Acrylic Teeth Market Size:

Acrylic Teeth market size is estimated to reach over USD 803.80 Million by 2032 from a value of USD 475.39 Million in 2024 and is projected to grow by USD 499.38 Million in 2024, growing at a CAGR of 7.4% from 2025 to 2032.

Acrylic Teeth Market Scope & Overview:

Acrylic teeth are artificial teeth made from a plastic resin, commonly polymethyl methacrylate (PMMA), used in dentures and other dental prosthetics. They offer a durable, lightweight, and affordable option for replacing missing teeth, often preferred for their ease of fabrication and adjustment. These teeth are long-lasting and resistant to wear. They provide a cost-effective solution for tooth replacement. They have an aesthetic appeal and function like natural teeth. These teeth are harder, more durable, and resistant to stains.

Acrylic Teeth Market Dynamics - (DRO) :

Key Drivers:

Rising adoption of acrylic teeth to prevent bone loss is boosting the market growth

Missing teeth lead to bone loss as the jawbone is not stimulated by the chewing force, causing the bone to gradually shrink. Bone loss causes facial changes, particularly if many teeth are missing. Acrylic teeth dentures help preserve the structural integrity of the jaw and prevent these changes. They restore some stimulation to the jawbone, which is lost when teeth are missing, and help support the gums, preventing them from shrinking or collapsing.

- For instance, Pyrax Polymers offers acrylic teeth moulded using Polymethacrylate acrylic resin. It is suitable for total, partial, and skeletal dental prosthesis.

Thus, the market trends analysis shows that the aforementioned factors are driving the acrylic teeth market growth.

Key Restraints :

Availability of alternatives is hindering the market growth

Alternatives to acrylic teeth for dentures and prosthetics include porcelain, zirconia, and composite resins. These materials offer different levels of durability, aesthetics, and cost, making them suitable for various needs. Porcelain offers high durability and resistance to staining. It is more resistant to wear and tear than acrylic. Zirconia is highly durable and strong, and provides a durable and long-lasting solution for tooth replacement. It offers excellent aesthetics and is often used in full-mouth restorations.

Moreover, composite resin is a versatile material that falls between acrylic and porcelain in terms of durability and aesthetics. Valplast is a flexible resin, offering comfort, aesthetics, and durability. They are thinner and lighter than acrylic dentures and do not require metal clasps. Chrome cobalt is a metal partial denture that offers strength and durability. Thus, the aforementioned factors are hindering the acrylic teeth market demand.

Future Opportunities :

Integration of 3D printing technology with acrylic teeth is boosting the market growth

3D printing technology enables the creation of highly accurate and customized dentures that fit perfectly in the patient's mouth, improving comfort and durability. It also reduces production time and labor costs. Dentists easily design and print teeth with specific shapes, sizes, and colors to match the patient's needs. 3D printing streamlines the fabrication process, reducing time and costs compared to traditional methods. 3D printing allows for the creation of complex structures, leading to faster and more efficient denture fabrication. 3D printing offers significant advantages for fabricating acrylic teeth, including increased accuracy, customization, and efficiency.

- For instance, SprintRay offers 3D printing materials for dental structures, including hybrid dentures, removable dentures, and others. This demonstrates the usage of 3D printing in making acrylic teeth.

Thus, the advancements in 3D printing technology for the creation of dentures are expected to promote the acrylic teeth market opportunities.

Acrylic Teeth Market Segmental Analysis :

By Type:

Based on type, the market is segmented into partial denture, complete denture, and overdenture.

Trends in the Type:

- The aging population and increased dental healthcare awareness are driving the adoption of partial dentures, which in turn is fueling the acrylic teeth market trends.

- The rising adoption of biocompatible polymers and thermoplastic materials to create stronger, lighter, and more comfortable partial dentures is driving the acrylic teeth market trends.

Complete dentures accounted for the largest revenue share in the acrylic teeth market share in 2024.

- Complete dentures are designed for patients who have lost all their natural teeth in one or both jaws.

- Additionally, the increasing popularity due to affordability, ease of fabrication, and ability to mimic the appearance of natural teeth is driving the adoption of complete dentures, in turn boosting the acrylic teeth market size.

- Further, advancements in the aesthetic appeal of dentures are driving the need for complete dentures, thereby driving the segment.

- Thus, according to acrylic teeth market analysis, rising advancements associated with complete dentures are driving the acrylic teeth market size.

Overdenture is anticipated to register the fastest CAGR during the forecast period.

- Overdentures are removable dental prosthetics offering a superior alternative to traditional dentures by providing enhanced stability and comfort.

- Additionally, advancements in prosthodontics and increasing adoption by patients seeking more durable and comfortable solutions are fueling the acrylic teeth market share.

- Further, the growing awareness among patients regarding long-term oral health benefits is boosting the adoption of overdentures.

- Therefore, according to acrylic teeth market analysis, the enhanced stability and comfort, as well as increasing use of dental implants for superior patient outcomes, are anticipated to boost the acrylic teeth market opportunities during the forecast period.

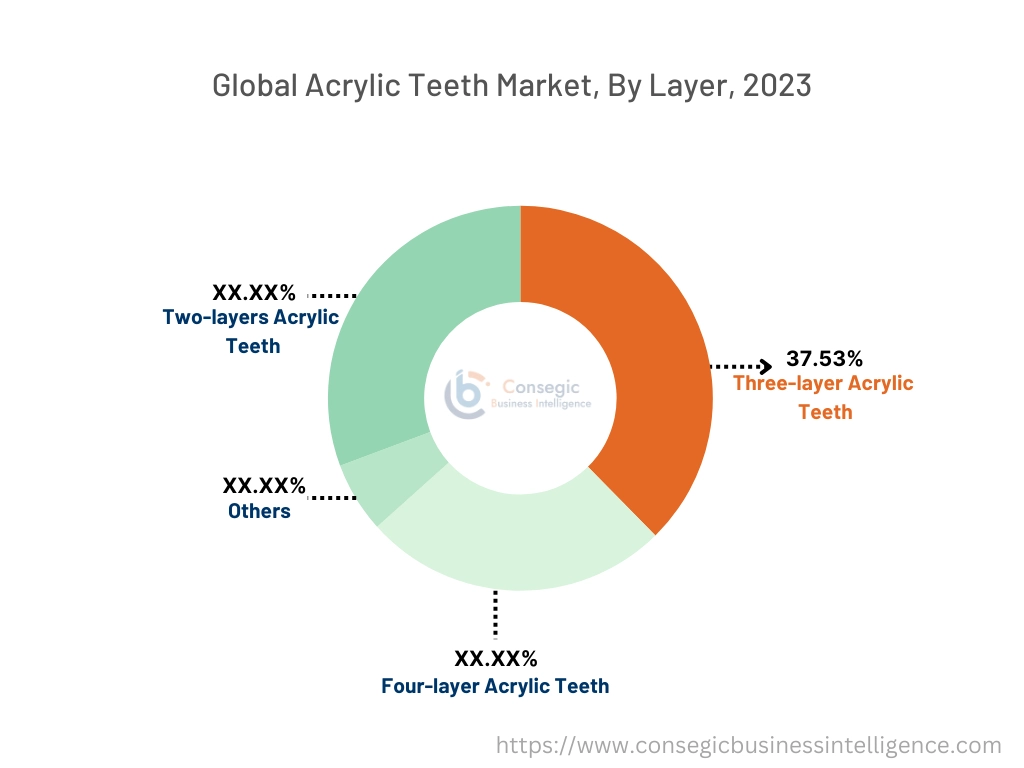

By Layers:

Based on layers, the market is segmented into two-layer, three-layer, four-layer, and others.

Trends in the Layers:

- Increasing interest in more wear-resistant materials for dentures is driving the adoption of the two-layer segment.

- Increasing focus on aesthetics and patient comfort, as well as improved fabrication techniques, is driving the adoption of three-layer segment.

Three-layer segment accounted for the largest revenue of 37.53% in the year 2024.

- The rising adoption of three-layer segment is driven due to their balance of durability, aesthetic appeal, and cost-effectiveness.

- Also, the components include a base layer for strength, a middle layer for color stability, and a top layer that mimics the natural enamel for a realistic appearance.

- Further, the widespread use of three-layer teeth in dental clinics and laboratories is contributing to the segment's dominance.

- Thus, as per the market analysis, the rising need for durable, aesthetic appeal, and cost-effective solutions is driving the acrylic teeth market demand.

Four-layer segment is anticipated to register the fastest CAGR during the forecast period.

- Four-layer acrylic teeth offer superior aesthetics and durability as compared to two and three-layer teeth.

- Additionally, the demand for highly aesthetic dental solutions is propelling the adoption of the four-layer segment.

- Further, patients increasingly prioritize the natural appearance of their dentures, which is further driving the adoption of four-layer segment.

- Therefore, as per the market analysis, the rising demand for premium-quality, highly aesthetic dental prosthetics is anticipated to boost the acrylic teeth market growth during the forecast period.

By Technology:

Based on technology, the market is bifurcated into CAD/CAM and 3D printing.

Trends in Technology:

- Increasing trend in adoption of CAD/CAM technology in the dental industry is driving the market development.

- The key factors driving the adoption of 3D printing include customization, reduced waste, accuracy, and precision, among others.

CAD/CAM accounted for the largest revenue in the year 2024.

- CAD/CAM technology is revolutionizing the production of acrylic teeth by enabling the precise design and fabrication of dental prosthetics.

- Additionally, the technology enables high levels of customization, accuracy, and efficiency in producing dentures, making it widely adopted by dental laboratories and clinics.

- Further, the technology helps to reduce patient discomfort and improve satisfaction by improving the functionality and fit of the acrylic teeth.

- Furthermore, as dental professionals continue to prioritize precision and patient outcomes, the CAD/CAM segment maintains its leadership in the market.

- Thus, as per the market analysis, the rising need for precise, efficient, and highly customizable dental prosthetics is driving the adoption of CAD/CAM technology.

3D printing is anticipated to register the fastest CAGR during the forecast period.

- The 3D printing technology is gaining traction in the dental industry due to its ability to produce highly detailed and customized dental prosthetics quickly and cost-effectively.

- Additionally, the 3D printing allows the fabrication of acrylic teeth with complex geometries, offering better fit and aesthetic outcomes.

- The growing adoption of digital dentistry and the increasing use of 3D printers in dental labs are driving the acrylic teeth market expansion.

- Furthermore, the ability to streamline the production process and improve product quality is expected to promote the adoption of 3D printing technology.

- Therefore, as per the market analysis, the advancements in digital dentistry and the demand for highly customized teeth design are anticipated to boost the market during the forecast period.

By Application:

Based on application, the market is bifurcated into functionality and aesthetics.

Trends in the Application:

- Rising trend in adoption of digital technologies and 3D printing has reduced production times, leading to quicker turnaround for patients.

- Rising adoption of teeth whitening is becoming a popular application in aesthetic dentistry, in turn boosting the market.

Functionality accounted for the largest revenue in the year 2024.

- Acrylic teeth are primarily designed to restore the functionality of natural teeth, allowing patients to chew, speak, and smile with confidence.

- Additionally, acrylic teeth are known for durability and wear resistance, making them an essential component in full and partial denture applications, which is paramount in functionality.

- Further, patients with complete tooth loss rely heavily on the functional benefits provided by teeth, particularly in older populations.

- Furthermore, the rising emphasis on restoring essential oral functions is driving the demand for functional acrylic teeth in various dental care settings.

- Thus, as per the market analysis, the rising need for functional and durable teeth is driving the functionality application.

Aesthetics is anticipated to register the fastest CAGR during the forecast period.

- The need for aesthetically pleasing dental prosthetics is increasing as patients seek solutions that not only restore oral function but also enhance their appearance.

- Additionally, the growing demand for personalized, high-quality dental prosthetics is driving this segment, particularly among younger and middle-aged patients.

- Further, advancements in dental materials and 3D printing technologies are enabling the production of highly realistic, aesthetically superior acrylic teeth.

- Therefore, the rising need for both functionality with enhanced cosmetic appeal is anticipated to boost the acrylic teeth market expansion during the forecast period.

By End-User:

Based on end user, the market is segmented into hospitals, dental clinics, and others.

Trends in the End User:

- Factors including ease of availability, affordability, and ease of fabrication are driving the market.

- Rising awareness regarding dental health and ease of access to advanced materials are propelling the adoption of dental clinics.

Dental clinic accounted for the largest revenue share in the year 2024.

- Dental clinics are the primary providers of acrylic teeth prosthetics, catering to patients requiring full and partial dentures.

- Additionally, the key advantages of dental clinics include cost-effectiveness, and non-invasive and increased functional solutions for patients with tooth loss, among others.

- Furthermore, the rising adoption of advanced technologies such as CAD/CAM and 3D printing, to offer more precise and personalized dental solutions, enhances patient outcomes, in turn propelling the market.

- Further, the growth of dental tourism, in countries with well-established dental care infrastructure, is driving the need for acrylic teeth in dental clinics.

- Thus, the increasing adoption of advanced dental solutions in dental clinics is driving the market.

Hospital is anticipated to register the fastest CAGR during the forecast period.

- Hospitals cater to a growing number of patients with severe dental injuries or oral conditions that necessitate full or partial dentures.

- Additionally, the growing number of patients with severe dental injuries or oral conditions is fueling the need for hospitals.

- Further, the increasing prevalence of dental trauma, combined with the rising number of oral surgeries, is propelling the need for hospitals.

- Therefore, the rising need for dental restorations in trauma cases and complex oral surgeries is anticipated to boost the market during the forecast period.

Regional Analysis:

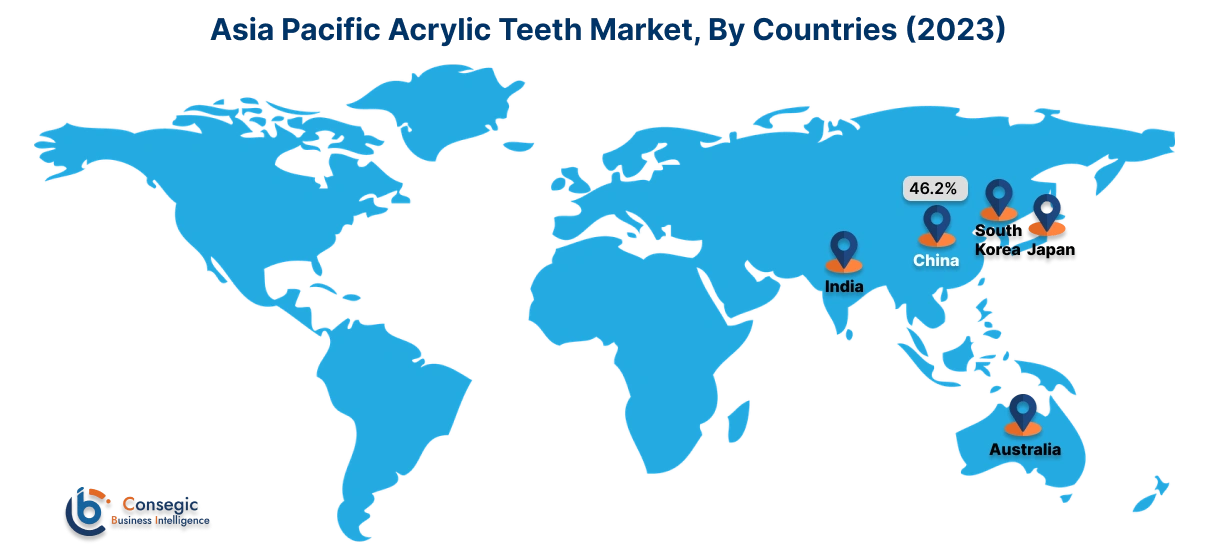

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

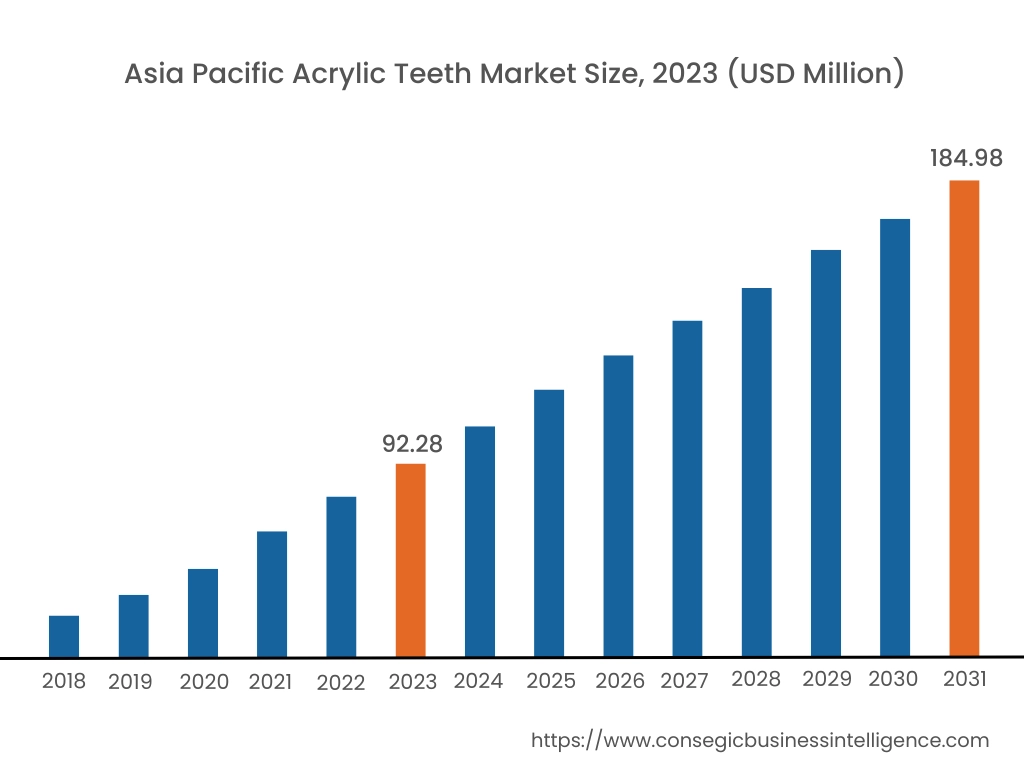

Asia Pacific region was valued at USD 173.28 Million in 2024. Moreover, it is projected to grow by USD 182.38 Million in 2025 and reach over USD 299.82 Million by 2032. Out of this, China accounted for the maximum revenue share of 46.20%. The market is mainly driven by rising disposable income and increasing dental care awareness. Furthermore, factors including rising expansion in rural areas due to limited access to dental services are projected to drive the acrylic teeth industry in the Asia Pacific region during the forecast period.

North America is estimated to reach over USD 193.96 Million by 2032 from a value of USD 114.63 Million in 2024 and is projected to grow by USD 120.42 Million in 2025. The North American region's growing high prevalence of dental disorders and the increasing elderly population offer lucrative growth prospects for the market. Additionally, the increasing awareness of dental aesthetics and the availability of affordable dental insurance are driving the market.

Europe holds a significant share in the market, due to growing requirement for dental prosthetics and dentures, particularly in countries with high elderly population. Additionally, the Middle East & Africa market for acrylic teeth is growing steadily due to improving healthcare services and rising awareness of oral health, among others. Further, Latin America is an emerging market for acrylic teeth, due to expanding access to dental care services, as well as rising aging population, which are further boosting the market development.

Top Key Players & Market Share Insights:

The global acrylic teeth market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global acrylic teeth market. Key players in the acrylic teeth industry include-

- Dentsply Sirona (USA)

- Kulzer GmbH (Germany)

- Yamahachi Dental Mfg. Co. (Japan)

- New Stetic S.A. (Colombia)

- Mitsui Chemicals, Inc. (Japan)

- GC Corporation (Japan)

- Modern Dental Group (Hong Kong)

- Shofu Inc. (Japan)

- Ivoclar Vivadent AG (Liechtenstein)

- VITA Zahnfabrik (Germany)

Recent Industry Developments :

Product Launch:

- In April 2022, Dentsply Sirona introduced Lab Software 22.0, featuring updated CAD and CAM tools with a unified user interface for design and manufacturing, expanded design options, and extended connectivity to CEREC Primemill. This upgrade enhances machine connectivity for users, whether they use Dentsply Sirona or other CAD/CAM systems.

Partnership:

- In October 2022, Ivoclar announced an expansion of its partnership with Exocad, integrating the Ivotion Denture add-on module into Exocad's DentalCAD software, enhancing digital dentistry processes. Exocad, a major dental software provider, serves a broad customer base and is known for its expertise in dental CAD/CAM solutions.

Acrylic Teeth Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2032 |

| Market Size in 2031 | USD 803.80 Million |

| CAGR (2024-2031) | 7.4% |

| By Type |

|

| By Layer |

|

| By Technology |

|

| By Application |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

What is the projected growth of the Acrylic Teeth Market? +

Acrylic Teeth market size is estimated to reach over USD 803.80 Million by 2032 from a value of USD 475.39 Million in 2024 and is projected to grow by USD 499.38 Million in 2024, growing at a CAGR of 7.4% from 2025 to 2032.

Why are acrylic teeth preferred over other materials? +

Acrylic teeth are preferred due to their lightweight nature, ease of customization, and affordability. Additionally, they offer better aesthetic qualities and are easier to adjust, making them a popular choice for denture wearers and dental professionals.

Which region is experiencing the highest demand for acrylic teeth? +

North America is experiencing the highest demand for acrylic teeth due to its aging population, rising awareness of oral health, and well-established dental care infrastructure.

What factors are driving innovation in the Acrylic Teeth Market? +

Innovation in the Acrylic Teeth Market is driven by the need for more durable and natural-looking teeth, leading to advancements in material technology. Manufacturers are focusing on improving the strength and longevity of acrylic teeth while enhancing their aesthetic appeal to meet patient demands.

Who are the leading players in the Acrylic Teeth Market? +

Major players in the Acrylic Teeth Market include Dentsply Sirona (USA), Ivoclar Vivadent AG (Liechtenstein), Kulzer GmbH (Germany), GC Corporation (Japan), Modern Dental Group (Hong Kong), Shofu Inc. (Japan), VITA Zahnfabrik (Germany), New Stetic S.A. (Colombia), Yamahachi Dental Mfg. Co. (Japan), and Mitsui Chemicals, Inc. (Japan).