Power Discrete Device Market Introduction :

Power Discrete Device Market size is estimated to reach over USD 39,175.00 Million by 2032 from a value of USD 24,102.89 Million in 2024 and is projected to grow by USD 25,182.25 Million in 2025, growing at a CAGR of 6.30 % from 2025 to 2032.

Power Discrete Device Market Definition & Overview:

Power discrete devices refer to semiconductor devices that are used in processing circuits of power electronics for controlling or converting of electric power. Power discrete devices offer a range of benefits including high power density, improved efficiency in power conversion, high reliability, low thermal dissipation, flexibility in operations, and others. The aforementioned benefits of power discrete devices are key determinants for increasing its deployment in automotive, it & telecommunication, consumer electronics, aerospace & defense, and other industries.

Power Discrete Device Market Insights :

Key Drivers :

Rising utilization of power discrete devices in automotive sector is driving the market growth

Power discrete devices are used in automotive sector, particularly in automobile electronics systems. Power discrete devices are utilized in various automotive components including oil-pressure valve control of the ABS system, motor drives, driver assist (ADAS) and autonomous navigation systems, hybrid and electric converters, infotainment systems, and other related components.

Factors including increasing automobile production, rising investments in automobile manufacturing facilities, and advancement in autonomous driving are among the key prospects driving the growth of the automotive sector.

For instance, according to the International Organization of Motor Vehicle Manufacturers, the total passenger car production across the world reached 61.59 million in 2022, depicting a growth of approximately 8% in comparison to 57.05 million in 2021. Thus, the rise in automobile production is driving the adoption of power discrete devices for aforementioned applications, in turn driving the growth of the market.

Increasing adoption of power discrete devices in consumer electronics is spurring the market growth

Power discrete devices utilized in the consumer electronics sector during the manufacturing of smartphones, tablets, television, and other consumer devices. Power discrete devices offer enhanced energy efficiency, faster speeds, and high-power density, which are prime aspects increasing its adoption in the consumer electronics sector.

Factors including rising penetration of smartphones, laptops, and other consumer devices, advancements in consumer electronics including IoT (Internet of Things) and AI (Artificial Intelligence) and increasing demand for energy-efficient devices are driving the growth of the consumer electronics sector.

According to Japan Electronics and Information Technology, the total production of electronic sector by the Japanese electronics industry was valued at USD 95.2 billion in 2021, witnessing a growth of 9.9% in comparison to 2020. Hence, the growing consumer electronics sector is driving the utilization of power discrete devices in smartphones, laptops, and other consumer devices, in turn proliferating the market growth.

Key Restraints :

High cost of raw materials is restraining the market growth

The primary raw materials utilized in the production of power discrete devices include silicon carbide, gallium nitride, and others. The aforementioned raw materials are often associated with high costs, which is a prime factor restricting market growth.

For instance, according to Otto Chemie Pvt. Ltd., the cost of gallium nitride with 99.99% assay is approximately USD 2,522 for 50 grams. Additionally, according to Henan Superior Abrasives Import & Export Co. Ltd, the average cost of silicon carbide ranges from USD 1,400 to USD 3,300 per ton. Therefore, the high costs of raw materials utilized in the production of power discrete devices are restraining the growth of the market.

Future Opportunities :

Rising application of power discrete devices in IT & telecommunication sector is expected to promote potential opportunities for market growth

The rising application of power discrete devices in the IT & telecommunication sector is expected to present potential opportunities for the growth of the power discrete device market. Power discrete devices are utilized in the IT & telecommunication sector for high-frequency amplifier applications involving 5G. Power discrete devices are often employed in advanced communication devices in order to support higher frequencies and higher power for an increased volume of data transmission. Additionally, power discrete devices are further utilized in the telecommunication sector for transmitting and receiving radio signals between two devices.

Factors including the increasing penetration of 5G infrastructure and rising adoption of smartphones and communication devices are among the major determinants fostering the growth of the IT & telecommunication sector. For instance, according to the Global System for Mobile Communications Association (GSMA), 5G connections are estimated to account for approximately 80% of total connections over the next five years. GSMA further states that around 1.8 billion 5G connections are expected to be established by 2025, representing a significant increase from 500 million 5G connections in 2020.

Therefore, the growth of telecommunication sector is anticipated to increase the application of power discrete devices, further promoting opportunities for market growth during the forecast period.

Power Discrete Device Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 39,175.00 Million |

| CAGR (2025-2032) | 6.3% |

| By Type | Transistor, Diode, Thyristor, Others |

| By End-User | Automotive, IT & Telecommunication, Consumer Electronics, Aerospace & Defense, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Infineon Technologies AG, Toshiba Electronic Devices & Storage Corporation, STMicroelectronics, Mitsubishi Electric Corp, Vishay Intertechnology Inc., Fuji Electric Co. Ltd., Renesas Electronics Corporation, ROHM Co., Ltd., Nexperia, and Microchip Technology Inc. |

Power Discrete Device Market Segmental Analysis :

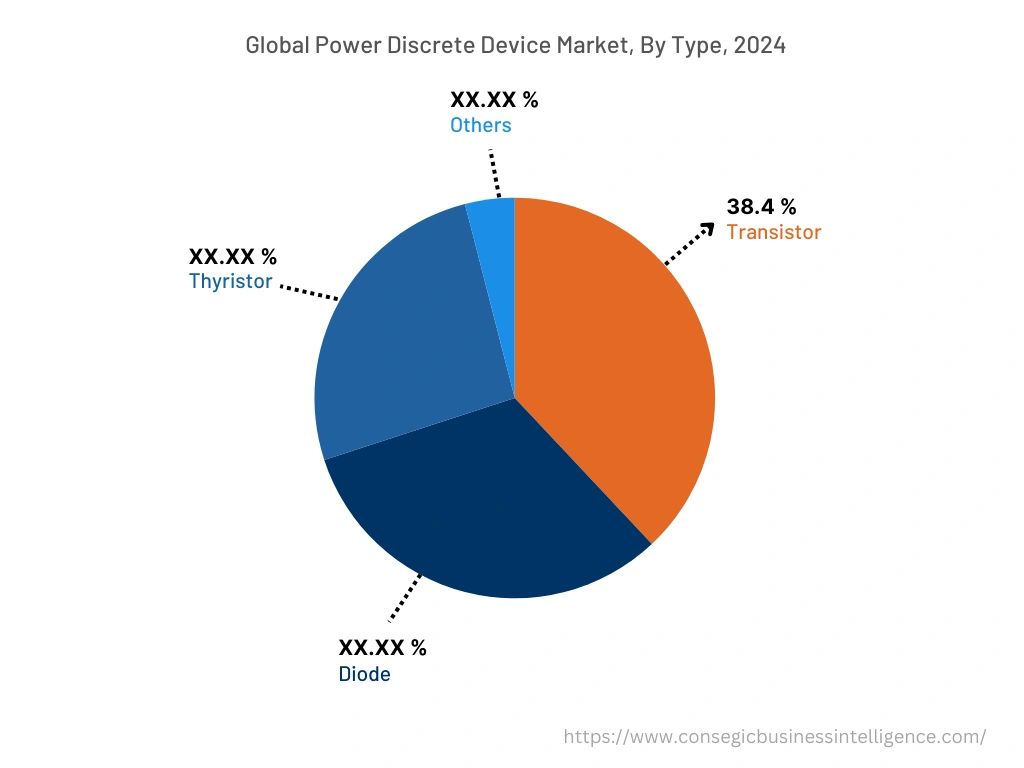

Based on the Type :

Based on the type, the market is bifurcated into transistor, diode, thyristor, and others. The transistor power discrete devices segment accounted for the largest revenue share of 38.4% in the year 2024. Transistors are three-terminal electronic devices that are utilized as amplifiers or switches and designed to control high current and voltage ratings. Moreover, transistors offer several benefits including high breakdown tolerance, faster-switching speeds, enhanced thermal conductivity, high electron mobility, and others. The above benefits of transistors are therefore increasing its application in automotive, aerospace, and industrial applications that require high-efficiency and high-frequency solutions.

In September 2022, Gallium Semiconductor launched a new series of GaN-based transistors for use in 5G infrastructure, industrial, aerospace, and medical applications. Hence, rising innovation associated with power transistors is among the key factors contributing to the growth of the market.

The diode segment is anticipated to register the fastest CAGR growth during the forecast period. Diodes are crystalline semiconductor devices, primarily composed of silicon, and are used in power electronics circuits for converting alternating current to direct current. The primary benefit of power discrete devices is its ability to protect electrical circuits from damage due to overvoltage, short circuits, and overcurrent.

In May 2023, Littelfuse Inc. launched a new series of TVS diodes that offers high power, to address the growing demand for TVS diodes compatible with automated PCB assembly process and integrated with a high surge rating. Therefore, the rising development of power discrete devices including diodes is expected to drive the market growth during the forecast period.

Based on the End-User :

Based on the end-user, the market is segregated into automotive, IT & telecommunication, consumer electronics, aerospace & defense, and others. The consumer electronics segment accounted for the largest revenue share in the year 2024. Factors including increasing penetration of smartphones, laptops, and other consumer devices, rising popularity of smart home devices, and growing demand for energy-efficient devices are driving the growth of the consumer electronics segment.

According to Atradius, the consumer electronics sector in Spain witnessed a growth of 3.5% in 2021 as compared to 2020. Atradius further states that the consumption of household appliances in Spain increased significantly by 14% in 2021. Therefore, the growth of consumer electronics sector is driving the adoption of power discrete devices for manufacturing of smartphones, tablets, television, and other consumer devices, in turn fostering market growth during the forecast period.

Automotive segment is expected to witness fastest CAGR growth during the forecast period. The growth of automotive segment is attributed to several factors including rising automobile production, increasing investments in automobile manufacturing facilities, and rising adoption of electric vehicles.

For instance, according to the International Organization of Motor Vehicle Manufacturers, the total automobile production in the European Union region reached 13,801,210 units in 2022, depicting an increase of 5% from 13,129,583 units in 2021. Thus, the increasing automobile production is driving the adoption of power discrete devices for utilization in various automotive components including motor drives, hybrid and electric converters, driver assist and autonomous navigation systems, and others. The above factors are anticipated to drive the growth of the market during the forecast period.

Based on the Region :

The regional segment includes North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

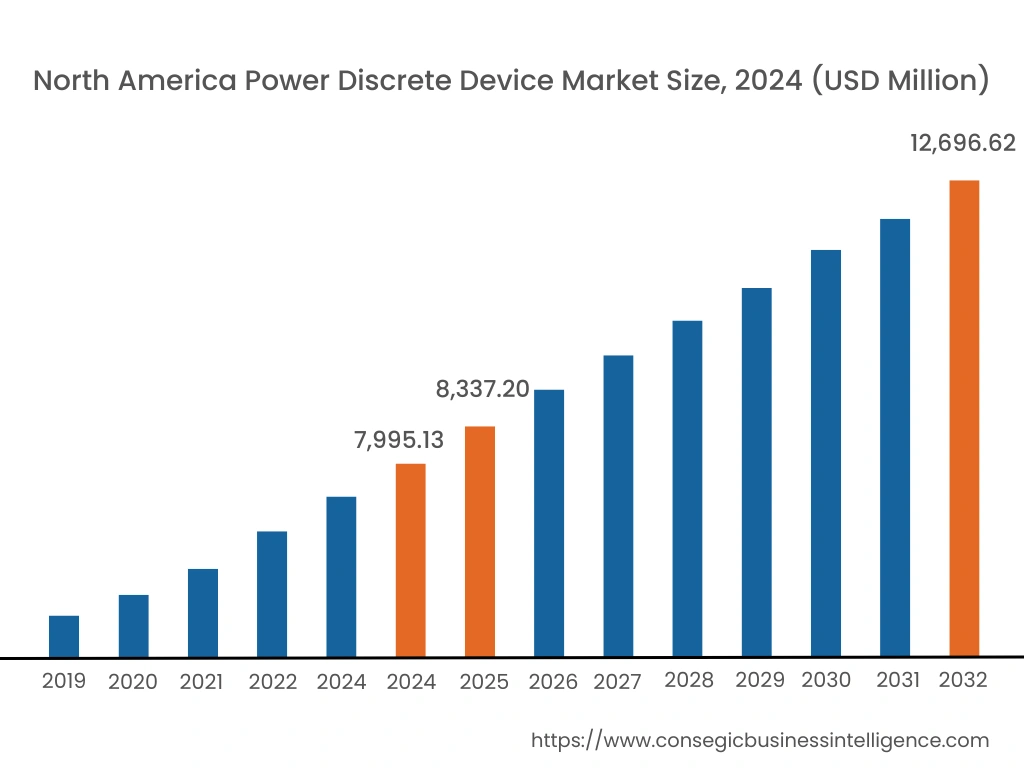

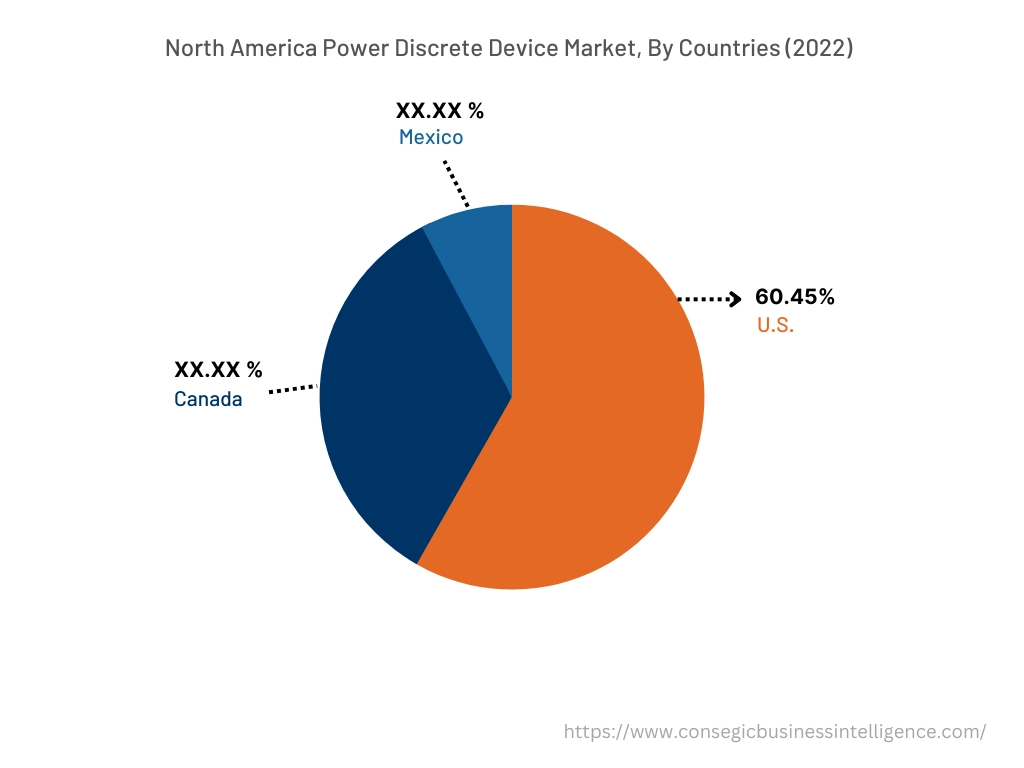

North America is estimated to reach over USD 12,696.62 Million by 2032 from a value of USD 7,995.13 Million in 2024 and is projected to grow by USD 8,337.20 Million in 2025. In addition, in the region, the U.S. accounted for the maximum revenue share of 60.45% in the same year. The adoption of power discrete devices in the North American region is primarily driven by its usage in automotive, IT & telecommunication, aerospace, and other sectors. Moreover, North America has been a major hub for the companies associated with autonomous vehicle manufacturing. The increasing application of power discrete devices in various automotive applications including hybrid and electric converters, driver assist and autonomous navigation systems, motor drives, and infotainment systems is among the significant factors driving the market growth in the region. For instance, according to the International Organization of Motor Vehicle Manufacturers, the overall automobile production in the United States reached 10.06 million in 2022, representing a growth of 9.7% in comparison to 2021. The above factors are propelling the growth of the power discrete device market in the North American region. Additionally, rising investments in the aerospace & defense sector are anticipated to provide lucrative growth aspects for the market in North America during the forecast period.

Asia-Pacific is expected to register the fastest CAGR growth of 6.7% during the forecast period. The growing pace of industrialization and development is creating lucrative opportunities for market growth in the region. Moreover, factors including the growth of multiple industries such as automotive, consumer electronics, and others are fostering the market growth for power discrete devices in the Asia-Pacific region.

For instance, according to the India Brand Equity Foundation, the overall consumer electronics industry in India was valued at USD 9.84 billion in 2021, and it is expected to grow at a high growth rate to reach USD 21.18 billion by 2025. Therefore, the growing consumer electronics sector is driving the deployment of power discrete devices for application in smartphones, laptops, and other devices, thereby proliferating the market growth in the Asia-Pacific region.

Top Key Players & Market Share Insights :

The power discrete device market is highly competitive with major players providing power discrete device to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and application launches to hold a strong position in power discrete device market. Key players in the power discrete device market include-

- Infineon Technologies AG

- Toshiba Electronic Devices & Storage Corporation

- ROHM Co. Ltd.

- Nexperia

- Microchip Technology Inc.

- STMicroelectronics

- Mitsubishi Electric Corp

- Vishay Intertechnology Inc.

- Fuji Electric Co. Ltd.

- Renesas Electronics Corporation

Recent Industry Developments :

- In May 2023, Nexperia launched its new power GaN (gallium nitride) field effect transistor optimized for low and high-voltage applications. The transistor offers high power efficiency and compact solution size in various power conversion applications.

Key Questions Answered in the Report

What is power discrete device? +

Power discrete devices refer to semiconductor devices that are used in processing circuits of power electronics for controlling or converting electric power.

What specific segmentation details are covered in the power discrete device report, and how is the dominating segment impacting the market growth? +

For instance, by type segment has witnessed transistors as the dominating segment in the year 2024, owing to its increasing utilization in automotive, aerospace, and industrial applications that require high-efficiency and high-frequency solutions.

What specific segmentation details are covered in the power discrete device market report, and how is the fastest segment anticipated to impact the market growth? +

For instance, by end-user segment has witnessed automotive as the fastest-growing segment during the forecast period due to the rising adoption of power discrete devices for various automotive components including oil-pressure valve control of the ABS system, motor drives, hybrid and electric converters, and others.

Which region/country is anticipated to witness the highest CAGR during the forecast period, 2025-2032? +

Asia-Pacific is anticipated to register fastest CAGR growth during the forecast period due to rapid pace of industrialization and growth of multiple industries such as automotive, consumer electronics, and others.