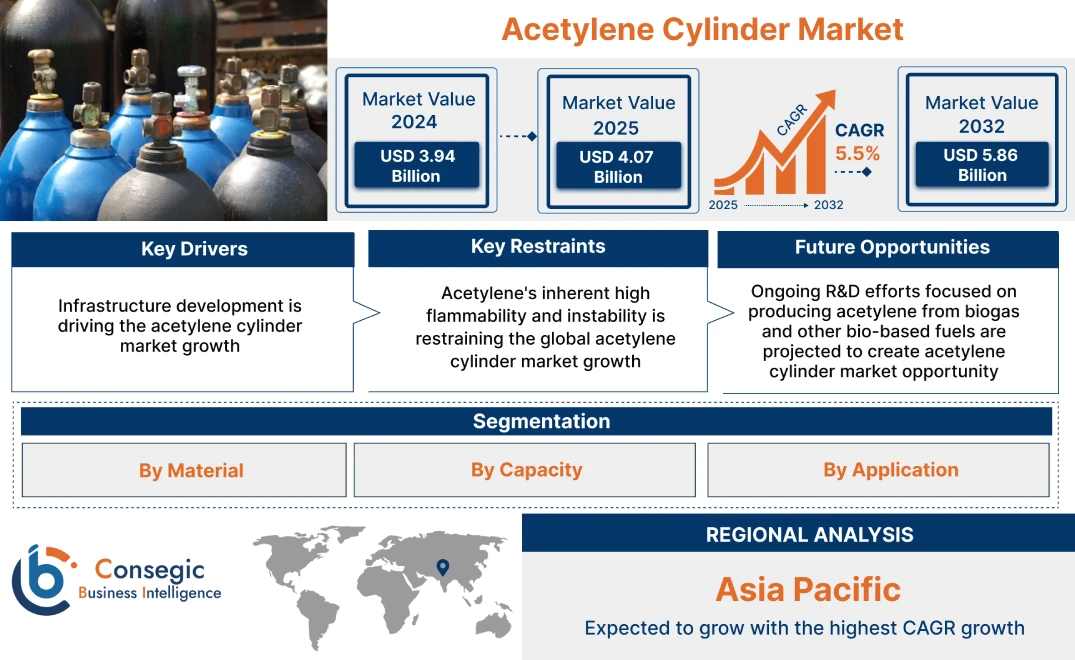

Acetylene Cylinder Market Size:

Acetylene Cylinder Market Size is estimated to reach over USD 5.86 Billion by 2032 from a value of USD 3.94 Billion in 2024 and is projected to grow by USD 4.07 Billion in 2025, growing at a CAGR of 5.5% from 2025 to 2032.

Acetylene Cylinder Market Scope & Overview:

An acetylene cylinder is a specialized container designed to store and transport acetylene gas, a highly flammable hydrocarbon used primarily for welding, cutting, and chemical synthesis. They are filled with a porous material, such as balsa wood or charcoal, soaked in acetone and acetylene gas is then dissolved in this acetone. This design is crucial because acetylene is unstable in its pure compressed form and can decompose explosively. The porous material stabilizes the gas, preventing large pockets of free acetylene from forming, while the acetone allows for a greater volume of gas to be safely stored at a lower pressure. These cylinders are typically maroon in color and have specific safety features, including fusible plugs that melt at high temperatures to release pressure and left-handed valve threads to prevent accidental connection to other gas systems.

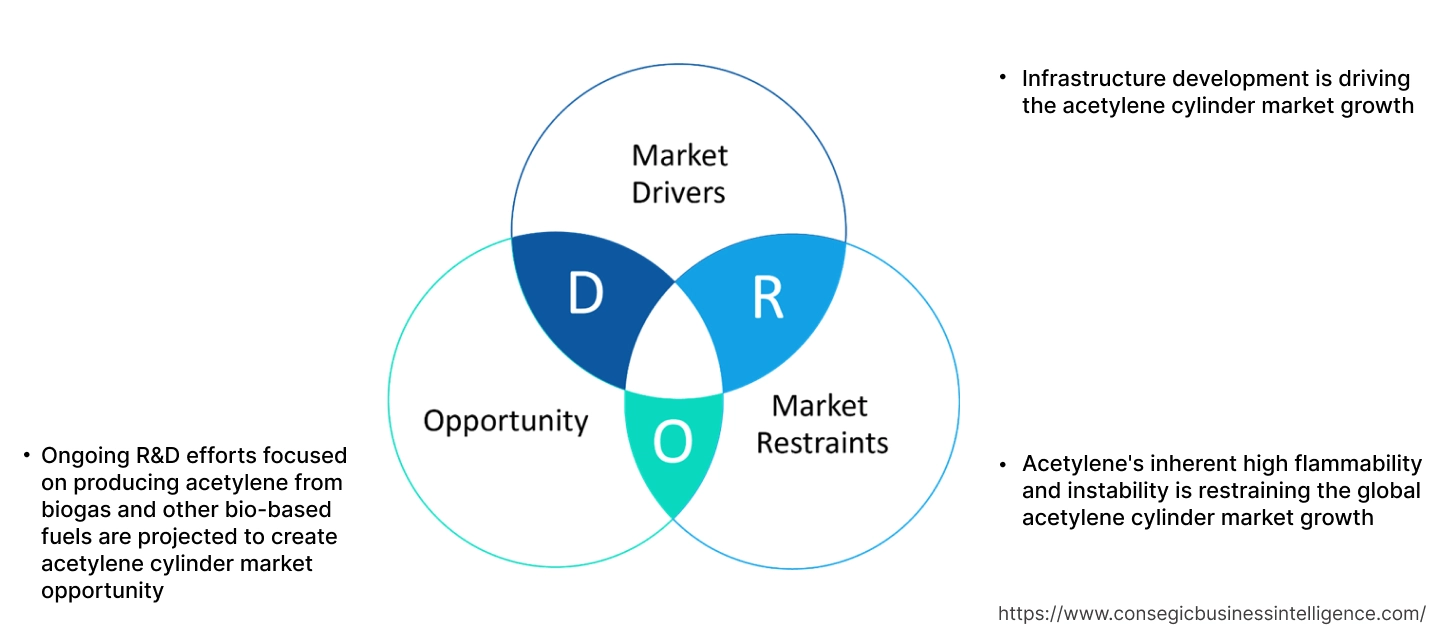

Key Drivers:

Infrastructure development is driving the acetylene cylinder market growth

Infrastructure projects, such as the construction of bridges, highways, railways, buildings, and pipelines, heavily rely on welding and cutting of steel and other metals. Acetylene, when combined with oxygen, produces a very high flame temperature, ideal for these applications. As infrastructure development accelerates, the demand for oxy-acetylene welding and cutting increases proportionally, leading to higher consumption of acetylene gas and, consequently, driving the acetylene cylinder market size.

- For instance, the Union Budget for fiscal year 2025-26 in India has allocated USD 128.64 billion, equivalent to 3.1% of the GDP, towards capital investment in infrastructure. Additionally, between April 2000 and September 2024, the construction development sector in India attracted USD 26.76 billion in FDI, while the construction (infrastructure) sector received USD 35.24 billion in FDI.

Consequently, infrastructure development is driving the acetylene cylinder market expansion.

Key Restraints:

Acetylene's inherent high flammability and instability is restraining the global acetylene cylinder market growth

The highly flammable nature of acetylene necessitates strict regulations concerning its production, storage, transportation, and usage. These regulations, implemented by various authorities worldwide like OSHA in the US and DSEAR in the UK, increase operational costs for businesses involved in the acetylene market. Compliance requires significant investments in safety equipment, training, and infrastructure, potentially hindering market expansion, especially for smaller players.

Additionally, acetylene's instability, particularly in its pure compressed form, leads to a high risk of fires and explosions if not handled correctly. This inherent danger necessitates specialized cylinders (filled with porous material and acetone to dissolve the gas), handling procedures, and safety measures. Accidents can lead to severe consequences, including injuries, fatalities, property damage, and environmental hazards, potentially impacting the reputation and growth of the industry.

Therefore, as per the analysis, these combined factors are significantly hindering acetylene cylinder market share.

Future Opportunities :

Ongoing R&D efforts focused on producing acetylene from biogas and other bio-based fuels are projected to create acetylene cylinder market opportunity

Traditional acetylene production often relies on non-renewable resources like coal or natural gas, contributing to greenhouse gas emissions. Biogas, derived from the anaerobic digestion of organic waste such as agricultural residues, sewage sludge, etc., offer a renewable and potentially carbon-neutral pathway for acetylene production. Successful commercialization of these methods significantly reduces the environmental footprint of acetylene, an attractive option for environmentally conscious industries. Additionally, shifting towards bio-based acetylene production would reduce the reliance on finite fossil fuel reserves and their price volatility. This increased energy independence can lead to more stable and potentially lower production costs, making acetylene more competitive with alternative fuels and processes, hence boosting acetylene cylinder market demand.

- For instance, in Mar 2024, Researchers in Japan from Doshisha University and Daikin Industries, Ltd. have developed a new strategy to produce the crucial hydrocarbon acetylene (C2H2) using carbon dioxide (CO2) and water (H2O) as starting materials, offering a potential pathway towards more sustainable acetylene production.

Hence, based on the analysis, ongoing R&D efforts focused on producing acetylene from biogas and other bio-based fuels are expected to create acetylene cylinder market opportunities.

Acetylene Cylinder Market Segmental Analysis :

By Material:

Based on the Material, the market is categorized into Steel Cylinders and Composite Cylinders.

Trends in the Material:

- Increasing trend towards the adoption of steel cylinders due to their established safety record, high strength, and lower cost.

- Composite cylinders are emerging as a potential alternative to steel cylinders, offering advantages such as lighter weight and better corrosion resistance.

Steel Cylinders accounted for the largest revenue share in 2024 and is also projected to register the fastest growth during the forecast period.

- Increasing focus on developing lighter-weight steel cylinder designs to improve portability and handling.

- Additionally, ongoing technological advancements aim to improve safety features in steel cylinders including enhanced valve technologies for better leak prevention and new safety features for high-capacity cylinders.

- Moreover, continuous improvements to enhance the durability and lifespan of steel cylinders through improved materials and design is further boosting the acetylene cylinder market size.

- For instance, Air Products Inc. offers industrial-grade acetylene (99.5% purity) supplied in a 40-liter steel cylinder containing 6 kg of the gas, ideal for metal fabrication processes like oxy-fuel welding, cutting, brazing, and heating.

- Thus, as per the acetylene cylinder market analysis, the aforementioned factors are driving the steel cylinders segment.

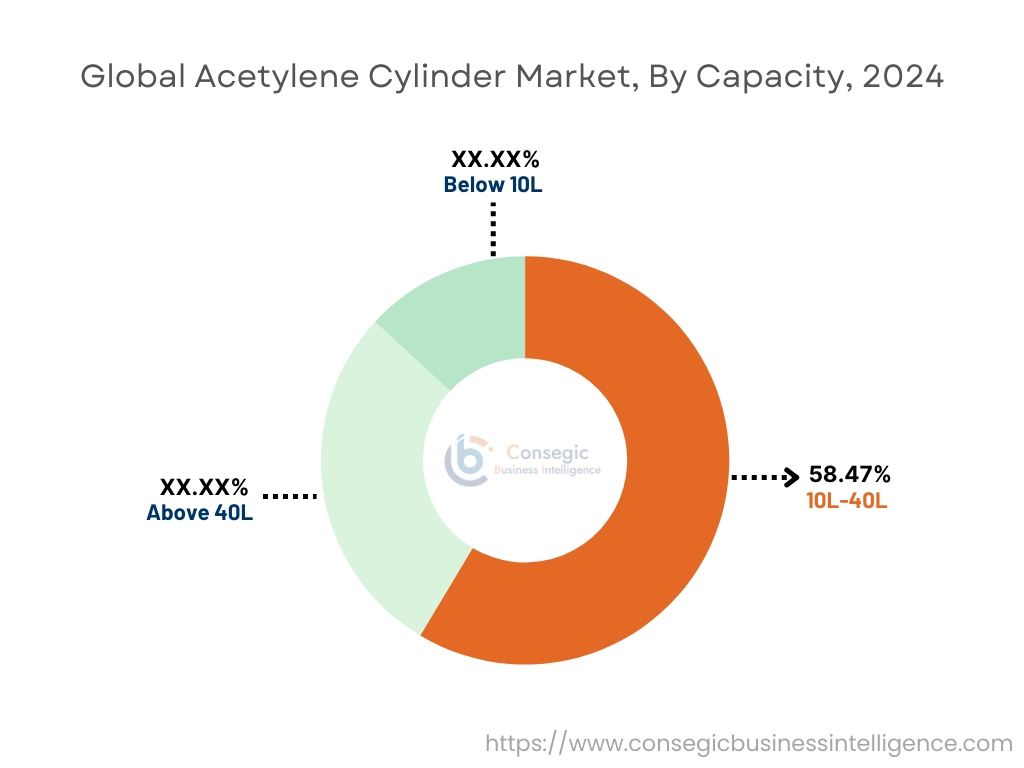

By Capacity:

Based on the Capacity, the market is classified into Below 10L, 10L-40L, and Above 40L.

Trends in the Capacity:

- Increased trend towards the adoption of below 10L cylinders, suitable for portable and light applications.

- Below 10L cylinders offer convenience and flexibility in various industrial and non-industrial settings, such as laboratories or for portable welding tasks.

10L-40L accounted for the largest revenue share of 58.47% in 2024.

- This range holds a significant market share due to its versatility and suitability for a wide array of industrial and scientific research contexts.

- This range strikes a balance between portability and capacity, suitable for applications like welding and metal fabrication in medium-scale operations, driving the acetylene cylinder market demand.

- Large-scale industrial users often favor this category for bulk purchases, optimizing storage and usage efficiency, thereby driving the market trend.

- For instance, BTP STRUCTURAL (I) PVT. LTD. is offering their BTPS 17.2 Ltr Acetylene Gas Cylinders, highlighting their robust steel construction for superior corrosion resistance. These leak-proof cylinders are designed for easy and safe shipping and include features like a removable metal cap, a safety fuse plug, and a permeable mass within the steel shell.

- Thus, as per the acetylene cylinder market analysis, the aforementioned factors are driving 10L-40L segment.

Above 40L is predicted to register the fastest CAGR during the forecast period.

- These larger cylinders are designed for heavy industrial use, requiring high volumes of acetylene for extensive welding, cutting, and fabrication tasks.

- They ensure continuous operation without frequent replacements in large-scale industries like factories.

- For instance, Air Products Inc. offers their Acetylene Premier, a 51-liter steel cylinder, fuel gas with reduced levels of PH3 and H2S for a cleaner flame and improved analytical outcomes.

- Subsequently, as per the market analysis, the aforementioned factors are collectively responsible in accelerating the market during the forecast period.

By Application:

Based on the Application, the market is categorized into Industrial, Chemical Synthesis, Scientific Research, and Others.

Trends in the Application:

- Increasing trend of high-purity acetylene cylinders in various experiments and applications, particularly in fields like materials science and nanotechnology.

- Acetylene is used in the synthesis of advanced materials like graphene and in carbon coating processes for enhancing conductivity and performance in electronic devices.

Industrial accounted for the largest revenue share in 2024.

- Acetylene remains a crucial gas in the metalworking sector for applications like oxyacetylene welding, cutting, brazing, soldering, and heat treatment due to its high flame temperature, hence driving the market trend.

- Growing trend towards automation in welding and cutting processes, which is enhancing the safety and efficiency of acetylene use in industrial settings is also boosting market size.

- The expanding automotive industry (including the production of battery components and lightweight vehicle structures) and increasing construction activities (steel framework, pipeline installations) are driving higher demand for acetylene in metal fabrication processes.

- For instance, in December 2024, India's total vehicle production across passenger vehicles, three-wheelers, two-wheelers, and quadricycles reached 1,921,268 units. The country is also projected to become the largest electric vehicle (EV) market by 2030, presenting an investment opportunity exceeding USD 200 billion in this sector.

- In conclusion, the aforementioned factors are contributing to the global acetylene cylinder market expansion.

Chemical Synthesis is predicted to register the fastest CAGR during the forecast period.

- Acetylene is a vital raw material and building block in the chemical industry for synthesizing a wide array of organic and inorganic chemicals.

- It is used in the production of essential chemicals such as vinyl chloride monomer (for PVC), acetic acid, acetaldehyde, acetic anhydride, 1,4-butanediol (for polyester and polyurethane), and acrylonitrile (for synthetic fibers).

- Ongoing research into new, sustainable methods for acetylene synthesis, including electrochemical processes using carbon dioxide and alternative feedstock like bioethanol, to reduce reliance on fossil fuels and lower the carbon footprint.

- Acetylene derivatives are used in the production of polymers, paints, adhesives, and coatings, with continuous development in this area.

- Subsequently, as per the market analysis, the aforementioned factors are collectively responsible in accelerating the market during the forecast period.

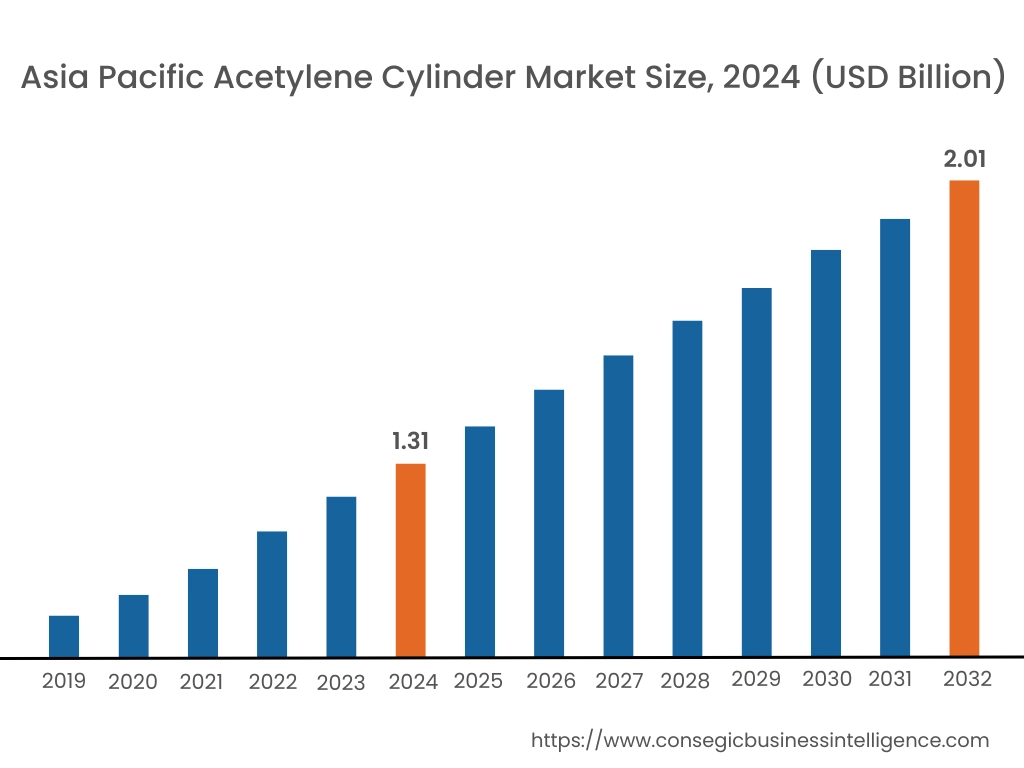

Regional Analysis:

The global acetylene cylinder market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

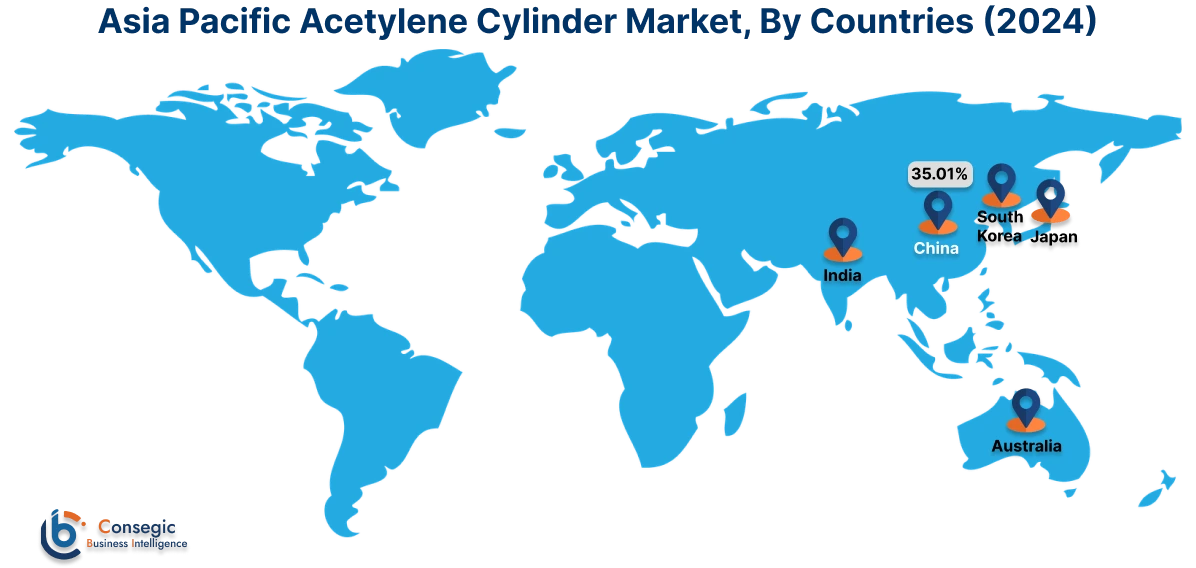

Asia Pacific was valued at USD 1.31 Billion in 2024. Moreover, it is projected to grow by USD 1.36 Billion in 2025 and reach over USD 2.01 Billion by 2032. Out of these, China accounted for the largest revenue share of 35.01% in 2024. The expanding chemical sector in the Asia Pacific region is indeed a significant driver for the acetylene cylinder market. Acetylene is used in the manufacturing of PVC (polyvinyl chloride) and acrylics, which have extensive applications in construction, automotive, and consumer goods. It is also used in the production of agrochemicals including pesticides and herbicides essential for the agricultural sector.

- For instance, India's robust chemical industry, the 6th largest globally and 3rd in Asia, contributes 7% to the nation's GDP. With over 80,000 commercial products, India accounts for 2.5% of global chemical sales, exporting to over 175 countries. Fueled by rising demand for specialty chemicals and petrochemicals, the sector is projected to reach USD 304 billion by 2025, exhibiting a strong CAGR of 9.3%.

North America region was valued at USD 1.19 Billion in 2024. Moreover, it is projected to grow by USD 1.22 Billion in 2025 and reach over USD 1.73 Billion by 2032. The aerospace sector in U.S. demands high-precision welding for manufacturing aircraft components using lightweight and high-strength materials. Oxy-acetylene welding provides the necessary control and heat intensity for these applications. Acetylene is also utilized in the maintenance, repair, and overhaul (MRO) of aircraft, thus contributing notably in accelerating the market expansion.

- For instance, according to FAA forecast, U.S. domestic air passenger growth is projected to average 4.7% annually over the next two decades. This figure is increased by double-digit growth in 2022 and 2023. Beyond this initial recovery, the forecast anticipates a more moderate average growth rate of 2.6 percent for the remainder of the 20-year period.

As per the acetylene cylinder market analysis, the European market is relatively mature with established players and stringent safety regulations, seeing growth from consistent industrial demand, especially in the automotive sector. Additionally, Latin America region shows increase, driven by expanding industrial sectors like oil & gas, and increasing infrastructure development in countries like Brazil. Further, the acetylene cylinder market is growing in Middle East and Africa due to increased industrialization, rising construction activities, and extension in the oil & gas sector, particularly in Saudi Arabia and the UAE.

Top Key Players and Market Share Insights:

The market is highly competitive with major players providing acetylene cylinder to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the acetylene cylinder industry include-

- Air Products (United States)

- Linde plc (Ireland)

- Worthington Cylinders (United States)

- Kanto Koatsu-Yoki Manufacturing Co., Ltd. (Japan)

- Harris Products Group (United States)

- Norris Cylinder (United States)

- Axcel Gases (India)

- GCE Group (Sweden)

- Messer Group (Germany)

- MATHESON (United States)

Acetylene Cylinder Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 5.86 Billion |

| CAGR (2025-2032) | 5.5% |

| By Material |

|

| By Capacity |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the acetylene cylinder market? +

The acetylene cylinder market size is estimated to reach over USD 5.86 Billion by 2032 from a value of USD 3.94 Billion in 2024 and is projected to grow by USD 4.07 Billion in 2025, growing at a CAGR of 5.5% from 2025 to 2032.

What specific segmentation details are covered in the acetylene cylinder report? +

The acetylene cylinder report includes specific segmentation details for material, capacity, application, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the acetylene cylinder market, chemical synthesis is the fastest-growing segment during the forecast period.

Who are the major players in the acetylene cylinder market? +

The key participants in the acetylene cylinder market are Air Products (United States), Linde plc (Ireland), Worthington Cylinders (United States), Norris Cylinder (United States), Axcel Gases (India), GCE Group (Sweden), Messer Group (Germany), MATHESON (United States), Kanto Koatsu-Yoki Manufacturing Co., Ltd. (Japan), Harris Products Group (United States), and Others.