Veterinary Diagnostic Imaging Market Size :

Veterinary Diagnostic Imaging Market size is estimated to reach over USD 2,746.32 Million by 2032 from a value of USD 1,408.77 Million in 2024 and is projected to grow by USD 1,506.85 Million in 2025, growing at a CAGR of 6.90% from 2025 to 2032.

Veterinary Diagnostic Imaging Market Scope & Overview:

Veterinary diagnostic imaging is a non-invasive technique for conducting medical imaging of animals to diagnose various diseases. Also, the devices encompass various techniques such as X-rays, ultrasound, CT scans, and MRI, designed to provide unique insights into an animal's anatomy and physiology. Additionally, diagnostic imaging is used to track the effectiveness of treatments and monitor the healing process, which in turn is fueling the veterinary diagnostic imaging market demand. Further, the rapid digital transformation is driving the adoption of digital radiography and other digital technologies is fueling the veterinary diagnostic imaging market growth.

How is AI Transforming the Veterinary Diagnostic Imaging Market?

AI is reshaping veterinary diagnostic imaging around the world by making scans more accurate, faster, and smarter. Veterinary clinics now use AI-powered tools that analyze X-rays, ultrasounds, CTs, and MRIs to flag subtle abnormalities that might otherwise go unnoticed, helping veterinarians catch issues early and act more confidently. These tools speed up image interpretation and automate routine steps like sorting and initial anomaly detection, giving vets more time to focus on patient care. In regions with limited access to specialists, AI-supported telemedicine lets vets get expert input quickly. As global demand for better animal healthcare grows, AI is a key driver in making diagnostic imaging more accessible and effective.

Veterinary Diagnostic Imaging Market Insights :

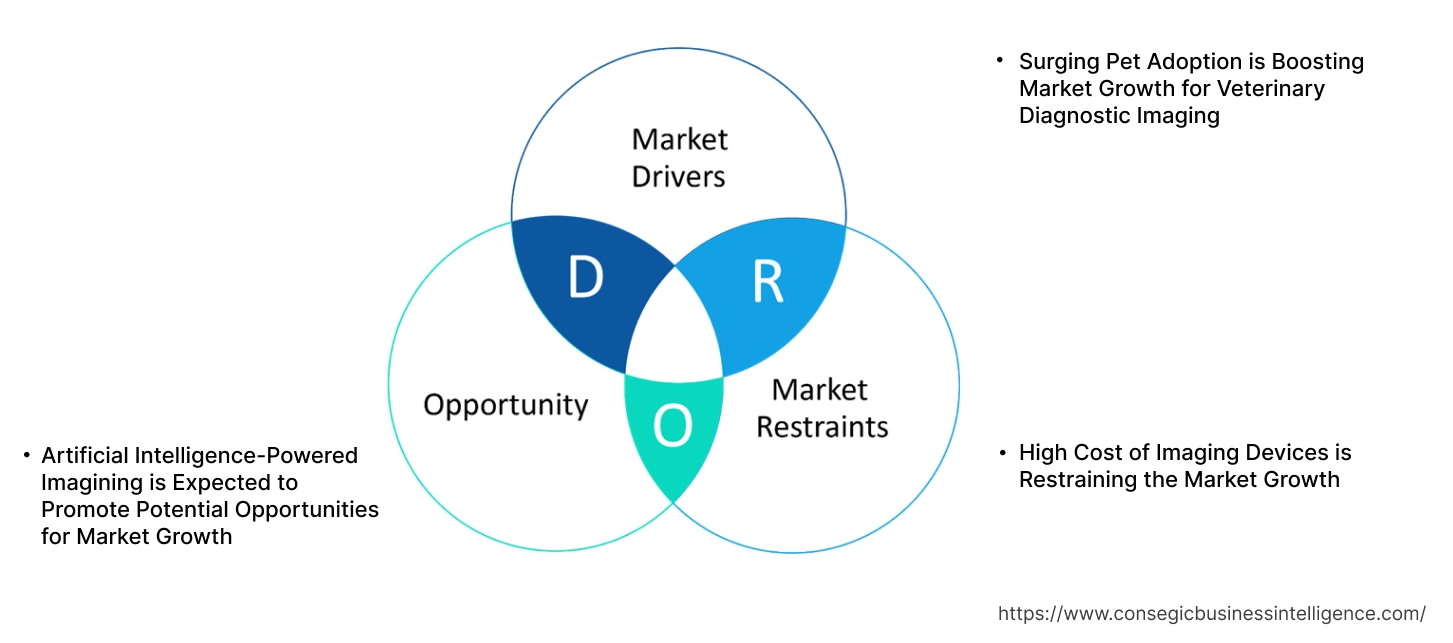

Veterinary Diagnostic Imaging Market Dynamics - (DRO) :

Key Drivers :

Surging Pet Adoption is Boosting Market Growth for Veterinary Diagnostic Imaging

Pet adoption rates are surging globally, with pets being increasingly viewed as family members, which in turn is driving investment in their health and well-being, including regular check-ups and diagnostics is driving the veterinary diagnostic imaging market growth. Additionally, the rising number of pet-related diseases, such as tumors, fractures, and cardiovascular issues, among others, is fueling the veterinary diagnostic imaging market demand. Further, the rising adoption of companion animals, including dogs, cats, and exotic pets, is driving the veterinary diagnostic imaging industry.

- For instance, in June 2025, according to The American Pet Products Association (APPA), cat ownership has increased with a rise of 23% from 40 million in 2023 to 49 million in 2024.

Therefore, the rising pet adoption rate is driving the demand for imaging solutions, in turn, proliferating the growth of the market.

Key Restraints :

High Cost of Imaging Devices is Restraining the Market Growth

The initial high cost of advanced equipment such as CT and MRI scanners, as well as ongoing costs for maintenance and potential upgrades, hinders the veterinary diagnostic imaging market expansion. Additionally, small-scale veterinary clinics often operate with a limited budget, making it difficult to afford these expensive technologies. Further, the high cost of diagnostic imaging also deters pet owners from seeking advanced diagnostic tests, which in turn restrains the market development.

Therefore, the high costs of devices for imaging are hindering the veterinary diagnostic imaging market expansion.

Future Opportunities :

Artificial Intelligence-Powered Imagining is Expected to Promote Potential Opportunities for Market Growth

AI algorithms are increasingly being integrated into tools for analyzing X-rays, ultrasounds, CT scans, and MRIs, enabling faster, more accurate, and consistent diagnoses. Also, AI algorithms detect changes in images, leading to easy detection and help improving treatment are driving the veterinary diagnostic imaging market opportunities. Further, AI significantly speeds up the diagnostic process, allowing for quicker treatment and improving patient outcomes is propelling the market progress.

- For instance, in May 2025, Antech launched RapidRead Dental, which is an AI-powered radiology tool designed for veterinary dentists. Additionally, the tool offers complete tooth-by-tooth analysis with 98% accuracy.

Hence, the rising integration of AI into tools is anticipated to increase the utilization of imaging solutions, in turn promoting prospects for veterinary diagnostic imaging market opportunities during the forecast period.

Veterinary Diagnostic Imaging Market Segmental Analysis :

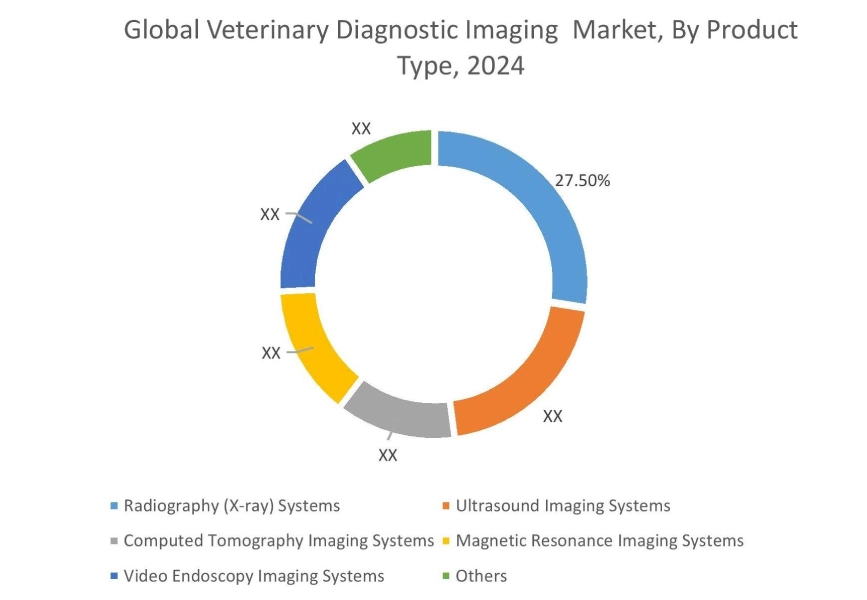

By Product Type :

Based on the product type, the market is segmented into radiography (X-ray) systems, ultrasound imaging systems, computed tomography imaging systems, magnetic resonance imaging systems, video endoscopy imaging systems, and others.

Trends in the Product Type:

- The increasing incidence of various animal diseases, including both infectious and non-infectious conditions, is driving the adoption of ultrasound imaging systems, which in turn is fueling the veterinary diagnostic imaging market trends.

- The adoption of higher resolution imaging, such as HD and 4K, provides greater clarity and detail, enabling more precise diagnosis of internal abnormalities is driving the adoption of video endoscopy imaging systems, which in turn fueling the veterinary diagnostic imaging market trends.

Radiography (X-ray) systems accounted for the largest revenue share of 27.50% in the year 2024.

- A significant rise in pet ownership, particularly in developed nations, is driving the need for radiography (X-ray) systems, which in turn is boosting the veterinary diagnostic imaging market share.

- Additionally, the rising number of veterinary hospitals and clinics equipped with advanced technologies such as radiography (X-ray) systems is boosting the veterinary diagnostic imaging market share.

- Further, the demand for improved diagnostic imaging in veterinary medicine is driving the need for the radiography (X-ray) systems segment, which in turn boosts the veterinary diagnostic imaging market size.

- For instance, SK Telecom Co., Ltd., launched X Caliber, which is an AI-based X-ray image product. The product is ideal for X-rays of dogs.

- Thus, according to the veterinarydiagnostic imaging market analysis, the demand for improved diagnostic imaging in veterinary is driving the market progress.

Ultrasound imaging systems are anticipated to register the fastest CAGR during the forecast period.

- Ultrasound imaging systems are a safe and non-invasive imaging technique, making them suitable for a wide range of applications in veterinary medicine.

- Additionally, the ultrasound imaging systems are often more affordable compared to other imaging modalities such as MRI or CT scans, making them accessible to a wider range of veterinary practices and budgets.

- Further, advancements such as integration of artificial intelligence (AI) for image analysis and telemedicine capabilities are driving the adoption of ultrasound imaging systems, which in turn boosts the veterinary diagnostic imaging market size.

- Therefore, the advancements in technology are anticipated to boost the market during the forecast period.

By Application :

Based on the application, the market is segmented into cardiology, oncology, neurology, orthopedics, and others.

Trends in the Application:

- The trend towards rising adoption of advanced technologies such as liquid biopsies and targeted therapies is improving treatment outcomes and enhancing the quality of life for animals with cancer.

- The trend towards the exploration of emerging therapies such as gene therapy and stem cell therapy is driving the market adoption in neurology.

Orthopedics accounted for the largest revenue share in the year 2024.

- The proliferation of digital X-ray systems due to their ease of use, speed, and ability to enhance image quality is driving the adoption of imaging technology by orthopedics.

- Additionally, MRI and CT scans are becoming more accessible and are crucial for detailed imaging of bone and joint structures, which in turn is driving the adoption by orthopedics.

- Further, the rise in the incidence of bone fractures due to the increase in the cases of road traffic accidents is driving the market growth.

- Thus, the proliferation of digital X-ray systems is driving the market progress.

Oncology is anticipated to register the fastest CAGR during the forecast period.

- The increasing prevalence of cancer in pets, as well as increased investment in R&D, is driving the market adoption by oncology.

- Additionally, the increasing investment in the development of oncology centres for the treatment of animals is boosting the market progress.

- Further, the increased adoption of digital imaging and data management systems is driving the adoption in oncology.

- For instance, in October 2021, the Southern Africa Animal Cancer Association partnered with the University of Pretoria for the launch of an oncology centre designed for animal treatment in South Africa.

- Therefore, the eased adoption of digital imaging and data management systems is anticipated to boost the market during the forecast period.

By Animal Type :

By Animal Type:

Based on the animal type, the market is bifurcated into small animals and large animals.

Trends in the Animal Type:

- The trend towards growing emphasis on proactive health management in large animals is driving the market adoption.

- The trend towards increasing adoption of multimodal imaging, which includes PET, CT, MRI, and others, is boosting the market adoption for diagnostics of small animals.

Small Animals accounted for the largest revenue share in the year 2024.

- The diagnostic imaging solution provides a comprehensive, multimodality diagnosis of diseases in small animals.

- Additionally, the launch of a new range of products aimed at imaging small animals is driving the market progress.

- Further, the rise of digital radiography and the development of AI-powered tools for image analysis are driving the market adoption for the small animal’s segment.

- For instance, in April 2023, Hallmarq Veterinary Imaging launched a zero-helium small animal 1.5T MRI aimed at small animals. The major focus of the company was to increase the presence of Hallmarq veterinary imaging in the global industry.

- Thus, according to the veterinarydiagnostic imaging market analysis, the rise of digital radiography is driving the market's progress.

Large Animal is anticipated to register the fastest CAGR during the forecast period.

- The rise of portable and specific imaging equipment for on-site imaging is driving the market adoption for the large animals segment.

- Additionally, AI and machine learning are being integrated into imaging systems to support image analysis, and automated diagnostics, which in turn aim to improve diagnostic accuracy and efficiency.

- Further, the rise of cloud-based platforms and telemedicine is enabling remote medication, helping diagnoses and treatment planning for large animals is driving the market progress.

- Therefore, as per the market analysis, the rise of cloud-based platforms and telemedicine is anticipated to boost the market during the forecast period.

By Region :

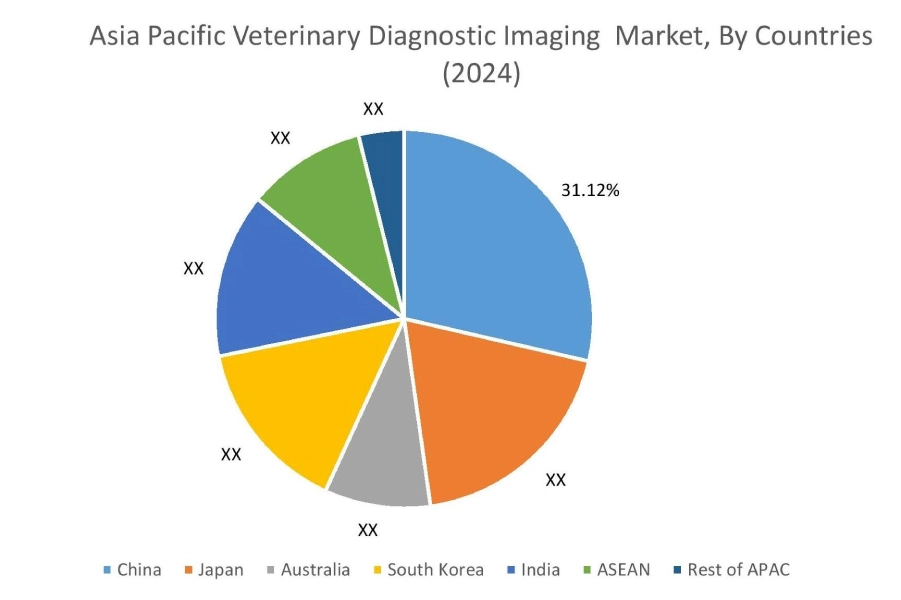

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

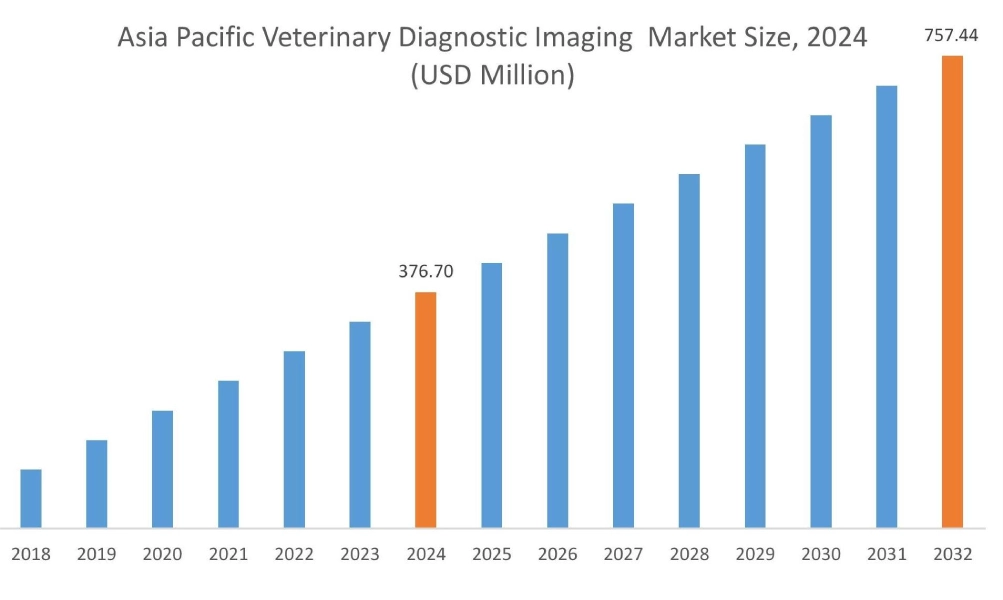

The Asia Pacific region was valued at USD 376.70 Million in 2024. Moreover, it is projected to grow by USD 403.98 Million in 2025 and reach over USD 757.44 Million by 2032. Out of this, China accounted for the maximum revenue share of 31.12%. The market progress is mainly driven by a surge in pet ownership and increasing awareness of animal health. Furthermore, factors including the rising disposable incomes and greater awareness among pet owners and veterinary professionals are projected to drive the market progress in the Asia Pacific region during the forecast period.

- For instance, in April 2025, according to GlobalPets, the dog population in India reached approximately 36.84 million in 2024, as well as the pet population of India recorded 34.96 million in 2022, which in turn is paving the way for market demand.

North America is estimated to reach over USD 894.20 Million by 2032 from a value of USD 455.02 Million in 2024 and is projected to grow by USD 487.03 Million in 2025. The North American region's increased pet spending and advancements in veterinary care offer lucrative growth prospects for the market. Additionally, the increased pet spending and advancements in veterinary care are driving the market progress.

- For instance, in January 2023, Esaote North America, Inc. launched the Magnifico Vet MRI system, which is an imaging solution designed for veterinary hospitals to provide diagnostic efficacy.

The regional analysis depicts that the growing awareness of advanced diagnostic techniques is driving the market in Europe. Additionally, the key factor driving the market is that governments and private sectors are investing in improving animal healthcare facilities and infrastructure, as well as expanding the livestock population is propelling the market adoption in the Middle East and African region. Further, the rising popularity of mobile veterinary services is paving the way for the progress of the market in the Latin American region.

Top Key Players & Market Share Insights:

The global veterinary diagnostic imaging market is highly competitive, with major players providing veterinary diagnostic imaging to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end user launches to hold a strong position in the veterinary diagnostic imaging industry. Key players in the veterinary diagnostic imaging market include-

- Esaote SPA(Italy)

- IDEXX Laboratories Inc.(USA)

- Hallmarq Veterinary Imaging (UK)

- Heska Corporation (USA)

- Shenzhen Mindray Animal Medical Technology Co., LTD. (China)

- Epica Animal Health(USA)

- Canon Medical Systems Corporation (Japan)

- Fujifilm Holdings Corporation (Japan)

- IMV Imaging (UK)

- Carestream Health (USA)

Recent Industry Developments :

Partnerships & Collaborations

- In June 2025, Vetology partnered with VetIT to expand AI-powered imaging tools and teleradiology solutions across the UK and Europe. The tools help to make informed diagnostic decisions, reduce time to treatment, and support patient care.

Veterinary Diagnostic Imaging Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 (USD Million) | USD 2,746.32 Million |

| CAGR (2025-2032) | 6.90% |

| By Product Type |

|

| By Application |

|

| By Animal Type |

|

| By Region |

|

| Key Players |

|

Key Questions Answered in the Report

How big is the veterinary diagnostic imaging market? +

The veterinary diagnostic imaging market size is estimated to reach over USD 2,746.32 Million by 2032 from a value of USD 1,408.77 Million in 2024 and is projected to grow by USD 1,506.85 Million in 2025, growing at a CAGR of 6.90% from 2025 to 2032.

Which segmentation details are covered in the veterinary diagnostic imaging report? +

The veterinary diagnostic imaging report includes specific segmentation details for product type, animal type, application, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the veterinary diagnostic imaging market, the ultrasound imaging systems are the fastest-growing segment during the forecast period due to advancements in technology, due to integration of artificial intelligence (AI) for image analysis, and telemedicine capabilities.

Who are the major players in the veterinary diagnostic imaging market? +

The key participants in the veterinary diagnostic imaging market are Esaote SPA (Italy), IDEXX Laboratories Inc. (USA), Epica Animal Health (USA), Canon Medical Systems Corporation (Japan), Fujifilm Holdings Corporation (Japan), IMV Imaging (UK), Carestream Health (USA), Hallmarq Veterinary Imaging (UK), Heska Corporation (USA), Shenzhen Mindray Animal Medical Technology Co., LTD. (China), and others.

What are the key trends in the veterinary diagnostic imaging market? +

The veterinary diagnostic imaging market is being shaped by several key trends including the increasing incidence of various animal diseases, including both infectious and non-infectious conditions as well as the adoption of higher resolution imaging such as HD and 4K, for providing greater clarity and detail, is driving the market progress.