Fourth Party Logistics Market Size:

Fourth Party Logistics Market Size is estimated to reach over USD 112.90 Billion by 2032 from a value of USD 65.78 Billion in 2024 and is projected to grow by USD 69.23 Billion in 2025, growing at a CAGR of 6.3% from 2025 to 2032.

Fourth Party Logistics Market Scope & Overview:

Fourth party logistics (4PL) involves outsourcing an entire supply chain to a single external provider, acting as a single point of contact for a company's logistics needs. 4PL providers can choose to use their own resources or team up with other logistics companies (3PLs) to complete the task. They also help businesses handle the increasing complexity and unpredictability of global supply chains by offering expertise in risk management, emergency preparedness, and response to crises.

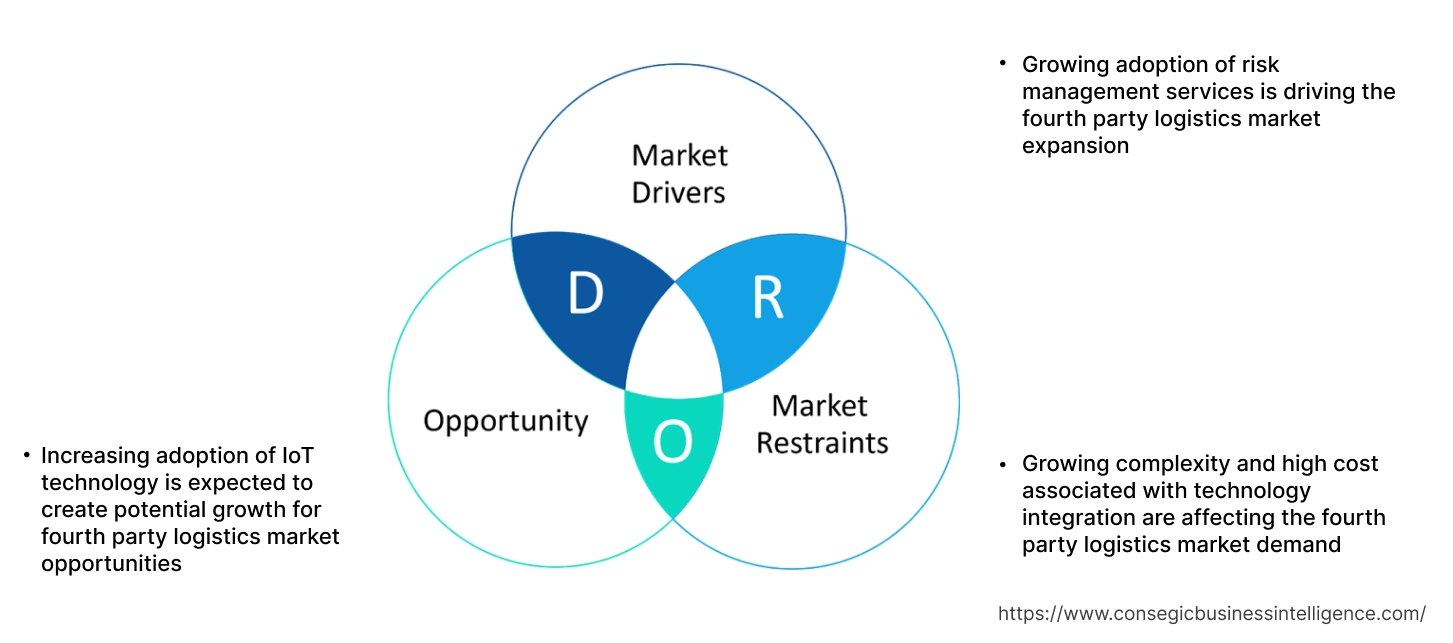

Fourth Party Logistics Market Dynamics - (DRO) :

Key Drivers:

Growing adoption of risk management services is driving the fourth party logistics market expansion

Several risks wait at various stages, threatening operational continuity, financial stability, and reputation. The effective risk management practices are essential to identify, assess, mitigate, and monitor risks, ensuring resilience and adaptability in the face of uncertainties. One of the primary areas where risk management plays a pivotal role is safeguarding against disruptions within the supply chain. By proactively identifying potential risks and implementing contingency plans, 4PL providers can minimize the impact of such disruptions, maintaining business continuity and ensuring the timely delivery of goods to clients. With the increasing reliance on global sourcing and complex logistics networks, risk management becomes more critical to mitigate supply chain vulnerabilities and protect against unforeseen events.

With the growing digitization of supply chain operations and the proliferation of sensitive data, cybersecurity risks pose a significant threat to the integrity and confidentiality of information. Implementing robust cybersecurity measures and data protection protocols is essential to safeguard against cyber threats and ensure the trust and confidence of clients and stakeholders.

- For instance, Anchanto’s risk management services help fourth party logistics to identify and mitigate potential risks before they impact business operations. This approach helps minimize disruptions and ensure business continuity.

Thus, according to the fourth party logistics market analysis, the growing adoption of risk management services is driving the fourth party logistics market size.

Key Restraints:

Growing complexity and high cost associated with technology integration are affecting the fourth party logistics market demand

As logistics operations become increasingly digitalized, 4PL providers must invest heavily in technology infrastructure and talent to remain competitive. The high cost of implementing advanced technologies and the risk of cybersecurity threats pose significant challenges for 4PL providers. Further, with the increasing reliance on digital technologies and interconnected systems within supply chains, the potential vulnerabilities to cyber threats have become more evident. Cyberattacks targeting fourth-party logistics providers can disrupt operations, compromise sensitive data, and undermine trust in the entire supply chain ecosystem. Additionally, with intense competition in the logistics industry, numerous players are competing for market share, which can lead to price wars and reduced profit margins. Thus, the aforementioned factors would further impact the fourth party logistics market size.

Future Opportunities :

Increasing adoption of IoT technology is expected to create potential growth for fourth party logistics market opportunities

IoT integration enables seamless connection and communication of various devices and sensors throughout the supply chain, facilitating real-time tracking, monitoring, and data exchange. By embedding IoT sensors in transportation vehicles, warehouses, and inventory storage facilities, 4PL providers can gather valuable insights into factors such as temperature, humidity, location, and product condition. This real-time data allows proactive decision-making, optimized route planning, and timely response to potential disruptions, ultimately improving operational efficiency and reducing costs. IoT integration enhances supply chain visibility, enabling stakeholders to track the movement and status of goods at every stage of the logistics process.

IoT-enabled solutions can support sustainability initiatives by optimizing resource utilization, reducing waste, and minimizing environmental impact throughout the supply chain. As the adoption of IoT technology continues to grow, driven by advancements in sensor technology, connectivity, and data analytics, 4PL providers are well-positioned to harness the full potential of IoT integration to deliver more agile, resilient, and competitive supply chain solutions for their clients.

- For instance, in July 2024, CEVA Logistics AG introduced IoT trackable devices into 20,000 reusable shipping boxes. CEVA has upgraded its service centers by adding advanced tracking during the box assembly process. Each box received four RFID tags and IoT devices, enabling live tracking and monitoring.

Thus, based on the fourth party logistics market analysis, the increasing adoption of IoT technology is expected to drive the fourth party logistics market opportunities.

Fourth Party Logistics Market Segmental Analysis :

By Service Type:

Based on service type, the market is segmented into supply chain management, warehouse and distribution management, order management, transportation management, inventory management and planning, carrier performance analysis, project management and business planning, carrier performance analysis, and others.

Trends in the service type:

- As businesses continue to expand their operations across borders, the need for a comprehensive logistics solution becomes necessary.

- The advancements in technology, such as IoT and AI, are enabling 4PL providers to offer more sophisticated and data-driven logistics solutions, further boosting the segment growth.

- Thus, based on the above analysis, these factors are driving the fourth party logistics market demand and trends.

The supply chain management segment accounted for the largest revenue share in the year 2024.

- Supply chain management is a critical component of 4PL services, focusing on the strategic coordination of business operations and activities within a company and across businesses within the supply chain.

- 4PL providers facilitate the seamless integration of supply chain processes, ranging from procurement to product delivery.

- They employ advanced analytics and innovative technologies to enhance visibility and optimize the entire supply chain, improve responsiveness and agility in transforming the market.

- For instance, P. Moller – Maersk’s NeoNav, a supply chain management solution for fourth party logistics services, is designed to integrate a wide range of information across platforms and players.

- Thus, based on the above analysis, these factors are further driving the fourth party logistics market growth.

The warehouse and distribution management segment is anticipated to register the fastest CAGR during the forecast period.

- Warehouse and distribution management are crucial for ensuring the timely and accurate distribution of products. This service type focuses on the storage, handling, and distribution of goods, optimizing inventory levels and warehousing operations.

- 4PL providers offer comprehensive warehousing solutions, from inventory management to order fulfillment, leveraging technology to enhance efficiency and reduce costs.

- The demand for these services is rising as companies seek to improve their distribution networks and enhance customer satisfaction by ensuring products are readily available and delivered on time.

- 4PL providers utilize sophisticated algorithms and predictive analytics to optimize distribution routes and schedules. This not only reduces transportation costs but also minimizes the carbon footprint, aligning with the growing trend towards sustainability in logistics operations.

- Thus, based on the above analysis and developments, these factors are expected to drive the fourth party logistics market share during the forecast period.

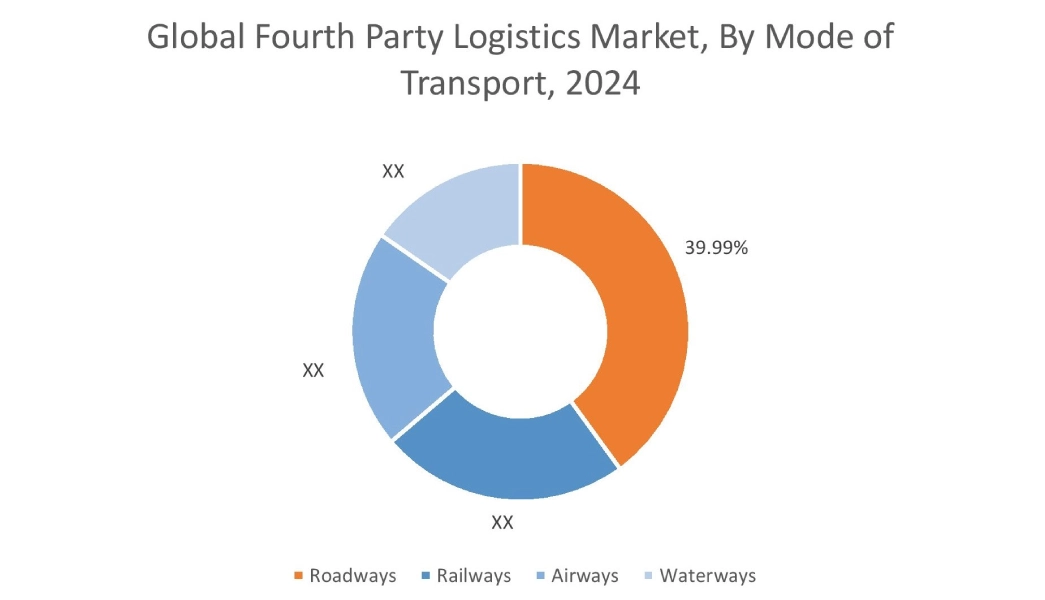

By Mode of Transport:

Based on the mode of transport, the market is segmented into roadways, railways, airways, and waterways.

Trends in the mode of transport:

- As businesses continue to globalize and seek cost-effective and sustainable logistics solutions, the demand for integrated multi-modal transport services is expected to grow, in turn driving the market expansion.

- By leveraging multiple modes of transport, 4PL providers offer comprehensive, flexible, and efficient logistics solutions, optimizing the movement of goods and enhancing the overall performance of the global supply chain.

The roadways segment accounted for the largest revenue share of 39.99% in the year 2024.

- Roadways remain the dominant mode of transport for 4PL services, offering flexibility, extensive network coverage, and cost-effectiveness for short to medium-distance shipments.

- The advantages of road transport, such as ease of access and the capability to provide door-to-door services, make it an integral part of the logistics solutions offered by 4PL providers.

- 4PL providers integrate advanced technologies such as GPS tracking and route optimization to enhance the efficiency of road transport. This ensures the timely delivery of goods and reduces transportation costs, making it a preferred option for many businesses.

- Thus, the above factors would further supplement the fourth party logistics market

The railways segment is anticipated to register the fastest CAGR during the forecast period.

- Railways offer a reliable and cost-effective mode of transport for large-volume shipments over long distances. This mode is advantageous for industries such as automotive and manufacturing, where the transportation of bulk goods is common.

- 4PL providers leverage the efficiency of rail transport to optimize supply chains, reduce costs, and minimize environmental impact.

- As global efforts towards sustainability intensify, there is a growing emphasis on railways as a more eco-friendly transport option, contributing to the increasing adoption of this mode for long-haul logistics solutions.

- These factors are anticipated to further drive the fourth party logistics market trends during the forecast period.

By End User:

Based on end user, the market is segmented into aerospace & defense, automotive, consumer electronics, food & beverages, healthcare, retail, and others.

Trends in the end user:

- The growing complexity of modern manufacturing processes, which involve multiple suppliers and locations, necessitates a comprehensive logistics solutions.

- The increasing focus on sustainability and green logistics opens possibilities for 4PL providers to introduce eco-friendly practices and solutions, catering to the growing demand for sustainable supply chain management across various industries. Thus, the aforementioned factors are driving the global market trends.

The retail segment accounted for the largest revenue in the year 2024.

- The rise of e-commerce has transformed the retail sector, necessitating efficient and reliable logistics solutions.

- 4PL providers offer end-to-end solutions that encompass everything, ranging from warehousing and inventory management to last-mile delivery. This comprehensive approach ensures that products reach consumers quickly and efficiently, thereby enhancing customer satisfaction and loyalty.

- 4PL providers offer strategic logistics solutions that optimize the entire supply chain, from sourcing and procurement to last-mile delivery, enabling retailers to enhance their service offerings and compete effectively in a highly competitive market.

- For instance, according to the India Brand Equity Foundation, the Indian retail sector is a significant contributor to the nation's economy, generating more than 10% of India's total Gross Domestic Product (GDP) and employing a substantial portion of the population (approximately 8%).

- Thus, the above factors are driving the fourth party logistics market growth.

The automotive segment is anticipated to register the fastest CAGR during the forecast period.

- The automotive sector is a significant end-user of 4PL services, where the complexity of global supply chains demands advanced logistics solutions.

- 4PL providers assist automotive manufacturers in optimizing inventory levels, managing supplier relationships, and ensuring the timely delivery of parts and components.

- With the industry's shift towards electric vehicles and smart manufacturing, the logistics requirements are evolving, necessitating more integrated and technology-driven solutions.

- 4PL providers are well-positioned to support these changes, offering strategic insights and services to enhance supply chain efficiency and resilience.

- For instance, CEVA Logistics provides a comprehensive range of logistics solutions and services for automotive sector on the basis of fourth party services providers. The logistics solutions provide components of new vehicles, spare parts distribution, and used vehicles.

- These factors are anticipated to drive the fourth party logistics market trends during the forecast period.

Regional Analysis:

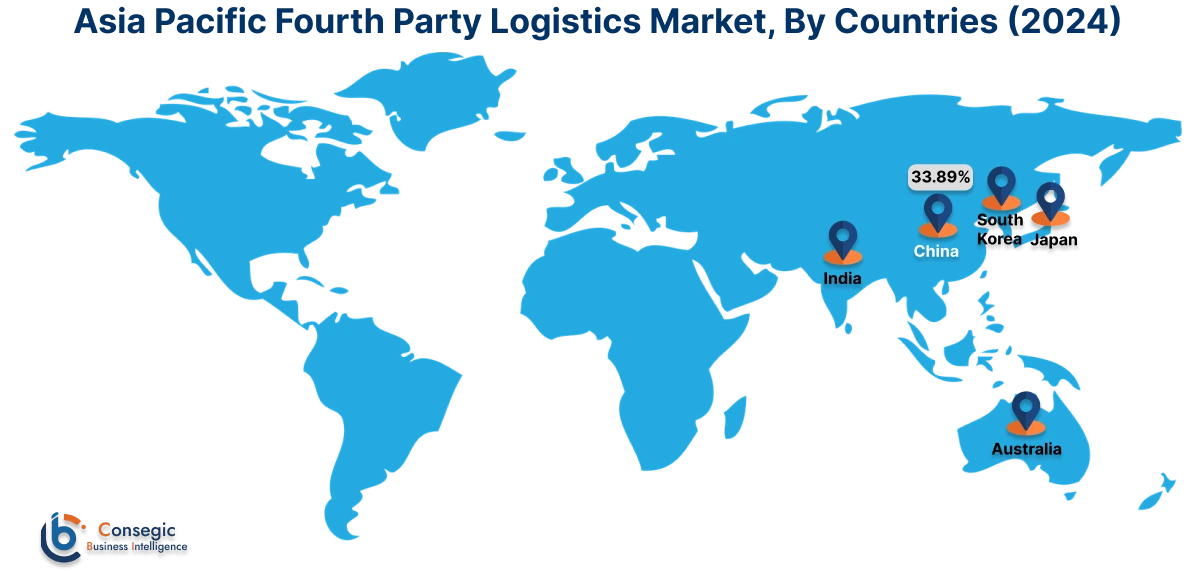

The global market has been classified by region into North America, Europe, Asia-Pacific, Middle East & Africa, and Latin America.

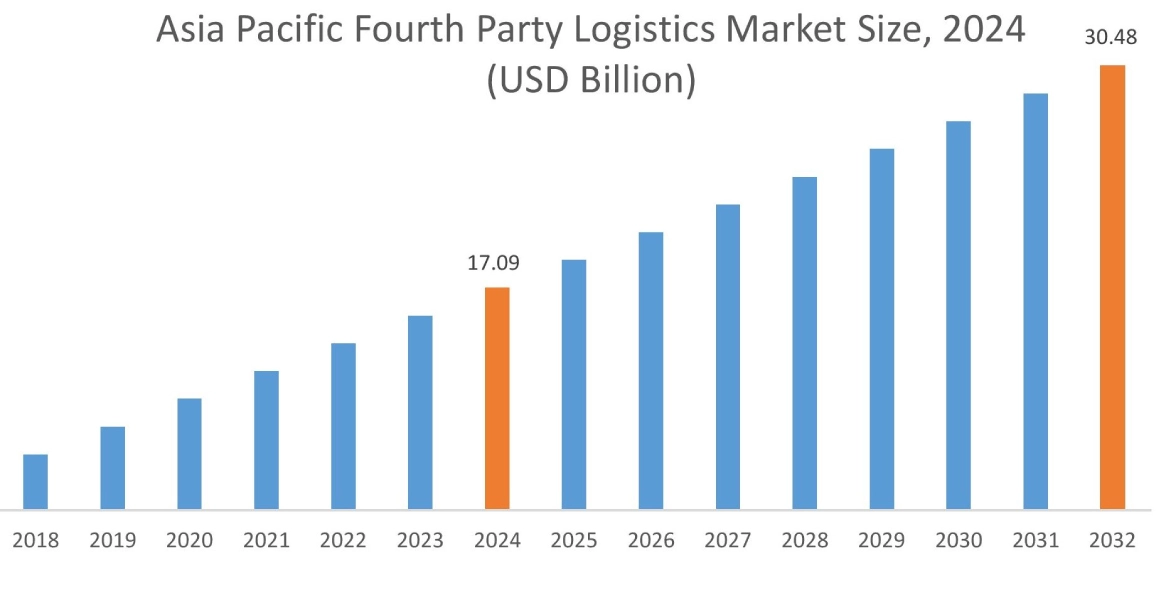

Asia Pacific fourth party logistics market expansion is estimated to reach over USD 30.48 billion by 2032 from a value of USD 17.09 billion in 2024 and is projected to grow by USD 18.04 billion in 2025. Out of this, the China market accounted for the maximum revenue split of 33.89%. The rapid growth of e-commerce and economic development in countries such as China, India, and Indonesia presents significant prospects for supply chain management across various sectors. Further, 4PL providers leverage cutting-edge technologies such as automation, blockchain, and AI to deliver innovative and personalized solutions, gaining a competitive edge in the market. As the region continues to industrialize and embrace digital transformation, the need for efficient logistics services provided by 4PLs is expected to grow. These factors would further drive the regional fourth party logistics market during the forecast period.

- For instance, in August 2023, CEVA Logistics announced the acquisition of Stellar Value Chain Solutions to boost its presence in the 4PL sector across India. The acquisition supports CEVA's plan to offer complete supply chain solutions to its clients. This deal allows CEVA Logistics to provide its new customers with worldwide knowledge, improved operational efficiency, and advanced innovation.

North America market is estimated to reach over USD 42.56 billion by 2032 from a value of USD 24.90 billion in 2024 and is projected to grow by USD 26.20 billion in 2025. North America holds a substantial share in the global market, supported by the presence of well-established industries and advanced infrastructure. The region's focus on technological innovation and the adoption of smart logistics solutions are key drivers for market growth. Further, North American companies are increasingly outsourcing their logistics operations to 4PL providers to enhance efficiency, reduce costs, and gain a competitive advantage. Moreover, the region's mature e-commerce market further fuels the need for 4PL services, as retailers seek comprehensive logistics solutions to meet consumer expectations for fast and reliable delivery. These factors would further drive the market in North America.

- For instance, in November 2024, C.H. Robinson launched C.H. Robinson Managed Solutions, a next-level logistics management system. This new offering aims to fulfil a growing need for shippers who want easy access to advanced transportation management system (TMS) technology, managed transportation (3PL), and full-scale logistics services (4PL) from a single provider. It is designed to handle the increasing complexity of supply chains with adaptable and large-scale solutions.

According to the analysis, the fourth party logistics industry in Europe is anticipated to witness significant development during the forecast period. European companies are increasingly adopting eco-friendly practices, creating opportunities for 4PL providers to offer sustainable logistics solutions. The region's complex regulatory environment and the need for compliance with stringent environmental standards drive the demand for 4PL services that can navigate these challenges.

The adoption of green logistics practices and the integration of advanced technologies in supply chain management are significant factors contributing to the growth of the 4PL market in Latin America. Further, 4PL providers in Middle East & Africa are leveraging cutting-edge technologies such as automation, blockchain, and AI to deliver innovative and personalized solutions, gaining a competitive edge in the market.

Top Key Players and Market Share Insights:

The global fourth party logistics market is highly competitive with major players providing solutions and services to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the fourth party logistics industry include-

- CEVA Logistics (France)

- Global4PL Supply Chain Services (U.S.)

- Logistics Plus Inc. (U.S.)

- XPO Logistics, Inc. (U.S.)

- GEODIS (France)

- P. Moller – Maersk (Denmark)

- 4PL Group (South Africa)

- Allyn International Services (U.S.)

- H Robinson (U.S.)

- DB Schenker (Germany)

Recent Industry Developments :

Partnership:

- In April 2024, XPO announced the partnership with UPL, to provide a comprehensive fourth-party logistics (4PL) solution to UPL. XPO's 4PL solution, Key-PL, will manage a large volume of around ten thousand transport orders for UPL across Europe.

Fourth Party Logistics Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 112.90 Billion |

| CAGR (2025-2032) | 6.3% |

| By Service Type |

|

| By Mode of Transport |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Fourth Party Logistics Market? +

Fourth Party Logistics market size is estimated to reach over USD 112.90 Billion by 2032 from a value of USD 65.78 Billion in 2024 and is projected to grow by USD 69.23 Billion in 2025, growing at a CAGR of 6.3% from 2025 to 2032.

Which is the fastest-growing region in the Fourth Party Logistics Market? +

Asia-Pacific region is experiencing the most rapid growth in the market.

What specific segmentation details are covered in the Fourth Party Logistics report? +

The fourth party logistics report includes specific segmentation details for service type, mode of transport, end user, and region.

Who are the major players in the Fourth Party Logistics Market? +

The key participants in the market are CEVA Logistics (France), A.P. Moller – Maersk (Denmark), 4PL Group (South Africa), Allyn International Services (U.S.), C.H Robinson (U.S.), DB Schenker (Germany), Global4PL Supply Chain Services (U.S.), Logistics Plus Inc. (U.S.), XPO Logistics, Inc. (U.S.), GEODIS (France), and others.