Pressure Control Equipment Market Size:

Pressure Control Equipment Market Size is estimated to reach over USD 8.58 Billion by 2032 from a value of USD 5.32 Billion in 2024 and is projected to grow by USD 5.52 Billion in 2025, growing at a CAGR of 5.7% from 2025 to 2032.

Pressure Control Equipment Market Scope & Overview:

Pressure control equipment (PCE) refers to devices that maintain fluid pressure moderation and monitoring in industries, more specifically in oil fields. Devices such as valves, blowout preventers, and control heads help maximize safety and enhance efficiency by avoiding excess pressure and maintaining optimum working conditions. Moreover, the advantages of using PCE include improved safety, automatic control of high pressure, and ease of installation among others.

Pressure Control Equipment Market Dynamics - (DRO) :

Key Drivers:

Growing need for green hydrogen and natural gas is driving the pressure control equipment market expansion

The global market is being propelled by the growing use of green hydrogen, which is made from renewable energy sources such as windmills, solar systems, and others, alongside the increasing need for natural gas such as methane and ethane that are recognized for lower carbon emissions. These developments are generating a strong market for pressure control machinery, which is crucial for maintaining secure and effective operations within the oil & gas sector.

- For instance, in August 2023, Greenfuel Energy Solutions announced the partnership with VENTREX, a company specializing in electronic pressure control for LNG (liquefied natural gas), H2 (hydrogen), and CNG (compressed natural gas), to introduce green hydrogen solutions and advanced natural gas to the Indian market.

Thus, according to the pressure control equipment market analysis, the growing need for green hydrogen and natural gas is driving the pressure control equipment market size.

Key Restraints :

Growing technological complexity is affecting the pressure control equipment market demand

One of the primary challenges associated with the market includes technological complexity, driven by development and implementation costs. Designing and manufacturing high-precision pressure control products requires substantial investment in research and development, as well as specialized manufacturing processes. Further, technological complexity also presents challenges in terms of maintenance and operational support. Complex systems may require specialized training for maintenance personnel, as well as ongoing technical support to ensure optimal performance and reliability. This can increase operational costs for end-users, particularly in industries where downtime can have significant financial and operational implications. Thus, the aforementioned factors would further impact the pressure control equipment market size.

Future Opportunities :

Growing need for artificial intelligence (AI)-driven well control solutions is expected to drive pressure control equipment market opportunities

AI-powered systems that are meant to control wellbore pressure provide significant improvements in the pressure control equipment market by combining advanced technologies aimed at optimizing drilling processes and enhancing safety standards. Wellbore pressures are managed using current data from pressure control systems through machine learning algorithms or predictive analytics, thus, minimizing the likelihood of blowouts. The collaboration enhances operational efficiency while increasing the need for highly specialized control equipment, which leads to enormous market openings since the sector is moving towards higher automation levels as well as more data-dependent operations.

- For instance, in July 2024, RoboWell, an autonomous well control solution developed by AIQ, was utilized by ADNOC in the NASR field in the offshore region. This technology uses cloud-based AI to autonomously modify well operations when required. As a result, safety is increased while efficiency is improved, travel and physical interventions are reduced significantly, and emissions are minimized.

Thus, based on the above pressure control equipment market analysis, the rising adoption of AI-driven well control solutions, which comprise pressure equipment is expected to drive the pressure control equipment market opportunities.

Pressure Control Equipment Market Segmental Analysis :

By Component:

Based on component, the market is segmented into valves, control heads, wellhead flange, wireline pressure control equipment, coiled tubing pressure control equipment, quick unions, flow tree, and others.

Valves are used for regulating pressure within pressure control systems. They open and close, automatically or manually, based on the pressure readings, maintaining the system at the desired pressure levels. Valves such as control valves, choke valves, and relief valves are often used in pressure control systems. Control valves are mainly used for controlling the flow rates and pressure in response to signals from a control system, which enables dynamic pressure management. Additionally, control heads are designed to manage and regulate pressure, which are essential in both onshore and offshore drilling environments.

Trends in the component:

- There is a rising trend towards adoption of sustainable pressure equipment as companies are increasingly focusing on innovations with minimized environmental impact.

- There is a rise in need for the control valves in the centrifugal pump systems where continuous flow is required for the machine to run efficiently without breakdown.

- Thus, based on the above analysis, these trends are driving the pressure control equipment market demand.

The valves segment accounted for the largest revenue in the year 2024.

Technological advancements and innovations in pressure reducing valve design and manufacturing processes are transforming the market landscape, offering enhanced performance, reliability, and functionality. Manufacturers are increasingly focusing on developing advanced pressure, reducing valve solutions with features such as digital control, remote monitoring, and predictive maintenance capabilities to meet the evolving needs of end-users. Moreover, the emergence of smart technologies and internet of things (IoT) integration is opening new prospects for optimizing pressure control systems and enabling real-time monitoring and adjustment.

- For instance, in October 2023, Purem by Eberspaecher introduced a gas control valve (GCV). GCV aims to address the transformation of the automotive sector and expand its product portfolio. The component is compatible with all segments including mobile power generators, fuel cell-powered passenger cars, commercial vehicles, off-highway vehicles, and trains.

Thus, based on the above analysis, these factors are further driving the pressure control equipment market growth.

The control heads segment is anticipated to register the fastest CAGR during the forecast period.

Pressure control heads are designed to manage and regulate pressure in wellbore that prevent blowouts by maintaining well integrity, which is essential in both onshore and offshore drilling environments. It plays a critical role in ensuring the safety and efficiency of drilling operations in the oil and gas sector. Moreover, the advanced sealing technology, compatibility with high-pressure and high-temperature operations, and integration with digital monitoring systems enhance the functionality and reliability of pressure control heads. Thus, based on the above analysis, these factors are expected to drive the pressure control equipment market share during the forecast period.

By Type:

Based on the type, the market is segmented into low-pressure and high-pressure.

Low pressure control system is designed to manage lower pressure environments, which typically include operations carried out in surface-level activities or near-surface operations, where pressure is not excessively high. Meanwhile, high pressure control system is designed to manage and control very high-pressure conditions that are usually prevalent in oil and gas operations, specifically during deep-water drilling, oil recovery, and others.

Trends in the type:

- The innovations such as automation, scalability, and integration with existing production lines have significantly enhanced the operational efficiency of high and low-pressure equipment, encouraging its adoption across various industries.

- As technological advancements continue to enhance the performance and cost-effectiveness of high and low-pressure systems, manufacturers are investing in upgrading their equipment to stay competitive and capitalize on emerging prospects in the high and low-pressure processing landscape.

- Thus, these factors would further supplement the pressure control equipment market trends and growth.

The high-pressure segment accounted for the largest revenue share in the year 2024 and is anticipated to register the fastest CAGR during the forecast period.

High-pressure equipment is designed to manage and regulate fluid or gas systems operating at elevated pressure levels. Further, high-pressure components typically incorporate durable materials and specialized sealing technologies to withstand extreme pressures and harsh environmental conditions encountered in offshore drilling rigs or deep-sea exploration. High-pressure components typically incorporate durable materials and specialized sealing technologies to withstand extreme pressures and harsh environmental conditions encountered in offshore drilling rigs or deep-sea exploration.

- For instance, in January 2021, High-Pressure Equipment Company (HiP) launched a triple pump model for the PT2020 automated pressure testing controller system. The system is used in varying hydrostatic tests to automate pressure control mechanisms. The new controller enables the smooth functioning of test benches that have been fitted with three different types of pumps, while simplifying the testing procedure.

Thus, the above factors would further supplement the pressure control equipment market share.

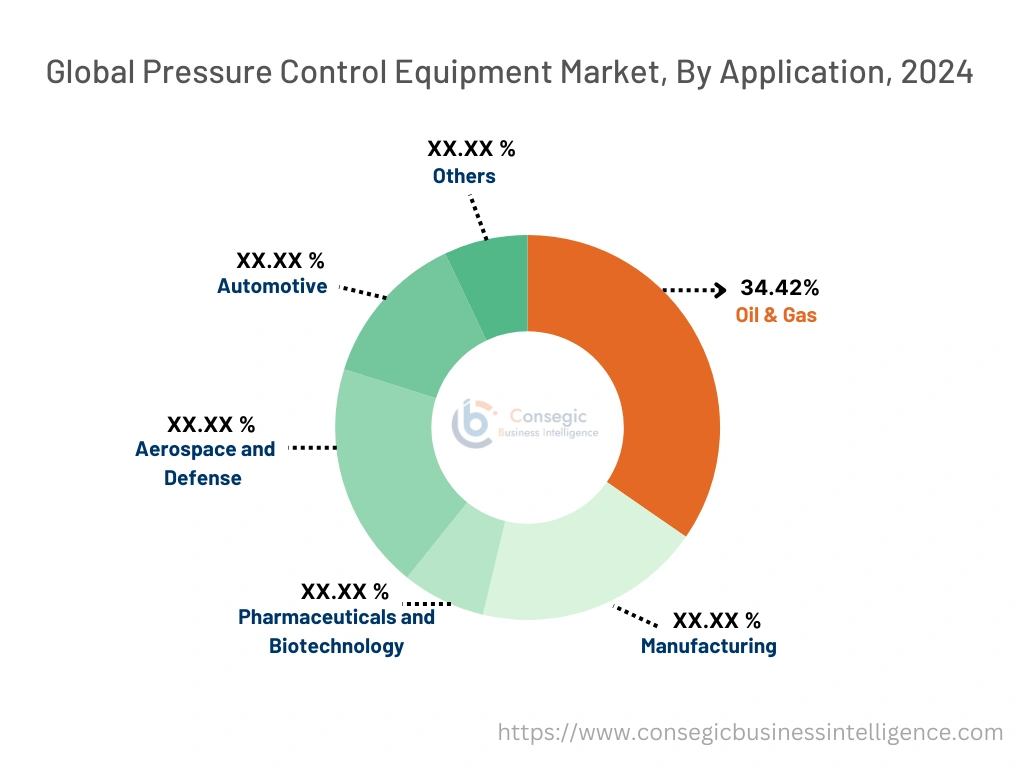

By Application:

Based on application, the market is segmented into manufacturing, automotive, aerospace and defense, oil and gas, pharmaceuticals and biotechnology, and others.

Pressure control devices are primarily used in oil & gas sector for applications including drilling operations, well testing, and oil & gas production operations. Moreover, pressure control devices are essential for managing high pressure during drilling. They prevent blowouts by controlling the flow of fluids and gases from the wellbore. Additionally, pressure control systems are also used in manufacturing sector for monitoring and maintaining consistent pressure levels in manufacturing processes, in turn contributing to improved process control, quality control, and consistency.

Trends in the application:

- The growing demand for energy, coupled with advancements in subsea technologies, is driving the adoption of pressure control systems in offshore drilling projects.

- The automotive sector is inclining towards hybrid vehicles, which are available with embedded pressure sensors and control valves used for fuel vapor, leakage control, and exhaust emission control among others.

- These factors are anticipated to further drive the pressure control equipment market trends during the forecast period.

The oil and gas accounted for the largest revenue share of 34.42% in 2024 and it is anticipated to register the fastest CAGR during the forecast period.

The increasing focus on environmental protection and operational safety in the oil and gas sector is influencing the application of pressure control equipment. Regulatory bodies across the globe are imposing stringent safety standards to mitigate the risks associated with oil and gas extraction. As a result, operators are investing in high-quality pressure control systems that comply with these regulations, further boosting its demand in both onshore and offshore applications. The ongoing digital transformation of the oil and gas sector is also encouraging the development of smart pressure control equipment that offers enhanced data analytics capabilities, supporting predictive maintenance and minimizing the risk of equipment failure.

- For instance, in March 2025, Schlumberger launched electric well control (EWC) technology, which aims to lower both upfront (capex) and ongoing (opex) costs while improving the safety of crucial drilling activities. By incorporating industrial internet of things (IIoT) elements into its design, EWC provides instant pressure readings, eliminating the need for traditional pressure gauges.

Therefore, the aforementioned factors are driving the pressure control equipment market growth.

Regional Analysis:

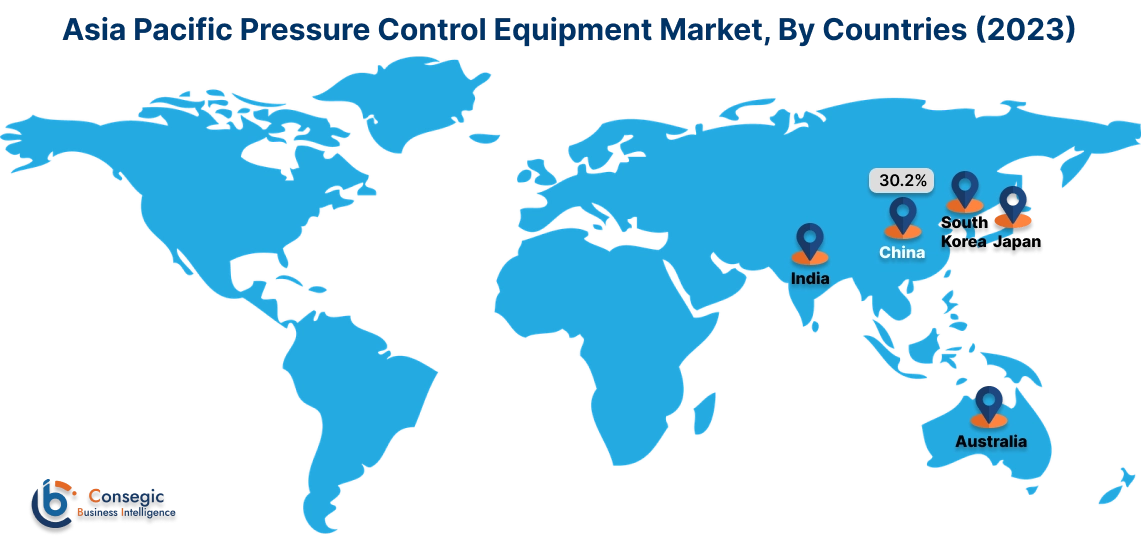

The global market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

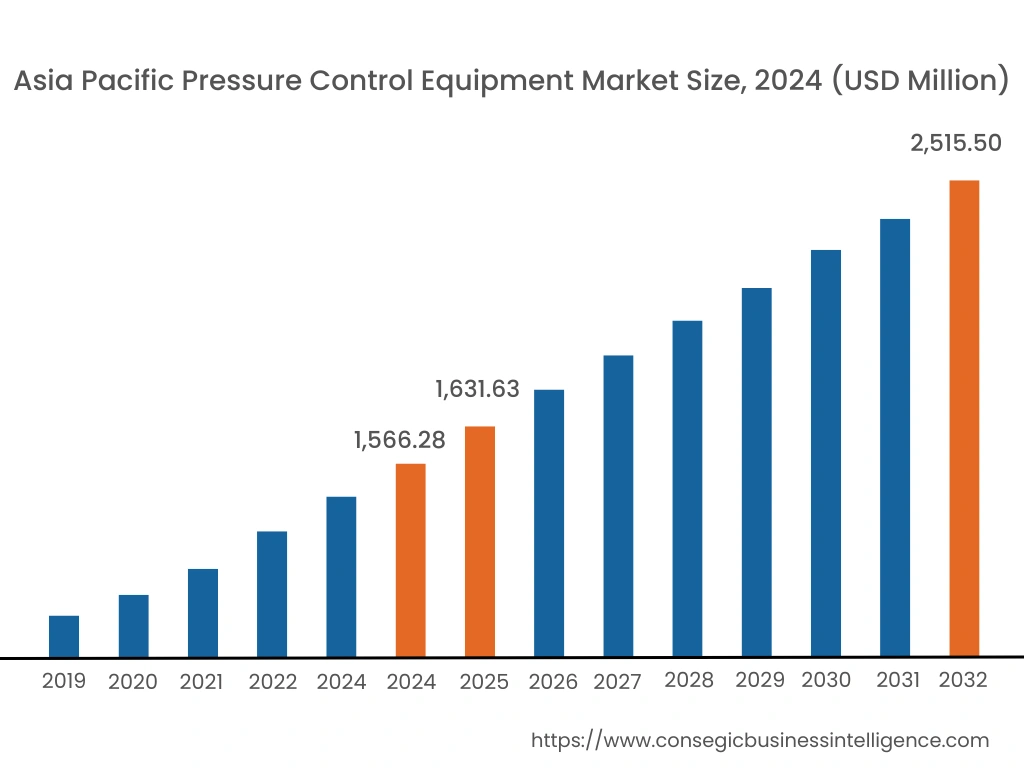

Asia Pacific Pressure Control Equipment market expansion is estimated to reach over USD 2.32 billion by 2032 from a value of USD 1.38 billion in 2024 and is projected to grow by USD 1.44 billion in 2025. Out of this, the China market accounted for the maximum revenue split of 30.20%. Asia-Pacific emerged as a rapidly growing region for pressure and control equipment, fueled by increasing industrialization, infrastructure development, and rising investments in energy exploration and production. Countries in the region are witnessing significant demand for pressure control solutions across diverse industries, including oil and gas, automotive manufacturing, and healthcare. Further, the region's economic growth and expanding industrial base contributed to its expanding market, with manufacturers focusing on localized production and strategic partnerships to capitalize on emerging opportunities. These factors would further drive the regional pressure control equipment market during the forecast period.

- For instance, according to the International Energy Agency, Asia Pacific accounted for the market share of 76.1% (domestic gas production) of the total gas supply in 2022. The above factors are driving the pressure control equipment industry in the region.

North America market is estimated to reach over USD 3.14 billion by 2032 from a value of USD 1.96 billion in 2024 and is projected to grow by USD 2.03 billion in 2025. North America holds a significant share in the global market, driven by technological advancements and the presence of key market players. The region's mature industrial base and the rapid adoption of IoT and Industry 4.0 technologies are fueling the need for advanced pressure control solutions. Further, the stringent regulatory standards for safety and environmental compliance is further boosting the market. The United States, being a major contributor, is focused on modernizing its infrastructure and industrial systems, creating a steady need for automatic pressure control valves. These factors would further drive the market trends in North America.

- For instance, in January 2021, Honeywell has launched its latest cabin pressure control and monitoring system (CPCMS) for commercial and military airplanes. The CPCMS improves the safety and comfort of those on board by reliably managing and tracking the air pressure inside the aircraft cabin.

According to the analysis, the pressure control equipment industry in Europe is growing significantly. The region is backed by the growing gas appliances sector, which caters to the surging request for heating devices, hot water production, and others across the region. Further, the Latin American region is experiencing a rising need for deep-water drilling projects along with the growth of hydrocarbon production. Countries such as Brazil, Argentina, and others are representing the cumulative expansion of the pressure control equipment market in the region.

Moreover, the Middle East & Africa is poised for moderate development. The determinants affecting the growth include the growing drill bits manufacturing projects in Saudi Arabia and UAE alongside the region's surging demand for gas supply, which are major factors driving the pressure control equipment market.

Top Key Players & Market Share Insights:

The global pressure control equipment market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global pressure control equipment market. Key players in the pressure control equipment industry include-

- Emerson Electric Co. (U.S.)

- NXL Technologies (Canada)

- TIS Manufacturing (U.K.)

- Brace Tool Inc. (U.S.)

- Parker Hannifin Corp (U.S.)

- Weatherford (U.S)

- Baker Hughes Company (U.S)

- The Weir Group PLC (U.K.)

- Maschinenfabrik Reinhausen (Germany)

- SLB (U.S)

Recent Industry Developments :

Product Launch:

- In May 2024, Emerson announced the launch of AVENTICS series 625 sentronic proportional pressure control valves. It features a control deviation capability of less than 0.5%m, which delivers high accuracy, flexibility, and support to pneumatic control engineering applications. The equipment is compatible with data acquisition software that makes it easier to quickly start up, monitor, and control valves directly on a PC.

Pressure Control Equipment Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 8.58 Billion |

| CAGR (2025-2032) | 5.7% |

| By Component |

|

| By Type |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Pressure Control Equipment Market? +

Pressure Control Equipment market size is estimated to reach over USD 8.58 Billion by 2032 from a value of USD 5.32 Billion in 2024 and is projected to grow by USD 5.52 Billion in 2025, growing at a CAGR of 5.7% from 2025 to 2032.

Which is the fastest-growing region in the Pressure Control Equipment Market? +

Asia-Pacific region is experiencing the most rapid growth in the market.

What specific segmentation details are covered in the Pressure Control Equipment report? +

The Pressure Control Equipment report includes specific segmentation details for component, type, application, and region.

Who are the major players in the Pressure Control Equipment Market? +

The key participants in the market are Emerson Electric Co. (U.S.), NXL Technologies (Canada), Weatherford (U.S), Baker Hughes Company (U.S), The Weir Group PLC (U.K.), Maschinenfabrik Reinhausen (Germany), SLB (U.S), TIS Manufacturing (U.K.), Brace Tool Inc. (U.S.), Parker Hannifin Corp (U.S.), and others.

What are the key trends in the Pressure Control Equipment Market? +

The Pressure Control Equipment market is being shaped by several key trends including the surge in demand for HVAC devices, Control vales in centrifugal pumps, and various applications in the automotive, oil, and gas sectors and other are the key trends in the pressure control equipment market.