Blood and Organ Bank Market Size :

Consegic Business Intelligence analyzes that the Blood and Organ Bank Market size is estimated to reach over USD 26,663.70 Million by 2032 from a value of USD 17,560.41 Million in 2024 and is projected to grow by USD 18,188.75 Million in 2025, growing at a CAGR of 5.40 % from 2025 to 2032.

Blood and Organ Bank Market Scope & Overview:

The blood bank is a center for storing blood and plasma samples for the transfusion process. Blood banks are engaged in various activities related to blood, including the collection of blood from donors, separated, typed into components, and transfused to the recipients. Further, every donated unit of blood is segregated into multiple components, namely red blood cells (RBC), plasma, and platelets, and each component is typically transfused to a different individual with specific requirements.

The organ bank refers to a center that manages organs for transplant. Additionally, the organ bank collects and recovers human organs for different applications such as education, medical research, and allograft transplantation.

Blood and Organ Bank Market Insights :

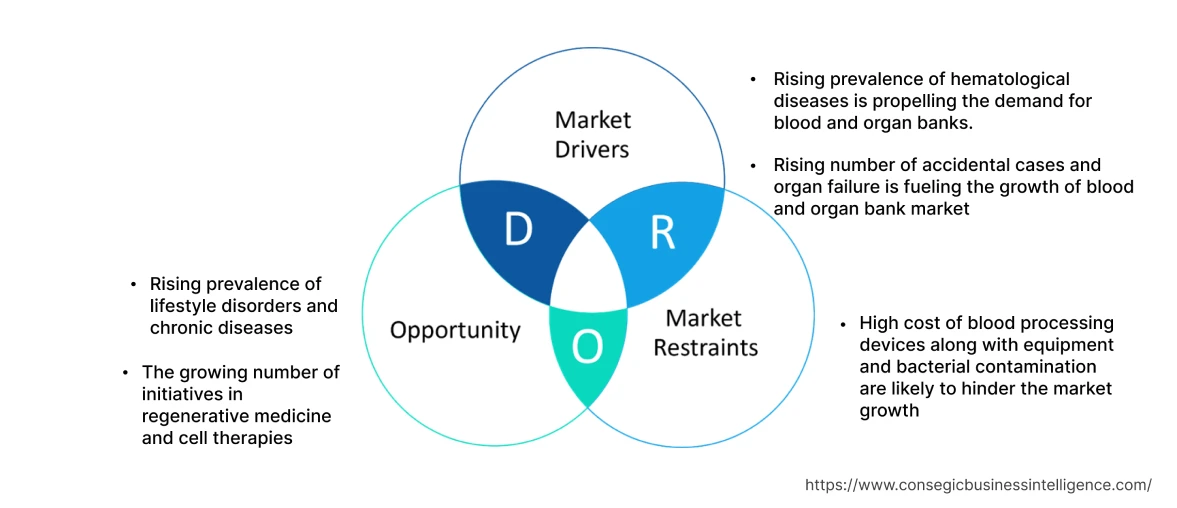

Blood and Organ Bank Market Dynamics - (DRO) :

Key Drivers :

Rising prevalence of hematological diseases is propelling the demand for blood and organ banks

Hematologic diseases is a type of disorders that mainly affect the blood & blood-forming organs and include rare genetic disorders such as anemia, hemophilia, blood clots, severe infection, and blood cancers (leukemia). Such types of hematologic diseases required blood transfusions because while suffering from any hematologic disorder it is difficult for the patient's body to produce healthy blood. For instance, according to the Leukemia & Lymphoma Society, in 2021, approximately 186,400 people in the U.S. were diagnosed with lymphoma, leukemia, or myeloma. Among these, lymphoma accounted for 48%, leukemia accounted for 33%, and myeloma accounted for 19% of the total cases in the U.S. in 2021. Hence, the increasing cases of hematological disorders is driving the demand for blood transfusion which is driving the growth of the blood and organ bank market.

Rising number of accidental cases and organ failure is fueling the growth of blood and organ bank market

Organ transplantations are performed to save the lives of patients affected by terminal organ failures and to improve their quality of life. In addition, the increasing number of accidental cases is driving the demand for blood transfusion due to the sudden loss of blood. For instance, according to the Ministry of Road Transport and Highways, in India, approximately 3,66,138 road accidents were reported in 2020, and 4,12,432 road accidents were reported in 2021. Thus, the increase in accident rates which resulted in organ failure incidences are leading to the growth in blood transfusion and organ transplantation procedures, thereby accelerating the growth of the blood and organ bank market.

Key Restraints :

High cost of blood processing and storage devices hinder the market growth

The variety of equipment including automated blood processing devices requires suitable ambient conditions during the storage and transportation of blood and organs. These devices require efficient functioning and timely maintenance, which results in a cost burden for blood banks. Bacterial and equipment contamination are the key factors leading to blood transfusion infection including dengue fever, hepatitis A virus, hepatitis C virus, and human immunodeficiency virus.

For instance, according to the data published by World Health Organization, globally, 58 million people are suffering from chronic hepatitis C virus infection, with about 1.5 million new infections occurring per year. Moreover, the WHO stated that unscreened blood transfusion is a major reason for the increasing prevalence of the hepatitis C virus. Hence, the rising prevalence of the high cost of blood processing devices and increasing incidents of transfusion-transmitted infections due to equipment and bacterial contamination is likely to hinder the market growth.

Future Opportunities :

Development of new hospital lead to more market opportunities

The blood bank ensures that hospitals have a safe, reliable blood supply for patients in need. Thus, the efficient supply of blood often reduces the probability of fatalities. The factors, including the increasing investment in the development of hospitals, government initiatives, and others are accelerating the development of hospital infrastructure. This, in turn, will rise the demand for blood supplies in hospitals, thereby augmenting the demand for blood banks.

For instance, in 2021, PCL Construction invested around US$ 1.7 billion in the development of a new St. Paul's Hospital Project in Canada. The development of a new hospital is expected to be completed in 2026. Thus, the development of new hospital infrastructure will create lucrative growth for the market in the upcoming years.

Blood and Organ Bank Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 (USD Million) | USD 26,663.70 Million |

| CAGR (2025-2032) | 5.4% |

| By Services Type | Red Blood Cell Collection, Blood Plasma Collection, Organ Bank, Tissue Bank, Health Screening, All Other Human Blood, Reproductive and Stem Cell Bank, and Others |

| End User | Hospitals, Diagnostics Centers, Ambulatory Surgery Centers, Blood Bank, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | The American National Red Cross, New England Donor Services, New York Blood Center, The Living Bank, Musculoskeletal Transplant Foundation, CBR Systems, Inc., Vitalant, Bio Products Laboratory Ltd., America's Blood Centers, Canadian Blood Services, and Terumo BCT, Inc. |

Blood and Organ Bank Market Segmental Analysis :

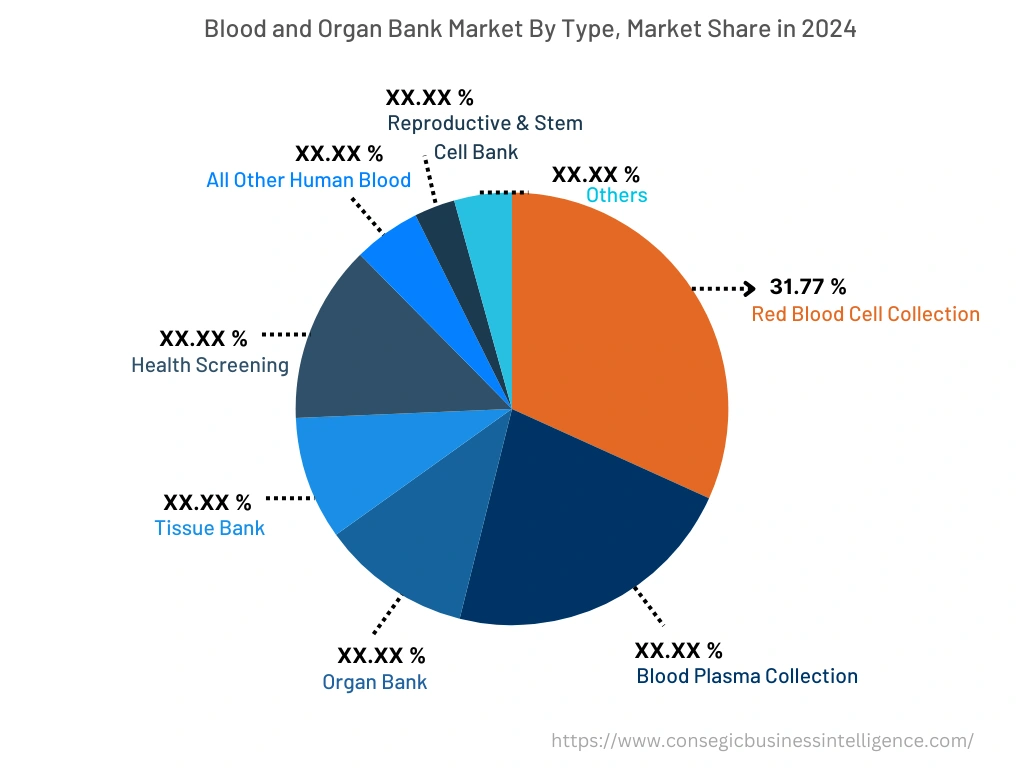

By Services Type :

The services type segment is categorized into red blood cell collection, blood plasma collection, organ bank, tissue bank, health screening, all other human blood, reproductive and stem cell bank, and others. In 2024, red blood cell collection segment accounted for the highest market share of 31.77% in the overall blood and organ bank market. This is due to the rising prevalence of chronic anemia and acute blood loss that primarily requires transfusion of red blood cells.

However, blood plasma collection services are expected to be the fastest-growing segment in the market during the forecast period. This is due to the growing use of immunoglobulins in several therapeutic areas, the increasing prevalence of rare diseases, and the rising number of plasma collection centers. For instance, in April 2022, Bio Products Laboratory Ltd (BPL), a manufacturer of plasma-derived protein therapies, announced the opening of its 29th plasma donation center. Hence, the growing number of plasma collection centers is a substantial factor expected to proliferate the market growth.

By End-User :

The end-user segment is classified into hospitals, diagnostics centers, ambulatory surgery centers, blood bank, and others. In 2024, the hospital segment accounted for the highest market share in the blood and organ bank market. This is due to the increasing surgery rate in hospitals for blood disorders, cardiac surgery, vascular surgery, and hepatobiliary surgery, among others.

However, the blood bank segment is expected to grow at the fastest CAGR over the forecast period due to the growing awareness about blood donation and the increasing prevalence of transfusion transmissible infection. In addition, several government initiatives associated with blood donation are driving the demand for blood and organ banks. For instance, in 2020, The Indian Red Cross Society launched a mobile app called ‘eBloodServices' for accessing blood services which are further driving the market growth.

By Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

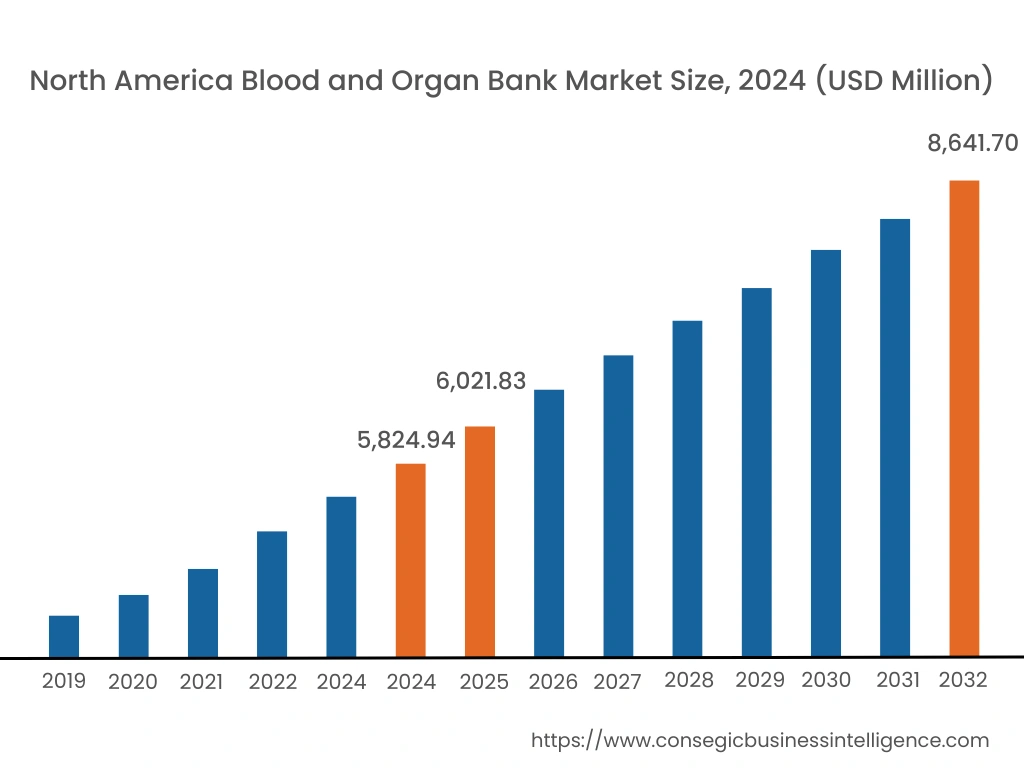

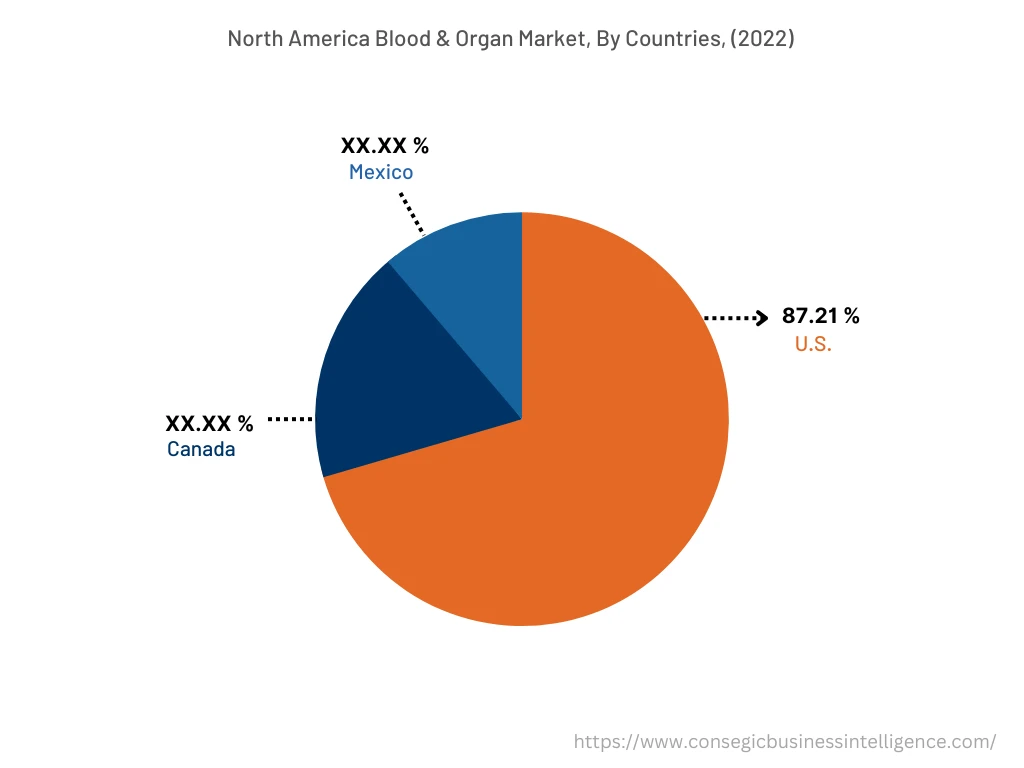

In 2024, North America accounted for the highest market share of 37.09% and was valued at USD 5,824.94 million and is expected to reach USD 8,641.70 million in 2032. In North America market the U.S. hold 87.21% of the market share, this is due to the increasing awareness regarding the importance of blood donation and the growing number of blood donors particularly in the U.S. For instance, according to the Centers for Disease Control and Prevention, in the U.S., there are 11 million blood donors and more than 14 million units of blood transfused annually. Hence, the aforementioned factor is driving the market growth in the region.

Moreover, Asia Pacific is expected to grow at the fastest CAGR of 5.8% during the forecast period. This is driven by the rising government initiatives in the Asia Pacific region to support blood donation and the increase in the number of blood banking units in developing nations, particularly in countries such as China and India.

Top Key Players & Market Share Insights:

The blood and organ bank market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include -

- The American National Red Cross

- New England Donor Services

- New York Blood Center

- The Living Bank

- Musculoskeletal Transplant Foundation

- CBR Systems, Inc.

- Vitalant

- Bio Products Laboratory Ltd.

- America's Blood Centers

- Canadian Blood Services

- Terumo BCT, Inc.

Recent Industry Developments :

- In January 2022, New York Blood Center (NYBC) and Innovative Blood Resources (IBR) announced the merger of their organizations. The merger of the two organizations will help to provide greater access to a broader inventory of blood products.

- In October 2021, Terumo BCT, Inc. declared the launch of new manufacturing facility in Costa Rica with an investment of USD 60 million to manufacture medical devices and products for collecting, separating, and processing blood and cells.

Key Questions Answered in the Report

What was the market size of the blood and organ bank market in 2024? +

In 2024, the market size of blood and organ bank was USD 17,560.41 million.

What will be the potential market valuation for the blood and organ bank market by 2032? +

In 2032, the market size of blood and organ bank will be expected to reach USD 26,663.70 million.

What are the key factors driving the growth of the blood and organ bank market? +

Rising prevalence of hematological diseases and growing number of accidental cases and organ failure are the key factors driving the growth of the blood and organ bank market.

What is the dominating segment in the blood and organ bank market, by services type? +

In 2024, the red blood cell collection segment accounted for the highest market share of 31.77% in the overall blood and organ bank market.

Based on current market trends and future predictions, which geographical region will have the fastest impact on the blood and organ bank market's growth in the coming years? +

Asia Pacific is expected to be the fastest-growing region in the market during the forecast period.