Gasket and Seal Materials Market Size:

Gasket and Seal Materials Market Size is estimated to reach over USD 89.78 Billion by 2032 from a value of USD 64.18 Billion in 2024 and is projected to grow by USD 65.81 Billion in 2025, growing at a CAGR of 4.5% from 2025 to 2032.

Gasket and Seal Materials Market Scope & Overview:

Gasket and seal materials are essential components used to prevent leaks and maintain pressure or containment within mechanical systems. While both serve to prevent leakage, they differ in their applications: gaskets create static seals between two stationary surfaces, like flanges, whereas seals are designed for dynamic applications involving moving parts, such as rotary shafts. These materials encompass a wide range of substances, including various rubbers (nitrile, silicone, and Viton), fibers, metals, and composites, each selected based on factors like temperature, pressure, chemical compatibility, and the nature of the application.

Gasket and Seal Materials Market Dynamics - (DRO) :

Key Drivers:

Expanding automotive industry is fueling the gasket and seal materials market growth

The increasing vehicle production is driving the need for the essential components that ensure their proper functioning. Gaskets and seals are necessary in automotive systems, from engines and transmissions to fuel systems and air conditioning. Additionally, governments worldwide are implementing stricter emission regulations, compelling manufacturers to develop efficient and leak-proof vehicles. This drives the need for high-performance gaskets and seals that can withstand demanding conditions and prevent fluid and gas leaks, thereby driving the gasket and seal materials market size.

- For instance, Germany's motor vehicle sales experienced a notable increase in December 2023, reaching 3,204,298 units. This figure represents a rise from the 2,963,748 units sold in the preceding year. Analysing historical data reveals that Germany's annual motor vehicle sales, tracked from 2005 to 2023, have averaged 3,482,279 units. The December 2023 sales, while higher than the previous year, are slightly below this long-term average.

Consequently, expanding automotive industry is driving the gasket and seal materials market expansion.

Key Restraints:

Chemical exposure poses a significant constraint on the gasket and seal materials market growth

Certain chemicals break down the polymer chains within gasket materials, leading to a loss of structural integrity and eventual failure. Also, few chemicals can cause gaskets to absorb them, resulting in swelling and dimensional changes. This swelling distorts the gasket, reducing its sealing ability and potentially causing leaks. Moreover, chemical exposure can alter the elasticity and resilience of gasket materials, rendering them unable to maintain a proper seal, leading to leaks, pressure loss, and system failures. Ultimately, chemical degradation, swelling, and loss of sealing properties contribute to premature gasket failure, requiring frequent replacements and increasing maintenance costs, further hindering the global gasket and seal materials market size.

Therefore, as per the analysis, these combined factors are significantly hindering gasket and seal materials market share.

Future Opportunities :

Implementation of stringent emission regulations within the oil and gas is projected to create gasket and seal materials market opportunity

Regulations aimed at reducing fugitive emissions (leaks of gases and vapors) necessitate the use of high-performance gaskets and seals that can prevent leaks effectively. This is expected to drive the need for advanced sealing solutions capable of handling high pressures, extreme temperatures, and corrosive chemicals. Additionally, companies in the oil and gas sector are increasingly focused on environmental compliance. They require sealing solutions that meet or exceed stringent regulatory standards, leading to the adoption of more advanced and reliable gasket and seal materials. Moreover, regulations targeting greenhouse gas emissions, particularly methane, require oil and gas companies to minimize leaks. This is expected to create need for sealing technologies that can prevent the escape of these gases, thus significantly boosting gasket and seal materials market demand.

- For instance, in Apr 2021, KLINGER United Kingdom launched KLINGER Eco-Seal spiral wound gasket, setting a new sustainability benchmark for the oil and gas sector. This gasket surpasses current ASME B16.20-2017 standards by achieving a leak tightness ten times greater than their standard gaskets, reducing fugitive emissions from flange connections.

Hence, based on the analysis, implementation of stringent emission regulations within oil and gas is expected to create gasket and seal materials market opportunities.

Gasket and Seal Materials Market Segmental Analysis :

By Product Type:

Based on the Product Type, the market is categorized into Gaskets and Seals.

Trends in the Product Type:

- Growing trend towards the adoption of metal-reinforced gaskets, such as spiral wound and kammprofile gaskets, for high-pressure and high-temperature applications, particularly in the oil and gas and chemical processing industries.

- Growing need for high-performance elastomers like fluoroelastomers (FKM/Viton), silicone, and perfluoroelastomers (FFKM) due to their superior resistance to extreme temperatures, chemicals, and harsh environments.

Seals accounted for the largest revenue share in 2024.

- Seals are used in numerous industries, including automotive, aerospace, and industrial machinery, thereby driving gasket and seal materials market.

- Additionally, seals encompass a broad range of products, including O-rings, oil seals, hydraulic seals, and mechanical seals, each designed for specific applications and operating conditions, which in turn is boosting market.

- Seals are subjected to significant wear and tears, necessitating frequent replacements, further boosting the gasket and seal materials market trend.

- Further, the development of high-performance seals used in modern machinery and equipment, capable of withstanding extreme conditions, is also driving the market trend.

- For instance, SKF launched the HMS5 and HMSA10, or SKF Edge seals, adhering to ISO 6194-1 and DIN 3760 standards for broad industrial use. Key features include an optimized, spring-loaded sealing lip, balanced flex section, and beaded outer diameter.

- Thus, as per the gasket and seal materials market analysis, the aforementioned factors are driving the seals segment.

Gaskets are predicted to register the fastest CAGR during the forecast period.

- Global industrial expansion and infrastructure projects are expected to drive need for gaskets used in static sealing applications across various sectors, including construction, power generation, and chemical processing.

- Additionally, the expansion of renewable energy sources, such as wind and solar, requires specialized gaskets for applications in turbines and solar panels.

- Moreover, the growing production of electric vehicles (EVs) is expected to create need for gaskets in battery systems, thermal management, and other applications.

- Innovations in gasket materials, such as expanded PTFE (ePTFE), advanced elastomers, and metal-reinforced composites, enhance performance and expand application at various temperature ranges.

- For instance, in Apr 2025, Lamons released the Extreme Temperature Gasket (XTG), an advancement of their High Temperature Gasket (HTG). The XTG significantly increases the temperature handling capacity to 1800°F (982°C), providing enhanced durability and high-temperature resistance for industrial applications.

- In conclusion, the above-mentioned factors are contributing significantly in spurring the market.

By Distribution Channel:

Based on the Distribution Channel, the market is classified into Original Equipment Manufacturer (OEM) and Aftermarket.

Trends in the Distribution Channel:

- OEMs are collaborating with gasket and seal manufacturers to develop customized solutions tailored to specific equipment and machinery.

- The aftermarket is driven by cost-conscious consumers and businesses seeking affordable replacement parts.

Original Equipment Manufacturer (OEM) accounted for the largest revenue share in 2024.

- OEMs prioritize high-quality materials to ensure the longevity and performance of their products, thereby driving the gasket and seal materials market demand.

- OEMs are incorporating smart gaskets and seals with integrated sensors and monitoring capabilities into their equipment to enable predictive maintenance and real-time performance monitoring.

- OEMs are streamlining their supply chains to ensure timely delivery and reduce costs, which involves working with suppliers who can provide efficient logistics and inventory management.

- For instance, June 2020, Permatex launched four new high-temperature gasket makers across its ULTRA, OPTIMUM, and The Right Stuff lines, designed to handle the increased thermal cycling demands of modern automotive engines.

- Thus, as per the gasket and seal materials market analysis, the aforementioned factors are driving Original Equipment Manufacturer (OEM) segment.

Aftermarket is predicted to register the fastest CAGR during the forecast period.

- Growing emphasis on extending the lifespan of existing equipment is leading to increased maintenance and repair activities, boosting aftermarket sales.

- There is a growing trend to repair rather than replace, and this is increasing the aftermarket demand.

- E-commerce platforms are also expanding the reach in the aftermarket, offering a wide range of gasket and seal products to consumers and businesses.

- Additionally, many aftermarket distributors are increasing the technical support they provide, as many customers require help with selection, and installation of gaskets and seals.

- For instance, in Jan 2024, Dorman Products launched 325 new motor vehicle parts, including three exhaust manifold hardware and gasket repair kits that target a significant 17 million repair opportunities.

- In conclusion, as per the analysis, the above-mentioned factors are contributing significantly in spurring the market.

By Application:

Based on the Application, the market is categorized into Pressure Vessels, Heat Exchangers, Manhole Covers, Valve Bonnets, and Pipe Flanges.

Trends in the Application:

- Emphasis on high-pressure and high temperature sealing solutions due to stringent safety regulations.

- Increasing need for gaskets that can conform to irregular surfaces and provide reliable sealing in manhole covers.

Heat Exchangers accounted for the largest revenue share in 2024 and is also predicted to register the fastest growth.

- Heat exchangers are essential components in numerous industries, including chemical processing, oil and gas, power generation, HVAC, and food and beverage.

- These exchangers operate under diverse conditions, involving various fluids, temperatures, and pressures which necessitates a wide range of gasket and seal materials.

- Heat exchangers handle critical fluids and operate under demanding conditions. Leaks lead to significant safety hazards, environmental damage, and operational disruptions which emphasizes the need for high-quality, reliable sealing solutions.

- The focus on energy efficiency and heat recovery in various industries is leading to the increased adoption of heat exchangers, creating a larger market for sealing solutions.

- In conclusion, the aforementioned factors are contributing to the growth of global gasket and seal materials market.

By End-User:

Based on the End User, the market is categorized into Oil and Gas, Electricals, Automotive, Aerospace, Marine and Rail, Paper and Pulp Industry, and Industrial Manufacturing.

Trends in the End User:

- Growing trend towards the adoption of high-performance gaskets and seals in oil and gas that can withstand extreme pressures, temperatures, and corrosive chemicals.

- Growing need for electrically conductive gaskets and seals for electromagnetic interference (EMI) shielding.

Automotive accounted for the largest revenue share of 30.25% in the market in 2024.

- Increasing focus on lightweight and high-temperature resistant gaskets and seals for improved fuel efficiency and reduced emissions.

- Additionally, growing need for specialized sealing solutions for electric vehicle (EV) battery systems and electric motors is also driving the market.

- For instance, Sumitomo Riko announced that Toyota will continue to utilize their improved "fuel cell gaskets" in the new Mirai FCEV, highlighting advancements in both quality and performance of this crucial component for fuel cell stacks.

- Consequently, as per gasket and seal materials market analysis, the above-mentioned factors are driving the adoption of these materials in the automotive sector.

Aerospace is predicted to register the fastest CAGR during the forecast period.

- Aerospace applications operate under extreme conditions, including wide temperature fluctuations, high pressures, and vibrations, which necessitates gaskets and seals, driving need for advanced materials and technologies.

- Weight reduction is critical in aerospace to improve fuel efficiency and reduce emissions. This drives the development and adoption of lightweight materials, such as advanced polymers and composites.

- The increasing need for air travel and the growing military aerospace sector are driving the production of aircraft and spacecraft, leading to a higher need for advanced materials.

- For instance, SKF provides high-performance carbon seals, including carbon face and circumferential seals, specifically designed for aerospace turbine engine main shaft bearings. These seals, engineered for sustainable operation, meet stringent quality and performance standards for both commercial and military aircraft.

- Subsequently, as per the market analysis, the aforementioned factors are collectively responsible in accelerating the market growth during the forecast period.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

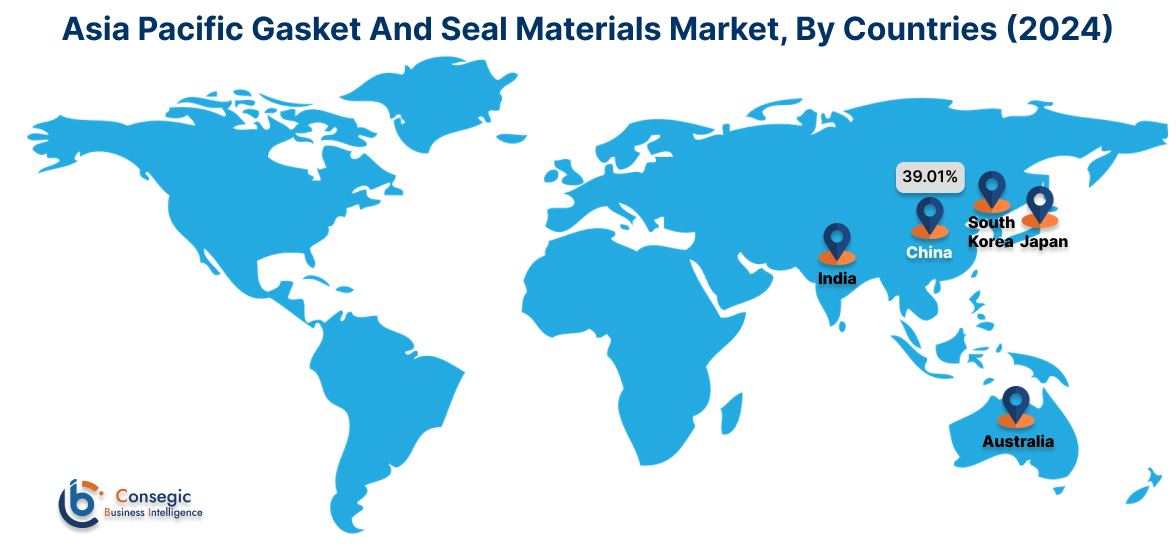

Asia Pacific was valued at USD 22.17 Billion in 2024. Moreover, it is projected to grow by USD 22.79 Billion in 2025 and reach over USD 31.81 Billion by 2032. Out of these, China accounted for the largest revenue share of 39.01% in 2024.

Countries like China and India are experiencing rapid industrial growth, increased manufacturing activity, and significant infrastructure development, which are driving the need for gaskets and seals across various sectors. Additionally, large-scale construction projects in the region require gaskets and seals for various applications, including pipelines, machinery, and infrastructure development. Moreover, the expanding electronics manufacturing sector in the region also contributes to market growth, as gaskets and seals are used in various electronic devices.

- For instance, from April 2000 to September 2024, the electronics goods sector in India attracted FDI inflows of USD 5.67 billion. It contributes approximately 0.6% in 2024 to the nation's GDP and is expected to grow at a CAGR of around 11%, reaching a market size of USD 34.5 billion by 2029.

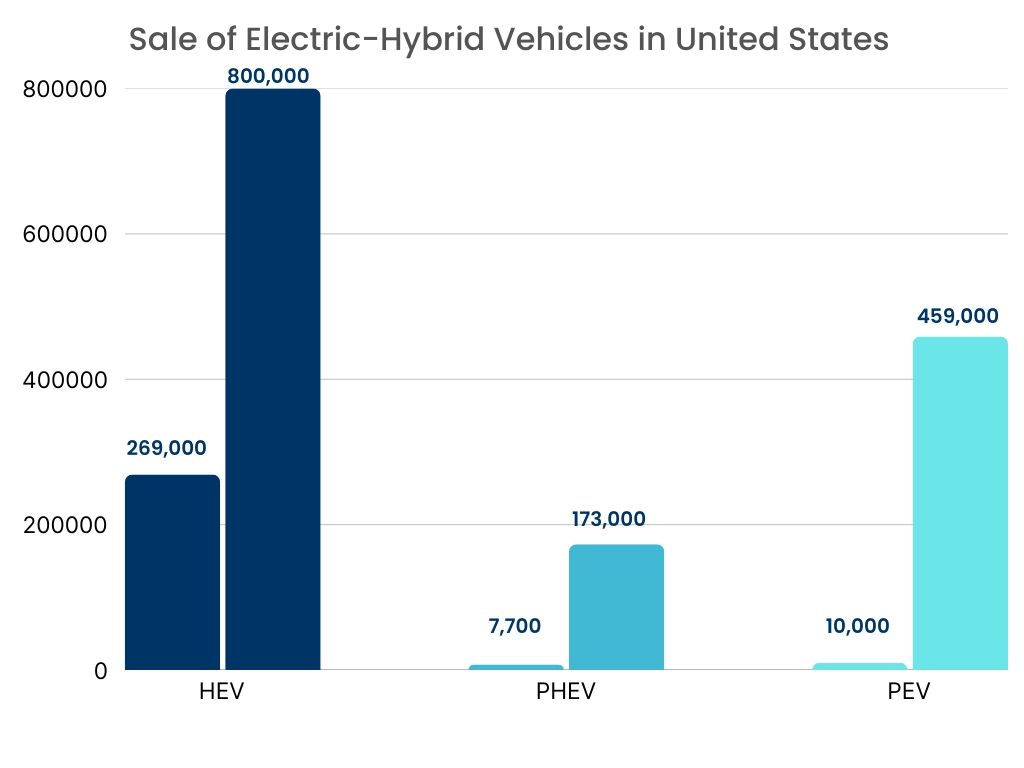

North America region was valued at USD 18.24 Billion in 2024. Moreover, it is projected to grow by USD 18.69 Billion in 2025 and reach over USD 25.23 Billion by 2032. North America has stringent environmental regulations, particularly in the United States, which is projected to drive the need for high-performance sealing solutions to minimize leaks and emissions. Additionally, the robust automotive sector, with a focus on improving vehicle efficiency and reducing emissions, drives the need for advanced sealing materials. Moreover, the increasing use of electric and hybrid vehicles further fuels the gasket and seal materials market demand.

- For instance, in the United States, the decade from 2011 to 2021 saw a significant surge in electric vehicle adoption. Hybrid-electric vehicle (HEV) sales nearly tripled, rising from approximately 269,000 to almost 800,000. Plug-in hybrid-electric vehicle (PHEV) sales experienced dramatic increase, jumping from roughly 7,700 to over 173,000. Similarly, plug-in electric vehicle (PEV) sales saw a substantial increase, climbing from about 10,000 to over 459,000.

As per the gasket and seal materials market analysis, stringent environmental regulations, a strong automotive sector, and a focus on technological innovation are driving the market in European countries. Additionally, in Latin America, industrialization, particularly in oil and gas, mining, and automotive, along with infrastructure projects, are boosting the need for reliable sealing. Further, the oil and gas sector significantly influence the market, raising the need for durable, high-performance seals, alongside growth in infrastructure and manufacturing.

Top Key Players and Market Share Insights:

The market is highly competitive with major players providing gasket and seal materials to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the market. Key players in the gasket and seal materials industry include-

- SKF (Sweden)

- Freudenberg-NOK Sealing Technologies (Germany)

- Garlock (USA)

- Timken (USA)

- 3M (USA)

- Henkel AG & Co. KGaA (Loctite) (Germany)

- Talbros Automotive Components Ltd. (India)

- Anabond Limited. (India)

- Phelps Industrial Products, LLC (USA)

- REDCO Rubber Engineering & Development Company (USA)

- VSP Technologies (USA)

- Arizona Sealing Devices, Inc. (USA)

- National Rubber Corp. (USA)

- Motion industries (USA)

Recent Industry Developments :

Product Launch:

- In Jan 2025, KLINGER A. W. Schultze has introduced a new gasket designed for hydrogen applications, utilizing their Waveline WLP process. This process pre-compresses gasket materials, significantly reducing entrapped air and resulting in a "wavy" cross-section. This design allows for effective sealing with lower compression force, crucial for the challenging nature of hydrogen, which is prone to leakage.

Gasket and Seal Materials Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 89.78 Billion |

| CAGR (2025-2032) | 4.5% |

| By Product Type |

|

| By Distribution Channel |

|

| By Application |

|

| By End-User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the gasket and seal materials market? +

The gasket and seal materials market size is estimated to reach over USD 89.78 Billion by 2032 from a value of USD 64.18 Billion in 2024 and is projected to grow by USD 65.81 Billion in 2025, growing at a CAGR of 4.5% from 2025 to 2032.

What specific segmentation details are covered in the gasket and seal materials report? +

The gasket and seal materials report includes specific segmentation details for product type, distribution channel, application, end user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the gasket and seal materials market, aerospace is the fastest-growing segment during the forecast period.

Who are the major players in the gasket and seal materials market? +

The key participants in the gasket and seal materials market are SKF (Sweden), Freudenberg-NOK Sealing Technologies (Germany), Garlock (USA), Timken (USA), 3M (USA), Henkel AG & Co. KGaA (Loctite) (Germany), Talbros Automotive Components Ltd. (India), Anabond Limited. (India), Phelps Industrial Products, LLC (USA), REDCO Rubber Engineering & Development Company (USA), VSP Technologies (USA), Arizona Sealing Devices, Inc. (USA), National Rubber Corp. (USA), Motion industries (USA), and Others.