Home Appliances Market Size :

Consegic Business Intelligence analyzes that the home appliances market size is growing with a CAGR of 4.3% during the forecast period (2023-2030), and the market is projected to be valued at 814.14 Billion by 2030 from 582.08 Billion in 2022.

Home Appliances Market Scope & Overview:

Home appliances are electrical or mechanical devices designed to assist various household tasks. They make daily tasks more convenient and efficient. These appliances are used for cooking, cleaning, food preservation, and others. These devices are majorly divided into three classifications, which include small appliances, major appliances, and smart appliances.

These appliances have made our lives easier and more convenient. They have also helped to improve our health and safety. For example, refrigerators and freezers help to keep food fresh and prevent foodborne illnesses. Washing machines and dryers help to keep our clothes clean and free of bacteria. This has resulted in a significant increase in the trends and sales of comfort home products. Based on the analysis, the surge in the working culture along with the increasing trends for technologically advanced and smart home appliances is improving the home appliances market demand across the globe.

Home Appliances Market Insights :

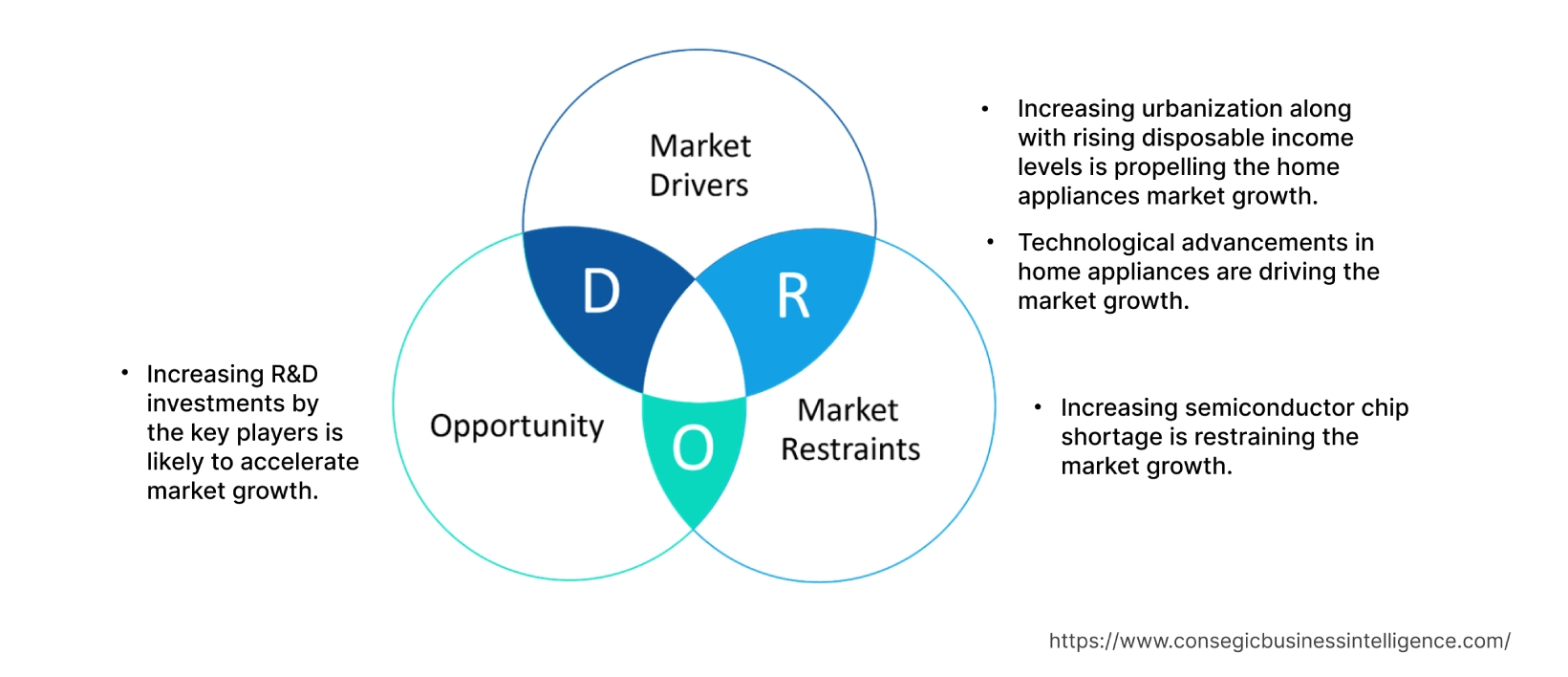

Home Appliance Market Dynamics - (DRO) :

Key Drivers :

Increasing urbanization along with rising disposable income levels is propelling the home appliances market growth

Home appliances are equipment that is used for various household applications such as cooking, cleaning, laundry, air conditioning, and others. The growing urbanization is heavily increasing the home appliances market trends. With rising level of disposable income people are spending more on appliances such as washing machines, refrigerators, air conditioners, water purifiers, food processors, and others. Furthermore, rapid urbanization also leads to increasing technology adoption, which leads to increased trends for smart home appliances which also leads to the high demand for these appliances. Hence, based on the analysis, the rapid expansion in urbanization and rising disposable income are the key driving factors for the home appliances market growth. For instance, according to the report by The World Bank in April 2023, 56% of the world's population resides in cities accounting for 4.4 billion inhabitants and this number is expected to double by 2050. For this reason, increasing urbanization along with rising disposable income levels is boosting the home appliances market growth.

Technological advancements in home appliances are driving the market expansion

Innovations such as smart sensors, IoT connectivity, and AI-driven features are transforming appliances into smart devices that offer convenience, efficiency, and improved user experiences. Smart home appliances equipped with IoT capabilities, allow users to remotely control and monitor their devices through smartphones or voice assistants. This level of connectivity not only enhances convenience but also enables energy-efficient usage, as users can adjust settings based on real-time information. Based on the analysis, major manufacturers are focusing on the launch of advanced and efficient appliances to provide advanced and innovative products for consumers across the globe. For instance, in April 2022, LG Electronics, a manufacturer of electronic devices announced the launch of AI-powered appliances and air conditioners product range. The increasing focus on the launch of innovative product launches by the various key players in the market is driving the market development worldwide.

Key Restraints :

Increasing semiconductor chip shortage is restraining the market expansion

Semiconductor chips such as microcontrollers, temperature sensors, and others are highly used in the manufacturing of technologically advanced these appliances. Various appliances such as refrigerators and washing machines, smart TVs, and washing machines heavily depend on these chips to offer enhanced features, connectivity, and automation. The shortage of semiconductor chips has resulted in supply disruptions, delayed production, and increased costs for manufacturers of appliances. As per the analysis, this has led to reduced availability of certain appliance models and in some cases increasing selling costs due to supply imbalances. According to the report by The World Economic Forum Organization in April 2022, there are several factors such as increasing demand for semiconductor chips from the automotive industry, complexity in the production of semiconductors, and disruption of the semiconductor industry due to Covid-19 pandemic have led to the global semiconductor chip shortages. The high demand for semiconductors for manufacturing smart home appliances is restraining the home appliances market trends.

Future Opportunities :

Increasing R&D investments by the key players is likely to accelerate market

Major players involved in the home appliance market globally are increasingly investing in their research and development activities for the development of advanced technologies and further creating lucrative home appliances market opportunities and trends in the coming years. This increasing spending on research and development activities by the key players worldwide is expected to drive market expansion. For instance, Samsung Electronics' total annual spending on research and development activities in the financial year 2022 accounted for USD 18611.98 million which was 9.3% higher than the previous year 2021. Furthermore, in 2021, Haier Smart Home continued to increase its investment in 5G, AI, IoT, and other technologies. The company's year-on-year investment in research and development activities increased by 22.0%. This increasing research and development expenses by home appliance manufacturers worldwide is expected to increase the launch of the latest innovations and technologies in appliances and create lucrative opportunities and home appliances market trends over the forecast period.

Home Appliances Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2017-2030 |

| Market Size in 2030 | USD 814.14 Billion |

| CAGR (2023-2030) | 4.3% |

| By Type | Major Appliances, Small Appliances, and Smart Home Appliances |

| By Product Type | Refrigeration Equipment, Cooking Appliances, Washing & Drying Equipment, Heating & Cooling Equipment, Food Processing Equipment, and Others |

| By Distribution Channel | Online (Company Owned Websites and E-Commerce Channels) and Offline (Supermarkets/Hypermarkets, Specialty Stores, and Others) |

| By Region | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Players | Whirlpool Corporation, Samsung Electronics Co. Ltd., Haier Inc., Bajaj Electricals Ltd., IFB Appliances, Panasonic Holdings Corporation, LG Electronics, Bosch-Siemens Hausgeräte, Electrolux AB, and Voltas Limited |

| Geographies Covered | |

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, Restraint or Challenges, Opportunities, Environment & Regulatory Landscape, PESTLE Analysis, PORTER Analysis, Key Technology Landscape, Value Chain Analysis, Cost Analysis, and Regional Trends & Forecast |

Home Appliances Market Segmental Analysis :

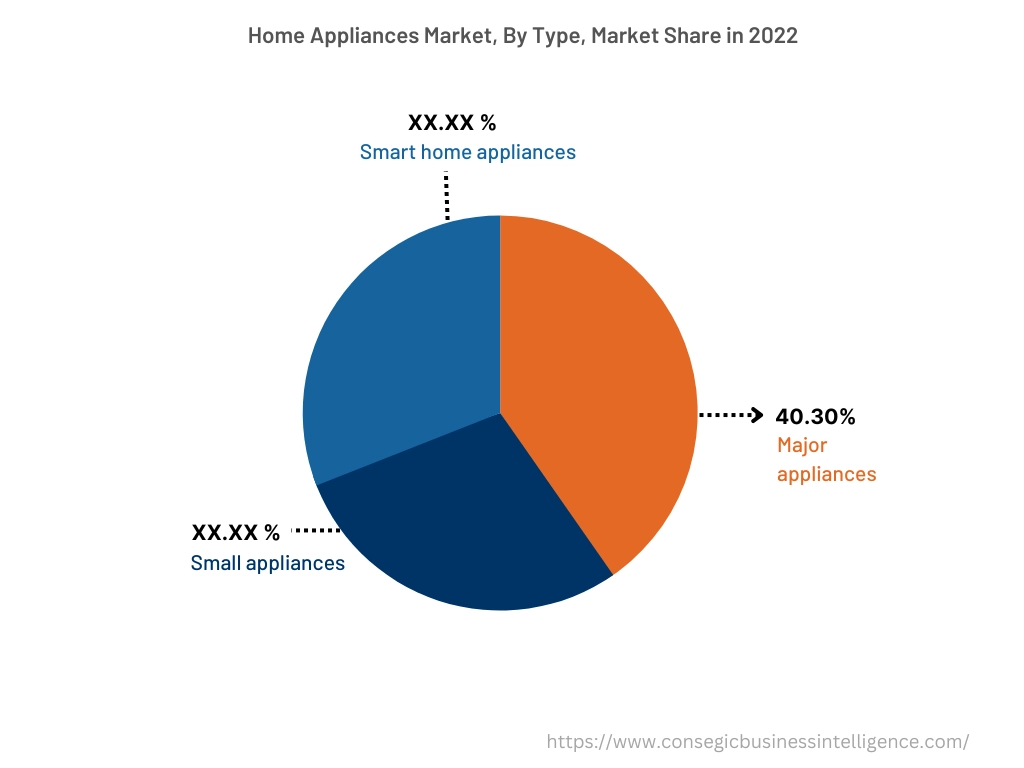

By Type :

The type segment is categorized into major appliances, small appliances, and smart home appliances. In 2022, the major appliances segment accounted for the highest home appliances market share of 40.30% in the overall home appliances market. Major appliances consist of equipment such as freezers, refrigerators, washing machines, dishwashers, air conditioners, ovens, and others. Based on the analysis, the kitchen and laundry have become an essential part of the home, which is creating a high demand for home essential appliances such as dishwashers, refrigerators, and washing machines. Various key players across the globe are focusing on the launch of new products to meet the growing demand from consumers worldwide. For instance, in October 2022, Whirlpool Corporation, an America-based appliances manufacturing company, announced the launch of a high-capacity dishwasher.

However, the smart home appliances segment is expected to grow at the fastest CAGR in the market during the forecast period. The developement of the segment is attributed to the increasing focus of the key players on developing remote monitoring IoT and AI-based home appliances. Businesses in the market are focusing on the development of food recognition, remote monitoring, automating heat sensing, and other technologies and integrating them into kitchen applications such as ovens and refrigerators. Companies such as Samsung, Panasonic, and others, have been introducing concepts such as refrigerator that identifies and monitors food, remote monitoring of a stovetop, and integrating artificial intelligence (AI) into appliances for recommendations. Hence, technological advancements, and contributions by market players will further foster market expansion over the forecast period.

By Product Type :

The product type segment is categorized into refrigeration equipment, cooking appliances, washing & drying equipment, heating & and cooling equipment, food processing equipment, and others. In 2022, the refrigeration equipment segment accounted for the highest market share in overall home appliances market. Increasing innovations in smart refrigerator technology are driving segment trends across the globe. For instance, in January 2020, Samsung Electronics Co., Ltd. introduced a new refrigerator with artificial intelligence (AI) features that can plan meals and connect with Samsung devices around the home. This new refrigerator is equipped with the company's AI ViewInside technology which scans items, identifies them, and sends updates when new or old items are out.

However, the food processing equipment segment is expected to grow at the fastest CAGR in the overall home appliances market. Food processing equipment is the kitchen appliances that allow users to quickly perform food preparation activities such as chopping, grinding, slicing, mixing, blending, kneading, and other activities. This food processing equipment comes in various categories such as dryers, mixers, chillers, feeders, fryers, grinders, homogenizers, separators, roasters, slicers, and others. Rising per capita income along with the increasing consumer spending on home and kitchen appliances are expected to drive the segment expansion across the globe over the forecast period.

By Distribution Channel :

The distribution channel segment is categorized into online and offline. In 2022, the offline segment accounted for the highest market share in the overall home appliances market. Further, the offline segment is categorized into supermarkets/hypermarkets, specialty stores, and others. The trends of the segment is attributed to the high presence of various brand stores, electronic stores, the presence of the appliances section in supermarkets and hypermarkets, and the existence of a strong distributor network of key manufacturers across the globe. The increasing launch of new brand outlets and stores is further driving segment trends across the globe. For instance, in July 2023, LG Electronics announced the launch of its new store in Srinagar, India to elevate the shopping experience and provide a one-stop shop for all lifestyle needs of a household for their consumers.

However, the online segment is expected to grow at the fastest CAGR in the overall home appliances market. The online segment is further categorized into company-owned websites and e-commerce channels. Online distribution channels provide the convenience of home delivery, easy purchasing, and convenience of purchasing from anywhere across the globe. The rising consumer preference for e-commerce purchases worldwide is expected to drive the segment development over the forecast period.

By Region :

The regional segment includes North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America.

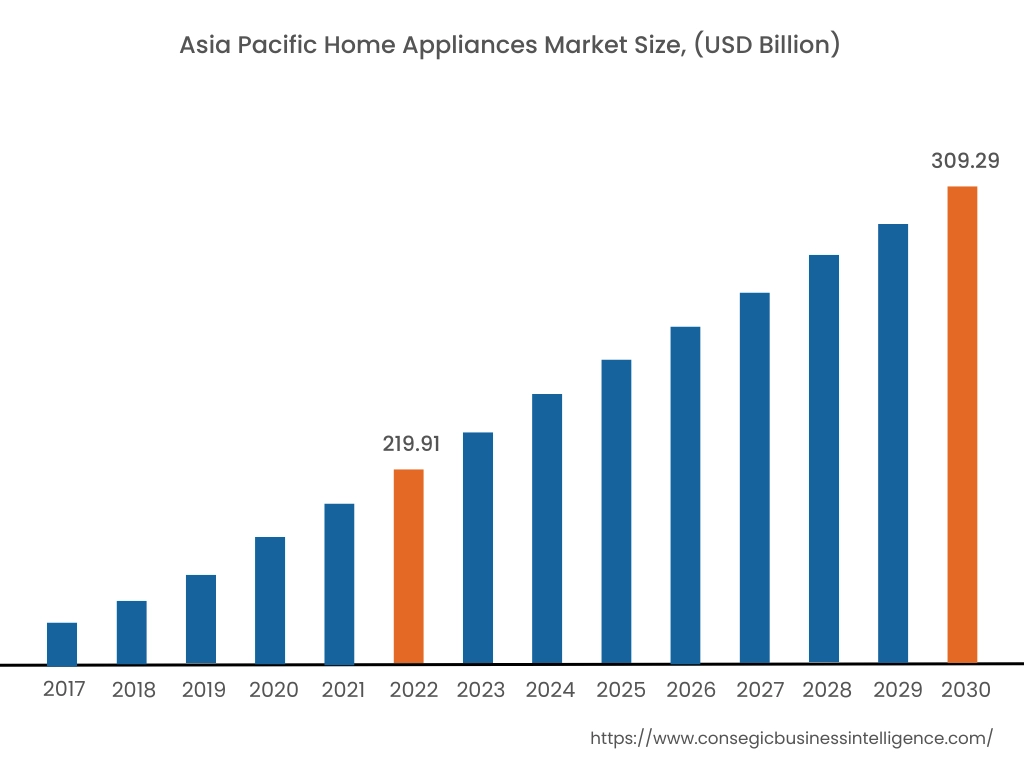

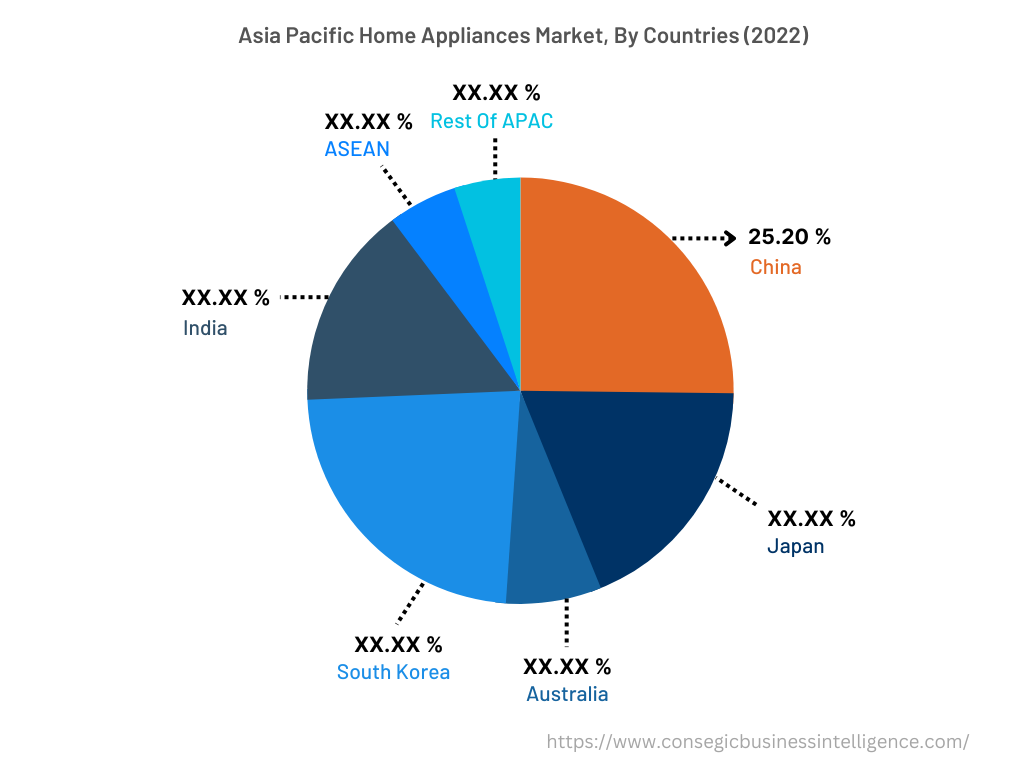

In 2022, Asia Pacific accounted for the highest market share of 37.78% valued at USD 219.91 billion and is expected to reach USD 309.29 billion in 2030. In the Asia Pacific region, China accounted for the highest market share of 25.20% during the base year 2022 owing to the high presence of large market players across the region, increasing adoption of growth strategies by key players across the region, and high manufacturing capabilities of the region. For instance, according to the report published by The Government of China in January 2022, the revenue of China's home appliance sector reached USD 95.3 billion in 2021, which was 7.1% higher compared with the previous year 2020. According to the same report, China is the largest manufacturing hub for appliances across the globe accounting for 60-70% of the global production capacity. Furthermore, the Asia Pacific region is dominated by some of the largest appliances manufacturers across the globe such as Samsung Electronics Co. Ltd., Haier Inc., Bajaj Electricals Ltd., Panasonic Holdings Corporation, and LG Electronics. Based on the analysis, this presence of large market players along with the high production capacity for appliances in the region is driving the home appliances market growth.

Moreover, Europe is expected to grow at the fastest CAGR of 4.9% during the forecast period due to rising demand for energy-efficient appliances and the high expenditure capability of end-users on smart home appliances is driving the market growth across the region. Furthermore, as per the home appliances market analysis, various key players in the home appliances market are focusing on expanding their business across the Europe region, which is also driving the market growth. For instance, in August 2022, Samsung Electronics Co. Ltd. announced its plan to grow its appliances business in the European market. Therefore, the aforementioned factors are anticipated to bolster the market growth in the Europe region.

Top Key Players & Market Share Insights:

The global Home Appliances Market is highly competitive, with several large players and numerous small and medium-sized enterprises. These companies have strong research and development capabilities and a strong presence in the market through their extensive product portfolios and distribution networks. The market is characterized by intense competition, with companies focusing on expanding their product offerings and increasing their market share through mergers, acquisitions, and partnerships. The key players in the market include-

- Whirlpool Corporation

- Samsung Electronics Co. Ltd.

- Bosch-Siemens Hausgeräte

- Electrolux AB

- Voltas Limited

- Haier Inc.

- Bajaj Electricals Ltd.

- IFB Appliances

- Panasonic Holdings Corporation

- LG Electronics

Recent Industry Developments :

- In August 2022, Egypt's Investment Authority and Haier Inc. signed a memorandum of understanding (MoU) to establish an industrial complex for the manufacture of household appliances and its other related industries with an investment of USD 130 billion.

- In August 2020, IFB Appliances announced the launch of new front-loaded washing machines Senator Smart Touch 8.5kg 1400 rpm and Senator VXS 8kg 1200 rpm. These new washing machines are meant to give customers choices that best suit their laundry requirements, along with offering the latest innovations in the industry.

- In February 2020, Haier India announced the launch of 83 products across categories along with its plans to develop the IoT in the home appliances industry. Haier is propelling its 2020 vision to strengthen its commitment to the Indian market with the launch of products in major categories such as refrigerators, air conditioners, washing machines, LED TVs, and others.

Key Questions Answered in the Report

What was the market size of the home appliances market in 2022? +

In 2022, the market size of home appliances was USD 582.08 billion

What will be the potential market valuation for the home appliances market by 2030? +

In 2030, the market size of home appliances will be expected to reach USD 814.14 billion.

What are the key factors driving the growth of the home appliances market? +

Increasing urbanization along with rising disposable income levels is propelling the home appliances market growth.

What is the dominating segment in the Home Appliances market by type? +

In 2022, the major appliances segment accounted for the highest market share of 40.30% in the overall Home Appliances market.

Based on current market trends and future predictions, which geographical region will have the fastest impact on the home appliances market's growth in the coming years? +

Europe is expected to be the fastest-growing region in the market during the forecast period.