Cardiac Stent Market Size :

Consegic Business Intelligence analyzes that the cardiac stent market size is growing with a CAGR of 6.6% during the forecast period (2024- 2031). The market accounted for USD 7,606.44 million in 2023 and is projected to be valued at USD 11,884.59 Million by 2031.

Cardiac Stent Market Scope & Overview :

A cardiac stent is a small wire mesh tube used to treat coronary artery disorders by keeping a blocked coronary artery open to increase blood flow to the heart. The stent is inserted into the affected artery with a balloon catheter, and it can be placed either primarily or after balloon angioplasty. Most stents are made of metal mesh, however, there are two types of these stents: bare-metal stents and drug-eluting stents. The latter is coated with medication that helps keep the artery open longer and eventually becomes a part of the artery it is placed in.

Once a stent is placed, the tissue will gradually coat it like a layer of skin, and it will be fully lined with tissue within 3 to 12 months, depending on whether or not it has a medicine coating. Most stents are coated with medicine to prevent scar tissue from forming inside the stent. As per the analysis, they release medicine within the blood vessel that slows the overgrowth of tissue within the stent. This helps prevent the blood vessels from becoming narrow again. Some stents don't have this medicine coating and are called bare metal stents (BMS). They may have higher rates of stenosis, but they don't require long-term use of antiplatelet medicines. This may be the preferred stent in people who are at high risk of bleeding.

Cardiac Stent Market Insights :

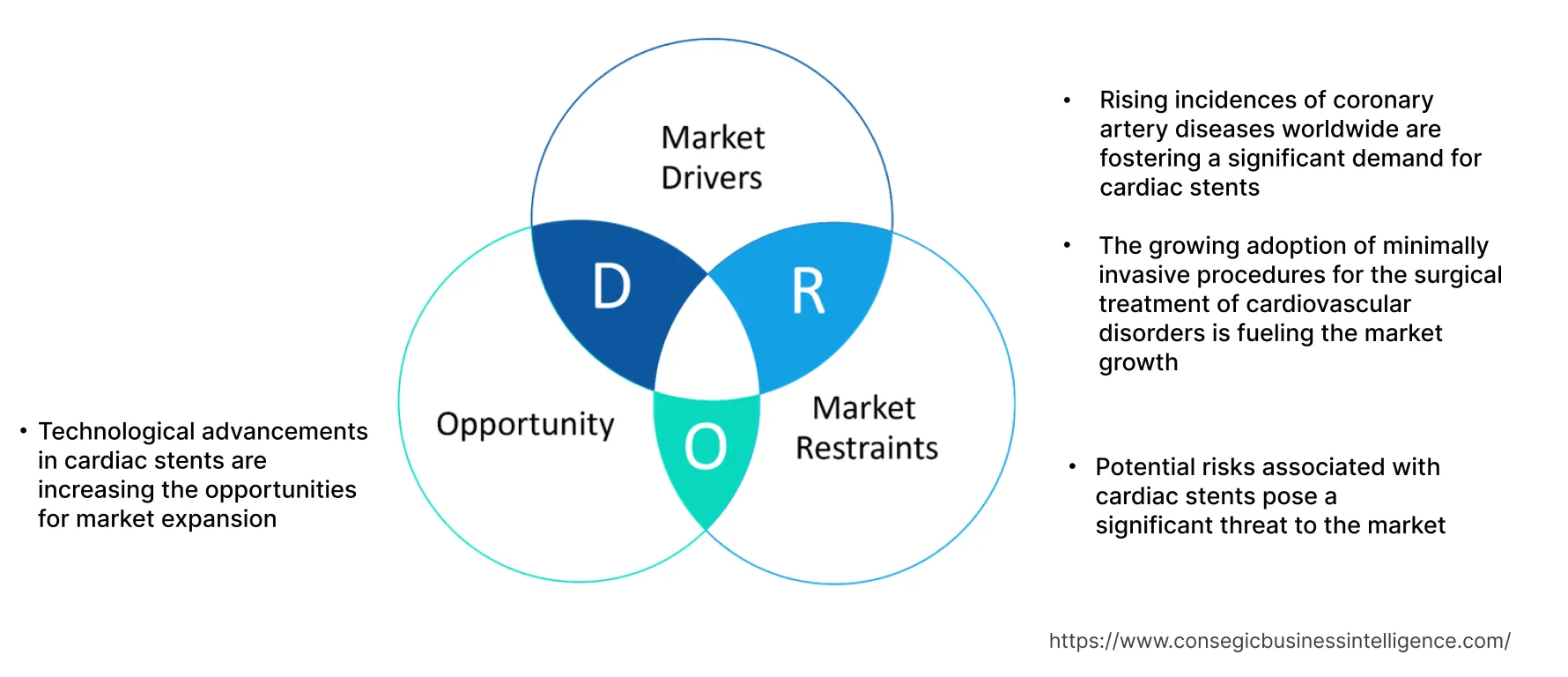

Cardiac Stent Market Dynamics - (DRO) :

Key Drivers :

Rising incidences of coronary artery diseases worldwide are fostering a significant demand for cardiac stents

The surging prevalence of coronary artery disorders, also known as coronary heart disease or ischemic heart disease is one of the prominent reasons fuelling the cardiac stent market demand. The underlying cause of coronary artery disease is atherosclerosis, which is characterized by the formation of luminal plaques of cholesterol and other substances. These plaques build up in the walls of the coronary arteries that supply blood to the heart and other parts of the body. Plaque buildup causes the inside of the arteries to narrow over time, which partially or blocks the blood flow. To procure this, a procedure called coronary angioplasty is performed to widen blocked or narrowed coronary arteries. In this procedure, coronary stents are utilized to treat an aneurysm, which is a bulge in the wall of an artery and allows the blood to move freely.

Furthermore, as per the analysis, the rising incidences of coronary artery diseases are propelling the trends for these stents or angioplasty procedures in cardiovascular disorders. For instance, according to the data published by the Centers for Disease Control and Prevention in May 2023, coronary heart disease is the most common type of heart disease, killing 375,476 people in 2021, an estimated about 2 in 10 deaths in adults less than 65 years old. Similarly, according to the report published by the National Institute of Health in October 2021, about 366,000 Americans die from coronary heart disease every year. As a result, an unprecedented rise in coronary artery disease incidence is boosting the trends for effective coronary stents for treatment.

The growing adoption of minimally invasive procedures for the surgical treatment of cardiovascular disorders is fueling the market growth.

The rising adoption of minimally invasive techniques for disease treatment assits as the potential factor fuelling the cardiac stent market demand. Stenting is a minimally invasive procedure, meaning it does not require a large, open incision in the body and is not considered major surgery. Minimally invasive coronary artery stenting offers several advantages over open heart surgery such as being less risky, reducing pain, and having shorter recovery times, as compared to traditional invasive heart surgery. This makes utilization of these stents more appealing to patients and clinicians alike.

Moreover, as per the analysis, the increasing approval of this minimally invasive stent by regulatory agencies is boosting the cardiac stent market expansion. For instance, in May 2022, the U.S. Food and Drug Administration approved the Onyx Frontier™ drug-eluting stent (DES) developed by Medtronic plc, a global leader in healthcare technology. The Onyx Frontier DES is approved in healthcare facilities to perform a minimally invasive procedure for the treatment of patients with coronary artery disease. Onyx Frontier DES is designed to improve deliverability and increase acute performance in even the most challenging of cases. Thus, the increasing trends for minimally invasive procedures along with the increasing innovations in these stents are propelling the market growth worldwide.

Key Restraints :

Potential risks associated with cardiac stents pose a significant threat to the market

Cardiac stents are complex devices that require careful design, advanced technology, and precision manufacturing to ensure that they meet the highest safety standards. The stent is often associated with certain major risks such as product failure, procedure recall, and health complications. Additionally, the stenting procedure includes risks such as allergic reactions to the drugs and contrast dye used during the procedure, damage to the blood vessels, rupture and burst of an aortic aneurysm, among others.

Moreover, the formation of blood clots within the treated blood vessel increases the risk of complications post-surgery operation leading to the recall of the procedure which further inhibits the trends for these stent. As a result, as per the analysis, the risks associated with these stents lower the adoption of the equipment across cardiac patients and thus hinder the growth of the market.

Future Opportunities :

Technological advancements in cardiac stents are increasing the opportunities for market expansion

The requirement for more convenient and safer solutions for angioplasty has motivated the rise in the development of stents with improved patient safety and functionality, thus creating lucrative opportunities and cardiac stent market trends. Continuous innovation in these stents is leading to the development of more sophisticated and effective stents for medical procedures in coronary artery disorders. Innovations in these stents such as drug-eluting stents, the use of biodegradable polymers, and bioresorbable scaffold systems are expected to propel the cardiac stent market. These advancements provide improved flexibility, and deliverability over traditional bare metal stents, and dissolve completely over time leaving no permanent implant in the artery.

Moreover, based on the analysis, innovations in product development by the leading companies may increase the competition in the market leading to the development of more advanced stents. For instance, in September 2023, Zeus, a global leader in advanced polymer solutions, announced the development of Absorv™ XSE oriented tubing for bioabsorbable products. Available in a variety of resins and expanded size ranges, Absorv XSE provides a highly customizable platform for design and offers an alternative to metallic products implanted permanently in the human body. Thus, a consistent need to come up with innovative technologies is expected to create cardiac stent market opportunities and trends.

Cardiac Stent Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2018-2031 |

| Market Size in 2031 | USD 11,884.59 Million |

| CAGR (2024-2031) | 6.6 % |

| By Product Type | Bare-Metal Stent and Drug-Eluting Stent |

| By End User | Hospitals, Cardiology Centers, Ambulatory Surgical Centers, and Others |

| By Region | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Players | Boston Scientific Corporation, amg International, SLTL Group, Medtronic, Abbott, B. Braun Interventional Systems Inc., Terumo Corporation, BD, Biosensors International Group, Ltd., MicroPort Scientific Corporation, Zeus Company Inc. and Cook |

| Geographies Covered | |

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Opportunities, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, Cost Analysis, and Regional Trends & Forecast |

Cardiac Stent Market Segmental Analysis :

By Product Type :

The product type segment is categorized into bare-metal stent and drug-eluting stent. In 2023, the drug-eluting stents segment accounted for the highest market cardiac stent market share in the cardiac stent market and is also expected to grow at the fastest CAGR over the forecast period. Drug-eluting stents are expandable mesh tubes that are coated with medication such as paclitaxel that is slowly released into the artery wall over time. This medication helps prevent the artery from narrowing again after the surgical procedure. Additionally, as per the analysis, this coating inhibits the expansion of smooth muscle cells and reduces the inflammation in the artery, further promoting healing and preventing re-stenosis.

In addition to this, new advancements and developments in drug-eluting stents are boosting the adoption of these stents in surgical centers which is expected to boost the segment. For instance, in August 2022, Medtronic, a global leader in medical technology, services, and solutions, launched its newest drug-eluting coronary stent, the Onyx Frontier drug-eluting stent (DES). The Onyx Frontier DES offers an innovative delivery system with an enhanced delivery designed to improve deliverability and increase acute performance in the most challenging cases. As a result, the advantages of drug-eluting stents with increased safety for patients are expected to create enormous opportunities for segment trends.

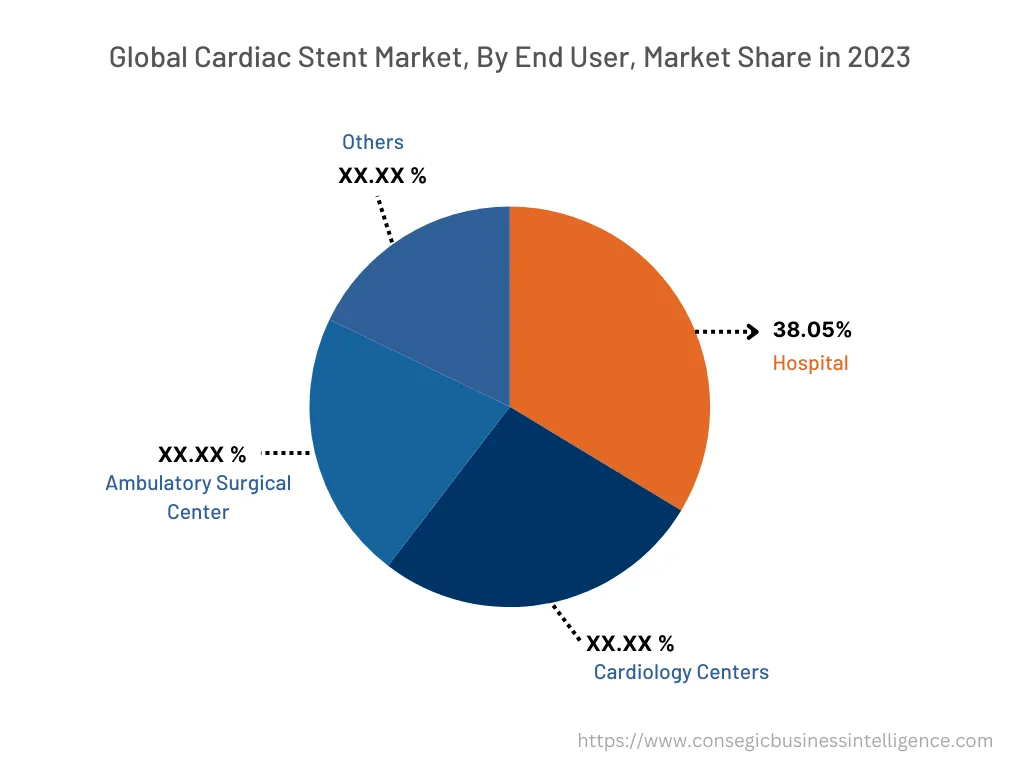

By End User :

The end user segment is categorized into hospitals, cardiology centers, ambulatory surgical centers, and others. In 2023, the hospitals segment accounted for the highest market share of 38.05% in the overall cardiac stent market. Hospitals are the primary users of these stents in critical surgeries of coronary artery disease to open blocked coronary arteries. Additionally, hospitals are equipped with the state-of-the-art healthcare infrastructure and medical personnel required for complex medical interventions. Moreover, the increasing hospital and government expenditure to improve the healthcare infrastructure facilities are fueling the adoption of advanced medical equipment and devices for cardiovascular disorder management, further raising the demand for these stents. For instance, according to the data published by the Office for National Statistics, Government of the UK in May 2023, healthcare expenditure in the UK was around USD 305.48 billion in 2022, which is an increase of 0.7% from spending in 2021. Thus, increasing demand for cardiac stents from hospitals and rising healthcare expenditure are boosting the segment trends.

Moreover, the cardiology centers segment is expected to hold the fastest CAGR over the forecast period owing to the increasing number of cardiology centers and cardiologists across the globe. Cardiology centers specialize in specific procedures including cardiac stenting, allowing for improved efficiency and outcomes. Cardiology centers are medical facilities dedicated to providing specialties specifically for cardiovascular disorders including diagnosis, treatment, surgery, and post-treatment care.

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

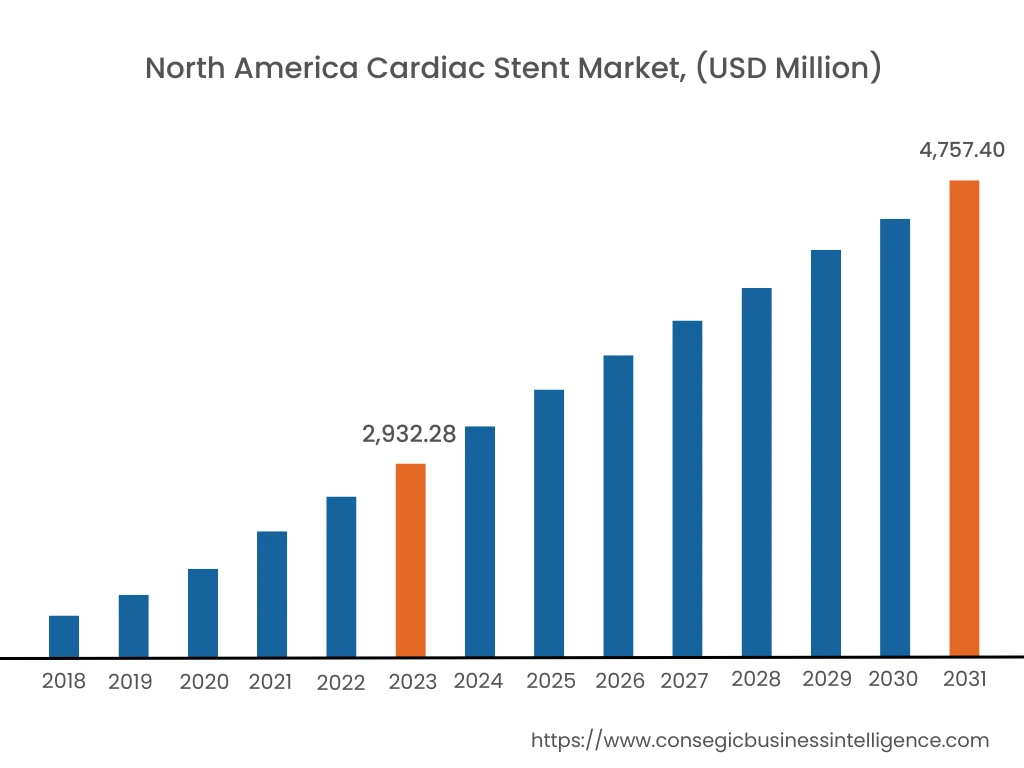

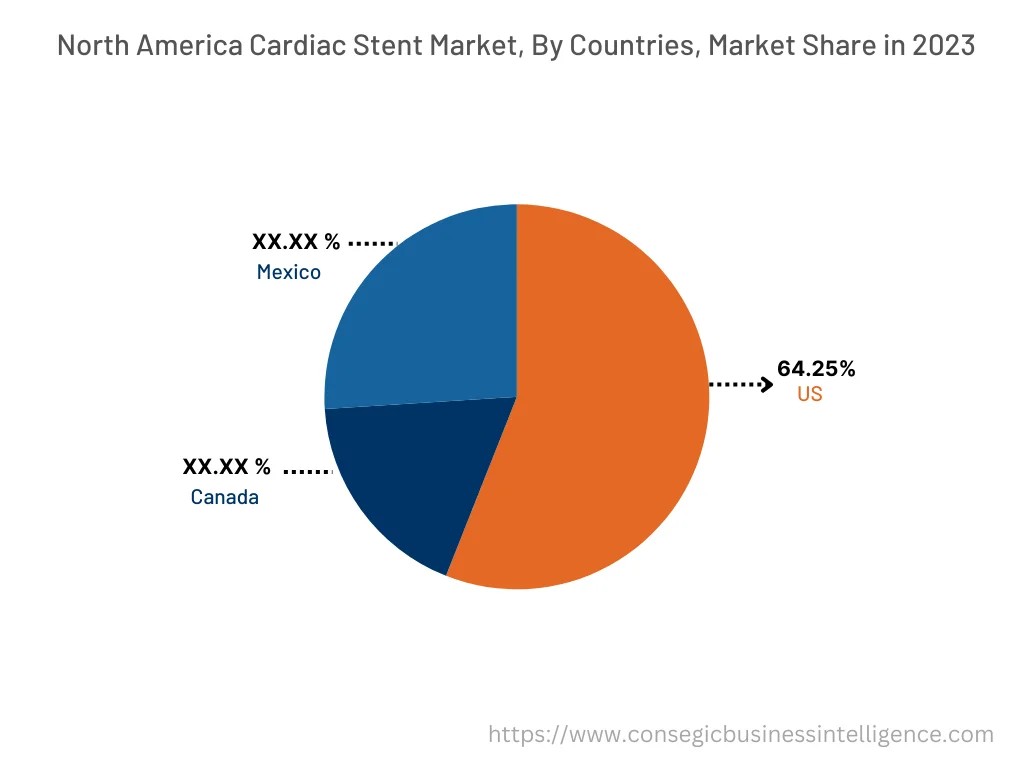

In 2023, North America accounted for the highest market share at 38.55% valued at USD 2,932.28 Million in 2023, it is expected to reach USD 4,757.40 Million in 2031. In North America, the U.S. accounted for a major market share of 64.25% in the year 2023. As per the cardiac stent market analysis, the changing lifestyle of the consumers in the region is increasing the risk of obesity and atherosclerosis which contribute as the risk factors for coronary artery disorders promoting the incidences of coronary artery disorders across the region. This high prevalence of disease is propelling the demand for more advanced stents for surgical treatments. Additionally, the presence of advanced healthcare infrastructure, the accessibility of advanced medical systems, and the high adoption rate of new technologies in the region are substantially boosting the expansion of the market. Overall, the rising prevalence of cardiovascular disorders and the advancements in healthcare facilities are propelling the cardiac stent market in North America.

Furthermore, the Asia Pacific region is expected to witness significant growth over the forecast period, growing at a CAGR of 7.2 % during the forecast year. The increasing prevalence of cardiovascular diseases in the region, and the increasing population in regions like India and China, are driving the cardiac stent market growth. Additionally, increasing initiatives by the governments of countries for better healthcare and public healthcare spending are expected to boost the market in this region. For instance, according to the data published by the India Brand Equity Foundation, in October 2023, the Indian government is planning to introduce a credit incentive program worth USD 6.8 billion to boost the country's healthcare infrastructure. Additionally, India's public expenditure on healthcare touched 2.1 % of GDP in 2023 and 2.2% in 2022, compared to 1.6% in 2021. As a result, increased government initiatives to provide better healthcare are expected to witness substantial market growth opportunities for these stents in the Asia Pacific region.

Top Key Players & Market Share Insights :

The global cardiac stent market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the cardiac stent industry include-

- BASF SE

- SABIC

- Mitsubishi Chemical Group Corporation.

- Shell

- Chevron Phillips Chemical Company LLC.

- Exxon Mobil Corporation.

- LyondellBasell Industries Holdings B.V.

- INEOS

- Sumitomo Chemical India ltd

- Dow

Recent Industry Developments :

- In August 2022, Medtronic, a global leader in medical technology, services, and solutions, announced the launch of its newest drug-eluting coronary stent, the Onyx Frontier drug-eluting stent (DES), following recent CE Mark approval. The Onyx Frontier DES offers an innovative delivery system and builds upon the acute performance and clinical data from the Resolute Onyx drug-eluting stent.

- In June 2022, Boston Scientific Corporation, a company dedicated to transforming lives through innovative medical solutions, announced an agreement with Synergy Innovation Co., Ltd, to purchase its majority stake of M.I.Tech Co., Ltd, ("M.I.Tech") a publicly traded Korean manufacturer and distributor of medical devices. M.I.Tech is the creator of the HANAROSTENT™ technology, a family of conformable, non-vascular, self-expanding metal stents, which have been distributed by Boston Scientific in Japan since 2015.