Electric Wheelbarrow Market Size:

Electric Wheelbarrow Market Size is estimated to reach over USD 2.51 Billion by 2032 from a value of USD 1.53 Billion in 2024 and is projected to grow by USD 1.60 Billion in 2025, growing at a CAGR of 6.9% from 2025 to 2032.

Electric Wheelbarrow Market Scope & Overview:

An electric wheelbarrow is a motorized version of the traditional manual wheelbarrow, designed to ease the transportation of heavy materials. It incorporates an electric motor, powered by a rechargeable battery, to drive the wheel and assist with movement. This powered assistance allows users to carry heavier loads and navigate various terrains more easily, becoming a valuable tool in construction, landscaping, gardening, and other industries.

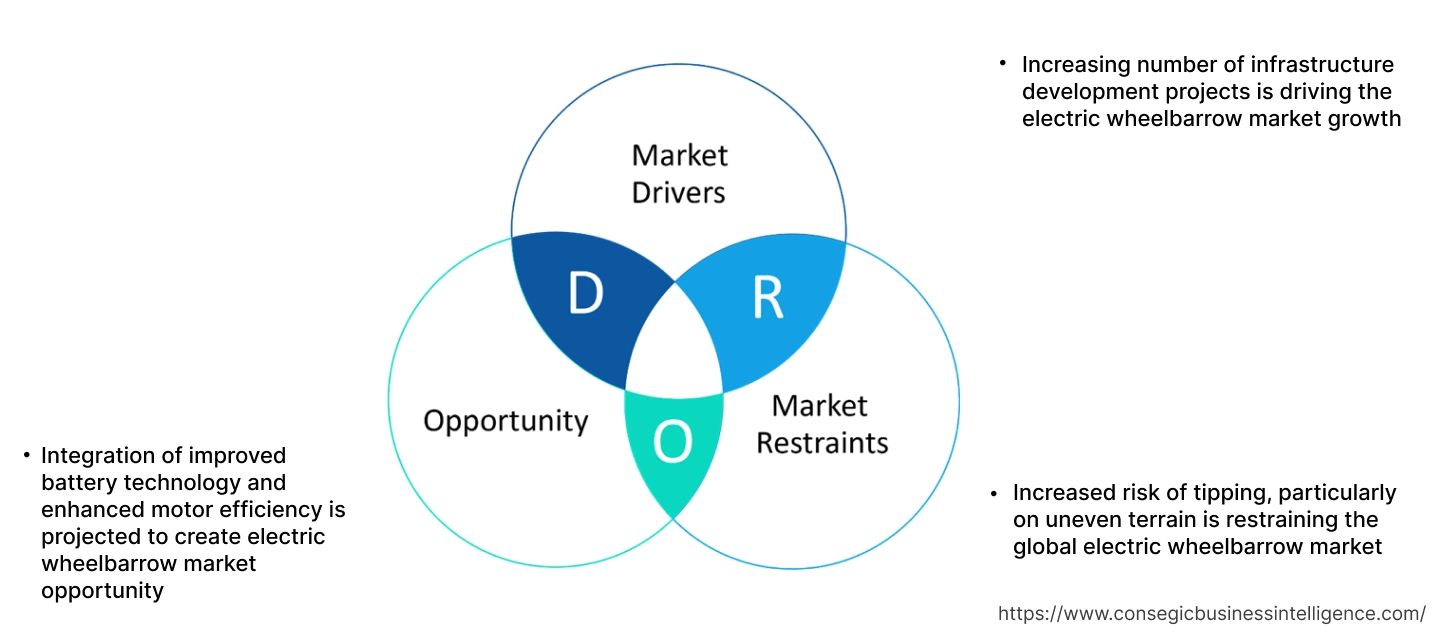

Key Drivers:

Increasing number of infrastructure development projects is driving the electric wheelbarrow market growth

Infrastructure projects require the movement of vast quantities of materials such as concrete, aggregates, sand, gravel, bricks, and asphalt across extensive construction sites. Electric wheelbarrows provide an efficient and less labor-intensive solution for transporting these materials compared to manual wheelbarrows, leading to increased productivity and faster project completion. Additionally, infrastructure projects involve construction in challenging terrains, including uneven ground, slopes, and confined spaces. Electric wheelbarrows, with features like robust tires, powerful motors, and controlled descent mechanisms, offer better maneuverability and stability, consequently driving the electric wheelbarrow market size.

- For instance, India, recognized as the world's fastest-growing developing economy with an 8.9% GDP growth in 2021, has ambitious development plans. The nation intends to invest substantial USD 1.4 trillion by 2023 towards building sustainable infrastructure.

Consequently, increasing number of infrastructure development projects is driving the electric wheelbarrow market growth.

Key Restraints:

Increased risk of tipping, particularly on uneven terrain is restraining the global electric wheelbarrow market

The primary concern is the potential for accidents and injuries caused by tipping, especially on construction sites or agricultural fields where uneven surfaces are common, leading to worker injuries and project delays. Additionally, the unsuitability for uneven surfaces restricts the usability of electric wheelbarrows in various applications, such as landscaping on sloped gardens, construction on rough terrain, or agriculture in fields with undulations. Addressing the tipping issue requires manufacturers to invest in enhanced design features like wider wheelbases and lower centers of gravity, which increase the production cost of electric wheelbarrows, further hampering the market expansion.

Therefore, as per the analysis, these combined factors are significantly hindering electric wheelbarrow market share.

Future Opportunities :

Integration of improved battery technology and enhanced motor efficiency is projected to create electric wheelbarrow market opportunity

Advancements in battery technology, particularly lithium-ion batteries, are leading to increased energy density and longer run times on a single charge. This reduces the need for frequent recharging, enhancing productivity and making electric wheelbarrows more practical for extended work periods. Additionally, efficient electric motors are expected to deliver increased power and torque, enabling electric wheelbarrows to handle heavier loads and navigate challenging terrains, including slopes and uneven surfaces. Further, integration of digital displays provides users with real-time information on battery level, speed, load weight, and other performance metrics, allowing for better control and management, hence boosting electric wheelbarrow market demand.

- For instance, in Apr 2024, Onewheel and Gorilla introduced the OnewheelBarrow, the first electric, self-balancing wheelbarrow. This innovative all-terrain device, powered by a 750-watt brushless motor, can carry up to 300 lbs and tackle steep inclines. Featuring a lithium battery, it offers a 6–8 mile range and speeds up to 18mph for efficient material transport. Bluetooth connectivity and a mobile app enable users to manage loads, adjust settings, and monitor performance.

Hence, based on the analysis, integration of improved battery technology and enhanced motor efficiency is expected to create electric wheelbarrow market opportunities.

Electric Wheelbarrow Market Segmental Analysis :

By Type:

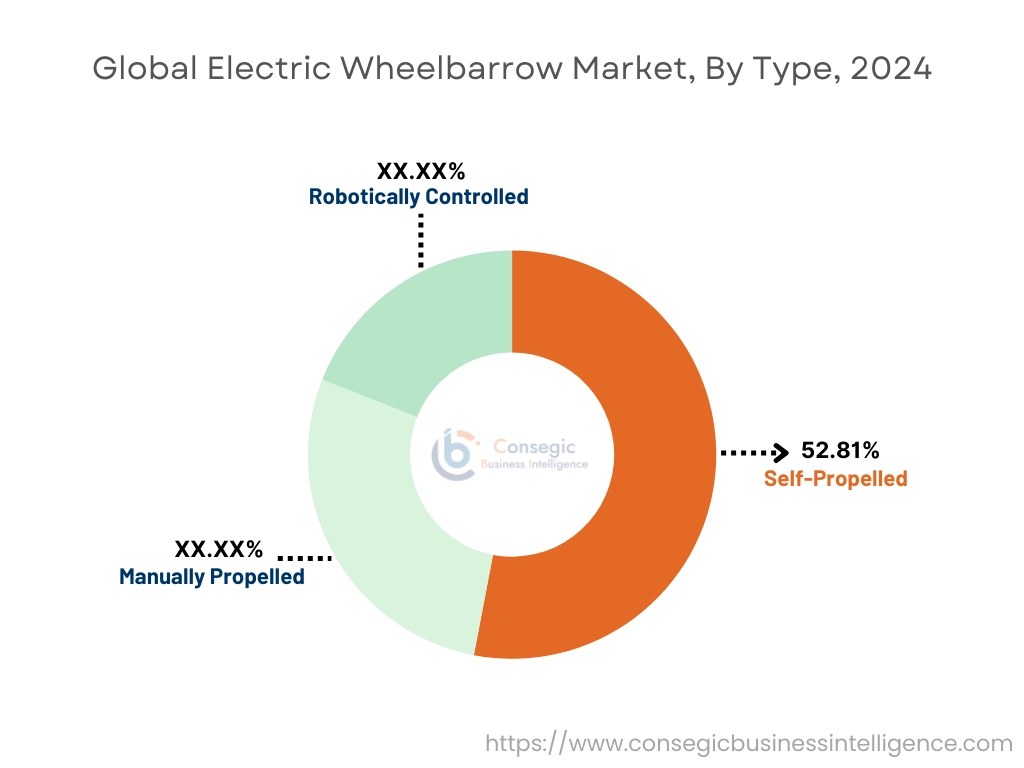

Based on the Type, the market is categorized into Self-Propelled, Manually Propelled, and Robotically Controlled.

Trends in the Type:

- Manually propelled electric wheelbarrows prioritize a smaller footprint and lighter weight for motility in tighter spaces.

- The key trend is the development of fully autonomous or semi-autonomous electric wheelbarrows that can follow workers, navigate pre-programmed routes, or be remotely controlled for material transport.

Self-Propelled Electric Wheelbarrows accounted for the largest revenue share of 52.81% in 2024 and is projected to register the fastest CAGR during the forecast period.

- Demand is increasing owing to the ability to handle heavy loads with minimal physical effort from the operator.

- Trends include advancements in battery technology for longer run times and more powerful motors to tackle various terrains and heavier loads.

- Moreover, manufacturers are focusing on user comfort with features like variable speed controls and balanced designs to reduce operator fatigue, further boosting the electric wheelbarrow market size.

- Many self-propelled models are being designed with robust tires and powerful differentials to navigate uneven surfaces and slopes effectively.

- For instance, Hammacher Schlemmer has unveiled a new Self-Propelled Wheelbarrow, a cordless, battery-powered tool capable of carrying up to 220 lbs of materials like soil and firewood. It features a handlebar throttle for effortless movement and allows users to select between two speeds (2 mph or 4 mph) and forward or backward directions.

- Thus, as per the electric wheelbarrow market analysis, the aforementioned factors is driving self-propelled electric wheelbarrows segment.

By Power Source:

Based on the Power Source, the market is classified into Battery-Powered, Solar-Powered, and Hybrid.

Trends in the Power Source:

- Adoption of hybrid systems, combining battery power with another energy source could offer a balance between electric operation for reduced emissions and extended range/power for heavier-duty tasks.

- There is a growing interest in solar-powered solutions, aligning with the broader push for renewable energy and sustainability.

Battery-Powered accounted for the largest revenue share in 2024 and is predicted to register the fastest CAGR during the forecast period.

- Continuous improvements in lithium-ion battery technology are leading to longer operating times, faster charging capabilities, increased energy density, and improved overall performance.

- Manufacturers are incorporating ergonomic designs and enhanced safety features to improve user comfort and reduce workplace injuries, driving the electric wheelbarrow market demand.

- Emerging trends include the integration of IoT for remote monitoring, diagnostics, and potentially even semi-autonomous or autonomous operation in the future.

- For instance, Makita introduced the DCU601 Battery Powered Wheelbarrow, which runs on two 18V LXT batteries connected in series. For extended operation, it can accommodate up to four batteries in a 2-series/2-parallel configuration. A convenient battery selection switch allows users to choose between different pairs of installed batteries.

- Thus, as per the electric wheelbarrow market analysis, the aforementioned factors are driving battery-powered segment growth.

By Payload Capacity:

Based on the Payload Capacity, the market is categorized into Less than 500 lbs, 500-1000 lbs, 1000-1500 lbs, and more than 1500 lbs.

Trends in the Payload Capacity:

- Increasing trend of 1000-1500 lbs for heavy-duty applications in industries like mining, infrastructure development, and potentially specialized agricultural tasks.

- Features such as four-wheel drive, advanced braking systems, and robust hydraulic or electric tipping mechanisms are driving the adoption of more than 1500 lbs.

Less than 500 lbs accounted for the largest revenue share in 2024.

- This range is driven by applications in gardening, landscaping, and lighter construction or DIY tasks, hence driving the market trend.

- Many battery-powered models fall into this category, offering a balance of capacity and portability, which in turn, is boosting market size.

- For instance, Ogracwheel launched the SKU:E-Wheelbarrow-FX-002, a 48V electric wheelbarrow with a 500W brushless motor and a 500 lbs capacity. It uses four 12V 7Ah sealed lead-acid batteries and features a humanized, user-friendly design with a differential dual-wheel system for enhanced maneuverability on various terrains, including slopes up to 15°.

- In conclusion, the above-mentioned reasons are contributing notably in spurring the market demand.

More than 1500 lbs is projected to register the fastest growth during the forecast period.

- More than 1500 lbs cater to specialized sectors requiring very high load-bearing capabilities, such as large-scale infrastructure projects and potentially military applications.

- These machines might blur the line between traditional wheelbarrows and compact material transporters or mini dumpers.

- Features such as four-wheel drive, advanced braking systems, and robust hydraulic or electric tipping mechanisms are present.

- In conclusion, the aforementioned factors are predicted to witness the more than 1500 lbs segment growth.

By Application:

Based on the Application, the market is categorized into Construction, Landscaping, Farming, Industrial, and Residential.

Trends in the Application:

- Farm environments involve uneven and challenging terrain, necessitating robustly built electric wheelbarrows with good traction.

- Electric wheelbarrows are popular among homeowners for gardening, yard work, and DIY projects, helping with tasks.

Construction accounted for the largest revenue share in the market in 2024.

- Electric wheelbarrows are gaining traction on construction sites due to their ability to increase efficiency in moving materials and enhance site safety by minimizing strain on workers, hence driving the market demand.

- Construction sites require moving substantial loads, leading to a growing need for electric wheelbarrows with higher payload capacities.

- Models designed for construction applications are built to withstand tough site conditions, emphasizing durable materials, puncture-resistant tires, and sturdy frames.

- Electric wheelbarrows with features like differential drive, multiple wheels, and powerful motors capable of handling inclines are popular for navigating construction sites.

- In conclusion, the aforementioned factors are contributing to the global electric wheelbarrow market expansion.

Industrial is expected to register the fastest growth during the forecast period.

- Electric wheelbarrows are starting to be used in industries like warehouses and factories for transporting smaller loads of parts, tools, and materials within the facility.

- The quiet and emission-free operation of electric wheelbarrows is advantageous in indoor industrial environments.

- Industrial applications require robust machines with safety features like emergency stops and clear visibility.

- Future trends could involve integration with warehouse management systems for streamlined material flow.

- Therefore, as per the market analysis, the above-mentioned reasons are expected to drive the growth in upcoming years.

Regional Analysis:

The global electric wheelbarrow market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

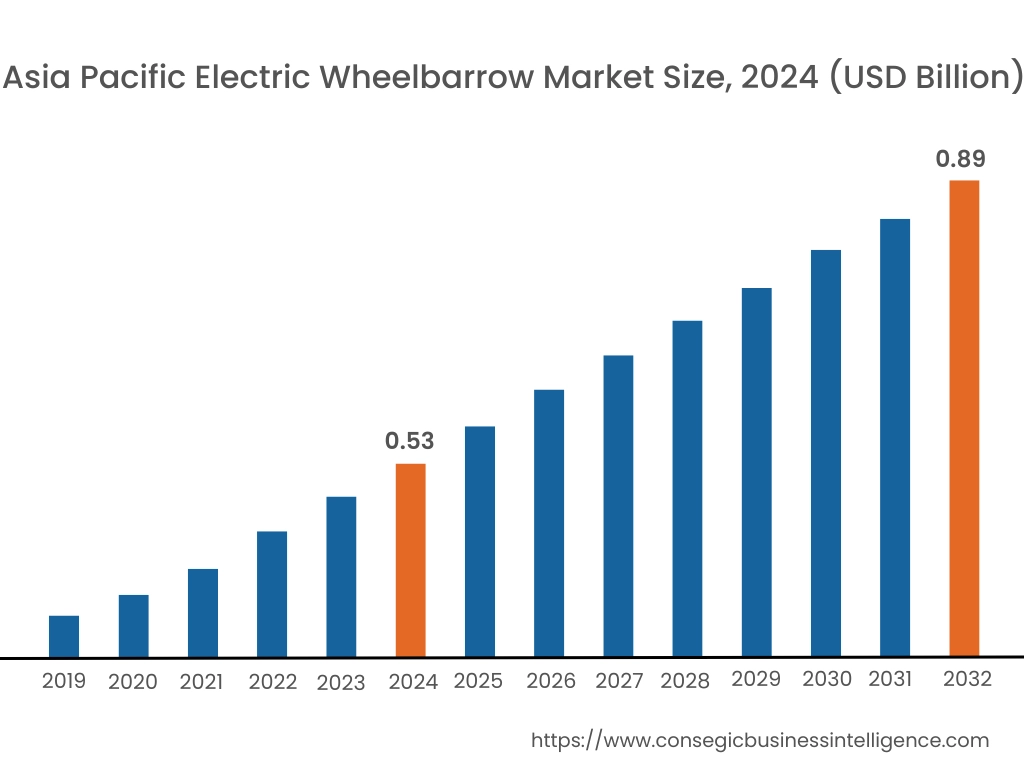

Asia Pacific was valued at USD 0.53 Billion in 2024. Moreover, it is projected to grow by USD 0.56 Billion in 2025 and reach over USD 0.89 Billion by 2032. Out of these, China accounted for the largest revenue share of 37.03% in 2024. Countries like China, India, and Southeast Asian nations are heavily investing in infrastructure projects, smart city development, and residential construction. This surge in construction activity fuels the need for efficient material handling equipment like electric wheelbarrows. Additionally, Asia Pacific encompasses the world's largest agricultural economies. The increasing adoption of mechanization in farming practices is driving the need for electric wheelbarrows for transporting crops, fertilizers, and other materials.

- For instance, India's foodgrain production reached 330.5 million metric tonnes in 2022-23, and the country is the world’s 2nd largest producer of food grains, fruits, and vegetables, and the 2nd largest exporter of sugar. For the Kharif season in 2023-24, rice production is estimated at 1,063.13 lakh tonnes, with anticipated procurement of 521.27 LMT rice for KMS 2023-24.

North America region was valued at USD 0.44 Billion in 2024. Moreover, it is projected to grow by USD 0.46 Billion in 2025 and reach over USD 0.71 Billion by 2032. The popularity of landscaping and gardening activities among homeowners and professionals contributes to the demand for electric wheelbarrows for tasks such as moving soil, mulch, and plants. Additionally, manufacturers are introducing advanced features like improved battery life, higher payload capacities, and enhanced maneuverability, which are driving adoption in North America.

As per the electric wheelbarrow market analysis, European countries have a strong focus on reducing carbon emissions and promoting sustainable practices, which encourages the adoption of electric-powered equipment like electric wheelbarrows. Additionally, increased investment in infrastructure projects and industry fuels the demand for efficient material handling equipment in Latin American countries. Further, electric wheelbarrows help reduce the physical strain on workers in the region's hot and harsh climates in Middle East and Africa countries.

Top Key Players and Market Share Insights:

The market is highly competitive with major players providing electric wheelbarrow to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the electric wheelbarrow industry include-

- Muck Truck (United Kingdom)

- Overland Carts (United States)

- Huzhou Daxi Zhenhua Corporation (China)

- Alitrak Southeast Asia and Oceania (Australia)

- Makita Corporation (Japan)

- Sherpa Tools (Netherlands)

- Nu-Star Material Handling (United States)

- Zallys srl (Italy)

- PowerPac Baumaschinen GmbH (Germany)

- Etesia UK (United Kingdom)

Electric Wheelbarrow Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 2.51 Billion |

| CAGR (2025-2032) | 6.9% |

| By Type |

|

| By Power Source |

|

| By Payload Capacity |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Electric Wheelbarrow market? +

The electric wheelbarrow market size is estimated to reach over USD 2.51 Billion by 2032 from a value of USD 1.53 Billion in 2024 and is projected to grow by USD 1.60 Billion in 2025, growing at a CAGR of 6.9% from 2025 to 2032.

What specific segmentation details are covered in the electric wheelbarrow report? +

The electric wheelbarrow report includes specific segmentation details for type, power source, payload capacity, application, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the electric wheelbarrow market, industrial is the fastest-growing segment during the forecast period.

Who are the major players in the electric wheelbarrow market? +

The key participants in the electric wheelbarrow market are Muck Truck (United Kingdom), Overland Carts (United States), Sherpa Tools (Netherlands), Nu-Star Material Handling (United States), Zallys srl (Italy), PowerPac Baumaschinen GmbH (Germany), Etesia UK (United Kingdom), Huzhou Daxi Zhenhua Corporation (China), Alitrak Southeast Asia and Oceania (Australia), Makita Corporation (Japan), and Others.