Smart Home Market Size:

Smart Home Market Size is estimated to reach over USD 265.10 Billion by 2032 from a value of USD 127.46 Billion in 2024 and is projected to grow by USD 137.46 Billion in 2025, growing at a CAGR of 10.6% from 2025 to 2032.

Smart Home Market Scope & Overview:

Smart home is a residence that uses internet-connected devices to enable the remote monitoring and management of appliances, such as heating, lighting, and others. These homes leverage connected devices and the Internet of Things (IoT) to provide homeowners with enhanced control over various household functions, ranging from lighting and security to heating and entertainment systems. This connectivity not only enhances the user experience but also contributes to energy savings and improved home security, which are compelling factors for consumers.

How is AI Transforming the Smart Home Market?

AI is being utilized in the smart home market, primarily for improving devices with personalization, automation, energy efficiency, and security through learning user habits and predictive maintenance. AI enables devices to understand voice commands, adapt to individual preferences, proactively manage household systems, and provide real-time security alerts. The integration of AI in smart homes helps in analyzing data from connected devices, learning user behaviors to automate tasks such as lighting, temperature control, and security, enhancing comfort, efficiency, and personalization. Key functions include predictive maintenance, real-time energy optimization, and advanced security features that distinguish threats from normal activity. In addition, voice assistants, powered by AI, enable hands-free control through natural language commands, integrating smart home technologies into daily routines. Therefore, the above factors are expected to create lucrative prospects for market growth in upcoming years.

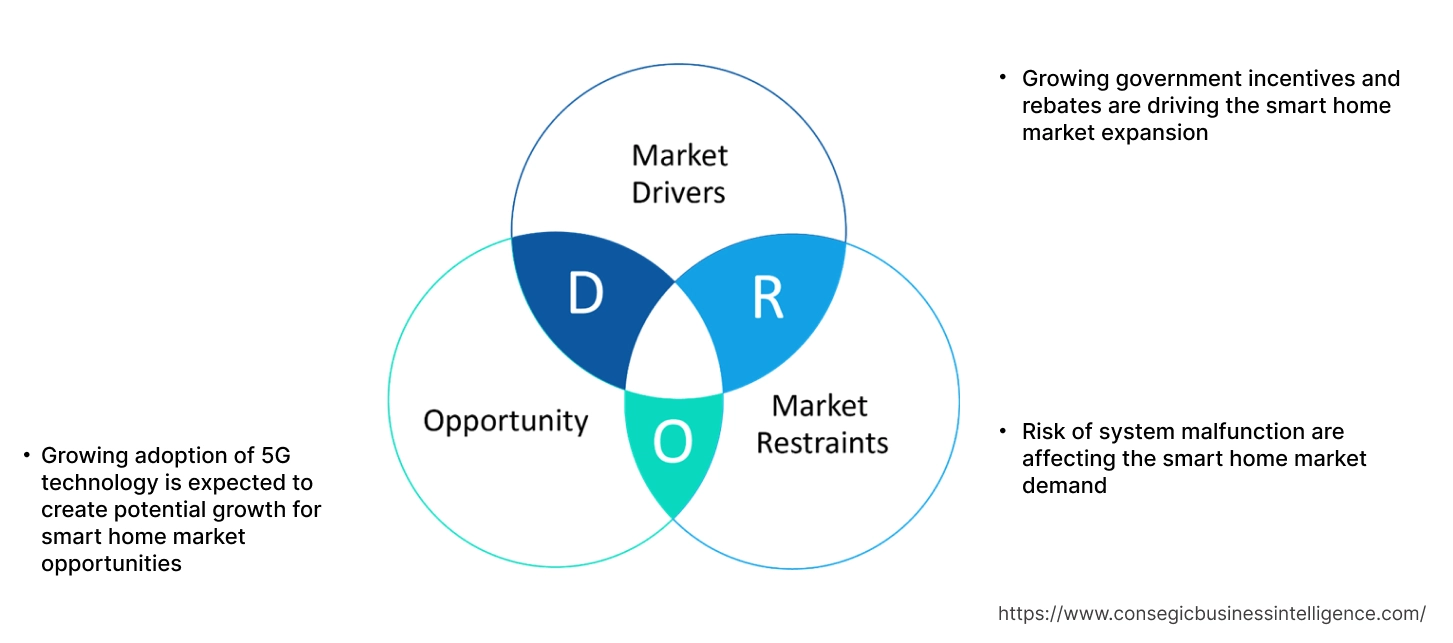

Key Drivers:

Growing government incentives and rebates are driving the smart home market expansion

Government incentives and rebates play a crucial role in driving the adoption of smart home technologies. Many governments worldwide are increasingly aware of the benefits of energy efficiency and sustainability, and they are implementing policies to encourage the use of smart home devices. These incentives often come in the form of tax credits, rebates, and grants for homeowners who install energy-efficient systems, such as smart thermostats, lighting controls, and HVAC systems. By reducing the upfront costs associated with these technologies, governments are making it more feasible for a broader range of consumers to invest in smart home solutions.

Utility companies often collaborate with governments to provide financial incentives for the adoption of intelligent home devices. These partnerships aim to reduce overall energy consumption and peak demand, thereby enhancing the stability and efficiency of the power grid. Certain programs also offer discounts or rebates on energy-efficient appliances, encouraging consumers to upgrade their homes.

- For instance, the German government introduced the Next Generation Media Programme, to support connected home initiatives. The scheme supports 11 projects in advanced technologies for development of new technologies and processes for smart homes.

Thus, according to the smart home market analysis, the growing government incentives and rebates are driving the smart home market size.

Key Restraints:

Risk of system malfunction are affecting the smart home market demand

Smart home systems offer convenience and cost-effectiveness, however, the complexity of installation and integration processes often leads to errors and technical glitches. The compatibility issues between different devices and the lack of standardized protocols increase the risk, as users by mistakenly configure incompatible components, resulting in system failures or performance degradation.

Further, these malfunctions not only undermine user experience but also affect consumer trust in smart home solutions. Thus, the aforementioned factors would further impact the smart home market size.

Future Opportunities :

Growing adoption of 5G technology is expected to create potential growth for smart home market opportunities

The growing adoption of 5G technology is expected to significantly enhance the global market. 5G networks offer faster data speeds, lower latency, and increased connectivity, which are essential for the seamless operation of smart home devices. With 5G, smart home systems can communicate more efficiently, enabling real-time responses and more reliable performance. This improved connectivity allows for better integration of various smart devices, enhancing the overall user experience while making homes smart and more appealing to consumers.

Further, the expansion of 5G networks is expected to accelerate the growth of the market by enabling broader and more reliable connectivity, particularly in areas where traditional broadband infrastructure is lacking. This is beneficial in suburban and rural regions, where the deployment of wired internet can be challenging and costly. By providing high-speed wireless connectivity, 5G can bridge the digital gap and make home technologies accessible to a wider audience.

- For instance, in February 2024, Fibocom announced the partnership with STMicroelectronics, to create a smart home system that allows seamless communication between devices using various protocols. This is achieved through the integration of Matter-compatible technologies, specifically the STM32WB55 and FG370, enabling centralized control. With this collaboration, Fibocom has embedded a smart home solution within 5G customer premises equipment (CPE). This integration utilizes ST's STM32WB55 microcontroller, which handles Bluetooth, Thread, and Zigbee, alongside Fibocom's FG370 5G module.

Thus, based on the above smart home market analysis, the growing adoption of 5G technology in home devices is expected to drive the smart home market opportunities.

Smart Home Market Segmental Analysis :

By Product:

Based on product, the market is segmented into security & access controls, lighting control, entertainment devices, HVAC, smart kitchen appliances, Home appliances, smart furniture, home healthcare, and other devices.

Trends in the product:

- The growing adoption of customizable automation solutions for HVAC control, entertainment control, and smart kitchens are driving the demand for advanced home devices.

- Artificial intelligence (AI)-driven voice technologies, such as Alexa, Google Assistant, and Siri, are transforming homes by enabling users to control their environments simply by speaking, which makes these systems much easier and more accessible to use.

- Thus, the above factors are driving the smart home market demand.

The security & access controls segment accounted for the largest revenue in the year 2024.

- Security and access control comprises smart locks, security cameras, and alarm systems. These products offer enhanced security features, such as real-time monitoring, remote access, and automated alerts, which provide homeowners with peace of mind and improved safety.

- The integration of artificial intelligence in security devices has further enhanced their functionality, enabling features such as facial recognition and suspicious activity detection.

- For instance, in January 2022, Arlo unveiled the home security system at CES 2022. The security system includes a full suite of home security cameras, which features multi-sensors that are capable of recognizing motion of door and windows.

- Thus, based on the above analysis, these factors are further driving the smart home market growth.

The home healthcare segment is anticipated to register the fastest CAGR during the forecast period.

- Home healthcare encompasses a range of products and services designed to enhance the quality of care for individuals within their homes.

- These solutions leverage technologies such as the Internet of Things (IoT), artificial intelligence (AI), and telemedicine to monitor, diagnose, and treat patients remotely.

- Wearable health devices, such as smartwatches, fitness trackers, and health-monitoring patches, offer real-time data on various health metrics such as heart rate, physical activity, sleep patterns, and blood oxygen levels. This surge in popularity is fuelled by advancements in sensor technology, increased consumer health awareness, and the growing trend towards preventive healthcare.

- Thus, based on the above analysis, these factors are expected to drive the smart home market share during the forecast period.

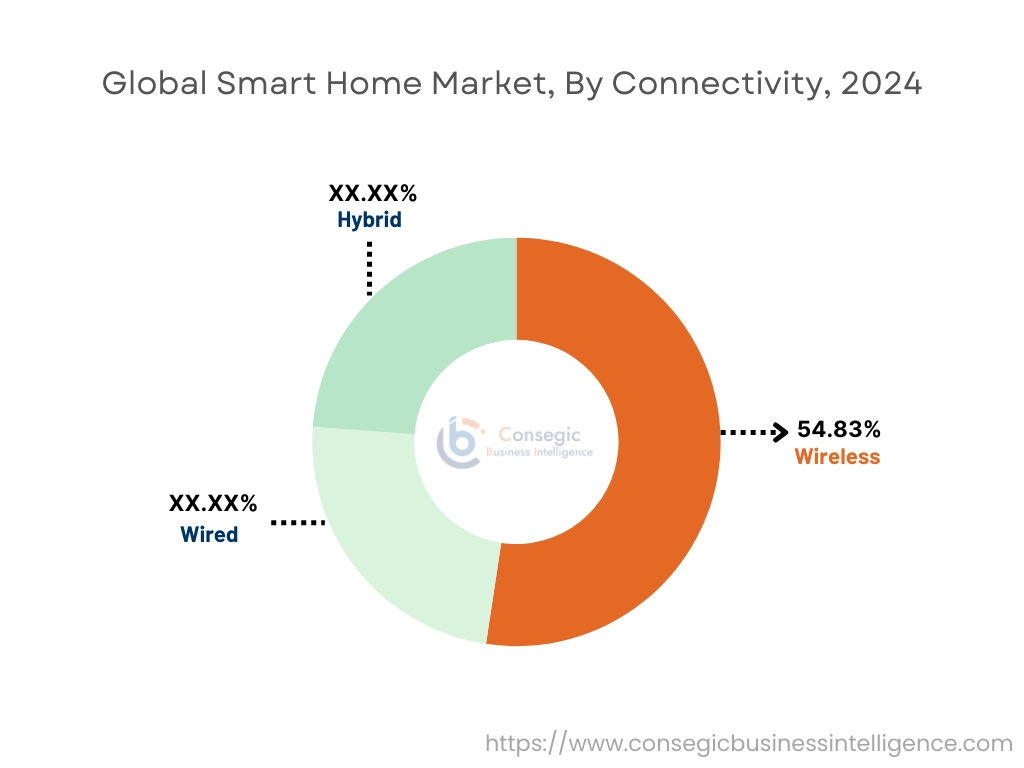

By Connectivity:

Based on connectivity, the market is segmented into wireless, wired, and hybrid.

Trends in the connectivity:

- Consumers are increasingly adopting advanced Wi-Fi routers to meet their escalating data needs, stimulated by the proliferation of smart devices.

- Rising adoption of IoT to enable seamless integration of different devices and systems within a home, allowing for automated and remote control through smartphones and other internet-connected devices, is driving the growth of the segment.

The wireless segment accounted for the largest revenue share of 54.83% in the year 2024 and it is expected to register the highest CAGR during the forecast period.

- The advancements in Bluetooth low energy (BLE) and enhanced near-field communication (NFC) capabilities are broadening the scope of wireless connectivity applications in home device solutions.

- Technological innovations, coupled with increasing adoption of IoT and digitalization trends, are driving the evolution of wireless connectivity solutions, shaping the future of interconnected devices and smart ecosystems worldwide.

- Wireless connectivity technologies such as Wi-Fi, Bluetooth, Zigbee, and Z-Wave play pivotal roles in enabling seamless communication between connected home devices. For example, smart thermostats can adjust temperatures remotely based on user preferences, while smart lighting systems can be controlled from anywhere using a smartphone app.

- For instance, in September 2024, ABB India launched AAB-free home, a wireless home automation solution, to enhance comfort, energy efficiency, security for the residential segment. It allows users to incorporate and control additional elements, such as EV chargers and smart kitchen appliances, through a single interface.

- Thus, based on the above analysis, these factors would further supplement the smart home market

By Application:

Based on application, the market is segmented into new construction and retrofit.

Trends in the application:

- Consumers are increasingly seeking innovative solutions to streamline daily tasks, improve home security, reduce energy consumption, and create personalized living experiences. As a result, the demand for advanced home devices such as smart thermostats, connected lighting systems, intelligent security cameras, and voice-activated assistants has increased significantly.

- With advancements in AI and machine learning (ML), connected home devices can now learn and adapt to individual user preferences, creating a more personalized and responsive environment. As consumer expectations for customized and intuitive solutions continue to rise, the ability to deliver highly personalized experiences will be a key differentiator and growth driver in the market.

The retrofit segment accounted for the largest revenue share in the year 2024.

- The segment development can be attributed to the rising popularity of upgrading existing homes with smart technology.

- Homeowners are increasingly choosing to add smart thermostats, lighting, security, and automation systems to their current residences. This trend is fuelled by the lower costs and simpler installation as compared to full renovations, making home modernization accessible to a broader audience.

- Thus, based on the above analysis, these factors are driving the smart home market growth and trends.

The new construction segment is anticipated to register the fastest CAGR during the forecast period.

- The new construction market is projected to experience the fastest growth, fuelled by the rising trend of integrating smart technologies into newly built homes.

- Developers are responding to consumer demand for energy efficiency, security, and convenience by incorporating advanced automation and connected devices from the ground up.

- Furthermore, evolving building codes are facilitating the inclusion of these smart systems in new constructions.

- These factors are anticipated to further drive the smart home market trends during the forecast period.

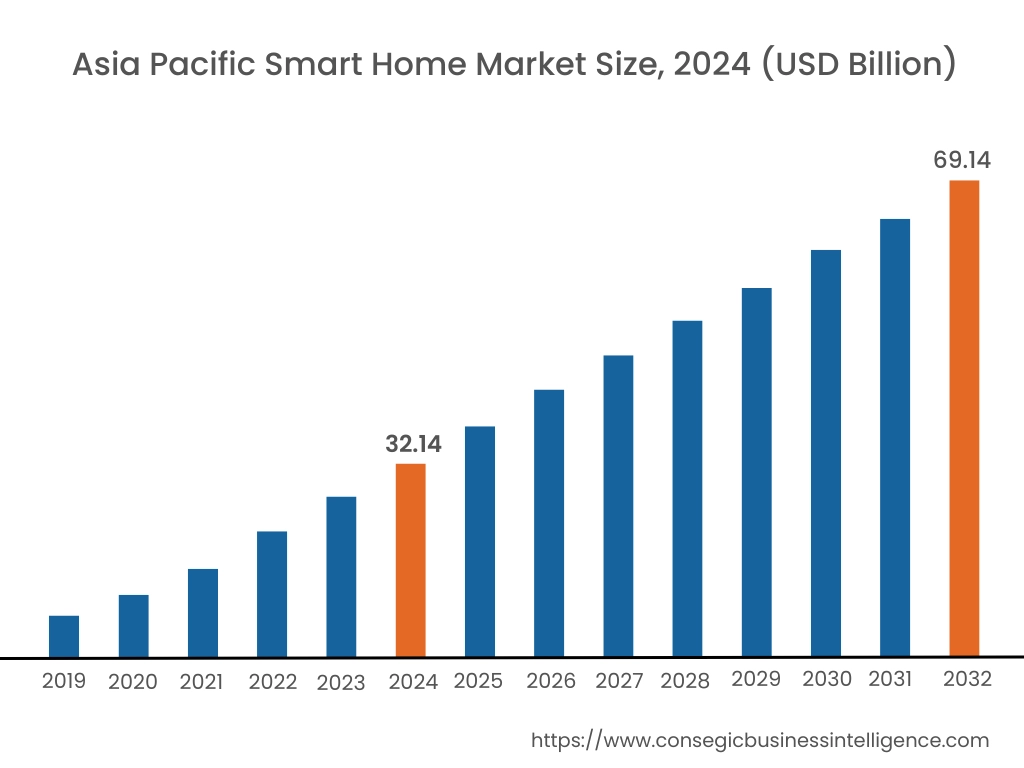

Regional Analysis:

The global market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa (MEA), and Latin America.

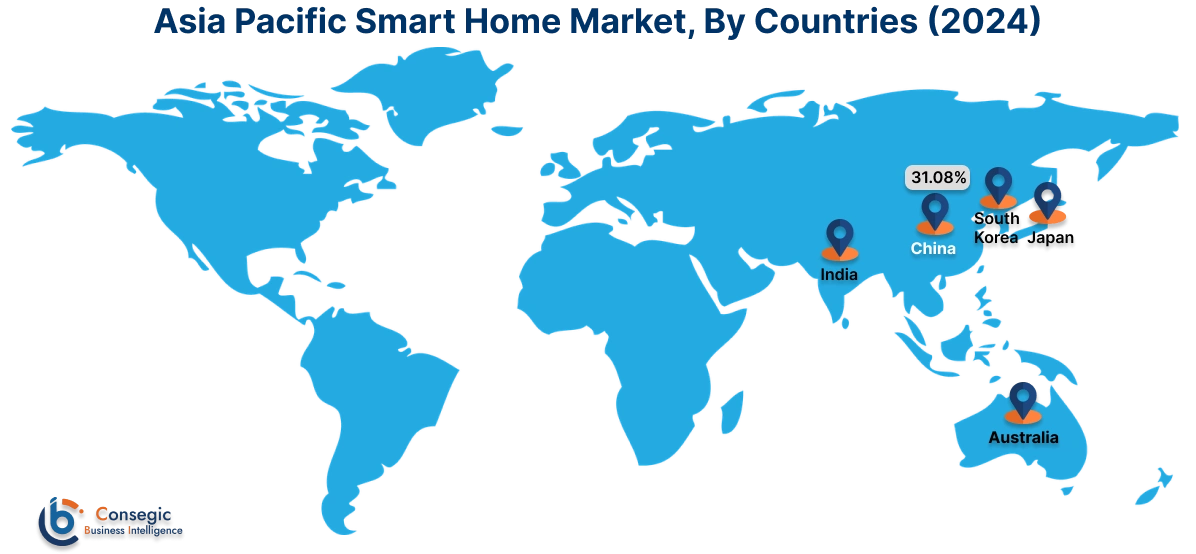

Asia Pacific smart home market expansion is estimated to reach over USD 69.14 billion by 2032 from a value of USD 32.14 billion in 2024 and is projected to grow by USD 34.76 billion in 2025. Out of this, the China market accounted for the maximum revenue split of 31.08%. The regional development can be attributed to the rapid urbanization, rising disposable incomes, and a growing middle-class eagerness to adopt new technologies. Further, China saw substantial market development due to its large population base and government initiatives to promote smart city development. The increasing availability of affordable home devices and the proliferation of internet connectivity across the region contributed to the growing market share. Moreover, the region's dynamic consumer electronics industry and expanding middle-class population present significant opportunities for market players to introduce tailored smart solutions. These factors would further drive the regional smart home market trends during the forecast period.

- For instance, in August 2024, LG Electronics showcased the ThinQ AI Home Hub, a new device designed to simplify home management. This hub enables users to control and monitor all their compatible LG appliances from a single point, offering a more convenient and connected living experience.

North America market is estimated to reach over USD 94.19 billion by 2032 from a value of USD 45.92 billion in 2024 and is projected to grow by USD 49.46 billion in 2025. North America holds the largest market share, driven by the substantial penetration of high-speed internet, widespread smartphone usage, and early adoption of smart technologies. The presence of major technology companies and continuous innovation in the sector also contribute to the region's dominance. Further, consumers in North America are increasingly integrating connected home devices into their daily lives for enhanced convenience, security, and energy management.

- For instance, in June 2024, ABB unveiled the ReliaHome Smart Panel, its first residential energy management platform for the U.S. and Canadian markets. Developed in partnership with Lumin, this solution optimizes on- and off-grid energy use through features like circuit scheduling, real-time control, and whole-home energy monitoring. Compatible with batteries, solar inverters, EV chargers, and generators, the panel supports energy savings and decarbonization goals while ensuring cybersecurity and reliable offline functionality. This launch aligns with ABB’s commitment to accelerating the energy transition through innovative home solutions.

Additionally, according to the analysis, the smart home industry in Europe is projected to witness significant development during the forecast period. The region's growth is fueled by rising consumer need for home automation, stringent energy efficiency regulations, and the increasing popularity of advanced home devices among users. Additionally, the presence of leading European technology companies and their ongoing innovation in home automation products plays a crucial role in expanding the market. Additionally, the growth of Latin American region can be attributed to increasing investments in digital infrastructure and growing adoption of home automation technologies in the developing countries. Further, in Middle East and African regions, the market is driven by urban development projects, increasing crime rates in urban centers, and rising adoption of IoT-enabled home security solutions. Governments in the region are investing in smart city initiatives, supporting the deployment of connected devices for enhanced residential security.

Top Key Players and Market Share Insights:

The global smart home market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the smart home industry include-

- LG Electronics, Inc. (South Korea)

- Siemens AG (Germany)

- Sony Group Corp. (Japan)

- ABB, Ltd. (Switzerland)

- Philips Lighting B.V. (Netherlands)

- Honeywell International, Inc. (U.S.)

- Schneider Electric SE (France)

- com, Inc. (U.S.)

- Google Nest (Google LLC) (U.S.)

- Samsung Electronics Co., Ltd. (South Korea)

- Legrand S.A. (France)

- Robert Bosch GmbH (Germany)

- Assa Abloy AB (Sweden)

Recent Industry Developments :

Partnership:

- In January 2024, Samsung announced a collaboration with Tesla, to integrate SmartThings Energy with Tesla's powerwall, solar inverter, wall connector, and EVs. Leveraging Tesla’s open APIs, this partnership enhances energy monitoring, storage, and management for homeowners. Features include syncing SmartThings Energy with Tesla’s powerwall storm watch for power outage alerts and AI energy mode to optimize backup energy. This integration aligns with Samsung’s net zero home initiative, offering seamless, energy-efficient home experiences.

Smart Home Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 265.10 Billion |

| CAGR (2025-2032) | 10.6% |

| By Product |

|

| By Connectivity |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Smart Home Market? +

Smart Home market size is estimated to reach over USD 265.10 Billion by 2032 from a value of USD 127.46 Billion in 2024 and is projected to grow by USD 137.46 Billion in 2025, growing at a CAGR of 10.6% from 2025 to 2032.

Which is the fastest-growing region in the Smart Home Market? +

Asia-Pacific is the region experiencing the most rapid growth in the market.

What specific segmentation details are covered in the Smart Home report? +

The smart home report includes specific segmentation details for product, connectivity, application, and region.

Who are the major players in the Smart Home Market? +

The key participants in the market are LG Electronics, Inc. (South Korea), Siemens AG (Germany), Schneider Electric SE (France), Amazon.com, Inc. (U.S.), Google Nest (Google LLC) (U.S.), Samsung Electronics Co., Ltd. (South Korea), Legrand S.A. (France), Robert Bosch GmbH (Germany), Assa Abloy AB (Sweden), Sony Group Corp. (Japan)ABB, Ltd. (Switzerland), Philips Lighting B.V. (Netherlands), Honeywell International, Inc. (U.S.), and others.