Smart Elevator Market Size:

Smart Elevator Market Size is estimated to reach over USD 36.81 Billion by 2032 from a value of USD 17.83 Billion in 2024 and is projected to grow by USD 19.21 Billion in 2025, growing at a CAGR of 10.5% from 2025 to 2032.

Smart Elevator Market Scope & Overview:

Smart elevators are advanced vertical transportation systems that utilize technology to optimize efficiency, safety, and user experience. They employ sensors, algorithms, and connectivity to analyze traffic patterns, predict passenger needs, and streamline elevator movement. This includes features like destination dispatch, predictive maintenance, enhanced security through access control, and energy-saving functionalities, all contributing to a more intelligent and responsive elevator service.

How is AI Transforming the Smart Elevator Market?

AI is playing a crucial role in the smart elevator market, particularly for facilitating predictive maintenance to forecast and prevent system failures, intelligent traffic management to optimize routes and reduce wait times by analyzing building traffic patterns, increasing energy efficiency through smart energy-saving techniques and regenerative braking, and enhanced security with unauthorized access detection and real-time monitoring. AI systems monitor elevator sensor data and identify potential faults or components that are likely to fail before they become critical, which enables proactive maintenance and reduces unexpected downtime. Therefore, the above factors are expected to positively impact the market growth in upcoming years.

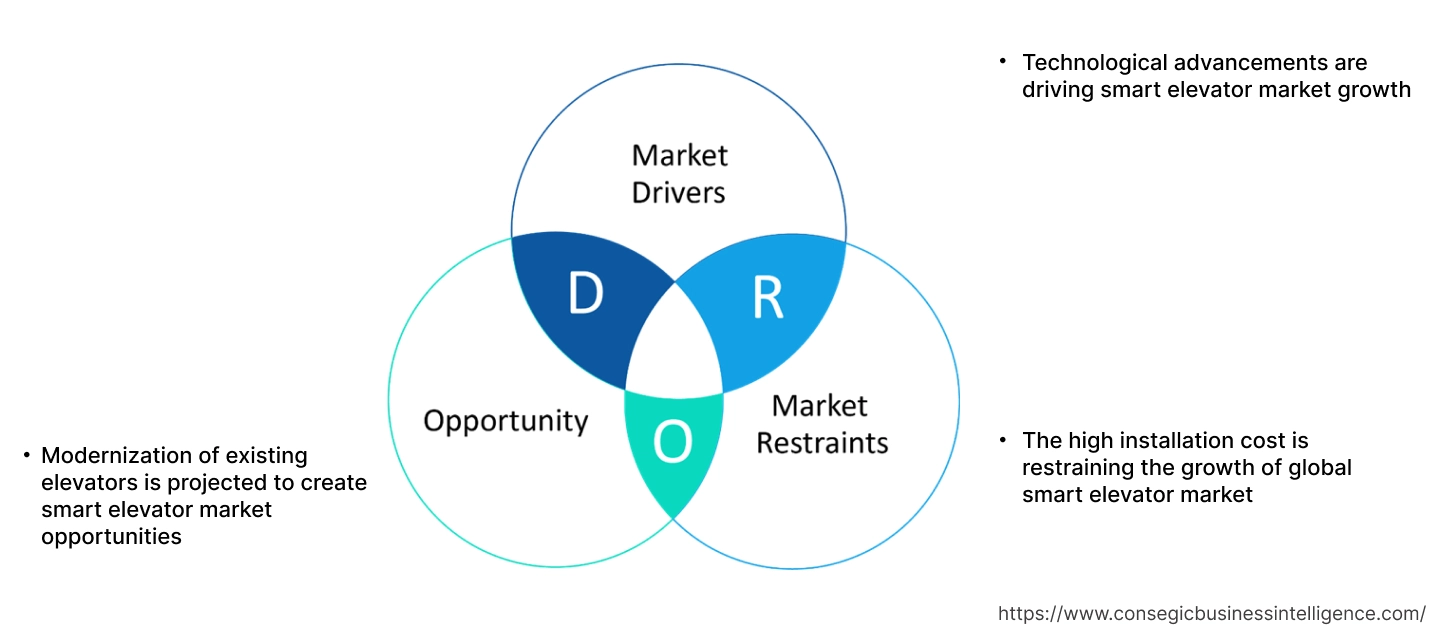

Key Drivers:

Technological advancements are driving smart elevator market growth

IoT connectivity enables real-time monitoring of elevator systems, which allows for predictive maintenance, minimizing downtime and reducing repair costs. Also, the data collected through IoT sensors provides valuable insights into elevator usage patterns, enabling optimization of traffic flow and energy consumption. Further, ML capabilities allow elevators to learn from usage patterns and adapt their performance accordingly. Additionally, AI algorithms analyze data to optimize elevator dispatch, reducing waiting times and improving passenger flow. AI also greatly enhances security through things like facial recognition, and other biometric security measures, hence boosting the smart elevator market trend.

- For instance, in Nov 2023, Otis Worldwide Corporation introduced the Otis Gen360, a new smart elevator system powered by its Otis ONE IoT platform. This system utilizes advanced safety technology (PESSRAL) and real-time data analysis to provide 24/7 monitoring of elevator health and performance. By leveraging IoT and AI, Otis ONE offers predictive insights and proactive communication, enabling service professionals to address potential issues remotely and minimize downtime, ultimately improving overall elevator reliability and customer experience.

Consequently, the aforementioned technological advancements are driving the smart elevator market expansion.

Key Restraints:

The high installation cost is restraining the growth of global smart elevator market

Smart elevators incorporate advanced technologies including IoT sensors, AI algorithms, and advanced control systems. These components increase the initial investment, and the integration of these technologies requires complex installation procedures, further hindering smart elevator market size. Additionally, implementing smart elevator systems necessitates upgrades to existing building infrastructure, including wiring, network connectivity, and communication systems. These infrastructure modifications contribute to the installation expenses, further restraining the global smart elevator market.

Therefore, as per the analysis, these combined factors are significantly hindering smart elevator market expansion.

Future Opportunities:

Modernization of existing elevators is projected to create smart elevator market opportunities

The widespread aging of elevator systems demands urgent modernization to comply with contemporary safety and efficiency benchmarks. Additionally, the rapid evolution of IoT, AI, and other smart technologies provides opportunities to enhance the performance and functionality of existing elevators. Modernization allows for the integration of these technologies, improving energy efficiency, safety, and user experience. Moreover, stricter safety regulations and increasing awareness of safety concerns are driving the demand for elevator upgrades. Modernization enables building owners to ensure compliance with current safety standards, thus boosting the smart elevator market demand.

- For instance, in Jan 2024, Otis Brazil successfully concluded a three-year project, modernizing 13 elevators at São Paulo's landmark Birmann 21 building. The project involved both technological and aesthetic upgrades and was completed on time. This modernization enhanced the building's vertical transportation system, bringing it up to current standards.

Hence, based on the analysis, modernization of existing elevators is expected to create smart elevator market opportunities.

Smart Elevator Market Segmental Analysis :

By Component:

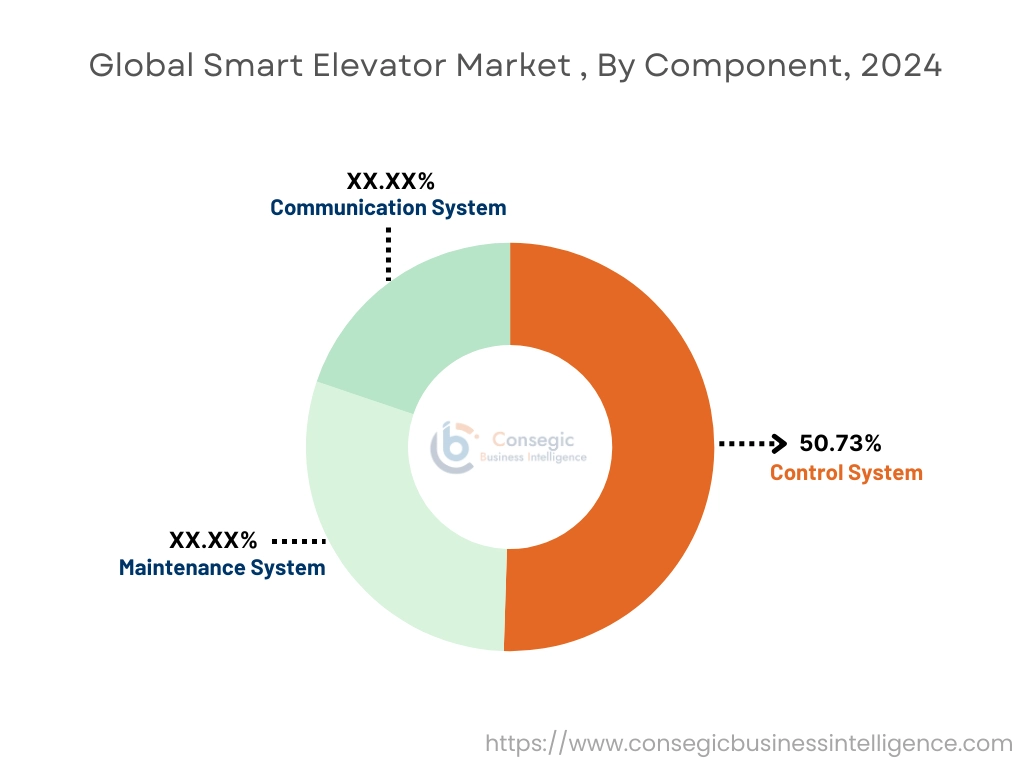

Based on the component, the market is classified into control system, maintenance system, and communication system.

Trends in the Component:

- Seamless integration allows elevators to coordinate with other building systems, such as HVAC, lighting, and security, which enables complete building management and enhanced energy efficiency.

- Growing trend towards the adoption of IoT sensors and data analytics enable real-time monitoring of elevator components.

Control System accounted for the largest revenue share of 50.73% in 2024.

- Growing trend towards the use of advanced algorithms for traffic optimization, and AI/ML for predictive adjustments, are leading to shorter wait times contributing to the growth of the smart elevator market share.

- The increased emphasis on hygiene is significantly driving the adoption of touchless and voice-activated controls, enhancing user experience and minimizing germ transmission.

- Moreover, AI is used to analyze data and optimize elevator performance, including traffic flow, energy consumption, and maintenance schedules.

- Furthermore, machine learning enables predictive maintenance, reducing downtime and improving reliability, the smart elevator market size.

- Thus, as per the smart elevator market analysis, the aforementioned factors are driving the control system segment growth.

Communication Systems is predicted to register the fastest CAGR during the forecast period.

- IoT technology enables seamless communication between elevators, building management systems, and maintenance personnel, which allows for real-time data collection and analysis.

- Increasing trend towards the adoption of digital displays and mobile apps to provide real-time information to passengers, such as wait times and elevator locations.

- Development of 5G networks is enabling faster and more reliable communication, improving the performance of smart elevator systems, important for real time data transfer used in predictive maintenance.

- Moreover, mobile applications are used to call elevators, receive notifications, and access personalized settings, is also driving the smart elevator market size.

- Consequently, the aforementioned factors are driving the growth of communication systems segment.

By Application:

Based on the application, the market is categorized into residential, commercial, institutional, and industrial.

Trends in Application:

- High-end residential buildings are increasingly incorporating smart elevators to enhance resident comfort and convenience.

- Growing trend towards the adoption of smart elevators in hospitals to transport patients and medical equipment quickly.

Commercial accounted for the largest revenue share in 2024.

- Commercial buildings' focus on minimizing their environmental footprint and operating costs is driving the adoption of smart elevators that incorporate energy-saving features, including regenerative drives and optimized controls.

- Green building certifications like LEED are causing more companies to install energy efficient elevators is also driving the smart elevator market size.

- Commercial spaces are investing in smart elevators with features such as digital displays, mobile app integration, personalized settings, and touchless/voice-activated controls to create a seamless environment, which in turn is driving smart elevator market demand.

- By prioritizing stylish designs and customization options, manufacturers are transforming wearables into fashionable accessories, further contributing to the smart elevator market growth.

- For instance, KONE's MonoSpace DX is a significant advancement in machine-room-less elevators, specifically designed for mid- and low-rise commercial buildings. It integrates robust digital connectivity via cloud-based APIs, allowing for future-proofed building systems and new digital services.

- Therefore, as per the market analysis, the aforementioned benefits are bolstering the smart elevator market trend.

Industrial is predicted to register the fastest growth during the forecast period.

- Smart elevators are being designed to handle loads in industrial settings, with features like automated loading/unloading and integration with warehouse management systems, hence driving the market demand.

- In industrial settings, elevators are engineered with stronger components and durable designs to endure heavy use, and predictive maintenance.

- By integrating safety features such as precise load monitoring, automated safety checks, and emergency communication systems, smart elevators are meeting the safety demands, thus boosting smart elevator market.

- Consequently, the growing industrial sector is contributing remarkably in driving the growth of smart elevator market.

- For instance, according to the Indian government, in November 2024, the mining, manufacturing, and electricity sectors experienced expansion rates of 1.9%, 5.8%, and 4.4%, respectively.

- Thus, as per the analysis, the aforementioned factors are driving the smart elevator market share.

Regional Analysis:

The global smart elevator market has been classified by region into North America, Europe, Asia-Pacific, MEA, and Latin America.

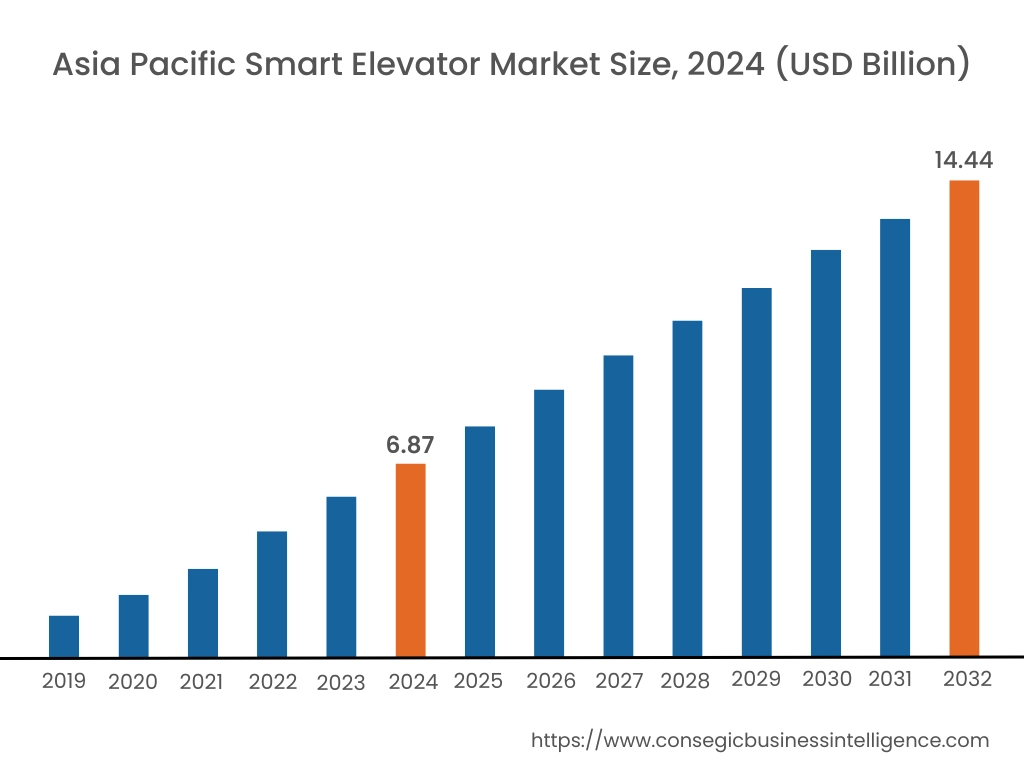

Asia Pacific region was valued at USD 6.87 Billion in 2024. Moreover, it is projected to grow by USD 7.42 Billion in 2025 and reach over USD 14.44 Billion by 2032. Out of these, China accounted for the largest revenue share of 32.55% in 2024. Governments across the region are investing heavily in infrastructure development, including the construction of modern transportation hubs, shopping malls, and office complexes. These projects require efficient and reliable vertical transportation solutions, creating a significant market for smart elevators. Additionally, the development of smart cities is also contributing notably in spurring the smart elevator market.

- For instance, in June 2024, India's Smart Cities Mission achieved significant progress, with 7,188 out of 8,018 projects (90%) completed as of July 3, 2024, representing an investment of ₹1,44,237 crore. Financially, the mission has utilized 93% of the ₹46,585 crore released by the government, which itself represents 97% of the total ₹48,000 crore budget. Furthermore, 74 of the 100 cities have received their full allocated government funding, indicating strong financial execution and project implementation.

North America was valued at USD 4.53 Billion in 2024. Moreover, it is projected to grow by USD 4.88 Billion in 2025 and reach over USD 9.34 Billion by 2032. The integration of IoT, AI, and cloud-based technologies is transforming the elevator industry in North America. Smart elevators are increasingly equipped with features like predictive maintenance, destination dispatch systems, and touchless controls, enhancing efficiency and user experience. Additionally, the focus on digital connectivity and real-time monitoring is driving the adoption of advanced elevator systems. Furthermore, the presence of key players in the region undergoing mergers and acquisitions is also bolstering market.

- For instance, in Nov 2020, ATIS, a major conveyance management company, has expanded its services by acquiring Colorado's A Smart Elevator Solution and 1 Able Elevator Inspector.

As per the smart elevator market analysis, Europe's smart elevator market is driven by a strong focus on sustainability and advanced technology. Stringent regulations and renovation projects fuel the adoption of energy-efficient and IoT-integrated elevators, enhancing safety and building management. While adoption is slower in Latin America compared to other regions, there's a growing need for cost-effective modernization and safety improvements in existing elevator systems. Moreover, MEA region is experiencing rapid increase, particularly in the Gulf, due to large-scale construction and smart city initiatives. High-end, technologically advanced elevators are in demand, along with increasing adoption of IoT and AI, as well as a growing focus on energy efficiency across diverse regions.

Top Key Players & Market Share Insights:

The market is highly competitive with major players providing smart elevator to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the smart elevator industry include-

- Otis Worldwide Corporation (USA)

- KONE Corporation (Finland)

- Hyundai Elevator (South Korea)

- Omega Elevators (India)

- ECE Elevators (India)

- Schindler Group (Switzerland)

- TK Elevator (Germany)

- Mitsubishi Electric (Japan)

- Hitachi (Japan)

- Fujitec (Japan)

Recent Industry Developments :

- In July 2024, Hitachi Elevator Asia Pte. Ltd. received the largest ever elevator supply and installation contract in Singapore, with an order for 450 lifts from the Housing & Development Board for its high-rise residential projects.

- In April 2024, Bosch highlighted its advanced visual and audio intelligence technologies, including edge-based analytics, video cameras, and IVA Pro, designed to improve security, safety, and operational efficiency across various industries.

Smart Elevator Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 36.81 Billion |

| CAGR (2025-2032) | 10.5% |

| By Component |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the smart elevator market? +

The smart elevator market size is estimated to reach over USD 36.81 Billion by 2032 from a value of USD 17.83 Billion in 2024 and is projected to grow by USD 19.21 Billion in 2025, growing at a CAGR of 10.5% from 2025 to 2032.

What specific segmentation details are covered in the smart elevator report? +

The smart elevator report includes specific segmentation details for component, application, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the smart elevator market, industrial is the fastest-growing segment during the forecast period.

Who are the major players in the smart elevator market? +

The key participants in the Smart Elevator market are Apple (USA), Google (Fitbit) (USA), Samsung (South Korea), Xiaomi (China), Huawei (China), Garmin (USA), Imagine Marketing (boAt) (India), Whoop (USA), Oura (Finland), Amazfit (Zepp Health) (China), Polar (Finland), Fossil (USA), Withings (France), Dexcom (USA), COROS (USA), and Others.