Transformer Substation Inspecting Robot Market Size:

Transformer Substation Inspecting Robot Market size is estimated to reach over USD 544.26 Million by 2032 from a value of USD 212.58 Million in 2024 and is projected to grow by USD 235.30 Million in 2025, growing at a CAGR of 12.5% from 2025 to 2032.

Transformer Substation Inspecting Robot Market Scope & Overview:

Transformer substation inspecting robot is an autonomous or remotely operated system designed to perform routine monitoring, thermal imaging, and fault detection tasks within electrical substations. These robots enhance inspection efficiency while minimizing human exposure to hazardous environments.

Equipped with high-resolution cameras, infrared sensors, LIDAR, and advanced data processing units, they navigate complex substation layouts, capture critical diagnostic information, and transmit real-time data to control centers. Some models feature obstacle avoidance, weather resistance, and automatic charging capabilities for uninterrupted operation.

The deployment of a transformer substation inspecting robot ensures early fault identification, reduced maintenance costs, and enhanced operational safety. It supports predictive maintenance strategies by providing consistent, high-accuracy inspection reports without service disruption. Their integration into grid management systems improves overall asset reliability, helping utility companies meet stringent performance standards while optimizing inspection frequency and response times in power distribution networks.

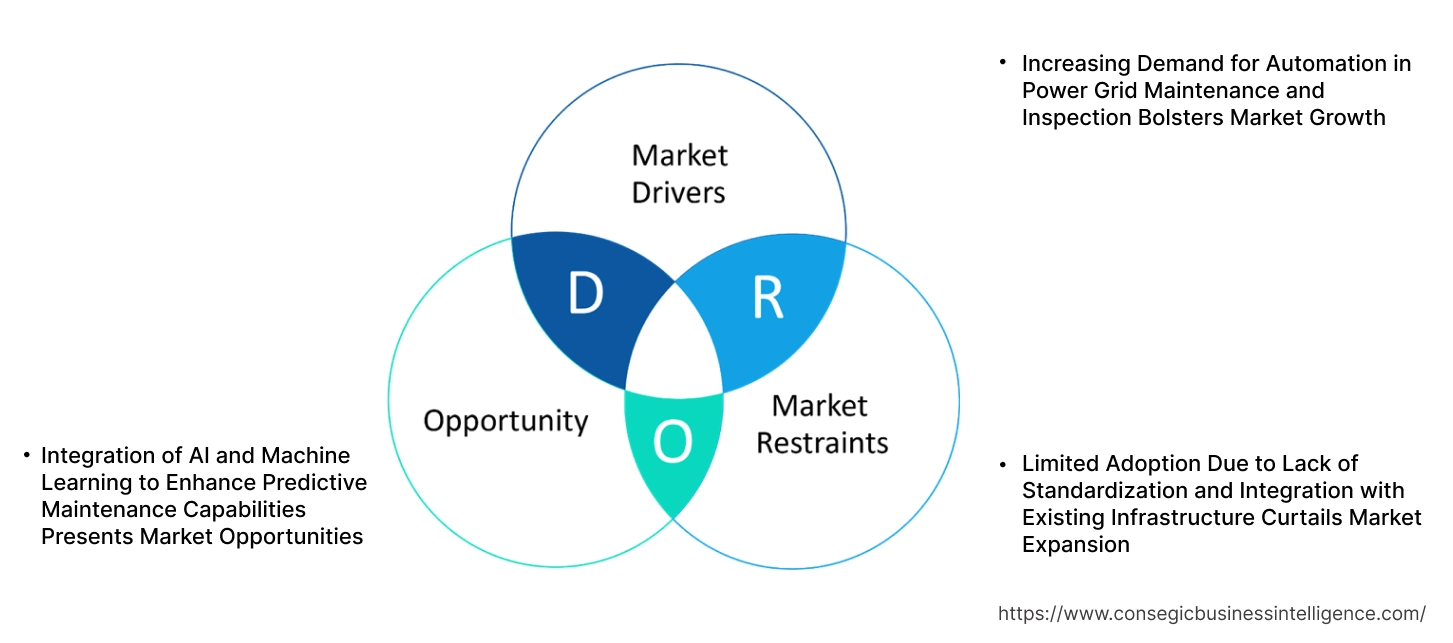

Transformer Substation Inspecting Robot Market Dynamics - (DRO) :

Key Drivers:

Increasing Demand for Automation in Power Grid Maintenance and Inspection Bolsters Market Growth

The power grid sector is increasingly shifting towards automation to enhance operational efficiency, reduce downtime, and minimize the risk of human error in high-risk environments such as substations. Transformer substation inspecting robots are at the forefront of this shift, providing reliable, automated solutions for monitoring and inspecting critical infrastructure. These robots offer faster, more consistent inspections compared to manual methods, ensuring that equipment remains in optimal condition and reducing the need for frequent human intervention in potentially hazardous environments. As utility companies and grid operators look for ways to optimize asset management and maintenance costs, the need for automation in the inspection process grows.

- For instance, in October 2022, Toshiba ESS conducted a full-scale launch of its inspection robot services for turbine generators used in power plants. This includes “ultra-thin robots” which utilize magnetic attraction to inspect small and medium-to-big generations, and “multi-function robots” that are able to handle baffles to provide a greater range of services. These robots enable in-depth inspections as well as reduce downtime.

This shift towards robotic technology, particularly for monitoring transformer substations, is driving the transformer substation inspecting robot market expansion, as more companies recognize the value of improved safety, efficiency, and operational reliability.

Key Restraints:

Limited Adoption Due to Lack of Standardization and Integration with Existing Infrastructure Curtails Market Expansion

Despite the growing potential of transformer substation inspecting robots, their adoption remains slow in many regions due to a lack of standardization and challenges in integrating them into existing power grid infrastructures. Different substations have varying designs, equipment types, and monitoring requirements, which makes it difficult to implement a universal robotic solution across all sites. Many utility companies are hesitant to adopt these advanced technologies due to the perceived complexity and costs of integrating new systems with their legacy infrastructure. Additionally, there is no standardized framework for the use of inspection robots, further complicating their widespread deployment. As demand for these solutions grows, the need for standardized, scalable systems that seamlessly integrate with diverse substations becomes critical. Until these barriers are addressed, they will continue to limit the transformer substation inspecting robot market growth.

Future Opportunities :

Integration of AI and Machine Learning to Enhance Predictive Maintenance Capabilities Presents Market Opportunities

The integration of AI and machine learning into transformer substation inspecting robots offers substantial market opportunities, particularly in predictive maintenance. These technologies allow robots to not only perform routine inspections but also analyze data patterns to predict potential equipment failures before they occur. By leveraging AI-driven insights, grid operators can schedule maintenance proactively, reducing unplanned downtime and costly repairs. This predictive approach helps in extending the lifespan of transformers and other critical infrastructure while ensuring uninterrupted service. The increasing demand for smart, data-driven solutions in grid management is propelling the growth of such technologies, offering valuable opportunities for the expansion of robotic inspection systems.

- For instance, in February 2024, Avangrid, in collaboration with Levatas and Boston Dynamics, unveiled a mobile robot dog called Spot to advance substation inspections using artificial intelligence. The robot is equipped with a camera with 30 times optical zoom and an infrared camera to perform visual and It also contains a core processor to enhance autonomous navigation and communications.

As utilities strive to enhance system reliability and reduce operational costs, the integration of AI and machine learning in these robots will play a key role in shaping the transformer substation inspecting robot market opportunities.

Transformer Substation Inspecting Robot Market Segmental Analysis :

By Robot Type:

Based on robot type, the market is segmented into ground-based, drone-based, and hybrid robots.

The ground-based robot segment accounted for the largest revenue share in 2024.

- Ground-based robots are designed for on-the-ground inspections of transformers, cables, and other critical components in substations.

- These robots are equipped with various sensors, cameras, and robotic arms to perform a wide range of inspections, including visual checks, gas leak detection, and thermal assessments.

- They are widely adopted in substations for their stability, precision, and ability to navigate difficult environments such as narrow aisles or hazardous areas.

- As per transformer substation inspecting robot market analysis, ground-based robots dominate due to their effectiveness in traditional substation inspections and their ability to carry heavier equipment.

The drone-based robot segment is expected to grow at the fastest CAGR during the forecast period.

- Drone-based robots are used for aerial inspections, enabling the assessment of overhead components such as transmission lines, transformers, and busbars.

- These robots are increasingly adopted in large substations or hard-to-reach areas where ground-based robots might struggle.

- Drones offer flexibility, speed, and the ability to capture high-definition imagery from various angles, significantly reducing downtime and increasing operational efficiency.

- According to segmental trends, the drone-based robots segment is bolstering the transformer substation inspecting robot market demand due to their cost-effectiveness and capability in performing remote inspections with minimal human intervention.

By Inspection Capability:

Based on inspection capability, the market is segmented into visual inspection, thermal inspection, ultrasonic inspection, and robotic arm inspection.

The visual inspection segment held the largest transformer substation inspecting robot market share in 2024.

- Visual inspection robots are equipped with high-resolution cameras and imaging tools to perform detailed assessments of transformer components, detecting potential issues such as rust, wear, or contamination.

- These robots are used extensively for routine checks, enabling quick identification of surface-level defects and allowing for preventive maintenance.

- The widespread adoption of visual inspection in transformer substations is driven by its ability to identify problems early and reduce the need for costly downtime.

- As per transformer substation inspecting robot market trends, the visual inspection segment remains dominant due to its affordability, simplicity, and effectiveness.

The thermal inspection segment is expected to grow at the fastest CAGR during the forecast period.

- Thermal imaging technology allows robots to detect hot spots and temperature imbalances within electrical components, helping to prevent failures and malfunctions.

- These robots use infrared sensors to monitor temperature variations in transformers and other critical equipment, which is essential for detecting issues like overheating or electrical faults.

- The increasing adoption of predictive maintenance strategies in the energy sector is driving need for thermal inspection robots.

- Hence, the thermal inspection segment is driving the transformer substation inspecting robot market expansion as more companies shift towards proactive maintenance to avoid costly repairs.

By Application:

Based on application, the transformer substation inspecting robot market is segmented into preventive maintenance, routine inspection, emergency response, and gas leak detection.

The preventive maintenance segment accounted for the largest revenue share in 2024.

- Preventive maintenance is essential to reduce the risk of transformer failure and increase the lifespan of electrical equipment.

- Robots equipped with various sensors can conduct regular, scheduled checks on key equipment, ensuring that any potential faults are identified and fixed before they lead to costly failures or unplanned downtime.

- The adoption of robotic systems for preventive maintenance is driven by their ability to perform detailed inspections without human intervention, reducing risks and improving safety.

- As per transformer substation inspecting robot market analysis, the need for robots in preventive maintenance continues to lead due to the need for improved operational reliability in power grids and substations.

The routine inspection segment is expected to grow at the fastest CAGR during the forecast period.

- Routine inspections are carried out at scheduled intervals to ensure that the equipment is functioning correctly and within specified parameters.

- Robots used in this segment are typically equipped with a range of sensors, including visual cameras, thermal sensors, and gas detectors, allowing for a comprehensive assessment of equipment.

- The increased need for maintaining aging infrastructure and enhancing operational efficiency is driving the growth of the routine inspection segment.

- Thus, the routine inspection segment continues to drive the transformer substation inspecting robot market growth as part of the broader trend towards automation in power generation and distribution.

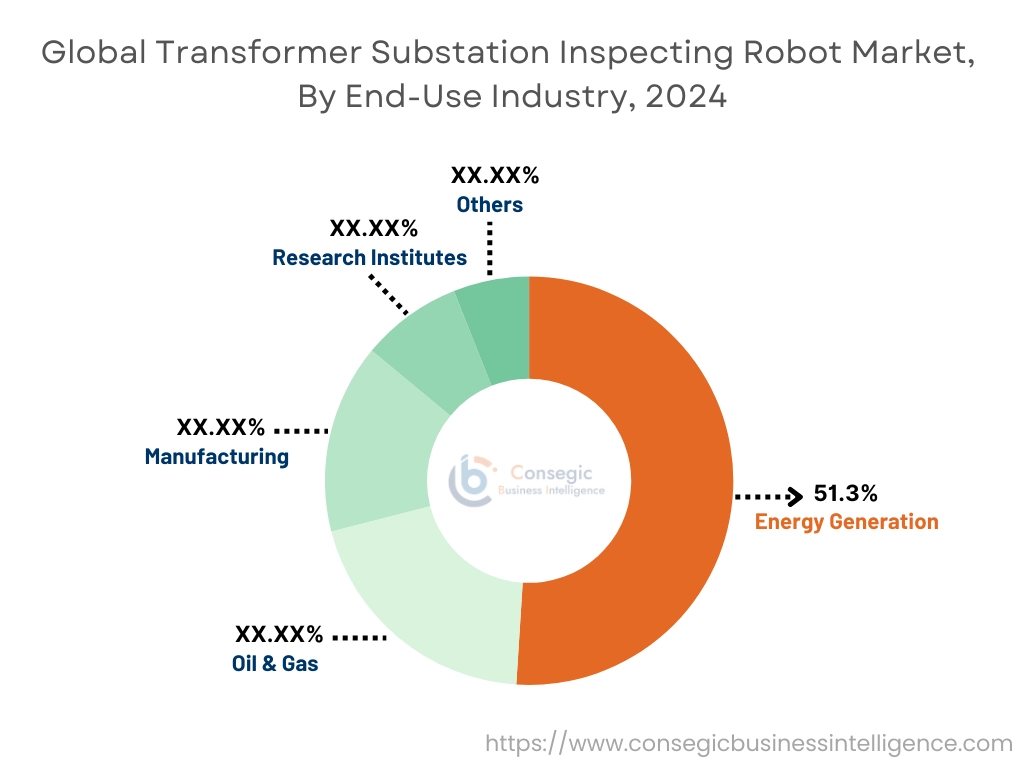

By End-Use Industry:

Based on end-use industry, the market is segmented into energy generation, oil & gas, manufacturing, research institutes, and others.

The energy generation segment held the largest transformer substation inspecting robot market share of 51.3% in 2024.

- Robots in energy generation applications are extensively used for inspecting transformers, circuit breakers, and other critical components of power plants and substations.

- With increasing global investments in renewable energy and the growing complexity of power grid infrastructure, the need for inspection robots in energy generation is on the rise.

- These robots help enhance the safety and reliability of power generation systems, contributing to uninterrupted power supply and energy efficiency.

- As per the transformer substation inspecting robot market demand, the energy generation sector remains the largest user of inspection robots, driven by its critical need for maintenance and safety.

The oil & gas segment is expected to grow at the fastest CAGR during the forecast period.

- In the oil & gas industry, robots are used for inspecting offshore and onshore facilities, pipelines, and transformer substations, where safety and operational efficiency are critical.

- The demand for robotic inspection systems is rising in this sector due to the harsh environments, remote locations, and hazardous conditions where traditional human inspection is challenging.

- The oil & gas industry’s focus on safety, operational efficiency, and reduced downtime is driving the adoption of robotic inspection technologies.

- According to transformer substation inspecting robot market trends, the oil & gas sector is rapidly adopting inspection robots as part of its ongoing efforts to improve safety standards and reduce operational risks.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

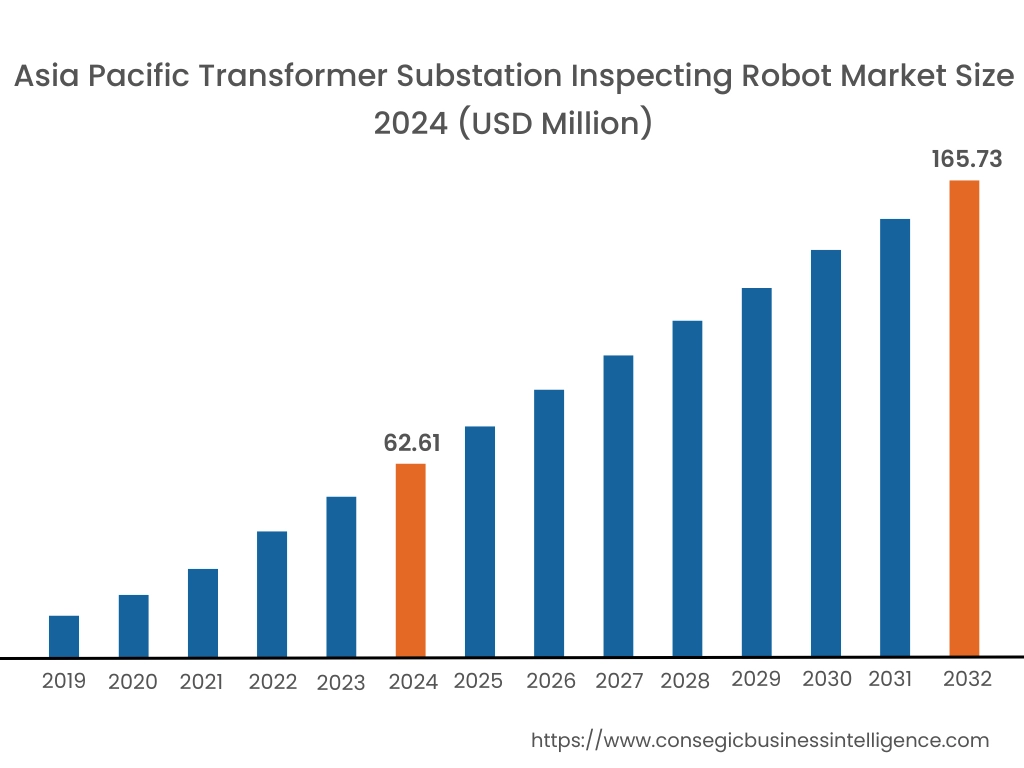

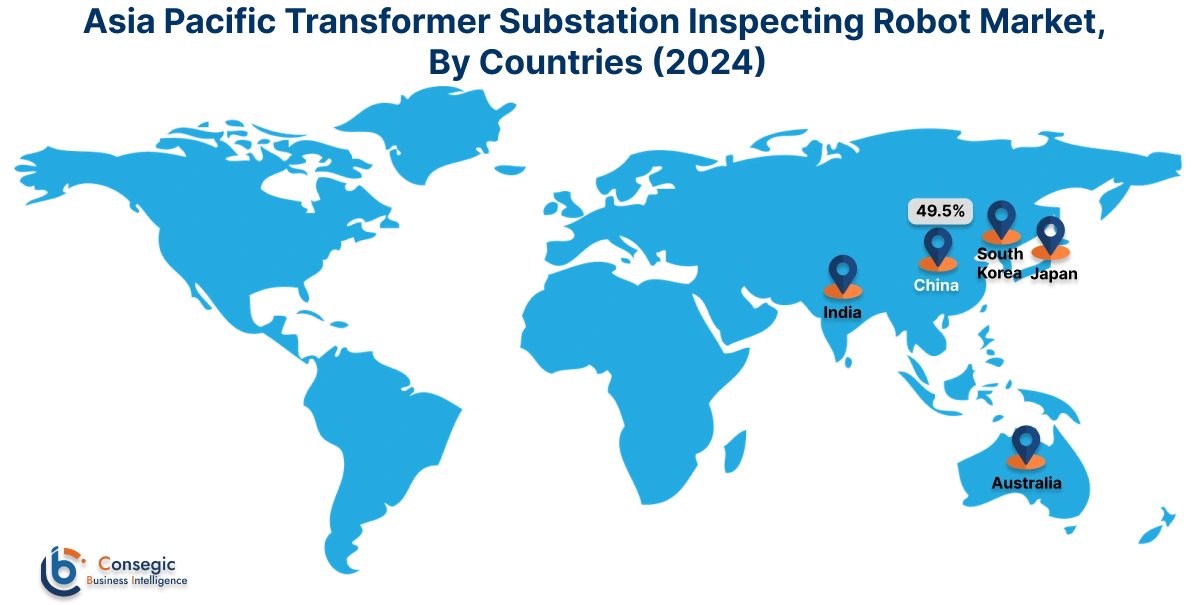

Asia Pacific region was valued at USD 62.61 Million in 2024. Moreover, it is projected to grow by USD 69.49 Million in 2025 and reach over USD 165.73 Million by 2032. Out of this, China accounted for the maximum revenue share of 49.5%. Asia-Pacific is witnessing the fastest growth, especially in China, Japan, South Korea, and Australia. Rapid grid expansion, frequent substation upgrades, and the need for 24/7 monitoring in densely populated and industrialized regions drive adoption. Market analysis reveals strong government support for smart infrastructure initiatives and the integration of AI-powered inspection robots into grid management systems. Growth is further reinforced by the increasing complexity of substations serving renewable energy hubs, where robots provide non-invasive, efficient, and scalable inspection solutions. Local manufacturers are also innovating cost-effective robotic platforms tailored to regional infrastructure standards.

North America is estimated to reach over USD 176.40 Million by 2032 from a value of USD 70.51 Million in 2024 and is projected to grow by USD 77.90 Million in 2025. North America leads in the transformer substation inspecting robot industry, with utilities in the United States and Canada integrating such robots to enhance grid reliability and reduce manual inspection risks. Market analysis highlights strong requirement for autonomous and semi-autonomous robotic systems equipped with thermal imaging, AI-driven fault detection, and real-time data reporting. Growth in this region is driven by aging infrastructure, stringent maintenance standards, and an increasing focus on worker safety. Utilities are also investing in predictive maintenance programs where robots are becoming integral to minimizing downtime and optimizing asset performance.

Europe represents a mature and innovation-focused market, particularly in countries like Germany, France, and the United Kingdom. Market analysis shows high demand for transformer substation inspecting robots capable of operating in compact substations, often integrated with remote data analytics platforms. The European market emphasizes environmental compliance and cyber-secure robotics systems.

- For instance, in February 2024, the SSEN Transmission’s Blackhillock high-voltage direct current (HVDC) switching station in Keith, Scotland, deployed the first autonomous robot for substation inspection in the country. The robot, EXTRM MK4.1, is developed by Ross Robotics to monitor and inspect electrical components, identifying any faults or future maintenance requirements in electricity stations.

The transformer substation inspecting robot market opportunity in Europe is closely tied to modernization programs in smart grids, growing investments in renewable energy infrastructure, and the region’s emphasis on adopting Industry 4.0 technologies for utility automation.

Latin America is gradually adopting transformer substation inspecting robots, with Brazil, Mexico, and Chile at the forefront. Market analysis indicates that utilities are increasingly interested in robotic inspections to improve grid reliability, especially in remote or hard-to-access substations. There is a growing trend toward leveraging robotic systems for predictive maintenance, minimizing equipment failure risks in critical power transmission networks. The market opportunity in this region is supported by investments in grid expansion projects, government-backed energy reforms, and rising awareness about operational safety and maintenance cost reduction.

In the Middle East and Africa, the market is emerging, primarily driven by infrastructure modernization in the UAE, Saudi Arabia, and South Africa. Market analysis shows rising interest in transformer substation inspecting robots to monitor critical substations in extreme environmental conditions such as high temperatures and dust-laden environments. Energy diversification initiatives and smart city developments further stimulate adoption. Although the market is still in the early stages, growth prospects are favorable as governments and utility companies seek to enhance power infrastructure resilience, reduce human intervention risks, and implement remote monitoring technologies.

Top Key Players and Market Share Insights:

The transformer substation inspecting robot market is highly competitive with major players providing products and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global transformer substation inspecting robot market. Key players in the transformer substation inspecting robot industry include –

- Zhejiang Guozi Robotics (China)

- SMP Robotics Systems Corps (United States)

- Hydro Québec (Canada)

- Shandong Luneng Intelligence Tech (China)

- Sino Robot (China)

- Yijiahe Technology (China)

- Dali Technology (China)

- Shenzhen Skyee Smart Grid Technology (China)

- CSG Smart Science & Technology (China)

- Zhengzhou Wanda Technology (China)

Recent Industry Developments :

Partnerships:

- In February 2024, Mitsubishi Electric Power Products, Inc. (MEPPI) and Skydio collaborated to design and unveil an autonomous drone solution for remote monitoring and automation of substation inspections. The drones enable the collection and analysis of electric utility substation data with superior efficiency, consistency, accuracy, and safety. They are equipped with computer vision technology and advanced machine learning to collect visual and thermal data from critical infrastructure facilities, systems and equipment.

Transformer Substation Inspecting Robot Market Report Insights:

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 544.26 Million |

| CAGR (2025-2032) | 12.5% |

| By Robot Type |

|

| By Inspection Capability |

|

| By Application |

|

| By End-Use Industry |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Transformer Substation Inspecting Robot Market? +

Transformer Substation Inspecting Robot Market size is estimated to reach over USD 544.26 Million by 2032 from a value of USD 212.58 Million in 2024 and is projected to grow by USD 235.30 Million in 2025, growing at a CAGR of 12.5% from 2025 to 2032.

What specific segmentation details are covered in the Transformer Substation Inspecting Robot Market report? +

The Transformer Substation Inspecting Robot market report includes specific segmentation details for robot type, inspection capabilities, application and end-use industry.

What are the end-use industries of the Transformer Substation Inspecting Robot Market? +

The end-use industries of the Transformer Substation Inspecting Robot Market are energy generation, oil & gas, manufacturing, research institutes, and others.

Who are the major players in the Transformer Substation Inspecting Robot Market? +

The key participants in the Transformer Substation Inspecting Robot market are Zhejiang Guozi Robotics (China), SMP Robotics Systems Corps (United States), Hydro Québec (Canada), Shandong Luneng Intelligence Tech (China), Yijiahe Technology (China), Dali Technology (China), Shenzhen Skyee Smart Grid Technology (China), CSG Smart Science & Technology (China), Zhengzhou Wanda Technology (China) and Sino Robot (China).