Stacked CMOS Image Sensor Market Size :

Stacked CMOS Image Sensor Market Size is estimated to reach over USD 20,587.39 Million by 2032 from a value of USD 9,155.58 Million in 2024, growing at a CAGR of 10.70% from 2025 to 2032.

Stacked CMOS Image Sensor Market Scope & Overview :

Stacked CMOS image sensor is referring to a type of sensor that utilizes a stacked structure comprising of a pixel chip composed of back-illuminated pixels that are stacked over a logic chip, in which the formation of signal processing circuits occurs. It offers a range of benefits including improved photo quality, reduced form factor, high accuracy, focus speed, subject recognition, and others. Their aforementioned benefits are key determinants for increasing its utilization in consumer electronics, automotive, and other industries.

Stacked CMOS Image Sensor Market Insights :

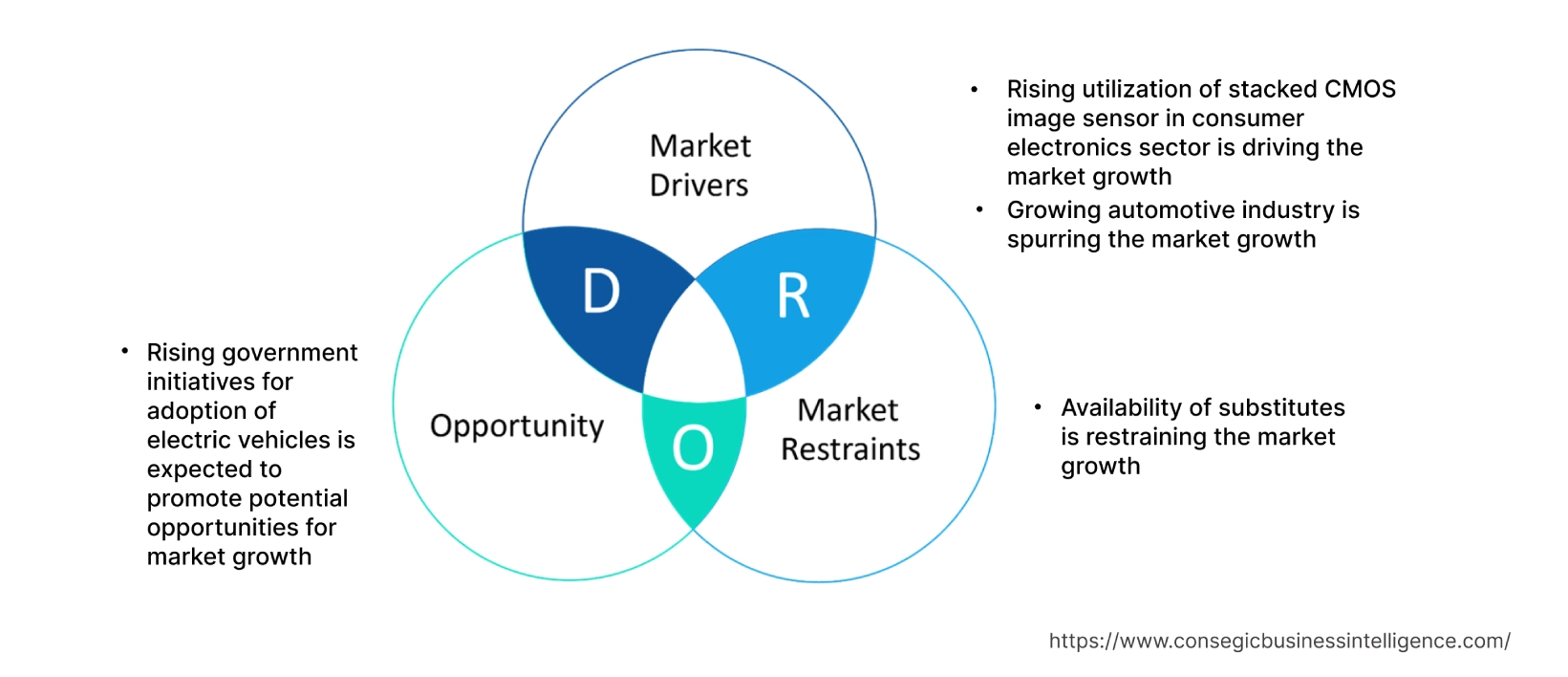

Stacked CMOS Image Sensor Market Dynamics - (DRO) :

Key Drivers :

Their rising utilization in consumer electronics sector

Stacked CMOS image sensors are primarily used in the consumer electronics sector, particularly for application in smartphones, laptops, digital cameras, and others. They are used in camera modules of consumer devices, attributing to its range of benefits including improved photo quality, high accuracy, reduced camera form factor, lower power consumption, and accurate subject recognition among others. The above mentioned benefits of are prime aspects for increasing its utilization consumer electronics sector.

Analysis of market trends indicates that factors including advancements in consumer electronics including artificial intelligence (AI) and internet of things (IoT), rising penetration of smartphones, computers, and other consumer devices, and increasing demand for smart devices are driving the expansion of the consumer electronics sector.

According to the Association of German Banks, the electronics industry in Germany witnessed a substantial proliferation in 2021. Its production and nominal sales of increased by 10% in 2021 as compared to 2020. Hence, the growing consumer electronics sector is driving their utilization in camera modules of consumer electronic devices, thereby enhancing stacked CMOS image sensor market demand.

Growing automotive industry

Stacked CMOS image sensor is used in the automotive industry for enhanced driving assistance, car safety, and driving comfort. Their deployment in automotive sector plays a crucial role in advanced driver-assistance systems (ADAS), in-cabin monitoring, and autonomous vehicle applications such as object detection, lane departure warning, and pedestrian recognition among others.

Assessment of market trends suggest that factors including the increasing production of automobiles, advancements in autonomous driving systems, and growing need for enhanced automobile sensor solutions and safety are driving the expansion of the automotive sector.

According to the OICA (International Organization of Motor Vehicle Manufacturers), the overall automotive production across the world reached 85.01 million in 2022, witnessing a proliferation of approximately 6% in comparison to 80.14 million in 2021. Hence, the growing automotive sector is increasing their adoption for utilization in automotive ADAS, in-cabin monitoring, and autonomous vehicle applications among others, which in turn proliferating the stacked CMOS image sensor market demand.

Key Restraints :

Availability of substitutes

CMOS image sensors have various substitutes such as CCD image sensors, and others. Comparatively, the substitutes have similar performance, properties, and applications, with respect to CMOS image sensors, which is a key factor restricting the market expansion.

For instance, CCD image sensor act as an ideal alternative to CMOS image sensors for automotive image sensing applications. Similarly, CCD image sensors are also used as an alternative to CMOS image sensors in high end broadcast quality video cameras. Moreover, CCD image sensors offer a range of benefits as compared to CMOS image sensors including higher sensitivity, lower noise, fewer defective pixels, and better image homogeneity. Analysis of market trends indicates that the availability of their substitutes is limiting the proliferation of the market.

Future Opportunities :

Rising government initiatives for adoption of electric vehicles

The rising government initiatives for manufacturing and adoption of electric vehicles (EVs) are expected to present potential opportunities for the expansion of the market. Image sensors are often used in electric vehicles for applications including advanced driver-assistance systems (ADAS), in-cabin monitoring, and autonomous vehicle applications among others.

Assessment of market trends suggest that factors including the advent of electro-mobility, availability of a wide range of models, accessibility of tax rebates and subsidies, and eco-friendliness are driving the adoption of electric vehicles. For instance, tax benefits and purchase incentives for electric vehicles are available in 21 countries listed in the European Union including Austria, Belgium, Netherlands, Poland, Spain, and other countries as of 2022. Further, governments worldwide are framing policies and initiative for reducing pollution and increasing the deployment of electric vehicles, which is anticipated to stimulate the adoption of EVs.

Therefore, rising government initiatives for adoption of electric vehicles are projected to increase their integration in EVs, which in turn is emerging as one of many stacked CMOS image sensor market opportunities during the forecast period.

Stacked CMOS Image Sensor Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 20,587.39 Million |

| CAGR (2025-2032) | 10.70% |

| Based on the Type | 2D Image Sensor and 3D Image Sensor |

| Based on the End-User | Automotive, Consumer Electronics, Medical, and Others |

| Based on the Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Sony Corporation, Samsung, STMicroelectronics, Canon Inc., OMNIVISION, Panasonic, SK HYNIX INC., SHARP CORPORATION, Nikon Corporation, ams-OSRAM AG |

Stacked CMOS Image Sensor Market Segmental Analysis:

By Type :

Based on the type, the market is bifurcated into 2D image sensor and 3D image sensor. The largest stacked CMOS image sensor market share was accounted to 2D image sensors segment in the year 2024. 2D image sensors offer several benefits including low power consumption, lower cost, higher sensitivity in the NIR range, higher frame rates, and good quality images and videos. The above benefits of 2D image sensors are increasing its application in automotive and medical industries among others.

According to the China Association of Automobile Manufacturers, the total production of passenger cars in China reached up to 14.8 million units in January-August 2022, depicting a YoY growth of 14.7%. Thus, the rising automotive production is among the key factors driving the adoption of 2D image sensors for utilization in automobile in-cabin sensing for driver monitoring, ADAS, and others, in turn is significantly boosting the stacked CMOS image sensor market growth.

The 3D image sensor segment is anticipated to register fastest CAGR growth during the forecast period. 3D image sensors offer higher sensitivity and more functionality per pixel. The primary benefit of 3D image sensors includes its ability to independently optimize detection and processing in dedicated processes. Analysis of market trends indicates that 3D image sensors provide high speed, high depth resolution, and flexible operation conditions. Stacked CMOS image sensor market analysis suggested that above mentioned benefits of 3D image sensors make it ideal for utilization in consumer electronics, automotive, and surveillance applications among others.

For instance, according to GSM Association, smartphone adoption in Germany is projected to reach 84% by 2025, depicting an increase from 80% in 2021. Therefore, the rising adoption of smartphones is projected to drive the demand for 3D image sensors for advanced camera capabilities including multiple lenses, high-resolution imaging, and AI-based features, in turn fueling the expansion of the market during the forecast period.

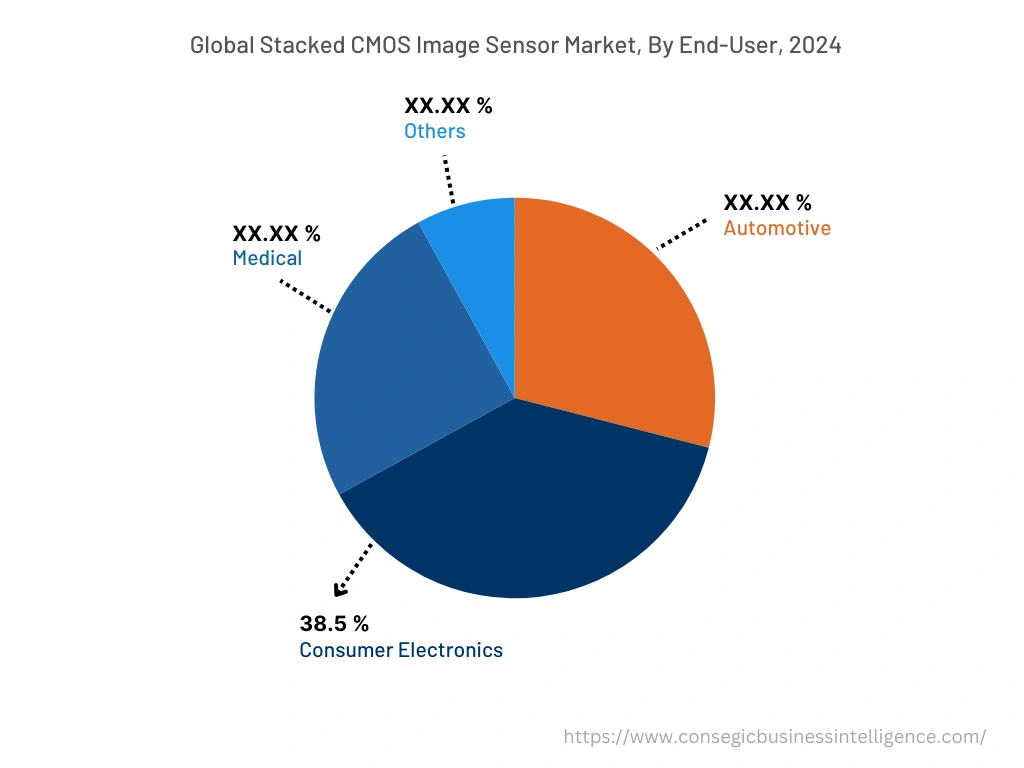

By End-User :

Based on the end-user, the market is segregated into automotive, consumer electronics, medical, and others. The largest stacked CMOS image sensor market share for end-user segment is accounted to consumer electronics for 38.5% in the year 2024. Factors including advancements in consumer electronics including artificial intelligence (AI) and internet of things (IoT), penetration of smartphones, computers, and other consumer devices, and increasing demand for energy-efficient and smart devices are driving the proliferation of the consumer electronics segment.

For instance, according to the Brazilian Electrical and Electronics Industry Association (ABINEE), the electrical and electronics sector in Brazil was valued at USD 42.2 billion in 2022, witnessing a growth of nearly 8% in comparison to USD 39.2 billion in 2021. Stacked CMOS image sensor market analysis indicated that the growing consumer electronics sector is driving the adoption of stacked sensors for utilization in camera modules of consumer devices, in turn proliferating the enlargement of the market.

Automotive segment is expected to witness fastest CAGR growth during the forecast period. The expansion of automotive segment is attributed to several factors including rising investments in expansion of automotive manufacturing facilities, increasing automobile production of automobiles, and advancements in autonomous driving systems.

For instance, according to European Automobile Manufacturers Association, the overall production of passenger cars in Europe Union reached 10.9 million in 2022, witnessing an incline of 8.3% as compared to 2021. They are primarily used in the automotive sector for applications including in-cabin monitoring, autonomous vehicles, and advanced driver-assistance systems (ADAS). Thus, the rising automotive production is projected to drive the their adoption, in turn is prominently driving the stacked CMOS image sensor market growth.

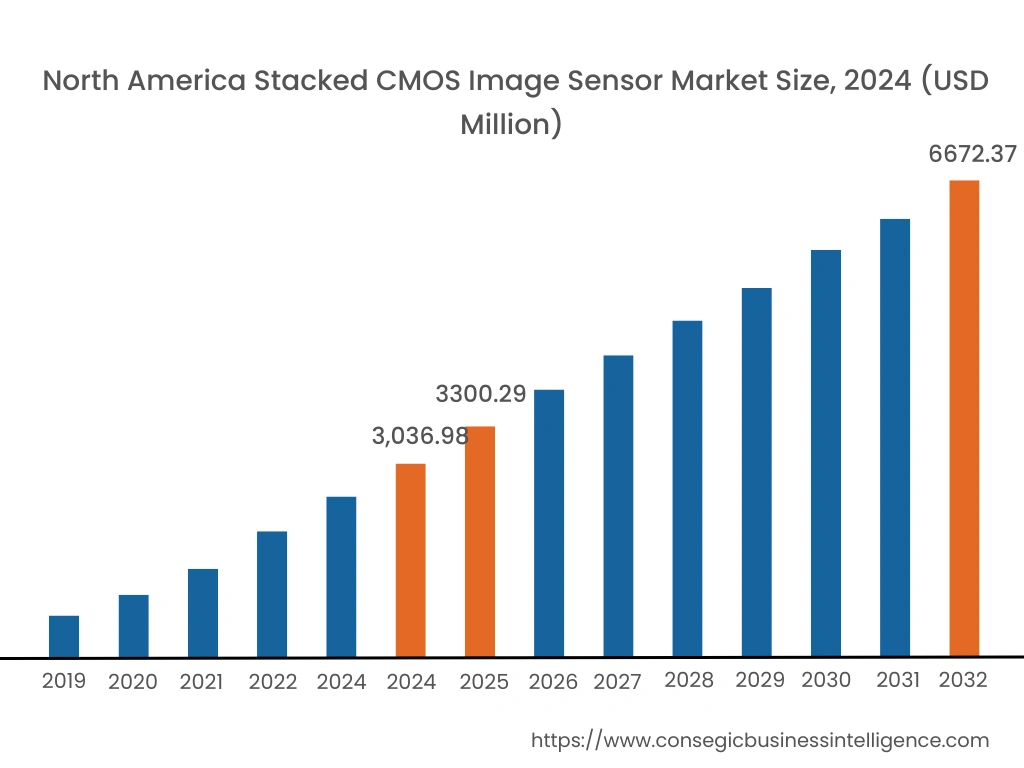

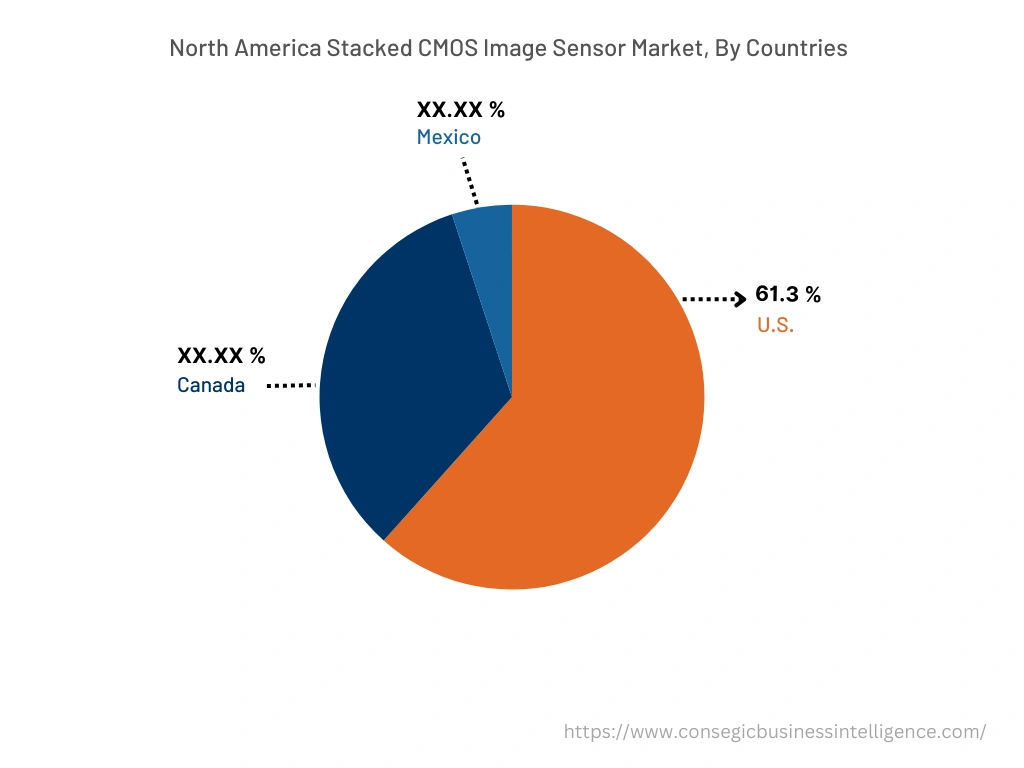

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

North America accounted for the largest revenue share of USD 3,036.98 Million in 2024 and is expected to reach USD 6,672.37 Million by 2032, registering a CAGR of 10.30% during the forecast period. In addition, in the region, the U.S. accounted for the maximum revenue share of 61.3% in the same year. Analysis of stacked CMOS image sensor market trends concludes that their adoption in the North American region is mostly driven by its utilization in automotive, medical, and other sectors. Moreover, the rising automobile production and their increasing use in automobile in-cabin monitoring and ADAS for driver assistance are among the significant factors driving the market expansion in the region.

For instance, according to the OICA (International Organization of Motor Vehicle Manufacturers), the automobile production in North America reached 14,798,146 units in 2022, representing a rise of around 10% from 13,467,065 units in 2021. Analysis of stacked CMOS image sensor market trends showcases that the growing automotive sector is propelling the deployment of sensors, in turn fostering market proliferation in the North American region. Additionally, increasing investments in electric vehicles and medical sector are anticipated to promote lucrative development aspects for the market in North America during the forecast period.

Asia-Pacific is expected to register fastest CAGR growth of 10.9% during the forecast period. The growing pace of industrialization and development is creating lucrative development aspects for the market in the region. Moreover, factors including the expansion of multiple industries such as consumer electronics, automotive, and others are fostering the market proliferation for stacked CMOS image sensor in the Asia-Pacific region.

For instance, according to the India Brand Equity Foundation, the consumer electronics sector in India was valued at USD 9.84 billion in 2021, and it is projected to grow at a considerable rate to reach USD 21.18 billion by 2025. Hence, the growing consumer electronics sector is anticipated to drive their utilization for deployment in camera modules of smartphones, laptops, and other consumer devices, thereby, proliferating the market expansion in the Asia-Pacific region during the forecast period.

Top Key Players & Market Share Insights :

The stacked CMOS image sensor market is highly competitive with major players providing stacked CMOS image sensor to the national and international markets. Companies operating in stacked CMOS image sensor industry are adopting several strategies in research and development (R&D), product innovation, and application launches to hold a strong position in stacked CMOS image sensor market. Key players in the stacked CMOS image sensor market include-

- Sony Corporation

- Samsung

- SHARP CORPORATION

- Nikon Corporation

- ams-OSRAM AG

- STMicroelectronics

- Canon Inc.

- OMNIVISION

- Panasonic

- SK HYNIX INC.

Recent Industry Developments :

- In December 2021, Sony introduced its stacked CMOS image sensor technology integrated with 2-layer transistor pixel. It is capable of reducing noise and widening dynamic range by increasing the saturation signal level.

Key Questions Answered in the Report

What is stacked CMOS image sensor? +

Stacked CMOS image sensors refer to a type of sensor that utilizes a stacked structure comprising of a pixel chip composed of back-illuminated pixels that are stacked over a logic chip, in which the formation of signal processing circuits occur.

What specific segmentation details are covered in the stacked CMOS image sensor report, and how is the dominating segment impacting the market growth? +

For instance, by type segment has witnessed 2D image sensor as the dominating segment in the year 2024, owing to its increasing utilization in automotive and medical industries among others.

What specific segmentation details are covered in the stacked CMOS image sensor market report, and how is the fastest segment anticipated to impact the market growth? +

For instance, by end-user segment has witnessed automotive as the fastest-growing segment during the forecast period due to the rising adoption of stacked CMOS image sensors in automotive ADAS, in-cabin monitoring, and autonomous vehicle applications.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2025-2032? +

Asia-Pacific is anticipated to register fastest CAGR growth of 10.9% during the forecast period due to rapid pace of industrialization and growth of multiple industries such as consumer electronics, automotive, and others.