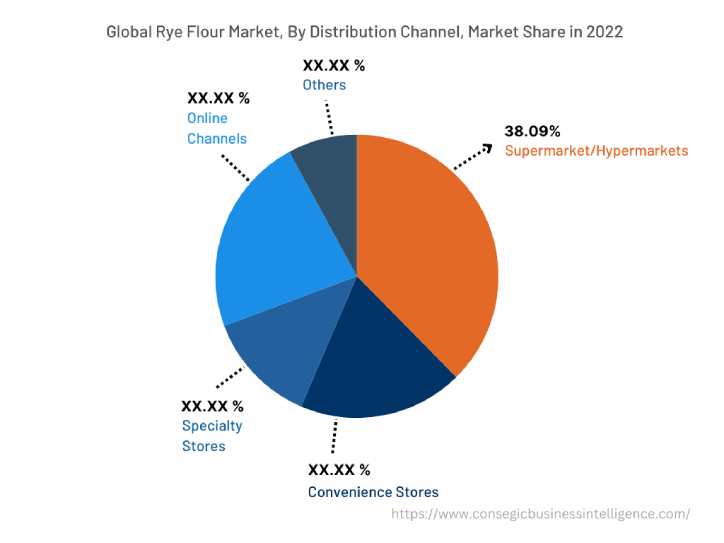

The distribution channel segment is categorized as supermarkets/hypermarkets, convenience stores, specialty stores, online channels, and others. In 2022, the supermarket/hypermarkets segment accounted for the highest market share of 38.09% in the overall rye flour market. Supermarkets/hypermarkets offer several advantages for customers like the variety of goods in one place, discounts on the food products, convenience or extended shopping hours, and multiple options for the same product. Additionally, as per the analysis, they also have a larger selection of products and food producers to choose from. Thus, the aforementioned factors are propelling the market trend.

Moreover, the online channels segment is expected to hold the highest CAGR over the forecast period. The increasing sale of food products through e-commerce platforms, innovations in online payment modes, and an increase in customer convenience through shopping are expected to provide lucrative rye flour market opportunities and trends for the online distribution channel over the forecast period. For instance, according to the data published by the National Investment Promotion and Facilitation Agency in 2023, the e-commerce market is expected to touch USD 350 billion in gross merchandise value by 2030 and online shoppers in India are expected to reach 500 million in 2030 from which is 150 million more than 2020.

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

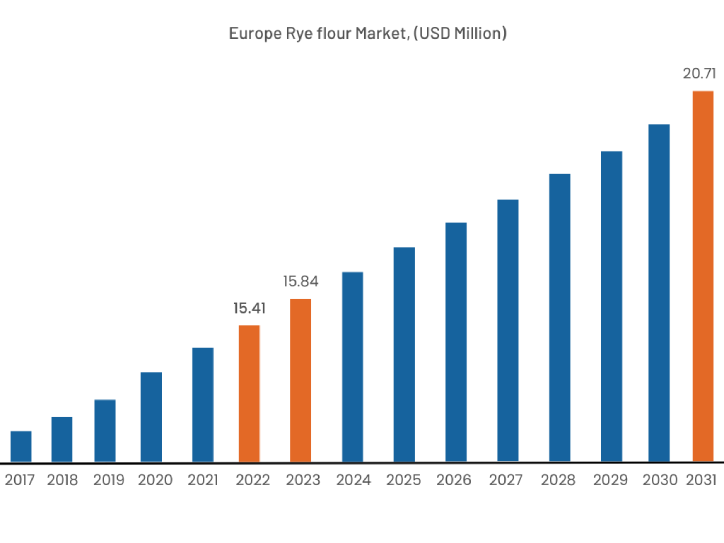

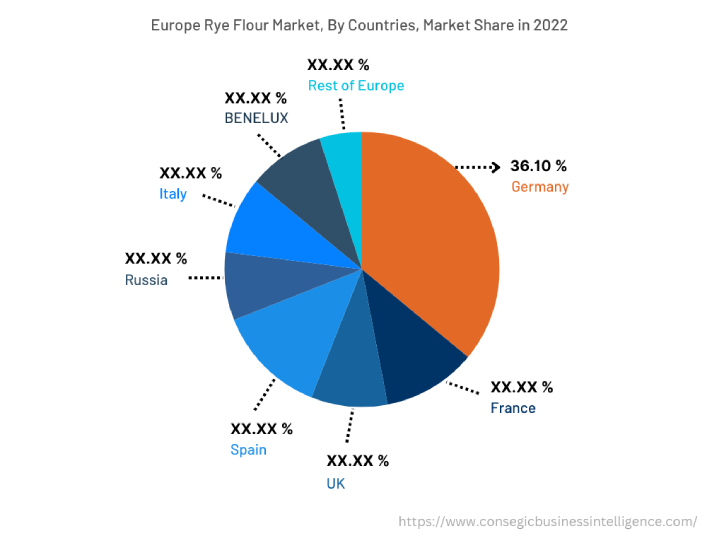

In 2022, Europe accounted for the highest rye flour market share at 36.10% valued at USD 15.41 Million in 2022 and USD 15.84 Million in 2023, it is expected to reach USD 20.71 Million in 2031. In Europe, Germany accounted for a major market share of 22.10% in the year 2022. This is the reason that Europe is the largest producer of rye across the globe and breads made from this flour are popular in Northern, Central, and Eastern Europe. Rye is widely cultivated in European, Russian, and Egyptian regions. For instance, according to the report published by the United States Department of Agriculture in November 2023, the total production of rye in the world was 12.52 million metric tons, out of which 8.01 million metric tons of rye was produced in the European Union alone. Overall, Europe has the largest demand for this flour due to a combination of factors, including its large population, high yield rich culinary tradition, and government support. Thus, as per the rye flour market analysis, the utilization and cultivation of the flour in this region is propelling the rye flour market trend.

Furthermore, the North America region is expected to witness significant growth over the forecast period, growing at a CAGR of 3.9% during 2023-2031. Awareness about the health benefits and consumption of rye based foods is rising in this region and collectively it is expected to drive the demand for this flour creating lucrative growth opportunities and trends for the global rye flour market in the North America region.

Top Key Players & Market Share Insights:

The rye flour market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- Great River Organic Milling

- Ratton Pantry Ltd.

- Arrowhead Mills

- Hodmedod's British Wholefoods.

- SwissBake

- Bob's Red Mill Natural Foods.

- Craggs & Co Farms Limited

- FWP Matthews Ltd

- La Milanaise.

- Shipton Mill

- Grain Millers, Inc.

- Swiss Bake Ingredients Pvt. Ltd.

- King Arthur Baking Company, Inc.

- Bay State Milling Company

- DOBELES DZIRNAVNIEKS AS

- Doves Farm Foods Ltd.

Recent Industry Developments :

- In February 2020, King Arthur Baking Company, Inc. launched updated ‘OO' Pizza Flour and Organic Flour. ‘OO' Pizza Flour has been formulated to help create pizza with a crispy crust and chewy interior crumb. Meanwhile, organic-based Rye Flour is a medium rye-based flour that King Arthur described as being "perfect for traditional bread."

- In February 2020, Bay State Milling Company is expanding its flour mill in Tolleson, Arizona, U.S. with a new grain storage elevator. The new elevator will add 1 million bushels of slipform concrete wheat storage to the facility's existing 1.6 million. Construction is expected to be completed by the 2020 wheat harvest.

Key Questions Answered in the Report

What was the market size of the rye flour market in 2022? +

In 2022, the market size of rye flour was USD 42.70 million.

What will be the potential market valuation for the rye flour industry by 2031? +

In 2031, the market size of rye flour will be expected to reach USD 57.12 million.

What are the key factors driving the growth of the rye flour market? +

Increasing demand for rye flour in the food industry is the key factor driving the market growth.

What is the dominant segment in the rye flour market for the distribution channel? +

In 2022, the supermarket/hypermarket segment accounted for the highest market share of 38.09% in the overall rye flour market.

Based on current market trends and future predictions, which geographical region is the dominating region in the Rye Flour market? +

Europe accounted for the highest market share in the overall market.