Hybrid Vehicles Market Size:

Hybrid Vehicles Market size is estimated to reach over USD 528.15 Billion by 2032 from a value of USD 259.57 Billion in 2024 and is projected to grow by USD 279.15 Billion in 2025, growing at a CAGR of 10.2% from 2025 to 2032.

Hybrid Vehicles Market Scope & Overview:

Hybrid vehicle (HV) uses both internal combustion engine (ICE) and an electrical motor to operate. The battery in these vehicles is not recharged using the external electric power, rather charged through regenerative braking and by the internal combustion engine. These vehicles provide better fuel efficiency as the battery provides auxiliary loads to reduce engine idling when the vehicle is stopped. Moreover, the key components in a hybrid vehicle include battery, DC/DC convertor, electric generator, exhaust system, fuel filter, fuel tank, internal combustion engine, transmission, traction battery pack, power electronics controller, and electric tractor motor. HVs provide better performance, fuel economy, and longer range.

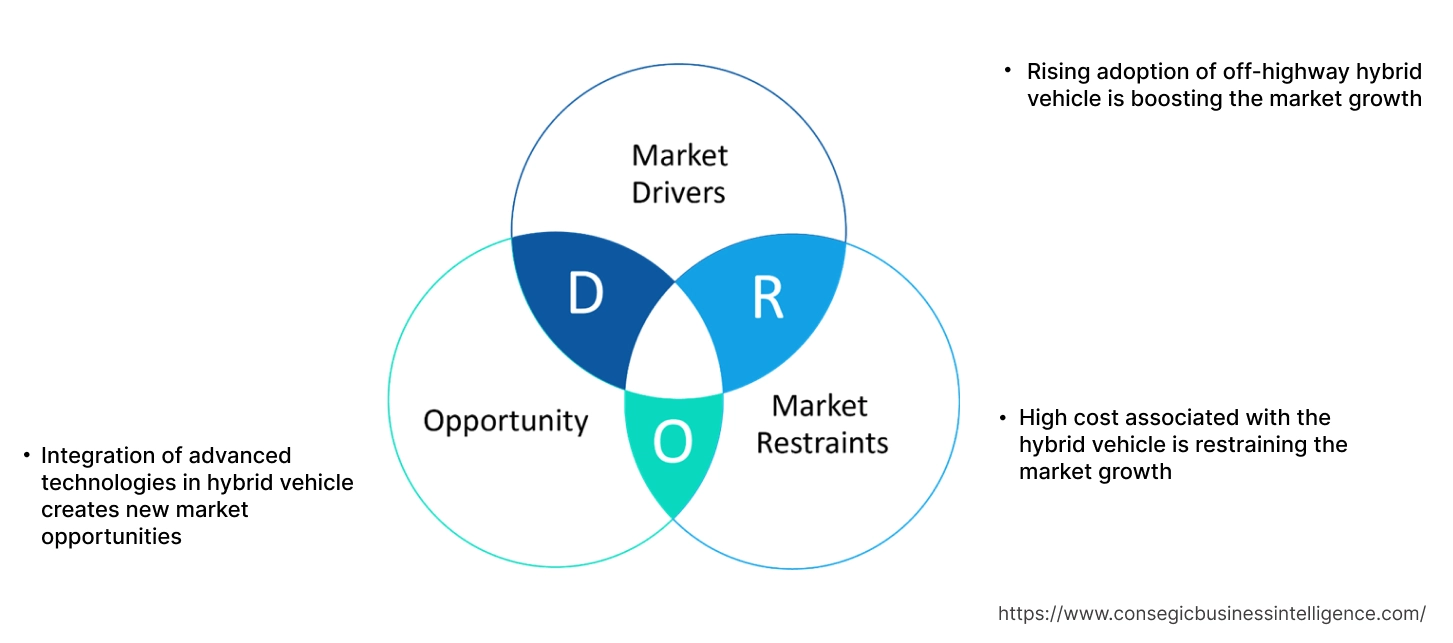

Key Drivers:

Rising adoption of off-highway hybrid vehicle is boosting the market growth

The hybrid off-highway vehicle is primarily being used due to its several benefits including reduced fuel consumption, reduced emissions, reduced downtime, reduced maintenance, lower fuel costs, reduced noise, improved fuel economy, improved performance, and enhanced range than pure electric vehicles. Moreover, these vehicles provide instant torque and improved acceleration for heavy tasks including load-lifting, operation in rough and uneven terrain, and others.

- For instance, in October 2023, Equipmake collaborated with Perkins to develop e-powertrain systems for hybrid off-highway vehicles. This aims to develop multi-fuel drop-in hybrid powertrain, which can be configured to provide performance in the range of 45-250kW depending upon application.

Thus, the aforementioned factors are boosting the adoption of these vehicles, in turn driving the hybrid vehicles market demand.

Key Restraints:

High cost associated with the hybrid vehicle is restraining the market growth

Hybrid vehicle is expensive compared to pure electric vehicles or conventional vehicles due to the increased number of components and functionalities integrated within the vehicles. These vehicles have both combustion engine and an electric motor adding up to the costs of the vehicle.

Moreover, the battery rack, traction battery, power electronics controller, and other components related to battery also add on to the final costs of the vehicle. Thus, the market analysis shows that the aforementioned factors are restraining the hybrid vehicles market demand.

Future Opportunities :

Integration of advanced technologies in hybrid vehicle creates new market opportunities

The integration of advanced technologies in HVs leads to improving fuel efficiency, dynamically optimizing the energy management systems, and enhancing the driving experience by real-time interaction with the driver as per the external conditions. Moreover, these advanced systems constantly modify the control parameters with respect to the input sensors, which enhances the vehicle performance, battery lifespan, and efficiency of the overall system.

- For instance, in February 2024, Toyota announced upgradation to its Toyota Yaris, a hybrid electric hatchback. The new Yaris is integrated with advanced technologies including adaptive cruise control (ACC), overtaking prevention support, lane departure alert, lane trace assist (LTA), rear seat reminder system (RSRS), and safe exit assist (SEA), among others.

Thus, the ongoing advancements in the technologies and their integration with HVs are projected to drive hybrid vehicles market opportunities during the forecast period.

Hybrid Vehicles Market Segmental Analysis :

By Component:

Based on the component, the market is segmented into body, chassis, electronics, powertrain, and others.

Trends in the Component:

- Rising demand for chassis to support battery, motor, and other components in a vehicle to provide safety is driving the hybrid vehicles market size.

- Increasing trend in adoption of electronics in vehicles to provide enhanced features and functionalities including wireless charging, driver assistance systems, and others.

The powertrain segment accounted for the largest revenue share in the market in 2024.

- The powertrain combines ICE with battery and one or more electric motors. The powertrain uses electric motors for low-speed driving and ICE for high-speed driving, leading to efficient and flexible power delivery.

- For instance, in July 2024, Stellantis announced that it extended its hybrid powertrain models in the European region. Moreover, the eDCT-hybrid powertrain is designed for optimal fuel efficiency, achieving up to 20% reduction in the CO2

- Therefore, the market analysis depicts that the aforementioned factors are driving the hybrid vehicles market growth.

The electronics segment is expected to register the fastest CAGR during the forecast period.

- The electronics consists of battery management systems, electric motors, generators, control units, sensors, charge port, parking brake, back guide monitor, convertors, and several other components. These components have wide applications depending on their structure and associated functionalities.

- For instance, in December 2024, Toyota Kirloskar Motor launched hybrid electric vehicle, integrated with electronic parking brake with brake hold function, anti-lock braking system with electronic brake-force distribution and brake assist.

- Thus, the analysis shows that the wide applications of electronics components are expected to drive the hybrid vehicles market trends during the forecast period.

By Electric Powertrain Type:

Based on the electric powertrain type, the market is segmented into parallel and series-parallel.

Trends in the Electric Powertrain Type:

- Rising trend in adoption of parallel electric powertrain to improve fuel efficiency and reduce emissions is driving the hybrid vehicles market size.

- Increasing demand for series-parallel electric powertrains due to flexibility in powertrain operation to operate in series or parallel mode or both simultaneously.

The parallel segment accounted for the largest revenue share in the hybrid vehicles market share in 2024.

- In parallel powertrain, both ICE and electric motor are connected with the driving axle. They are used as per the requirement while the vehicle can be driven with IC engine only, electrically, or with a combination of both.

- For instance, in September 2024, Honda launched two-motor hybrid electric parallel powertrain. The 2023 CR-V and 2023 Accord models used a new fourth-generation of the powertrain systems positioning two electric motors parallelly.

- Thus, the market analysis shows that the aforementioned factors are driving the hybrid vehicles market trends.

The series-parallel segment is expected to register the fastest CAGR during the forecast period.

- A series-parallel hybrid powertrain has an additional mechanical connection (clutch) between the two electric machines. At low speeds, when the clutch open, the powertrain operates as a series hybrid and at high vehicle speed, when the clutch is closed, the powertrain operates as a parallel hybrid.

- For instance, in December 2024, Subaru introduced 2025 Subaru Crosstrek, with series-parallel hybrid system. The Crosstrek model improves fuel efficiency by 20% with 1.1 kWh battery and a 118-hp electric motor.

- Thus, the above benefits are expected to drive the hybrid vehicles market expansion during the forecast period.

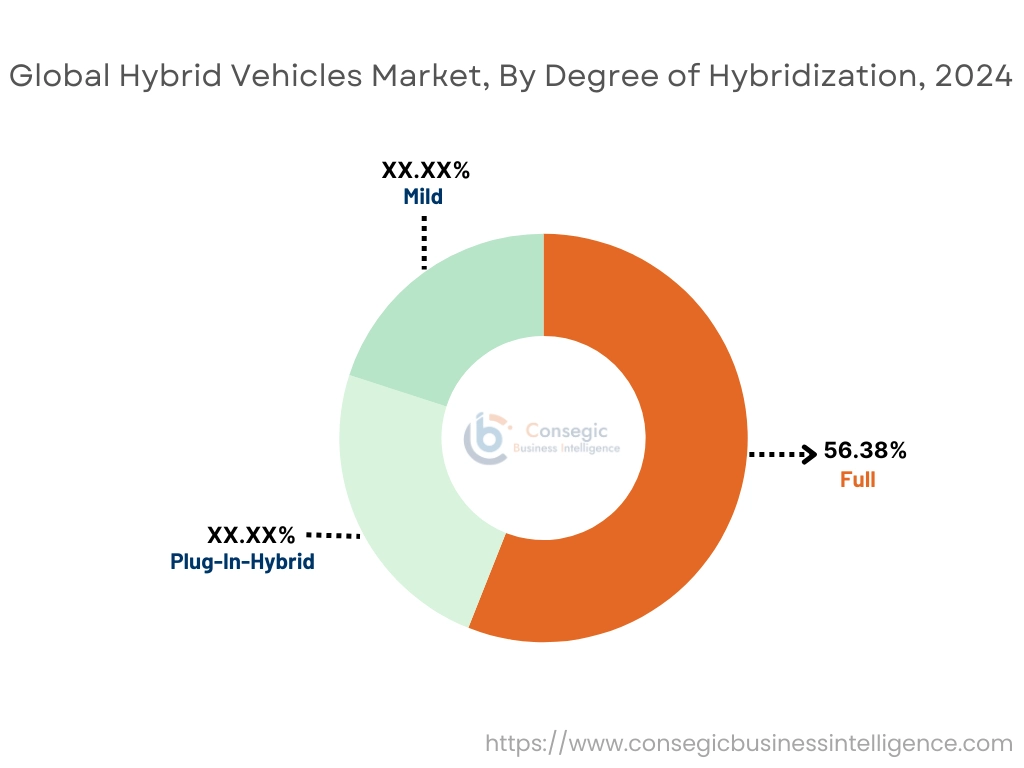

By Degree of Hybridization:

Based on the degree of hybridization, the market is segmented into mild, full, and plug-in-hybrid.

Trends in the Degree of Hybridization:

- Rising adoption of mild-hybrid vehicle due to cost effectiveness while maintaining the smooth driving experience.

- Increasing demand for plug-in-hybrid vehicles due to convenience to charge battery as per the requirement.

The full segment accounted for the largest revenue share of 56.38% in 2024.

- The full hybrid vehicles utilize both ICE and an electric motor, allowing for seamless switching between power sources depending on driving conditions.

- For instance, Suzuki offers full hybrid electric vehicles in its product offerings. Suzuki Swace is a fully loaded self-charging hybrid with an elegant interior design focusing on comfort and spaciousness.

- Therefore, the hybrid vehicles market analysis shows that the aforementioned factors are driving the market expansion.

The plug-in-hybrid segment is expected to register the fastest CAGR during the forecast period.

- The plug-in-hybrid vehicles (PHEVs) can be recharged by plugging them into an external power source, allowing for convenient and cost-effective charging.

- For instance, in March 2025, Karma Automotive announced Amaris series of plug-in-hybrid coupe. The series is expected to be launched in the market in the late 2026.

- Thus, the wide benefits provided by plug-in hybrid models are expected to boost the hybrid vehicles market expansion during the forecast period.

By Vehicle Type:

Based on the vehicle type, the market is segmented into passenger car and commercial vehicle.

Trends in the Vehicle Type:

- Rising adoption of buses, trucks, and off-highway vehicles with hybrid technology to reduce emissions and improvise fuel efficiency.

- Increasing demand for hybrid passenger cars across the globe due to rising disposable incomes and increasing awareness regarding environmental benefits provided by hybrid cars.

The passenger car segment accounted for the largest revenue in the hybrid vehicles market share in 2024.

- Hybrid passenger cars combine electric motors with ICEs offering reduced emissions, improved fuel efficiency, and a smoother driving experience, while also using regenerative braking for energy recovery.

- For instance, in November 2022, Toyota launched its second hybrid passenger car in India. The car is a seven-seater offering eco-friendly vehicle to the buyers.

- Therefore, the widespread adoption of passenger hybrid vehicles is boosting the hybrid vehicles market growth.

The commercial vehicle segment is expected to register the fastest CAGR during the forecast period.

- The commercial hybrid vehicles offer benefits including lower emissions, reduced running costs, lower maintenance, improved fuel efficiency, and government incentives.

- For instance, in May 2024, BYD launched BYD SHARK, its first hybrid pickup truck in Mexico. The truck is integrated with diverse user-centric features and advanced technology.

- Thus, the rising development of commercial hybrid vehicles is expected to boost the hybrid vehicles market opportunities during the forecast period.

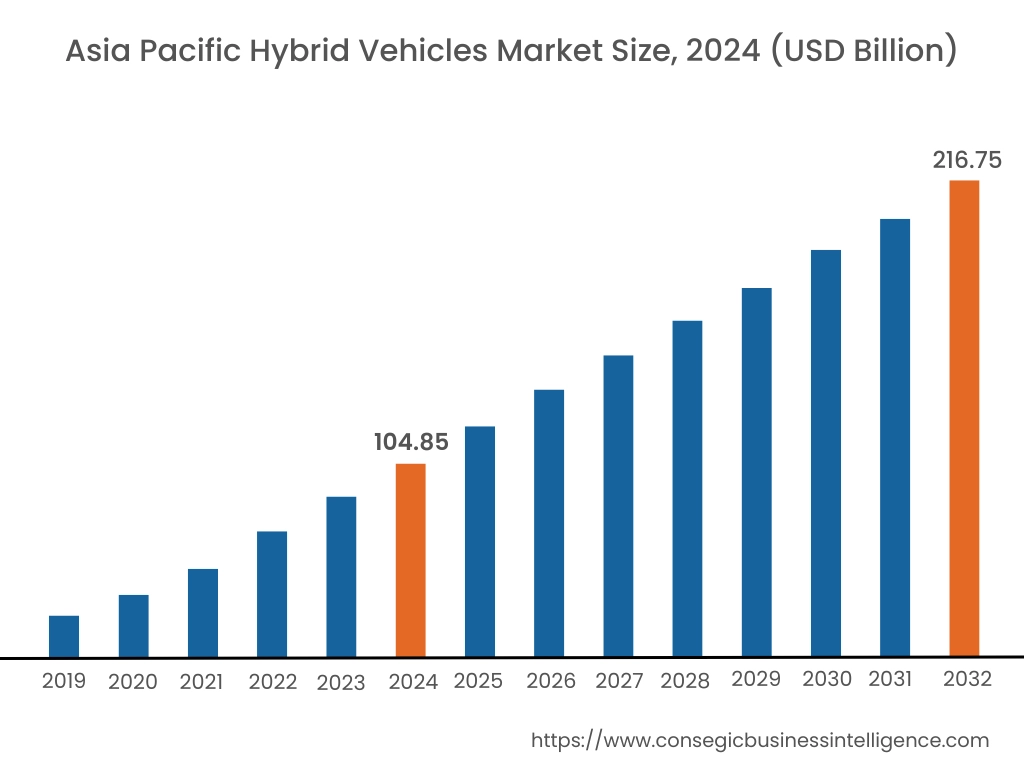

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

Asia Pacific region was valued at USD 104.85 Billion in 2024. Moreover, it is projected to grow by USD 112.91 Billion in 2025 and reach over USD 216.75 Billion by 2032. Out of this, China accounted for the maximum revenue share of 37.22%. The market growth in Asia-Pacific region is driven due to rising disposable incomes, established vehicle manufacturing units, rising urbanization, and other factors.

- For instance, in May 2024, China’s BYD launched latest generation of plug-in hybrid technology. The technology achieves a record low fuel consumption of 2.9 liters per 62.1 miles.

North America is estimated to reach over USD 140.12 Billion by 2032 from a value of USD 68.36 Billion in 2024 and is projected to grow by USD 73.56 Billion in 2025. The North American market growth is proliferating due to factors including rising development of charging infrastructure, environmental awareness, and affordability among others.

- For instance, in June 2024, Honda launched production of hydrogen plug-in hybrid car in U.S. The CR-V e:FCEV hydrogen plug-in hybrid car is being produced at the site.

Additionally, in Europe, the market is growing due to rise in environmental concerns and the growing demand for sustainable transportation industry in the region. Moreover, as per the hybrid vehicles market analysis, in Latin America, Middle East and Africa, the market is primarily growing due to rising consumer preference towards more eco-friendly and sustainable vehicle options, paving the way for the market growth.

Top Key Players and Market Share Insights:

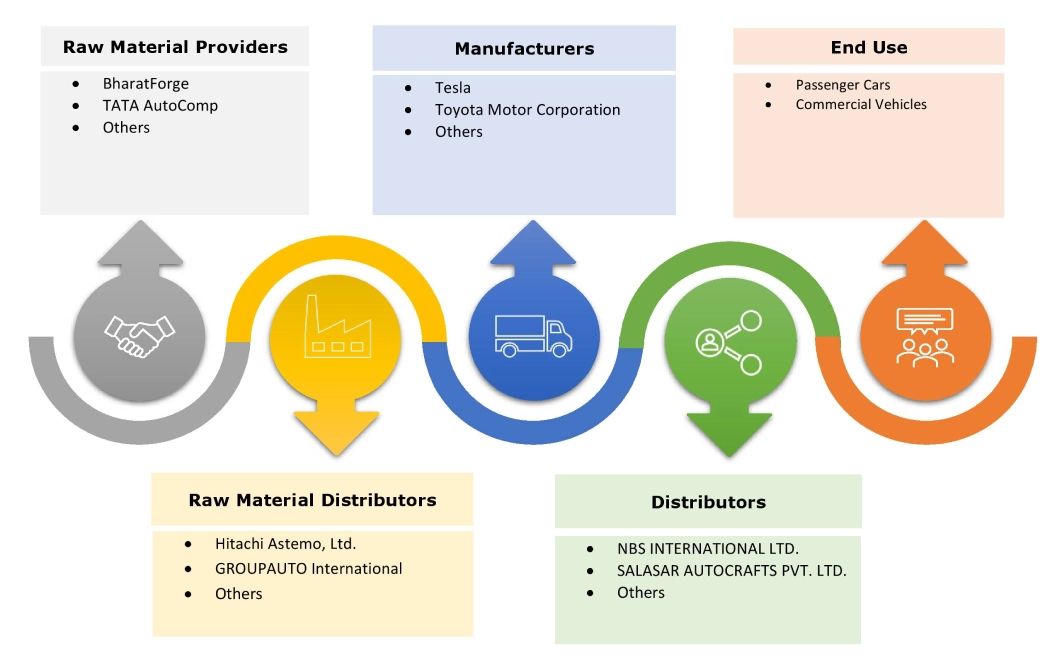

The hybrid vehicles industry is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global hybrid vehicles market. Key players in the hybrid vehicles industry include -

- AB Volvo (Sweden)

- Daimler AG (Germany)

- Nissan Motor Corporation (Japan)

- Toyota Motor Corporation (Japan)

- Volkswagen AG (Germany)

- Ford Motor Company (U.S.)

- BYD Company Ltd. (China)

- Honda Motor Co., Ltd. (Japan)

- Hyundai Motor Company (South Korea)

- Kia Motors Corporation (South Korea)

Recent Industry Developments :

- In December 2024, Toyota announced launch of Alphard and Vellfire PHEV models in Japan. The six-seater models offer enhanced rising experience and reduced noise.

Hybrid Vehicles Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 528.15 Billion |

| CAGR (2025-2032) | 10.2% |

| By Component |

|

| By Electric Powertrain Type |

|

| By Degree of Hybridization |

|

| By Vehicle Type |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the hybrid vehicles market? +

Hybrid Vehicles Market size is estimated to reach over USD 528.15 Billion by 2032 from a value of USD 259.57 Billion in 2024 and is projected to grow by USD 279.15 Billion in 2025, growing at a CAGR of 10.2% from 2025 to 2032.

What are the major segments covered in the hybrid vehicles market report? +

The segments covered in the report are component, electric powertrain type, degree of hybridization, vehicle type, and region.

Which region holds the largest revenue share in 2024 in the hybrid vehicles market? +

Asia Pacific holds the largest revenue share in the hybrid vehicles market in 2024.

Who are the major key players in the hybrid vehicles market? +

The major key players in the market are AB Volvo (Sweden), BYD Company Ltd. (China), Daimler AG (Germany), Ford Motor Company (U.S.), Honda Motor Co., Ltd. (Japan), Hyundai Motor Company (South Korea), Kia Motors Corporation (South Korea), Nissan Motor Corporation (Japan), Toyota Motor Corporation (Japan), and Volkswagen AG (Germany).