Dispersing Agents Market Size :

Dispersing Agents Market Size is estimated to reach over USD 12.19 Billion by 2032 from a value of USD 7.37 Billion in 2024 and is projected to grow by USD 7.72 Billion in 2025, growing at a CAGR of 5.9% from 2025 to 2032.

Global Dispersing Agents Market Scope & Overview:

Dispersing agents, also known as dispersants, are substances that enhance the separation and even distribution of particles within a liquid medium. These agents, which include polymers, surfactants, and complexing agents, offer several benefits. They improve solution stability, boost the effectiveness of pigments in products like paints, and enhance the consistency of pharmaceutical formulations.

Global Dispersing Agents Market Insights :

Dispersing Agents Market Dynamics - (DRO) :

Key Drivers :

Expanding applications in the construction sector are driving the dispersing agents market expansion

The increasing urbanization and infrastructure development projects in multiple regions worldwide necessitate the extensive use of paints and coatings, which, in turn, rely heavily on dispersants for enhanced performance. Furthermore, dispersants are crucial in ensuring the stability and uniformity of paints and coatings, thereby enhancing their quality and durability. As a result, the rising need for high-quality construction materials acts as a catalyst for the growth of the dispersants.

- For instance, according to the Press Information Bureau, in October 2021, the Dubai government and India signed an agreement to develop infrastructure in Jammu and Kashmir. This extensive collaboration includes the construction of IT towers, specialized hospitals, medical colleges, logistics centers, industrial parks, and multipurpose towers.

Thus, according to the dispersing agents market analysis, the expanding applications of dispersants in the construction sector are driving the dispersing agents market size and trends.

Key Restraints :

Fluctuating raw material prices and stringent regulations are affecting the dispersing agents market demand

One of the primary restraints limiting the market includes the fluctuating raw material prices, which can affect the cost of production and, consequently, the pricing of dispersants. Additionally, the stringent regulatory environment, particularly in developed regions, poses a challenge for manufacturers. Compliance with environmental and safety regulations can increase operational costs and impact profit margins. Moreover, the rising competition from alternative technologies and substitutes can pose a threat to the dispersants. Therefore, the aforementioned factors would further impact the dispersing agents market.

Future Opportunities :

Growing focus on eco-friendly dispersants is expected to create potential growth for dispersing agents market opportunities

The chemical industry's push for advanced, eco-friendly solutions is boosting the need for sustainable dispersants. This increased need is fueled by growing environmental awareness and regulations aimed at reducing the environmental impact of these substances. Dispersants, including polymers, surfactants, and complexing agents, are crucial in many industries, making a sustainable approach essential. They encourage environmentally friendly attributes and regulatory compliance benefits, as they are often derived from renewable sources like biomass and agricultural waste. This reduces reliance on fossil fuels and lowers carbon emissions. These sustainable options also feature low toxicity, a reduced carbon footprint, renewable sourcing, and biodegradability, with many new environmentally harmless chemical solutions now available.

- For instance, in September 2023, Dow introduced EcoSense 2470, a new surfactant designed for the home care market. This sustainable solution leverages innovative carbon capture technology, offering consumers an environmentally friendly option that helps them achieve their formulation goals without compromising performance.

Thus, based on the above dispersing agents market analysis, the above factors are expected to drive the dispersing agents market opportunities and trends.

Dispersing Agents Market Segmental Analysis :

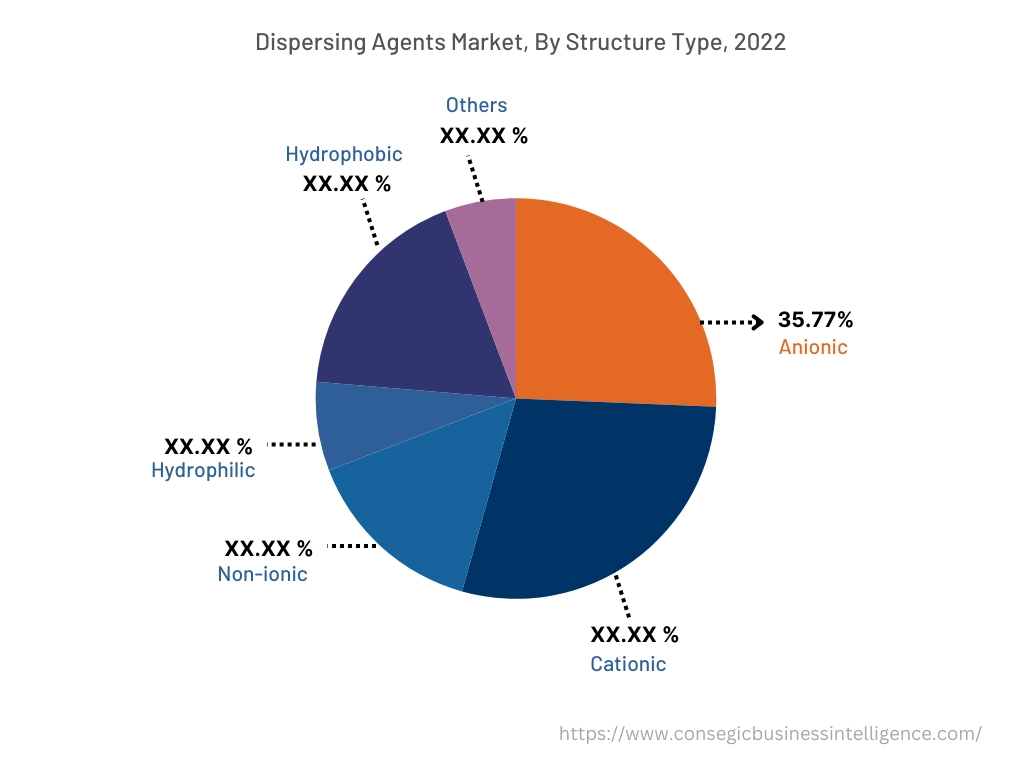

By Structure Type :

Based on structure type, the dispersing agents market is segmented into anionic, cationic, non-ionic, hydrophilic, hydrophobic, and others.

Trends in the structure type:

- Amphoteric dispersants, possessing both acidic and basic groups, offer unique functionalities and are suitable for specialized applications. They provide superior performance in challenging environments, making them ideal for high-end industrial applications.

- The need for dispersing agents for inks is expected to grow as the printing industry continues to evolve, with an increasing focus on digital printing technologies and sustainable practices, thereby, driving the dispersing agents market growth.

- Thus, the above analysis and factors are driving the dispersing agents market demand and trends.

The anionic segment accounted for the largest revenue share of 39.90% in the year 2024.

- Anionic dispersants are widely used due to their excellent stability and compatibility with a variety of systems.

- These dispersants are particularly effective in water-based systems and are extensively used in applications such as paints and coatings, where they help in achieving uniform pigment distribution.

- The dominance of anionic dispersants in the market is attributed to their cost-effectiveness and growing demand from the construction and automotive industries.

- For instance, in June 2020, Clariant introduced new pigment dispersion solutions aimed at assisting North American industrial coatings manufacturers with their tinting reformulation needs. These solutions are designed to simplify and improve the color-matching process for industrial paints and coatings.

- Thus, based on the above analysis, these factors are further driving the dispersing agents market growth and trends.

The non-ionic segment is anticipated to register the fastest CAGR during the forecast period.

- Non-ionic dispersants are characterized by their neutrality and are suitable for both aqueous and non-aqueous systems.

- These dispersants are gaining traction due to their versatility and ability to function effectively in a wide range of pH environments.

- Their usage is widespread in industries such as pharmaceuticals and oil & gas, where stability and performance are critical.

- The increasing preference for non-ionic dispersants in various applications is expected to contribute significantly to the market's growth.

- Thus, based on the above analysis, these developments are expected to drive the dispersing agents market share and trends during the forecast period.

By End User Industry :

Based on end user, the dispersing agents market is segmented into construction, paints and coatings, detergent, agricultural, pharmaceuticals, pulp and paper, oil and gas, automotive, and others.

Trends in the end user:

- The innovations in detergent formulations that require specific dispersant characteristics are anticipated to create new opportunities in the end user segment.

- The push towards sustainable paper production processes is likely to increase the adoption of eco-friendly dispersants.

- Based on the above analysis, the factors are anticipated to further drive the dispersing agents market trends during the forecast period.

The paints and coatings segment accounted for the largest revenue share in the year 2024 and it is expected to register the highest CAGR during the forecast period.

- The paints & coatings segment is the largest application area for dispersants, driven by the growing construction and automotive industries.

- Dispersants play a critical role in ensuring the stability, uniformity, and color strength of paints and coatings, which are essential for high-quality finishes and durability.

- The increasing demand for advanced coatings with enhanced properties is expected to sustain the growth of the segment.

- Thus, based on the above analysis, these factors would further supplement the dispersing agents market trends.

By Region :

The global market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

Asia Pacific dispersing agents market expansion is estimated to reach over USD 2.68 billion by 2032 from a value of USD 1.52 billion in 2024 and is projected to grow by USD 1.60 billion in 2025. Out of this, the China market accounted for the maximum revenue split of 35.23%. Asia Pacific is expected to lead the global market, driven by rapid industrialization, urbanization, and the expansion of key end-use industries. Countries in the region are investing in infrastructure and construction projects. Further, the region's thriving automotive and textile industries are contributing to the demand for dispersants. These factors would further drive the regional dispersing agents market share and trends during the forecast period.

- For instance, according to the India Brand Equity Foundation, in August 2023, India significantly increased its capital investment in infrastructure for the budget 2023-24, raising the outlay by 33% to reach USD 122 billion, which accounts for 3.3% of the GDP. Furthermore, India intends to invest a substantial USD 1.4 trillion in infrastructure over the next five years through its 'National Infrastructure Pipeline' initiative. Thus, the above factors are expected to boost the market in Asia-Pacific region during the forecast period.

Europe market is estimated to reach over USD 5.53 billion by 2032 from a value of USD 3.36 billion in 2024 and is projected to grow by USD 3.52 billion in 2025. Industries in Europe are increasingly adopting water-based dispersing agents due to regulatory pressure to reduce VOC (volatile organic compound) emissions. This shift is also driven by rising need for dispersants from the automotive, construction, and packaging sectors. The continuous demand for dispersants is further supported by innovations in green chemistry and growing infrastructure investment. Moreover, the move towards incorporating renewable materials in industrial formulations is boosting the adoption of advanced dispersing solutions. Hence, the factors are further driving the regional market in Europe.

Additionally, according to the analysis, the dispersing agents industry in North America is expected to witness significant development during the forecast period. North America holds a substantial share in the dispersing agent market, attributed to the presence of well-established industries and a high level of technological advancement. Meanwhile, the rising infrastructure development and urbanization in Latin America are expected to boost the demand for dispersants. Further, the Middle East has extensive oil & gas activities, presenting significant growth prospects for dispersant manufacturers. These factors are driving the regional dispersing agents market size.

Top Key Players & Market Share Insights :

The global dispersing agents market is highly competitive with major players providing products to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the dispersing agents industry include-

- BASF SE (Germany)

- CLARIANT (Switzerland)

- Ashland (U.S.)

- LG Chem (South Korea)

- CHRYSO UK (U.K.)

- LANXESS (Germany)

- Nouryon (The Netherlands)

- Solvay (Belgium)

- Evonik (Germany)

- Allnex GMBH (Germany)

- Dow (U.S.)

Recent Industry Developments :

Product Launch:

- In April 2024, BASF introduced Efka PX 4360, a new solvent-based dispersing agent. This next-generation product utilizes CFRP technology to deliver enhanced performance, durability, and storage stability.

Dispersing Agents Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2031 |

| Market Size in 2031 (USD Million) | USD 12.19 Billion |

| CAGR (2023-2031) | 5.9% |

| By Structure Type | Anionic, Cationic, Non-ionic, Hydrophilic, Hydrophobic, and Others. |

| By End User Industry | Construction, Paints and Coatings, Detergent, Agricultural, Pharmaceuticals, Pulp and Paper, Oil and Gas Sector, Automotive, and Other |

| By Region | North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

| Key Players | BASF SE, CLARIANT, Arkema, Nouryon, Solvay, Evonik, Dow, Ashland, LG Chem, CHRYSO UK, Allnex GMBH, and LANXESS |

| Geographies Covered | |

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Opportunities, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, Cost Analysis, and Regional Trends & Forecast |

Key Questions Answered in the Report

How big is the Dispersing Agents Market? +

Dispersing Agents market size is estimated to reach over USD 12.19 Billion by 2032 from a value of USD 7.37 Billion in 2024 and is projected to grow by USD 7.72 Billion in 2025, growing at a CAGR of 5.9% from 2025 to 2032.

Which is the fastest-growing region in the Dispersing Agents Market? +

Asia-Pacific is the region experiencing the most rapid growth in the market.

What specific segmentation details are covered in the Dispersing Agents report? +

The dispersing agents report includes specific segmentation details for structure type, end user, and region.

Who are the major players in the Dispersing Agents Market? +

The key participants in the market are BASF SE (Germany), CLARIANT (Switzerland), Nouryon (The Netherlands), Solvay (Belgium), Evonik (Germany), Allnex GMBH (Germany), Dow (U.S.), Ashland (U.S.), LG Chem (South Korea), CHRYSO UK (U.K.), LANXESS (Germany), and others.

Based on current market trends and future predictions, which geographical region is the dominating region in the Dispersing Agents market? +

Asia Pacific accounted for the highest market share in the overall market.