Automotive Parts Market Size:

Automotive Parts Market Size is estimated to reach over USD 165.71 Billion by 2032 from a value of USD 113.90 Billion in 2024 and is projected to grow by USD 117.48 Billion in 2025, growing at a CAGR of 5.1% from 2025 to 2032.

Automotive Parts Market Scope & Overview:

Automotive parts refer to any component or assembly, which are designed for installation in a vehicle, and consist of body panels, engine parts, and electrical systems, among others. With the growing awareness of sustainability and environmental concerns, there is a rising demand for eco-friendly materials and manufacturing processes in the parts. As a result, manufacturers are investing in research and development to create interior automotive parts and accessories using recycled materials, renewable resources, and energy-efficient production methods.

How is AI Transforming the Automotive Parts Market?

AI is increasingly being integrated into automotive parts sector, particularly in the design, manufacturing, and quality control of vehicle parts. AI-powered systems are used for automating vehicle parts production processes, in turn reducing human error, and improving overall production efficiency. AI-powered robots are used in various stages of the production process, further increasing productivity and reducing costs. In addition, AI-powered systems can inspect automobile parts for defects during production, which helps in improving product quality and reducing error rates. Consequently, the above factors are projected to boost the market growth in upcoming years.

Automotive Parts Market Dynamics - (DRO) :

Key Drivers:

Rising vehicle production is driving the automotive parts market expansion

The growth in global vehicle production is a significant driver for the global market, with increasing urbanization playing a crucial role. As more people move to urban areas, the demand for personal transportation rises, leading to a surge in vehicle ownership. This trend is particularly evident in emerging economies where rapid urbanization is accompanied by an expanding middle class with rising disposable incomes. With more vehicles on the road, there is a growing need for reliable auto parts, such as suspension systems, brake and pads, and control arms, among others, to ensure safe operation and mitigate the risks associated with increased traffic density and congestion in urban environments.

Further, the rising disposable incomes contribute to the need for higher-quality vehicles equipped with advanced safety features, including state-of-the-art automotive components. Consumers are increasingly willing to invest in vehicles that offer superior performance, comfort, and safety, thereby driving the need for reliable automotive components.

- For instance, in March 2024, Tata Motors has signed a Memorandum of Understanding (MoU) with Tamil Nadu government, to set-up an automobile manufacturing facility in the state. With this MoU, Tamil Nadu investment promotion and facilitation agencies will enable Tata Motors to commence the production of vehicles. The MoU stated an investment of USD 1,081.6 million over 5 years.

Thus, according to the automotive parts market analysis, the growing vehicle production is driving the automotive parts market size and trends.

Key Restraints:

Supply chain disruptions are affecting the automotive parts market demand

The global automotive sector has been significantly impacted by supply chain disruptions, particularly in the realm of interior components and accessories. These disruptions have emerged from various factors, including the COVID-19 pandemic, geopolitical tensions, and natural disasters. The pandemic led to factory shutdowns, reduced production capacities, and logistical challenges, disrupting the flow of materials and components across borders. Further, the sector’s reliance on complex global supply chains has made it vulnerable to geopolitical tensions and trade disputes. In addition to this, tariffs, trade restrictions, and political uncertainties have led to increased costs and disruptions in the procurement of raw materials and components, further worsening the supply chain challenges.Thus, the above analysis depicts that the aforementioned factors would further impact on the automotive parts market size.

Future Opportunities :

Growing demand for electric vehicles is expected to create potential growth for automotive parts market opportunities

As the automotive sector shifts towards sustainability and efficiency, electric powertrains are gaining attraction due to their lower environmental impact and reduced reliance on fossil fuels. This shift has profound implications for steering systems, which must adapt to the unique characteristics of electric vehicles. Electric vehicles often incorporate advanced automotive systems, which replace traditional mechanical linkages with electronic controls. These advanced automotive systems allow for more precise control and enable vehicle manufacturers to optimize vehicle responsiveness and energy efficiency. Moreover, these systems pave the way for semi-autonomous and autonomous driving features, where inputs and systems can be dynamically adjusted based on real-time data from sensors and cameras.

- For instance, in December 2023, Nexteer achieved global production milestone of 100 million electric vehicle power steering systems, while enabling advanced safety performance and fuel efficiency. The company’s power steering systems can be found in several vehicles, such as Ford F150, GMC Hummer EV, Ford Bronco, and Jeep Avenger, among others.

Thus, based on the above automotive parts market analysis, the growing demand for electric vehicles is expected to drive the automotive parts market opportunities and trends.

Automotive Parts Market Segmental Analysis :

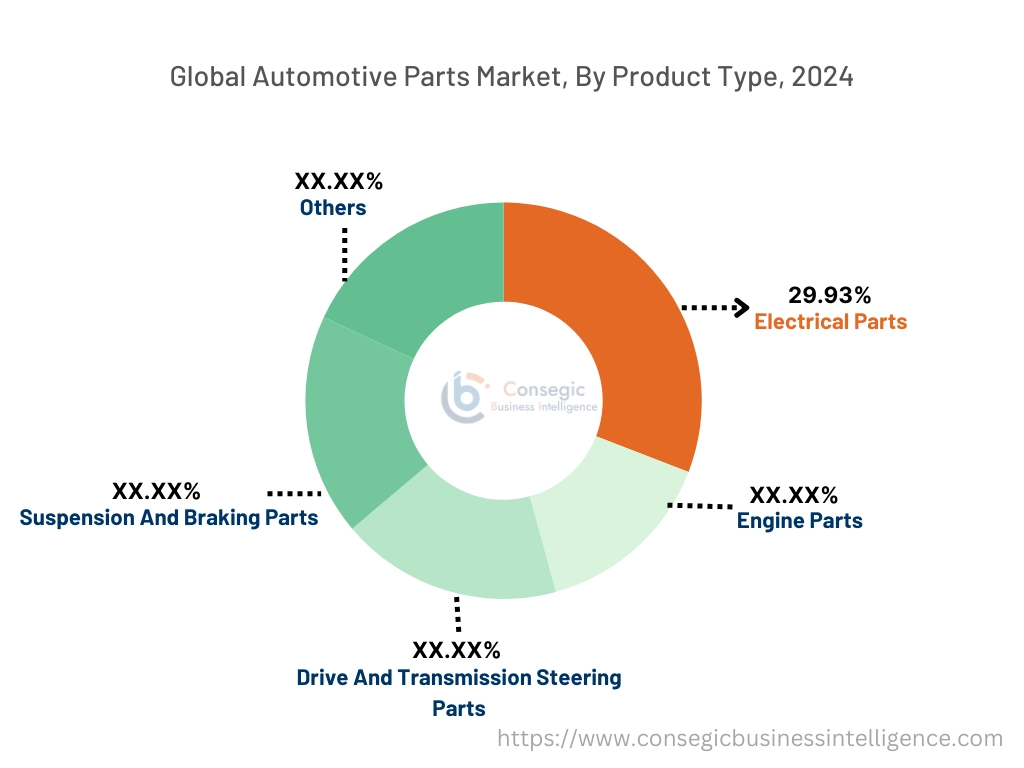

By Product Type:

Based on product type, the automotive parts market is segmented into engine parts, electrical parts, drive and transmission steering parts, suspension and braking parts, and others

Trends in product type:

- By developing advanced brake systems optimized for ADAS applications, manufacturers can differentiate themselves in a competitive market landscape, enhance their value proposition to OEMs and consumers, and position themselves as key enablers of vehicle safety and performance in the connected and autonomous mobility.

- The advancements in materials science and engineering have enabled the development of lighter, more durable, and efficient engines. Manufacturers are leveraging materials such as lightweight alloys, composites, and advanced ceramics to improve performance while reducing weight and fuel consumption.

- Thus, the above trends are driving the automotive parts market demand.

The electrical parts segment accounted for the largest revenue share of 28.93% in the year 2024.

- With the rise of electric vehicles (EVs), hybrid electric vehicles (HEVs), and plug-in hybrid electric vehicles (PHEVs), electrical components have become integral to optimizing the performance and efficiency of electrified powertrains.

- Autonomous driving technology has rapidly evolved, with automakers and tech companies investing heavily in research and development to bring fully autonomous vehicles to the market. This has led to the proliferation of sensors, cameras, radar systems, and other electrical and electronic components that enable vehicles to perceive their surroundings and make real-time decisions.

- Thus, based on the above analysis, these developments are further driving the automotive parts market growth.

The suspension and braking parts segment are anticipated to register the fastest CAGR during the forecast period.

- There is a growing emphasis on the integration of smart technologies into brake systems. R&D initiatives are centered on incorporating sensors and electronic control units (ECUs) to enable features such as predictive maintenance, autonomous emergency braking, and regenerative braking.

- Manufacturers are focusing on developing lightweight and energy-efficient suspension components to improve fuel efficiency and reduce carbon emissions.

- Consumers are increasingly prioritizing a smooth ride experience, especially in regions where road infrastructure may be less developed. This has led to a surge in the adoption of advanced suspension technologies, such as adaptive and air suspension systems, across various vehicle segments.

- For instance, in June 2023, EBC Brakes introduced fully-floating two-piece discs high-performance brake pad options for GB7 BMW M2. With this launch, the company will provide aftermarket performance components for vehicles, while enhancing the driving experience.

- Thus, based on the above analysis, these factors are expected to drive the automotive parts market share during the forecast period.

By Vehicle Type:

Based on vehicle type, the automotive parts market is segmented into passenger vehicles, light commercial vehicles, heavy commercial vehicles, and sports vehicles.

Trends in vehicle type:

- As consumer preferences shift toward more advanced technology and aesthetic appeal in vehicles, the need for infotainment systems, advanced seating, and customized automotive parts continue to grow.

- Commercial vehicles, including trucks, buses, and trailers, require robust suspension systems to support heavy loads and ensure stability and control during transportation. The suspension systems offer benefits such as adjustable ride height and improved load distribution, making them ideal for commercial applications.

The passenger vehicles segment accounted for the largest revenue in the year 2024.

- Passenger vehicles constitute a significant segment of the global market, which includes sedans, hatchbacks, SUVs, and crossovers. These systems are essential for sustaining steering stability, which facilitates smooth handling and control for both drivers and passengers.

- To cater driver comfort and vehicle dynamics, automotive manufacturers are eager to incorporate advanced suspension components, such as steering systems, to enhance handling characteristics and reduce vibrations.

- For instance, in October 2022, Hitachi Astemo, Ltd. has unveiled a prototype for an advanced steer-by-wire steering system. This innovative technology eliminates the need for traditional steering wheels, thereby increasing cabin space. Such advancements are essential for the development of future-generation vehicles and autonomous cars.

- Thus, on the above analysis, these developments in the passenger vehicles segment are driving the automotive parts market growth.

The sports vehicles segment is anticipated to register the fastest CAGR during the forecast period.

- The rise of electric sports cars with advancements in battery technology and electric powertrain are enabling performance levels that compete traditional combustion engine vehicles.

- Consumers, particularly younger demographics, are increasingly seeking personalised vehicles. This is fuelling the growth in the aftermarket, with need or performance enhancements and custom interiors.

- These developments in the sports vehicles segment are anticipated to further drive the automotive parts market trends during the forecast period.

By Sales Channel:

Based on sales channel, the automotive parts market is segmented into OEMs, aftermarket, repair/service center, auto dealership, and retail store.

Trends in sales channel:

- Online sales platforms are becoming increasingly prominent, providing convenient access to a diverse range of automotive products for consumer and repair shops. These trends are further disrupting the traditional distribution channels.

- Both OEMs and aftermarket suppliers are placing greater emphasis on quality and reliability. This sift is influenced by customer expectations and the necessity to uphold vehicle safety and performance.

The OEMs segment accounted for the largest revenue share in the year 2024.

- OEMs, which include vehicle manufacturers, are pivotal in the initial integration of automobile parts into new vehicles throughout the production process. These collaborations with OEMs typically involve long-term contracts to guarantee the integration of automobile parts that comply with rigorous quality standards and specifications.

- The OEM segment gains from the consistent requirement for automotive products, fuelled by rising vehicle production volumes and the ongoing necessity for automotive components that promote vehicle safety, stability, and performance.

- Technological innovations in suspension systems and an increasing focus on driving comfort further enhance the need for advanced systems from OEMs.

- Thus, based on the above analysis, the rise in technological innovations would further supplement the global market share.

The aftermarket segment is anticipated to register the fastest CAGR during the forecast period.

- Many vehicle owners seek aftermarket products that allow them to enhance the aesthetics, performance, and functionality of their vehicles according to their individual preferences. This includes options such as aftermarket wheels, performance upgrades, interior accessories, and exterior styling enhancements.

- Aftermarket suppliers frequently emphasize value-added services such as product warranties, technical support, and installation assistance to distinguish themselves in a competitive market environment.

- For instance, in March 2021, SKF India’s automotive aftermarket segment launched three new products designed to meet the evolving needs of customers across various sectors in India. The new offerings include steering and suspension systems for 4-wheelers, timing belts, and chain and sprockets for 2-wheelers. This innovative product range features high quality, superior strength, and long-lasting durability

- These developments in the sales channel segment is anticipated to further drive the automotive parts market trends during the forecast period

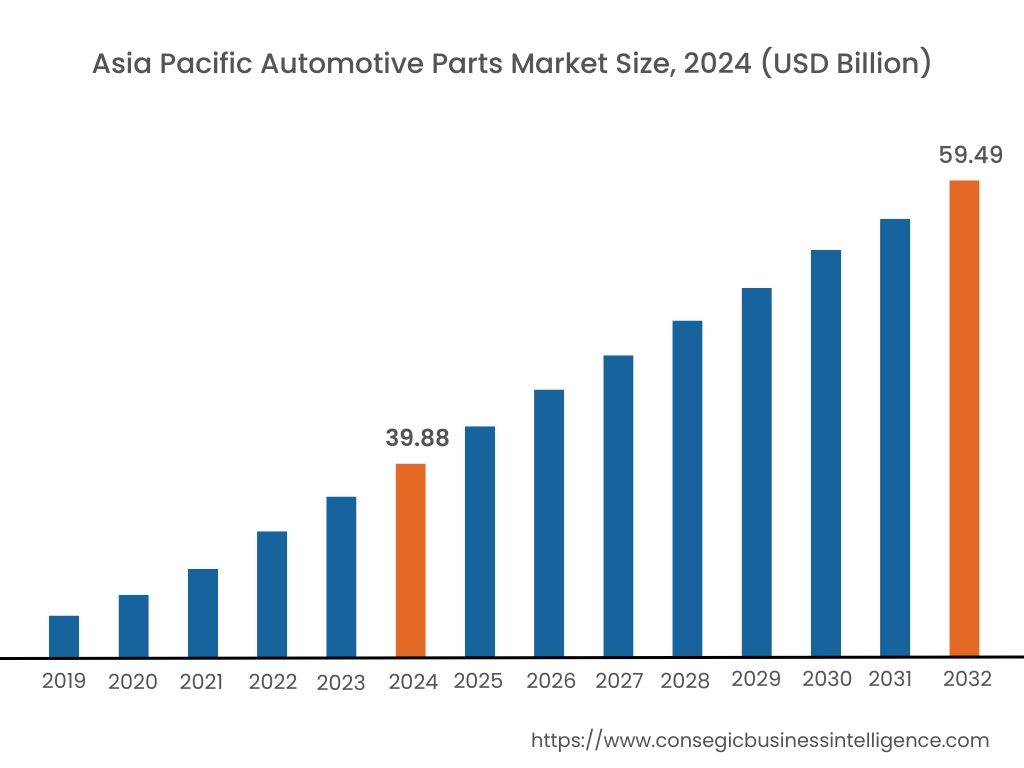

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

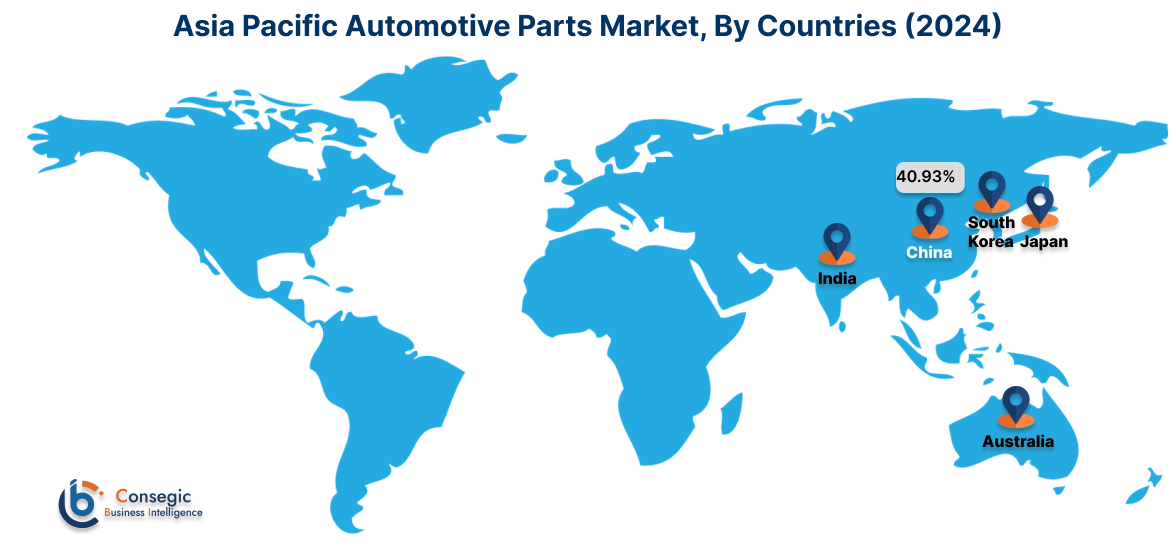

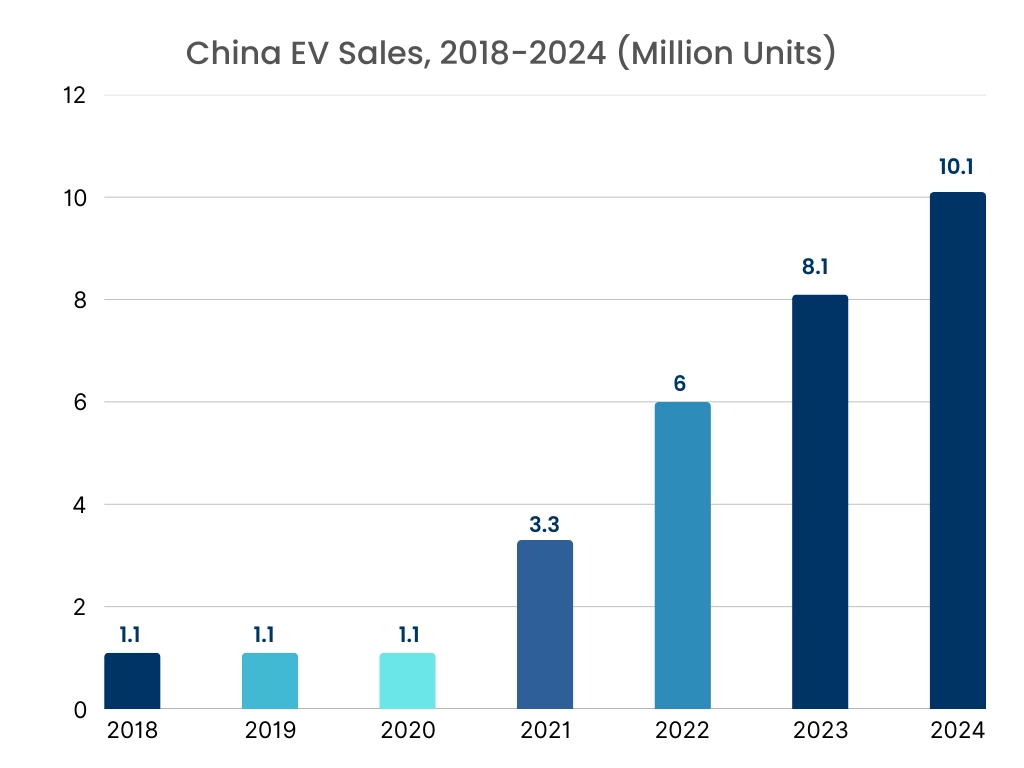

Asia Pacific automotive parts market expansion is estimated to reach over USD 59.49 billion by 2032 from a value of USD 39.88 billion in 2024 and is projected to grow by USD 41.22 billion in 2025. Out of this, the China market accounted for the maximum revenue split of 40.93%. The Asia Pacific region is expected to become a profitable market for automotive products, influenced by rapid urbanization, increasing disposable incomes, and growing vehicle production. Countries such as China, Japan, and India are experiencing notable development in automotive manufacturing and sales, providing significant prospects for market participants. Furthermore, the transition to electric vehicles (EVs) in countries such as China is accelerating market development, as EV manufacturers focus on developing lightweight and durable automotive components to enhance vehicle performance and efficiency. These factors would further drive the regional automotive parts market share during the forecast period.

- For instance, in December 2024, BYD, the Chinese car manufacturer, sold 509,440 electric passenger vehicles and plug-in hybrid vehicles, which includes 207,734 EVs, bringing the total annual sales of battery-powered cars to 1.76 million. The company's overall annual sales rose by 41% compared to the previous year.

North America market is estimated to reach over USD 44.74 billion by 2032 from a value of USD 30.79 billion in 2024 and is projected to grow by USD 31.76 billion in 2025. North America holds a significant share of the global automotive component market, owing to its established automotive industry, technological expertise, and robust consumer demand. Further, the United States hosts several major automakers and component suppliers, contributing to the region's market dominance. Moreover, the region's focus on advanced safety features, vehicle electrification, and autonomous driving technologies presents lucrative opportunities for component manufacturers, further solidifying North America's position in the global auto component market. These factors would further drive the automotive parts in the regional market.

- For instance, in May 2022, Tenneco Inc. announced that 2022 Mercedes AMGSL-Class would feature intelligent suspension technologies from their Monroe brand portfolio. The new models of Mercedes will be available with Tenneco’s CSVA2 semi-active kinetic suspension systems.

According to the analysis, the automotive parts industry in Europe is projected to witness significant development during the forecast period. The focus on emission reduction and enhanced fuel efficiency has led to the incorporation of advanced suspension systems, including idler arms, in vehicles. Further, innovations in automotive design and the presence of key market players play a vital role in the regional growth. Additionally, countries such as Brazil and Mexico have dynamic automotive industries and rising vehicle sales, but economic uncertainties and political instability may affect market progression. The increasing emphasis on vehicle safety standards, along with the development of after-market sales channels, presents prospects for market development. Further, in the MEA region, the market is anticipated to witness moderate growth during the forecast period. Factors such as infrastructure development, urbanization, and escalating investments in the automotive sector are driving market development. The rising need for commercial vehicles, particularly in the construction and logistics sectors, is fueling the adoption of several automotive components.

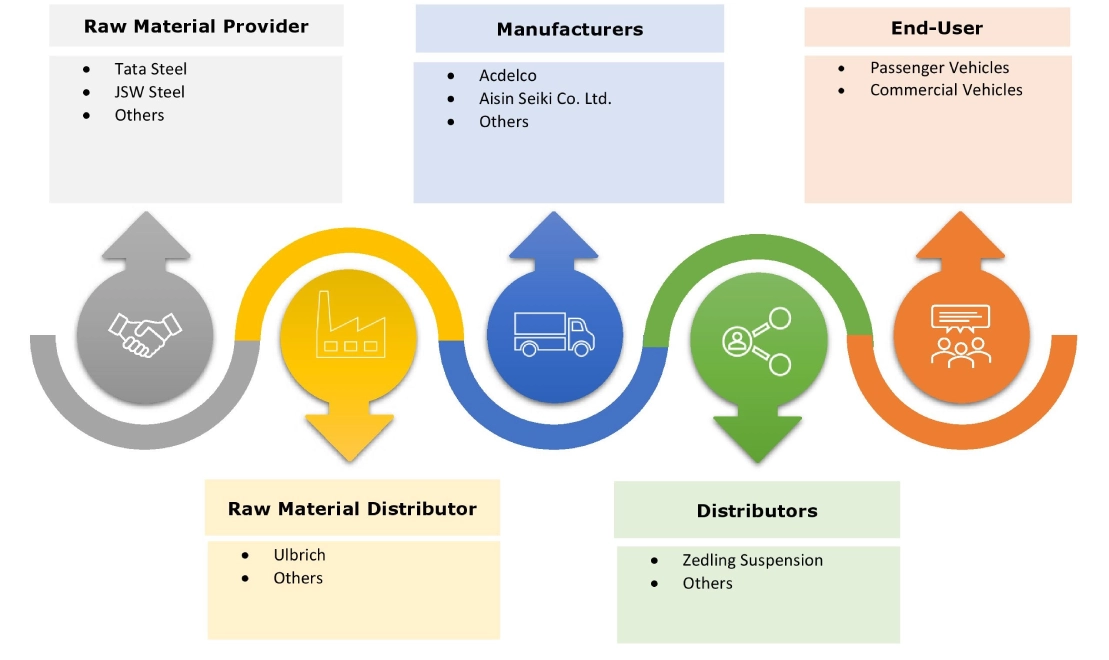

Top Key Players and Market Share Insights:

The global automotive parts market is highly competitive with major players providing automotive solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the automotive parts industry include-

- Acdelco (U.S.)

- Aisin Seiki Co. Ltd. (Japan)

- Akebono Brake Industry Co. Ltd. (Japan)

- Aptiv PLC (U.S.)

- Brembo S.p.A (Italy)

- Continental AG (Germany)

- Denso Corporation (Japan)

- Faurecia S.A. (France)

- Magna International Inc. (Canada)

- Robert Bosch GmbH (Germany)

- Valeo SA (France)

- ZF Friedrichshafen AG (Germany)

Recent Industry Developments :

Product Launch:

- In September 2024, Continental AG unveiled new product offerings, including chassis, steering components, sensors for driver assistance systems, and high-pressure fuel pumps. These product offerings are being further improved with services for high-quality repairs, such as Remote Support, a digital service that supports workshops during video chat.

Automotive Parts Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 165.71 Billion |

| CAGR (2025-2032) | 5.1% |

| By Product Type |

|

| By Vehicle Type |

|

| By Sales Channel |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Automotive Parts market? +

Automotive Parts Market Size is estimated to reach over USD 165.71 Billion by 2032 from a value of USD 113.90 Billion in 2024 and is projected to grow by USD 117.48 Billion in 2025, growing at a CAGR of 5.1% from 2025 to 2032.

Which is the fastest-growing region in the Automotive Parts market? +

Asia-Pacific is the region experiencing the most rapid growth in the market.

What specific segmentation details are covered in the Automotive Parts report? +

The automotive parts report includes specific segmentation details for product type, vehicle type, sales channel, and region.

Who are the major players in the Automotive Parts market? +

The key participants in the market are Acdelco (U.S.), Aisin Seiki Co. Ltd. (Japan), Akebono Brake Industry Co. Ltd. (Japan), Aptiv PLC (U.S.), Brembo S.p.A (Italy), Continental AG (Germany), Denso Corporation (Japan), Faurecia S.A. (France), Magna International Inc. (Canada) , Robert Bosch GmbH (Germany), Valeo SA (France), ZF Friedrichshafen AG (Germany), and others.