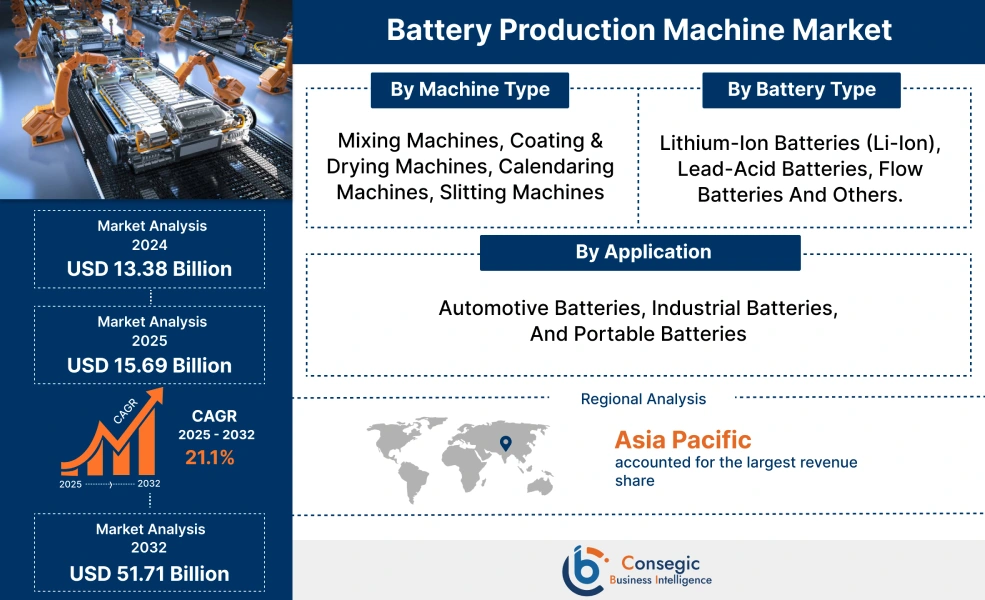

Battery Production Machine Market Size:

Battery Production Machine Market is estimated to reach over USD 51.71 Billion by 2032 from a value of USD 13.38 Billion in 2024 and is projected to grow by USD 15.69 Billion in 2025, growing at a CAGR of 21.1% from 2025 to 2032.

Battery Production Machine Market Scope & Overview:

Battery production machines are specialized industrial equipment used to manufacture various types of batteries, from raw material processing to final assembly and testing. These machines automate and streamline the complex processes involved in creating battery cells, modules, and packs, ensuring precision, efficiency, and high-volume output. The different types of machines used include mixing machines, coating & drying machines, calendaring machines, and slitting machines among others. Further, key trends driving the need for battery production machines include advancement of next-generation battery technologies and increasing focus on sustainable and circular battery manufacturing. Additionally, growing automobile industry and increasing need for energy storage systems in renewable energy industry drives the market.

How is AI Transforming the Battery Production Machine Market?

AI is being integrated in the battery production machine market, primarily for enhancing various stages of battery production, ranging from material discovery and manufacturing to quality control. AI-powered machines enable smarter, more precise, and highly automated production lines. Moreover, AI-driven quality control systems equipped with computer vision can detect microscopic defects during battery production. Additionally, AI-powered machines can optimize battery production processes, predict equipment failures, and ensure consistent battery performance and longevity. Thus, the above factors are expected to create lucrative prospects for market growth in the upcoming years.

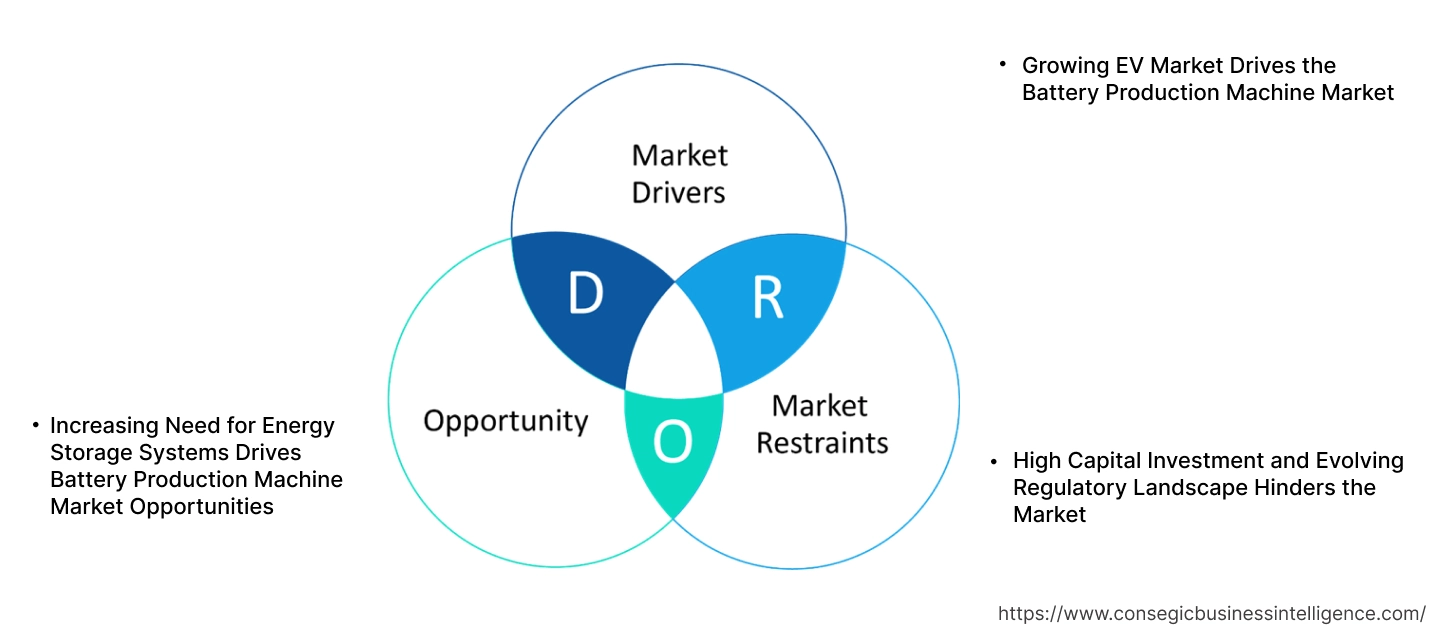

Battery Production Machine Market Dynamics - (DRO) :

Key Drivers:

Growing EV Market Drives the Battery Production Machine Market

Rising adoption of electric vehicles stands as the primary catalyst for the growing battery production machine market. As governments worldwide intensify efforts to reduce carbon emissions through stringent regulations and consumer incentives, the need for high-performance, cost-effective EV batteries has surged exponentially. This unprecedented surge directly translates into massive investments by automotive manufacturers and dedicated battery companies in establishing and expanding gigafactories. Consequently, there is an urgent need for advanced, highly automated machinery capable of producing these complex lithium-ion batteries at immense scales, ensuring both quality and efficiency to meet the burgeoning EV production targets.

- For instance, according to IEA electric car sales in Europe rose from 2.7 million units in 2022 to 3.2 million units in 2023. The increased sales are driving the need for batteries.

Thus, stringent regulations and need for high-performance, cost-effective EV batteries drive the battery production machine market size.

Key Restraints:

High Capital Investment and Evolving Regulatory Landscape Hinders the Market

The market for battery production machines faces significant hurdles due to the high capital investment required to establish and expand manufacturing facilities. The specialized, high-precision machinery, coupled with the need for cleanroom environments and extensive R&D, requires substantial upfront financial commitment, making it challenging for new entrants and potentially limiting the pace of expansion even for established players.

Furthermore, an evolving regulatory landscape adds complexity and uncertainty. New and frequently updated regulations concerning battery safety, environmental impact, raw material sources, and end-of-life management necessitate continuous adjustments in production processes and machinery. This requires ongoing investment in compliance, potentially increasing operational costs, and creating a dynamic environment that manufacturers must constantly navigate.

Future Opportunities :

Increasing Need for Energy Storage Systems Drives Battery Production Machine Market Opportunities

The increasing global need for Energy Storage Systems (ESS) is a significant driver in the battery production machine market. As the world transitions towards renewable energy sources like solar and wind, the intermittent nature of their power generation necessitates robust storage solutions to ensure grid stability and reliability. This rising need for large-scale, long-duration batteries for grid integration, commercial applications, and even residential backup power is fueling massive investments in new battery manufacturing capacities. Consequently, machine manufacturers are finding lucrative opportunities in developing and supplying specialized, high-capacity, and efficient production equipment tailored for industrial and utility-scale battery formats.

- For instance, according to IEA, global renewable electricity generation is projected to nearly double by 2030, reaching over 17,000 terawatt-hours (TWh), a substantial increase from 2023 levels. The increase in renewable energy generation will drive the need for energy storage systems.

Thus, based on analysis, increasing need for energy storage systems drives battery production machine market opportunities.

Battery Production Machine Market Segmental Analysis :

By Machine Type:

Based on the machine type, the market is segmented into mixing machines, coating & drying machines, calendaring machines, slitting machines, electrode stacking machines, assembling and handling machines, formation & testing machines, and others.

Trends in the Machine Type:

- There's a growing need for mixing machines that produce extremely uniform and homogeneous slurries due to increasing need for higher energy density and more stable batteries which in turn drives the market growth.

- To accommodate the larger electrodes used in EV batteries and to boost production efficiency, calendaring machines are being designed with wider rollers and higher operational speeds which in drive the battery production machine market size.

Formation & Testing Machines accounted for the largest revenue share in the year 2024 and is anticipated to register the fastest CAGR during the forecast period.

- Formation and testing systems are designed with more channels per unit of space and improved energy recovery systems to reduce electricity consumption during the long formation process in turn driving the battery production machine market share.

- Further, AI and machine learning are increasingly used to analyze data to predict battery performance, identify potential defects early, optimize formation protocols, and improve overall yield which in turn drives the market growth.

- Furthermore, growing need for accelerated aging tests and more comprehensive testing methodologies drives the battery production machine market trends.

- Thus, based on battery production machine market analysis, more comprehensive testing, incorporation of data analytics and AI, and energy efficiency are driving the market growth.

By Battery Type:

Based on the battery type, the market is segmented into Lithium-ion Batteries (Li-ion), lead-acid batteries, flow batteries and others.

Trends in the Battery Type:

- There's a push towards producing more advanced lead-acid batteries, such as Enhanced Flooded Batteries (EFBs) and Absorbent Glass Mat (AGM) batteries which in turn drive the battery production machine market demand.

- Growing requirement for flow batteries in utility-scale deployment drives the battery production machine market share.

Lithium-ion Batteries (Li-ion) accounted for the largest revenue share in the year 2024 and is anticipated to register the fastest CAGR during the forecast period.

- Increasing trend of automation in material handling, robotic assembly, real-time data monitoring, AI-driven process optimization, and digital twins are driving the battery production machine market trends.

- Further, growing need for LFP (Lithium Iron Phosphate) and high-nickel (NMC, NCA) chemistries in different EV segments drives the battery production machine industry.

- For instance, Rosendahl Nextrom is a leading global provider of production technologies for various industries, including batteries, cable & wire, and optical fiber. For battery sector, the company offers manufacturing solutions specifically for lithium-ion battery systems. The company emphasizes quality, customization, product know-how, and close cooperation to meet customer needs.

- Thus, as per battery production machine market analysis, increased automation and a growing EV segment drives the market growth.

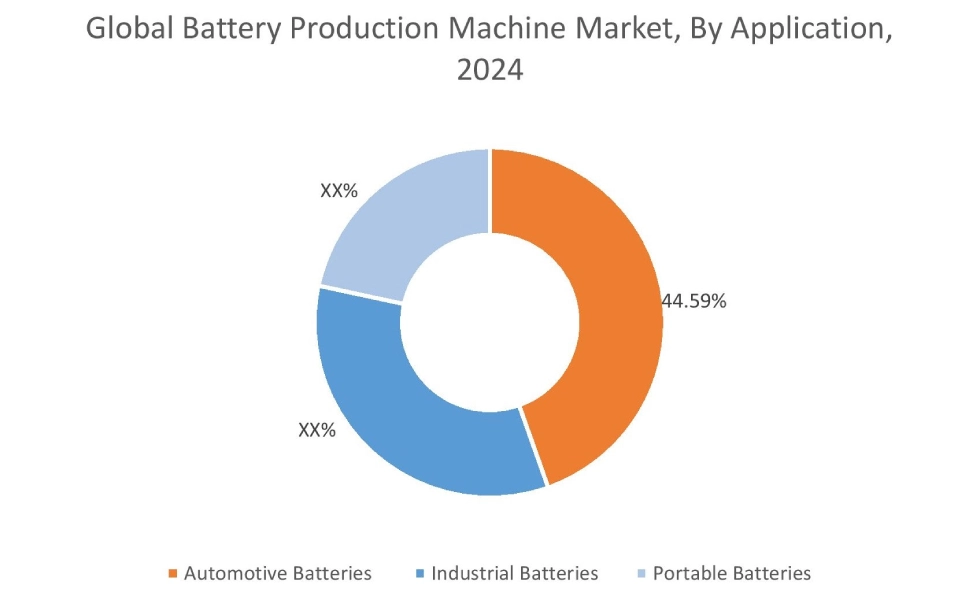

By Application:

Based on the application, the market is automotive batteries, industrial batteries, and portable batteries.

Trends in the Application:

- Devices demand increasingly smaller and thinner portable batteries with higher energy density which in turn drives the battery production machine market expansion.

- Increasing size of consumer electronics market subsequently propels the battery production machine market demand.

Automotive batteries accounted for the largest revenue share of 44.59% in the year 2024.

- The increasing environmental regulation and technological advancement drives the electric vehicle market which in turn drives the market growth.

- Further, automotive OEMs are increasingly integrating battery production more closely with their vehicle assembly which in turn drives the battery production machine market growth.

- Furthermore, growing focus on advanced safety and quality control for critical applications drives battery production machine market growth.

- For instance, as per the European Automobile Manufacturers' Association (ACEA), vehicle production worldwide reached 85.4 million units in 2022, observing a 5.7% rise from 2021. The increasing vehicle production in turn drives the adoption of automotive batteries.

- Thus, based on analysis, technological advancement, integration with vehicle assembly and supply chains, and focus on safety is driving the market.

Industrial batteries segment is anticipated to register the fastest CAGR during the forecast period.

- Industrial applications often require batteries with extremely long cycle lives and robust performance in turn driving the market.

- Further, growing focus on cost-efficiency and energy recovery in production drives the battery production machine market expansion.

- Furthermore, increasing demand for Energy Storage Systems (ESS) drives the market.

- Therefore, based on analysis, aforementioned trends are anticipated to boost the market during the forecast period.

Regional Analysis:

The regions covered are North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

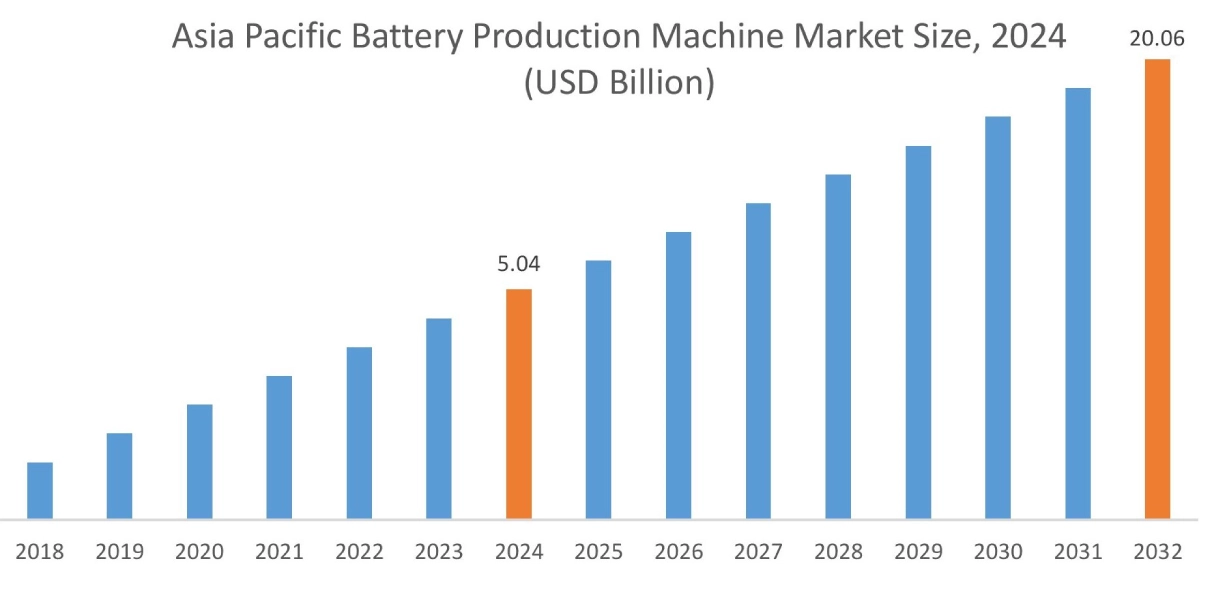

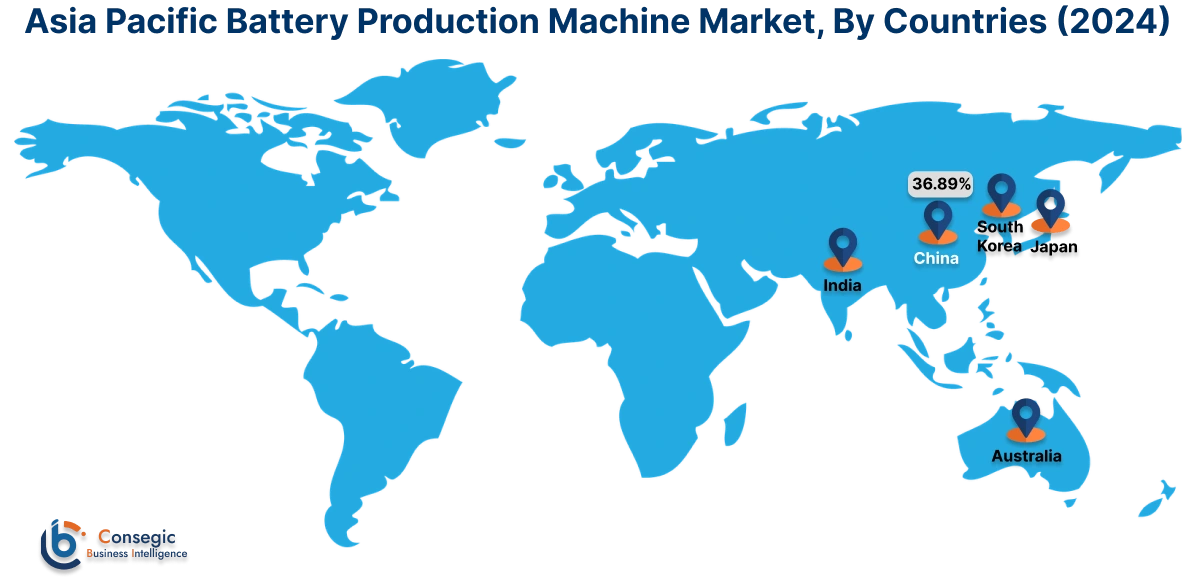

Asia Pacific region was valued at USD 5.04 Billion in 2024. Moreover, it is projected to grow by USD 5.92 Billion in 2025 and reach over USD 20.06 Billion by 2032. Out of this, China accounted for the maximum revenue share of 36.89%. The market for battery production machine is mainly driven by dominant position in electric vehicle (EV) manufacturing and sales and presence of major global battery manufacturers. Additionally, robust government support and increasing demand for energy storage systems (ESS) for renewable energy integration further propel this market.

- For instance, according to Global EV Outlook 2024 by IEA, the sales of electric cars in China significantly increased from 5.9 million units in 2022 to 8.2 million units in 2023. This substantial rise in electric vehicle adoption is directly fueling a surging demand for batteries.

North America is estimated to reach over USD 14.19 Billion by 2032 from a value of USD 3.65 Billion in 2024 and is projected to grow by USD 4.28 Billion in 2025. The North American market is primarily driven by robust government incentives and significant investments by major automotive OEMs to localize EV battery.

- In November 2023, Dürr Group expanded its offerings in battery electrode production by acquiring French company Ingecal, allowing them to supply calendering systems.

The regional analysis depicts that European Green Deal Industrial Plan and related initiatives, aiming to establish a competitive, sustainable, and circular domestic battery value chain in Europe is driving the market. Additionally, the factors driving the market in the Middle East and African region are significant government initiatives and growing demand for Electric Vehicles (EVs). Further, accelerating adoption of electric vehicles in key regional markets like Brazil and increasing investments in renewable energy projects is paving the way for the progress of market trends in Latin America region.

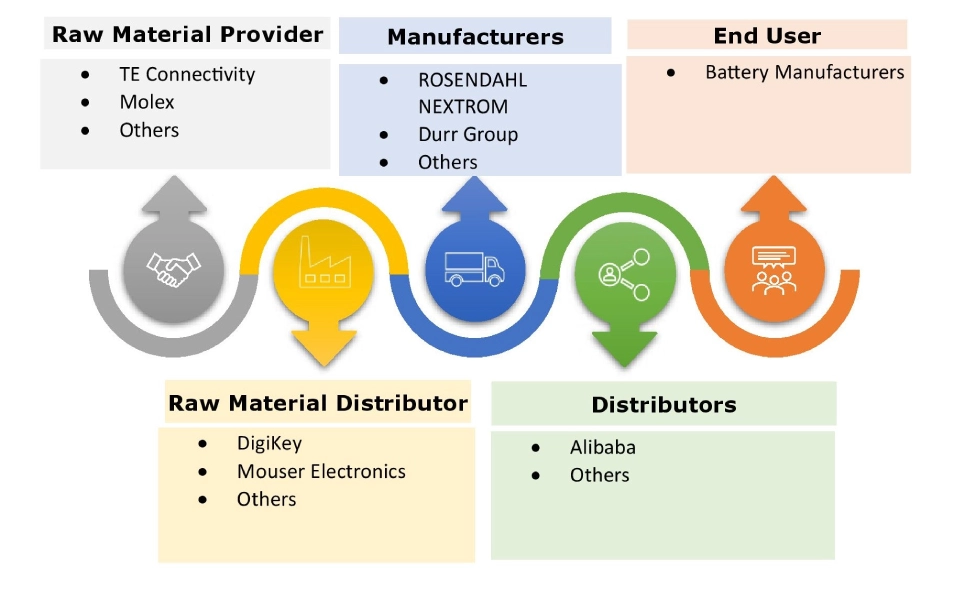

Top Key Players and Market Share Insights:

The global battery production machine market is highly competitive with major players providing solutions to the national and international markets. Key players are adopting several strategies in research and development (R&D), product innovation, and end-user launches to hold a strong position in the battery production machine industry. Key players in the global battery production machine market include-

- ROSENDAHL NEXTROM (Austria)

- Lead Intelligent Equipment Co., Ltd. (China)

- Manz AG (Germany)

- Bühler Group (Switzerland)

- Nordson Corporation (U.S.)

- TORAY ENGINEERING Co. Ltd. (Japan)

- Durr Group (Germany)

- Hitachi High-Tech Corporation (Japan)

- Schuler Group (Germany)

- Yinghe Technology Co., Ltd. (China)

Recent Industry Developments :

Collaboration and Partnership:

- In January 2025, Dürr Systems AG secured a significant order from Italian battery manufacturer FIB S.p.A. to supply a giga-coating system for electrode production. The order includes four anode and four cathode lines, along with associated calenders, slitters, and solvent recovery systems.

- In May 2024, LEAD Intelligent and TÜV Rheinland Greater China have signed a strategic cooperation agreement to accelerate the global expansion of Chinese new energy equipment. The aim is to leverage TÜV Rheinland's expertise in testing, inspection, and certification to enhance LEAD Intelligent's international presence and promote high-quality, efficient new energy equipment worldwide.

Battery Production Machine Market Report Insights :

| Report Attributes | Report Details |

| Study Timeline | 2019-2032 |

| Market Size in 2032 | USD 51.71 Billion |

| CAGR (2025-2032) | 21.1% |

| By Machine Type |

|

| By Battery Type |

|

| By Application |

|

| By Region |

|

| Key Players |

|

| North America | U.S. Canada Mexico |

| Europe | U.K. Germany France Spain Italy Russia Benelux Rest of Europe |

| APAC | China South Korea Japan India Australia ASEAN Rest of Asia-Pacific |

| Middle East and Africa | GCC Turkey South Africa Rest of MEA |

| LATAM | Brazil Argentina Chile Rest of LATAM |

| Report Coverage |

|

Key Questions Answered in the Report

How big is the Battery Production Machine market? +

The Battery Production Machine market is estimated to reach over USD 51.71 Billion by 2032 from a value of USD 13.38 Billion in 2024 and is projected to grow by USD 15.69 Billion in 2025, growing at a CAGR of 21.1% from 2025 to 2032.

What specific segmentation details are covered in the Battery Production Machine report? +

The Battery Production Machine report includes specific segmentation details for machine type, battery type, application, and regions.

Which is the fastest segment anticipated to impact the market growth? +

In the battery production machine market, lithium-ion batteries (Li-ion) is the fastest growing segment during the forecast period.

Who are the major players in the Battery Production Machine market? +

The key participants in the Battery Production Machine market are ROSENDAHL NEXTROM (Austria), Lead Intelligent Equipment Co., Ltd. (China), TORAY ENGINEERING Co. Ltd. (Japan), Durr Group (Germany), Hitachi High-Tech Corporation (Japan), Schuler Group (Germany), Yinghe Technology Co., Ltd. (China), Manz AG (Germany), Bühler Group (Switzerland), Nordson Corporation (U.S.) and others.

What are the key trends in the Battery Production Machine market? +

The Battery Production Machine market is being shaped by several key trends including advancement of next-generation battery technologies and increasing focus on sustainable and circular battery manufacturing. Additionally, growing automobile and renewable energy sector drives the market.