Aerosol Valve Market Size :

Consegic Business Intelligence analyzes that the Aerosol Valve Market size is estimated to reach over USD 2,965.36 Million by 2032 from a value of USD 2,241.64 Million in 2024 and is projected to grow by USD 2,281.50 Million in 2025, growing at a CAGR of 3.60% from 2025 to 2032.

Aerosol Valve Market Scope & Overview:

Aerosol valves are devices that release products in spray mode from pressurized containers. They are designed to spray a fixed volume of liquid when the spray actuator is pressed. An aerosol valve used in the spray can or system regulates the entrance and exit of a fluid to or from a source, leverage the pressure between two fluids to force product through an atomizer and creates a fine mist. When the actuator is pressed, the stem moves down, which opens the valve and allows the pressurized liquid or gas to flow out of the can. The spring then pushes the stem back up to the closed position when the actuator is released.

They are most used in the packaging of personal care products, such as deodorant and hairspray, as well as household and food products, insecticides, decorative and technical products. Most aerosol valves are continuous spray mode, meaning that they dispense the product continuously when the actuator is pressed.

Aerosol Valve Market Insights :

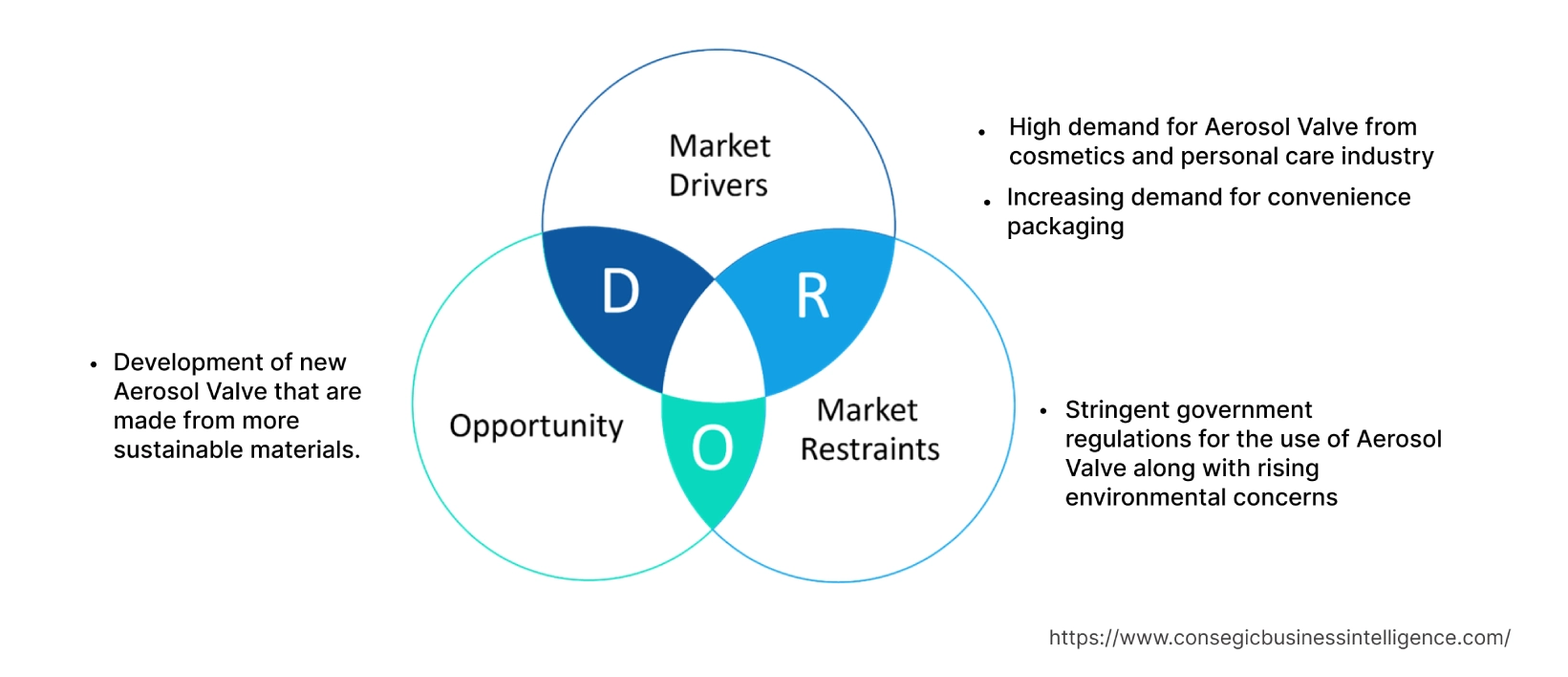

Aerosol Valve Market Dynamics - (DRO)

Key Drivers :

High demand for aerosol valves from cosmetics and personal care industry push the market for growth

Aerosol valves are used in cosmetics and personal care products to regulate the flow of fluid or vapor from a container. The valve atomizes the contents of the container so that it exits as a fine spray. Aerosol valves are used in many personal care products such as hair styling, hair mousse, lace adhesive spray, dry shampoo, sunscreen spray, deodorants, antiperspirants, perfumes, body sprays. The increasing use of aerosol cans for the packaging applications of cosmetics and personal care products are influencing the demand for aerosol valves across the globe. For instance, in September 2023, Aptar Beauty launched a range of overcap-free aerosol actuators. The actuators use a twist-to-lock technology that protects the formula without the need for an overcap. Moreover, high use of aerosol cans in the personal care sector is driving the market growth. For instance, according to the data published by Aerobal Organization, 80% of the world's production goes into the body care sector, mainly deodorants and perfumes as well as hair care products. Hence, the growing use of aerosol packing across cosmetics and personal care industry is driving the market growth for aerosol valves worldwide.

Increasing demand for convenience packaging elevate the market

The increasing demand for convenience packaging is a major trend that is driving the growth of the aerosol valve market. Aerosol valves offer several advantages that make them ideal for convenience products, such as ease of use, portability, hygiene, and versatility. Aerosol valves allow consumers to dispense products quickly and easily, without the need to measure or pump. This is especially convenient for products that are used frequently, such as deodorant and hairspray. Moreover, aerosol cans are lightweight and portable, making them ideal for travel and on-the-go use. This is important for consumers who are increasingly busy and have less time to spend on routine tasks such as grooming.

Owing to the high demand for convenience packaging, various players involved in the personal care, cosmetics and other industries are focusing on the adoption of aerosol packaging for their products, which is driving the demand for aerosol valves across the globe. For instance, in August 2022, Fekkai, which is hair care products manufacturer announced the launch of Clean Stylers Green Aerosols Collection, a line of hair care products that use Solstice Propellant Technology. This technology creates a non-ozone depleting aerosol that produces a quick-drying, non-flaking mist. The collection is designed for environmentally conscious consumers. Thus, the increasing demand for convenience packaging is particularly evident in emerging markets, which is factor driving the global aerosol valves market.

Key Restraints :

Stringent government regulations for the use of aerosol valves along with rising environment concerns alleviate the market

Aerosol valves are often made of plastic, which is a non-biodegradable material. Additionally, some aerosol propellants can be harmful to the environment. These environmental concerns are leading some consumers to choose alternative packaging options, such as pump bottles and tubes. Governments around the world are enacting regulations to reduce the environmental impact of aerosol products. For example, the European Union has banned the use of certain types of aerosol propellants.

These regulations are making it more expensive and difficult for aerosol valve manufacturers to operate. Furthermore, In the United States, the Environmental Protection Agency (EPA) regulates aerosol cans under the Toxic Substances Control Act (TSCA). TSCA requires that aerosol cans be labeled with certain information, such as the type of propellant used and the manufacturer's name and address. TSCA also prohibits the use of certain propellants, such as CFCs. Thus, this stringent regulation and growing environmental concerns are restraining the growth of aerosol valves market.

Future Opportunities :

Development of new aerosol valves that are made from more sustainable materials create new market opportunities

The development of new aerosol valves that are made from more sustainable materials is a positive trend for the aerosol valves market. Aerosol valves are often made of plastic, which is a non-biodegradable material. Additionally, some aerosol propellants can be harmful to the environment. New aerosol valves that are made from more sustainable materials, such as recycled plastic or bio-based materials, can help to reduce the environmental impact of aerosol products. Consumers are increasingly aware of the environmental impact of their purchases and are looking for products that are made from sustainable materials and that have a minimal environmental impact.

New aerosol valves that are made from more sustainable materials can help aerosol product manufacturers to meet this demand. This increasing launch of new products made of sustainable materials created lucrative growth opportunities for the global aerosol valves market over the forecast period. For instance, in September 2023, Aptar Beauty is a manufacturer of primary packaging solutions and dispensing systems for personal care and pharmaceutical markets. Furthermore, in January 2023, Precision Valve Corporation announced the launch of two "radically innovative" actuators SMART 35 and STYLISH 52 powered by STORM technology. SMART 35 offers the same functionalities as more complex and heavier actuators, including the same spray quality. Thus, increasing innovation in the aerosol valves are expected to create lucrative growth opportunities for the growth of global aerosol valves market over the forecast period.

Aerosol Valve Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 2,965.36 Million |

| CAGR (2025-2032) | 3.6% |

| By Type | Continuous and Metered |

| By Valve Type | Vertical Valve and Tilt Valve |

| By End User | Cosmetics & Personal Care, Healthcare, Food & Beverage, Homecare, Automotive, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Summit Packaging Systems, Aptar Group, Clayton Corp., Salvalco, KOH-I-NOOR Mlada Vozice a.s., Mitai Valve, LINDAL Group, Precision Valve Corporation, Coster Tecnologie Speciali S.p.A., Newman Green, Aroma Industries, and Guangzhou Zhongpin Aerosol Valves Co., Ltd. |

Aerosol Valve Market Segmental Analysis :

By Type :

The type is categorized into continuous and metered. In 2024, the continuous segment accounted for the highest market share in the aerosol valves market, and it is also expected to grow at the highest CAGR over the forecast period. A continuous aerosol valve is a type of aerosol valve that releases the contents of the can in a continuous stream when the actuator is pressed. Continuous aerosol valves are the most common type of aerosol valve and are used in a wide variety of products, including personal care products, household products, and food and beverage products. The demand for continuous aerosol valves is increasing as it is simple and inexpensive to design and manufacture and these valves are versatile and can be used to dispense a wide variety of products. Third, continuous aerosol valves offer several advantages over other dispensing methods, such as pumps and triggers. Continuous aerosol valves are very convenient to use. Consumers can simply press the actuator to dispense the product in a continuous stream. This is especially convenient for products that are used frequently, such as deodorant and hairspray. The high convenience offered by the continuous aerosol valves is the major factor driving the segment growth across the globe.

By Valve Type :

The valve type is categorized into vertical valve and tilt valve. In 2024, the valve type segment accounted for the highest market share in the aerosol valves market, and it is also expected to grow at the highest CAGR over the forecast period. A vertical tilt aerosol valve is a type of aerosol valve that can be activated in either a vertical or tilted position. This type of valve is typically used in products that are designed to be sprayed upside down, such as hairspray and cooking spray. Vertical tilt aerosol valves offer several advantages over other types of aerosol valves. They are very versatile and can be used to dispense a wide variety of products, and they provide a precise and controlled spray. Vertical tilt aerosol valves are mostly used in hairsprays, increasing launch of hairspray is driving the segment growth globally. For instance, in January 2023, L'Oréal announced the launch of Elnett Satin Extra Strong Hold Hairspray. This hairspray provides a strong hold without stiffness or stickiness. It also uses a vertical tilt valve for easy application. Thus, the high demand for these products is driving the segment's growth worldwide.

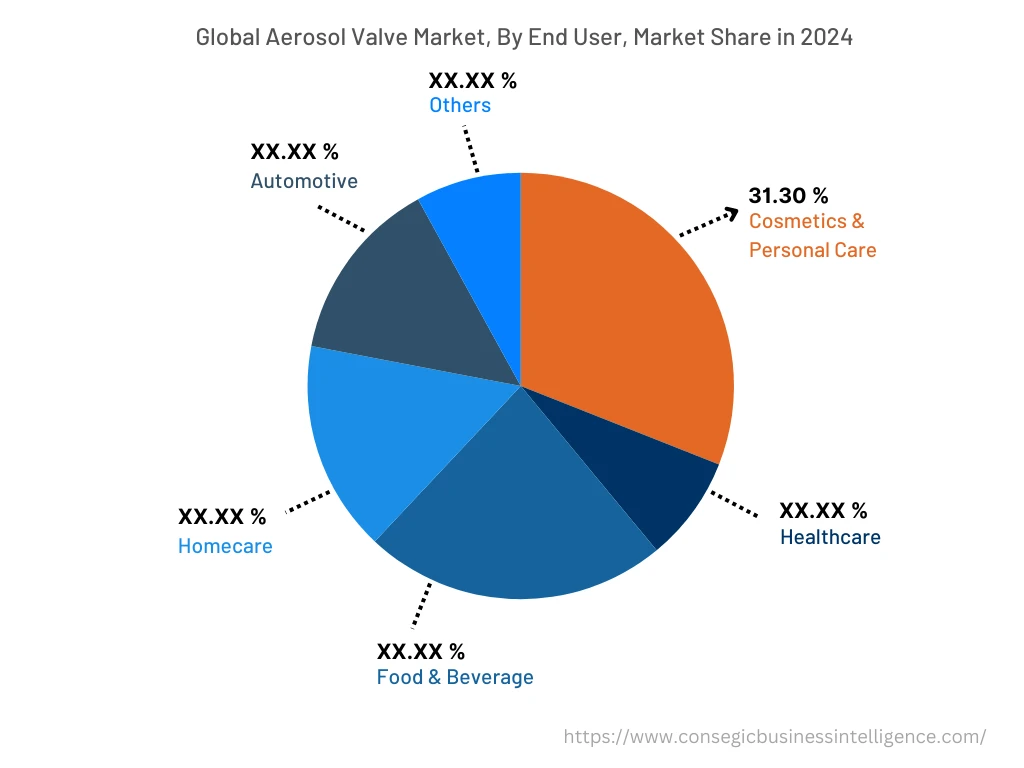

By End-User :

The end user segment is categorized into cosmetics & personal care, healthcare, food & beverage, homecare, automotive, and others. In 2024, the cosmetics & personal care segment accounted for the highest market share of 31.30% in the overall aerosol valves market. It is also expected to grow at the highest CAGR over the forecast period. Aerosol valves are in the cosmetics and personal care industry and are used for the packaging of products, such as deodorant, hairspray, and shaving cream. The fastest growing end user of aerosol valves is the personal care industry. This is due to the increasing demand for personal care products, such as deodorant, hairspray, and shaving cream, which are typically packaged in aerosol cans. The personal care industry is expected to continue to grow in the coming years, driven by factors such as rising disposable incomes, increasing urbanization, and growing awareness of personal hygiene. This growth will lead to an increased demand for aerosol valves, as more and more personal care products are packaged in aerosol cans. Significant growth in the personal care industry across the globe is driving the segment growth. For instance, according to the report by the International Trade Administration in March 2021, the revenues Indonesia beauty and persona care market are projected to reach USD 7.5 billion in 2021 and the personal care industry accounting for a revenue of USD 3.2 billion. Thus, the significant growth in the personal care market is driving the segment growth across the globe over the forecast period.

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

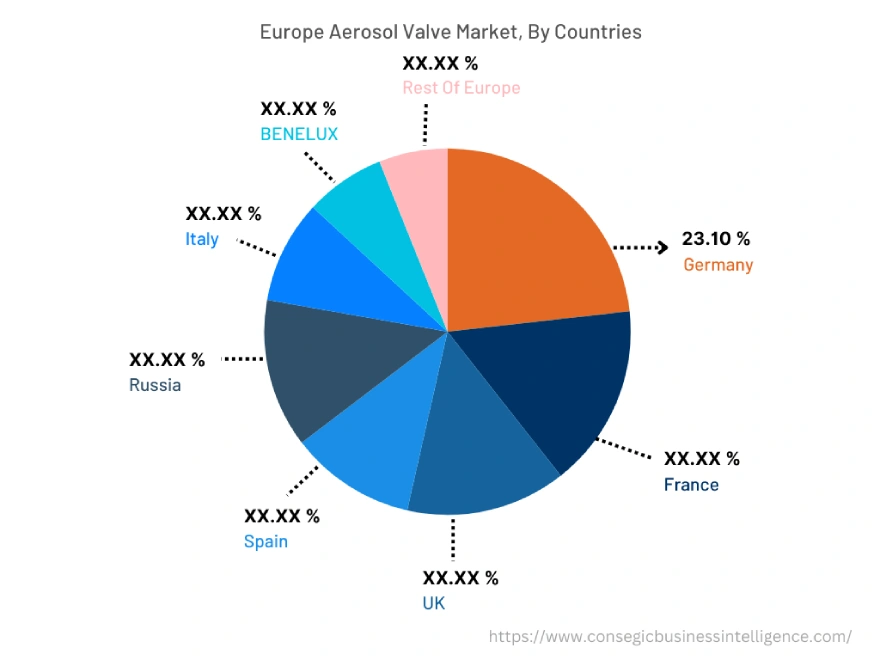

In 2024, Europe accounted for the highest market share valued at USD 606.87 Million in 2024 and USD 618.34 Million in 2025, it is expected to reach USD 813.4 Million in 2032. In Europe, Germany hold the highest market share of 23.10% in 2022. The high production of aerosol across Europe is one of the major factors that is influencing the market growth across the region. For instance, according to the report Published by the European Aerosol Federation in 2022, the European aerosol production accounted for 5.2 billion units in 2021 which increased to 5.3 billion units in 2022. Furthermore, according to the same report, The United Kingdom, Germany, and France provide more than 55% of the annual aerosol production in Europe in all segments. Together with Italy, Netherlands, and Spain, more than 4.0 billion units of aerosol dispensers are produced in 2022. This increasing production of aerosol in Europe is increasing the demand for Aerosol Valve and thus driving the market growth across the region.

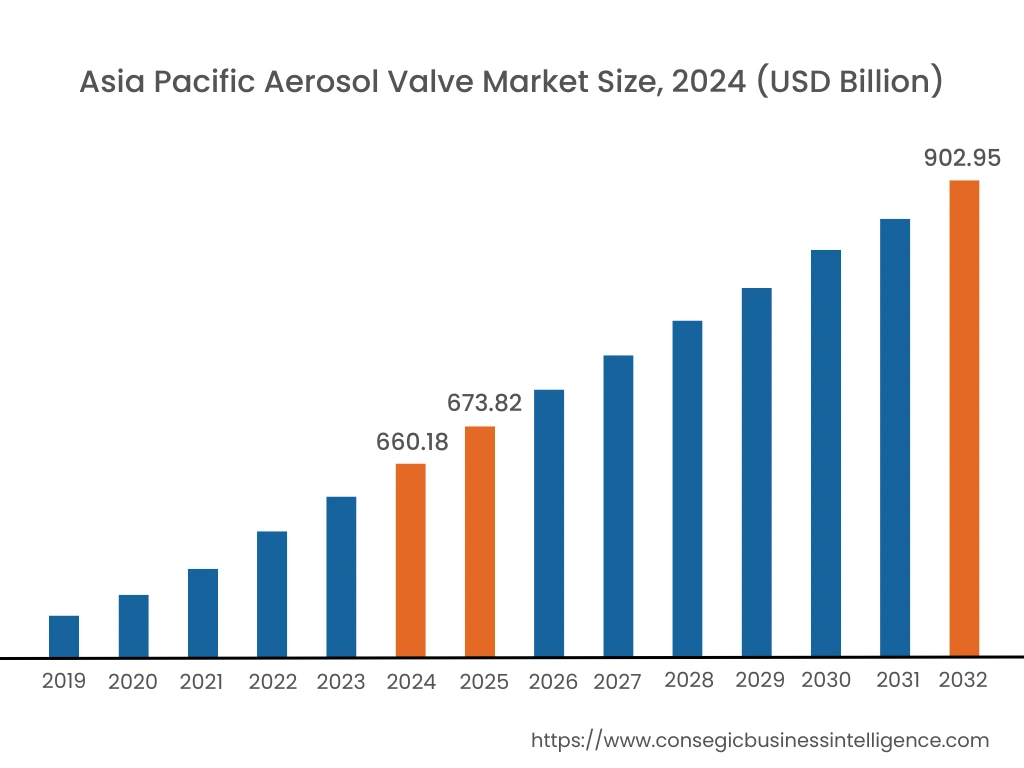

Furthermore, the Asia Pacific region is expected to witness significant growth over the forecast period, growing at a CAGR of 4.1% during 2025-2032. The expansion of the retail sector along with the growing awareness about personal care among the population in the region. Consumers in the Asia Pacific region is becoming more aware of the importance of personal hygiene. For instance, according to the report by the National Investment Promotion and Facilitation Agency, the premium beauty and personal care products in the country is expected to grow at a CAGR of 54% from 2021 to 2026. These factors are creating lucrative growth opportunities for the Aerosol Valve market in the Asia Pacific region.

Top Key Players & Market Share Insights:

The Aerosol Valve market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- AptarGroup, Inc.

- Precision Valve Corporation

- Newman Green

- Aroma Industries

- Guangzhou Zhongpin Aerosol Valve Co., Ltd.

- Coster Group

- Clayton Corp.

- Salvalco

- KOH-I-NOOR Mlada Vozice a.s.

- Mitai Valve

- LINDAL Group

Recent Industry Developments :

- In January 2023, Precision Valve Corporation announced the launch of two radically innovative actuators powered by STORM Technology that negate the need for inserts, lightweight, and feature no overcap.

- In February 2022, Salvalco launched its Eco-Valve, which is made from recycled plastic and uses nitrogen as a propellant. This valve is a more sustainable alternative to traditional aerosol valves, which are made from virgin plastic and use hydrocarbon propellants.

Key Questions Answered in the Report

What was the market size of the Aerosol Valve market in 2024? +

In 2024, the market size of Aerosol Valve was USD 2,147.50 Million.

What will be the potential market valuation for the Aerosol Valve industry by 2031? +

In 2031, the market size of Aerosol Valve will be expected to reach USD 2,815.07 Million.

What are the key factors driving the growth of the Aerosol Valve market? +

High demand for Aerosol Valve from cosmetics and personal care industries across the globe is fueling market growth at the global level.

What is the dominant segment in the Aerosol Valve market for the end user? +

In 2024, the cosmetics & personal care segment accounted for the highest market share of 31.40% in the overall Aerosol Valve market.

Based on current market trends and future predictions, which geographical region is the dominating region in the Aerosol Valve market? +

Europe accounted for the highest market share in the overall market.