Automotive Leasing Market Size:

Automotive Leasing Market size is estimated to reach over USD 187.82 Billion by 2032 from a value of USD 121.68 Billion in 2024 and is projected to grow by USD 126.35 Billion in 2025, growing at a CAGR of 6.0% from 2025 to 2032.

Automotive Leasing Market Scope & Overview:

Automotive leasing refers to a vehicle financing option that allows the customer to use the vehicle for a specified period of time. Auto leasing often comes with lower monthly payments and zero to minimal down payments, making it very popular. Auto leasing has seen an upward trend among consumers who prefer lower EMI, less cash investment upfront, and the flexibility of switching to a new vehicle when the lease contract ends. Moreover, many automotive lease providers offer the option to buy the vehicle at residual value, making it popular as the consumers do not have to pay more than the depreciated value.

How is AI Impacting the Automotive Leasing Market?

AI is transforming the automotive leasing market by streamlining operations, improving customer experiences, and enhancing decision-making. With AI-powered analytics, leasing companies can better assess customer credit profiles, driving behavior, and residual vehicle values, enabling more accurate risk assessment and pricing models. AI-driven chatbots and virtual assistants simplify customer interactions by offering instant support, personalized recommendations, and seamless contract management. Predictive analytics also optimize fleet management by forecasting maintenance needs and vehicle utilization, reducing downtime and operational costs. Additionally, AI enhances fraud detection and ensures compliance through real-time monitoring. As mobility preferences shift toward flexible ownership models, AI is becoming central to making automotive leasing more efficient, customer-centric, and profitable.

Automotive Leasing Market Dynamics - (DRO) :

Key Drivers:

Rising Demand for Luxury Cars is Propelling the Automotive Leasing Market Growth

Auto leasing has witnessed robust growth in the leasing of luxury vehicles as the need for luxury vehicles has increased in recent times. Luxury car loans generally require a larger initial down payment and come with higher monthly installments (EMIs). Further, due to the rapid depreciation of luxury vehicles, financing them is often a less favorable option compared to leasing, as the borrower ultimately bears the significant cost of this depreciation. Furthermore, when a customer loans a vehicle, they pay for the depreciation and the vehicle, whereas in leasing, the customer only has to pay for the depreciation, making leasing popular in the luxury vehicles segment.

- For instance, according to the IBEF, every hour, six vehicles over USD 58000 were sold in India in 2024. The increase in the sale of vehicles in this price segment shows that the ownership of luxury cars has increased in India, compared to 2019, when the sales were just two vehicles every hour.

Hence, the increase in leasing of luxury cars is proliferating the automotive leasing market size.

Key Restraints :

Restrictions Associated with Usage and Ownership of Vehicles During a Lease are Restraining the Automotive Leasing Market Growth

Auto leasing does not give ownership of the vehicle to the lessee since it is a rental agreement. Many people prefer buying a vehicle due to the freedom buying comes with it, like modifying the vehicle and the option to sell after the repayment of the outstanding loan. Auto leasing also comes with mileage limitations that restrict the number of miles a lessee can drive during the lease period. Any increase in the miles driven beyond the specified limit is subject to penalties incurred by the lessee.

Moreover, when a lessee leases a vehicle, they are responsible for the excessive wear and tear of the vehicle during the lease agreement and have to pay the cost of the wear and tear to the vehicle company at the end of the lease period. Some examples of excessive wear and tear are broken or missing parts, broken glass, damaged body panels, and excessively worn tires. Thus, the restrictive nature of vehicle leasing poses a threat to the growth of the automotive leasing market.

Future Opportunities :

Growing Adoption of Electric Vehicles is Expected to Drive the Automotive Leasing Market Opportunities

Electric Vehicles (EVs) have experienced growth in recent years due to the savings in fuel costs as well as the technological advancements in the vehicles. Many electric vehicle manufacturers are investing in research and development, resulting in the release of new models every few years, which favors leasing over loaning the vehicles. Leasing the vehicle makes it easy to switch from one model to another since the agreement is usually only for a few years.

- For instance, Tesla offers many options, including the option to upgrade to a new Tesla vehicle at the end of the leasing period. The upgrade aims to provide the lessee the option to lease a newer Tesla model with better features and software updates.

Thus, the rising technological advancements and adoption associated with electric vehicles are projected to drive the automotive leasing market opportunities during the forecast period.

Automotive Leasing Market Segmental Analysis :

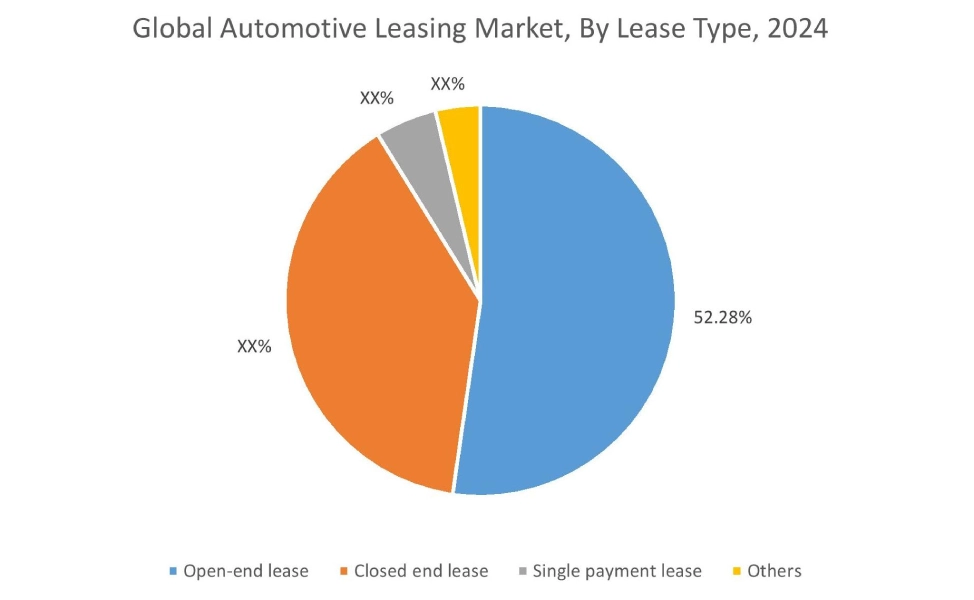

By Lease Type:

Based on lease type, the market is segmented into open-end lease, closed end lease, single payment lease, and others.

Trends in the lease type:

- Increasing preference of consumers for open-end lease options due to no set parameters around vehicle damage.

- Factors like the flexibility of returning the vehicle after the lease period and no restrictions on mileage allowance are driving the open-end lease segment.

Open-end lease accounted for the largest revenue share of 52.28% in the year 2024, and it is anticipated to register the fastest CAGR during the forecast period.

- Open-end lease is ideal for consumers who prefer using a vehicle before purchasing if they are unsure about buying.

- Many car and financing companies allow the consumer to buy out their vehicle at the end of the lease period at flexible residual values.

- Additionally, the inclusion of General Asset Protection (GAP) insurance offers protection to customers in the event the customer owes more than the vehicle’s actual cash value.

- For instance, GM Financial offers many features for open-end leases, like flexible residuals at the end of the lease and GAP coverage to offer security in the event something happens to the vehicle or if the vehicle depreciates.

- According to the market analysis, the rising adoption of open-end leases as a result of the flexibility of buying the vehicle at the end of tenure and GAP insurance coverage is driving the automotive lease market.

By Vehicle Type:

Based on vehicle type, the market is segmented into passenger vehicles and commercial vehicles.

Trends in the vehicle type:

- Rising demand for commercial vehicle leasing is due to growth in large, medium, and small-sized fleet owners.

- Factors including lower monthly payments and flexible lease options are driving the passenger vehicles segment.

Passenger vehicles accounted for the largest revenue share in the year 2024.

- Passenger vehicle sales have experienced growth due to rising income levels, affordable pricing options, and growth in leasing services offered by car companies.

- Many financial institutions offer attractive interest rates and monthly payments on car leases compared to car loans, making car leasing popular.

- For instance,Ford offers a Red Carpet Lease option to customers looking to lease Ford cars. With Red Carpet Lease, the customers can customize mileage options and pay lower monthly payments, owing to the fact that the payments cover a portion of the vehicle instead of the entire vehicle.

- According to the analysis, increasing adoption of passenger vehicle leasing due to attractive interest rates and pricing options is driving the automotive leasing market trends.

Commercial vehicles are anticipated to register the fastest CAGR during the forecast period.

- Commercial vehicles are used by businesses, fleet management services, and governments for the purpose of transporting goods or services.

- Commercial vehicle leasing comes with many advantages, including tax deductions, as the monthly payments are counted as business expenses.

- Moreover, leasing providers offer features including leases on trucks that are customized to the business’s needs with specific add-ons.

- For instance, Penske Truck Leasing offers leasing on heavy-duty trucks with customizable tandem-axle sleeper tractors, suitable for truck drivers who want the comfort of a sleeper berth for long journeys.

- According to the automotive leasing market analysis, the increasing advancements related to commercial vehicle leasing are anticipated to boost the automotive leasing market trends during the forecast period.

By Fuel Source:

Based on the fuel source, the market is segmented into internal combustion engine (ICE) vehicles and electric vehicles (EVs).

Trends in the fuel source:

- Increasing adoption of leasing for ICE vehicles with customized options like high mileage payment plans, GAP coverage, and various end-of-lease plans is driving the automotive leasing market share.

- Growing investments in electric vehicle infrastructure to support growing electric car demand are driving the market.

Internal combustion engine (ICE) vehicles accounted for the largest revenue share in the year 2024.

- ICE vehicle leasing is driven primarily by the dominant portion of ICE cars with petrol and diesel-based engines.

- ICE vehicle leasing is popular due to the relatively cheaper price of the vehicles compared to electric vehicles, resulting in the automotive leasing market expansion.

- Moreover, many companies today offer additional insurance coverage on top of GAP to protect car owners from unexpected expenses in the form of wear and tear.

- For instance, Ford, a major manufacturer of ICE vehicles, offers WearCare to protect vehicle owners from wear and tear for vehicles that weigh up to 16,000 lbs.

- Therefore, the increasing adoption of auto leasing solutions in ICE vehicles due to additional insurance coverage options is driving the automotive leasing market size.

Electric vehicles (EVs) are anticipated to register the fastest CAGR during the forecast period.

- The fuel efficiency of Electric Vehicles makes them a popular choice among consumers who prefer the affordability that comes from reduced fuel costs.

- Moreover, governments have started introducing tax incentives for businesses or individuals leasing electric cars due to their reduced CO2 emissions.

- For instance, according to KIA, when a company leases an electric car in the UK, it can claim 50% of the Value Added Tax (VAT) charged on the monthly leasing payments.

- Thus, the rising number of electric vehicles leasing due to tax incentives is propelling the overall market during the forecast period.

By End User:

Based on the end user, the market is segmented into individuals and enterprises.

Trends in the end user:

- Increasing adoption of auto leasing for individuals through mobile apps and websites, driving the automotive leasing market share.

- There is a rising trend towards the utilization of auto leasing by enterprises for various business purposes, like online taxi services, among others.

Individuals accounted for the largest revenue share in the market in 2024.

- The dominance of individual customers is attributed to the rising adoption of auto leasing services offering customized and tailored leasing plans to individuals.

- Many online platforms today offer leasing solutions for electric vehicles through the internet, offering vehicle selection, lease plans, document verification, and vehicle delivery.

- For instance, Alt Mobility offers electric vehicle leases in just 3 steps. The steps involve selecting vehicle make, model, and lease tenure on their website. The user then has to submit documents and pay the deposit amount. Once approved, the vehicles are delivered to the nearest authorised dealer in the user’s location.

- Therefore, the increasing development of auto leasing solutions through online platforms is driving the automotive leasing market.

Enterprises are anticipated to register the fastest CAGR during the forecast period.

- Automotive leases are increasingly being used by enterprises for fleet management and handling due to reduced maintenance expenses and streamlined operations.

- Moreover, the utilization of auto leasing for corporate car leases for employee mobility has driven the industry.

- For instance, Orix India offers corporate car lease solutions for companies looking to lease cars for employees and other business mobility-related requirements.

- Hence, the growing demand for enterprise due to an increase in the utilization of leasing for fleets has resulted in the automotive leasing market expansion during the forecast period.

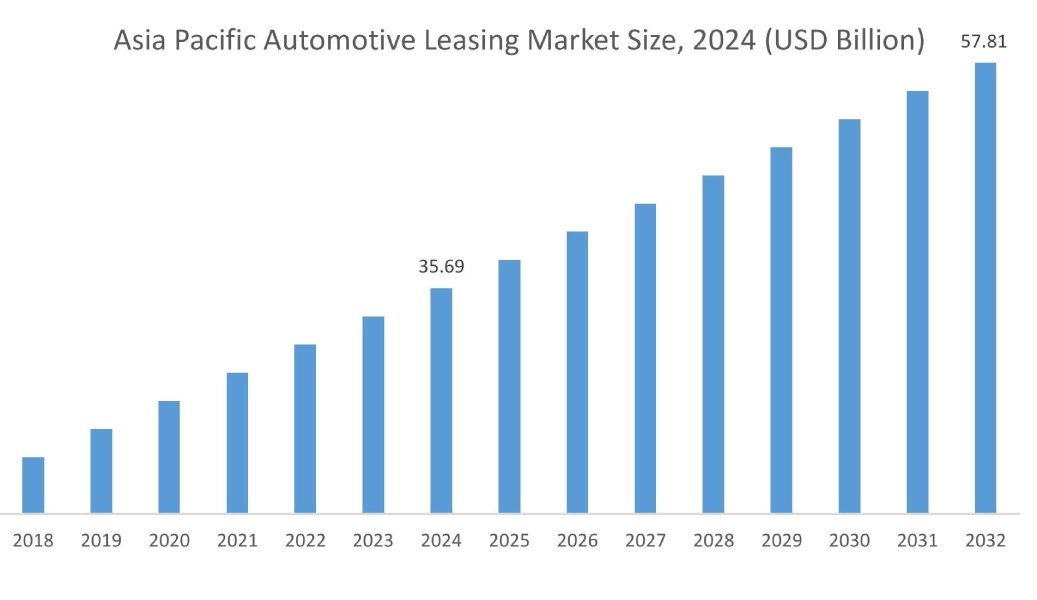

Regional Analysis:

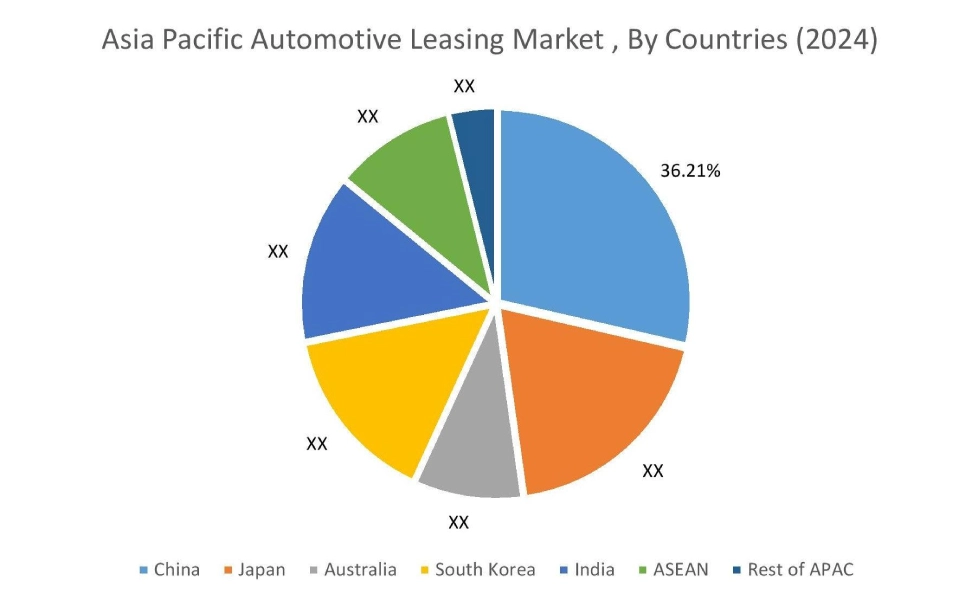

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 35.69 Billion in 2024. Moreover, it is projected to grow by USD 37.21 Billion in 2025 and reach over USD 57.81 Billion by 2032. Out of this, China accounted for the maximum revenue share of 36.21%. As per the automotive leasing market analysis, the adoption of auto leasing in the Asia-Pacific region is primarily driven by the growing awareness among consumers regarding automotive leasing, increasing adoption of ride sharing services, and others.

- For instance, Uber India has partnered with Xchange Leasing India Private Limited to lease out cars to Partners on Uber, allowing Drivers to earn without having to own a car.

North America is estimated to reach over USD 59.71 Billion by 2032 from a value of USD 38.79 Billion in 2024 and is projected to grow by USD 40.26 Billion in 2025. In North America, the rise in the automotive leasing industry is driven by the growing investments in electric/hybrid cars and driverless cars. Moreover, the increasing adoption of commercial electric buses is contributing to the automotive leasing market demand.

- For instance, in September 2024, MTR Western announced the launch of fully electric buses for environmental sustainability and increased customer satisfaction.

Additionally, the regional analysis depicts that the increasing electric vehicle ownership is driving the automotive leasing market demand in Europe. Furthermore, as per the market analysis, the market demand in Latin America is growing at a considerable rate due to the increasing adoption of vehicle leasing by enterprises. Middle East and African regions are expected to grow at a considerable rate due to the increasing number of financial companies offering financial products, including automotive leasing products.

Top Key Players & Market Share Insights:

The global automotive leasing market is highly competitive, with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the automotive leasing market. Key players in the automotive leasing industry include-

- Ally Financial Inc. (U.S.)

- Alt Mobility (India)

- Tesla (U.S.)

- Bank of America Corporation (U.S.)

- Toyota Motor Corporation (Japan)

- Tata Motors Finance Ltd. (India)

- Credit Union Leasing of America (U.S.)

- Ford Motor Company (U.S.)

- Honda Motor Co. Ltd. (Japan)

- Element Fleet Management Corp. (Canada)

Recent Industry Developments :

Partnership:

- In May 2024, Kia India partnered with Orix Auto to launch a new program called Kia Lease. Kia lease aims to offer leasing options to customers who wish to lease Kia vehicles for 24 to 60 months with different mileage options.

Product Launch:

- In February 2025, Volkswagen announced the launch of a new leasing program called the Drive electric-drive ID.3. The leasing program aims to offer private lessees and individual commercial lessees the ability to drive the electric ID.3 models at lower monthly rates.

Automotive Leasing Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 187.82 Billion |

| CAGR (2025-2032) | 6.0% |

| By Lease Type |

|

| By Vehicle Type |

|

| By Fuel Source |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the automotive leasing market? +

The automotive leasing market is estimated to reach over USD 187.82 Billion by 2032 from a value of USD 121.68 Billion in 2024 and is projected to grow by USD 126.35 Billion in 2025, growing at a CAGR of 6.0% from 2025 to 2032.

Which is the fastest-growing region in the automotive leasing market? +

Asia-Pacific region is experiencing the most rapid growth in the automotive leasing market.

What specific segmentation details are covered in the automotive leasing market report? +

The automotive leasing market report includes specific segmentation details for lease type, vehicle type, fuel source, end user, and region.

Who are the major players in the automotive leasing market? +

The key participants in the automotive leasing market are Ally Financial Inc. (U.S.), Tata Motors Finance Ltd. (India), Credit Union Leasing of America (U.S.), Ford Motor Company (U.S.), Honda Motor Co. Ltd. (Japan), Element Fleet Management Corp. (Canada), Alt Mobility (India), Tesla (U.S.), Bank of America Corporation (U.S.), Toyota Motor Corporation (Japan), and Others.