Electric Excavator Market Size:

Electric Excavator Market Size is estimated to reach over USD 4.87 Billion by 2032 from a value of USD 1.97 Billion in 2024 and is projected to grow by USD 2.17 Billion in 2025, growing at a CAGR of 13.4% from 2025 to 2032.

Electric Excavator Market Scope & Overview:

An electric excavator is a type of earthmoving equipment powered by electricity instead of a traditional internal combustion engine. These machines typically use electric motors to drive hydraulic pumps, which in turn control the excavator's boom, dipper (arm), bucket, and other components. They offer advantages such as reduced noise and emissions, which are ideal for sensitive environments or confined spaces.

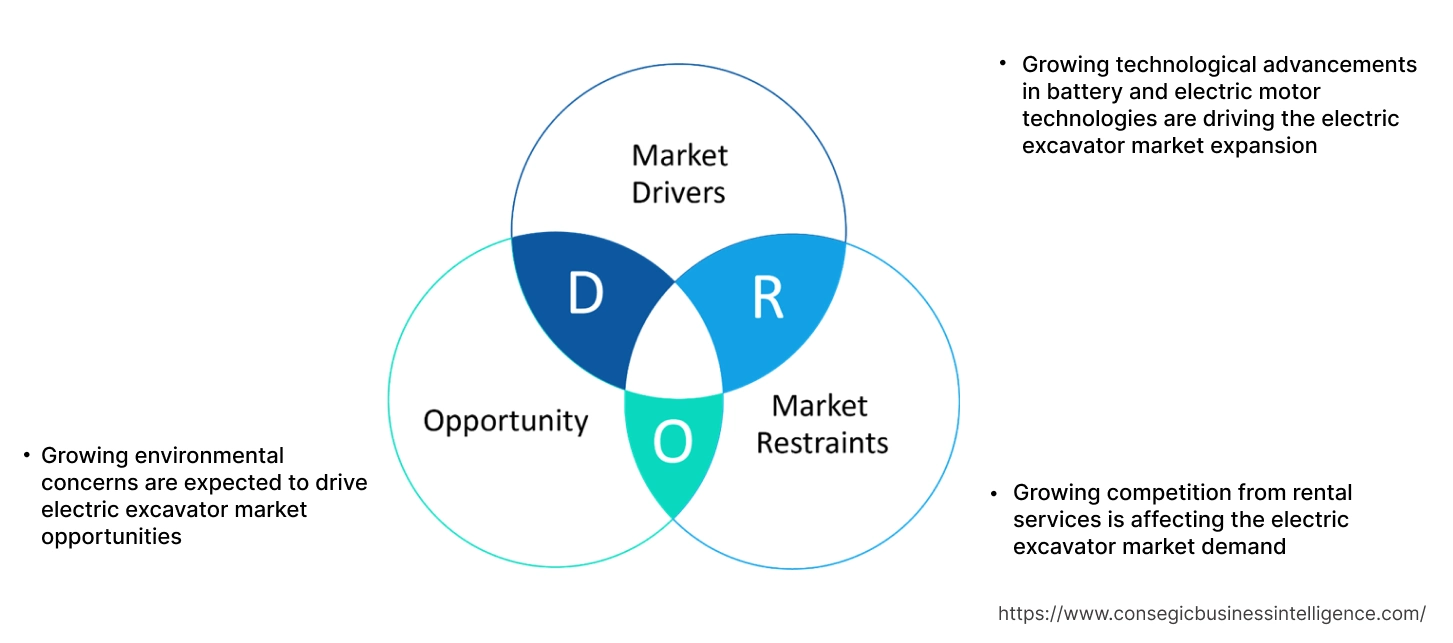

Electric Excavator Market Dynamics - (DRO) :

Key Drivers:

Growing technological advancements in battery and electric motor technologies are driving the electric excavator market expansion

The development of more efficient, long-lasting, and faster-charging battery systems, particularly lithium-ion batteries, has significantly enhanced the capability of electric construction machineries. These advancements have addressed one of the major concerns regarding electric machinery, operational efficiency and battery life. With improved battery technology, these excavators offer comparable or even superior performance to their diesel counterparts, which is boosting their adoption across various sectors. Further, by combining expertise in engineering with advancements in areas such as automation, electrification, and data analytics, manufacturers can create cutting-edge solutions that meet the evolving needs of customers while also addressing sustainability concerns.

- For instance, in July 2023, Komatsu introduced a new 3-ton class electric mini excavator powered by a lithium-ion battery in Europe. This new machine represents a significant update to their existing PC30E-5 electric mini excavator in the same weight class. The new excavator utilizes a lithium-ion battery instead of a traditional lead-acid battery, which offers the benefits of longer operating times on a single charge and contributes to a more compact and lighter overall machine design.

Thus, according to the electric excavator market analysis, the growing technological advancements in battery and electric motor technologies are driving the electric excavator market size and growth.

Key Restraints:

Growing competition from rental services is affecting the electric excavator market demand

The global market is facing intensified competition from rental services, which offer an alternative to outright purchase for businesses and contractors. Rental services provide flexibility in equipment usage, allowing companies to access excavators as needed without the burden of ownership costs such as maintenance, storage, and depreciation.

Additionally, rental services often offer a diverse fleet of excavators, including specialized models for specific applications, catering to the varied requirements of construction projects. As a result, many end-users are opting for rental solutions to manage project costs efficiently and adapt to fluctuating needs, presenting a challenge to traditional sales-based business models in the excavator market. Thus, the aforementioned factors would further impact the electric excavator market size.

Future Opportunities :

Growing environmental concerns are expected to drive electric excavator market opportunities

Environmental concerns, including climate change and air pollution, have prompted governments and market players to adopt greener solutions. This has led to the development of hybrid excavators that produce fewer emissions and have lower fuel consumption compared to their conventional counterparts. Additionally, advancements in engine technology and the use of alternative fuels such as biodiesel are further contributing to reducing the environmental footprint of excavators. Moreover, stricter regulations regarding emissions and noise pollution in many regions are incentivizing companies to invest in cleaner and more efficient excavator models.

- For instance, in April 2025, Volvo CE has showcased its zero emission excavator’s line-up at Bauma 2025. Volvo CE also offers traditional diesel-powered versions of all the zero-emission models being presented. These diesel options provide significant improvements in fuel efficiency, achieving improvements of over 15%.

Thus, based on the above electric excavator market analysis, the growing environmental concerns is expected to drive the electric excavator market opportunities and growth.

Electric Excavator Market Segmental Analysis :

By Propulsion:

Based on propulsion, the market is segmented into pure electric and hybrid.

Trends in the propulsion:

- The segment growth can be attributed to increasing environmental regulations, advancements in battery technology, and the growing preference towards more sustainable construction practices.

- Construction companies are increasingly focusing on sustainability to improve their corporate social responsibility profiles, which is further boosting the demand for electric and hybrid excavators.

- Thus, based on the above analysis, the above trends are driving the electric excavator market demand.

The pure electric segment accounted for the largest revenue share in the year 2024.

- The innovations such as solid-state batteries and improvements in lithium-ion battery chemistry are expected to further enhance the performance metrics of pure electric excavators, making them a sustainable alternative to their diesel-powered counterparts.

- These machines are ideal for tasks such as landscaping, utility work, and small-scale construction projects. The ease of maneuverability and lower operating costs make compact excavators a better choice among contractors.

- For instance, in July 2023, Komatsu Ltd. unveiled 210LCE-11 and PC200LCE-11 models of pure electric excavators, which are equipped with lithium-ion batteries.

- Thus, based on the above analysis, these factors are further driving the electric excavator market growth.

The hybrid segment is anticipated to register the fastest CAGR during the forecast period.

- Hybrid excavators, with their lower emissions and fuel consumption compared to traditional models, are gaining traction as an alternative. These machines not only reduce the carbon footprint but also help companies adhere to regulatory requirements, thereby avoiding potential fines and enhancing their corporate social responsibility profiles.

- For industries such as construction and mining, where operational costs are a major concern, the adoption of hybrid excavators can lead to substantial financial savings over the machine's lifecycle. As companies become more aware of these economic benefits, the demand for hybrid models is expected to surge.

- The integration of telematics and IoT technologies in hybrid excavators is enabling better fleet management, predictive maintenance, and real-time monitoring, thereby, increasing their need in modern construction and mining operations.

- Thus, based on the above analysis and developments, these factors are expected to drive the electric excavator market share and growth during the forecast period.

By Product Type:

Based on the product type, the market is segmented into wheeled, crawler, mini/ compact, and others.

Trends in the product type:

- Leading companies in the market are focusing on developing multi-functional products that can seamlessly transition between different roles on a construction site. This adaptability not only improves operational efficiency but also increases the value proposition for end-users, who can benefit from reduced equipment investment and operational costs.

- The innovations in energy storage and power management systems are enabling these machines to deliver higher efficiency and lower emissions, regardless of their size.

The mini/compact segment accounted for the largest revenue share in the year 2024.

- Compact excavators are gaining popularity due to their versatility and ability to operate in confined spaces. These excavators are particularly favored in urban construction projects where space is limited.

- The demand for compact excavators is driven by their ease of transportation, lower operational costs, and suitability for landscaping and small-scale construction projects.

- Despite their smaller dimensions, advancements in battery technology have enabled these machines to deliver substantial power, making them an optimal choice for contractors focusing on urban and residential projects.

- The adaptability of mini excavators for various applications such as digging, trenching, and material handling makes them a preferred choice for general contractors and construction firms.

- For instance, in February 2025, Volvo introduced straight boom for mini electric excavator, EC18, a 1.8-ton battery machine, which is developed for indoor demolition. A straight boom generally provides greater horizontal and vertical reach as compared to a standard two-piece boom. This extended reach often simplifies the process of manoeuvring the machine into the optimal position for the task.

- Thus, based on the above analysis, these factors would further supplement the electric excavator market

The crawler segment is anticipated to register the fastest CAGR during the forecast period.

- The growing need for eco-friendly excavators, coupled with stringent environmental regulations, is driving the market, prompting manufacturers to invest in sustainable technologies and cleaner engine solutions.

- Rugged terrain operation capabilities offer significant prospects for companies operating in industries such as construction, agriculture, and off-road vehicle manufacturing.

- The increasing mining activities are projected to boost the segment. Electric crawler excavators are known for their efficiency and productivity. They dig and move large amounts of earth or minerals quickly, making them essential for large-scale mining operations.

- These developments in the crawler segment are anticipated to further drive the electric excavator market trends during the forecast period.

By Operating Weight:

Based on operating weight, the market is segmented into less than 4000 lbs, 4000-10000 lbs, and more than 10000 lbs.

Trends in the operating weight:

- With the increasing focus on reducing carbon emissions in heavy industries, heavy duty excavators are poised to become more dominant. Manufacturers are investing in R&D to develop high-performance electric models that can match or even surpass the capabilities of traditional diesel-powered excavators.

- Manufacturers are expanding their electric construction machinery portfolios to include a broader range of dimensions and capabilities, including larger models.

The less than 4000 lbs segment accounted for the largest revenue in the year 2024.

- These machines are particularly suited for tasks in extremely confined indoor or outdoor spaces where zero emissions and low noise are critical.

- The feasibility and performance of these ultra-compact excavators heavily rely on advancements in compact and lightweight battery technology that still provide sufficient power and operating time for typical tasks.

- For indoor work or projects in highly regulated green zones within cities, electric power is essential to comply with air quality standards.

- For instance, in April 2024, Firstgreen Industries launched Rockeat, a new series of electric skid-steer loaders that produce zero emissions and do not have a cabin. These innovative machines feature a low profile, a 360-degree camera system, remote control operation, particularly in tasks such as excavation or material handling, and the ability to lift loads between 1,500 and 3,300 pounds.

- Thus, based on the above developments, these factors are driving the electric excavator market growth.

The more than 10000 lbs segment is anticipated to register the fastest CAGR during the forecast period.

- These machines offer superior digging power, increased load-carrying capacity, and enhanced durability to withstand extreme working conditions.

- They are primarily employed in operations that require moving vast amounts of material efficiently, reducing project timelines and labor costs.

- Additionally, the integration of smart technologies, automation, and improved engine performance in large excavators further boosts productivity and operational efficiency, making them a crucial asset in large-scale industrial projects.

- These factors are anticipated to further drive the electric excavator market trends during the forecast period.

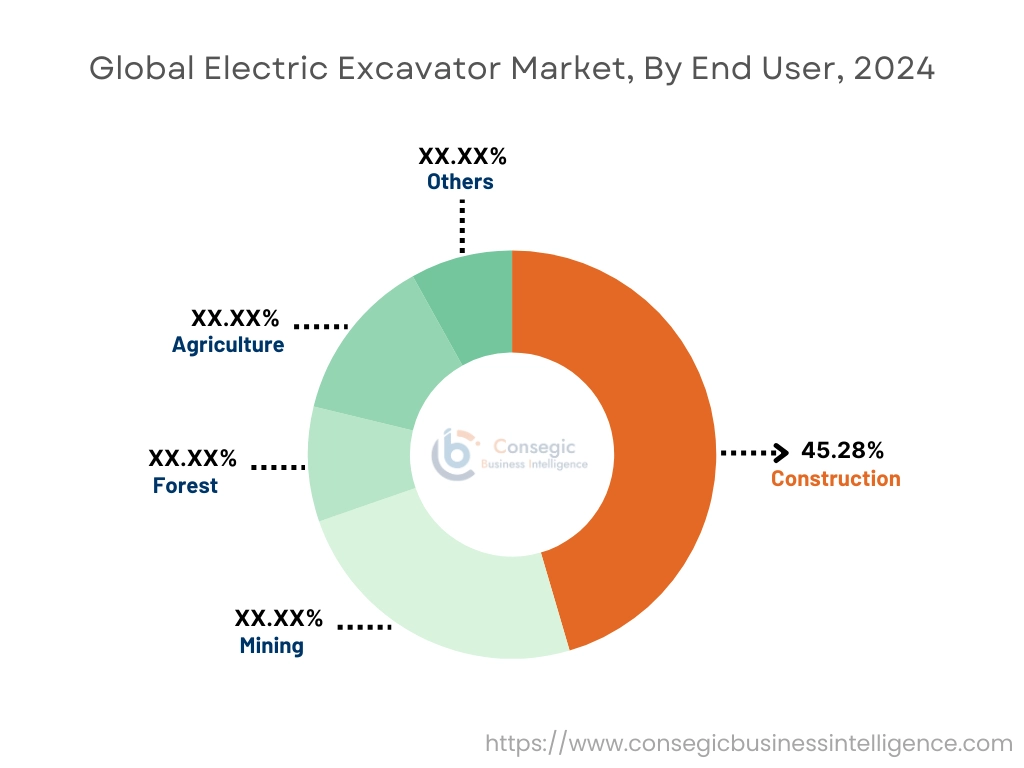

By End User:

Based on end user, the market is segmented into construction, mining, forest, agriculture, and others.

Trends in the end user:

- The commercial sector benefits from the lower maintenance requirements and reduced fuel costs associated with excavators, making them a cost-effective and environmentally friendly choice. As businesses continue to prioritize sustainability in their operations, the need for construction machineries in the commercial sector is expected to grow.

- Their ability to operate efficiently in harsh terrains, coupled with high digging force and durability, makes them necessary for open-pit and underground mining operations. The increasing need for minerals, metals, and energy resources is expected to drive the segment, encouraging manufacturers to introduce advanced excavators with automation capabilities.

The construction segment accounted for the largest revenue share of 45.28% in the year 2024 and it is expected to register the highest CAGR during the forecast period.

- Contractors are increasingly adopting hybrid excavators to improve operational efficiency, reduce fuel consumption, and meet environmental regulations. The cost-saving benefits and enhanced performance of hybrid excavators make them an ideal option for contractors looking to optimize their operations and deliver sustainable projects.

- The growing focus on sustainable urban infrastructure and the rise of smart city projects are propelling the demand for electric earthmovers in this sector, where legislation and public opinion are increasingly favouring environmentally friendly solutions.

- For instance, in October 2022, Caterpillar expanded its construction sector portfolio with four battery electric light and heavy duty machines. The machines include 906 compact wheel loader, 320 medium excavator, 950 GC medium wheel loader, and 301.9 mini excavator. Caterpillar also intends to provide an external DC fast charging solution for these electric machines.

- Thus, based on the above factors, these developments are driving the global market trends.

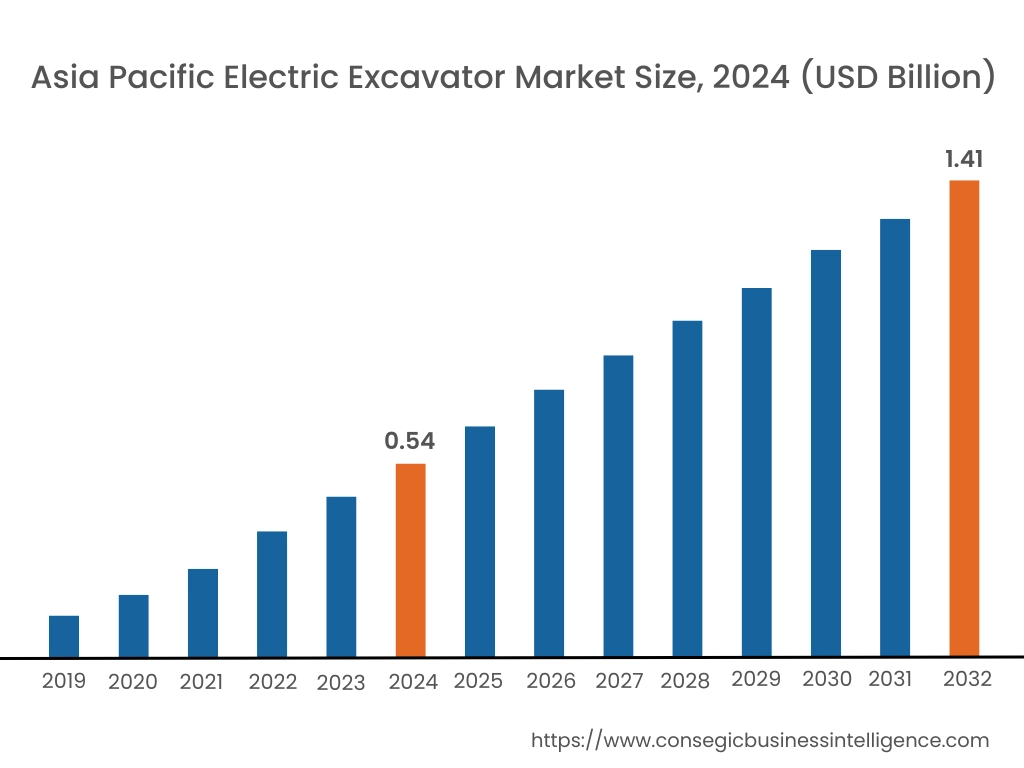

Regional Analysis:

The global market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa (MEA), and Latin America.

Asia Pacific electric excavator market expansion is estimated to reach over USD 1.41 billion by 2032 from a value of USD 0.54 billion in 2024 and is projected to grow by USD 0.60 billion in 2025. Out of this, the China market accounted for the maximum revenue split of 38.44%. The rapid urbanization, significant infrastructure investments, and supportive government policies promoting the use of electric machinery are key factors driving the regional market. Further, countries in the region are leading the way in adopting electric construction equipment, driven by their commitment to reducing carbon emissions and fostering sustainable development. These factors would further drive the regional electric excavator market during the forecast period.

- For instance, in January 2025, Tata Hitachi launched electric excavator and next-generation machines at BAUMA Conexpo. These electric machines cater to the shifting needs of the construction sector by providing considerable savings in running and upkeep costs, all while advancing environmental sustainability.

North America market is estimated to reach over USD 1.89 billion by 2032 from a value of USD 0.77 billion in 2024 and is projected to grow by USD 0.85 billion in 2025. The presence of major construction and mining companies, along with stringent environmental regulations, drives the need for electric and hybrid excavators in the region. Further, the United States and Canada are among the key countries adopting advanced construction machinery. The growing awareness regarding the benefits of electric and hybrid excavators is expected to boost the regional market growth. Moreover, the increasing environmental consciousness in the region has increased the demand for eco-friendly construction equipment. Countries in the region are rigorously implementing emission reduction policies, which have spurred the adoption of electric machinery in the construction sector, boosting need for electric and hybrid excavators. These factors would further drive the market in North America.

- For instance, in January 2024, Caterpillar Inc. showcased its electric machines and energy solutions at CES 2024. The company showcased a zero-emission underground loader designed for mining, which uniquely features an onboard battery with rapid charging technology, and a mini excavator.

According to the analysis, the electric excavator industry in Europe is anticipated to witness significant development during the forecast period. The European market is characterized by a strong emphasis on innovation and technological advancements, creating a favorable environment for the growth of hybrid excavators. The market in Europe is expected to grow at a steady pace, with increasing investments in sustainable infrastructure projects and the adoption of hybrid excavators by major construction companies.

Additionally, Latin America presents lucrative prospects for excavator manufacturers, driven by infrastructure development projects in countries like Brazil and Argentina. The region's focus on upgrading transportation networks, expanding industrial facilities, and enhancing agricultural productivity contributes to the need for excavators across various sectors. Further, the Middle East and Africa exhibit considerable potential for the excavator market, supported by ongoing infrastructure projects, particularly in the Gulf Cooperation Council (GCC) countries. The investments in mega construction and urban development projects, along with the expansion of the mining sector, drive the need for excavators in the MEA region.

Top Key Players and Market Share Insights:

The global electric excavator market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the electric excavator industry include-

- Bharat Earth Movers (India)

- Case Construction Equipment (U.S.)

- Komatsu (Japan)

- Kubota Corp. (Japan)

- Nagano Industry Co., Ltd. (Japan)

- Sany Group (China)

- Terex (U.S.)

- Volvo Construction Equipment (Sweden)

- Yanmar Holdings Co. Ltd. (Japan)

- Caterpillar (U.S.)

- Çukurova Ziraat (Turkey)

- Deere & Company (U.S.)

- Doosan Bobcat, Inc. (South Korea)

- Guangxi LiuGong Machinery (China)

- Hitachi Construction Machinery (Japan)

- JCB, Inc. (U.K.)

- KATO Works (Japan)

- Kobelco Construction Machinery U.S.A Inc. (U.S.)

Recent Industry Developments :

Product Launch:

- In January 2025, JCB unveiled a new electric excavator the 8008E CTS, at the Executive Hire Show (EHS). The machine includes several important features, such as a 9.9kWh battery, providing sufficient power for a standard full workday, an operating weight of under 1 ton for convenient transportation using a van or pick-up truck, and both 110V and 230V charging options to accommodate construction site power availability.

Electric Excavator Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 4.87 Billion |

| CAGR (2025-2032) | 13.4% |

| By Propulsion |

|

| By Product Type |

|

| By Operating Weight |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Electric Excavator Market? +

Electric Excavator market size is estimated to reach over USD 4.87 Billion by 2032 from a value of USD 1.97 Billion in 2024 and is projected to grow by USD 2.17 Billion in 2025, growing at a CAGR of 13.4% from 2025 to 2032.

Which is the fastest-growing region in the Electric Excavator Market? +

Asia-Pacific region is experiencing the most rapid growth in the market.

What specific segmentation details are covered in the Electric Excavator report? +

The electric excavator report includes specific segmentation details for propulsion, product type, operating weight, end user, and region.

Who are the major players in the Electric Excavator Market? +

The key participants in the market are Bharat Earth Movers (India), Case Construction Equipment (U.S.), Caterpillar (U.S.), Çukurova Ziraat (Turkey), Deere & Company (U.S.), Doosan Bobcat, Inc. (South Korea), Guangxi LiuGong Machinery (China), Hitachi Construction Machinery (Japan), JCB, Inc. (U.K.), KATO Works (Japan), Kobelco Construction Machinery U.S.A Inc. (U.S.), Komatsu (Japan), Kubota Corp. (Japan), Nagano Industry Co., Ltd. (Japan), Sany Group (China), Terex (U.S.), Volvo Construction Equipment (Sweden), Yanmar Holdings Co. Ltd. (Japan), and others.