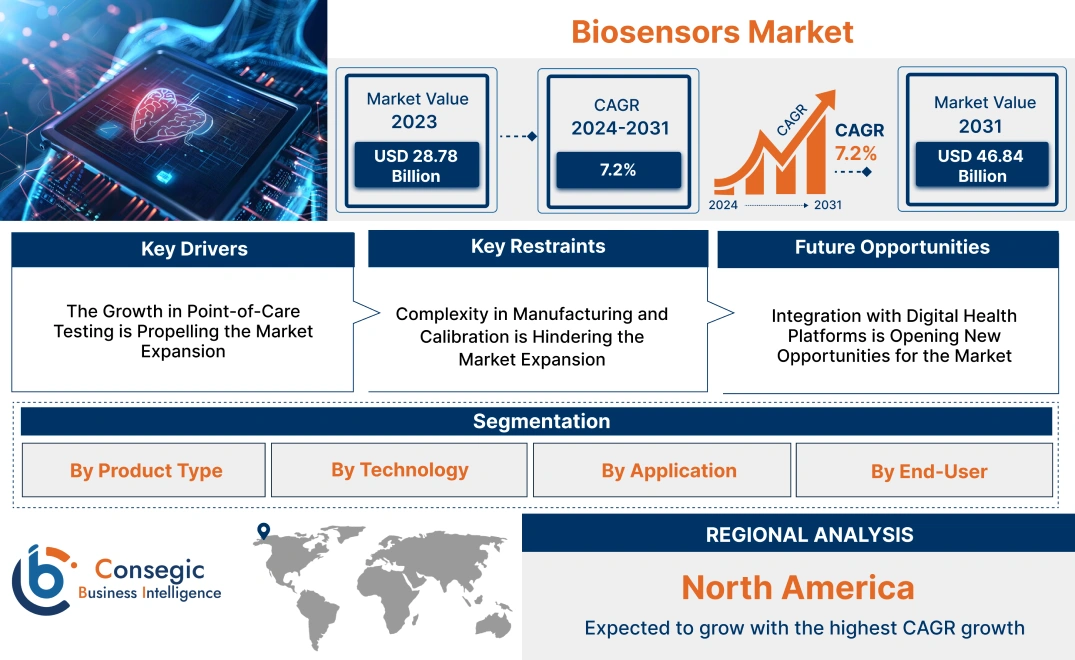

Biosensors Market Size:

Biosensors Market size is estimated to reach over USD 46.84 Billion by 2031 from a value of USD 28.78 Billion in 2023, growing at a CAGR of 7.2% from 2024 to 2031.

Biosensors Market Scope & Overview:

Biosensors are analytical devices that detect biological molecules or chemical compounds by converting a biological response into a measurable signal. The biological component can range from enzymes, antibodies, and nucleic acids to whole cells or tissues, which selectively interact with a target substance or analyte. They are made up of three major components: bioreceptor, transducer, electronics, and signal processor. The evolution of this technology holds the potential for rapid, accurate, and non-invasive detection methods in real-time applications. They are increasingly applied in diverse fields including medical diagnostics, biotechnology for detecting pathogens, environmental monitoring, and bioprocessing.

How is AI Impacting the Biosensors Market?

AI is significantly impacting the biosensors market by enhancing their capabilities, particularly in data analysis, diagnostic accuracy, and real-time monitoring. AI algorithms can process vast amounts of biosensor data, improve signal quality, and extract meaningful insights. This collaboration is leading to more precise and faster diagnostics, personalized healthcare, and more efficient disease management.

Biosensors Market Dynamics - (DRO) :

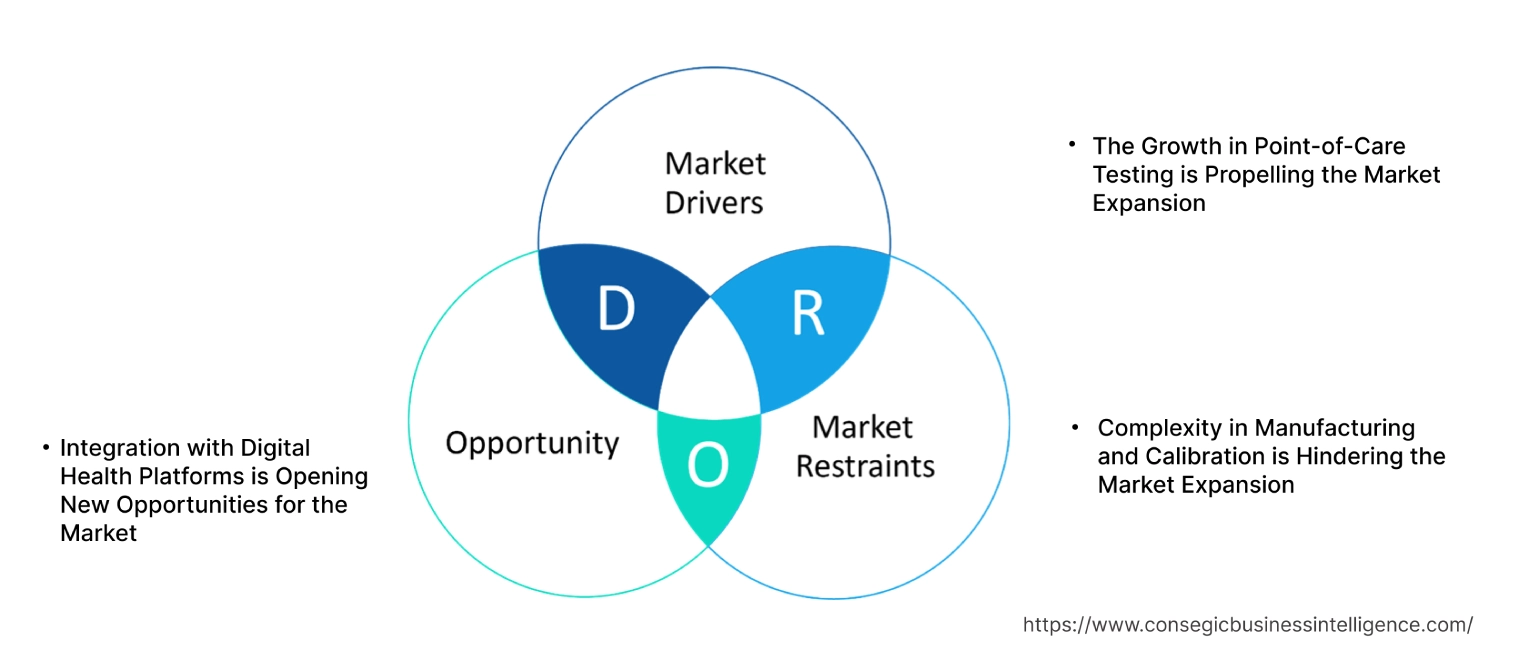

Key Drivers:

The Growth in Point-of-Care Testing is Propelling the Market Expansion

The growth of point-of-care testing (PCOT) in biosensors has been significant in recent years, driven by advancements in technology and the increasing demand for rapid, on-site diagnostics. It refers to the medical diagnostic testing conducted at or near the site of patient care, allowing for quick decision-making without the need to send samples to a lab. Point-of-care biosensor devices reduce the overall cost of healthcare by minimizing hospital visits, lab work, and lengthy diagnostic processes. PCOT biosensors, like glucose monitors for diabetes or portable cholesterol tests, are essential tools for the ongoing management of chronic diseases, enabling patients to monitor their health in real time.

- In 2024, based on the EmStat Product line, PalmSens offers potential modules or ready-to-market solutions that expedite the development of point-of-care instruments.

Therefore, the growth of PCOT is transforming healthcare by offering more accessible, affordable, and rapid diagnostics for real-time health assessment, boosting the biosensors market growth.

Key Restraints :

Complexity in Manufacturing and Calibration is Hindering the Market Expansion

High complexity in the manufacturing and calibration of biosensors leads to several drawbacks that affect their cost, scalability, reliability, and usability. Complex manufacturing often requires specialized materials such as rare enzymes, antibodies, and nanomaterials along with advanced techniques like microfabrication which leads to higher costs. Biosensors with complex designs require frequent calibration to maintain accuracy, especially in applications where environmental factors affect the performance which increases the maintenance costs. The combination of complex manufacturing and calibration processes makes the biosensor less accessible to the average user. This reduces the ease of use in low-resource settings where the biosensors need to be reliable and low maintenance.

Therefore, the analysis shows that the high complexity of biosensor manufacturing and calibration limits the widespread adoption and practical usability of biosensors, restraining the biosensors market demand.

Future Opportunities :

Integration with Digital Health Platforms is Opening New Opportunities for the Market

The future of biosensors in the context of integration with digital health platforms presents numerous opportunities to revolutionize healthcare delivery, diagnostics, and personal health management. By collecting continuous data on various physiological parameters, biosensors in wearables will help in personalizing healthcare by allowing interventions in individuals' unique health profiles. AI algorithms will help to analyze biosensor data to offer automated, personalized recommendations for health improvements such as changes in diet, exercise, or medication.

- In 2024, Epicore Biosystems' discovery patch is a recent development that collects sweat samples from the user throughout a set period, such as during a workout. The sweat can then be easily analyzed to detect certain analytes or discover new biomarkers.

Therefore, as per the market trends analysis, the convergence of biosensors and digital health is set to empower both patients and healthcare providers for better health outcomes, creating biosensors market opportunities.

Biosensors Market Segmental Analysis :

By Product Type:

Based on product type the market is segmented into Wearable Biosensors (Fitness Trackers, Smartwatches, and Health Patches), Implantable Biosensors (Glucose Sensors, and Cardiac Monitors), Non-Wearable Biosensors (Handheld Devices and Diagnostic Equipment), In-vitro Biosensors (Lab-on-a-Chip Devices, and Diagnostic Test Kits).

Trends in the Product Type:

- Wearable biosensors now feature Bluetooth and WIFI connectivity which allows seamless integration with smartphones and health apps.

- Data connectivity in implantable biosensors allows them for remote monitoring and telehealth applications, enhancing patient management and engagement.

The wearable biosensor accounted for the largest revenue of the total biosensors market share in the year 2023.

- The increasing prevalence of chronic diseases has heightened the need for continuous monitoring solutions. Wearable biosensors allow patients to manage their conditions proactively reducing hospital visits and improving overall health outcomes.

- They offer real-time data on heart rate, glucose levels, physical activity, and sleep patterns as they provide continuous monitoring of vital signs and fitness metrics. Thus creating revenue generation from the market.

- They are used in diverse applications such as fitness tracking, medical diagnostics, and wellness monitoring. This versatility has broadened their market appeal.

- For instance, the Lifesignals UbiqVue wearable biosensor is a single-use multi-parameter patch that constantly gathers and sends essential biomedical data wirelessly or remotely.

- Thus, the wearable biosensor application accounted for the largest revenue due to the rising technological innovations, the need for chronic disease management, and a shift towards preventive healthcare, driving the biosensors market growth.

The implantable biosensors segment is anticipated to register the fastest CAGR during the forecast period.

- Implantables significantly enhance the quality of life for patients by providing continuous health monitoring, reducing the need for frequent doctor visits, and enabling timely medical interventions.

- As they provide real-time data healthcare providers are now able to respond quickly to changes in a patient's condition, potentially reducing hospitalization rates.

- The applications of implantable biosensors are broadening, including monitoring glucose levels, intracranial pressure, and cardiac functions. This diversification is attracting interest from various sectors within the industry.

- For instance, GlobalSpec states that patients can walk around more freely and receive continuous diagnostic data streams and medical surveillance due to the advancements in implantable devices.

- Thus, as innovation continues and the market expands, implantable biosensors are poised to play a crucial role in enhancing patient care and improving health outcomes, boosting the biosensors market trends.

By Technology:

Based on technology the market is segmented into Electrochemical Biosensors, Optical Biosensors, Piezoelectric Biosensors, Thermal Biosensors, and Magnetic Biosensors.

Trends in the Technology:

- Piezoelectric biosensors are widely used in environmental monitoring, especially for detecting pollutants, toxins, and pathogens in water and air.

- AI and machine learning are increasingly being used to analyze complex data generated by optical biosensors.

The electrochemical biosensors application accounted for the largest revenue of the overall biosensors market share in the year 2023.

- Electrochemical biosensors are widely used in the food sector, agriculture, pharmaceuticals, and point-of-care diagnostics for monitoring glucose, lactate, cholesterol, and other biomarkers.

- They offer a high degree of sensitivity, capable of detecting even minute concentrations of analytes. They are even capable of rapid detection and response times, making them ideal for real-time monitoring.

- For instance, Creative Biolabs sees scalable manufacturing as they specialize in the design of electrochemical biosensors, such as ion-selective electrodes which utilize precision printing in diagnostics.

- Thus, they hold a vital place in the market due to their cost-effectiveness, high sensitivity, and wide application across healthcare, boosting the biosensors market demand.

The optical biosensors segment is anticipated to register the fastest CAGR during the forecast period.

- The growing demand for early and accurate diagnosis, particularly in cancer and infectious disease monitoring is a significant driver for the growth of optical biosensors in healthcare.

- They are increasingly being integrated into portable, point-of-care testing devices, allowing for rapid diagnostics in clinical settings, home care, and resource-limited settings.

- Optical biosensors do not require labeling of the targeted molecules such as fluorescent or radioactive tags which simplifies the detection process and reduces interference.

- For instance, optical biosensors use WAVEchip's no-clog microfluid cartridge which is capable of handling a wide range of sample types and sizes. It enables analysts to directly measure real-time interactions between molecules.

- Thus, the segment is poised for rapid growth driven by its high sensitivity, technological innovations, and wide range of applications across various sectors, proliferating the biosensors market opportunities.

By Application:

Based on application the market is segmented into Medical Diagnostics (Glucose Monitoring, Cardiac Monitoring, and Cancer Detection), Environmental Monitoring (Pollution Detection, and Water Quality Testing), Food & Beverage Industry (Quality Control and Contaminant Detection), Biotechnology and Pharmaceutical Research (Drug Discovery and Clinical Trials).

Trends in the Application:

- AI and machine learning are being integrated with biosensors to interpret large sets of diagnostic data to help in identifying trends and anomalies.

- The integration of biosensors with the Internet of Things technology allows for the creation of networks of sensors that can communicate in real-time, enabling comprehensive environmental monitoring on a large scale.

The medical diagnostics application accounted for the largest revenue in the year 2023.

- Blood glucose monitoring is one of the most common uses of biosensors in diagnostics which is for monitoring blood glucose levels in diabetic patients.

- Rapid diagnostic tests for infectious diseases like COVID-19, influenza, and HIV rely heavily on biosensor technology to deliver results quickly and accurately.

- They reduce the need for complex, time-consuming lab-based tests, making diagnostics more accessible and cost-effective. They enable widespread screening, even in resource-limited settings thus contributing to larger market adoption.

- For instance, the AICARE A609 blood glucose monitoring system has features like strip ejection which stops contamination during diagnostics and they even have glucose oxidase technology for measurements of glucose levels.

- Thus, the medical diagnostics segment leads the market due to the critical role biosensors play in early disease detection and continuous health monitoring.

The environmental monitoring segment is anticipated to register the fastest CAGR during the forecast period.

- Biosensors in environmental monitoring are widely recognized for their ability to detect pollutants and toxic substances with high sensitivity and specificity.

- Environmental biosensors are portable making them ideal for field-based applications. They are also integrated with remote monitoring systems, providing real-time data from distant or difficult-to-access locations.

- Technological innovations such as the development of nanomaterial-based biosensors that have enhanced sensitivity and durability. These improvements make them more accessible for widespread monitoring applications and drive revenue.

- For instance, Quantum Dot-based optical biosensors are used for the detection of pesticides in drinking water and also in agriculture.

- Thus, as environmental concerns continue to rise, biosensors will be a key tool for addressing pollution and protecting the environment with monitoring appliances, boosting the biosensors market trends.

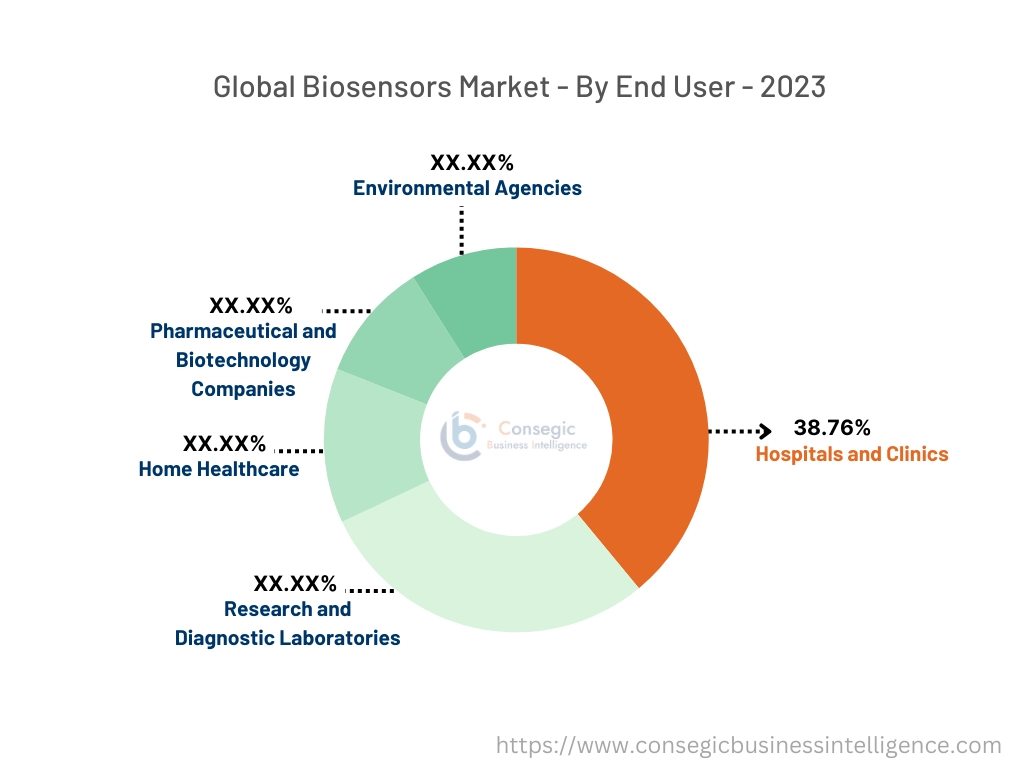

By End-User:

Based on end-user the market is segmented into Hospitals and Clinics, Research and Diagnostic Laboratories, Home Healthcare, Pharmaceutical and Biotechnology Companies, and Environmental Agencies.

Trends in the End-User:

- Multiplexed biosensors are being developed in hospitals and clinics to detect multiple biomarkers simultaneously.

- Biosensors are integrated with telemedicine platforms thus allowing patients to share their data with healthcare providers remotely.

The hospitals and clinics segment accounted for the largest revenue share of 38.76% in the year 2023.

- Hospitals and clinics utilize biosensors for continuous monitoring of vital signs in critically ill patients, including heart rate, blood pressure, oxygen levels, and respiratory rates.

- Biosensors in clinical settings have the ability to provide near-instant diagnostic results. This is critical in emergency care, where time is of the essence.

- Compared to traditional laboratory diagnostics, biosensors offer a more effective solution for hospitals and clinics. By reducing the need for large, complex lab equipment.

- For instance, Aplife Biotech states that electrochemical biosensors are vital equipment for bringing diagnosis closer to the patient and providing speedier reactions at hospitals, doctors' offices, during an emergency transfer, at home, or even in remote rural areas.

- Thus, the segmental analysis shows that the application of biosensors in hospitals and clinics is rapidly transforming healthcare delivery by enhancing diagnostics and improving patient monitoring.

The home healthcare segment is anticipated to register the fastest CAGR during the forecast period.

- Biosensors in home healthcare enable individuals to manage chronic conditions, monitor vital signs, and receive real-time health insights. This reduces the burden on healthcare systems, promotes patient independence, and leads to more proactive health management.

- The home healthcare segment reduces the overall cost of care by minimizing hospital admissions, emergency room visits, and other in-person medical consultations.

- Devices such as smartwatches, fitness trackers, and patches incorporate biosensors to monitor health parameters in the comfort of their homes, thus leading to revenue generation and wider acceptance.

- For instance, The Apple Health app on watches and iPhones consists of biosensors that detect steps taken, walking and running distance, and calories burned based on the wearer's body measurements. This allows the app to continuously monitor a person's general health on a daily basis.

- Thus, the biosensors market analysis shows that the home healthcare segment is a fast-growing market with advances in telemedicine, AI, wearable technology, and many more.

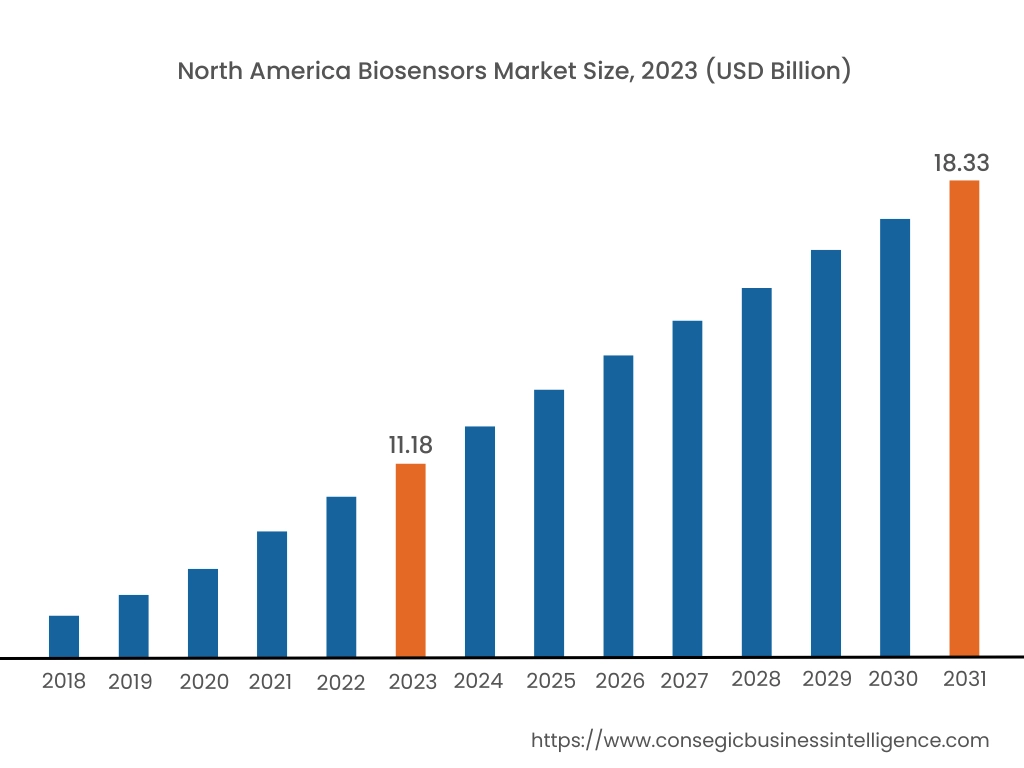

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2023, North America accounted for the highest market share at 38.85% and was valued at USD 11.18 Billion, and is expected to reach USD 18.33 Billion in 2031. In North America, the U.S. accounted for the highest market share of 73.05% during the base year of 2023. As per the biosensors market analysis, the North American market is one of the most advanced and rapidly growing markets in the world, driven by technological advancements, high healthcare spending, and a strong focus on early diagnostics. The region is led mainly by the US and Canada which has witnessed widespread adoption of biosensors in various industries such as healthcare, environment, and food.

- In 2024, Canatu's electrochemical biosensors boost sensitivity by tenfold in vitro matrices. Superior sensitivity is enabled by their patented dry deposition method, which produces the most sophisticated carbon nanotubes with an extremely large and pure reaction surface area.

Asia Pacific is expected to witness the fastest CAGR over the forecast period of 7.9% during 2024-2031. The Asia Pacific region is emerging as a significant player in the global market due to the growing incidence of chronic diseases such as diabetes, cancer, and cardiovascular diseases. Countries like China, India, and Japan are creating demand for biosensor devices as they are essential for early diagnosis and continuous monitoring, boosting the biosensors market expansion in the region.

- In May 2023, innovative medical gadgets have been designed, manufactured, and marketed by Biosensors International. Their commitment lies in providing biosensors to meet the demands of the healthcare industry.

The regional analysis depicts that Europe is a hub for several leading research institutions and companies focused on biosensor technology. Innovations in nanotechnology, microfluidics, and biotechnology are leading to the development of more accurate and cost-effective biosensors. The Middle East and Africa are poised for growth in the market as it is driven by increasing healthcare demands, technological advancements, and a focus on preventive healthcare. The food industry is leveraging biosensors for quality control and safety monitoring and thus helps in detecting contaminants and pathogens, promoting the biosensors market expansion.

Latin America region is witnessing advancements in biosensor technology, including the development of portable and user-friendly devices. Innovations in microelectronics and biotechnology are enhancing performance and accessibility.

Top Key Players & Market Share Insights:

The biosensors market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the global biosensors market. Key players in the biosensors industry include -

- Abbott Laboratories (USA)

- Medtronic (USA)

- Siemens Healthineers AG (Germany)

- GE Healthcare (USA)

- Honeywell International Inc. (USA)

- Dexcom Inc. (USA)

- Roche Diagnostics Ltd. Nederland B.V. (Switzerland)

- Bio-Rad Laboratories Inc. (USA)

- Osmetech Plc (UK)

- Biosense Webster (Johnson & Johnson) Inc. (USA)

Recent Industry Developments :

Partnerships and Collaborations:

- In August 2022, Medtronic announces a partnership with BioIntelliSense for exclusive U.S. distribution of multi-parameter wearable devices that enable monitoring of patients remotely from in-hospital to home.

Merges and Acquisitions:

- In January 2023, SD Biosensor and SJL Partners announced the acquisition of Meridian Bioscience which is a firm that develops, manufactures, markets, and sells a wide range of innovative diagnostic tools.

Biosensors Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 46.84 Billion |

| CAGR (2024-2031) | 7.2% |

| By Product Type |

|

| By Technology |

|

| By Application |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Biosensors Market? +

Biosensors Market size is estimated to reach over USD 46.84 Billion by 2031 from a value of USD 28.78 Billion in 2023, growing at a CAGR of 7.2% from 2024 to 2031.

Which is the fastest-growing region in the biosensors market? +

The fastest-growing region in the biosensors market is North America.

What specific segmentation details are covered in the biosensors market report? +

The specific segments that are covered in the biosensors market are product type, technology, application, and end-user.

Who are the major players in the biosensors market? +

The major players in the biosensors market are Abbott Laboratories (USA), Medtronic (USA), Dexcom Inc. (USA), Roche Diagnostics Ltd. (Switzerland), Siemens Healthineers AG (Germany), GE Healthcare (USA), Honeywell International Inc. (USA), Bio-Rad Laboratories Inc. (USA), Osmetech Plc (UK), and Biosense Webster (Johnson & Johnson) Inc. (USA).