Energy Measurement ICs Market Introduction :

Energy Measurement ICs Market size is estimated to reach over USD 9,250.18 Million by 2031 from a value of USD 5,079.61 Million in 2022 and is projected to grow by USD 5,324.75 Million in 2023, growing at a CAGR of 7.1% from 2023 to 2031.

Energy Measurement ICs Market Definition & Overview :

Energy measurement ICs are designed for high accuracy electrical energy measurement in single and multi-phase power line systems. These devices are primarily used for measuring line current and voltage, along with calculating reactive, active, and apparent energy as well as instantaneous RMS current and voltage. Moreover, based on the analysis, they offer a range of benefits including auto calibration, high performance, wide operating temperature, improved power quality measurements, and other trends. The aforementioned benefits of these devices are major determinants for increasing its utilization in smart plugs, smart appliances, smart meters, and other related applications.

Energy Measurement ICs Market Insights :

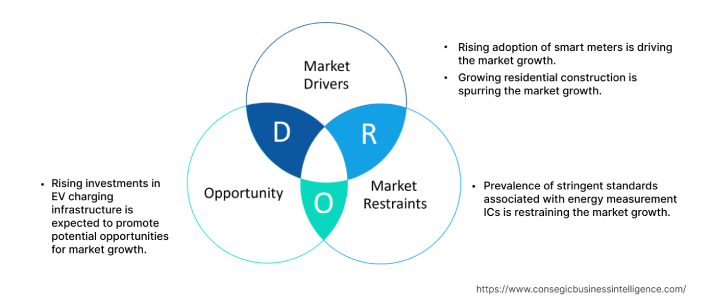

Energy Measurement ICs Market Dynamics - (DRO) :

Key Drivers :

Rising adoption of smart meters is driving the market.

Energy measurement ICs are primarily integrated in smart meters for measuring consumption of electric energy, current, voltage levels, and power factor among others. Moreover, as per the analysis, the integration of these devices in smart meters enables real-time monitoring of utility consumption by both consumer and utility supplier.

Factors including rising smart city projects, improved energy efficiency, and increasing government initiatives for installation of smart meters are primary aspects fostering the adoption of smart meters.

According to U.S. Energy Information Administration, the electric utilities across the United States installed approximately 119 million smart metering infrastructure in 2022, representing nearly 72% of total electric meters installations. Furthermore, approximately 3.9 million smart power meters have been installed across India by multiple government schemes as of February 2022.

Therefore, according to the analysis, the rising trend and adoption of smart meters is driving the integration of these devices in smart meters for measuring consumption of electric energy, current, voltage levels, and power factor, in turn proliferating the market.

Growing residential construction is spurring the market

Energy measurement ICs are utilized in residential buildings, particularly for applications in smart meters, smart appliances, and others. They are often integrated in smart meters and smart appliances installed in residential buildings to measure and monitor a building's energy consumption.

Factors including the rising disposable income, growing investments and government policies including subsidies, rebates, and tax incentives for residential construction are among the major prospects driving the residential sector.

For instance, in 2022, the Government of the United Kingdom introduced a home-building fund to support new residential development in the country. The UK Government provides direct investments ranging from USD 2.5 million to USD 6.2 million to residential builders in the country.

Additionally, according to the State of Nevada of the United States, the new residential building permits reached 23,406 units in Nevada in 2021, depicting an increase of approximately 19% as compared to 19,716 units in 2020. Hence, the rise in residential construction is further driving the adoption of these devices in modern residential buildings for measuring and monitoring a building's energy consumption, in turn driving the market.

Key Restraints :

Prevalence of stringent standards associated with energy measurement ICs is restraining the market

Energy measurement IC manufacturers have to compulsorily comply with various stringent standards and regulations, which is a prime factor restricting market.

For instance, energy measurement IC manufacturers have to comply with various standards such as RoHS (Restriction of Hazardous Substances) Directive, IEC (International Electrotechnical Commission) standard - IEC 62053-21, IEC 62053-22, EN50470-3, and others.

Additionally, materials used in these devices must comply with RoHS in relation to Directive 2011/65/EU, including the amendment to Annex II, 2015/863/EU. Meanwhile, IEC 62053-21 and IEC 62053-22 standards are applicable to electricity meters of accuracy classes 0, 1, 2, and 5 for measurement of alternating current electrical active energy in 60 Hz or 50 Hz networks.

Further, EN50470-3 is a European Standard that is applicable to newly manufactured electricity metering equipment particularly designed for commercial, residential, and light industrial usage for the measurement of alternating current electrical active energy in 50 Hz networks. Therefore, the prevalence of the aforementioned standards associated with the energy measurement ICs market trend is constraining the market.

Future Opportunities :

Rising investments in EV charging infrastructure is expected to promote potential opportunities for market

The rising investments in EV charging infrastructure is expected to present potential opportunities for the energy measurement ICs market. These devices are often integrated in EV charging electricity meters for storing and transmitting data regarding charging duration, energy consumption, and other related information, which can be further used for analyzing the charging patterns and behaviors of electric vehicle users for improving the efficiency of EV charging infrastructure.

As per the energy measurement ICs market analysis, factors including the advances in electro mobility, increasing adoption of electric vehicles, and growing investments in public EV charging infrastructure are promoting lucrative development aspects for the industry.

For instance, in March 2023, the Union Minister of Heavy Industries of India sanctioned around USD 97.4 million for setting up 7,432 public EV charging stations across the country. Meanwhile, in 2022, the Government of India allocated a total fund of approx. USD 120.84 million under the FAME-II scheme for supporting the deployment of EV charging infrastructure in the country.

Hence, rising trends and investments in EV charging infrastructure is anticipated to increase the utilization of these devices for application in EV charging electricity meters for storing and transmitting data associated with energy consumption, charging duration, and others, in turn promoting energy measurement ICs market opportunities during the forecast period.

Energy Measurement ICs Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2031 |

| Market Size in 2031 | USD 9,250.18 Million |

| CAGR (2023-2031) | 7.1% |

| Based on the Type | Single Phase and Polyphase |

| Based on the Sales Channel | Direct Sales and Distributor Sales |

| Based on the Application | Smart Plugs, Smart Appliances, Smart Meters, EV Charging, and Others |

| Based on the End-User | Residential, Commercial, and Industrial |

| Based on the Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Analog Devices Inc., STMicroelectronics, Microchip Technology Inc. Cirrus Logic Inc., NXP Semiconductors, Infineon Technologies AG, Texas Instruments Incorporated, Arch Meter Corporation, Silicon Laboratories, Renesas Electronic Corporation |

| Geographies Covered | |

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Opportunities, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, Cost Analysis, and Regional Trends & Forecast |

Energy Measurement ICs Market Segmental Analysis :

Based on the Type :

Based on the type, the market is bifurcated into single phase and polyphase. The polyphase segment accounted for the largest revenue share in the year 2022. Polyphase energy measurement ICs are capable of measuring current and voltage in three phases simultaneously while providing precise measurements of energy consumption. Moreover, these polyphase offer a range of benefits including more accurate measurements, improved load balancing, power quality monitoring, real-time data on energy consumption, and others. The aforementioned benefits of polyphase are driving its utilization for measurements of energy consumption in commercial and industrial sectors among others.

For instance, Analog Devices Inc. is a manufacturer of these ICs that offers ADE7754 model of polyphase energy measurement IC in its product portfolio. The polyphase energy measurement IC is integrated with a serial interface and a pulse output that provides various solutions for measuring active and apparent energy from the six analog input. Thus, rising innovation associated with polyphase energy measurement ICs is among the prime factors driving the market.

The single phase segment is anticipated to register the fastest CAGR during the forecast period. Single phase energy measurement ICs are primarily designed for use in electrical meters intended for measuring the power consumption in a single-phase power supply. Moreover, single phase materials provide several benefits including lower cost, simple installation and operations, and versatility among others. Additionally, they are mostly integrated in energy meters installed in residential buildings among others.

For instance, STMicroelectronics offers STPM01 model of single phase energy measurement ICs that is optimized for reliable measurement of reactive, active, and apparent energy in a power line system. The single phase energy measurement IC features ripple free active energy pulsed output, tamper detection, and multiple other features. Therefore, the rising advancements related to these materials are anticipated to boost the industry during the forecast period.

Based on the Sales Channel :

Based on the sales channel, the market is segregated into direct sales and distributor sales. The distributor sales segment accounted for the largest revenue share in the year 2022. The distributor sales channel of these devices comprises of both offline and online modes. As per the analysis, in the online mode, these devices are bought from e-commerce websites such as Alibaba, eBay, Indiamart, and others. The offline mode includes the distribution of these devices through specialist stores, regional distributors, and others. In addition, buying from a distributor also benefits the consumer to select the best product available in the market.

For instance, Microchip Technology Inc. and STMicroelectronics are among few of these ICs manufacturers that offers a range of single phase and polyphase energy measurement ICs through several regional distributors including DigiKey Corporation, Premier Farnell Limited, and others. Therefore, the increasing availability of these devices in distributor sales channel is a prime factor proliferating the segment.

The direct sales channel segment is anticipated to register fastest CAGR during the forecast period. In direct sales channel, products are sold directly to customers. Moreover, based on the analysis, the direct sales channel also comprises of online mode, in which the manufacturers sell the products through company owned websites. Additionally, purchasing these devices from direct sales channel offers various benefits such as faster response time, higher product quality, competitive pricing, competitive pricing, and higher return on investments, which are primary factors increasing the purchase of these devices from direct sales channel.

For instance, Texas Instruments Incorporated is among few of these ICs manufacturers that offer a broad range of these ICs for direct purchase through company website. Thus, the availability of these devices in direct sales channels, attributing to its above benefits, is a key factor projected to drive the demand of the segment during the forecast period.

Based on the Application :

Based on the application, the market is segregated into smart plugs, smart appliances, smart meters, EV charging, and others. The smart meters segment accounted for the largest revenue share in the year 2022. Factors including rising demand and trend for smart city projects, improved energy efficiency, and increasing government initiatives for installation of smart meters are driving the smart meter segment.

For instance, the government of India recently launched Smart Metering National Project in which approx. 1.57 million smart power meters have been installed across India as of February 2022 to promote the deployment of smart metering infrastructure in the country. These ICs are primarily integrated in smart meters for measuring consumption of electric energy, current, voltage levels, power factor, and other relevant information. Thus, the rising adoption of smart meters is driving the segment.

Smart appliances segment is expected to witness fastest CAGR during the forecast period. The expansion of smart appliances segment is primarily driven by multiple factors including increasing purchasing power of consumers, changing consumer lifestyle, and growing demand for energy-efficient household appliance among others.

For instance, in September 2023, Samsung introduced its new A-40% washing machine. The A-40% smart washing machine is integrated with AI Wash that provides advanced sensing capabilities of the laundry to improve washing performance while minimizing waste. The smart washing machine is capable of optimizing the amount of detergent and water and constantly adjusting the soaking, rinsing, and spinning times to attain the best results efficiently and quickly. Further, energy measurements ICs are often integrated in electricity meter that is used for measuring consumption of an individual household appliance. Therefore, the rising innovation associated with smart appliances is projected to drive the smart appliances segment during the forecast period.

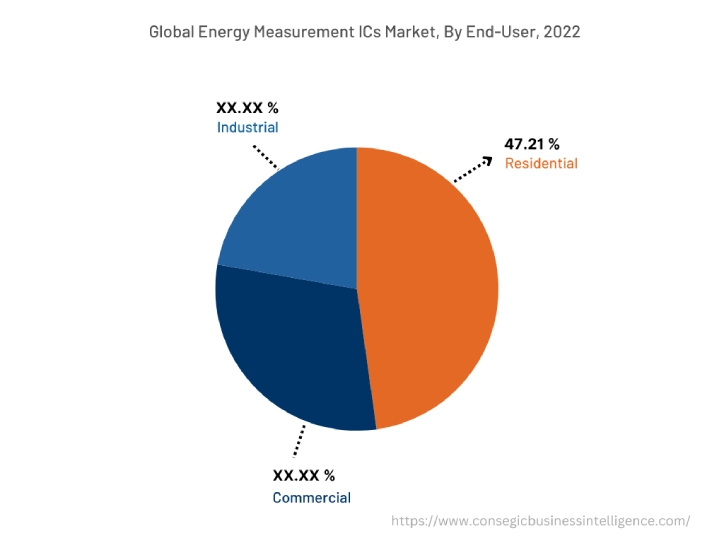

Based on the End-User :

Based on the end-user, the market is segregated into residential, commercial, and industrial. The residential segment accounted for the largest energy measurement ICs market share of 47.21% in the year 2022. Factors including the rising disposable income, growing investments and government policies including subsidies, rebates, and tax incentives for residential construction are driving the residential segment.

For instance, according to CoreLogic Inc., the overall sales of multi-family residential property in the United States observed a substantial rise of 26% during the second quarter of 2021 in comparison to 2019. Therefore, the expansion of residential sector is driving the utilization of these devices for measuring and monitoring a building's energy consumption, in turn fostering the energy measurement ICs market growth and trend of the market.

Commercial segment is expected to witness fastest CAGR during the forecast period. The expansion of commercial segment is primarily driven by multiple factors including the rising pace of urbanization, increasing commercial construction, and rising government initiatives for the installation of smart metering systems among others.

For instance, according to the UK Office for National Statistics, the total private commercial construction orders in the United Kingdom was valued at USD 4,295.1 million in fourth quarter of 2022, demonstrating an incline of 5.5% as compared to fourth quarter of 2019. Therefore, the rise in commercial construction is projected to drive the adoption of these devices for integration in smart metering solutions installed within commercial buildings to determine the amount of energy consumption, in turn fueling the market during the forecast period.

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

North America is estimated to reach over USD 3,402.21 Million by 2031 from a value of USD 1,843.39 Million in 2022 and is projected to grow by USD 1,934.53 Million in 2023.

The market growth for these devices in North America is primarily driven by multiple factors including increasing demand and investments in building and construction projects and rising installation of smart meters for energy measurement and monitoring in residential and commercial buildings in the region. For instance, according to Statistics Canada, investments in the building & construction sector was valued at USD 20.4 billion in January 2023, depicting an incline of 1.5% in contrast to the previous year. Additionally, investments in the residential sector in Canada increased by 1.9% to USD 14.9 billion, while the non-residential sector increased by 0.5% to USD 5.6 billion in January 2023. The aforementioned factors are projected to drive the adoption of energy measurement ICs trends in residential and commercial buildings for measuring and monitoring a building's energy consumption and improving energy efficiency, in turn driving the market growth in North America during the forecast period.

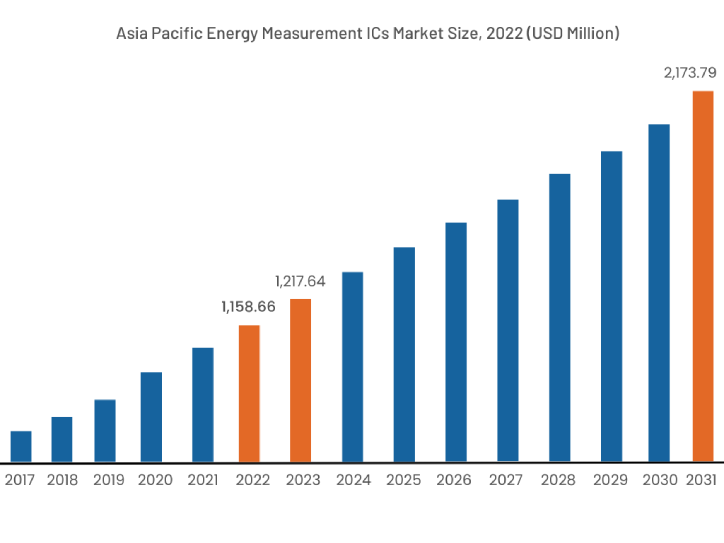

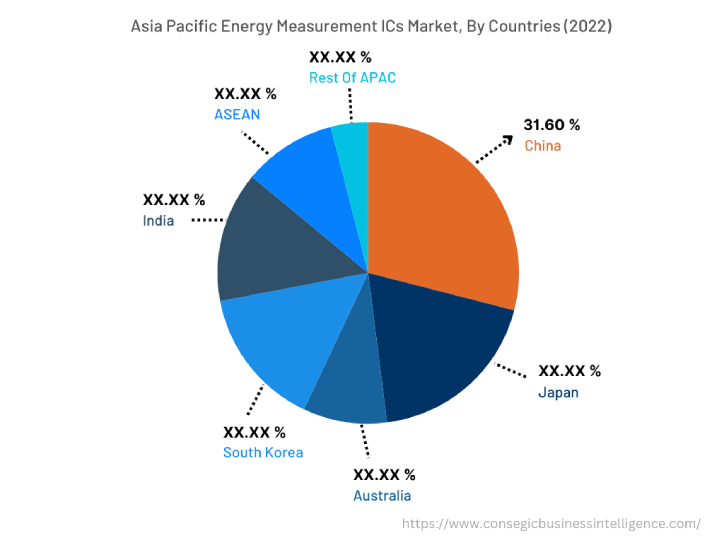

Asia-Pacific is expected to grow with the highest CAGR growth of 7.5% and is estimated to reach over USD 2,173.79 Million by 2031 from a value of USD 1,158.66 Million in 2022 and is projected to grow by USD 1,217.64 Million in 2023. In addition, in the region, the China accounted for the maximum revenue share of 31.60% in the same year.

The rapid pace of urbanization, industrialization, and development is promoting lucrative growth aspects for market growth in the region. Moreover, the rising government initiatives for the development of smart cities are contributing to the market growth for this device in the Asia-Pacific region.

For instance, the government of China introduced several initiatives such as China's 14th five-year Development Plan (2021 to 2025), National New-type Urbanization Plan, and smart cities projects that intends to facilitate the development of smart homes in the country. Furthermore, multiple factors including the increasing commercial and industrial construction along with rising need for smart metering solutions are projected to drive the energy measurement ICs market demand and trend in the Asia-Pacific region during the forecast period.

Top Key Players & Market Share Insights :

The energy measurement ICs market is highly competitive with major players providing these devices to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and application launches to hold a strong position in energy measurement ICs industry. Key players in this market include-

- Analog Devices Inc.

- STMicroelectronics

- Cirrus Logic Inc.

- NXP Semiconductors

- Infineon Technologies AG

- Microchip Technology Inc.

- Texas Instruments Incorporated

- Arch Meter Corporation

- Silicon Laboratories

- Renesas Electronic Corporation

Key Questions Answered in the Report

What is energy measurement ICs? +

Energy measurement ICs are designed for high accuracy electrical energy measurement in single and multi-phase power line systems.

What specific segmentation details are covered in the energy measurement ICs report, and how is the dominating segment impacting the market growth? +

For instance, by type segment has witnessed polyphase as the dominating segment in the year 2022, owing to the increasing adoption of polyphase energy measurement ICs for measurements of energy consumption in commercial and industrial sectors among others.

What specific segmentation details are covered in the energy measurement ICs market report, and how is the fastest segment anticipated to impact the market growth? +

For instance, by application segment has witnessed smart appliances as the fastest-growing segment during the forecast period due to rising integration of energy measurement ICs in electricity meter that is used for measuring consumption of individual household appliances.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2023-2031? +

Asia-Pacific is anticipated to register fastest CAGR growth during the forecast period due to rapid pace of urbanization and rising building & construction projects in the region.