Voice over LTE (VoLTE) Market Size :

Voice over LTE (VoLTE) Market size is estimated to reach over USD 940.1 Billion by 2030 from a value of USD 37.8 Billion in 2022, growing at a CAGR of 50.7% from 2023 to 2030.

Voice over LTE (VoLTE) Market Scope & Overview:

Voice over LTE (VoLTE) refers to a technology that allows voice calls to be transmitted over a 4G LTE (Long-Term Evolution) network. LTE was originally designed as a data-only network, primarily for faster mobile internet access. However, with the introduction of VoLTE, voice calls are carried over the LTE network, eliminating the need for older circuit-switched networks, namely 2G and 3G. Additionally, VoLTE offers several benefits compared to traditional voice services including high-definition (HD) voice quality, resulting in clearer and more immersive sound calls. Moreover, VoLTE also offers faster call setup times and supports advanced features including simultaneous voice and data, allowing users to browse the internet or use data services during a call without interruptions.

Voice over LTE (VoLTE) Market Insights :

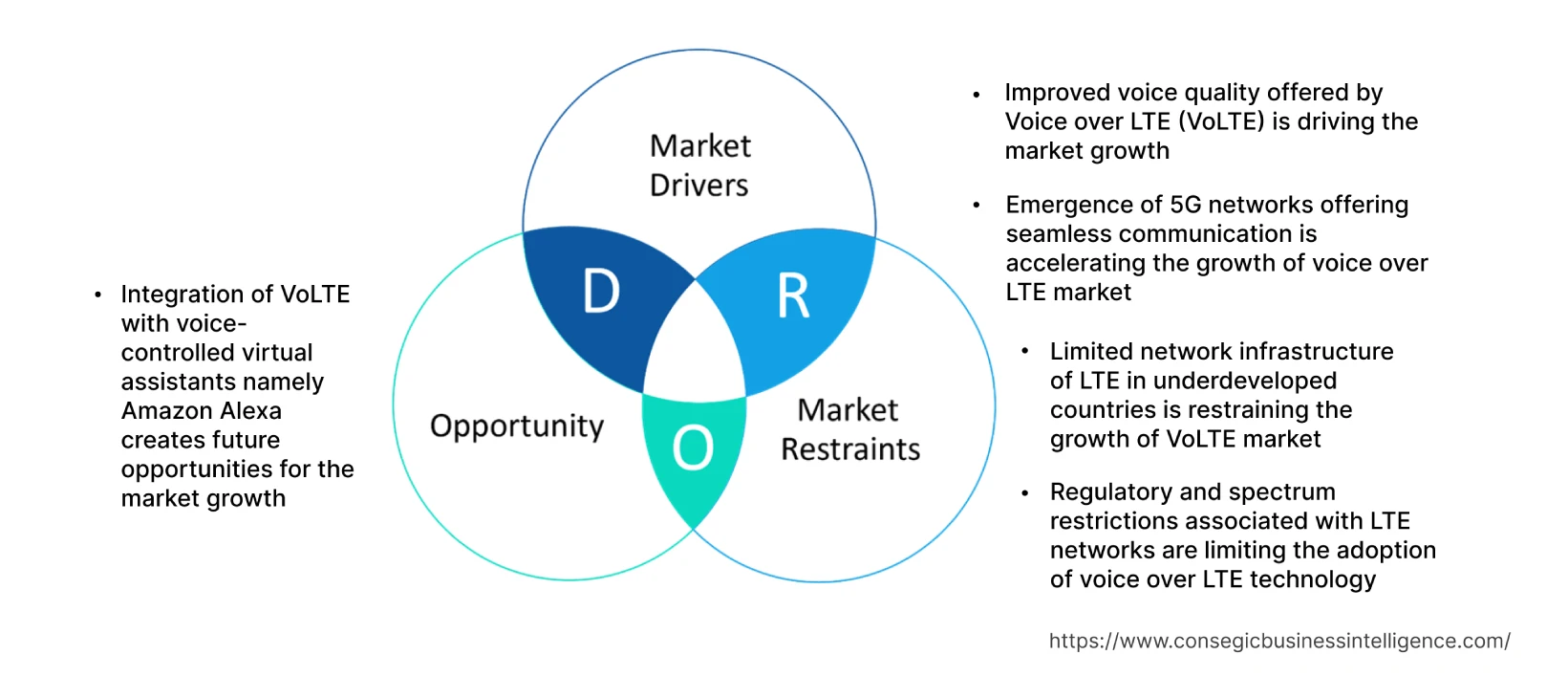

Voice over LTE (VoLTE) Market Dynamics - (DRO) :

Key Drivers :

Improved voice quality offered by Voice over LTE (VoLTE) is driving the market growth

VoLTE offers high-definition (HD) voice quality, delivering clearer and more explicit voice calls compared to traditional circuit-switched networks. The enhanced voice clarity improves the overall user experience, leading to higher customer satisfaction and increased adoption of VoLTE services. In addition, VoLTE technology reduces background noise, resulting in improved voice clarity, thus enhancing the user's call experience even in noisy environments. Moreover, VoLTE supports a broader range of audio frequencies, allowing for a more dynamic and expressive voice conversation. Voice over LTE captures and produces a wider spectrum of human speech, including tones, and subtleties that are lost in traditional voice calls. For instance, in June 2023, Airtel launched the first Voice over LTE (VoLTE) technology in Zambia to offer a high-definition call experience to users. VoLTE enables calling and browsing simultaneously along with offering crystal clear high-definition voice quality, thus contributing significantly in driving the growth of the voice over LTE (VoLTE) market.

Emergence of 5G networks offering seamless communication is accelerating the growth of voice over LTE market

5G networks are designed to be compatible with LTE, enabling a seamless transition of VoLTE services to 5G networks without disruption. Compatibility allows network operators to leverage the existing VoLTE infrastructure and expand the service offerings to 5G users, driving the adoption of VoLTE in the 5G era. In addition, 5G networks offer increased capacity and network efficiency, enabling operators to handle more voice and data traffic simultaneously, and providing a robust platform for VoLTE services. Moreover, 5G networks provide ultra-low latency, reducing the delay in transmitting voice, thus felicitating real-time, high-quality voice communication over VoLTE. The network enables faster call setup times and enhances the overall user experience, hence contributing significantly in driving the growth of the VoLTE market. For instance, in November 2022, E-Networks invested USD 35 Million in developing Guyana's first 5G VoLTE cellular network. The development of 5G VoLTE network enables seamless communication without disruption, thus contributing considerably in accelerating the growth of voice over LTE market.

Key Restraints :

Limited network infrastructure of LTE in underdeveloped countries is restraining the growth of VoLTE market

Limited LTE network infrastructure in underdeveloped countries serves as the major factor restraining the growth of the voice over LTE market. VoLTE requires advanced LTE network infrastructure to transmit voice calls, and the unavailability of the required network infrastructure is hindering the adoption and growth of the VoLTE market. Additionally, in underdeveloped countries, conventional technologies, namely 2G and 3G are still prevalent and the users rely on circuit-switched voice networks for effective communication. Moreover, government's with limited financial resources in underdeveloped countries delay the deployment and expansion of LTE networks, thus restraining the growth of the voice over LTE market.

Regulatory and spectrum restrictions associated with LTE networks are limiting the adoption of voice over LTE technology

Regulatory frameworks and licensing requirements play a crucial role in the deployment of VoLTE services. Additionally, regulatory policies regarding spectrum usage, network interconnection, and quality of service standards have a significant impact on the VoLTE market. However, spectrum availability and allocation vary across different regions and countries. Insufficient and fragmented spectrum allocations limit the capacity and quality of VoLTE services, thereby impeding market growth. For instance, in May 2021, according to the General Services Administration (GSA) report, the low-band spectrum of 450 MHz, 600 MHz, and 700 MHz frequency ranges are appropriate for the efficient functioning of LTE networks. Telecommunication operators are investing heavily to establish the infrastructure that operates within the aforementioned ranges, leading to additional upfront costs, hence impeding the growth of the global VoLTE Market.

Future Opportunities :

Integration of VoLTE with voice-controlled virtual assistants namely Amazon Alexa creates future opportunities for the market growth

Integrating VoLTE with voice-controlled virtual assistants enables users to make voice calls and send messages using virtual assistant devices. The integration allows users to make voice calls by giving voice commands to the devices, thus expected to create opportunities for market growth. Additionally, VoLTE integration allows for seamless multi-device communication through virtual assistants. Users initiate calls on the virtual assistant devices and seamlessly transfer the calls to smartphones or other VoLTE-enabled devices, enabling uninterrupted communication across multiple devices, and enhancing convenience and accessibility for users. Moreover, VoLTE integration ensures high-quality and reliable voice calls through voice-controlled virtual assistants. Traditional voice calls made through virtual assistants rely on older cellular technologies, resulting in potential quality issues. Voice calls made through VoLTE-integrated virtual assistants improve call quality and reliability of VoLTE networks, hence creating potential opportunities for market growth.

Voice over LTE (VoLTE) Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 940.1 Billion |

| CAGR (2023-2030) | 50.7% |

| By Device | Smartphones, Laptops, Wearables, Tablets, and Routers |

| By Technology | Voice Over IP Multimedia Subsystems (VoIMS), Circuit Switch Fall Back (CSFB), Simultaneous Voice and LTE (SVLTE), Single Radio Voice Call Continuity (SRVCC), and Voice Over LTE via Generic Access Network (VOLGA) |

| By End-User | Commercial, Government, and Corporate |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | AT&T Inc., Bell Canada, Bharati Airtel Limited, D2 Technologies, Huawei Technologies Co. Ltd., Mitel Networks Corporation, Nokia Corporation, SUMA móvil (Grupo Ingenium Tecnología), Telefonaktiebolaget LM Ericsson, Vodafone Idea Limited |

Voice over LTE (VoLTE) Market Segmental Analysis :

By Device :

The device segment is classified into smartphones, laptops, wearables, tablets, and routers. Smartphones accounted for the largest market share in 2022 and are also projected to witness the fastest CAGR during the forecast period. The growth is attributed to the widespread adoption of smartphones, with billions of users relying on smartphones as the primary communication device. In addition, modern smartphones are equipped with built-in VoLTE support features, eliminating the need to install additional hardware or software to access VoLTE services. Moreover, VoLTE offers superior voice quality compared to traditional voice services. The improved audio clarity, reduced background noise, and high-definition voice capabilities increase the adoption of VoLTE among smartphone users, valuing clear and reliable voice communication. In conclusion, the increasing adoption of smartphones is driving the growth of the voice over LTE market by enabling seamless communication. For instance, according to India Cellular and Electronics Association (ICEA), smartphone shipments accounted to 225.4 Million units in 2020 as compared to 206.5 Million units in 2019, with a rise of 9.2%. In addition, smartphone shipment is projected to reach 351.6 Million by 2024, thus contributing remarkably in propelling the growth of the VoLTE market.

By Technology :

The technology segment is categorized into Voice over IP Multimedia Subsystems (VoIMS), Circuit Switch Fall Back (CSFB), Simultaneous Voice and LTE (SVLTE), Single Radio Voice Call Continuity (SRVCC), and Voice over LTE via Generic Access Network (VOLGA). VoIMS accounted for the largest market share in 2022 as VoIMS is based on standardized protocols and architectures defined by organizations including 3GPP (Third Generation Partnership Project) and the Internet Engineering Task Force (IETF). The standardization ensures interoperability between different network elements and devices, enabling seamless voice communication across networks and vendors. Additionally, VoIMS offers advanced features namely seamless handovers, call routing, and enhanced service capabilities, thus becoming a comprehensive solution for voice services over LTE. For instance, in March 2022, GL Communications Inc. introduced MAPS Session Initiation Protocol (SIP) IMS, an IP Multimedia Subsystem (IMS) network to enable effective communication over VoLTE networks. The advanced technology enables seamless communication over LTE networks, thus contributing notably in fueling the market growth.

Circuit Switch Fall Back (CSFB) segment is anticipated to witness the fastest CAGR in the voice over LTE market during the forecast period. CSFB enables seamless migration from circuit-switched networks to VoLTE by utilizing the existing circuit-switched infrastructure. Additionally, CSFB allows LTE networks to switch to 2G or 3G networks for voice services, ensuring compatibility and uninterrupted voice communication during the transition phase. Moreover, CSFB ensures quality voice services are provided in areas with low LTE coverage or with 2G and 3G networks, allowing users to have effective voice communication. Consequently, the ability of Circuit Switch Fall Back (CSFB) to offer uninterrupted voice communication even in areas of low LTE networks is contributing significantly in boosting the market growth.

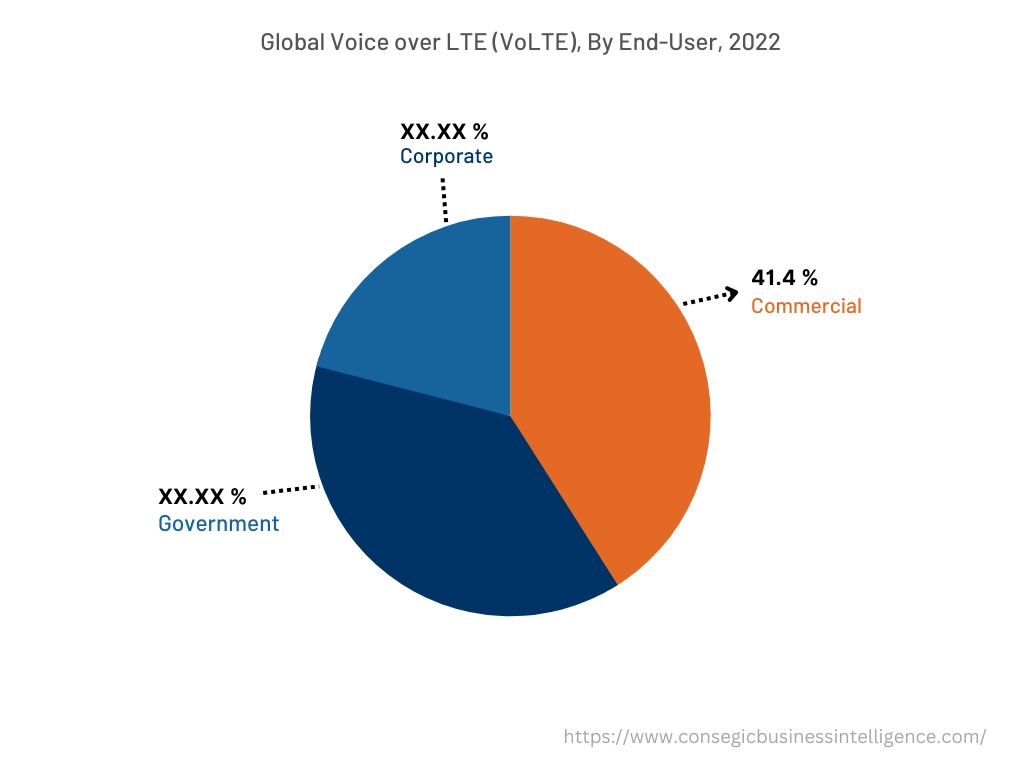

By End-User :

The end-user segment is trifurcated into commercial, government, and corporate. Commercial segment accounted for the largest market share of 41.4% in 2022 as the sector relies heavily on voice communication and VoLTE enables high-definition voice calls, providing improved call clarity for businesses including customer service centers, sales teams, and conference calls. In addition, VoLTE reduces call setup times compared to traditional circuit-switched networks, vital for businesses that require efficient communication, allowing for faster response times and improved customer service. Moreover, VoLTE supports RCS (Rich-Communication Services) that enables businesses to use enhanced messaging services, including group chat, file sharing, location sharing, read receipts, and video sharing. Consequently, the aforementioned factors are collectively responsible in propelling the growth of the voice over LTE market.

Corporate sector is projected to witness the fastest CAGR in the VoLTE market during the forecast period. VoLTE offers high-definition voice calls with superior voice quality and clarity, essential for corporate communication, ensuring clear and effective communication between employees, teams, and clients. In addition, VoLTE is seamlessly integrated with Unified Communications platforms, enabling businesses to integrate voice calls with other communication channels including instant messaging, video conferencing, and presence information. Furthermore, VoLTE supports various advanced call features, including call transfer, call hold, call waiting, conference calling, and call forwarding. The features enhance productivity and enable efficient call management within the corporate environment, thus contributing notably in accelerating the market growth. For instance, in March 2022, Mobicom Corporation launched advanced VoLTE technology in Mongolia to enhance call quality and enable seamless communication. VoLTE technology increases the frequency of the calls from 300-3400 hertz to 50-14000 hertz and also consumes less battery power, hence contributing remarkably in spurring the growth of the corporate sector.

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

North America accounted for the largest revenue share in the year 2022 as the region, particularly the United States is at the forefront of LTE network deployments. In addition, the early adoption of 4G technology and significant investments in building robust LTE infrastructure is promoting market growth. Moreover, the increasing adoption of smartphones and development of 5G infrastructure in the region are creating a large customer base for VoLTE services to enable effective and seamless communication. Furthermore, the presence of key players in the region constantly applying innovations and strategic decisions to expand the market portfolio is also driving VoLTE market growth. For instance, in February 2023, Mavenir completed the migration of O2 mobile users to the virtualized IMS (IP Multimedia Subsystem) solution providing VoLTE solutions. The migration was made to offer improved flexibility and agility to consumers under the same platform and at lower costs, thus contributing significantly in bolstering the market growth.

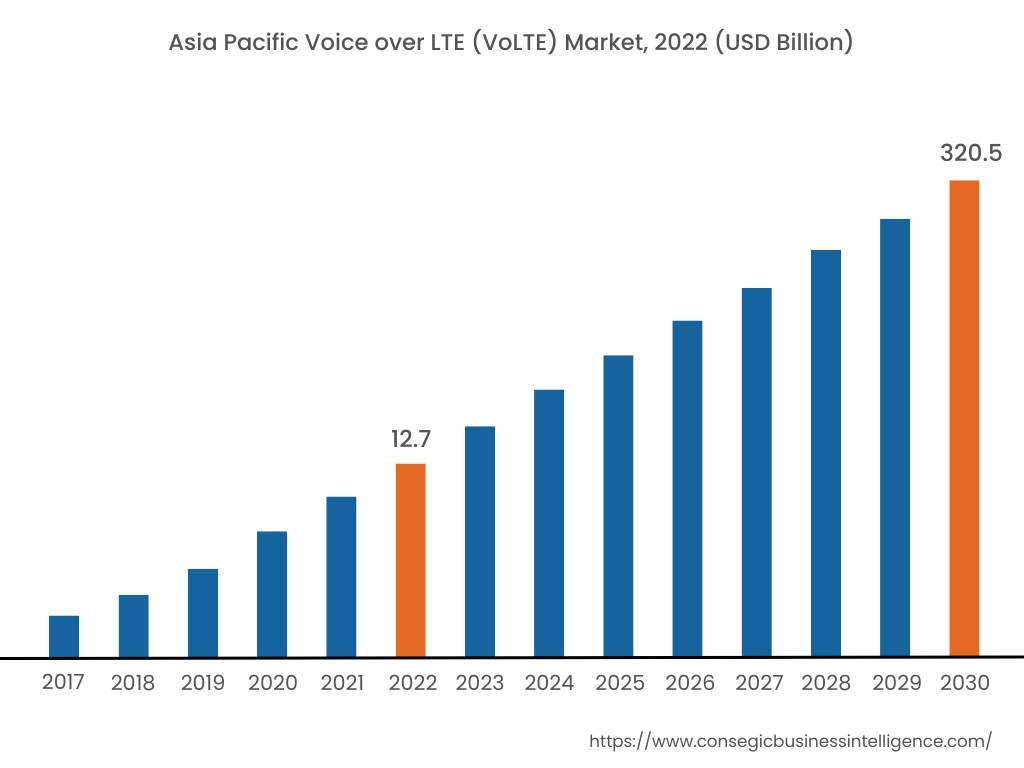

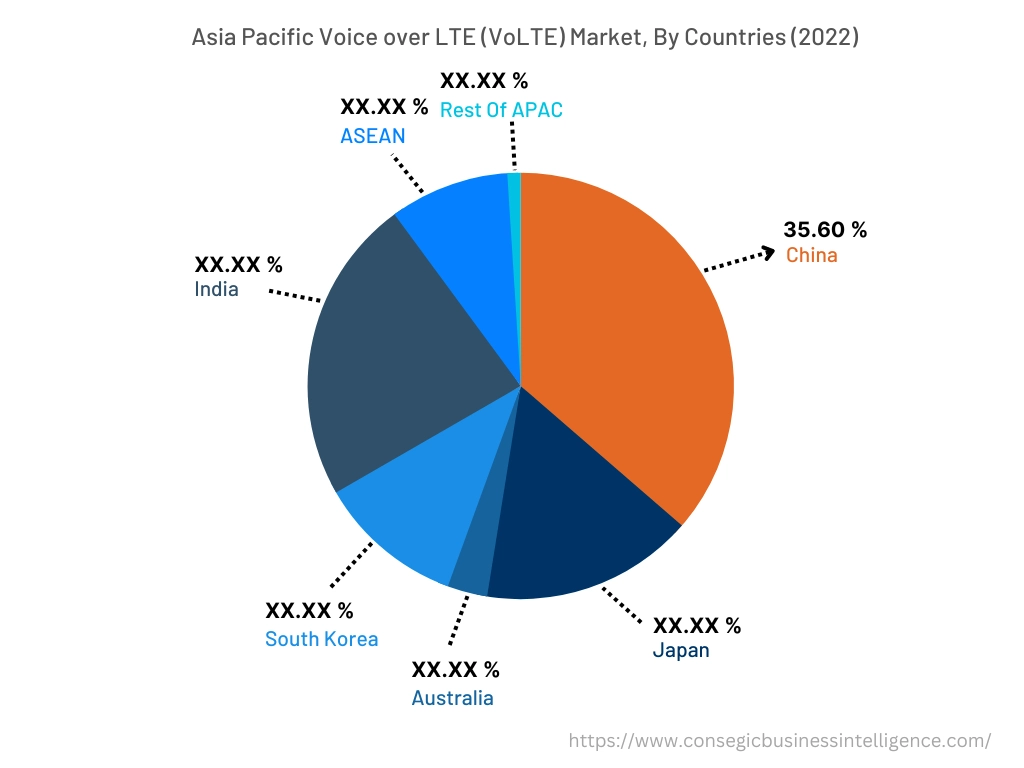

Asia Pacific accounted to USD 12.7 Billion in 2022 and is expected to register the fastest CAGR of 51.0% accounting to USD 320.5 Billion in 2030 in the voice over LTE (VoLTE) market. In addition, in the region, China accounted for the maximum revenue share of 35.6% in the year 2022. The growth in the region is credited to the presence of two densely populated countries including China and India that creates a large customer base for the growth of the VoLTE market. Additionally, Asia Pacific region is witnessing rapid digitalization across various sectors, including e-commerce, banking, healthcare, and entertainment. The digital transformation is driving the need for advanced communication services to support real-time voice and data interactions. VoLTE, with the seamless integration of voice and data services, is ideal to cater to the evolving communication needs of businesses and consumers in the region. In conclusion, the large customer base and rapid digitalization are the major factors responsible for fueling the growth of the VoLTE market in the region.

Top Key Players & Market Share Insights :

The landscape of the voice over LTE (VoLTE) market is highly competitive and has been examined in the report, along with complete profiles of the key players operating in the industry. In addition, the surge in innovations, acquisitions, mergers, and partnerships has further accelerated the growth of the voice over LTE (VoLTE) market. Major players in the market include-

- AOC

- DIC CORPORATION

- Scott Bader Company Ltd

- Poliya

- Swancor Advanced Materials Co Ltd

- INEOS

- Interplastic Corporation

- SHOWA DENKO K.K

- Sino Polymer Co. Ltd

- Polynt

Recent Industry Developments :

- In February 2023, SUMA móvil (Grupo Ingenium Tecnología) announced to launch VoLTE service using JSC Ingenium technology to improve the call quality of users by offering an integrated voice service regardless of 3G, 4G, or 5G access technology. The advanced technology offers 10 times faster connection and better-quality HD voice calls even in noisy environments, thus providing convenience to the users.

- In November 2022, Vi introduced Voice over LTE to offer high-quality sound by reducing background noise in calls. Vi VoLTE enables faster call connections along with delivering rich audio quality to the users.

Key Questions Answered in the Report

What is voice over LTE (VoLTE)? +

Voice over LTE (VoLTE) refers to a technology that allows voice calls to be transmitted over a 4G LTE (Long-Term Evolution) network.

What specific segmentation details are covered in the voice over LTE (VoLTE) market report, and how is the dominating segment impacting the market growth? +

Commercial segment dominates the market as VoLTE enables high-definition voice calls, providing improved call clarity for businesses including customer service centers, sales teams, and conference calls that rely heavily on voice communication.

What specific segmentation details are covered in the voice over LTE (VoLTE) market report, and how is the fastest segment anticipated to impact the market growth? +

Corporate sector will register the fastest CAGR as VoLTE offers high-definition voice calls with superior voice quality and clarity, essential for corporate communication, ensuring clear and effective communication between employees, teams, and clients.

Which region is anticipated to witness the highest CAGR during the forecast period, 2023-2030? +

Asia Pacific is anticipated to witness the fastest CAGR during the forecast period due to the large customer base and rapid digitalization in the region.