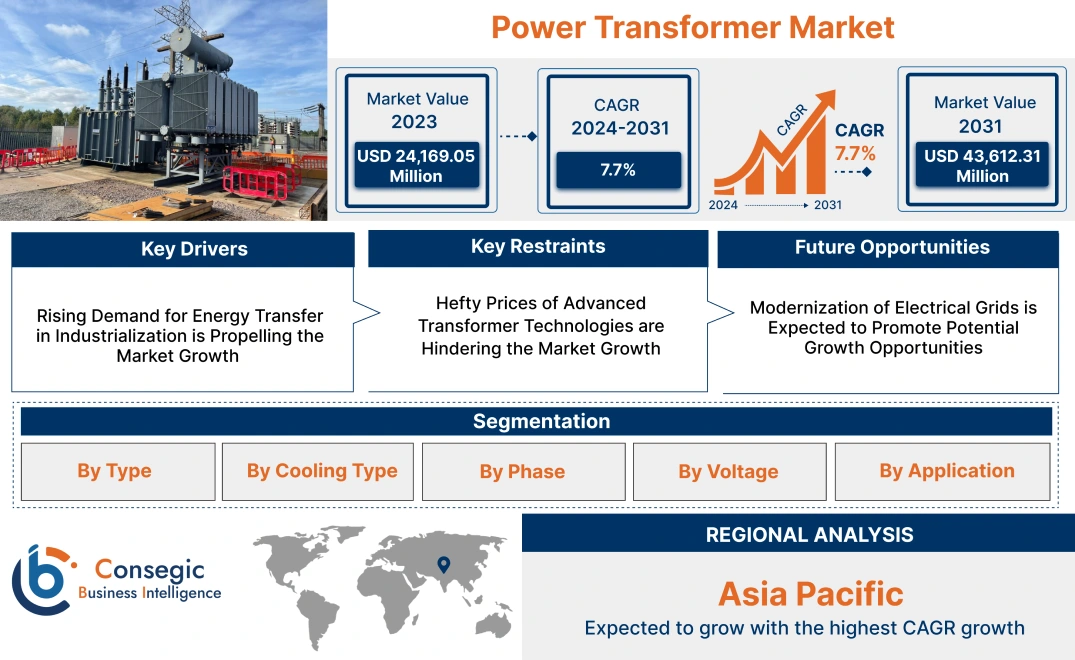

Power Transformer Market Size:

Power Transformer Market size is estimated to reach over USD 43.87 Billion by 2032 from a value of USD 25.59 Billion in 2024 and is projected to grow by USD 26.93 Billion in 2025, growing at a CAGR of 7.6% from 2025 to 2032.

Power Transformer Market Scope & Overview:

A power transformer is a static electrical device designed to transfer electrical energy between two or more circuits through electromagnetic induction. Its primary function is to step up or step down voltage levels in an AC electrical power system without changing the frequency. This voltage transformation is crucial for long-distance power transmission and for adapting voltage levels to suit various applications, from high-voltage industrial equipment to low-voltage household appliances.

How is AI Impacting the Power Transformer Market?

AI is impacting the power transformer market by enabling smarter, more efficient, and reliable grid operations. Predictive maintenance, a key AI application, analyzes real-time sensor data from transformers to anticipate potential failures, allowing for proactive repairs and minimizing costly downtime. This shifts maintenance from reactive to preventative. Furthermore, AI optimizes load forecasting and power distribution, reducing thermal stress on transformers and enhancing energy efficiency. This intelligent management extends asset lifespan and lowers operational costs. AI also improves fault diagnosis by quickly identifying abnormalities, leading to faster resolutions and enhanced grid stability, ultimately supporting the modernization of existing infrastructure and the integration of renewable energy sources.

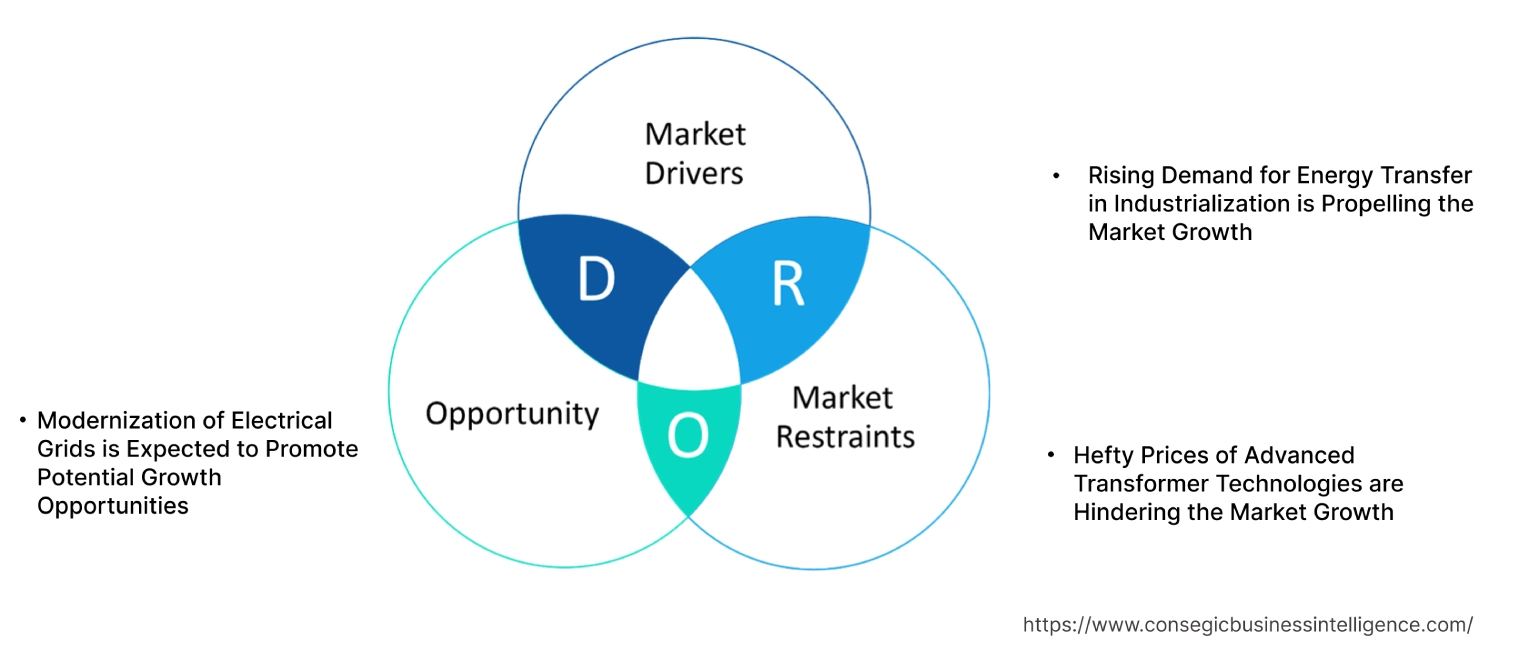

Power Transformer Market Dynamics - (DRO) :

Key Drivers:

Rising electricity demand is driving power transformer market growth

The increasing global population and industrial activities necessitates upgrading and reinforcing the grid with powerful and efficient transformers to handle the increased load, driving the market growth. Additionally, to cater to the rising electricity demand, utilities need to expand their transmission and distribution networks to reach new areas. This expansion requires the installation of new power transformers at substations and distribution points to step down high-voltage electricity, consequently driving the power transformer market size.

- For instance, according to S. Energy Information Administration, in 2022, the United States reached its highest ever electricity consumption at 4.07 trillion kWh, a 3.2% increase from 2021 and a staggering 14 times the consumption in 1950. Residential and commercial electricity sales saw increases of 2.6% and 4.7% respectively compared to 2021 and the industrial sector's electricity sales also increased by 2.0% from the previous year.

Consequently, rising electricity demand is driving power transformer market growth.

Key Restraints :

Limitation of transformers to alternating current (AC) is restraining the global power transformer market

High-voltage direct current (HVDC) transmission is recognized as a more efficient method for long-distance power transfer compared to AC, especially for submarine cables. HVDC reduces line losses and offers better control over power flow. Since standard AC transformers cannot directly interface with HVDC systems, specialized types of converters (AC-DC and DC-AC) are required at the sending and receiving ends. Moreover, while AC transformers are crucial for integrating most renewable sources into the AC grid, some renewable energy technologies, like solar photovoltaic systems, generate direct current, further hampering the market expansion. Therefore, as per the analysis, these combined factors are significantly hindering power transformer market share.

Future Opportunities :

Integration of digital technologies into power transformers is projected to create market opportunity

Digital technologies enable real-time monitoring of transformer parameters like voltage, current, temperature, oil levels, and dissolved gases. This data is analyzed to detect anomalies, predict failures, and enable proactive maintenance, reducing downtime and extending the transformer's lifespan. Additionally, by leveraging data analytics algorithms on the collected data, utilities move from time-based to condition-based maintenance, optimizing resource utilization, and minimizing the risk of unexpected breakdowns, hence boosting power transformer market demand.

- For instance, in Oct 2024, Hammond Power Solutions (HPS) launched HPS Smart Transformers, extending availability to both medium and low voltage applications. This innovative solution incorporates Industrial Internet of Things (IIoT)-enabled power monitors, allowing users to gain valuable data insights. By providing critical information, HPS Smart Transformers empower users to anticipate and resolve potential problems, thereby preventing expensive operational disruptions.

Hence, based on the analysis, integration of digital technologies is expected to create power transformer market opportunities.

Power Transformer Market Segmental Analysis :

By Type:

Based on the Type, the market is categorized into Step-Up Transformers and Step-Down Transformers.

Step-up and step-down transformers are used to change the voltage level of alternating current electricity. Step-up transformers increase the voltage, while step-down transformers decrease it. This transformation is achieved by adding the number of turns in primary and secondary windings of the transformer. Moreover, step-up transformers have more turns in the secondary while the step-down transformers have more turns in the primary. Additionally, step-up transformers are used for power transmission while step-down transformers are used for power distribution and device use.

Trends in the Type:

- Step-up transformers are essential for increasing voltage levels from power plants to extra-high voltage for efficient long-distance power transmission, minimizing energy loss.

- Certain applications such as X-ray machines and high-powered equipment, require step-up transformers to achieve the necessary high voltage levels.

Step-Down Transformers accounted for the largest revenue share in 2024 and is also projected to register the fastest CAGR.

Step-down transformers are essential for reducing high transmission voltages to lower, safer levels for distribution to residential, commercial, and industrial consumers. Additionally, with the rise of decentralized power generation and microgrids, smaller step-down transformers are needed for localized power distribution and grid connection, thereby boosting the power transformer market size.

- For instance, in Sep 2023, Larson Electronics launched a robust 3-phase buck and boost step-down transformer designed for both indoor and outdoor use. This transformer, with a 540V primary input, enhances reliability and protects connected equipment from critical failures by providing power source isolation.

Thus, as per the power transformer market analysis, the aforementioned factors are driving step-down transformers segment.

By Cooling Type:

Based on the Cooling Type, the market is classified into Oil-Immersed Transformers and Dry-Type Transformers.

Oil-immersed and dry-type transformers are both used for voltage transformation, but differ significantly in their cooling and insulation methods. Oil-immersed transformers use oil to insulate and cool the windings, while dry-type transformers rely on air or a solid insulation material including resin. Oil-immersed transformers are more cost-effective and efficient, making them suitable for high-voltage applications outdoors, while dry-type transformers are preferred for indoor installations, particularly where fire safety is a concern. Moreover, oil-immersed transformers require regular oil maintenance while dry-type transformers require less maintenance.

Trends in the Cooling Type:

- Oil-immersed transformers are adopted in large power plants and long-distance transmission, due to their superior insulation and cooling capabilities.

- Increasing trend towards the adoption of dry-type transformers, in indoor and populated areas like commercial buildings, hospitals, and residential complexes, due to their enhanced fire safety and reduced environmental impact.

Oil-Immersed Transformers accounted for the largest revenue share in 2024.

There is an increasing emphasis on using environmentally friendly insulating oils, such as natural ester oils, to mitigate the environmental risks associated with mineral oil spills and improve biodegradability. Additionally, higher fire points and low heat of combustion of oil-immersed transformers are also contributing notably in spurring the market growth.

- For instance, in Apr 2021, Adani Electricity Mumbai Limited (AEML) commissioned India's first 220kV, 125MVA power transformer filled with synthetic ester oil in its Mumbai transmission network. This marks a move towards enhanced safety and performance compared to traditional mineral oil transformers, as synthetic ester oil offers a higher fire point, lower heat of combustion, improved high-temperature operation, and the potential for a longer transformer lifespan due to better insulation paper preservation.

Thus, as per the power transformer market analysis, the aforementioned factors are driving oil-immersed transformers segment growth.

Dry-Type Transformers is also projected to register the fastest CAGR during the forecast period.

Dry-type transformers are used in renewable energy installations, such as solar and wind farms, due to their safety features and ability to operate effectively in diverse environmental conditions. In addition, innovations in solid insulation materials and improved air-cooling designs enabling dry-type transformers to handle higher voltage and power ratings. Larger units are incorporating fans for forced air cooling to enhance heat dissipation. Additionally, key players are also expanding their reach in dry-type transformers which is further contributing to the market.

- For instance, in Apr 2025, Hitachi Energy announced to invest USD 22.5 million to expand and modernize its dry-type transformer manufacturing in Southwest Virginia. This includes opening a new 75,000-square-foot facility in Atkins and upgrading their existing, leading North American dry-type transformer production site in Bland.

Thus, as per the power transformer market analysis, the aforementioned factors are driving dry-type transformers segment growth.

By Phase:

Based on the Phase, the market is divided into Single-Phase Transformers and Three-Phase Transformers.

Single-phase and three-phase power transformers differ primarily in the number of phases they handle. Single-phase transformers operate with one alternating current (AC) phase, while three-phase transformers use three AC phases. Three-phase transformers have a more complex construction due to the need for three windings. Single-phase transformers are generally used for residential and smaller commercial applications, while three-phase transformers are used in industrial and commercial settings that require higher power ratings.

Trends in the Phase:

- Increasing trend towards incorporating smart grid technologies into single-phase transformers for better monitoring, control, and efficient power distribution.

- Three-Phase Transformers are widely used in industrial and large commercial loads due to their efficiency in handling high power need and providing stable power supply.

Three-Phase Transformers accounted for the largest revenue in 2024 and is also projected to register the fastest CAGR.

Three-phase transformers are vital for stepping up the voltage from large solar and wind farms for efficient transmission to the grid, hence driving the market trend. Additionally, these transformers are being equipped with digital monitoring and control systems for smart grid applications, enabling optimized performance and predictive maintenance. Moreover, key manufacturers are also producing and expanding their three-phase transformers reach, which in turn, is further contributing to the market.

- For instance, in Feb 2025, Eaton invested USD 340 million to boost its U.S. production of three-phase transformers, critical for reliable electrical power. This initiative includes establishing a new manufacturing facility in South Carolina, expected to begin operations and hiring in 2027. Eaton will also continue its three-phase transformer production at its existing two facilities in Wisconsin.

In conclusion, the above-mentioned reasons are contributing notably in spurring the market.

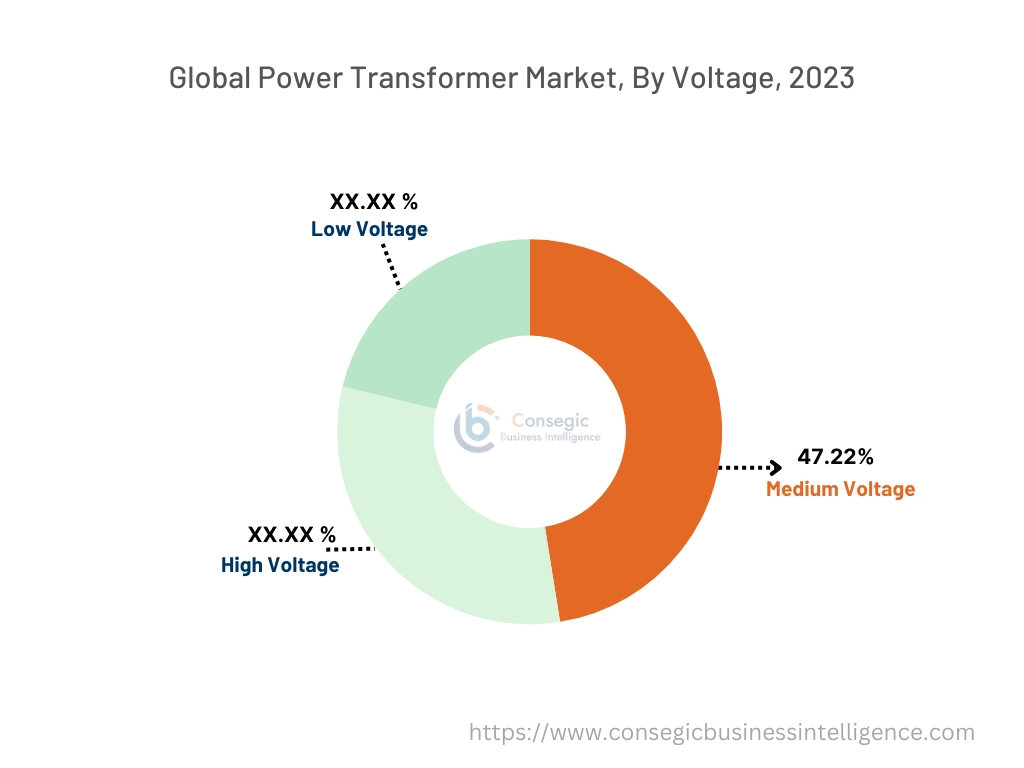

By Voltage:

Based on the Voltage, the market is categorized into Low Voltage, Medium Voltage, and High Voltage.

Low, medium, and high voltage transformers play crucial roles in the power distribution system, each tailored for specific voltage levels and applications. Low-voltage transformers handle the lowest voltages, medium-voltage transformers handle intermediate voltages, and high-voltage transformers handle the highest voltages. Low-voltage transformers are used for residential and small commercial applications, while medium-voltage transformers serve larger industrial facilities and substations. High-voltage transformers are used for long-distance transmission and large-scale power generation.

Trends in the Voltage:

- Low voltage transformers are integrated into smart grids, equipped with real-time monitoring and control capabilities to enhance grid stability and performance.

- Medium voltage transformers are essential for stepping down voltage for large industrial facilities, commercial buildings, and infrastructure projects.

Medium Voltage accounted for the largest revenue share of 47.22% in 2024.

Rising preference for dry-type medium voltage transformers in environmentally sensitive or indoor applications due to their enhanced safety and reduced environmental risk is driving the market trend. Additionally, medium voltage transformers are vital in connecting medium-sized renewable energy installations (like commercial solar farms) to the grid. Moreover, utilities are investing in advanced medium voltage transformers as part of grid modernization efforts to enhance reliability and efficiency. Thus, as per the power transformer market analysis, the aforementioned factors are driving power transformer segment expansion.

High Voltage Transformers is predicted to register the fastest CAGR during the forecast period.

High voltage transformers remain essential for efficient long-distance power transfer and interconnecting different grids, with ongoing investments in transmission infrastructure. Also, high voltage transformers are equipped with advanced monitoring, control, and communication capabilities to support smart grid operations and stability. Moreover, there is a strong emphasis on the reliability and resilience of high voltage transformers, including advanced insulation systems and protective measures.

- For instance, Bharat Heavy Electricals Limited (BHEL), through its in-house research and development efforts, successfully commissioned India's first 1200 kV Ultra High Voltage Alternating Current (UHVAC) transformer with a 333 MVA rating. This achievement highlights BHEL's commitment to advancing indigenous power technology.

Subsequently, the above-mentioned factors are contributing notably in spurring power transformer market expansion.

By Application :

Based on the Application, the market is categorized into Residential, Commercial, and Industrial.

Power transformers are essential for efficient and safe electricity distribution in residential, commercial, and industrial settings, acting as a crucial component in power grids. Commercial buildings, including shopping malls, offices, and hotels, rely on transformers to step down voltage from the high-voltage transmission grid to the lower voltages needed for lighting, HVAC systems, and other equipments. Industrial plants and manufacturing facilities utilize power transformers to step down voltage from the high-voltage transmission grid to the levels required by heavy machinery, motors, furnaces, and other equipments. In residential sector, distribution transformers step down the high voltage from the transmission lines to the standard 110V or 220V used by household appliances, ensuring safe and efficient power for lighting, heating, air conditioning, and other devices.

Trends in the Application:

- Rise of residential solar photovoltaic (PV) systems is leading to increased need for single-phase transformers capable of handling bidirectional power flow and integrating seamlessly with the grid.

- Commercial buildings, with their complex HVAC systems, lighting, and electronic equipment, have growing power needs, requiring larger and more reliable transformers.

Industrial accounted for the largest revenue share in 2024 and is also predicted to witness the fastest CAGR.

Industrial facilities, with their heavy machinery and processes, are major consumers of electricity, requiring high-capacity and robust three-phase transformers. Additionally, transformers in industrial settings must withstand harsh operating conditions and provide a reliable power supply to ensure uninterrupted production. Moreover, transformers are essential for general electrical distribution at both onshore and offshore oil and gas facilities. They step down high voltage from the grid to lower voltages required to power various equipment and infrastructure.

- For instance, in Apr 2025, Shell expanded its transformer liquid offerings by incorporating the Shell MIDEL range, known for its synthetic ester-based insulating fluids. This addition, alongside the existing Shell Diala, signifies Shell's commitment to driving innovation, enhancing reliability, and supporting the energy transition within the power energy industry.

Thus, as per the power transformer market analysis, the aforementioned factors are driving industrial segment.

Regional Analysis:

The global power transformer market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

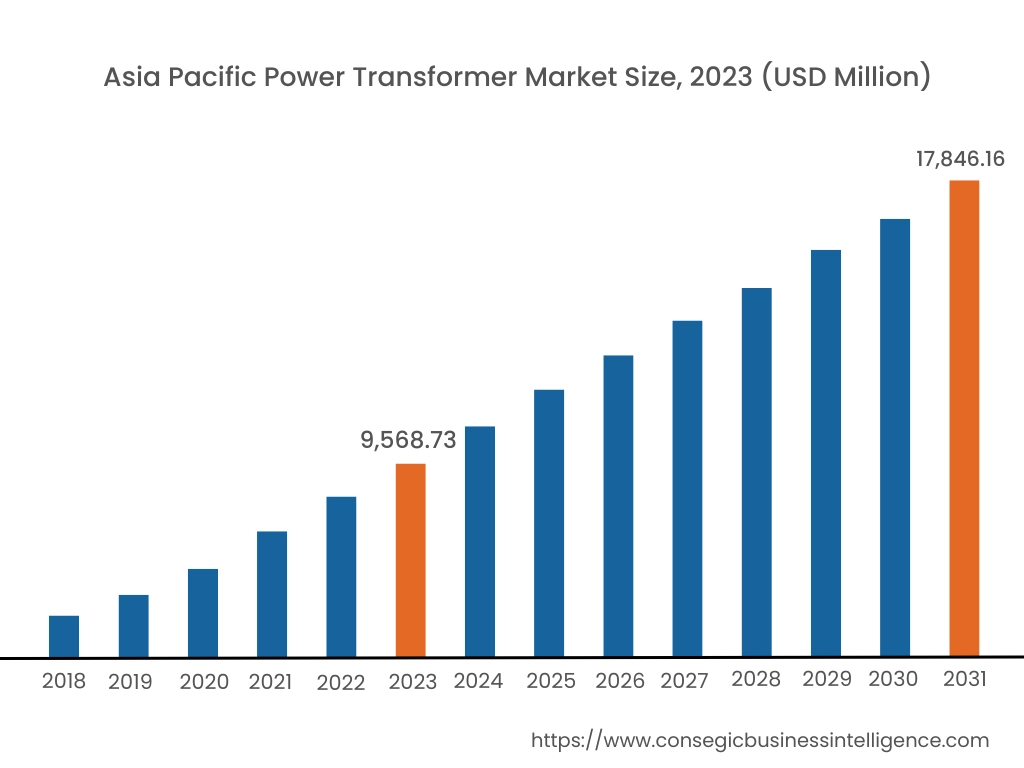

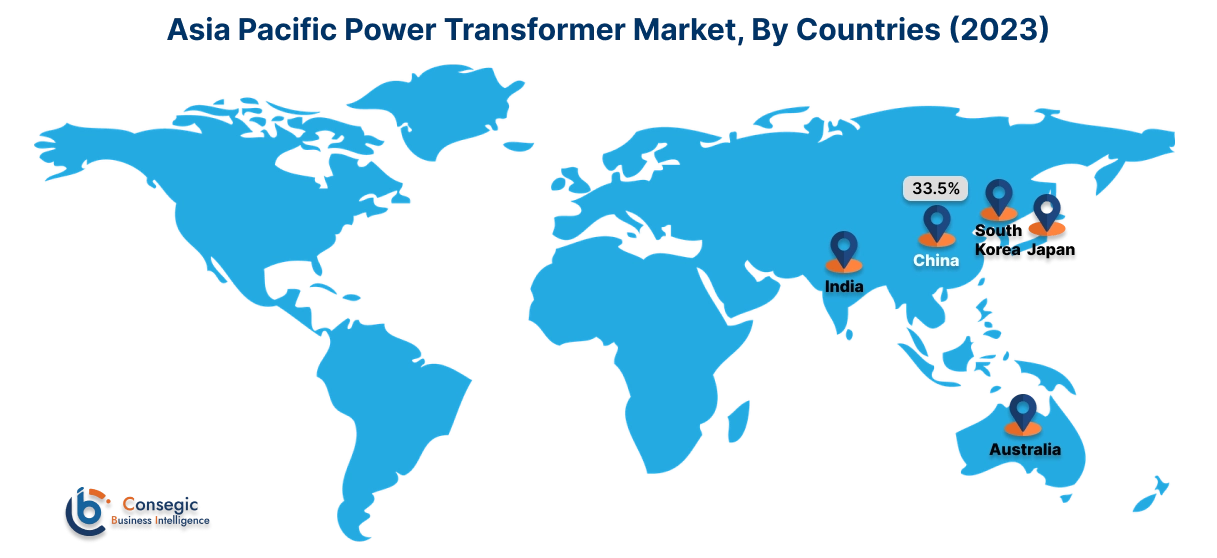

In 2024, Asia Pacific was valued at USD 9.55 Billion and is expected to reach USD 16.45 Billion in 2032. In Asia Pacific, China accounted for the highest share of 33.5% during the base year of 2024. Governments across the Asia Pacific are heavily investing in infrastructure projects, including the extension of power grids and rural electrification programs. Initiatives like India's "Power for All" and substantial grid development investments in China are directly fueling the need for new transformers.

- For instance, GEAPP (Global Energy Alliance for People and Planet) announced to invest USD 100 million in India to scale decarbonization technologies, including AI-driven grid optimization in Rajasthan. This aligns with India's ambitious plan to invest USD 107 billion by 2032 in developing additional transmission lines to support its goal of nearly tripling its clean power capacity.

North America region was valued at USD 6.10 Billion in 2024. Moreover, it is projected to grow by USD 6.52 Billion in 2025 and reach over USD 12.42 Billion by 2032. North American power transformer market is driven by increasing investments in energy infrastructure, regulatory initiatives promoting sustainable practices, and the growing demand for electricity. Additionally, the transition to electric vehicles (EVs) and the need for charging infrastructure is creating new opportunities for transformer deployment.

As per the power transformer market analysis, European power transformer market is experiencing growth due to the rising demand for electricity and increasing investments in the energy sector. Moreover, countries like Mexico and Brazil, with increasing electricity demand and infrastructure development projects, are expected to drive market growth. Furthermore, ME&A power transformer market is driven by rapid industrialization, infrastructure development, and increasing investments in power generation and transmission projects.

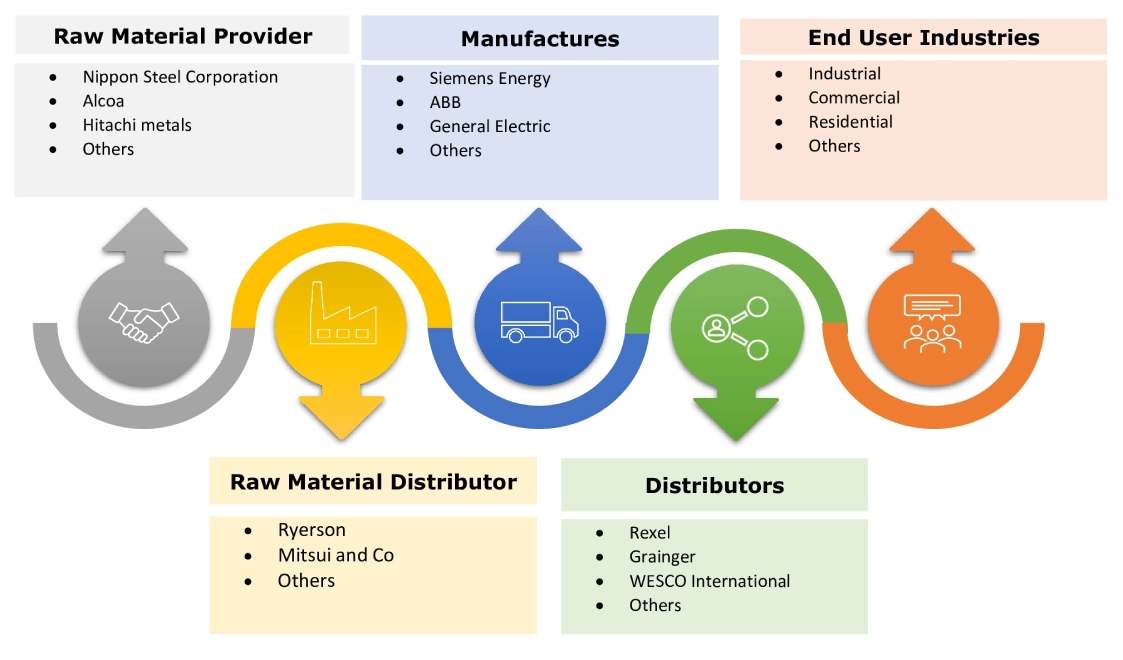

Top Key Players & Market Share Insights:

The market is highly competitive with major players providing power transformer to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the power transformer industry include-

- Siemens Energy (Germany)

- GE Vernova (United States)

- Alstom Grid (France)

- CG Power and Industrial Solutions (India)

- Bharat Heavy Electricals Limited (BHEL) (India)

- WEG (Brazil)

- SPX Transformer Solutions (United States)

- Mitsubishi Electric (Japan)

- Toshiba Energy Systems & Solutions (Japan)

- Hyundai Electric (South Korea)

- Schneider Electric (France)

- Eaton (Ireland)

- TBEA (China)

- XD Group (China)

Recent Industry Developments :

Launch:

- In Feb 2024, Schneider Electric launched its EcoStruxure Transformer Expert service in the UK and Ireland, offering businesses a simple and affordable way to digitally monitor their oil transformers. This subscription-based solution uses IoT sensors and software analytics to track transformer health, providing data-driven insights into aging and risk.

- In Feb 2023, Hitachi Energy launched the next-generation TXpert Hub, a key component of their transformer digitalization system. This hub gathers, stores, and analyzes data from digital sensors on transformers, enabling enhanced monitoring.

Expansion:

- In Feb 2021, Hitachi ABB Power Grids secured a USD 20 million order from Türkiye's TEİAŞ to supply power transformers for a grid expansion. This aims to provide affordable, reliable electricity to remote areas, replacing polluting diesel generators.

Power Transformer Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 43.87 Billion |

| CAGR (2024-2031) | 7.6% |

| By Type |

|

| By Cooling Type |

|

| By Phase |

|

| By Voltage |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the power transformer market? +

The power transformer market size is estimated to reach over USD 43.87 Billion by 2032 from a value of USD 25.59 Billion in 2024 and is projected to grow by USD 26.93 Billion in 2025, growing at a CAGR of 7.6% from 2025 to 2032.

What specific segmentation details are covered in the power transformer report? +

The power transformer report includes specific segmentation details for type, cooling type, phase, voltage, application, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the power transformer market, industrial is the fastest growing segment during the forecast period.

Who are the major players in the Power Transformer market? +

The key participants in the power transformer market are ABB (Switzerland), Siemens Energy (Germany), GE Vernova (United States), Mitsubishi Electric (Japan), Toshiba Energy Systems & Solutions (Japan), Hyundai Electric (South Korea), Schneider Electric (France), Eaton (Ireland), TBEA (China), XD Group (China), Alstom Grid (France), CG Power and Industrial Solutions (India), Bharat Heavy Electricals Limited (BHEL) (India), WEG (Brazil), SPX Transformer Solutions (United States), and Others.