Grinding Machines Market Size:

Grinding Machines Market is estimated to reach over USD 8.81 Billion by 2032 from a value of USD 5.97 Billion in 2024 and is projected to grow by USD 6.16 Billion in 2025, growing at a CAGR of 5.3% from 2025 to 2032.

Grinding Machines Market Scope & Overview:

Grinding machines are power tools used to shape or finish a workpiece by removing material through abrasive cutting. These machines utilize a rotating abrasive wheel or belt to achieve precise dimensions and smooth surfaces on a variety of materials. The machines are used for a wide range of applications in industries including automotive, aerospace and defense, electronics, medical, and construction among others. Further key benefits including enhanced precision and surface finish, increased automation, and the ability to process a wide range of materials are driving the market. Furthermore, key trends driving the market include increasing integration of automation and CNC technology and the development of advanced abrasive materials.

Key Drivers:

Growing Automotive Sector Drives the Grinding Machines Market Growth

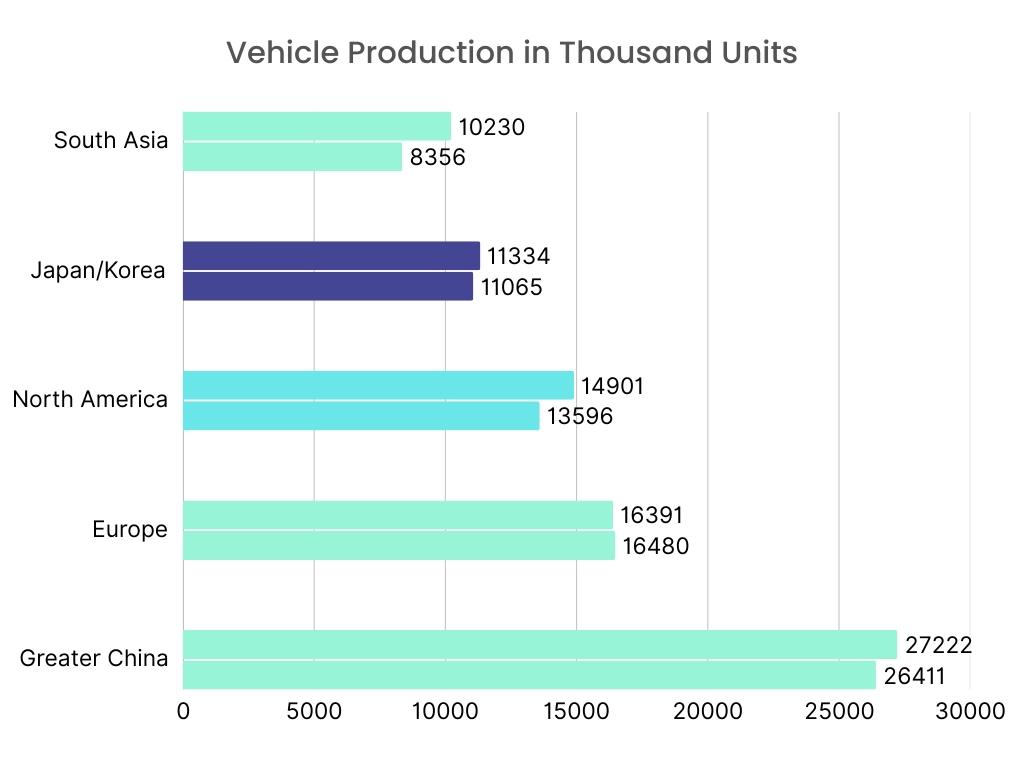

The expanding automotive sector acts as a significant catalyst for the grinding machines market. Increased vehicle production, including both internal combustion engine vehicles and electric vehicle segment, requires a high volume of precision-engineered components. Grinding machines are crucial in achieving tight tolerances and fine surface finishes required for critical parts like engine blocks, crankshafts, gears, and battery housing. Additionally, the pursuit of improved performance, fuel efficiency, and durability further drives the demand for advanced grinding technologies capable of processing lightweight materials and complex geometries.

- For instance, as per the European Automobile Manufacturers' Association (ACEA), vehicle production worldwide reached 85.4 million units in 2022, observing a 5.7% rise from 2021. The increased production of automobiles is driving the market growth of grinders.

Therefore, grinding machines market size is significantly driven by rising vehicle ownership, which is fueled by technological advancements, a focus on sustainability, increasing disposable incomes, and expanding urbanization.

Key Restraints:

High Initial Investment Costs are Limiting the Market

The substantial upfront investment required for advanced grinding machines poses a considerable limitation to market growth, particularly for small and medium-sized enterprises. These high costs encompass not only the machinery itself but also associated expenses like installation, specialized tooling, and initial training for operators. This financial barrier can deter potential buyers, especially those with limited capital or uncertain production volumes, leading them to opt for less sophisticated or used equipment. Consequently, the high initial outlay restricts broader market penetration and can slow down the adoption of newer, more efficient grinding technologies, ultimately hindering the overall growth potential of the market.

Future Opportunities :

Integration of Smart Manufacturing and Industry 4.0 Drives Grinding Machines Market Opportunities

The increasing integration of smart manufacturing and industry 4.0 technologies presents significant opportunities for the grinding machines market. The embedding of sensors, IoT connectivity, and data analytics into grinding machines enables real-time monitoring of performance and predictive maintenance to minimize downtime. Further, connectivity facilitates seamless integration with other smart factory systems, allowing for data-driven decision-making and improved overall productivity. Furthermore, the ability to remotely monitor and control grinding processes enhances operational flexibility, ultimately fueling market growth and innovation. Thus, based on analysis, integration of smart manufacturing and industry 4.0 drives grinding machines market opportunities.

Grinding Machines Market Segmental Analysis :

By Type:

Based on the type, the market is segmented into non-precision grinder and precision grinder.

Trends in the Type:

- There is a growing need for portable and flexible non-precision grinders that can be easily moved and adapted for various tasks in construction in turn driving the grinding machines market trends.

- Increasing integration of sensors, IoT connectivity, and AI systems for real-time monitoring and predictive maintenance are expected to drive grinding machines market size.

Precision grinders accounted for the largest revenue share in the year 2024 and is anticipated to register the fastest CAGR during the forecast period.

- Increasing demand for precision grinders across various industries including aerospace, automotive, electronics, and medical for obtaining tight tolerances and fine surface finishes which in turn drives the grinding machines market share.

- Further, there is an increasing trend in the integration of Computer Numerical Control (CNC) technology into precision grinders, allowing for more accurate and automated control over the grinding process.

- Furthermore, innovations in abrasive materials such as Cubic Boron Nitride (CBN) and diamond are enhancing the capabilities of precision grinders which in turn drives the grinding machines market trends.

- For instance, PALMARY MACHINERY CO., LTD. offers PC-12S which is a high-quality, economic servo-type centerless grinder that uses a servo motor for more precision and easier regulation.

- Thus, as per grinding machines market analysis, rising need for precision components, integration of CNC technology, and advanced abrasive materials are driving the grinding machines market share.

By Operation:

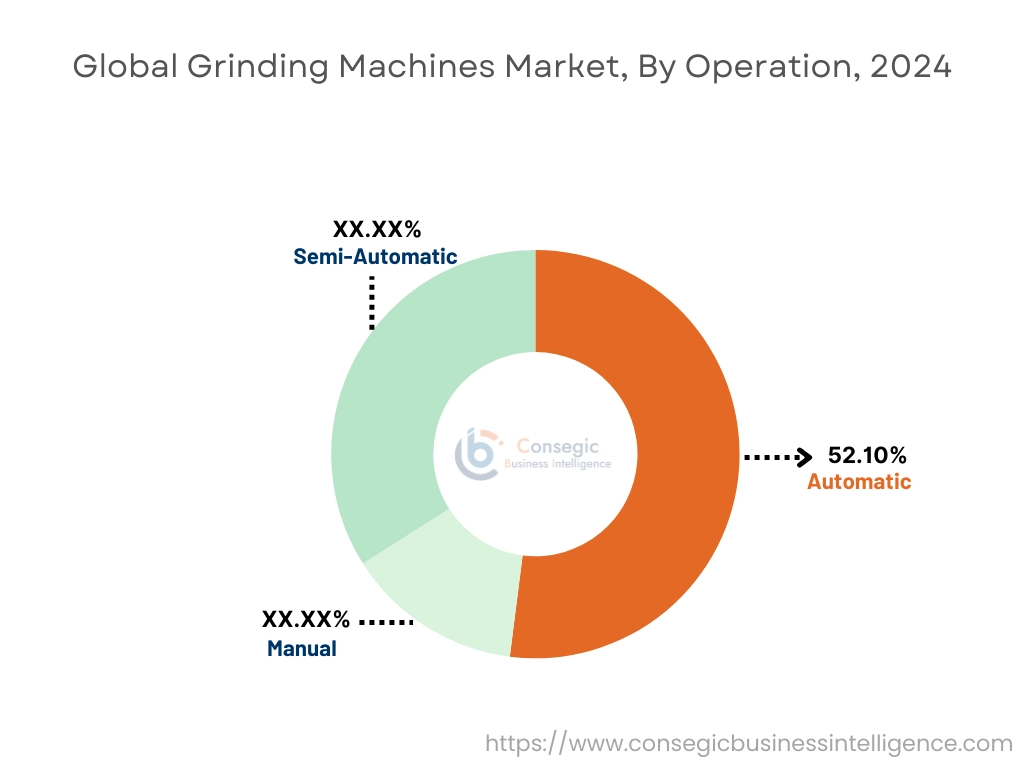

Based on the operation, the market is segmented into manual, semi-automatic, and automatic.

Trends in the Operation:

- Semi-automatic grinders offer a balance between the flexibility of manual operation and the increased efficiency of automation, which in turn drives the grinding machines market demand.

- Manual grinders remain a cost-effective and versatile option for smaller workshops, tool and die shops, and maintenance facilities in turn driving the market.

Automatic accounted for the largest revenue share of 52.10% in the year 2024 and is anticipated to register the fastest CAGR during the forecast period.

- Growing advancements in CNC controls, direct drive spindles, and linear motor technology are driving the grinding machines market demand.

- Further, growing integration with industry 4.0 and smart manufacturing is driving the grinding machines industry.

- Furthermore, to further enhance productivity and reduce manual labor, automatic grinders are increasingly being integrated with robotic arms.

- For instance, in May 2022, TSCHUDIN AG, a specialist in high-precision centerless cylindrical grinding, and the UNITED GRINDING Group, a broad provider of precision grinding solutions, have formed a strategic partnership involving cross-ownership. The goal is to offer customers more comprehensive support through complementary grinding solutions.

- Thus, as per grinding machines market analysis, advancements in CNC technology and increased use of robotics are driving the market.

By End User:

Based on the end user, the market is segmented into automotive, aerospace and defense, electronics, medical, industrial manufacturing, construction, energy, and others.

Trends in the End User:

- The transition to EVs necessitates high-precision grinding for critical components like motor shafts, gears, and battery housings which in turn drives the grinding machines market expansion.

- The trend towards smaller and more powerful electronic devices requires micro-precision grinding for components like semiconductor wafers and connectors which subsequently propels the grinding machines market.

Industrial manufacturing accounted for the largest revenue share in the year 2024.

- In the industrial manufacturing landscape, there's a continuous focus on improving efficiency and reducing production costs which in turn drives the market.

- Further, to enhance productivity and reduce reliance on manual labor, industrial manufacturers are increasingly adopting automated grinding systems.

- Furthermore, grinding machines play a crucial role in maintaining and sharpening cutting tools, dies, and molds used in various industrial processes which in turn drives grinding machines market growth.

- For instance, Komatsu NTC offers NTG-4SP which features a minimized machining chamber with grinding wheel spindle. The key features include synchronous double center drives with automatic adjustment for various workpiece lengths and powerful built-in motor for the grinding wheel spindle.

- Thus, based on analysis, aforementioned factors are driving the market.

Aerospace and defense is anticipated to register the fastest CAGR during the forecast period.

- Growing requirement of intricate and high-precision components made from advanced materials like titanium alloys, nickel-based superalloys, and ceramics is driving the market

- Further, growing focus on achieving stringent quality standards and maintaining material integrity during the grinding process, which subsequently propels the grinding machines market expansion.

- Therefore, based on analysis, need for high-precision grinding and stringent quality standards are anticipated to boost the growth of the market during the forecast period.

Regional Analysis:

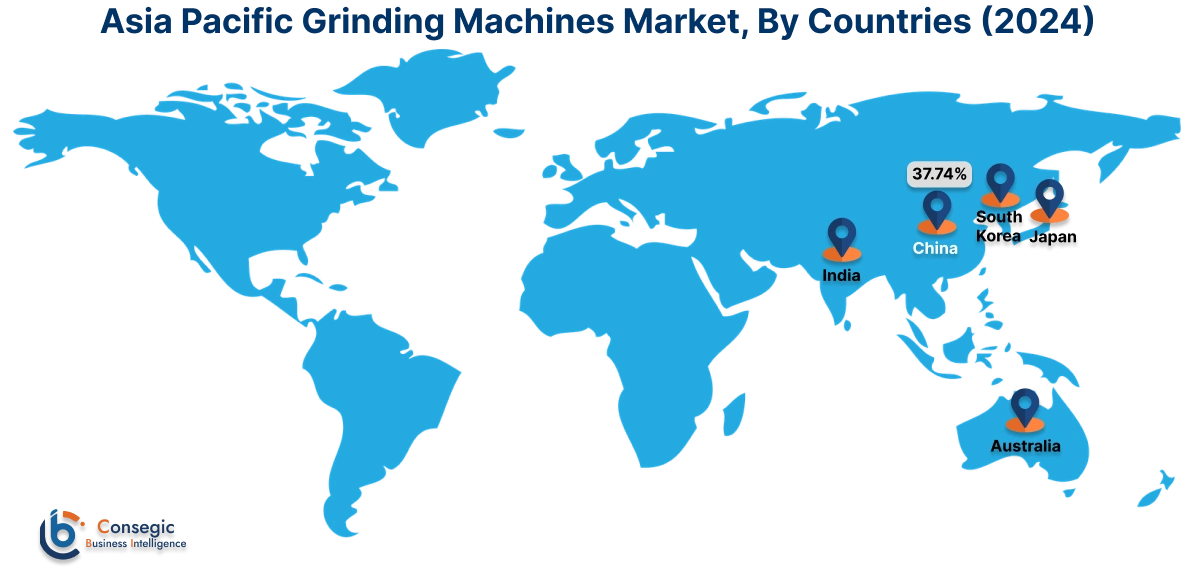

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

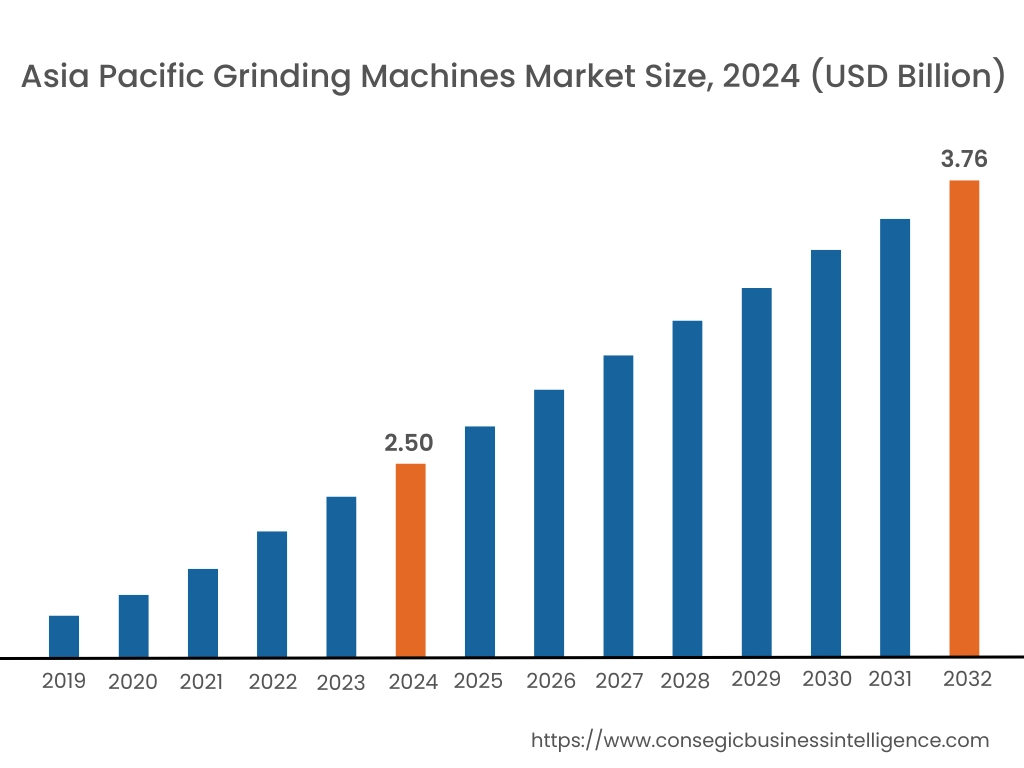

Asia Pacific region was valued at USD 2.50 Billion in 2024. Moreover, it is projected to grow by USD 2.59 Billion in 2025 and reach over USD 3.76 Billion by 2032. Out of this, China accounted for the maximum revenue share of 37.74%. The market growth for grinding machines is mainly driven by rapid industrialization and the expansion of key manufacturing sectors such as automotive, aerospace, and electronics.

- For instance, in October 2024, Nidec Machine Tool, launched the ZI25A which is a high-speed, high-precision internal gear grinding machine. This machine targets the growing demand for larger, more durable, efficient, and quieter internal gears used in applications like automotive drive units, reducers, and robot joints.

North America is estimated to reach over USD 2.10 Billion by 2032 from a value of USD 1.43 Billion in 2024 and is projected to grow by USD 1.48 Billion in 2025. The North American market is primarily driven by strong presence of established automotive and aerospace industries, along with increasing investments in advanced manufacturing technologies and automation to enhance productivity and efficiency.

- For instance, in October 2024, The UNITED GRINDING Group signed an agreement to acquire the GF Machining Solutions Division (GFMS) from Georg Fischer AG. The strategic acquisition aims to create a global leader in ultra-precision machining by combining the strengths of both companies and offering customers more comprehensive solutions.

The regional trends analysis depicts stringent environmental regulations, growing investments in advanced automation technologies, and focus on high-precision manufacturing in Europe are driving the market. Additionally, the factors driving the market in the Middle East and African region are increasing investments in industrial infrastructure development and growing energy sector. Further, increasing industrialization, particularly in the automotive and construction sectors is paving the way for the progress of market trends in Latin America region.

Top Key Players and Market Share Insights:

The global grinding machines market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in grinding machines industry. Key players in the global grinding machines market include-

- Danobat (Spain)

- WAIDA MFG.CO., LTD. (Japan)

- Hardinge Inc. (US)

- Ace Micromatic Group (India)

- Rieter (Switzerland)

- Fritz Studer AG (Switzerland)

- ANCA (Australia)

- AMADA MACHINERY CO., LTD. (Japan)

- JTEKT Machinery (Japan)

- JUNKER Group (Germany)

Recent Industry Developments :

Product Launch:

- In March 2025, STUDER (UNITED GRINDING Group) launched an enhanced version of its successful favoritCNC universal cylindrical grinding machine. The updated model offers modern grinding technology with high precision, user-friendly operation, and an excellent price-performance ratio for external and internal cylindrical grinding.

Merger and Acquisition:

- In January 2024, Koyo Machinery USA merged with JTEKT Machinery Americas. The integration aims to provide customers with enhanced products, services, and support by combining Koyo Machinery USA's precision grinding expertise with JTEKT Machinery's offerings.

Grinding Machines Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 8.81 Billion |

| CAGR (2025-2032) | 5.3% |

| By Type |

|

| By Operation |

|

| By End User |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the grinding machines market? +

The grinding machines market is estimated to reach over USD 8.81 Billion by 2032 from a value of USD 5.97 Billion in 2024 and is projected to grow by USD 6.16 Billion in 2025, growing at a CAGR of 5.3% from 2025 to 2032.

What specific segmentation details are covered in the grinding machines report? +

The grinding machines report includes specific segmentation details for type, operation, end user, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the grinding machines market, automatic operation is the fastest-growing segment during the forecast period.

Who are the major players in the grinding machines market? +

The key participants in the grinding machines market are Danobat (Spain), WAIDA MFG.CO., LTD. (Japan), Fritz Studer AG (Switzerland), ANCA (Australia), AMADA MACHINERY CO., LTD. (Japan), JTEKT Machinery (Japan), JUNKER Group (Germany), Hardinge Inc. (US), Ace Micromatic Group (India), Rieter (Switzerland), and others.

What are the key trends in the grinding machines market? +

The grinding machines market is shaped by several key trends including increasing demand for precision-machined components across industries including automotive, aerospace, and medical, coupled with advancements in automation and CNC technology.