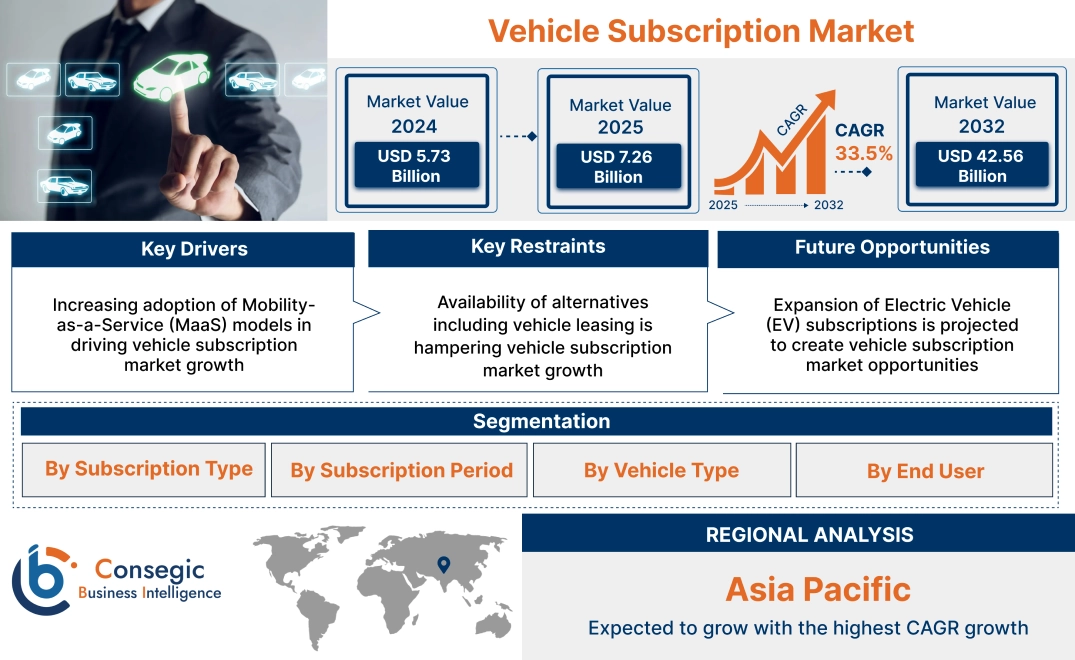

Vehicle Subscription Market Size:

Vehicle Subscription Market Size is estimated to reach over USD 42.56 Billion by 2032 from a value of USD 5.73 Billion in 2024 and is projected to grow by USD 7.26 Billion in 2025, growing at a CAGR of 33.5% from 2025 to 2032.

Vehicle Subscription Market Scope & Overview:

A vehicle subscription is a service that provides customers with access to a vehicle for a recurring fee, usually on a monthly basis. Unlike traditional car ownership or leasing, vehicle subscriptions offer greater flexibility including insurance, maintenance, and the option to switch vehicles within the subscription period. This model offers a flexible transportation solution, eliminating the need for long-term car ownership.

How is AI Transforming the Vehicle Subscription Market?

AI is transforming the vehicle subscription market by enabling deeper personalization, optimizing fleet management, and streamlining the customer journey from acquisition to ongoing service. Also, Chatbots and virtual assistants provide 24/7 support, answer queries, and facilitate the subscription process, creating a more frictionless experience. Further, AI personalizes infotainment systems, provides real-time traffic updates, and enables over-the-air software updates for a continuously evolving user experience. Thus, AI processes vehicle data to predict potential breakdowns, allowing for proactive maintenance that reduces downtime and keeps vehicles operational.

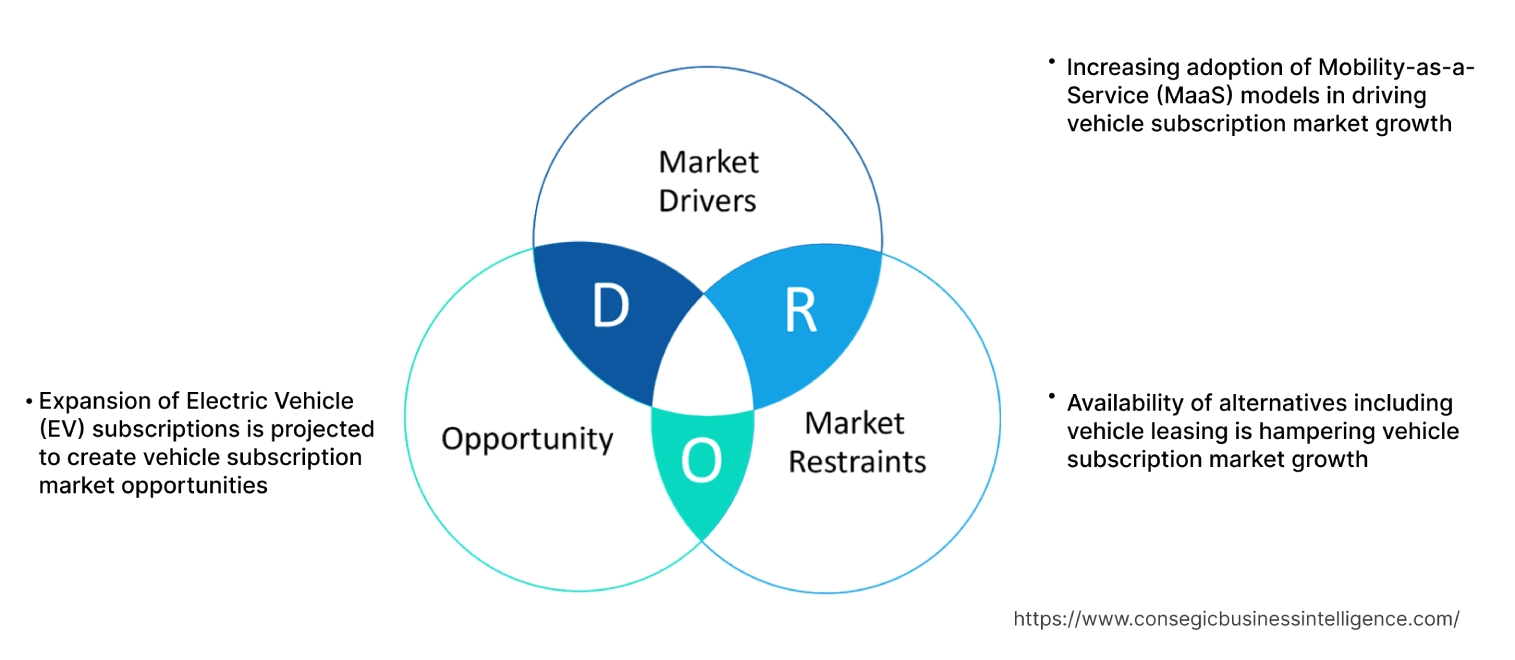

Vehicle Subscription Market Dynamics - (DRO) :

Key Drivers:

Increasing adoption of Mobility-as-a-Service (MaaS) models in driving vehicle subscription market growth

MaaS emphasizes flexible, on-demand transportation solutions and vehicle subscriptions align with this trend. MaaS platforms integrate various transportation services, including ride-hailing, car-sharing, and public transit. Vehicle subscriptions fit seamlessly into this ecosystem, providing an additional layer of flexible mobility. Additionally, MaaS prioritizes user convenience, offering streamlined booking, payment, and service delivery through digital platforms. Vehicle subscription services have adopted this approach, providing easy access to vehicles with all-inclusive packages, hence boosting the vehicle subscription market size.

- For instance, in August 2021, SUN Mobility launched "Integrated Mobility-as-a-Service" (MaaS) package, combining electric vehicles with unlimited battery swapping for a fixed contract period. This all-inclusive service aims to simplify EV adoption by offering a bundled solution that covers both the vehicle and its energy needs through their established battery swapping technology.

Consequently, the growing adoption of Mobility-as-a-Service (MaaS) models is driving the vehicle subscription market expansion.

Key Restraints:

Availability of alternatives including vehicle leasing is hampering vehicle subscription market growth

Leasing provides a structured and affordable option, with lower monthly payments than buying, becoming an ideal option for users desiring long-term vehicle access and conventional expenses. Its established infrastructure and consumer familiarity present a significant hurdle for emerging subscription models. Additionally, services like car-sharing and ride-hailing provide on-demand access to vehicles, especially for short-term needs. In urban areas, where parking and congestion are concerned, these alternatives offer convenient solutions, reducing the necessity for personal vehicle ownership or subscription. The flexibility of paying only for usage, rather than a fixed monthly fee, appeals to budget-conscious consumers, further restraining the growth of the global vehicle subscription market.

Therefore, as per the analysis, these combined factors are significantly hindering vehicle subscription market expansion.

Future Opportunities :

Expansion of Electric Vehicle (EV) subscriptions is projected to create vehicle subscription market opportunities

EV subscriptions are expected to alleviate consumer concerns about the high upfront costs of EVs and battery range anxiety. Offering flexible subscription terms allows consumers to experience EVs without long-term commitments, reducing the risk of switching to electric. In addition, subscriptions accelerate the transition to electric mobility by providing access to EVs for a broader range of consumers. Moreover, EV subscriptions align with the growing demand for sustainable transportation solutions, appealing to environmentally conscious consumers. By promoting EV adoption, subscription services contribute to reducing carbon emissions and fostering a greener mobility ecosystem, thus boosting the vehicle subscription market demand.

- For instance, in May 2023, Merge Electric Fleet Solutions introduced "FleetScription" a complete EV subscription package designed for businesses. This service simplifies fleet electrification by bundling duty-capable EVs, charging infrastructure, data analytics, deployment planning, and driver support into a single, comprehensive offering, aiming to reduce the risks associated with transitioning to electric fleets.

Hence, based on the analysis, increasing adoption of Electric Vehicle (EV) subscriptions is expected to create vehicle subscription market opportunities.

Vehicle Subscription Market Segmental Analysis :

By Subscription Type:

Based on the Subscription Type, the market is bifurcated into Single Brand Subscription and Multi Brand Subscription.

Trends in the Subscription Type:

- Single brand subscription provide access to the latest models and technologies from the specific brand.

- Growing adoption of multi-brand subscriptions to offer greater flexibility, allowing users to switch between different models based on their needs.

Multi Brand Subscription accounted for the largest revenue in 2024 and is also projected to witness the fastest CAGR during the forecast period.

- Multi-brand subscriptions provide flexibility enabling users to switch between different vehicle types based on their needs. For instance, a subscriber might opt for a compact car for daily commutes and an SUV for weekend trips.

- Consumers prioritize the ability to access diverse range of models, which allows them to experience different driving dynamics and features.

- Additionally, multi-brand subscriptions offer less restrictive alternative to traditional car ownership. Subscribers avoid the financial burden of depreciation, long-term contracts, and the stress of reselling vehicles.

- For instance, in November 2021, Mahindra Finance launched "Quiklyz," a multi-brand vehicle subscription service, targeting both corporate and individual customers. Quiklyz simplifies vehicle access by handling registration, insurance, and maintenance, offering a wide selection of cars from various manufacturers. This service aims to provide a flexible and hassle-free alternative to traditional car ownership for both businesses and consumers.

- Thus, as per the vehicle subscription market analysis, the aforementioned factors are driving the multi-brand subscriptions segment.

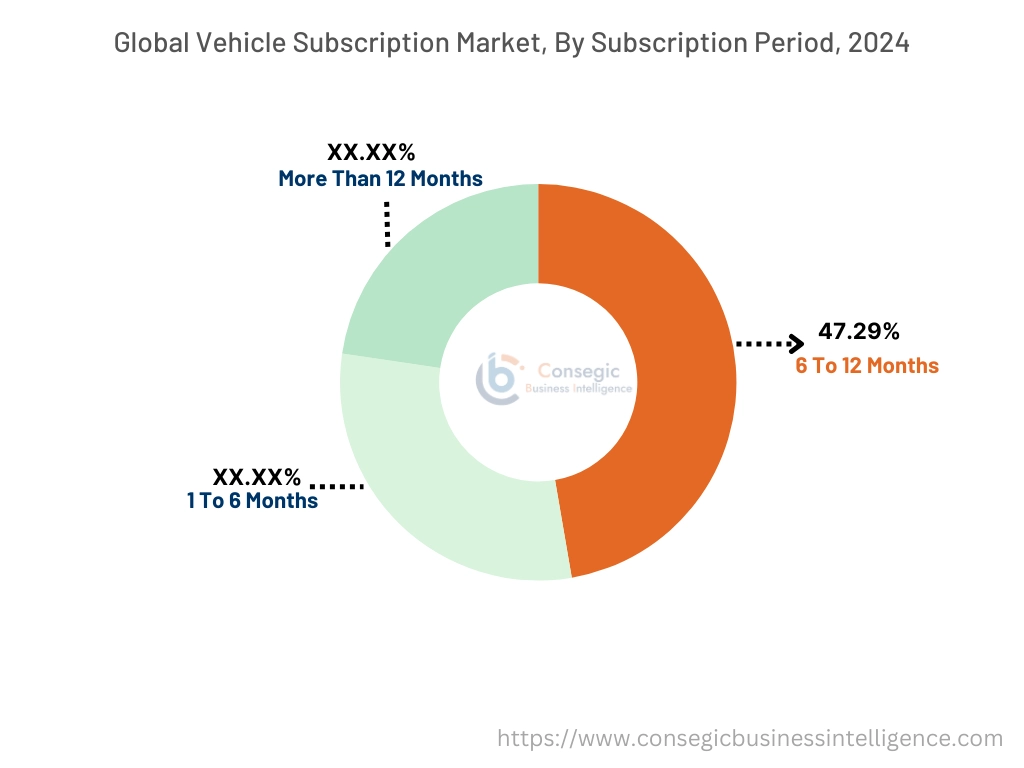

By Subscription Period:

Based on the Subscription Period, the market is categorized into 1 to 6 Months, 6 to 12 Months, and More than 12 Months.

Trends in Subscription Period:

- 1 to 6 months segment is ideal for individuals with temporary transportation needs, such as seasonal workers and for people relocating for short periods.

- Growing adoption of vehicles for 6 to 12 months is gaining traction as it strikes a balance between flexibility and practicality.

6 to 12 Months accounted for the largest revenue share of 47.29% in 2024.

- This duration strikes a balance between short-term flexibility and longer-term usability. It provides consumers with sufficient time to experience a vehicle without the need of traditional leasing or ownership.

- It also allows consumers to truly experience a car across diverse driving conditions and throughout the year, thus driving the vehicle subscription market demand.

- 6-to-12-month period provides ample time for potential buyers to assess a vehicle's fit, particularly for those considering future purchases.

- Therefore, as per the market analysis, the aforementioned benefits are bolstering the vehicle subscription market trend.

1 to 6 Months is predicted to register the fastest CAGR during the forecast period.

- It offers a low-commitment way to test-drive vehicles before making a longer-term commitment to a subscription.

- In densely populated urban areas, where parking and long-term car ownership is challenging, short-term subscriptions are expected to provide a convenient alternative.

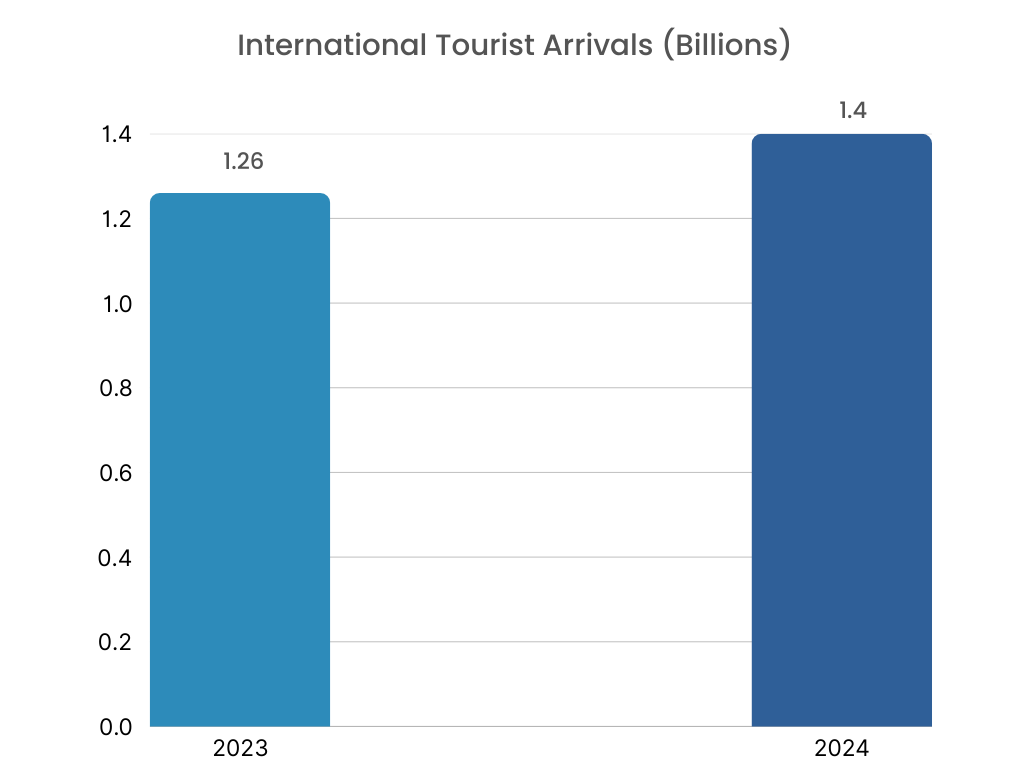

- Further, the tourism industry is a major driver of this trend, with travelers seeking temporary transportation solutions.

- For instance, according to UN Tourism, approximately 1.4 billion international tourist arrivals were recorded, marking an 11% increase from 2023 and indicating a 99% recovery compared to 2019 figures.

- Therefore, the above-mentioned factors are contributing notably in spurring the vehicle subscription industry.

By Vehicle Type:

Based on the Vehicle Type, the market is bifurcated into IC Engine Vehicles and Electric Vehicles.

Trends in the Vehicle Type:

- Growing trend towards the adoption of subscription services to offer a convenient way for consumers without the long-term commitment of ownership.

- IC engine vehicles have established infrastructure, wider availability, and lower upfront costs compared to EVs.

IC Engine Vehicles accounted for the largest revenue share in 2024.

- Subscription providers have greater access to a diverse range of IC engine vehicles, making them available for consumers, hence driving the market demand.

- The widespread availability of gas stations enhances the convenience of IC engine vehicles, thus fuelling the market.

- Generally, IC engine vehicles have lower upfront costs compared to EVs, enabling subscription providers to offer competitive pricing, thereby boosting the market size.

- Thus, as per the analysis, the aforementioned factors are driving the vehicle subscription market share.

Electric Vehicles are predicted to register the fastest growth during the forecast period.

- Consumers are becoming conscious of their environmental impact, driving need for sustainable transportation solutions. EVs offer a cleaner alternative to traditional IC engine vehicles, aligning with this growing trend.

- Governments worldwide are implementing policies to promote EV adoption, including subsidies, tax breaks, and stringent emission regulations, which create a favorable environment for EVs.

- For instance, in September 2021, Volkswagen introduced "AutoAbo," a subscription service in Germany, allowing customers to rent its popular electric ID.3 and ID.4 models on a monthly basis. ID.3 is available starting at EUR 499 per month, offering a flexible entry point into electric vehicle usage. This initiative aims to provide a convenient and accessible way for consumers to experience Volkswagen's EV lineup without the commitment of traditional ownership.

- Subsequently, the aforementioned factors are collectively responsible in driving the vehicle subscription market trend.

By End-User:

Based on the End User, the market is bifurcated into Private and Corporate.

Trends in the End User:

- Growing adoption of subscription services by private consumers due to the flexibility and convenience.

- Corporate clients are utilizing vehicle subscriptions for fleet management, seeking to optimize costs and streamline operations.

Corporate accounted for the largest revenue share in 2024 and is also predicted to witness the fastest growth.

- Subscriptions offer a flexible way to scale fleets up or down based on business needs, driving the market demand.

- Companies are using subscriptions for employee mobility, particularly for short-term projects or temporary assignments, thus fueling the market.

- EV subscriptions are gaining traction in the corporate sector as companies strive to meet sustainability goals.

- Corporate subscriptions also provide a way to reduce the administrative burden of fleet management, thus boosting the vehicle subscription market size.

- Thus, as per the analysis, the aforementioned factors are driving the vehicle subscription market share.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

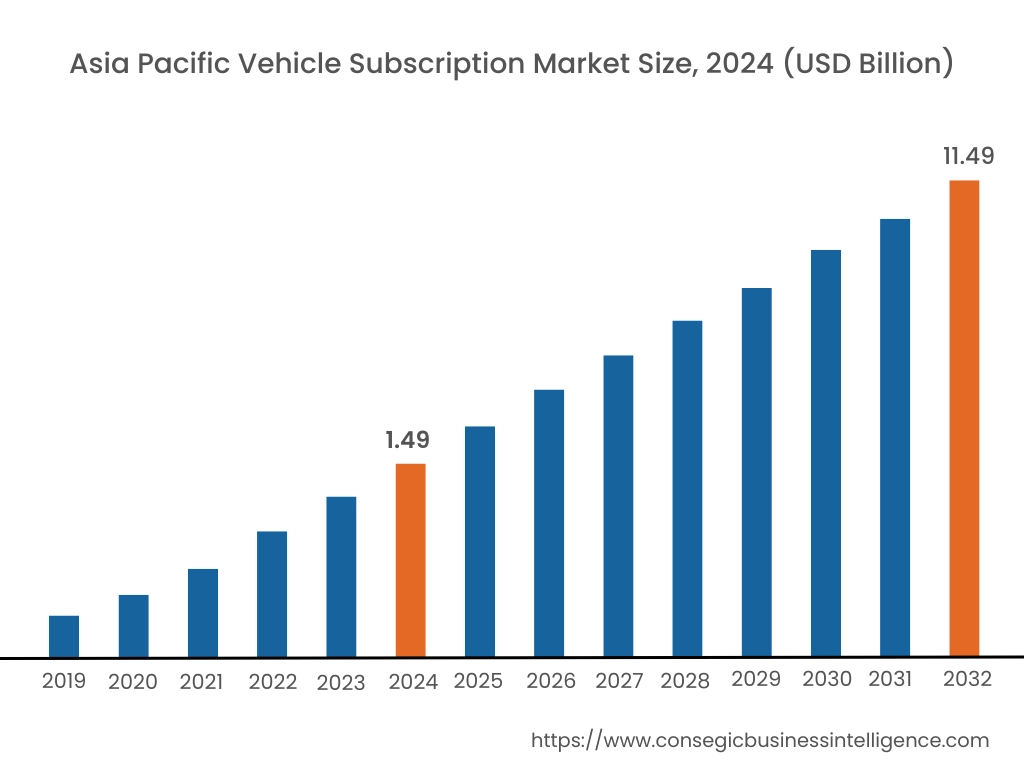

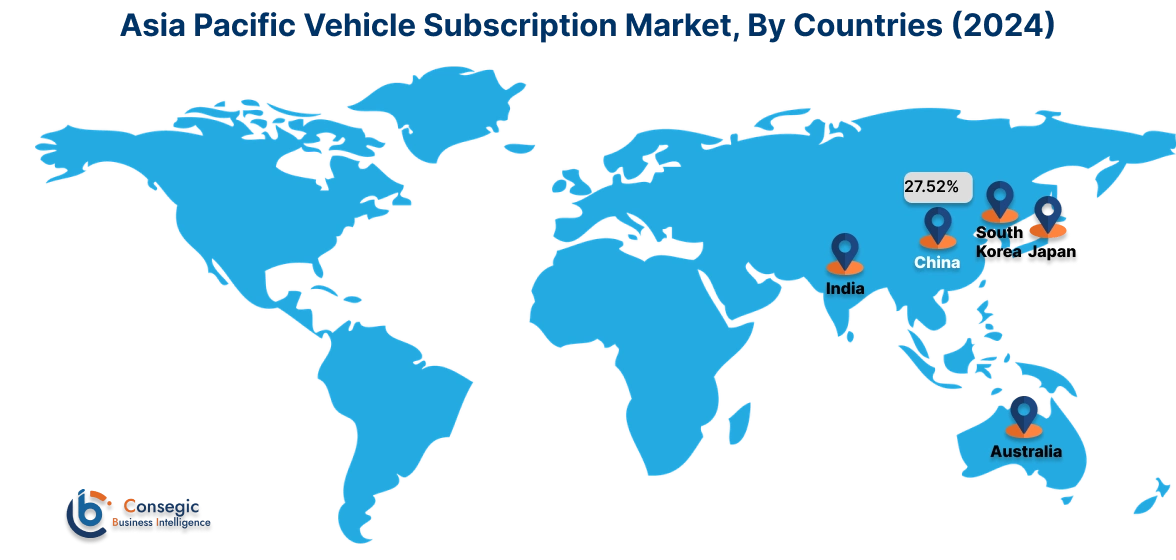

Asia Pacific region was valued at USD 1.49 Billion in 2024. Moreover, it is projected to grow by USD 1.89 Billion in 2025 and reach over USD 11.49 Billion by 2032. Out of these, China accounted for the largest revenue share of 27.52% in 2024. The increasing integration of digital technologies into vehicles and mobility services is enhancing the appeal of vehicle subscriptions in Asia Pacific countries. Online platforms, mobile apps, and connected car features are making it easier for consumers to access and manage their subscriptions. Also, the accelerating adoption of EVs in the Asia-Pacific region is creating new opportunities for these services, further contributing to market development.

- For instance, in India's electric vehicle (EV) market is rapidly expanding, with significant EV adoption in 3-wheelers and growing percentages in 2-wheelers and cars. The surge is driving substantial increase in the Indian EV battery market, projected to increase from USD 16.77 billion in 2023 to USD 27.70 billion by 2028.

North America was valued at USD 1.87 Billion in 2024. Moreover, it is projected to grow by USD 2.37 Billion in 2025 and reach over USD 13.79 Billion by 2032. Vehicle subscriptions are gaining traction for corporate fleets, offering businesses flexible and cost-effective transportation solutions in American countries. Additionally, the market includes a mix of original equipment manufacturers (OEMs), independent service providers, and rental car companies offering subscription options. Furthermore, the increasing vehicle sales are also contributing notably in propelling the growth of vehicle subscription market.

- For instance, Mexico's motor vehicle sales experienced an increase in January 2025, rising by 5.4% compared to the previous month's 2.1%. This reflects a positive curve in the Mexican automotive market, with January's sales reaching 123,669 units. While the historical average growth rate sits at 6.2%, this recent rise indicates a strengthening market.

As per the vehicle subscription market analysis, Europe is experiencing robust growth, driven by shifting consumer preferences towards flexible mobility solutions. There is a strong increase in electric vehicle subscriptions, supported by government incentives and growing environmental awareness. In Latin America, infrastructure challenges exist, however the market is attracting attention from both established automakers and emerging mobility providers. Further, in ME&A region, particularly in the Gulf region, premium and luxury vehicles are increasing, which in turn, is driving the market.

Top Key Players and Market Share Insights:

The market is highly competitive with major players providing vehicle subscription to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the vehicle subscription industry include-

- ZoomCar (India)

- Wagonex Limited (UK)

- Volvo Car Corporation (Sweden)

- Volkswagen (Germany)

- Tesla (USA)

- Tata Motors (India)

- Lyft Inc. (USA)

- LeasePlan (Netherlands)

- Hyundai Motor India (India)

- General Motors (USA)

- FlexDrive (USA)

- Fair Financial Corp. (USA)

- Drover Limited (UK)

- DriveMyCar Rentals Pty Ltd (Australia)

- Daimler AG (Germany)

- Cox Automotive (USA)

- Clutch Technologies, LLC (USA)

- Cluno GmbH (Germany)

- CarNext (Netherlands)

- BMW AG (Germany)

Recent Industry Developments :

- In February 2023, Hyundai introduced Evolve+ at the Chicago Auto Show, a convenient subscription model for electric vehicles that streamlines ownership by including insurance, roadside assistance, and maintenance in the monthly price.

- In January 2022, GO extended its availability to include Philadelphia, Northern New Jersey, Miami, and Orlando, joining its existing markets in Atlanta, Dallas, Houston, and Charlotte.

Vehicle Subscription Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 42.56 Billion |

| CAGR (2025-2032) | 33.5% |

| By Subscription Type |

|

| By Subscription Period |

|

| By Vehicle Type |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the vehicle subscription market? +

The vehicle subscription market size is estimated to reach over USD 42.56 Billion by 2032 from a value of USD 5.73 Billion in 2024 and is projected to grow by USD 7.26 Billion in 2025, growing at a CAGR of 33.5% from 2025 to 2032.

What specific segmentation details are covered in the vehicle subscription report? +

The vehicle subscription report includes specific segmentation details for subscription type, subscription period, vehicle type, end user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the vehicle subscription market, electric vehicles are the fastest-growing segment during the forecast period.

Who are the major players in the vehicle subscription market? +

The key participants in the vehicle subscription market are ZoomCar (India), Wagonex Limited (UK), Volvo Car Corporation (Sweden), Volkswagen (Germany), Tesla (USA), Tata Motors (India), Lyft Inc. (USA), LeasePlan (Netherlands), Hyundai Motor India (India), General Motors (USA), FlexDrive (USA), Fair Financial Corp. (USA), Drover Limited (UK), DriveMyCar Rentals Pty Ltd (Australia), Daimler AG (Germany), Cox Automotive (USA), Clutch Technologies, LLC (USA), Cluno GmbH (Germany), CarNext (Netherlands), BMW AG (Germany) and Others.

How big is the vehicle subscription market? +

The vehicle subscription market size is estimated to reach over USD 42.56 Billion by 2032 from a value of USD 5.73 Billion in 2024 and is projected to grow by USD 7.26 Billion in 2025, growing at a CAGR of 33.5% from 2025 to 2032.

What specific segmentation details are covered in the vehicle subscription report? +

The vehicle subscription report includes specific segmentation details for subscription type, subscription period, vehicle type, end user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the vehicle subscription market, electric vehicles are the fastest-growing segment during the forecast period.

Who are the major players in the vehicle subscription market? +

The key participants in the vehicle subscription market are ZoomCar (India), Wagonex Limited (UK), Volvo Car Corporation (Sweden), Volkswagen (Germany), Tesla (USA), Tata Motors (India), Lyft Inc. (USA), LeasePlan (Netherlands), Hyundai Motor India (India), General Motors (USA), FlexDrive (USA), Fair Financial Corp. (USA), Drover Limited (UK), DriveMyCar Rentals Pty Ltd (Australia), Daimler AG (Germany), Cox Automotive (USA), Clutch Technologies, LLC (USA), Cluno GmbH (Germany), CarNext (Netherlands), BMW AG (Germany) and Others.