EPA and DHA Market Size :

Consegic Business Intelligence analyzes that the EPA and DHA market size is growing with a healthy CAGR of 6.2% during the forecast period (2025-2032), and the market is projected to be valued at USD 2,929.55 Million by 2032 from USD 1,816.07 Million in 2024.

EPA and DHA Industry Scope & Overview:

Docosahexaenoic acid (DHA) and eicosapentaenoic acid (EPA) are long-chain omega-3 fatty acids that are sourced from various animals and vegetables. The major sources of the acids include Fish Oil, Algae Oil, Krill Oil, and Others. They are vital for proper fetal development, such as retinal, neuronal, and immune function. In addition, they minimize inflammation and the risk of chronic diseases, such as heart disease, asthma, and others. As a result of the above benefits, they are frequently utilized in various applications, including dietary supplements, infant formulas, pharmaceuticals, fortified food & beverages, and many more.

EPA and DHA Market Insights :

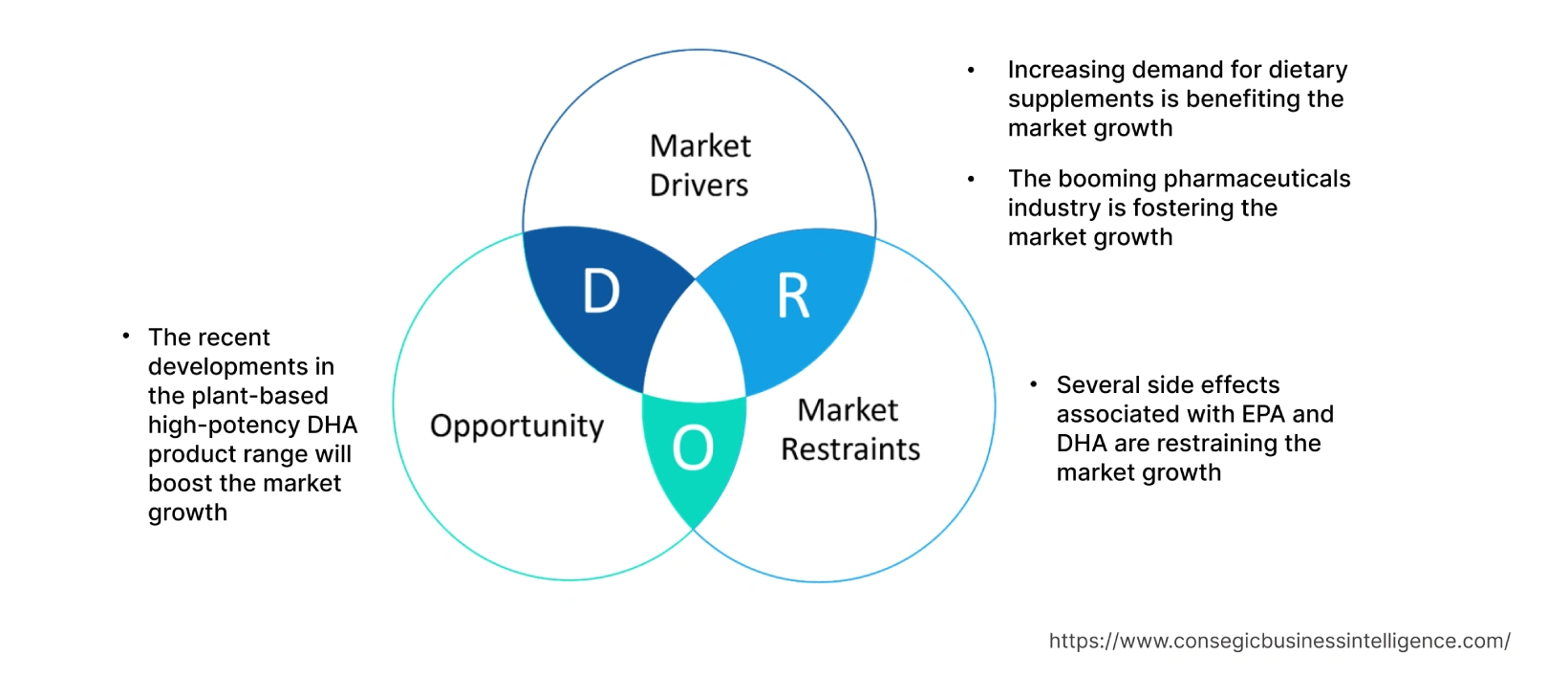

EPA and DHA Market Dynamics - (DRO) :

Key Drivers :

Increasing demand for dietary supplements is benefiting the market.

EPA and DHA are ideal for dietary supplements to prevent the body by stimulating the growth of good bacteria in the digestive system. The rising awareness about cognitive function at the global level is favoring the adoption of dietary supplements at the global level.

- For instance, as per the recent survey published 2021 IFIC Survey, consumers are increasingly consuming probiotics and prebiotics to maintain a healthy gut microbiome.

- Additionally, nearly one in four respondents, which is 24% of the total respondents said digestive health is the most important aspect of their overall health. These respondents further stated that they consume prebiotics to maintain better gut health.

Hence, the increasing demand for dietary supplements is fueling the adoption of acids to reduce the risk of hypertension. This prominent determinant is fostering the revenue of EPA and DHA market growth.

The booming pharmaceutical industry is fostering EPA and DHA market development.

EPA and DHA ensure superior functioning such as reducing inflammation, lower cholesterol levels, improving cognitive symptoms, and others. As a result, they are ideal for pharmaceutical products such as vitamin E medication, diabetes medicines, and others. Factors such as surging government initiatives in pharmaceuticals, and the development of new plants, among others, are some of the prime factors accelerating the surge of the pharmaceutical industry in Europe.

- For instance, according to the European Federation of Pharmaceutical Industries and Associations (EFPIA), in 2020, Europe's pharmaceutical production was Euro 286,697 million (USD 320,950.1 million). In 2021, the production of pharmaceuticals increased to Euro 300,000 million (USD 335,842.5 million), an increase of 4.6% over 2020.

Thus, the market analysis portrays that the booming pharmaceutical industry is boosting the demand for fatty acids to mediate anti-inflammatory effects. This, in turn, is driving the EPA and DHA market demand.

Key Restraints :

Several side effects associated with EPA and DHA are restraining the market growth.

EPA and DHA are beneficial for superior diet and gut health. However, they are sourced from fish oil, algae oil, and krill oil, among others. These sources pose several side effects to the end consumers. For instance, acids sourced from fish oil can have several side effects, including bloating, nausea, or burping. Additionally, they can have several rare serious allergic reactions, such as itching/swelling, rash, trouble breathing, severe dizziness, and others. Hence, the analysis of market trends depicts that the above-mentioned side effects related to the acids are posing a major roadblock to the EPA and DHA market growth during the projected forecast period.

Future Opportunities :

The recent developments in the plant-based high-potency DHA product range will boost the market.

The leading industry players in the DHA market are substantially deploying a strategy for innovations in plant-based high-potency DHA, which are utilized for efficient gut health. Also, companies dealing in the plant-based high-potency DHA product range are developing new products with new upgrades.

- For illustration, in May 2020, Royal DSM, a global manufacturer of nutritional products DHA SF55-O200DS oil, a plant-based high potency DHA oil for maternal and infant nutrition portfolio.

As a result, market trends analysis shows that the innovations in the plant-based high-potency DHA product range will create a prominent EPA and DHA market opportunity in the forecast years.

EPA and DHA Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 2,929.55 Million |

| CAGR (2025-2032) | 6.2% |

| By Type | Eicosapentaenoic Acid (EPA) and Docosahexaenoic Acid (DHA) |

| By Source | Fish Oil, Algae Oil, Krill Oil, and Others |

| By Application | Infant Formula, Dietary Supplements, Fortified Food and Beverages, Pharmaceuticals, and Others |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | KD Pharma Group, Corbion NV, Novasep Holding SAS, Neptune Wellness Solutions, BASF SE, Omega Protein Corporation, Croda International PLC, Novotech Nutraceuticals, Polaris SA, and AlgalR NutraPharms Pvt. Ltd |

EPA and DHA Market Segmental Analysis :

By Type :

The type segment is categorized into eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA).

In 2024, the docosahexaenoic acid (DHA) segment accounted for the largest revenue of the total EPA and DHA market share. Docosahexaenoic acid (DHA) is vital for the advancement and efficient functional development of the brain in infants. In addition, DHA is required for frequent maintenance the normal brain function in adults. The deficiencies related to DHA are associated with deficits in learning. Hence, the inclusion of plentiful DHA in the diet enhances learning ability. Docosahexaenoic acid (DHA) is an ideal solution for applications such as dietary supplements, food & beverage, and others.

- For instance, according to the Food Supplements Europe report, about 88% of people have used dietary supplements once in their lifetime, and from that 93% have used in between March 2021 to March 2022.

Thus, segmental trends analysis depicts that the increasing adoption of docosahexaenoic acid (DHA) in dietary supplements to ensure efficient brain functioning, in turn, is benefiting the EPA and DHA market demand.

However, the eicosapentaenoic acid (EPA) segment is projected to be the fastest-growing segment during the forecast period. This is due to the increasing new developments associated with eicosapentaenoic acid (EPA) at the global level, which is augmenting EPA and DHA market trends.

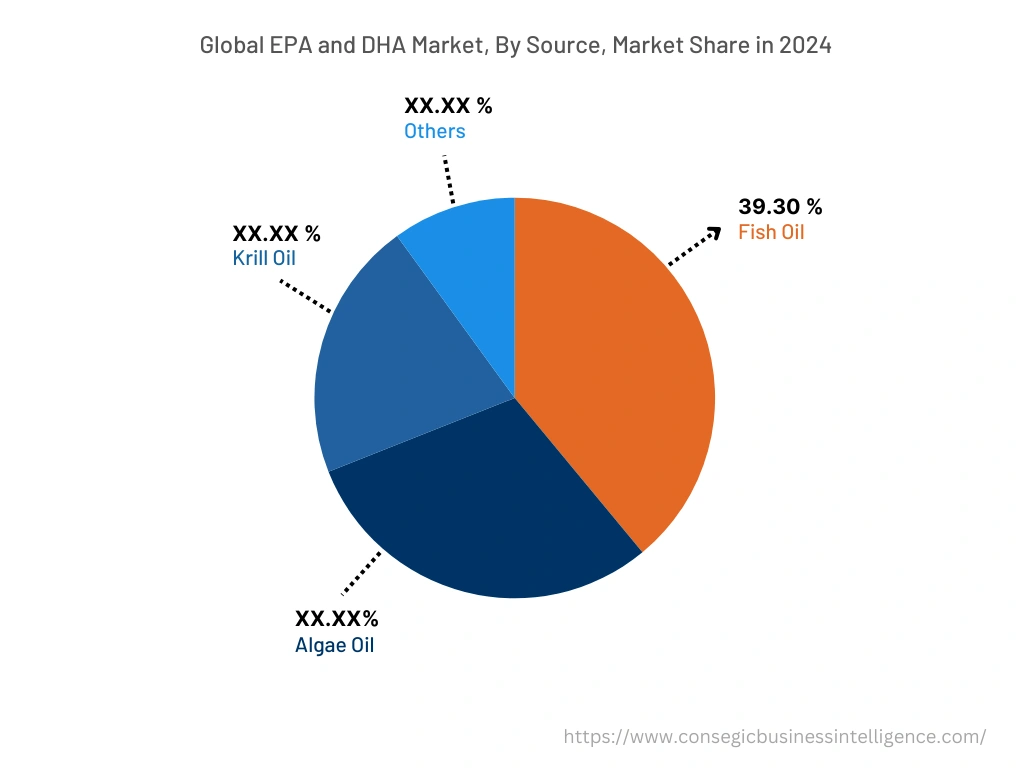

By Source :

The source segment is categorized into fish oil, algae oil, krill oil, and others.

In 2024, the fish oil segment accounted for the highest market share of 39.30% in the overall EPA and DHA market share and is expected to be the fastest-growing segment during the forecast period. Fish oil has a significant content of selenium, vitamin B12, high levels of protein, superior magnesium level, and higher potassium, among others. These crucial nutrients ensure a superior level of fatty acid content in fish oil. The fish oils such as mackerel, salmon, seabass, oysters, sardines, shrimp, and others have a significant level of fatty acids. The development of new DHA products sourced from fish oil is increasing.

- For instance, in September 2021, AAK, a Sweden-based manufacturer of plant-based fats and oils formed a partnership with Progress Biotech to supply the infant formula manufacturer with DHA. The product is equipped with omega-3 fatty acids called DHA sourced from fish oils.

Thus, analysis of segmental trends portrays that the development of new DHA sourced from fish oil to increase the nutrient level is promoting EPA and DHA market opportunities at the global level.

By Application :

The application segment is categorized into infant formula, dietary supplements, fortified food and beverages, pharmaceuticals, and others.

In 2024, the dietary supplements segment accounted for the largest revenue in the market. EPA and DHA are employed in dietary supplements to ensure superior health benefits such as significant brain and eye development of fetuses and infants. Furthermore, the utilization of EPA and DHA in dietary supplements ensures a reduction in heart disease risks, reduces the risk of early preterm births, reduces inflammation, supports muscle recovery after exercise, and may reduce your risk of certain cancers. The low intake of micronutrients is a significant public health concern, as it makes individuals more vulnerable to infections and disorders. This, in turn, is resulting in surging consumption of dietary supplements at the global level.

- For instance, according to the initial finding of the 2022 Consumer Survey on Dietary Supplements of the Council for Responsible Nutrition (CRN), a trade association dedicated to dietary supplements and the functional food industry, 75% of Americans are using dietary supplements daily.

Hence, the rising adoption of dietary supplements is fueling the demand for the acids to lower blood pressure fostering EPA and DHA market trends.

However, the pharmaceuticals segment is expected to be the fastest-growing segment during the forecast period. This growth is attributed to factors such as increasing investment in new pharmaceutical manufacturing facilities, increasing government initiatives, and others.

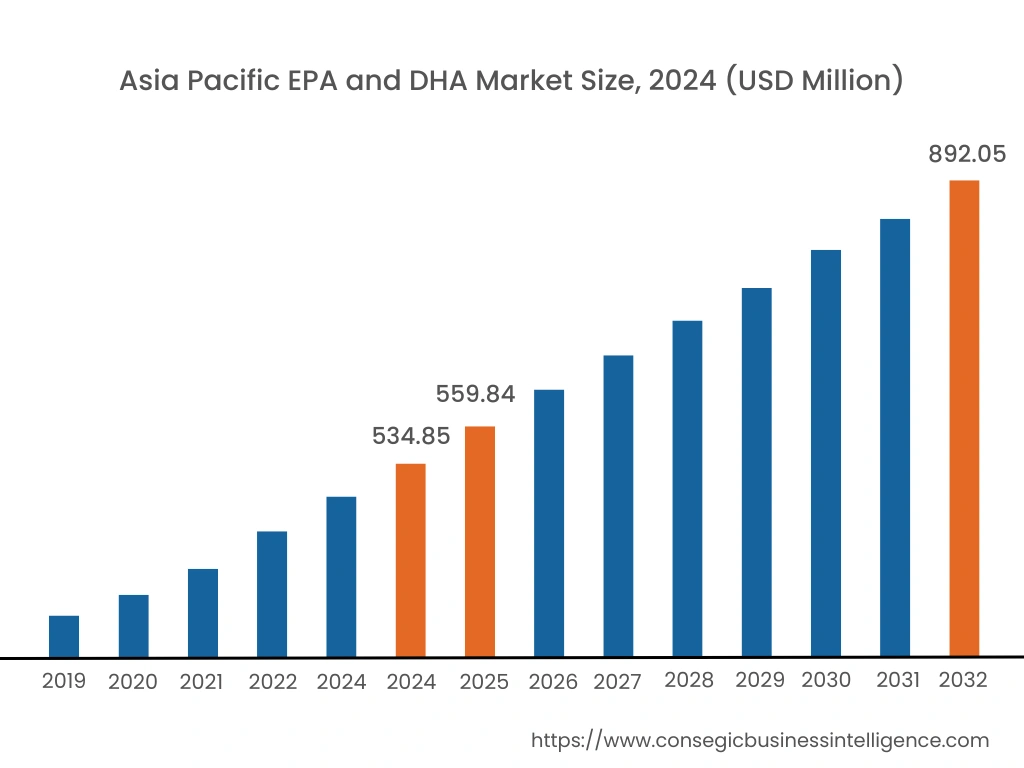

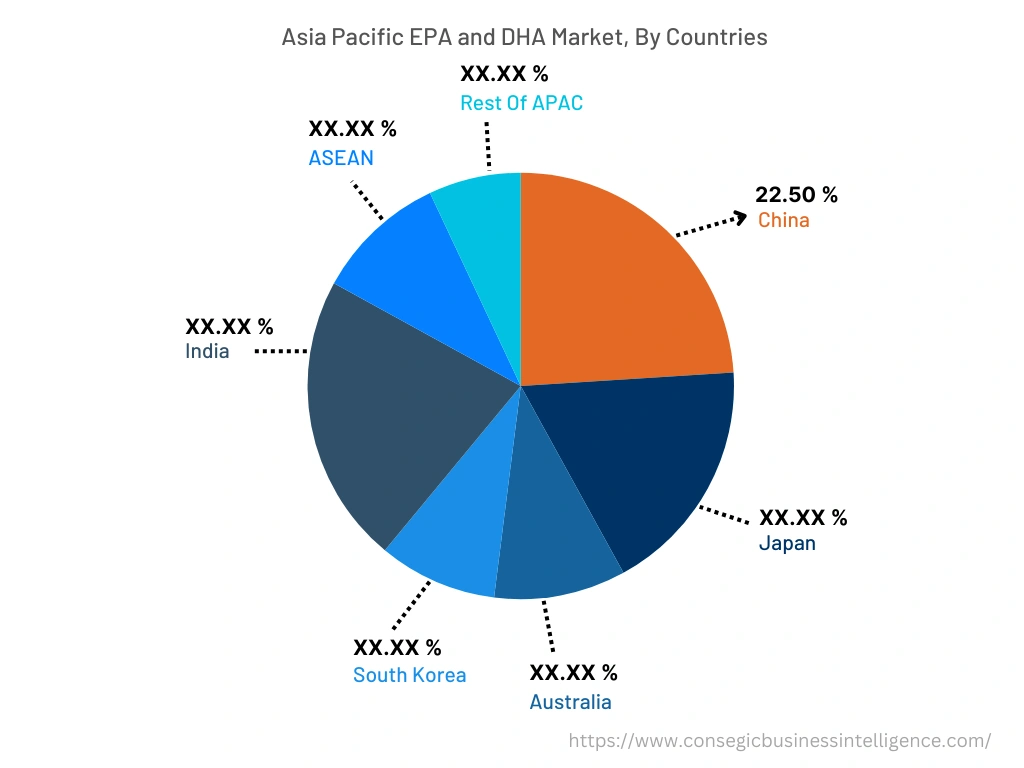

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

In 2024, Asia Pacific accounted for the highest market share at 38.12% valued at USD 534.85 million, and is expected to reach USD 892.05 million in 2032. In Asia Pacific, China accounted for the highest market share of 22.50% during the base year of 2024. As per the EPA and DHA market analysis, advancements in sectors such as food & beverage, pharmaceuticals, and others are accelerating the market trends.

- For instance, according to the General Statistics Office of Vietnam, the total medicines output in Vietnam in 2019 was USD 3255.6 million, and in 2020 it was USD 3484.5 million, a 7.03% rise.

- Additionally, according to the India Brand Equity Foundation (IBEF), in the year 2020, the pharmaceuticals market in India was valued at USD 42.0 billion, and by the year 2024, it is projected at USD 65.0 billion, an increase of 54.8%.

Therefore, the advancement in the above-mentioned industries is supplementing the EPA and DHA market expansion.

Furthermore, the regional trends analysis shows that Europe is expected to witness significant growth over the forecast period, growing at a CAGR of 6.8% during 2025-2032. Prominent factors such as the presence of key players in the European region, the development of new food products, and others are boosting the market growth in the European region.

Top Key Players & Market Share Insights:

The EPA and DHA market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The global EPA and DHA market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the EPA and DHA industry include-

- KD Pharma Group

- Corbion NV

- Novotech Nutraceuticals

- Polaris SA

- AlgalR NutraPharms Pvt. Ltd

- Novasep Holding SAS

- Neptune Wellness Solutions

- BASF SE

- Omega Protein Corporation

- Croda International PLC

Recent Industry Developments :

- In February 2023, Grøntvedt Biotech, headquartered in Norway launched CETO3 for its cetoleic acid and omega-3 ingredient. Cetoleic acid is ideal for application for the manufacturing of eicosapentaenoic acid (EPA) and docosahexaenoic acid (DHA). Hence, the recent development of products is accelerating the market growth.

Key Questions Answered in the Report

What was the market size of the EPA and DHA industry in 2024? +

In 2024, the market size of EPA and DHA was USD 1,816.07 million.

What will be the potential market valuation for the EPA and DHA industry by 2032? +

In 2032, the market size of EPA and DHA will be expected to reach USD 2,929.55 million.

What are the key factors driving the growth of the EPA and DHA market? +

Increasing demand for dietary supplements is benefiting the growth of the global EPA and DHA market.

What is the dominating segment in the EPA and DHA market by source? +

In 2024, the fish oil segment accounted for the highest market share of 39.30% in the overall EPA and DHA market.

Based on current market trends and future predictions, which geographical region is the dominating region in the EPA and DHA market? +

Asia Pacific accounted for the highest market share in the overall EPA and DHA market.