Bloodstream Infection Testing Market Size :

Consegic Business Intelligence analyzes that the Global Bloodstream Infection Testing Market size is growing with a CAGR of 4.5% during the forecast period (2023-2031). The market accounted for USD 3,283.63 million in 2022 and USD 3,415.65 million in 2023, and the market is projected to be valued at USD 4,860.22 Million by 2031.

Bloodstream Infection Testing Market Scope & Overview:

Bloodstream infection testing is a laboratory procedure that checks for the presence of bacteria, fungi, or other microorganisms in the bloodstream. This test is often used to diagnose sepsis and septic shock, which are serious and potentially life-threatening conditions. It is required for the confirmation of sepsis and accurate identification of causative agents.

Furthermore, several advanced or automated diagnostic techniques have emerged as alternatives to conventional blood culture methods to detect and identify pathogens directly from whole blood. This has improved the sensitivity, selectivity, and accuracy and reduced the time required for pathogen identification. It includes PCR, Fluorescence in situ hybridization, MALDI-TOF mass spectrometry, microarray, and nuclear magnetic resonance-based testing.

Bloodstream Infection Testing Market Insights :

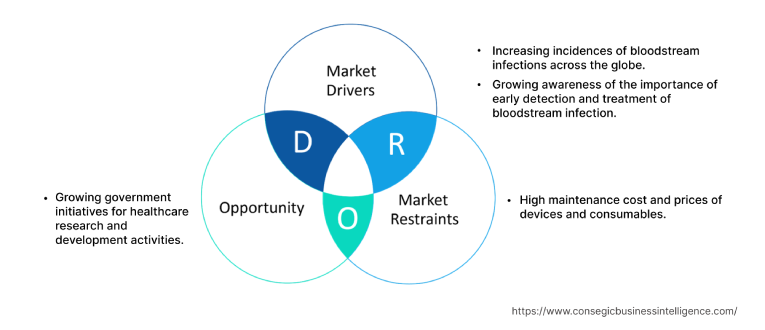

Bloodstream Infection Testing Market Dynamics - (DRO) :

Key Drivers :

Increasing incidences of bloodstream infections across the globe.

Bloodstream infections are the leading cause of death worldwide. This drives the demand for accurate and advanced testing solutions for bloodstream infections. Healthcare-associated infections, intravascular catheter-associated infections, and antimicrobial resistance harm the patients. Additionally, using invasive medical procedures and devices in COVID-19 patients has increased the risk of healthcare-associated bloodstream infections. These infections can evolve into serious deep-seated infectious complications such as bacterial endocarditis, lung abscesses, and infectious embolic events to major organs such as the brain and kidneys. For instance, according to the World Health Organization in June 2023, Bloodstream infections due to a range of resistant pathogens that are mostly associated with health care, were found to be the second most frequent cause of the global burdens attributable to and associated with AMR in 2019, causing almost 1.5 million deaths around the world. The analysis of market trends concludes that the growing incidences of bloodstream infections across the globe are driving the bloodstream infection testing market demand globally.

Growing awareness of the importance of early detection and treatment of bloodstream infection

Bloodstream infections (BSIs) are serious medical conditions caused by the presence of bacteria or fungi in the bloodstream. Bloodstream infections can lead to several complications, including sepsis, septic shock, and death. Early detection and treatment of BSIs are crucial for improving patient outcomes and reducing mortality. There is a significant rise in the number of blood infections across the globe leading to various lethal complications among the population. For instance, according to the report by HIV.gov, a US government website that provides information and resources on HIV and AIDS in July 2023, approximately 86% of people with HIV globally knew their HIV status in 2022. The remaining 14% (about 5.5 million people) did not know they had HIV and still needed access to HIV testing services. HIV testing is an essential gateway to HIV prevention, treatment, care, and support services. The global target for HIV status awareness is 95% by 2025. The analysis of market trends concludes that the growing awareness of the importance of early detection and treatment of BSIs is driving the adoption of newer and more sensitive BSI testing technologies. This is leading to an increase in the demand for BSI testing services and driving market proliferation.

Key Restraints :

High maintenance cost and prices of devices and consumables

The high cost of ownership and maintenance of devices is the restraining factor for the bloodstream infection testing market growth. Automated devices required for both conventional and advanced bloodstream infection tests such as PCR machines, and MALDI- TOF analyzers are equipped with several advanced features and functions. Additionally, these devices need special teams for their service, hence managing them is very expensive.

Furthermore, the high cost of instruments, consumables, and labor significantly affects end-user industries. Diagnostic laboratories and research industries require multiple such systems and hence capital cost increases ominously. On the other hand, research institutes run on limited funds, so they cannot afford such systems. Thus, all these factors contribute to the higher cost of bloodstream injection testing which is hampering the growth of the bloodstream infection testing market trends.

Future Opportunities :

Growing government initiatives for healthcare research and development activities

Extensive research activities have created ample space for the development and growth of the bloodstream infection testing market opportunities. Technological advancement such as next-generation sequencing of microbial cell-free DNA (mcfDNA-seq) is expected to emerge as a promising diagnostic method for bloodstream infection. Moreover, these techniques will help to develop sensitive, rapid, specific, and cost-efficient detection methods to decrease the negative impact of bloodstream infections for rapid antimicrobial susceptibility testing (AST) to enable the reduction of antibiotic therapy as early as possible. Since the COVID pandemic, several government initiatives have also supported the bloodstream infection testing market demand to reduce the rising cases of sepsis and antimicrobial resistance. For instance, In February 2020, in the United Kingdom, the National Institute for Health and Care Excellence (NICE) issued guidance recommending the use of rapid bloodstream infection testing in certain settings, such as emergency departments and intensive care units. The analysis of trends in the market concludes that the growing government initiatives for healthcare research and development activities are emerging as one of many bloodstream infection testing market opportunities that will drive market expansion across the globe over the forecast period.

Bloodstream Infection Testing Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2031 |

| Market Size in 2031 | USD 4,860.22 Million |

| CAGR (2023-2031) | 4.5% |

| By Product Type | Consumables, Instruments, and Software |

| By Technology | Conventional, PCR Methods, Nucleic Acid Testing, Mass Spectroscopy, and POC Testing |

| By End User | Hospitals, Diagnostic Centers, Research Institutes, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Thermo Fisher Scientific Inc., F. Hoffmann-La Roche Ltd, Abbott, BioMeruix, Cepheid, Luminex Corporation., Accelerate Diagnostics, Bruker, HiMedia Laboatories, and Diasorin |

Bloodstream Infection Testing Market Segmental Analysis :

By Product Type :

The product type of segmentation is categorized into consumables, instruments, and software. In 2022, the consumables segment accounted for the highest bloodstream infection testing market share. Consumable bloodstream infection testing refers to the use of disposable materials and reagents to detect bloodstream infections. These consumables are used in a variety of testing methods, including blood culture, nucleic acid testing (NAT), and mass spectrometry. Consumables are used in every bloodstream infection test, such as blood culture bottles, media, and reagents. Additionally, consumables are relatively inexpensive and have a short shelf life, which drives their demand across the globe.

Moreover, the instruments are expected to hold the highest CAGR over the forecast period. Instruments products in bloodstream infection testing are devices that are used to detect and identify bacteria and fungi in the bloodstream. These devices are becoming increasingly popular because they offer several advantages over traditional methods of testing, such as blood culture. Advancements in instruments such as automated blood culture systems and molecular diagnostics instruments are helping to reduce the turnaround time for testing. The superior performance characteristics of the products are creating lucrative growth prospects for the segment over the forecast period.

By Technology :

The technology segment is categorized into conventional, PCR methods, nucleic acid testing, mass spectroscopy, and POC testing. In 2022, the conventional segment accounted for the highest market share in the bloodstream infection testing market share. Conventional bloodstream infection (BSI) testing is the traditional method for detecting bacteria and fungi in the bloodstream. It involves collecting a blood sample and incubating it in a nutrient-rich broth for several days. If bacteria or fungi are present in the blood sample, they will grow in the broth and can be detected by a laboratory technician. The analysis of segment trends concludes that the growing awareness of the importance of early detection and treatment of bloodstream infections is driving market expansion across the globe.

Moreover, the POC testing is expected to hold the highest CAGR over the forecast period. Point-of-care (POC) testing refers to the use of small, portable devices to detect bloodstream infections at the patient's bedside. POC testing devices can be used to detect bacteria, fungi, and viruses in the bloodstream. POC tests produce results in minutes or hours, compared to days for traditional laboratory-based tests. This can lead to earlier diagnosis and treatment of bloodstream infections, which can improve patient outcomes. The faster turnaround time of POC testing is creating lucrative growth prospects for POC testing over the forecast period.

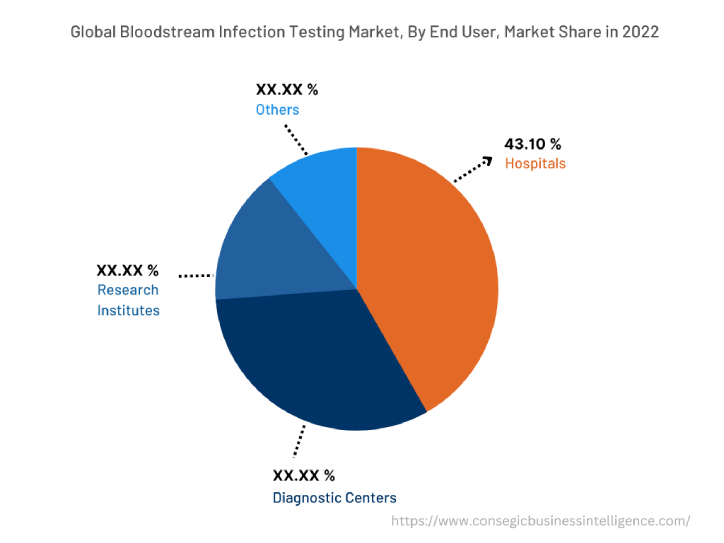

By End-User :

The end user segment is categorized into hospitals, diagnostic centers, research institutes, and others. In 2022, the hospitals segment accounted for the highest market share of 43.10% in the application segment. Hospitals are the primary setting where bloodstream infections are diagnosed and treated. Hospitals have the necessary infrastructure and resources to perform a variety of bloodstream infection tests, including blood culture, nucleic acid testing (NAT), and mass spectrometry. Assessment of market trends indicates that the increasing number of hospitals across the developing economies is driving the demand for bloodstream infection testing from the healthcare industry across the globe. For instance, according to the report by Investment Information and Credit Rating Agency, in August 2023, the hospital industry is expecting a robust revenue increase of 8-10% in FY24, with an operating profit margin of 22-23%. Thus, the growing need for the testing procedure from the healthcare industry is driving the bloodstream infection testing market growth.

Moreover, the diagnostic centers are expected to hold the highest CAGR over the forecast period. The need for bloodstream infection testing is growing from diagnostic centers due to the increasing requirement for outpatient infection testing. Diagnostic centers offer patients a convenient and affordable way to get tested for bloodstream infections. Growing government initiatives for the development of diagnostic centers are fueling the market growth. For instance, according to the report by the Government of the United Kingdom in May 2023, The government has committed USD 2.81 billion to launch up to 160 community diagnostic centers (CDCs) by March 2025. Analysis of bloodstream infection testing market trends concludes that the growing number of diagnostic centers is expected to drive segment growth across the globe.

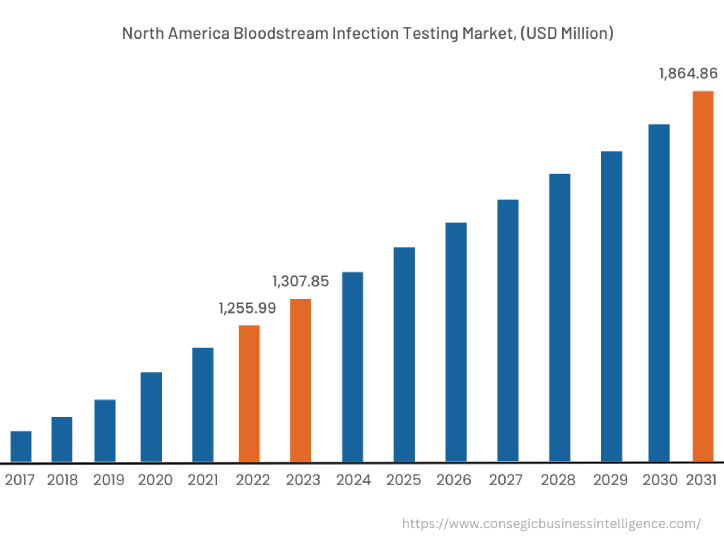

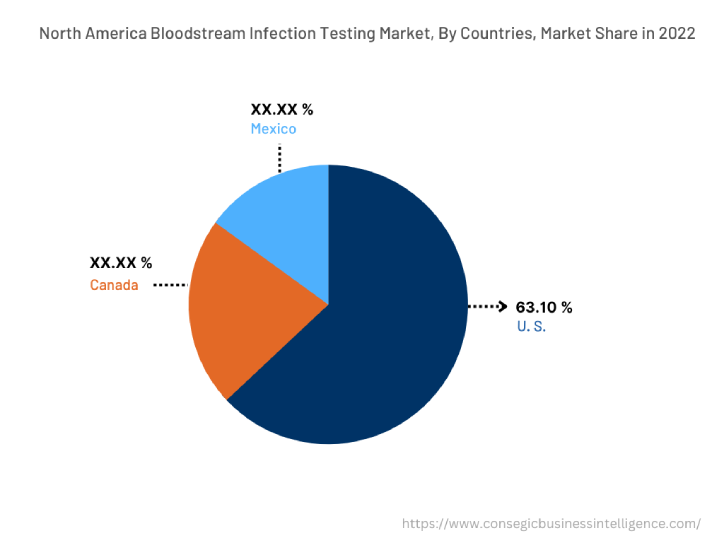

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2022, North America accounted for the highest market share at 38.25% valued at USD 1,255.99 Million in 2022 and USD 1,307.85 Million in 2023, it is expected to reach USD 1,864.86 Million in 2031. In North America, the U.S. accounted for the highest market share of 63.10% in the base year 2022. The bloodstream infection testing market analysis concluded that the significant rise in bloodstream infections across the North American region is driving market proliferation across the region. For instance, According to the Centers for Disease Control and Prevention (CDC) in September 2021, at least 1.7 million adults in the U.S. develop sepsis each year which leads to 270,000 every year. Furthermore, according to the report by the National Institute of Health in November 2022, An estimated 250,000 bloodstream infections occur annually, and most are related to the presence of intravascular devices. In the United States, the CLABSI rate in intensive care units (ICU) is estimated to be 0.8 per 1000 central line days. Thus, the growing prevalence of blood infections in the North American region is driving the market expansion.

Furthermore, the Asia Pacific region is expected to witness significant growth over the forecast period, growing at a CAGR of 4.9% during 2023-2031. The analysis of regional trends concludes that the significant proliferation in healthcare infrastructure across the region across the region is increasing the need for bloodstream infection testing. For instance, according to a report by the National Institute of Health in May 2023, China's healthcare budget is gradually increasing. The ratio of health expenditures to GDP in 2021 was 6.5%. It was only 4.3% to 5.2% during the period from 2000 to 2010. The total national health expenditure in 2021 will be USD 1184.9 billion. Thus, the significant development of healthcare infrastructure is expected to drive market proliferation over the forecast period.

Top Key Players & Market Share Insights:

The bloodstream infection testing market is highly competitive, with several large players and numerous small and medium-sized enterprises. The major companies operating in the bloodstream infection testing industry have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. Assessment of market trends indicates that the market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market through mergers, acquisitions, and partnerships. The key players in the market include-

- Thermo Fisher Scientific Inc.

- F. Hoffmann-La Roche Ltd

- Bruker

- HiMedia Laboatories

- Diasorin

- Abbott

- BioMeruix

- Cepheid

- Luminex Corporation.

- Accelerate Diagnostics

Recent Industry Developments :

- In April 2020, Thermo Fisher Scientific announced a collaboration with NanoPin Technologies, Inc. to develop a highly sensitive analytical workflow for infectious disease diagnosis and patient monitoring. The collaboration aims to improve blood-based infectious disease detection technology.

- In December 2021, Roche launched the first infectious disease tests on the Cobas 5800 System in countries accepting the CE mark for blood testing. The Cobas 5800 System is a compact, fully automated molecular system that helps address the lab requirements. The tests are designed to support patient management of human immunodeficiency virus, Hepatitis B and C virus.

Key Questions Answered in the Report

What was the market size of the bloodstream infection testing market in 2022? +

In 2022, the market size of bloodstream infection testing was USD 3,283.63 million.

What will be the potential market valuation for bloodstream infection testing by 2031? +

In 2031, the market size of bloodstream infection testing will be expected to reach USD 4,860.22 million.

What are the key factors driving the growth of the bloodstream infection testing market? +

Increasing incidences of bloodstream infections across the globe are fueling market growth at the global level.

What is the dominant segment in the bloodstream infection testing market for the end user? +

In 2022, the hospitals segment accounted for the highest market share of 43.10% in the overall bloodstream infection testing market.

Based on current market trends and future predictions, which geographical region is the dominating region in the bloodstream infection testing market? +

North America accounted for the highest market share in the overall market.