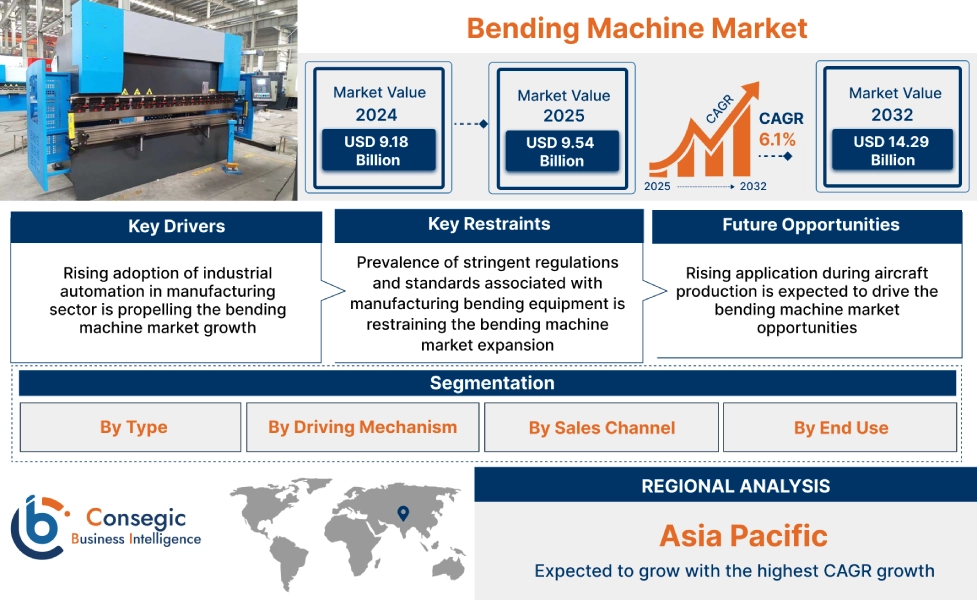

Bending Machine Market Size:

Bending Machine Market size is estimated to reach over USD 14.29 Billion by 2032 from a value of USD 9.18 Billion in 2024 and is projected to grow by USD 9.54 Billion in 2025, growing at a CAGR of 6.1% from 2025 to 2032.

Bending Machine Market Scope & Overview:

Bending machine refers to an industrial tool that is designed to form a bend in a specific work piece. Bending equipment are suitable for bending sheet metal along with shaping work pieces in sheet metal fabrication. Bending equipment are primarily used for various purposes, including bending tubes, rolling plates, and folding plates among others. Moreover, bending machines offer a broad range of benefits such as high precision, versatile applications, automated functions, increased production efficiency, and others.

How is AI Transforming the Bending Machine Market?

AI is transforming the global bending machine market by making it smarter, more precise, and more efficient. Machine learning algorithms allow these systems to monitor real-time data and automatically adjust bending parameters like force and angle based on material characteristics and job specifics, reducing errors and material waste. AI also enables predictive maintenance, spotting mechanical wear or potential faults before downtime occurs. When paired with robotics and automation, AI-controlled bending machines can switch tools, reposition materials, and fine-tune operations with minimal human intervention. Across industries from automotive to aerospace these intelligent systems are boosting productivity, ensuring consistent quality, and paving the way for flexible, high-efficiency manufacturing.

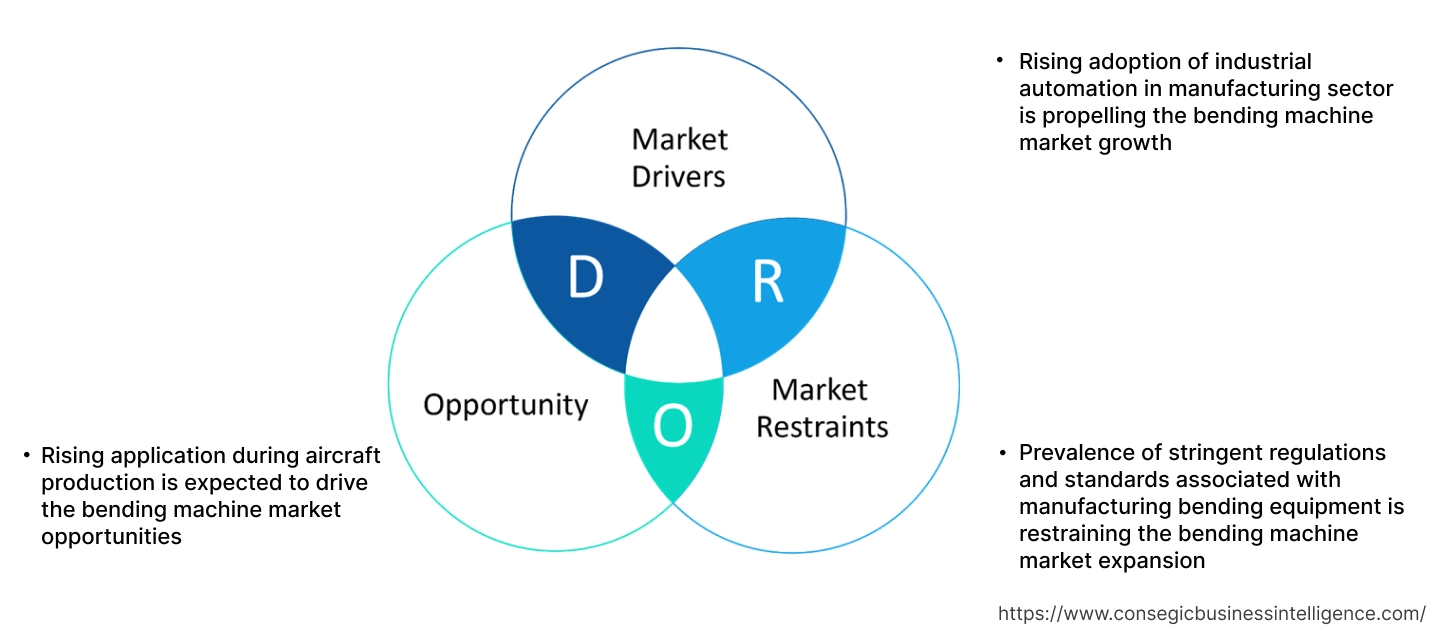

Bending Machine Market Dynamics - (DRO) :

Key Drivers:

Rising adoption of industrial automation in manufacturing sector is propelling the bending machine market growth

Industry 4.0 enabled manufacturing represents automation readiness, extreme flexibility, minimal human intervention, and highest productivity. It emphasizes the use of automation and automated equipment to enhance production efficiency and flexibility. Bending machines are increasingly integrated into automated production lines for shaping metal and other materials, which enables faster processing times, leading to higher operational efficiency. Similarly, the use of automated bending machine in manufacturing sector can assist manufacturers in bending and producing components with high precision and consistency. Additionally, modern bending equipment are often equipped with advanced features and control systems that provide greater flexibility in production lines without significant downtime. As a result, the rising adoption of industrial automation in manufacturing sector is further driving the market.

- For instance, in May 2024, the manufacturing output in India witnessed an increase of 4.6%, primarily driven by a robust performance in pharmaceuticals (+7.5%) and basic metals (+7.8%).

Therefore, as per the analysis, the growing manufacturing sector and rising adoption of industrial automation is driving the adoption of automated bending machine, in turn proliferating the bending machine market size.

Key Restraints:

Prevalence of stringent regulations and standards associated with manufacturing bending equipment is restraining the bending machine market expansion

The manufacturers of bending equipment have to comply with various stringent standards such as ISO (International Organization for Standardization) standard, American National Standards Institute: ANSI B11.12-2005, CE (Conformite Européenne), and others.

ISO standard is among the primary standards that includes ISO 9001 and ISO 14001, which apply to quality management and environmental management respectively. ISO standards provide a set of guidelines for bending equipment manufacturers to establish levels of homogeneity in accordance with the management, provision of services, and product development in the industry. Meanwhile, ISO 6909 standard states technical safety requirements for design, production and supply of bending equipment that are developed to work cold metal or material partly of cold metal.

Additionally, bending equipment manufacturers must comply with ANSI B11.12-2005 standard, which specifies safety requirements for roll forming and roll bending machines. Furthermore, CE certification ensures that the bending equipment manufacturer takes responsibility for the compliance of a product with all applicable to European health, performance safety, and environmental requirements. Therefore, the prevalence of aforementioned regulations and standards associated with manufacturing bending equipment are restraining the market.

Future Opportunities :

Rising application during aircraft production is expected to drive the bending machine market opportunities

Bending equipment plays a vital role in aircraft manufacturing, particularly in the production of aircraft component. Aircraft manufacturing typically involves the use of various metals, including aluminum, titanium, and others. Bending equipment is mainly used to form these materials into complex shapes that are required for several aircraft components including wing structures, fuselage sections, airframe and support structure, and others. Moreover, CNC bending tools offer high precision and consistent results, which enables manufacturers to produce aircraft parts with high precision and consistency.

- For instance, in October 2022, Tata Advanced Systems Limited, in partnership with Airbus Defence & Space S.A., launched its new C-295 transport aircraft manufacturing facility in Gujarat, India. The project is worth nearly USD 3 billion and includes the delivery of 56 C-295 transport aircrafts to the Indian Air force.

Thus, as per the analysis, the increasing development of aircraft manufacturing facilities is projected to increase the adoption of bending equipment during production of various aircraft components, in turn driving the bending machine market opportunities during the forecast period.

Bending Machine Market Segmental Analysis :

By Type:

Based on type, the market is segmented into manual, semi-automatic, and automatic.

Trends in the type:

- Factors including progressions in technology and growing adoption of industrial automation are among the key prospects driving the growth of the automatic machines segment.

- There is a rising trend towards utilization of semi-automatic bending equipment, attributing to its several benefits such as increased flexibility, improved quality control, and cost-efficiency among others.

Automatic segment accounted for a significant revenue in the overall market in 2024, and it is anticipated to register fastest CAGR growth during the forecast period.

- Automatic bending equipment refers to advanced industrial machines that are designed to perform bending operations with minimal human intervention. They can automatically load materials, set bending parameters, and execute the bending process without operator input.

- Automatic bending equipment is usually integrated with computer numerical control (CNC) technology, which enables automatic execution of programmed bending tasks.

- Moreover, automatic machines are capable of operating continuously along with handling large production volumes with high precision and accuracy.

- For instance, Bystronic Laser India Pvt. Ltd.offers automatic bending equipment in its product offerings. Bystronic’s automatic machine offers superior precision and bend accuracy.

- According to the bending machine market analysis, rising advancements associated with automatic bending tools are driving the bending machine market size.

By Driving Mechanism:

Based on driving mechanism, the market is segmented into mechanical, hydraulic, pneumatic, and electric.

Trends in the driving mechanism:

- Increasing adoption of hydraulic bending equipment, attributing to its several benefits including high force generation, robustness, precise control, and the ability to bend complex shapes.

- Rising trend towards utilization of electric bending equipment due to its eco-friendly & sustainable operations and minimal maintenance requirements.

Hydraulic segment accounted for the largest revenue share in the total bending machine market share in 2024.

- Hydraulic bending equipment utilizes hydraulic cylinders for generating the force necessary for bending. This type of machine is particularly effective for handling large and heavy components.

- Moreover, hydraulic bending equipment offers a range of benefits including high force generation, precise control, robustness, and the ability to bend complex shapes.

- For instance, AMOB Group offers CH series of hydraulic bending equipment in its product portfolio. The hydraulic machines offer several benefits such as ease of operation, sustainability, along with efficient and precise bending of high-strength materials.

- Therefore, rising developments associated with hydraulic bending equipment are driving the market.

Electric segment is anticipated to register fastest CAGR growth during the forecast period.

- Electric bending equipment utilizes electrical power for generating force and controlling the bending operation.

- Electric bending equipment usually consists of a robust frame, an electric drive system, bending tool, and a control panel. It offers high efficiency and are usually designed for precision bending tasks.

- Moreover, electric bending equipment provides numerous benefits including increased energy efficiency, cleaner operation, minimal maintenance requirements, and precise and quick operation among others.

- For instance, Unison Ltd offers All-Electric Tube Bending equipment in its product offerings. The electric bending equipment are designed for utilization in several industries including automotive, aerospace, shipbuilding, oil & gas, and others.

- Hence, the increasing advancements related to electric bending equipment are projected to drive the market during the forecast period.

By Sales Channel:

Based on sales channel, the market is segmented into direct sales and distributor sales.

Trends in the sales channel:

- Factors including the availability of excellent support and warranty, higher product quality, and reliable shipping and return policies are key prospects driving the direct sales channel segment.

- Factors such as higher accessibility to a variety of products, higher flexibility, and expanded reach are major determinants for driving the distributor sales channel segment.

Direct sales channel segment accounted for a significant revenue in the overall bending machine market share in 2024.

- In direct sales channel, bending equipment are sold directly to customers through numerous physical outlets including company outlets among others.

- Moreover, the direct sales channel also consists of online mode, wherein the manufacturers sell the machines through its own company websites.

- Additionally, purchasing bending equipment from direct sales channel offers numerous benefits including faster response time, higher product quality, higher return on investments, competitive pricing, and others which are key determinants for increasing the purchase of bending equipment from direct sales channel.

- For instance, TRUMPFis a bending equipment manufacturer that offers a broad range of bending equipment for direct purchase through the company website.

- Therefore, increasing availability of bending equipment in direct sales channels are driving the bending machine market trends.

Distributor sales segment is anticipated to register fastest CAGR growth during the forecast period.

- The distributor sales channel involves indirect distribution of bending equipment, wherein the machines are purchased from several regional distributors operating in multiple regions worldwide.

- Moreover, distributor sales channel provides several benefits including increased market reach, reduced capital expenditure, increased cost efficiency, and others. The above benefits of distributor sales channel are further increasing its utilization for sales of bending equipment.

- For instance, Advance Automation Machinery, Marc Techno Engineers, and others are few of the distributors of bending equipment.

- Hence, the increasing availability of bending equipment in distributor sales channel is anticipated to boost the bending machine market growth during the forecast period.

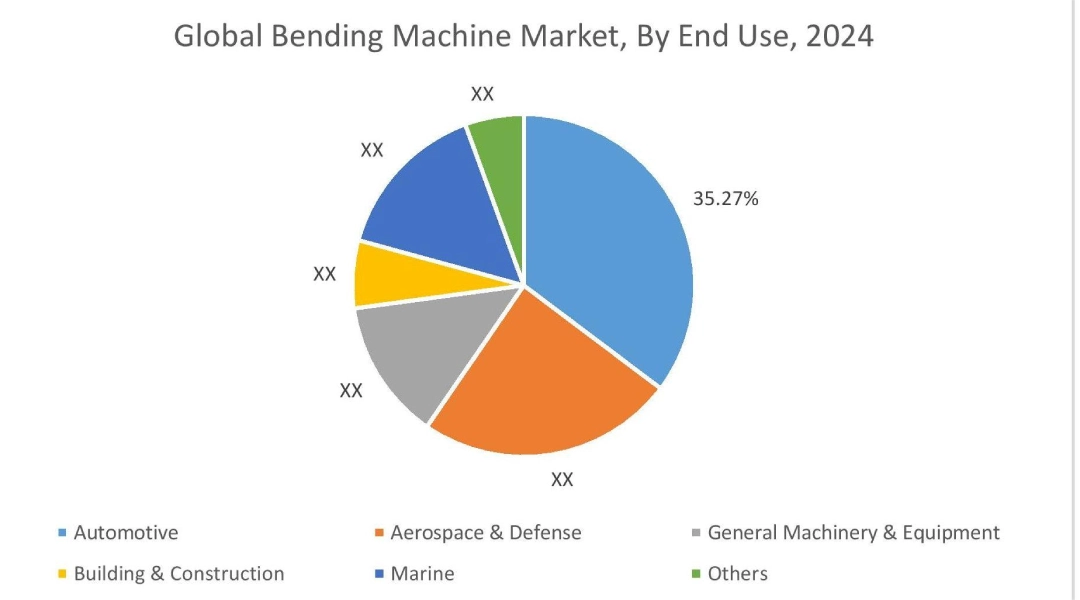

By End Use:

Based on the end use, the market is segmented into automotive, aerospace & defense, general machinery & equipment, building & construction, marine, and others.

Trends in the end use:

- Factors including the increasing development of automotive manufacturing facilities and rising vehicle production are key aspects propelling the automotive segment.

- Factors including growing commercial flight activities, increasing production of commercial aircraft, and rising need for advanced military aircraft for enhancement of aerial defense capabilities are primary determinants for driving the aerospace & defensesegment.

Automotive segment accounted for the largest revenue share of 35.27% in the total market share in 2024.

- Automotive manufacturing involves the production of parts and assemblies that must withstand frequent use, high stress, and extreme conditions.

- Bending equipment is primarily used in automotive sector for metal bending applications to transform flat sheets into complex shapes for providing structural integrity within automobiles.

- Moreover, bending equipment is used during automobile manufacturing for producing a wide array of automotive parts, ranging from chassis and frames to enclosures and brackets.

- For instance, according to the International Organization of Motor Vehicle Manufacturers, the total passenger car production in Europe reached up to 15,449,729 units in 2023, representing an increase of nearly 13% from 13,727,841 units in 2022.

- According to the analysis, the rising automotive production is propelling the bending machine market trends.

Aerospace & defense segment is anticipated to register substantial CAGR growth during the forecast period.

- Aircraft manufacturing typically involves the use of various metals, including aluminum, titanium, and others.

- Bending equipment is mainly used to form these materials into complex shapes that are required for several aircraft components including wing structures, fuselage sections, airframe and support structure, and others.

- For instance, Airbus, a European aircraft manufacturer, delivered 735 commercial aircraft in 2023, representing an incline of 11% in comparison to 661 deliverables in 2022.

- According to the analysis, the rising adoption of bending equipment during aircraft manufacturing is expected to boost the market during the forecast period.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

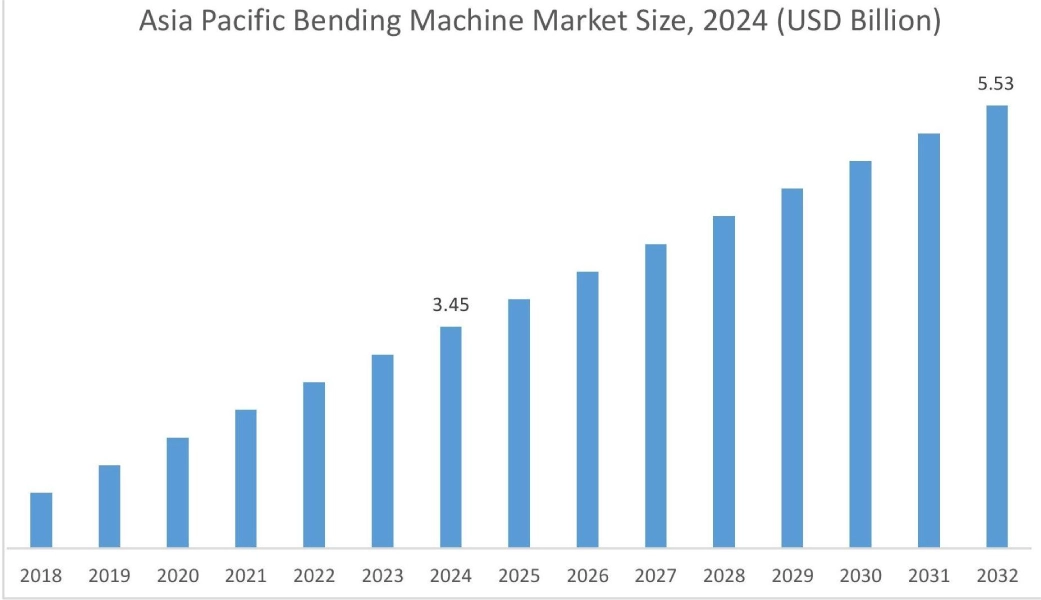

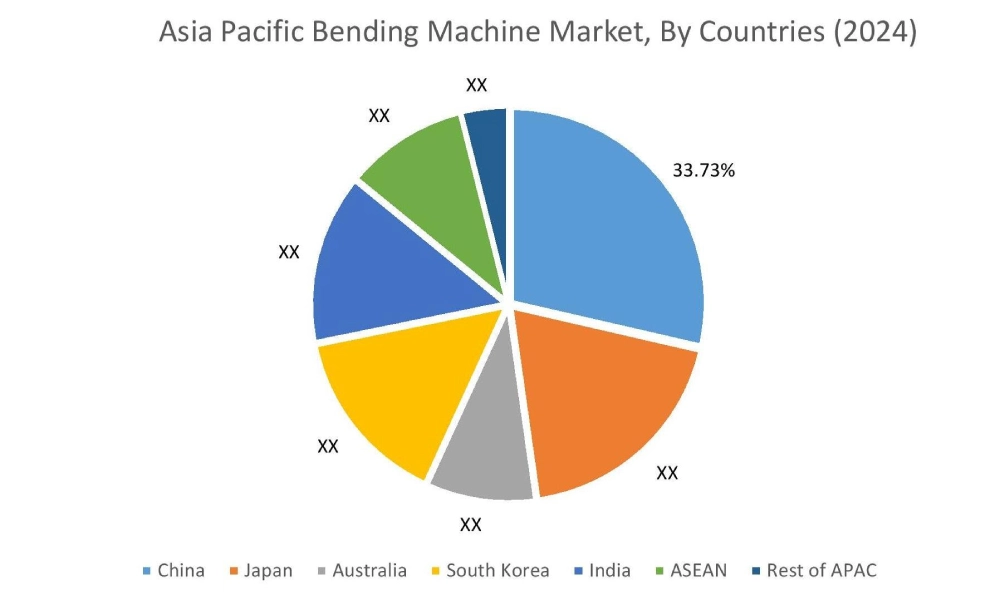

Asia Pacific region was valued at USD 3.45 Billion in 2024. Moreover, it is projected to grow by USD 3.60 Billion in 2025 and reach over USD 5.53 Billion by 2032. Out of this, China accounted for the maximum revenue share of 33.73%. As per the bending machine market analysis, the adoption of bending equipment in the Asia-Pacific region is primarily driven by increasing government investments in industrial manufacturing, rising automobile production, and increasing building & construction activities among others. Additionally, the rising advancements in automotive production and increasing adoption of bending equipment for producing automobile parts and components are further accelerating the bending machine market expansion.

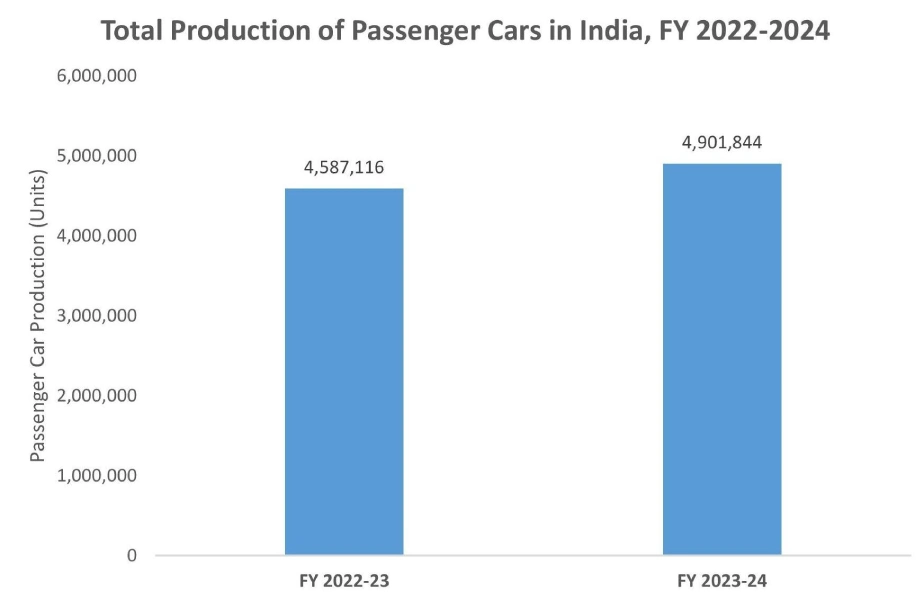

- For instance, according to the Society of Indian Automobile Manufacturers (SIAM), the total production of passenger cars in India reached 49,01,844 units during FY 2023-24, representing an incline of 7% in comparison to 45,87,116 units during FY 2022-23. The above factors are further propelling the market demand in the Asia-Pacific region.

North America is estimated to reach over USD 3.94 Billion by 2032 from a value of USD 2.57 Billion in 2024 and is projected to grow by USD 2.67 Billion in 2025. In North America, the growth of bending machine industry is driven by rising production of automobiles and increasing aircraft manufacturing in the region. Similarly, rising development of commercial aircraft is further contributing to the bending machine market demand.

- For instance, Boeing, a U.S.-based aerospace company, delivered approximately 136 commercial aircraft during the second quarter of 2023, depicting an increase of 4.6% in comparison to 130 commercial aircraft deliverables during the first quarter of 2023. The above factors are boostingthe market demand in North America.

Additionally, the regional analysis depicts that the increasing vehicle production, rising shipbuilding activities, and favorable government measures for adoption of industrial automation are propelling the bending machine market demand in Europe. Furthermore, as per the market analysis, the market demand in Latin America, Middle East, and African regions is expected to grow at a considerable rate due to factors such as rising pace of industrialization, increasing manufacturing output, growing construction activities, and increasing investments in advanced industrial machinery among others.

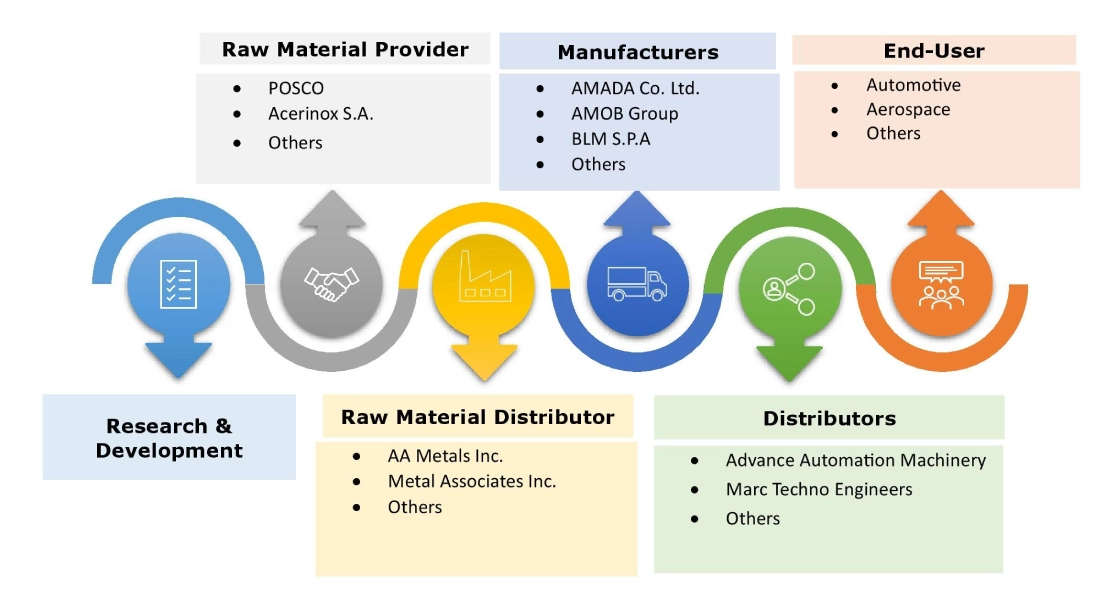

Top Key Players and Market Share Insights:

The global bending machine market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the bending machine market. Key players in the bending machine industry include-

- AMADA Co. Ltd.(Japan)

- AMOB Group(Portugal)

- Inductaflex Ltd. (United Kingdom)

- LVD Group NV (Belgium)

- Schwarze Robitec GmbH (Germany)

- TRUMPF SE Co. KG (Germany)

- BLM S.P.A(Italy)

- Haco Machinery Private Limited (India)

- Hochstrate Maschinenbau Umformtechnologien GmbH (Germany)

- EUROMAC SPA (Italy)

- HAEUSLER AG (Switzerland)

Recent Industry Developments :

Product Launch:

- In February 2023, TRUMPF launched its new generation of bending equipment, TruBend series 8000. The machine offers a remarkably efficient performance during bending very large parts and enables workers to easily bend and remove work pieces that require a large box height.

Bending Machine Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 14.29 Billion |

| CAGR (2025-2032) | 6.1% |

| By Type |

|

| By Driving Mechanism |

|

| By Sales Channel |

|

| By End Use |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the bending machine market? +

The bending machine market was valued at USD 9.18 Billion in 2024 and is projected to grow to USD 14.29 Billion by 2032.

Which is the fastest-growing region in the bending machine market? +

Asia-Pacific is the region experiencing the most rapid growth in the bending machine market.

What specific segmentation details are covered in the bending machine report? +

The bending machine report includes specific segmentation details for type, driving mechanism, sales channel, end use, and region.

Who are the major players in the bending machine market? +

The key participants in the bending machine market are AMADA Co. Ltd. (Japan), AMOB Group (Portugal), BLM S.P.A (Italy), Haco Machinery Private Limited (India), Hochstrate Maschinenbau Umformtechnologien GmbH (Germany), EUROMAC SPA (Italy), HAEUSLER AG (Switzerland), Inductaflex Ltd. (United Kingdom), LVD Group NV (Belgium), Schwarze Robitec GmbH (Germany), TRUMPF SE Co. KG (Germany), and others.